Beruflich Dokumente

Kultur Dokumente

US Internal Revenue Service: Irb03-11

Hochgeladen von

IRSOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

US Internal Revenue Service: Irb03-11

Hochgeladen von

IRSCopyright:

Verfügbare Formate

Bulletin No.

2003–11

March 17, 2003

HIGHLIGHTS

OF THIS ISSUE

These synopses are intended only as aids to the reader in

identifying the subject matter covered. They may not be

relied upon as authoritative interpretations.

INCOME TAX EMPLOYEE PLANS

Rev. Rul. 2003–28, page 594. Announcement 2003–13, page 603.

Charitable contributions; patents. Under section 170(a) of the Form 5310, Application for Determination for Terminat-

Code, a taxpayer’s contribution to a qualified charity of: (1) a li- ing Plan. The Service announces that Form 5310 has been re-

cense to use a patent is not deductible if the taxpayer retains any vised and is now available. This form is used to request

substantial right in the patent; (2) a patent subject to a condi- determination letters for terminating qualified employee ben-

tional reversion is not deductible unless the likelihood of the re- efit plans.

version is so remote as to be negligible; and (3) a patent subject

to a license or transfer restriction generally is deductible, but the EXEMPT ORGANIZATIONS

restriction reduces the amount of the charitable contribution for

section 170 purposes.

Announcement 2003–14, page 603.

A list is provided of organizations now classified as private foun-

Rev. Rul. 2003–29, page 587. dations.

Election in respect of losses attributable to a disaster. This

ruling lists the areas declared by the President to qualify as ma-

jor disaster or emergency areas during 2002 under the Disas-

ADMINISTRATIVE

ter Relief and Emergency Assistance Act.

Rev. Rul. 2003–27, page 597.

Rev. Proc. 2003–24, page 599. Employee stock ownership plan (ESOP). This ruling con-

Exceptions from loss transactions. This procedure provides cerns basis adjustments of S corporation stock held by an em-

that certain losses are not taken into account in determining ployee stock ownership plan (ESOP).

whether a transaction is a reportable transaction for purposes

of the disclosure rules under section 1.6011–4(b)(5) of the regu-

Rev. Proc. 2003–23, page 599.

lations.

This document provides procedures under which a corpora-

tion’s S status will not be terminated by a direct rollover of stock

Rev. Proc. 2003–25, page 601. from its employee stock ownership plan (ESOP) to a partici-

Transactions with significant book-tax difference, excep- pant’s individual retirement account (IRA).

tions. This procedure provides that certain book-tax differ-

ences are not taken into account in determining whether a

transaction is a reportable transaction for purposes of the dis-

closure rules under section 1.6011–4(b)(6) of the regulations.

Announcements of Disbarments and Suspensions begin on page 605.

Finding Lists begin on page ii.

The IRS Mission

Provide America’s taxpayers top quality service by helping them

understand and meet their tax responsibilities and by applying

the tax law with integrity and fairness to all.

Introduction

The Internal Revenue Bulletin is the authoritative instrument of the decisions, rulings, and procedures must be considered, and Ser-

Commissioner of Internal Revenue for announcing official rul- vice personnel and others concerned are cautioned against reach-

ings and procedures of the Internal Revenue Service and for pub- ing the same conclusions in other cases unless the facts and

lishing Treasury Decisions, Executive Orders, Tax Conventions, circumstances are substantially the same.

legislation, court decisions, and other items of general inter-

est. It is published weekly and may be obtained from the Super- The Bulletin is divided into four parts as follows:

intendent of Documents on a subscription basis. Bulletin contents

are consolidated semiannually into Cumulative Bulletins, which Part I.—1986 Code.

are sold on a single-copy basis. This part includes rulings and decisions based on provisions of

the Internal Revenue Code of 1986.

It is the policy of the Service to publish in the Bulletin all sub-

stantive rulings necessary to promote a uniform application of Part II.—Treaties and Tax Legislation.

the tax laws, including all rulings that supersede, revoke, modify,

This part is divided into two subparts as follows: Subpart A, Tax

or amend any of those previously published in the Bulletin. All pub-

Conventions and Other Related Items, and Subpart B, Legisla-

lished rulings apply retroactively unless otherwise indicated. Pro-

tion and Related Committee Reports.

cedures relating solely to matters of internal management are

not published; however, statements of internal practices and pro-

cedures that affect the rights and duties of taxpayers are pub- Part III.—Administrative, Procedural, and Miscellaneous.

lished. To the extent practicable, pertinent cross references to these sub-

jects are contained in the other Parts and Subparts. Also in-

Revenue rulings represent the conclusions of the Service on the cluded in this part are Bank Secrecy Act Administrative Rulings.

application of the law to the pivotal facts stated in the revenue Bank Secrecy Act Administrative Rulings are issued by the De-

ruling. In those based on positions taken in rulings to taxpay- partment of the Treasury’s Office of the Assistant Secretary (En-

ers or technical advice to Service field offices, identifying de- forcement).

tails and information of a confidential nature are deleted to prevent

unwarranted invasions of privacy and to comply with statutory Part IV.—Items of General Interest.

requirements. This part includes notices of proposed rulemakings, disbar-

ment and suspension lists, and announcements.

Rulings and procedures reported in the Bulletin do not have the

force and effect of Treasury Department Regulations, but they The first Bulletin for each month includes a cumulative index for

may be used as precedents. Unpublished rulings will not be re- the matters published during the preceding months. These

lied on, used, or cited as precedents by Service personnel in the monthly indexes are cumulated on a semiannual basis, and are

disposition of other cases. In applying published rulings and pro- published in the first Bulletin of the succeeding semiannual pe-

cedures, the effect of subsequent legislation, regulations, court riod, respectively.

The contents of this publication are not copyrighted and may be reprinted freely. A citation of the Internal Revenue Bulletin as the source would be appropriate.

For sale by the Superintendent of Documents, U.S. Government Printing Office, Washington, DC 20402.

March 17, 2003 2003–11 I.R.B.

Part I. Rulings and Decisions Under the Internal Revenue Code of 1986

Section 139.—Disaster Relief able year in which the disaster occurred. For The President has determined that, dur-

Payments purposes of § 165(i), a disaster includes an ing 2002, the areas listed below have been

event declared a major disaster or an emer- adversely affected by disasters of suffi-

Taxpayers are informed of the areas declared gency under the Act. cient severity and magnitude to warrant as-

by the President to qualify as major disaster or

emergency areas during 2002 under the Disaster

Section 1.165–11(e) of the Income Tax sistance by the Federal Government under

Relief and Emergency Assistance Act. See Rev. Regulations provides that the election to de- the Act.

Rul. 2003–29, on this page. duct a disaster loss for the preceding year A cumulative list of the areas warrant-

must be made by filing a return, an ing assistance each year under the Act (be-

Section 165.—Losses amended return, or a claim for refund on ginning in 1998) is available at the Federal

or before the later of (1) the due date of the Emergency Management Agency (FEMA)

26 CFR 1.165–11: Election in respect of losses taxpayer’s income tax return (determined Internet site at www.fema.gov. Accord-

attributable to a disaster. without regard to any extension of time to ingly, the Internal Revenue Service re-

(Also § 139, 1033; 1.1033(1)–1.) file the return) for the taxable year in which quests comments regarding the need for

the disaster actually occurred, or (2) the due future publication of this revenue ruling.

Election in respect of losses attribut-

date of the taxpayer’s income tax return (de- Comments should be submitted by May 1,

able to a disaster. This ruling lists the ar-

termined with regard to any extension of 2003, either to:

eas declared by the President to qualify as

time to file the return) for the taxable year

major disaster or emergency areas during

immediately preceding the taxable year in Internal Revenue Service

2002 under the Disaster Relief and Emer-

which the disaster actually occurred. P.O. Box 7604

gency Assistance Act.

The provisions of § 165(i) apply only to Ben Franklin Station

Rev. Rul. 2003–29 losses that are otherwise deductible under Washington, DC 20044

§ 165(a). An individual taxpayer may de- Attn: CC:PA:T:CRU (ITA)

Under § 165(i) of the Internal Revenue duct losses if they are incurred in a trade Room 5041

Code, if a taxpayer suffers a loss attribut- or business, if they are incurred in a trans-

or electronically via the Service internet site

able to a disaster occurring in an area sub- action entered into for profit, or if they are

at: Notice.Comments@irscounsel.treas.gov

sequently determined by the President of the casualty losses under § 165(c)(3).

(the Service comments e-mail address). All

United States to warrant assistance by the A determination by the President that an

comments will be available for public in-

Federal Government under the Disaster Re- area warrants assistance by the Federal Gov-

spection and copying.

lief and Emergency Assistance Act, 42 ernment under the Act is also relevant to

U.S.C. §§ 5121–5204c (1988 & Supp. V § 139(a) (regarding the exclusion from gross FURTHER INFORMATION

1993) (the Act), the taxpayer may elect to income of certain qualified disaster relief

claim a deduction for that loss on the tax- payments) and § 1033(h) (regarding the de- For further information regarding this

payer’s federal income tax return for the ferral of gain realized upon the involun- revenue ruling, contact James R. Roy at

taxable year immediately preceding the tax- tary conversion of certain property). (202) 622–4950 (not a toll-free call).

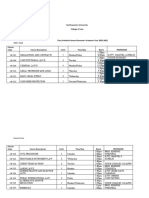

Disaster Area Disaster Description Disaster Date

Alabama

Counties of Baldwin and Mobile FEMA–1438–DR September 23–October 1

Tropical Storm Isidore

Counties of Barbour, Bibb, Blount, Calhoun, FEMA–1442–DR November 5–12

Cherokee, Cleburne, Cullman, Dale, DeKalb, Severe Storms and Tornadoes

Etowah, Fayette, Franklin, Greene, Hale, Henry,

Houston, Jefferson, Lamar, Lawrence, Marion,

Marshall, Morgan, Pickens, Shelby, St. Clair,

Talladega, Tuscaloosa, Walker, and Winston

2003–11 I.R.B. 587 March 17, 2003

Disaster Area Disaster Description Disaster Date

Alaska

Fairbanks North Star Borough, McGrath and Lime FEMA–1423–DR April 27–May 30

Village in the Iditarod Regional Education Flooding

Attendance Area (REAA), Aniak, Crooked Creek,

Red Devil, and Sleetmute in the Kuspuk REAA,

Kwethluk in the Lower Kuskokwim REAA,

Alakanuk and Emmonak in the Lower Yukon

REAA, and Ekwok and Stuyahok in the Southwest

Region REAA.

Fairbanks North Star Borough, Denali Borough, FEMA–1440–DR November 3–10

Matanuska-Susitna Borough; the Regional Earthquake

Education Attendance Areas of Delta Greely,

Alaska Gateway, Copper River, and

Yukon-Koyukuk; the cities of Tetlin, Mentasta

Lake, Nothway, Dot Lake, Chistochina, and

Tanacross; and the unincorporated communities of

Slana and Tok.

Kenai Peninsula Borough, Kodiak Island Borough FEMA–1445–DR October 23–December 20

and Chignik Bay Area, to include Chignik Lake Severe Winter Storms, Flooding,

and Chignik Lagoon Coastal Erosion, and Tidal Surge

Arizona

Counties of Apache, Coconino, Gila, and Navajo; FEMA–1422–DR June 18–July 7

and the Fort Apache Indian Reservation Wildfires

Arkansas

Counties of Ashley, Clay, Cleburne, Columbia, FEMA–1400–DR December 15, 2001–January

Craighead, Crittenden, Franklin, Greene, Severe storms and flooding 30, 2002

Independence, Jackson, Lincoln, Little River,

Logan, Monroe, Poinsett, Prairie, Scott, Stone,

White, and Woodruff

Colorado

Counties of Adams, Alamosa, Arapahoe, Archuleta, FEMA–1421–DR April 23–June 6

Baca, Bent, Boulder, Broomfield, Chaffee, Wildfires

Cheyenne, Clear Creek, Conejos, Costilla, Crowley,

Custer, Delta, Denver, Dolores, Douglas, Eagle,

Elbert, El Paso, Fremont, Garfield, Gilpin, Grand,

Gunnison, Hinsdale, Huerfano, Jackson, Jefferson,

Kiowa, Kit Carson, Lake, La Plata, Larimer,

Las Animas, Lincoln, Mesa, Mineral, Moffat,

Montezuma, Montrose, Otero, Ouray, Park, Pitkin,

Pueblo, Rio Blanco, Rio Grande, Routt, Saguache,

San Juan, San Miguel, Summitt, Teller,

Washington, Weld, and Yuma; the Southern Ute

and Ute Mountain Reservations; and the Cities of

Broomfield and Denver

March 17, 2003 588 2003–11 I.R.B.

Disaster Area Disaster Description Disaster Date

Guam

Territory of Guam FEMA–1426–DR July 5–6

Typhoon Chata’an

Territory of Guam FEMA–1446–DR December 8–16

Super Typhoon

Pongsona

Illinois

Counties of Adams, Alexander, Bond, Brown, FEMA–1416–DR April 21–May 23

Calhoun, Cass, Champaign, Christian, Clark, Clay, Severe Storms,

Clinton, Coles, Crawford, Cumberland, DeWitt, Tornadoes, and

Douglas, Edgar, Edwards, Effingham, Ford, Flooding

Fayette, Franklin, Fulton, Gallatin, Greene,

Hamilton, Hancock, Hardin, Iroquois, Jackson,

Jasper, Jefferson, Jersey, Johnson, Lawrence,

Logan, McDonough, Macon, Macoupin, Madison,

Marion, Mason, Massac, Menard, Monroe,

Montgomery, Morgan, Moultrie, Piatt, Pike, Perry,

Pope, Pulaski, Randolph, Richland, St. Clair,

Saline, Sangamon, Schuyler, Scott, Shelby, Union,

Vermillion, Wabash, Washington, Wayne, White,

and Williamson

Indiana

Counties of Brown, Crawford, Dearborn, Dubois, FEMA–1418–DR April 28–June 7

Franklin, Gibson, Greene, Hamilton, Jackson, Severe Storms,

Jefferson, Johnson, Knox, Marion, Martin, Tornadoes and Flooding

Montgomery, Ohio, Orange, Owen, Parke, Pike,

Posey, Putnam, Sullivan, Switzerland, Union,

Vermillion, Vigo, and Washington

Counties of Bartholomew, Blackford, Brown, FEMA–1433–DR September 20

Daviess, Decatur, Delaware, Fayette, Franklin, Severe Storms and

Gibson, Grant, Greene, Hamilton, Hancock, Tornadoes

Hendricks, Henry, Jay, Johnson, Knox, Lawrence,

Madison, Marion, Monroe, Morgan, Owen, Pike,

Posey, Randolph, Rush, Shelby, Sullivan, Tipton,

and Vanderburg

Iowa

Counties of Allamakee, Benton, Buchanan, Cedar, FEMA–1420–DR June 3–25

Clayton, Clinton, Delaware, Des Moines, Dubuque, Severe Storms and

Fayette, Henry, Iowa, Jackson, Johnson, Jones, Flooding

Lee, Linn, Louisa, Muscatine, Scott, and

Winneshiek

2003–11 I.R.B. 589 March 17, 2003

Disaster Area Disaster Description Disaster Date

Kansas

Counties of Allen, Anderson, Barber, Bourbon, FEMA–1402–DR January 29–February 15

Butler, Chautauqua, Coffey, Cowley, Crawford, Severe Winter Ice Storm

Douglas, Elk, Franklin, Greenwood, Johnson,

Labette, Linn, Miami, Montgomery, Neosho,

Osage, Sumner, Wilson, Woodson, and Wyandotte

Kentucky

Counties of Bath, Bell, Bourbon, Boyd, Breathitt, FEMA–1407–DR March 17–21

Carter, Clay, Elliott, Fleming, Greenup, Harlan, Severe Storms and Flooding

Johnson, Knott, Knox, Laurel, Lawrence, Lee,

Leslie, Letcher, Lewis, McCreary, Magoffin,

Menifee, Montgomery, Morgan, Nicholas, Owsley,

Perry, Powell, Rowan, Wayne, and Whitley

Counties of Breathitt, Breckenridge, Crittenden, FEMA–1414–DR April 27–May 10

Edmondson, Floyd, Grayson, Green, Hancock, Severe Storms,

Hardin, Henderson, Hopkins, Laurel, Letcher, Tornadoes, and Flooding

Marion, Martin, McLean, Meade, Ohio, Owsley,

Pike, Rockcastle, Union, and Webster

Louisiana

Parishes of East Baton Rouge, Iberia, Jefferson, FEMA–1435–DR September 21–October 1

Lafourche, Livingston, Orleans, Plaquemines, Tropical Storm Isidore

St. Bernard, St. Charles, St. James, St. John the

Baptist, St. Mary, St. Tammany, Tangipahoa, and

Terrebonne

Parishes of Acadia, Allen, Ascension, Assumption, FEMA–1437–DR October 1–16

Avoyelles, Beauregard, Calcasieu, Caldwell, Hurricane Lili

Cameron, Catahoula, East Baton Rouge, East

Feliciana, Evangeline, Iberia, Iberville, Jefferson

Davis, Jefferson, Lafayette, Lafourche, LaSalle,

Livingston, Natchitoches, Orleans, Ouachita,

Plaquemines, Pointe Coupee, Rapides, St. Bernard,

St. Charles, St. Helena, St. James, St. John the

Baptist, St. Landry, St. Martin, St. Mary,

St. Tammany, Tangipahoa, Terrebonne, Vermillion,

Vernon, Washington, West Baton Rouge, and

West Feliciana

Mariana Islands, Northern

Island of Rota FEMA–1430–DR July 4–5

Typhoon Chata’an

Island of Rota FEMA–1447–DR December 8–16

Super Typhoon Pongsona

Maryland

Counties of Calvert, Charles, and Dorchester FEMA–1409–DR April 28

Tornado

March 17, 2003 590 2003–11 I.R.B.

Disaster Area Disaster Description Disaster Date

Michigan

Counties of Baraga, Gogebic, Houghton, FEMA–1413-DR April 10–May 9

Marquette, and Ontonagan Flooding

Micronesia, Federated States of

Yap State FEMA–1417–DR February 27–March 3

Typhoon Mitag

Chuuk State FEMA–1427–DR July 2–4

Tropical Storm Chata’an,

including Flooding, Mudslides,

and Landslides

Minnesota

Counties of Becker, Beltrami, Clay, Clearwater, FEMA–1419-DR June 9–28

Goodhue, Hubbard, Itasca, Kittson, McLeod, Severe Storms, Flooding, and

Pennington, Polk, Roseau, and Wright Tornadoes

Mississippi

Counties of Amite, Hancock, Harrison, Jackson, FEMA–1436–DR September 23–October 6

Lincoln, Pearl River, Pike, and Stone Hurricane Isidore

Counties of Clay, Lafayette, Lowndes, Monroe, FEMA–1443–DR November 10–11

Noxubee, and Oktibbeha Severe Storms and Tornadoes

Missouri

Counties of Adair, Audrain, Barton, Bates, Benton, FEMA–1403–DR January 29–February 13

Boone, Buchanan, Caldwell, Carroll, Cass, Cedar, Severe Winter Ice Storm

Chariton, Clark, Clay, Clinton, Cooper, Daviess,

Grundy, Henry, Howard, Jackson, Johnson, Knox,

Lafayette, Lewis, Linn, Livingston, Macon,

Marion, Monroe, Morgan, Pettis, Platte, Ralls,

Randolph, Ray, Saline, Scotland, Shelby, St. Clair,

Sullivan, and Vernon

Counties of Adair, Barry, Barton, Bollinger, Boone, FEMA–1412–DR April 24–June 10

Butler, Camden, Cape Girardeau, Carroll, Carter, Severe Storms and Tornadoes

Cedar, Christian, Chariton, Clark, Cooper,

Crawford, Dade, Dallas, De Kalb, Dent, Douglas,

Dunklin, Greene, Grundy, Hickory, Howard,

Howell, Iron, Jasper, Jefferson, Johnson, Knox,

Laclede, Lafayette, Lawrence, Lewis, Lincoln,

Linn, Livingston, McDonald, Macon, Madison,

Maries, Marion, Mercer, Miller, Mississippi, New

Madrid, Newton, Oregon, Osage, Ozark, Pemiscot,

Perry, Phelps, Pike, Polk, Pulaski, Ralls, Ray,

Reynolds, Ripley, Schuyler, Scotland, Scott,

Shannon, Shelby, St. Francois, St. Genevieve,

Stoddard, Stone, Sullivan, Taney, Texas, Vernon,

Washington, Wayne, Webster, and Wright

2003–11 I.R.B. 591 March 17, 2003

Disaster Area Disaster Description Disaster Date

Montana

Counties of Glacier, Hill, Liberty, Pondera, and FEMA–1424–DR June 8–21

Toole; and the Blackfeet Indian Reservation Severe Storms and Flooding

New York

County of Erie FEMA–1404–DR December 24–29, 2001

Severe Winter Storm

Counties of Cattaraugus, Chautauqua, Erie, FEMA–3170–EM December 24–29, 2001

Genesee, and Wyoming Snowstorm

Counties of Clinton and Essex FEMA–1415–DR April 20

Earthquake

North Carolina

Counties of Alamance, Alexander, Anson, Burke, FEMA–1448–DR December 4–6

Cabarrus, Caldwell, Catawba, Chatham, Cleveland, Severe Ice Storms

Davidson, Durham, Edgecombe, Forsyth, Franklin,

Gaston, Granville, Guilford, Halifax, Harnett,

Iredell, Lee, Lincoln, McDowell, Mecklenburg,

Montgomery, Moore, Nash, Orange, Person,

Randolph, Rowan, Rutherford, Stanly, Union,

Vance, and Wake

North Dakota

Counties of Grand Forks, Pembina, Stutsman, FEMA–1431–DR June 8–August 11

Traill, and Walsh; and the Fort Berthold Indian Severe Storms, Tornadoes, and

Reservation Flooding

Ohio

Counties of Hancock, Ottawa, Paulding, Putnam, FEMA–1444–DR November 10

Seneca, and Van Wert Severe Storms and Tornadoes

Oklahoma

Counties of Alfalfa, Beaver, Becker, Beckham, FEMA–1401–DR January 30–February 11

Blaine, Caddo, Canadian, Cimarron, Cleveland, Ice Storm

Comanche, Creek, Custer, Dewey, Ellis, Garfield,

Garvin, Grady, Grant, Greer, Harmon, Harper,

Jackson, Kay, Kingfisher, Kiowa, Lincoln, Logan,

Major, McClain, Noble, Nowata, Oklahoma,

Osage, Pawnee, Payne, Pottawatomie, Roger Mills,

Rogers, Stephens, Texas, Tillman, Tulsa,

Washington, Washita, Woods, and Woodward

Oregon

Counties of Coos, Curry, Douglas, Lane, and Linn FEMA–1405–DR February 7–8

Severe Winter Storm with High

Winds

March 17, 2003 592 2003–11 I.R.B.

Disaster Area Disaster Description Disaster Date

Tennessee

Counties of Anderson, Bedford, Bledsoe, Blount, FEMA–1408–DR January 23–March 20

Cannon, Claiborne, Clay, Cocke, Cumberland, Severe Storms and Flooding

Decatur, DeKalb, Dickson, Fentress, Giles,

Grainger, Hancock, Hardin, Hawkins, Jackson,

Lauderdale, Lawrence, Lewis, Lincoln, Loudon,

McNairy, Macon, Marshall, Maury, Meigs,

Overton, Roane, Scott, Sevier, Van Buren, Warren,

and Wayne

Counties of Anderson, Bedford, Carroll, Coffee, FEMA–1441–DR November 9–12

Crockett, Cumberland, Gibson, Henderson, Severe Storms, Tornadoes, and

Madison, Marshall, Montgomery, Morgan, Flooding

Rutherford, Scott, Sumner, and Tipton

Texas

Counties of Atascosa, Bandera, Bee, Bexar, Blanco, FEMA–1425–DR June 29–July 31

Brown, Burnet, Caldwell, Calhoun, Callahan, Severe Storms and Flooding

Coleman, Comal, Dimmit, Duval, DeWitt,

Eastland, Frio, Gillespie, Goliad, Gonzales,

Guadalupe, Hays, Jim Wells, Jones, Karnes,

Kendall, Kerr, La Salle, Live Oak, McMullen,

Medina, Nueces, Real, San Patricio, San Saba,

Taylor, Travis, Uvalde, Victoria, Wilson, and

Zavala

Counties of Brazoria, Frio, Galveston, Jim Wells, FEMA–1434–DR September 6–30

La Salle, Live Oak, Matagorda, Nueces, San Tropical Storm Fay

Patricio, Webb, and Wharton

Counties of Aransas, Hardin, Harris, Jefferson, FEMA–1439–DR October 24–November 15

Liberty, Montgomery, Nueces, Orange, and San Severe Storms, Tornadoes, and

Patricio Flooding

Vermont

Counties of Caledonia, Essex, Franklin, Lamoille, FEMA–1428–DR June 5–13

and Orleans Severe Storms and Flooding

Virginia

Counties of Dickenson, Lee, Russell, Scott, Smyth, FEMA–1406–DR March 17–20

Tazewell, Washington, Wise, and Wythe; and Severe Storms and Flooding

Independent City of Norton

Counties of Buchanan and Tazewell FEMA–1411–DR April 28–May 3

Severe Storms and Tornado

West Virginia

Counties of Logan, McDowell, Mercer, Mingo, and FEMA–1410–DR May 2–20

Wyoming Severe Storms, Flooding, and

Landslides

2003–11 I.R.B. 593 March 17, 2003

Disaster Area Disaster Description Disaster Date

Wisconsin

Counties of Adams, Clark, Dunn, Marathon, FEMA–1429–DR June 21–25

Marinette, Portage, Waushara, and Wood Severe Storms and Flooding

Counties of Barron, Burnett, Chippewa, Clark, FEMA–1432–DR September 2–6

Dunn, Langlade, Lincoln, Marathon, Polk, Portage, Severe Storms, Tornadoes, and

Price, Rusk, Sawyer, Shawano, St. Croix, Taylor, Flooding

Washburn, Waupaca, and Wood

Section 170.—Charitable, Situation 2. Y contributes a patent to Section 170(f)(2) allows a charitable con-

etc., Contributions and Gifts University subject to the condition that tribution deduction, in the case of prop-

A, a faculty member of University and erty that the donor transfers in trust, if the

26 CFR 1.170–1: Charitable, etc., contributions an expert in the technology covered by trust is a charitable remainder annuity trust,

and gifts; allowance of deduction.

the patent, continue to be a faculty mem- a charitable remainder unitrust, or a pooled

(Also §§ 170; 1.170A–7.)

ber of University during the remaining income fund. Further, § 170(f)(2) allows a

Charitable contributions; patents. Un- life of the patent. If A ceases to be a deduction for the value of an interest in

der section 170(a) of the Code, a taxpay- member of University’s faculty before property (other than a remainder interest)

er’s contribution to a qualified charity of: the patent expires, the patent will revert that the donor transfers in trust if the in-

(1) a license to use a patent is not deduct- to Y. The patent will expire 15 years terest is in the form of a guaranteed annu-

ible if the taxpayer retains any substantial after the date Y contributes it to Univer- ity or the trust instrument specifies that the

right in the patent; (2) a patent subject to sity. On the date of the contribution, the interest is a fixed percentage, distributed

a conditional reversion is not deductible un- likelihood that A will cease to be a yearly, of the fair market value of the trust

less the likelihood of the reversion is so re- member of the faculty before the patent property (to be determined yearly) and the

mote as to be negligible; and (3) a patent expires is not so remote as to be grantor is treated as the owner of such in-

subject to a license or transfer restriction negligible. terest for purposes of applying § 671.

generally is deductible, but the restriction By its terms, § 170(f)(3)(A) does not ap-

reduces the amount of the charitable con- Situation 3. Z contributes to University ply to, and therefore does not disallow a de-

tribution for section 170 purposes. all of Z’s interests in a patent. The trans- duction for, a contribution of an interest that,

fer agreement provides that University even though partial, is the taxpayer’s en-

Rev. Rul. 2003–28 may not sell or license the patent for a tire interest in the property. If, however, the

period of 3 years after the transfer. This property in which such partial interest ex-

ISSUES restriction does not result in any benefit ists was divided in order to create such in-

to Z, and under no circumstances can the terest, and thus avoid § 170(f)(3)(A), a

(1) Is a taxpayer’s contribution to a patent revert to Z.

qualified charity of a license to use a patent deduction is not allowed. Section 1.170A–

deductible under § 170(a) of the Internal LAW AND ANALYSIS 7(a)(2)(i) of the Income Tax Regulations.

Revenue Code if the taxpayer retains any Sections 170(f)(3)(B)(ii) and 1.170A–

substantial right in the patent? Issue (1) 7(b)(1) allow a deduction under § 170 for

(2) Is a taxpayer’s contribution to a a contribution not in trust of a partial in-

Section 170(a) provides, subject to cer- terest that is less than the donor’s entire in-

qualified charity of a patent subject to a

tain limitations, a deduction for any chari- terest in property if the partial interest is an

conditional reversion deductible under

table contribution, as defined in § 170(c), undivided portion of the donor’s entire in-

§ 170(a)?

payment of which is made within the tax-

(3) Is a taxpayer’s contribution to a terest. An undivided portion of a donor’s

able year.

qualified charity of a patent subject to a li- entire interest in property consists of a frac-

Section 170(f)(3) denies a charitable con-

cense or transfer restriction deductible un- tion or percentage of each and every sub-

tribution deduction for certain contribu-

der § 170(a)? stantial interest or right owned by the donor

tions of partial interests in property. Section

in such property and must extend over the

FACTS 170(f)(3)(A) denies a charitable contribu-

tion deduction for a contribution of less than entire term of the donor’s interest in such

Situation 1. X contributes to University, the taxpayer’s entire interest in property un- property and in other property into which

an organization described in § 170(c) less the value of the interest contributed such property is converted. A charitable con-

(qualified charity), a license to use a would be allowable as a deduction under tribution in perpetuity of an interest in prop-

patent, but retains the right to license the § 170(f)(2) if the donor were to transfer the erty not in trust does not constitute a

patent to others. interest in trust. contribution of an undivided portion of the

March 17, 2003 594 2003–11 I.R.B.

donor’s entire interest if the donor trans- or percentage of each and every substan- tion on the marketability or use of property,

fers some specific rights and retains other tial interest or right that X owns in the the amount of the charitable contribution is

substantial rights. patent. As a result, the contribution in Situ- the fair market value of the property at the

In enacting § 170(f)(3), Congress was ation 1 constitutes a transfer of a partial in- time of the contribution determined in light

concerned with situations in which taxpay- terest, and no deduction under § 170(a) is of the restriction. See also Cooley v. Com-

ers might obtain a double benefit by tak- allowable. The result would be the same if missioner, 33 T.C. 223, 225 (1959), aff’d

ing a deduction for the present value of a X had retained any other substantial right per curiam, 283 F.2d 945 (2d Cir. 1960).

contributed interest while also excluding in the patent. For example, no deduction

In Situation 3, Z transfers to Univer-

from income subsequent receipts from the would be allowable if X had contributed the

sity all of Z’s interests in the patent with

donated interest. In addition, Congress was patent (or license to use the patent) solely

the restriction that University cannot trans-

concerned with situations in which, be- for use in a particular geographic area while

retaining the right to use the patent (or li- fer or license the patent for a period of 3

cause the charity does not obtain all or an years after the transfer. Unlike the condi-

cense) in other geographic areas.

undivided portion of significant rights in the tional reversion in Situation 2, the restric-

property, the amount of a charitable con- Issue (2) tion on transfer or license is not a condition

tribution deduction might not correspond to that can defeat the transfer. Thus, Z’s con-

the value of the benefit ultimately received Section 1.170A–1(e) provides that if, as

tribution is deductible under § 170(a), as-

by the charity. The legislative solution was of the date of a gift, a transfer of prop-

suming all other applicable requirements of

to guard against the possibility that such erty for charitable purposes is dependent

§ 170 are satisfied, and subject to the per-

problems might arise by denying a deduc- upon the performance of some act or the

happening of a precedent event in order for centage limitations of § 170. See Publica-

tion in situations involving partial inter-

it to become effective, no deduction is al- tion 526, Charitable Contributions

ests, unless the contribution is cast in certain

lowable unless the possibility that the chari- (describing other requirements for, and limi-

prescribed forms. See H.R. Rep. No. 91–

table transfer will not become effective is tations on, the deductibility of charitable

413 at 57–58 (1969), 1969–3 C.B. 200,

so remote as to be negligible. Similarly, un- contributions). Under § 1.170A–1(c), how-

237–239; S. Rep. No. 91–552 at 87 (1969),

1969–3 C.B. 423, 479. The scope of der § 1.170A–7(a)(3), if, as of the date of ever, the restriction reduces what would oth-

§ 170(f)(3) thus extends beyond situations a gift, a transfer of property for charitable erwise be the fair market value of the

in which there is actual or probable ma- purposes may be defeated by the perfor- patent, and therefore reduces the amount of

nipulation of the non-charitable interest to mance of some act or the happening of Z’s charitable contribution. If Z had re-

the detriment of the charitable interest, or some event, no deduction is allowable un- ceived a benefit in exchange for the con-

situations in which the donor has merely as- less the possibility that such act or event tribution, the value of the benefit would

signed the right to future income. Rev. Rul. will occur is so remote as to be negligible. further reduce the amount of Z’s chari-

88–37, 1988–1 C.B. 97. In Situation 2, Y’s contribution of the table contribution. See § 1.170A–1(h); Rev.

Section 170(f)(3)(A) and § 1.170A– patent is contingent upon A continuing as Rul. 67–246, 1967–2 C.B. 104. See also

7(a)(1) treat a contribution of the right to a member of University’s faculty for an ad- Singer Co. v. United States, 449 F.2d 413,

use property that the donor owns, such as ditional 15 years, the remaining life of the

423–424 (Ct. Cl. 1971).

a contribution of a rent-free lease, as a con- patent. On the date of the contribution, the

tribution of less than the taxpayer’s entire possibility that A will cease to be a mem- HOLDINGS

interest in the property. Similarly, if a tax- ber of the faculty before the expiration of

payer contributes an interest in motion pic- the patent is not so remote as to be negli- Under the facts of this revenue ruling:

ture films, but retains the right to make gible. Therefore, no deduction is allow- (1) A taxpayer’s contribution to a quali-

reproductions of such films and exploit the able under § 170(a). fied charity of a license to use a patent is

reproductions commercially, § 1.170A– not deductible under § 170(a) if the tax-

Issue (3)

7(b)(1)(i) treats the contribution as one of payer retains any substantial right in the

less than the taxpayer’s entire interest in the Section 1.170A–1(c)(1) provides that if patent.

property. In both cases, the taxpayer has not a charitable contribution is made in prop- (2) A taxpayer’s contribution to a quali-

contributed an undivided portion of its en- erty other than money, the amount of the fied charity of a patent subject to a condi-

tire interest in the property. Accordingly, nei- contribution is the fair market value of the tional reversion is not deductible under

ther contribution is deductible under property at the time of the contribution, re- § 170(a), unless the likelihood of the re-

§ 170(a). duced as provided in § 170(e). version is so remote as to be negligible.

In Situation 1, X contributes a license to Section 1.170A–1(c)(2) provides that the (3) A taxpayer’s contribution to a quali-

use a patent, but retains a substantial right, fair market value is the price at which the fied charity of a patent subject to a li-

i.e., the right to license the patent to oth- property would change hands between a cense or transfer restriction is deductible

ers. The license granted to University is willing buyer and a willing seller, neither under § 170(a), assuming all other appli-

similar to the rent-free lease described in being under any compulsion to buy or sell cable requirements of § 170 are satisfied,

§ 1.170A–7(a)(1) and the partial interest in and both having reasonable knowledge of and subject to the percentage limitations of

motion picture films described in § 1.170A– relevant facts. § 170, but the restriction reduces what

7(b)(1)(i), in that it constitutes neither X’s Rev. Rul. 85–99, 1985–2 C.B. 83, pro- would otherwise be the fair market value

entire interest in the patent, nor a fraction vides that when a donor places a restric- of the patent at the time of the contribu-

2003–11 I.R.B. 595 March 17, 2003

tion, and therefore reduces the amount of Section 409.—Qualifications Section 1033.—Involuntary

the charitable contribution for § 170 pur- for Tax Credit Employee Conversions

poses.

Stock Ownership Plans

26 CFR 1.1033–1: Involuntary conversions; non-

DRAFTING INFORMATION recognition of gain.

Is an employee stock ownership plan (ESOP) re-

The principal authors of this revenue rul- quired to adjust its basis in S corporation stock un- Taxpayers are informed of the areas declared by

ing are Martin L. Osborne and Susan der section 1367(a) of the Internal Revenue Code for the President to qualify as major disaster or emer-

the ESOP’s pro rata share of the corporation’s items? gency areas during 2002 under the Disaster Relief and

Kassell of the Office of Associate Chief Upon the distribution of S corporation stock by an Emergency Assistance Act. See Rev. Rul. 2003–29,

Counsel (Income Tax & Accounting). For ESOP to a participant, is the stock’s net unrealized ap- page 587.

further information regarding this revenue preciation under section 402(e)(4) determined using

ruling, contact Ms. Kassell at (202) 622– the ESOP’s adjusted basis in the stock? See Rev. Rul.

2003–27, page 597.

5020 (not a toll-free call). Section 1361.—S Corpora-

tion Defined

Is a corporation’s S status terminated by a di-

Section 401.—Qualified rect rollover of stock from its employee stock own- 26 CFR 1.1361–1: S corporation defined.

ership plan (ESOP) to a participant’s individual

Pension, Profit-Sharing, and retirement account (IRA)? See Rev. Proc. 2003–23, Is an employee stock ownership plan (ESOP) re-

Stock Bonus Plans page 599. quired to adjust its basis in S corporation stock un-

der § 1367(a) of the Internal Revenue Code for the

26 CFR 1.401–1: Qualified pension, profit-sharing, ESOP’s pro rata share of the corporation’s items?

and stock bonus plans. Upon the distribution of S corporation stock by an

Section 511.—Imposition of ESOP to a participant, is the stock’s net unrealized ap-

Is a corporation’s S status terminated by a di- Tax on Unrelated Business In- preciation under § 402(e)(4) determined using the

rect rollover of stock from its employee stock own- ESOP’s adjusted basis in the stock? See Rev. Rul.

ership plan (ESOP) to a participant’s individual

come of Charitable, etc., Or- 2003–27, page 597.

retirement account (IRA)? See Rev. Proc. 2003–23, ganizations

page 599.

26 CFR 1.511–3: Provisions generally applicable Is a corporation’s S status terminated by a di-

to the tax on unrelated business income. rect rollover of stock from its employee stock own-

Section 402.—Taxability of Is an employee stock ownership plan (ESOP) re-

ership plan (ESOP) to a participant’s individual

retirement account (IRA)? See Rev. Proc. 2003–23,

Beneficiary of Employees’ quired to adjust its basis in S corporation stock un- page 599.

Trust der § 1367(a) of the Internal Revenue Code for the

ESOP’s pro rata share of the corporation’s items?

Upon the distribution of S corporation stock by an

26 CFR 1.402(a)–1: Eligible rollover distributions:

ESOP to a participant, is the stock’s net unrealized ap-

Section 1366.—Pass-Thru of

questions and answers.

preciation under § 402(e)(4) determined using the Items to Shareholders

Is an employee stock ownership plan (ESOP) re- ESOP’s adjusted basis in the stock? See Rev. Rul.

quired to adjust its basis in S corporation stock un- 2003–27, page 597. 26 CFR 1.1366–1: Shareholder’s share of items of

der section 1367(a) of the Internal Revenue Code for an S corporation.

the ESOP’s pro rata share of the corporation’s items?

Is an employee stock ownership plan (ESOP) re-

Upon the distribution of S corporation stock by an Section 512.—Unrelated quired to adjust its basis in S corporation stock un-

ESOP to a participant, is the stock’s net unrealized ap-

preciation under section 402(e)(4) determined using Business Taxable Income der § 1367(a) of the Internal Revenue Code for the

the ESOP’s adjusted basis in the stock? See Rev. Rul. ESOP’s pro rata share of the corporation’s items?

2003–27, page 597. 26 CFR 1.512(a)–1: Definition. Upon the distribution of S corporation stock by an

ESOP to a participant, is the stock’s net unrealized ap-

Is an employee stock ownership plan (ESOP) re- preciation under § 402(e)(4) determined using the

quired to adjust its basis in S corporation stock un- ESOP’s adjusted basis in the stock? See Rev. Rul.

26 CFR 1.402(c)–2: Eligible rollover distributions: der § 1367(a) of the Internal Revenue Code for the 2003–27, page 597.

questions and answers. ESOP’s pro rata share of the corporation’s items?

Upon the distribution of S corporation stock by an

Is a corporation’s S status terminated by a di- ESOP to a participant, is the stock’s net unrealized ap- Is a corporation’s S status terminated by a di-

rect rollover of stock from its employee stock own- preciation under § 402(e)(4) determined using the rect rollover of stock from its employee stock own-

ership plan (ESOP) to a participant’s individual ESOP’s adjusted basis in the stock? See Rev. Rul. ership plan (ESOP) to a participant’s individual

retirement account (IRA)? See Rev. Proc. 2003–23, 2003–27, page 597. retirement account (IRA)? See Rev. Proc. 2003–23,

page 599. page 599.

March 17, 2003 596 2003–11 I.R.B.

Section 1367.—Adjustments LAW of which could affect the liability for tax

to Basis of Stock of of any shareholder and (ii) nonseparately

Section 501(a) provides that an organi- computed income or loss.

Shareholders, etc. zation described in § 401(a) is exempt from Under § 1367(a)(1), the basis of each

26 CFR 1.1367–1: Adjustments to basis of tax under subtitle A of the Code. Section shareholder’s stock in an S corporation is

shareholder’s stock in an S corporation. 401(a) provides that a trust created or or- increased for any period by the sum of the

(Also §§ 402, 409, 511, 512, 1361, 1366, 4975; ganized in the United States and forming following items determined with respect to

1.402(a)–1.) a part of a stock bonus, pension, or profit- that shareholder for such period: (i) items

Employee stock ownership plan sharing plan of an employer for the exclu- of income described in § 1366(a)(1)(A), (ii)

(ESOP). This ruling concerns basis sive benefit of its employees or their any nonseparately computed income de-

adjustments of S corporation stock held beneficiaries constitutes a qualified trust if termined under § 1366(a)(1)(B), and (iii) the

by an employee stock ownership plan the requirements of that section are satis- excess of the deductions for depletion over

(ESOP). fied. the basis of the property subject to deple-

Section 4975(e)(7) provides that an tion.

Rev. Rul. 2003–27 ESOP is a defined contribution plan (i) Under § 1367(a)(2), the basis of each

which is either a stock bonus plan which shareholder’s stock in an S corporation is

ISSUES is qualified or a stock bonus and money decreased for any period (but not below

purchase plan both of which are qualified zero) by the sum of the following items de-

(1) Is an employee stock ownership plan under § 401(a), and which are designed to termined with respect to that shareholder for

(ESOP) required to adjust its basis in S cor- invest primarily in employer securities and the period: (i) distributions by the corpo-

poration stock under § 1367(a) of the In- (ii) which is otherwise defined in regula- ration which were not includible in the in-

ternal Revenue Code for the ESOP’s pro tions prescribed by the Secretary. A plan is come of the shareholder by reason of

rata share of the corporation’s items? not treated as an ESOP unless it meets the § 1368, (ii) the items of loss and deduc-

(2) Upon the distribution of S corpora- requirements of § 409(h), § 409(o), and if tion described in § 1366(a)(1)(A), (iii) any

tion stock by an ESOP to a participant, is applicable, § 409(n), § 409(p), and § 664(g), nonseparately computed loss determined un-

the stock’s net unrealized appreciation un- and, if the employer has a registration- der § 1366(a)(1)(B), (iv) any expense of the

der § 402(e)(4) determined using the type class of securities (as defined in corporation not deductible in computing its

§ 409(e)(4)), it meets the requirements of taxable income and not properly charge-

ESOP’s adjusted basis in the stock?

section 409(e). able to capital account, and (v) the amount

FACTS Section 511(a)(1) imposes a tax on the of the shareholder’s deduction for deple-

unrelated business taxable income (as de- tion for any oil and gas property held by

Corporation X, a calendar year S cor- fined in § 512(a)) of organizations described the S corporation to the extent such de-

poration, maintains plan Y, an ESOP, as de- in § 511(a)(2), which includes organiza- duction does not exceed the proportion-

fined in section 4975(e)(7) of the Internal tions described in § 401(a). Section ate share of the adjusted basis of such

Revenue Code (Code). Y holds 100 shares 512(e)(1) provides that if an organization property allocated to such shareholder un-

of X stock that it purchased on January 1, described in § 1361(c)(6) holds stock in an der § 613A(c)(11)(B).

2001, for $10,000 with employer contri- S corporation, the interest is treated as an Section 402(a) provides that any amount

interest in an unrelated trade or business distributed by an employees’ trust described

butions. Y’s pro rata share of X’s income

and, notwithstanding any other provisions in § 401(a) that is exempt from tax under

for X’s 2001 taxable year is $1,000 (com-

of Part III of Subchapter F, all items of in- § 501(a) is taxable to the distributee in the

prised entirely of nonseparately computed come, loss, or deduction taken into ac- taxable year of the distributee in which dis-

income of $10 per share), which Y prop- count under § 1366(a) and any gain or loss tributed, under § 72 (relating to annuities).

erly reports on Form 5500, Annual Return/ on the disposition of the stock in the S cor- Section 402(e)(4)(B) provides that, for

Report of Employee Benefit Plan. X makes poration are taken into account in comput- purposes of § 402(a) and § 72, in the case

no distributions to its shareholders during ing the unrelated business taxable income of any lump-sum distribution that includes

2001. of the organization. Section 512(e)(3) pro- securities of the employer corporation, there

A, an individual who is a U.S. citizen, vides that § 512(e) does not apply to em- is excluded from gross income the net un-

is an employee of X and a participant in Y. ployer securities (within the meaning of realized appreciation (NUA) attributable to

Y holds five shares of X stock for the ben- § 409(l)) held by an ESOP described in that part of the distribution that consists of

efit of A from January 1 to December 31, § 4975(e)(7). securities of the employer corporation.

2001. On December 31, 2001, Y distrib- Section 1366(a)(1) provides that, in de- Section 402(e)(4)(C) provides that NUA

utes the five shares of X stock to A, sub- termining the tax of a shareholder for the and the resulting adjustments to basis are

shareholder’s taxable year in which the tax- determined in accordance with regulations

ject to A’s right to require X to repurchase

able year of the S corporation ends, there prescribed by the Secretary.

the shares under a fair valuation formula in

is taken into account the shareholder’s pro Section 1.402(a)–1(b)(2) of the Income

accordance with § 409(h). On that date, the

rata share of the corporation’s (i) items of Tax Regulations provides that the amount

fair market value of the five shares is $580.

income (including tax-exempt income), loss, of NUA in securities of the employer cor-

deduction, or credit the separate treatment poration that are distributed by the trust is

2003–11 I.R.B. 597 March 17, 2003

the excess of the market value of the se- with the rules of § 402(c), A will have $550 enue ruling, contact Mr. Gerson at (202)

curities at the time of distribution over the of ordinary income as a result of the dis- 622–3050 (not a toll-free call). For fur-

cost or other basis of the securities to the tribution. ther information regarding the employee

trust. plans aspects of the revenue ruling, con-

HOLDINGS tact the Employee Plans’ taxpayer assis-

ANALYSIS tance telephone service at 1–877–829–

(1) An employee stock ownership plan 5500 (a toll-free call) between the hours of

Stock of an S corporation held by an (ESOP) is required to adjust its basis in S 8:00 a.m. and 6:30 p.m. Eastern Time,

ESOP is subject to the same basis adjust- corporation stock under § 1367(a) for the Monday through Friday or contact

ments under § 1367(a) as stock held by any ESOP’s pro rata share of the corporation’s Mr. Linder at (202) 283–9888 (not a toll-

other S corporation shareholder. Accord- items. free call).

ingly, Y must increase its basis in X stock (2) Upon the distribution of S corpora-

under § 1367(a)(1) for the items of in-

tion stock by an ESOP to a participant, the

come described in § 1366(a)(1). Specifi-

cally, Y’s pro rata share of X’s

stock’s net unrealized appreciation under Section 4975.—Tax on

§ 402(e)(4) is determined using the Prohibited Transactions

nonseparately computed income for X’s

ESOP’s adjusted basis in the stock.

2001 taxable year increases the basis of

26 CFR 54.4975–7: Other statutory exemptions.

each share of X stock held by Y by $10. DRAFTING INFORMATION

Therefore, the basis of each of the five Is an employee stock ownership plan (ESOP) re-

shares of X stock held by Y for the ben- The principal authors of this revenue rul- quired to adjust its basis in S corporation stock un-

der § 1367(a) of the Internal Revenue Code for the

efit of A is increased by $10 from $100 to ing are Craig Gerson of the Office of As-

ESOP’s pro rata share of the corporation’s items?

$110. sociate Chief Counsel (Passthroughs and Upon the distribution of S corporation stock by an

Under § 402(e)(4) and § 1.402(a)– Special Industries), John Ricotta of the Of- ESOP to a participant, is the stock’s net unrealized ap-

1(b)(2), the amount of NUA in the X stock fice of Division Counsel/Associate Chief preciation under § 402(e)(4) determined using the

is $30, the excess of the market value of Counsel (Tax Exempt and Government En- ESOP’s adjusted basis in the stock? See Rev. Rul.

2003–27, page 597.

the stock at the time of distribution ($580) tities) and Steven Linder of the Employee

over Y’s adjusted basis in the stock ($550). Plans, Tax Exempt and Government Enti-

Unless A rolls the distributed stock over into ties Division. For further information re-

an eligible retirement plan in accordance garding the S corporation aspects of the rev-

March 17, 2003 598 2003–11 I.R.B.

Part III. Administrative, Procedural, and Miscellaneous

26 CFR 1.1362–2: Termination of election.

(Also §§ 401, 402, 409, 1361, 1362, 1366.)

Rev. Proc. 2003–23 Under § 401(a)(31) and A–1 of .01 The terms of the ESOP require that

§ 1.401(a)(31)–1 of the Income Tax Regu- the S corporation repurchase its stock im-

SECTION 1. PURPOSE lations, a qualified plan, including an ESOP, mediately upon the ESOP’s distribution of

is required to permit the distributee of any the stock to an IRA;

Treasury and the Service have deter- eligible rollover distribution (as defined in .02 The S corporation actually repur-

mined that it is consistent with the pur- § 402(c)(4)) to have the distribution paid in chases the S corporation stock contempo-

poses of, and policies underlying, employee a direct rollover (as defined in A–3 of raneously with, and effective on the same

stock ownership plans (ESOPs) to enable § 1.401(a)(31)–1) to an eligible retirement day as, the distribution; and

an ESOP to direct certain rollovers of dis- plan (as defined in § 402(c)(8)(B)) speci- .03 No income (including tax-exempt in-

tributions of S corporation stock to an in- fied by the distributee. Therefore, an ESOP come), loss, deduction, or credit attribut-

dividual retirement plan (IRA) in that holds S corporation stock and per-

able to the distributed S corporation stock

accordance with a distributee’s election mits distributions in the form of employer

under § 1366 is allocated to the partici-

without terminating the corporation’s S elec- securities is required to permit partici-

pant’s IRA.

tion. Accordingly, if the requirements of this pants to elect to have any distribution of S

revenue procedure are satisfied, the Ser- corporation stock that is an eligible roll- SECTION 5. DRAFTING

vice will not treat a corporation’s S elec- over distribution be paid in a direct roll- INFORMATION

tion as terminated when an ESOP distributes over to an eligible retirement plan specified

stock of that corporation to a participant’s by the distributee, including an IRA. An The principal authors of this revenue

IRA in a direct rollover. IRA trustee or custodian, however, is not procedure are Craig Gerson of the Office

a permissible S corporation shareholder. See of Associate Chief Counsel (Passthroughs

SECTION 2. BACKGROUND §§ 1361(b) and 1361(c)(6). and Special Industries), John Ricotta of the

Under § 409(h)(2)(B), an ESOP that pro- Office of Division Counsel/Associate Chief

In 1996, Congress amended vides for distributions in the form of se- Counsel (Tax Exempt and Government En-

§ 1361(b)(1)(B) of the Internal Revenue curities of an employer that is an S tities) and Steven Linder of the Employee

Code to make ESOPs (as defined in corporation is permitted to provide that the

Plans, Tax Exempt and Government Enti-

§ 4975(e)(7)), along with other plans quali- S corporation stock included in the distri-

ties Division. For further information re-

fied under § 401(a), eligible S corpora- bution is subject to a repurchase require-

garding the S corporation aspects of the

tion shareholders. A fundamental purpose ment. Thus, an ESOP is permitted to

revenue procedure, contact Mr. Gerson at

of an ESOP, including an ESOP that holds provide that any stock in an S corpora-

tion that is distributed is subject to imme- (202) 622–3050 (not a toll-free call). For

stock in an S corporation, is to provide par-

diate repurchase by the S corporation on a further information regarding the employee

ticipants with equity ownership in the em- plans aspects of the revenue procedure, con-

ployer corporation through participation in direct rollover of the stock from the ESOP

to an IRA. tact the Employee Plans’ taxpayer assis-

the ESOP, including through distributions tance telephone service at 1–877–829–

of employer securities to participants. See SECTION 3. SCOPE 5500 (a toll-free call) between the hours of

S. Rep. 94–938 at 180, 1976–3 C.B. 218 8:00 a.m. and 6:30 p.m. Eastern Time,

(stating that an ESOP “is a technique of cor- This revenue procedure sets forth cer- Monday through Friday or contact

porate finance designed to build benefi- tain requirements related to an ESOP’s dis- Mr. Linder at (202) 283–9888 (not a toll-

cial equity ownership of shares in the tribution of S corporation stock to a free call).

employer corporation in its employees”). participant where the participant elects to

Section 409(h) generally requires that an have the S corporation stock distributed to

ESOP provide for distributions in the form an IRA in a direct rollover. If these re-

quirements are satisfied, the Service will ac- 26 CFR 601.105: Examination of returns and

of employer securities. An ESOP meets the claims for refund, credit or abatement; determina-

requirements of § 409(h)(1)(A) if a par- cept the position that the distribution does tion of correct tax liability.

ticipant who is entitled to a distribution has not affect the S corporation’s election to be (Also Part 1, §§ 6011, 6111, 6112; 1.6011–4,

the right to demand that his benefits be dis- taxed as an S corporation. 301.6111–2, 301.6112–1.)

tributed in the form of employer securi- SECTION 4. APPLICATION Rev. Proc. 2003–24

ties. Section 409(h)(2)(B) provides that an

ESOP maintained by an S corporation is The Service will accept the position that SECTION 1. PURPOSE

permitted to provide for distributions only an S corporation’s election is not affected

in cash or for distributions of employer se- as a result of an ESOP’s distribution of S This revenue procedure provides that cer-

curities subject to a repurchase require- corporation stock where the participant di- tain losses are not taken into account in de-

ment which meets the requirements of rects that such stock be distributed to an termining whether a transaction is a

§ 409(h)(1)(B). IRA in a direct rollover, provided that: reportable transaction for purposes of the

2003–11 I.R.B. 599 March 17, 2003

disclosure rules under § 1.6011–4(b)(5) of (e) the asset is not, and has never been, sale or exchange of the asset (except in the

the Income Tax Regulations. part of a straddle within the meaning of case of stock or securities traded on an es-

§ 1092(c), excluding a mixed straddle un- tablished securities market, the settlement

SECTION 2. BACKGROUND der § 1.1092(b)–4T. date) for which the loss is claimed.

.01 Section 1.6011–4 requires a tax- (2) Qualifying basis. For purposes of .03 Other losses. The following losses

payer who participates in a reportable trans- section 4 of this revenue procedure, a tax- under § 165 are not taken into account in

action to disclose the transaction in payer’s basis in an asset (less adjustments determining whether a transaction is a loss

accordance with the procedures provided in for any allowable depreciation, amortiza- transaction under § 1.6011–4(b)(5):

tion, or casualty loss) is a qualifying ba- (1) A loss from fire, storm, ship-

§ 1.6011–4. Under § 1.6011–4(b), there are

sis if— wreck, or other casualty, or from theft, un-

six categories of reportable transactions. One

(a) the basis of the asset is equal to, and der § 165(c)(3);

category of reportable transaction is a loss

is determined solely by reference to, the (2) A loss from a compulsory or in-

transaction. A loss transaction is defined in

amount (including any option premium) voluntary conversion as described in

§ 1.6011–4(b)(5). §§ 1231(a)(3)(A)(ii) and 1231(a)(4)(B);

.02 Section 1.6011–4(b)(8)(i) provides paid in cash by the taxpayer for the asset

and for any improvements to the asset; (3) A loss arising from any mark-

that a transaction will not be considered a to-market treatment of an item under

reportable transaction, or will be excluded (b) the basis of the asset is determined

under § 358 by reason of a transaction un- §§ 475, 1256, 1296(a), 1.446–4(e), 1.988–

from any individual category of report- 5(a)(6), or 1.1275–6(d)(2), provided that the

able transaction, if the Commissioner makes der § 355 or § 368, and the taxpayer’s ba-

taxpayer computes its loss by using a quali-

a determination by published guidance that sis in the property exchanged in the

fying basis (as defined in section 4.02(2)

transaction was described in this section

the transaction is not subject to the report- of this revenue procedure) or a basis re-

4.02(2);

ing requirements of § 1.6011–4. sulting from previously marking the item

(c) the basis of the asset is determined

to market, or computes its loss by mak-

SECTION 3. SCOPE under § 1014;

ing appropriate adjustments for previously

(d) the basis of the asset is determined

determined mark-to-market gain or loss as

This revenue procedure applies to tax- under § 1015, and the donor’s basis in the

provided, for example, in § 475(a) or

payers that may be required to disclose re- asset was described in this section 4.02(2);

§ 1256(a)(2);

portable transactions under § 1.6011–4 or

(4) A loss arising from a hedging

and/or material advisors that may be re- (e) the basis of the asset is determined

transaction described in § 1221(b), if the

quired to maintain lists under § 301.6112–1. under § 1031(d), the taxpayer’s basis in the

taxpayer properly identifies the transac-

property that was exchanged for the asset

tion as a hedging transaction, or from a

SECTION 4. APPLICATION in the § 1031 transaction was described in

mixed straddle account under § 1.1092(b)–

this section 4.02(2), and any debt instru-

.01 In general. Losses from the sale or 4T;

ment issued or assumed by the taxpayer in

exchange of an asset with a qualifying ba- (5) A loss attributable to basis in-

connection with the § 1031 transaction is

sis under section 4.02 or losses described creases under § 860C(d)(1) during the pe-

treated as a payment in cash under sec-

in section 4.03 of this revenue procedure riod of the taxpayer’s ownership;

tion 4.02(3) of this revenue procedure.

are not taken into account in determining (6) A loss attributable to the aban-

(3) Debt instruments. Except as pro-

whether a transaction is a reportable trans- donment of depreciable tangible property

vided below, an amount paid in cash will

action. that was used by the taxpayer in a trade or

not be disregarded for purposes of sec-

business and that has a qualifying basis un-

.02 Sale or exchange of an asset with a tion 4.02(2) of this revenue procedure

der section 4.02(2) of this revenue proce-

qualifying basis. merely because the taxpayer issued a debt

dure;

(1) General rule. A loss under § 165 of instrument to obtain the cash. However, if

(7) A loss arising from the bulk sale

the Internal Revenue Code from the sale or the taxpayer has issued a debt instrument

of inventory if the basis of the inventory is

exchange of an asset is not taken into ac- to the person (or a related party as de-

determined under § 263A; or

count in determining whether a transac- scribed in § 267(b) or § 707(b)) who sold

(8) A loss that is equal to, and is de-

tion is a loss transaction under § 1.6011– or transferred the asset to the taxpayer, as-

termined solely by reference to, a pay-

4(b)(5) if— sumed a debt instrument (or took an as-

ment of cash by the taxpayer (for example,

(a) the basis of the asset (for purposes set subject to a debt instrument) issued by

a cash payment by a guarantor that re-

of determining the loss) is a qualifying ba- the person (or a related party as described

sults in a loss or a cash payment that is

sis; in § 267(b) or § 707(b)) who sold or trans-

treated as a loss from the sale of a capital

(b) the asset is not an interest in a ferred the asset to the taxpayer, or issued

asset under § 1234A or § 1234B).

passthrough entity (within the meaning of a debt instrument in exchange for improve-

§ 1260(c)(2)); ments to an asset, the taxpayer will be SECTION 5. EFFECTIVE DATE

(c) the loss from the sale or exchange treated as having paid cash for the asset or

of the asset is not treated as ordinary un- the improvement only if the debt instru- This revenue procedure is effective for

der § 988; ment is secured by the asset and all amounts transactions entered into on or after Feb-

(d) the asset has not been separated from due under the debt instrument have been ruary 28, 2003. However, if a taxpayer ap-

any portion of the income it generates; and paid in cash no later than the time of the plies § 1.6011–4 retroactively, as provided

March 17, 2003 600 2003–11 I.R.B.

in § 1.6011–4(h), to transactions entered into and/or material advisors that may be re- .16 Items resulting from debt-for-debt ex-

on or after January 1, 2003, then this rev- quired to maintain lists under § 301.6112–1. changes.

enue procedure will be effective January 1, .17 Items resulting solely from the treat-

2003, for those transactions. SECTION 4. APPLICATION ment as a sale, purchase, or lease for book

purposes and as a financing arrangement for

SECTION 6. DRAFTING Book-tax differences arising by reason

tax purposes.

INFORMATION of the following items are not taken into ac-

.18 Treatment of a transaction as a sale

count in determining whether a transac-

The principal author of this revenue pro- for book purposes and as a nontaxable

tion has a significant book-tax difference

cedure is Tara P. Volungis of the Office of transaction under § 860F(b)(1)(A) for tax

under § 1.6011–4(b)(6):

Associate Chief Counsel (Passthroughs and purposes, not including differences result-

.01 Items to the extent a book loss or ex-

Special Industries). For further informa- ing from the application of different valu-

pense is reported before or without a loss

tion regarding this revenue procedure, con- ation methodologies to determine the

or deduction for federal income tax pur-

tact Ms. Volungis at (202) 622–3080 (not relative value of REMIC interests for pur-

poses.

a toll-free call). poses of allocating tax basis among those

.02 Items to the extent income or gain

interests.

for federal income tax purposes is reported

.19 Items resulting from differences

before or without book income or gain.

solely due to the use of hedge accounting

26 CFR 601.105: Examination of returns and .03 Depreciation, depletion under § 612,

claims for refund, credit or abatement; determina- for book purposes but not for tax purposes,

and amortization relating solely to differ-

tion of correct tax liability. the use of hedge accounting under

ences in methods, lives (for example, use-

(Also Part I, §§ 6011, 6111, 6112; 1.6011–4, § 1.446–4 for tax purposes but not for book

301.6111–2, 301.6112–1.) ful lives, recovery periods), or conventions

purposes, or the use of different hedge ac-

as well as differences resulting from the ap-

Rev. Proc. 2003–25 counting methodologies for book and tax

plication of §§ 168(k), 1400I, or 1400L(b).

purposes.

.04 Percentage depletion under § 613 or

SECTION 1. PURPOSE .20 Items resulting solely from (i) the use

§ 613A, and intangible drilling costs de-

of a mark-to-market method of account-

This revenue procedure provides that cer- ductible under § 263(c).

ing for book purposes and not for tax pur-

tain book-tax differences are not taken into .05 Capitalization and amortization un-

poses, (ii) the use of a mark-to-market

account in determining whether a transac- der §§ 195, 248, and 709.

method of accounting for tax purposes but

tion is a reportable transaction for pur- .06 Bad debts or cancellation of indebt-

not for book purposes, or (iii) in the case

poses of the disclosure rules under edness income.

of a taxpayer who uses mark-to-market ac-

§ 1.6011–4(b)(6) of the Income Tax Regu- .07 Federal, state, local, and foreign

counting for both book purposes and tax

lations. taxes.

purposes, the use of different methodolo-

.08 Compensation of employees and in-

SECTION 2. BACKGROUND gies for book purposes and tax purposes.

dependent contractors, including stock op-

.21 Items resulting from the applica-

tions and pensions.

.01 Section 1.6011–4 requires a tax- tion of § 1286.

.09 Charitable contributions of cash or

payer who participates in a reportable trans- .22 Inside buildup, death benefits, or cash

tangible property.

action to disclose the transaction in surrender value of life insurance or annu-

.10 Tax exempt interest, including mu-

accordance with the procedures provided in ity contracts.

nicipal bond interest.

§ 1.6011–4. Under § 1.6011–4(b), there are .23 Life insurance reserves determined

.11 Dividends as defined in § 316 (in-

six categories of reportable transactions. One under § 807 and non-life insurance re-

cluding any dividends received deduc-

category of reportable transaction is a trans- serves determined under § 832(b).

tion), amounts treated as dividends under

action with a significant book-tax differ- .24 Capitalization of policy acquisi-

§ 78, distributions of previously taxed in-

ence. A transaction with a significant book-

come under §§ 959 and 1293, and income tion expenses of insurance companies.

tax difference is defined in § 1.6011–4(b)(6).

inclusions under §§ 551, 951, and 1293. .25 Imputed interest income or deduc-

.02 Section 1.6011–4(b)(8)(i) provides

.12 A dividends paid deduction by a tions under §§ 483, 1274, 7872, or

that a transaction will not be considered a

publicly-traded REIT. 1.1275–4.

reportable transaction, or will be excluded

.13 Patronage refunds or dividends of co- .26 Gains and losses arising under

from any individual category of report-

operatives without a § 267 relationship to §§ 986(c), 987, and 988.

able transaction, if the Commissioner makes

the taxpayer. .27 Items excluded under § 883, § 921,

a determination by published guidance that

.14 Items resulting from the applica- or an applicable treaty from a foreign cor-

the transaction is not subject to the report-

tion of § 1033. poration’s income that would otherwise be

ing requirements of § 1.6011–4.

.15 Items resulting from the applica- subject to tax under § 882.

SECTION 3. SCOPE tion of §§ 354, 355, 361, 367, 368, or 1031, .28 Section 481 adjustments.

if the taxpayer fully complies with the fil- .29 Inventory valuation differences

This revenue procedure applies to tax- ing and reporting requirements for these whether attributable to differences in last-

payers that may be required to disclose re- sections, including any requirement in the in, first-out (LIFO) computations or obso-

portable transactions under § 1.6011–4 regulations or in forms. lescence reserves.

2003–11 I.R.B. 601 March 17, 2003

.30 Section 198 deductions for environ- on or after January 1, 2003, then this rev- and Special Industries). For further infor-

mental remediation costs. enue procedure will be effective January 1, mation regarding this revenue procedure,

2003, for those transactions. contact Ms. Chyr at (202) 622–3080 (not

SECTION 5. EFFECTIVE DATE a toll-free call).

SECTION 6. DRAFTING

This revenue procedure is effective for INFORMATION

transactions entered into on or after Feb-

ruary 28, 2003. However, if a taxpayer ap- The principal author of this revenue pro-

plies § 1.6011–4 retroactively, as provided cedure is Charlotte Chyr of the Office of

in § 1.6011–4(h), to transactions entered into the Associate Chief Counsel (Passthroughs

March 17, 2003 602 2003–11 I.R.B.

Part IV. Items of General Interest

Form 5310, Application for with the current revision of Schedule Q, will Christian Village of Eastern Virginia,

Determination for not direct the applicant to this require- Inc., Mechanicsville, VA

ment. Therefore, applicants who file the Christmas in May Chaska, Chaska, MN

Terminating Plan, Revised

prior revision of Form 5310 with the cur-

November 2002 rent revision of Schedule Q are reminded

Citizens Against Rural Exploitation

Nonprofit Corporation,

Announcement 2003–13 to include the appropriate additional dem- Elfin Forest, CA

onstrations or statements with respect to

Form 5310, Application for Determina- §§ 401(a)(4) and 410(b). Coast Watch Society,

tion for Terminating Plan, which is used to Mount Vernon, WA

request determination letters for terminat- Community at the Crossroads, Inc.,

ing qualified employee benefit plans, has Eldersburg, MD

been revised. Among the changes to Form Foundations Status of Certain Comprehensive Community

5310 is the inclusion of questions relat- Organizations Development, Inc., Bethesda, MD

ing to the nondiscrimination requirements Conscious Relationships Institute, Inc.,

of § 401(a)(4) and the minimum cover- Announcement 2003–14 Richmond, MA

age requirements of § 410(b). Because of

this change, Schedule Q (Form 5300), Elec- The following organizations have failed Converse County Education Corporation,

tive Determination Requests, is not re- to establish or have been unable to main- Douglas, WY

quired to be filed with the revised Form tain their status as public charities or as op- Cuban Braille Mission for the Blind,

5310. Form 5310 applicants may still erating foundations. Accordingly, grantors Glendale, CA

choose to file Schedule Q to broaden the and contributors may not, after this date, Del Mar Home and School Club,

scope of the determination letter to ad- rely on previous rulings or designations in Santa Cruz, CA

dress certain other nondiscrimination re- the Cumulative List of Organizations (Pub-

Distinguished Place of Honor, Inc.,

quirements. Form 6088, Distributable lication 78), or on the presumption aris-

Houston, TX

Benefits From Employee Pension Benefit ing from the filing of notices under section

508(b) of the Code. This listing does not Dotted Lines, Inc., Elsmere, KY

Plans (Rev. 6/97), is required to be filed

with Form 5310 for most defined benefit indicate that the organizations have lost their Eaglewing Theatre Company,

plans and in certain other cases. status as organizations described in sec- San Jose, CA

The revised Form 5310 and instruc- tion 501(c)(3), eligible to receive deduct- Eastern Carolina Public Radio,

tions may be ordered from IRS distribu- ible contributions. Conifer, CO

tion centers by calling 1–800–TAX FORM. Former Public Charities. The follow- Elsie Schulte Trust, Tallahassee, FL

In addition, the form and instructions may ing organizations (which have been treated

as organizations that are not private foun- Eternal Hope, Inc., Anthem, AZ

be downloaded from http://www.irs.gov/

forms_pubs/forms.html. Form 5310 may be dations described in section 509(a) of the Fair Play, Inc., Sunland, CA

filed as downloaded from the web site; i.e., Code) are now classified as private Family Builders, Berkeley, CA

the requirement to provide a duplicate front foundations: Foundation for Excellence, Inc.,

page (or pink copy) has been eliminated. Adilisha Baraza, Inc., Cleveland, OH Santa Clara, CA

Applicants may continue to file the prior Aliso Niguel High School Dance Team, Freedom Fund, Inc., Oakland, CA

(June 1997) revision of Form 5310 through Aliso Viejo, CA

September 30, 2003. Applicants who file the Friends of Elmsford Shelter Animals,

prior revision of Form 5310 should in- Allies for Mentoring Asian Youth, Inc., Scarsdale, NY

clude the June 1998 revision of Schedule Minneapolis, MN Friends of Falling Waters, Inc.,

Q, if available, or the current (August 2001) Amazon Productions, Inc., Denver, CO Chipley, FL

revision of Schedule Q. An application for American Children Foundation, Inc., GDC Community Outreach, Inc.,

a determination letter for a terminating plan Roswell, GA Jackson, MS

must either show that the plan satisfies the Badger Excellence in Education Greater Atlantic City Youth Association,

nondiscriminatory contributions or ben- Foundation, Inc., Layfayette, LA Inc., Atlantic City, NJ

efits requirements of § 401(a)(4) and the