Beruflich Dokumente

Kultur Dokumente

US Internal Revenue Service: Irb07-42

Hochgeladen von

IRSOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

US Internal Revenue Service: Irb07-42

Hochgeladen von

IRSCopyright:

Verfügbare Formate

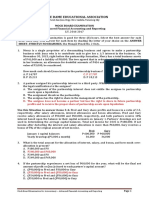

Bulletin No.

2007-42

October 15, 2007

HIGHLIGHTS

OF THIS ISSUE

These synopses are intended only as aids to the reader in

identifying the subject matter covered. They may not be

relied upon as authoritative interpretations.

INCOME TAX Announcement 2007–90, page 856.

Pre-approved defined contribution plans; determination

letters. This announcement states that the program for de-

Rev. Rul. 2007–61, page 799. termination letters for pre-approved defined contribution plans,

This ruling suspends Rev. Rul. 2007–54, 2007–38 I.R.B. 604, which are submitted on Form 5307, is being closed for a tem-

and informs taxpayers that Treasury and the Service intend porary period of time.

to address the issues considered in Rev. Rul. 2007–54 by

regulations. Rev. Rul. 2007–54 suspended.

Notice 2007–79, page 809. EXEMPT ORGANIZATIONS

This notice allows Electronic Return Originators (EROs) to sign

the following forms by rubber stamp, mechanical device (such Announcement 2007–96, page 859.

as signature pen), or computer software program: Form 8453, The IRS has revoked its determination that The Georgetown

U.S. Individual Income Tax Declaration for an IRS e-file Return; Foundation of Sandy, UT; Lumberton Family Life Center, Inc.,

Form 8878, IRS e-file Signature Authorization for Form 4868 or of Lumberton, MS; Truth in Youth & Family Services, Inc., of

Form 2350; and Form 8879, IRS e-file Signature Authorization. Leland, NC; and Cunningham Charitable Group of Los Angeles,

CA, qualify as organizations described in sections 501(c)(3)

Announcement 2007–88, page 801. and 170(c)(2) of the Code.

This announcement contains an official copy of the diplomatic

notes exchanged between the United States and Angola provid-

ing for a reciprocal exemption from taxation for income from TAX CONVENTIONS

the international operation of ships and aircraft. It includes the

United States offer and the Angola acceptance in Portuguese

and an English translation of the Angolan note. Announcement 2007–88, page 801.

This announcement contains an official copy of the diplomatic

notes exchanged between the United States and Angola provid-

EMPLOYEE PLANS ing for a reciprocal exemption from taxation for income from

the international operation of ships and aircraft. It includes the

United States offer and the Angola acceptance in Portuguese

REG–113891–07, page 821. and an English translation of the Angolan note.

Proposed regulations under section 436 of the Code provide

guidance regarding benefit restrictions for certain underfunded

defined benefit pension plans and regarding the use of certain

funding balances maintained for defined benefit pension plans.

(Continued on the next page)

Finding Lists begin on page ii.

ADMINISTRATIVE

Notice 2007–79, page 809.

This notice allows Electronic Return Originators (EROs) to sign

the following forms by rubber stamp, mechanical device (such

as signature pen), or computer software program: Form 8453,

U.S. Individual Income Tax Declaration for an IRS e-file Return;

Form 8878, IRS e-file Signature Authorization for Form 4868 or

Form 2350; and Form 8879, IRS e-file Signature Authorization.

Rev. Proc. 2007–63, page 809.

This procedure provides optional rules for deeming substan-

tiated the amount of certain business expenses of traveling

away from home reimbursed to an employee or deductible by

an employee or self-employed individual. Rev. Proc. 2006–41

superseded.

Rev. Proc. 2007–64, page 818.

This procedure modifies a scope provision and one of the terms

and conditions under which the Service grants approval of re-

quests by corporations for changes in annual accounting pe-

riods filed under Rev. Proc. 2006–45, 2006–45 I.R.B. 851.

Rev. Proc. 2006–45 modified and clarified.

Announcement 2007–91, page 857.

This document provides a change of location for a public

hearing on proposed regulations (REG–142695–05, 2007–39

I.R.B. 681) providing guidance on cafeteria plans under section

125 of the Code.

Announcement 2007–92, page 857.

This document provides a change of location for a public

hearing on proposed regulations (REG–128224–06, 2007–36

I.R.B. 551) providing guidance on which costs incurred by

estates or non-grantor trusts are subject to the 2–percent

floor for miscellaneous itemized deductions under section

67(a) of the Code.

Announcement 2007–93, page 858.

This document contains corrections to final and temporary reg-

ulations (T.D. 9344, 2007–36 I.R.B. 535) relating to the dis-

charge of liens under sections 7425 and 6343 of the Code.

Announcement 2007–94, page 858.

This document contains corrections to proposed regulations by

cross-reference to temporary regulations (REG–148951–05,

2007–36 I.R.B. 550) relating to the discharge of liens under

sections 7425 and 6343 of the Code.

October 15, 2007 2007–42 I.R.B.

The IRS Mission

Provide America’s taxpayers top quality service by helping applying the tax law with integrity and fairness to all.

them understand and meet their tax responsibilities and by

Introduction

The Internal Revenue Bulletin is the authoritative instrument of court decisions, rulings, and procedures must be considered,

the Commissioner of Internal Revenue for announcing official and Service personnel and others concerned are cautioned

rulings and procedures of the Internal Revenue Service and for against reaching the same conclusions in other cases unless

publishing Treasury Decisions, Executive Orders, Tax Conven- the facts and circumstances are substantially the same.

tions, legislation, court decisions, and other items of general

interest. It is published weekly and may be obtained from the

The Bulletin is divided into four parts as follows:

Superintendent of Documents on a subscription basis. Bulletin

contents are compiled semiannually into Cumulative Bulletins,

which are sold on a single-copy basis. Part I.—1986 Code.

This part includes rulings and decisions based on provisions of

It is the policy of the Service to publish in the Bulletin all sub- the Internal Revenue Code of 1986.

stantive rulings necessary to promote a uniform application of

the tax laws, including all rulings that supersede, revoke, mod- Part II.—Treaties and Tax Legislation.

ify, or amend any of those previously published in the Bulletin. This part is divided into two subparts as follows: Subpart A,

All published rulings apply retroactively unless otherwise indi- Tax Conventions and Other Related Items, and Subpart B, Leg-

cated. Procedures relating solely to matters of internal man- islation and Related Committee Reports.

agement are not published; however, statements of internal

practices and procedures that affect the rights and duties of

taxpayers are published. Part III.—Administrative, Procedural, and Miscellaneous.

To the extent practicable, pertinent cross references to these

subjects are contained in the other Parts and Subparts. Also

Revenue rulings represent the conclusions of the Service on the included in this part are Bank Secrecy Act Administrative Rul-

application of the law to the pivotal facts stated in the revenue ings. Bank Secrecy Act Administrative Rulings are issued by

ruling. In those based on positions taken in rulings to taxpayers the Department of the Treasury’s Office of the Assistant Sec-

or technical advice to Service field offices, identifying details retary (Enforcement).

and information of a confidential nature are deleted to prevent

unwarranted invasions of privacy and to comply with statutory

requirements. Part IV.—Items of General Interest.

This part includes notices of proposed rulemakings, disbar-

ment and suspension lists, and announcements.

Rulings and procedures reported in the Bulletin do not have the

force and effect of Treasury Department Regulations, but they

may be used as precedents. Unpublished rulings will not be The last Bulletin for each month includes a cumulative index

relied on, used, or cited as precedents by Service personnel in for the matters published during the preceding months. These

the disposition of other cases. In applying published rulings and monthly indexes are cumulated on a semiannual basis, and are

procedures, the effect of subsequent legislation, regulations, published in the last Bulletin of each semiannual period.

The contents of this publication are not copyrighted and may be reprinted freely. A citation of the Internal Revenue Bulletin as the source would be appropriate.

For sale by the Superintendent of Documents, U.S. Government Printing Office, Washington, DC 20402.

2007–42 I.R.B. October 15, 2007

Place missing child here.

October 15, 2007 2007–42 I.R.B.

Part I. Rulings and Decisions Under the Internal Revenue Code

of 1986

Section 62.—Adjusted Section 436.—Funding- under the Life Insurance Company Tax Act

Gross Income Defined Based Limits on Benefits of 1959 (the 1959 Act) are to serve as in-

and Benefit Accruals Under terpretive guides to those 1984 Act provi-

A revenue procedure provides optional rules for

deeming substantiated the amount of certain business

Single-Employer Plans sions that carry over the provisions of prior

law. See H. Rep. No. 432, Pt. 2, 98th

expenses of traveling away from home reimbursed to 26 CFR 1.436–1: Limits on benefits and benefit ac-

an employee or deductible by an employee or self- Cong., 2d Sess. 1402; S. Prt. 169, Vol.

cruals under single employer defined benefit plans.

employed individual. See Rev. Proc. 2007-63, page 1, 98th Cong. 2d Sess. 524. Since Rev.

809. The proposed regulations under section 436 pro- Rul. 2007–54 was issued, some taxpayers

vide guidance regarding benefit restrictions that have argued that the provisions on which

apply to certain underfunded defined benefit pension the ruling is based carried over from the

Section 162.—Trade or plans. The proposed regulations reflect changes 1959 Act to the 1984 Act, and that the rul-

Business Expenses made by the Pension Protection Act of 2006. See ing should not be applied retroactively be-

REG-113891-07, page 821.

A revenue procedure provides optional rules for cause its analysis is not consistent with cer-

deeming substantiated the amount of certain business tain authorities under the 1959 Act.

expenses of traveling away from home reimbursed to Section 442.—Change of The Treasury Department and the Inter-

an employee or deductible by an employee or self- Annual Accounting Period nal Revenue Service (IRS) believe it is im-

employed individual. See Rev. Proc. 2007-63, page

portant that the company’s share and poli-

809. This revenue procedure modifies a scope provision

cyholders’ share of net investment income

and one of the terms and conditions under which the

Service grants approval of requests by corporations

be determined in a manner that effectively

Section 267.—Losses, for changes in annual accounting periods filed under prevents the double benefit that otherwise

Expenses, and Interest With Rev. Proc. 2006–45, 2006–45 I.R.B. 851. See Rev. would result from the use of tax favored in-

Respect to Transactions Proc. 2007-64, page 818. vestment income (such as dividends qual-

Between Related Taxpayers ifying for the dividends received deduc-

tion) to fund the company’s obligations to

A revenue procedure provides optional rules for Section 807.—Rules for

policyholders. In addition, the Treasury

deeming substantiated the amount of certain business Certain Reserves

expenses of traveling away from home reimbursed to

Department and the IRS are mindful of

an employee or deductible by an employee or self- (Also § 812.) the benefit of notice and public comment

employed individual. See Rev. Proc. 2007-63, page and believe the issues in the revenue ruling

809. This ruling suspends Rev. Rul. would more appropriately be addressed by

2007–54, 2007–38 I.R.B. 604, and informs regulation. Accordingly, this ruling sus-

taxpayers that Treasury and the Service pends Rev. Rul. 2007–54 and informs tax-

Section 274.—Disallowance intend to address the issues considered in payers that the Treasury Department and

of Certain Entertainment, Rev. Rul. 2007–54 by regulations. Rev. the IRS intend to address in regulations the

etc., Expenses Rul. 2007–54 suspended. issues considered in Rev. Rul. 2007–54.

A revenue procedure provides optional rules for Until such time, the issues should be an-

deeming substantiated the amount of certain business Rev. Rul. 2007–61 alyzed as though Rev. Rul. 2007–54 had

expenses of traveling away from home reimbursed to not been issued. Regulations also may pro-

an employee or deductible by an employee or self- Rev. Rul. 2007–54, 2007–38 I.R.B.

vide guidance for determining required in-

employed individual. See Rev. Proc. 2007-63, page 604, released on August 16, 2007, ad-

terest under section 812(b)(2) if neither the

809. dresses the determination of life insurance

prevailing State assumed rate nor the ap-

reserves under section 807 of the Inter-

plicable Federal rate is used to determine

nal Revenue Code for a variable contract

Section 430.—Minimum the reserves for an insurance or annuity

where some or all of the reserves are ac-

Funding Standards for contract. This project has been added to

counted for as part of a life insurance com-

Single-Employer Defined pany’s separate account reserves. The rul-

the 2007-2008 Priority Guidance Plan and

Benefit Pension Plans ing also addresses the interest rate used un-

will be reflected in the next periodic update

to that plan.

26 CFR 1.430(f)–1: Effect of prefunding balance and der section 812(b)(2) to calculate required

funding standard carryover balance. interest on the reserves if the amounts of

EFFECT ON OTHER DOCUMENTS

those reserves are determined under sec-

The proposed regulations under section 430(f) tion 807(d)(2).

provide guidance regarding the use of certain fund- Rev. Rul. 2007–54 is suspended.

Sections 807 and 812 were added to

ing balances maintained for defined benefit pension

plans. The proposed regulations reflect changes

the Code by the Deficit Reduction Act of DRAFTING INFORMATION

made by the Pension Protection Act of 2006. See 1984, P.L. 98–369 (the 1984 Act). The leg-

REG-113891-07, page 821. islative history of the 1984 Act provides The principal author of this revenue rul-

that the regulations, rulings and case law ing is Stephen D. Hooe of the Office of

2007–42 I.R.B. 799 October 15, 2007

Associate Chief Counsel (Financial Insti- issues considered in Rev. Rul. 2007–54 by regula- Section 6061.—Signing

tutions & Products). For further infor- tions. See Rev. Rul. 2007-61, page 799. of Returns and Other

mation regarding this revenue ruling, con- Documents

tact Mr. Hooe at (202) 622–3900 (not a Section 898.—Taxable

toll-free call). This notice allows Electronic Return Originators

Year of Certain Foreign (EROs) to sign the following forms by rubber stamp,

Corporations mechanical device (such as signature pen), or com-

puter software program: Form 8453, U.S. Individ-

Section 812.—Definition This revenue procedure modifies a scope provision ual Income Tax Declaration for an IRS e-file Return;

of Company’s Share and and one of the terms and conditions under which the Form 8878, IRS e-file Signature Authorization for

Policyholders’ Share Service grants approval of requests by corporations Form 4868 or Form 2350; and Form 8879, IRS e-file

for changes in annual accounting periods filed under Signature Authorization. See Notice 2007-79, page

A revenue ruling that suspends Rev. Rul. Rev. Proc. 2006–45, 2006–45 I.R.B. 851. See Rev. 809.

2007–54, 2007–38 I.R.B. 604, and informs taxpayers Proc. 2007-64, page 818.

that Treasury and the Service intend to address the

October 15, 2007 800 2007–42 I.R.B.

Part II. Treaties and Tax Legislation

Subpart A.—Tax Conventions and Other Related Items

United States Angola and aircraft for taxable years beginning on The text of the agreement is as follows.

Reciprocol Exemption or after January 1, 2006. The diplomatic

Agreement notes reproduced herein contain the terms

of the reciprocal exemptions.

Announcement 2007–88 The principal author of this announce-

ment is Patricia Bray of the Office of

The United States and Angola have ex- Associate Chief Counsel (International).

changed diplomatic notes evidencing a re- For further information regarding this an-

ciprocal exemption agreement for income nouncement, contact Patricia Bray at (202)

from the international operation of ships 622–5871 (not a toll-free call).

2007–42 I.R.B. 801 October 15, 2007

October 15, 2007 802 2007–42 I.R.B.

2007–42 I.R.B. 803 October 15, 2007

October 15, 2007 804 2007–42 I.R.B.

2007–42 I.R.B. 805 October 15, 2007

October 15, 2007 806 2007–42 I.R.B.

2007–42 I.R.B. 807 October 15, 2007

October 15, 2007 808 2007–42 I.R.B.

Part III. Administrative, Procedural, and Miscellaneous

Alternative Signature Methods SECTION 3. REQUIREMENTS FOR of an employee for lodging, meal, and in-

for Electronic Return USE OF ALTERNATIVE METHODS cidental expenses, or for meal and inci-

Originators OF SIGNING dental expenses, incurred while traveling

away from home are deemed substantiated

The alternative methods of signing that under § 1.274–5 of the Income Tax Reg-

Notice 2007–79 this notice authorizes must include either ulations when a payor (the employer, its

SECTION I. PURPOSE a facsimile of the individual ERO’s signa- agent, or a third party) provides a per diem

ture or of the ERO’s printed name. EROs allowance under a reimbursement or other

This notice provides that the Internal using one of these alternative means are expense allowance arrangement to pay for

Revenue Service will allow Electronic Re- personally responsible for affixing their the expenses. In addition, this revenue

turn Originators (EROs) to sign the follow- signatures to returns or requests for exten- procedure provides an optional method for

ing forms by rubber stamp, mechanical de- sion. employees and self-employed individuals

vice (such as signature pen), or computer This notice applies only to EROs that who are not reimbursed to use in comput-

software program: Form 8453, U.S. Indi- sign Form 8453, Form 8878, or Form ing the deductible costs paid or incurred

vidual Income Tax Declaration for an IRS 8879, and does not alter the signature re- for business meal and incidental expenses,

e-file Return; Form 8878, IRS e-file Signa- quirements for any other type of document or for incidental expenses only if no meal

ture Authorization for Form 4868 or Form currently required to be manually signed, costs are paid or incurred, while travel-

2350; and Form 8879, IRS e-file Signature such as elections, applications for changes ing away from home. Use of a method

Authorization. in accounting method, powers of attorney, described in this revenue procedure is not

or consent forms. In addition, this notice mandatory, and a taxpayer may use actual

SECTION 2. BACKGROUND does not alter the requirement that Form allowable expenses if the taxpayer main-

8453, Form 8878, or Form 8879 be signed tains adequate records or other sufficient

Section 6061 of the Internal Revenue

by the taxpayer making these forms by evidence for proper substantiation. This

Code and Treas. Reg. § 1.6061–1(a) gen-

handwritten signature or other authorized revenue procedure does not provide rules

erally provide that any tax return, state-

means. under which the amount of an employee’s

ment, or other document shall be signed

in accordance with forms, instructions, or lodging expenses will be deemed substan-

SECTION 4. EFFECTIVE DATE tiated when a payor provides an allowance

regulations prescribed by the Secretary.

Publication 1345, Handbook for Autho- This notice applies to any Form 8453, to pay for those expenses but not meal and

rized IRS e-file Providers of Individual Form 8878, or Form 8879 filed on or after incidental expenses.

Income Tax Returns, sets forth the proce- October 15, 2007. SECTION 2. BACKGROUND AND

dures for completing the Form 8453, Form CHANGES

8878, and Form 8879. If providing the sig- SECTION 5. DRAFTING

nature on a paper declaration, the taxpayer INFORMATION

.01 Section 162(a) of the Internal Rev-

and the ERO (and the paid preparer if dif- enue Code allows a deduction for all the or-

ferent from the ERO) must complete and The principal author of this notice is

Michael E. Hara of the Office of Asso- dinary and necessary expenses paid or in-

sign the Form 8453 before the electronic curred during the taxable year in carrying

data portion of the return is submitted. ciate Chief Counsel (Procedure & Admin-

istration). For further information regard- on any trade or business. Under that pro-

Taxpayers may wish to sign their returns vision, an employee or self-employed in-

electronically, but may choose to authorize ing this notice, contact Michael E. Hara at

(202) 622–4910 (not a toll-free call). dividual may deduct expenses paid or in-

their ERO to enter their Personal Identi- curred while traveling away from home in

fication Number (PIN) in the electronic pursuit of a trade or business. However,

return record by completing the appro- under § 262, no portion of the travel ex-

26 CFR 601.105: Examination of returns and claims

priate IRS e-file signature authorization for refund, credit, or abatement; determination of penses that is attributable to personal, liv-

form. Form 8879 authorizes an ERO to correct tax liability. ing, or family expenses is deductible.

enter PINs on Individual Income Tax Re- (Also Part I, §§ 62, 162, 267, 274; 1.62–2, 1.162–17,

1.267(a)–1, 1.274–5.)

.02 Section 274(n) generally limits the

turns, and Form 8878 authorizes an ERO amount allowable as a deduction under

to enter PINs on Forms 4868, Application § 162 for any expense for food, bever-

for Automatic Extension of Time To File Rev. Proc. 2007–63

ages, or entertainment to 50 percent of

U.S. Individual Income Tax Return; and the amount of the expense that otherwise

Form 2350, Application for Extension of SECTION 1. PURPOSE would be allowable as a deduction. In the

Time To File U.S. Income Tax Return. case of any expenses for food or bever-

This revenue procedure updates Rev. ages consumed while away from home

Proc. 2006–41, 2006–43 I.R.B. 777, and (within the meaning of § 162(a)(2)) by an

provides rules under which the amount of individual during, or incident to, the pe-

ordinary and necessary business expenses riod of duty subject to the hours of service

2007–42 I.R.B. 809 October 15, 2007

limitations of the Department of Trans- Section 62(c) further provides that the sub- travel pursuant to rules prescribed under

portation, § 274(n)(3) gradually increases stantiation requirements described therein § 274(d) and § 1.274–5(g) or (j), and that

the deductible percentage to 80 percent do not apply to any expense to the extent the employee is not required to return, is

for taxable years beginning in 2008 or that, under the grant of regulatory authority subject to withholding and payment of

thereafter. For taxable years beginning in prescribed in § 274(d), the Commissioner employment taxes. See §§ 31.3121(a)–3,

2007, the deductible percentage for these has provided that substantiation is not re- 31.3231(e)–1(a)(5), 31.3306(b)–2, and

expenses is 75 percent. quired for the expense. 31.3401(a)–4 of the Employment Tax

.03 Section 274(d) provides, in part, .07 Under § 1.62–2(c), a reimburse- Regulations. Because the employee is not

that no deduction is allowed under § 162 ment or other expense allowance arrange- required to return this excess portion, the

for any travel expense (including meals ment satisfies the requirements of § 62(c) reasonable period of time provisions of

and lodging while away from home) unless if it meets the requirements of business § 1.62–2(g) (relating to the return of ex-

the taxpayer complies with certain sub- connection, substantiation, and returning cess amounts) do not apply to this portion.

stantiation requirements. Section 274(d) amounts in excess of expenses as specified .09 Under § 1.62–2(h)(2)(i)(B)(4), the

further provides that regulations may pre- in the regulations. If an arrangement meets Commissioner has the discretion to pre-

scribe that some or all of the substantiation these requirements, all amounts paid under scribe special rules regarding the timing of

requirements do not apply to an expense the arrangement are treated as paid under withholding and payment of employment

that does not exceed an amount prescribed an accountable plan and are excluded from taxes on per diem allowances.

by the regulations. income and wages. If an arrangement does .10 Section 1.274–5(j)(1) grants the

.04 Section 1.274–5(g), in part, grants not meet these requirements, all amounts Commissioner the authority to establish a

the Commissioner the authority to pre- paid under the arrangement are treated as method under which a taxpayer may elect

scribe rules relating to reimbursement paid under a nonaccountable plan and are to use a specified amount for meals paid or

arrangements or per diem allowances for included in the employee’s gross income, incurred while traveling away from home

ordinary and necessary expenses paid must be reported as wages or compensa- in lieu of substantiating the actual cost of

or incurred while traveling away from tion on the employee’s Form W–2, and are meals.

home. Pursuant to this grant of author- subject to the withholding and payment of .11 Section 1.274–5(j)(3) grants the

ity, the Commissioner may prescribe employment taxes. Section 1.62–2(e)(2) Commissioner the authority to establish a

rules under which these arrangements or specifically provides that substantiation of method under which a taxpayer may elect

allowances, if in accordance with reason- certain business expenses in accordance to use a specified amount for incidental

able business practice, are regarded (1) as with rules prescribed under the authority of expenses paid or incurred while traveling

equivalent to substantiation, by adequate § 1.274–5(g) or (j) is treated as substantia- away from home in lieu of substantiating

records or other sufficient evidence, of the tion of the amount of the expenses for pur- the actual cost of incidental expenses.

amount of travel expenses for purposes poses of § 1.62–2. Under § 1.62–2(f)(2), .12 Sections 3.02(1)(a), 4.04(6), and

of § 1.274–5(c), and (2) as satisfying the the Commissioner may prescribe rules un- 5.06 of this revenue procedure provide

requirements of an adequate accounting der which an arrangement providing per transition rules for the last 3 months of

to the employer of the amount of travel diem allowances is treated as satisfying the calendar year 2007.

expenses for purposes of § 1.274–5(f). requirement of returning amounts in ex- .13 Section 5.02 of this revenue pro-

.05 For purposes of determining ad- cess of expenses, even though the arrange- cedure contains revisions to the per diem

justed gross income, § 62(a)(2)(A) allows ment does not require the employee to re- rates for high-cost localities and for other

an employee a deduction for expenses al- turn the portion of the allowance that re- localities for purposes of section 5.

lowed by Part VI (§ 161 and following), lates to days of travel substantiated and .14 Section 5.03 of this revenue proce-

subchapter B, chapter 1 of the Code, paid that exceeds the amount of the employee’s dure contains the list of high-cost localities

or incurred by the employee in connection expenses deemed substantiated pursuant to and section 5.04 of this revenue procedure

with the performance of services as an em- rules prescribed under § 274(d), provided describes changes to the list of high-cost

ployee under a reimbursement or other ex- the allowance is reasonably calculated not localities for purposes of section 5.

pense allowance arrangement with a payor. to exceed the amount of the employee’s .15 Sections 7.10 and 8.06 of this

.06 Section 62(c) provides that an ar- expenses or anticipated expenses and the revenue procedure refer to Rev. Rul.

rangement is not treated as a reimburse- employee is required to return within a rea- 2006–56, 2006–46 I.R.B. 874, which

ment or other expense allowance arrange- sonable period of time any portion of the describes circumstances when a payor’s

ment for purposes of § 62(a)(2)(A) if it— allowance that relates to days of travel not reimbursement or other expense allowance

(1) does not require the employee to substantiated. arrangement evidences a pattern of abuse

substantiate the expenses covered by the .08 Section 1.62–2(h)(2)(i)(B) pro- of the rules of § 62(c) and the regulations

arrangement to the payor, or vides that, if a payor pays a per diem thereunder.

(2) provides the employee with the right allowance that meets the requirements of

to retain any amount in excess of the sub- § 1.62–2(c)(1), the portion, if any, of the SECTION 3. DEFINITIONS

stantiated expenses covered under the ar- allowance that relates to days of travel sub-

rangement. stantiated in accordance with § 1.62–2(e), .01 Per diem allowance. The term “per

that exceeds the amount of the employee’s diem allowance” means a payment under a

expenses deemed substantiated for the

October 15, 2007 810 2007–42 I.R.B.

reimbursement or other expense allowance connection with the performance of ser- was identified by the payor either by mak-

arrangement that is — vices as an employee of the employer stops ing a separate payment or by specifically

(1) paid with respect to ordinary and for sleep or rest. identifying the amount of the allowance,

necessary business expenses incurred, or (3) Incidental expenses. The term “in- or (b) an allowance computed on that ba-

that the payor reasonably anticipates will cidental expenses” has the same meaning sis was commonly used in the industry

be incurred, by an employee for lodging, as in the Federal Travel Regulations, 41 in which the employee is employed. See

meal, and incidental expenses, or for meal C.F.R. 300–3.1 (2007). Thus, based on the § 1.62–2(d)(3)(ii).

and incidental expenses, for travel away current definition of “incidental expenses”

from home in connection with the perfor- in the Federal Travel Regulations, “inci- SECTION 4. PER DIEM

mance of services as an employee of the dental expenses” means fees and tips given SUBSTANTIATION METHOD

employer, to porters, baggage carriers, bellhops, ho-

(2) reasonably calculated not to exceed tel maids, stewards or stewardesses and .01 Per diem allowance. If a payor pays

the amount of the expenses or the antici- others on ships, and hotel servants in for- a per diem allowance in lieu of reimburs-

pated expenses, and eign countries; transportation between ing actual lodging, meal, and incidental ex-

(3) paid at or below the applicable fed- places of lodging or business and places penses incurred or to be incurred by an

eral per diem rate, a flat rate or stated where meals are taken, if suitable meals employee for travel away from home, the

schedule, or in accordance with any other can be obtained at the temporary duty amount of the expenses that is deemed sub-

Service-specified rate or schedule. site; and the mailing cost associated with stantiated for each calendar day is equal to

.02 Federal per diem rate and federal filing travel vouchers and payment of em- the lesser of the per diem allowance for

M&IE rate. ployer-sponsored charge card billings. that day or the amount computed at the

(1) In general. The federal per diem .03 Flat rate or stated schedule. federal per diem rate (see section 3.02 of

rate is equal to the sum of the applicable (1) In general. Except as provided in this revenue procedure) for the locality of

federal lodging expense rate and the appli- section 3.03(2) of this revenue procedure, travel for that day (or partial day, see sec-

cable federal meal and incidental expense an allowance is paid at a flat rate or stated tion 6.04 of this revenue procedure).

(M&IE) rate for the day and locality of schedule if it is provided on a uniform .02 Meal and incidental expenses only

travel. and objective basis with respect to the ex- per diem allowance. If a payor pays a

(a) CONUS rates. The rates for lo- penses described in section 3.01 of this per diem allowance only for meal and in-

calities in the continental United States revenue procedure. The allowance may be cidental expenses in lieu of reimbursing

(“CONUS”) are set forth in Appendix A paid with respect to the number of days actual meal and incidental expenses in-

to 41 C.F.R. ch. 301. However, in apply- away from home in connection with the curred or to be incurred by an employee

ing section 4.01, 4.02, or 4.03 of this rev- performance of services as an employee for travel away from home, the amount of

enue procedure, taxpayers may continue or on any other basis that is consistently the expenses that is deemed substantiated

to use the CONUS rates in effect for the applied and in accordance with reasonable for each calendar day is equal to the lesser

first 9 months of 2007 for expenses of all business practice. Thus, for example, an of the per diem allowance for that day or

CONUS travel away from home that are hourly payment to cover meal and inciden- the amount computed at the federal M&IE

paid or incurred during calendar year 2007 tal expenses paid to a pilot or flight atten- rate for the locality of travel for that day

in lieu of the updated GSA rates. A tax- dant who is traveling away from home in (or partial day). A per diem allowance

payer must consistently use either these connection with the performance of ser- is treated as paid only for meal and inci-

rates or the updated rates for the period Oc- vices as an employee is an allowance paid dental expenses if (1) the payor pays the

tober 1, 2007, through December 31, 2007. at a flat rate or stated schedule. Likewise, employee for actual expenses for lodging

(b) OCONUS rates. The rates for local- a payment based on the number of miles based on receipts submitted to the payor,

ities outside the continental United States traveled (such as cents per mile) to cover (2) the payor provides the lodging in kind,

(“OCONUS”) are established by the Sec- meal and incidental expenses paid to an (3) the payor pays the actual expenses for

retary of Defense (rates for non-foreign lo- over-the-road truck driver who is traveling lodging directly to the provider of the lodg-

calities, including Alaska, Hawaii, Puerto away from home in connection with the ing, (4) the payor does not have a reason-

Rico, the Northern Mariana Islands, and performance of services as an employee is able belief that lodging expenses were or

the possessions of the United States) and an allowance paid at a flat rate or stated will be incurred by the employee, or (5) the

by the Secretary of State (rates for for- schedule. allowance is computed on a basis similar

eign localities), and are published in the (2) Limitation. An allowance that is to that used in computing the employee’s

Per Diem Supplement to the Standardized computed on a basis similar to that used wages or other compensation (such as the

Regulations (Government Civilians, For- in computing the employee’s wages or number of hours worked, miles traveled,

eign Areas) (updated on a monthly basis). other compensation (such as the number or pieces produced).

(c) Internet access to the rates. The of hours worked, miles traveled, or pieces .03 Optional method for meal and in-

CONUS and OCONUS rates may be found produced) does not meet the business con- cidental expenses only deduction. In lieu

on the Internet at www.gsa.gov. nection requirement of § 1.62–2(d), is not of using actual expenses in computing the

(2) Locality of travel. The term “lo- a per diem allowance, and is not paid at amount allowable as a deduction for or-

cality of travel” means the locality where a flat rate or stated schedule, unless, as dinary and necessary meal and inciden-

an employee traveling away from home in of December 12, 1989, (a) the allowance tal expenses paid or incurred for travel

2007–42 I.R.B. 811 October 15, 2007

away from home, employees and self-em- CONUS locality of travel, and $58 as the (6) Transition rules. Under the calen-

ployed individuals who pay or incur meal federal M&IE rate for any OCONUS lo- dar-year convention provided in section

expenses may use an amount computed at cality of travel. A payor that uses either (or 4.04(3), a taxpayer who used the federal

the federal M&IE rate for the locality of both) of these special rates with respect to M&IE rates during the first 9 months of

travel for each calendar day (or partial day) an employee must use the special rate(s) calendar year 2007 to substantiate the

the employee or self-employed individual for all amounts subject to section 4.02 of amount of an individual’s travel expenses

is away from home. This amount will be this revenue procedure paid to that em- under sections 4.02 or 4.03 of Rev. Proc.

deemed substantiated for purposes of para- ployee for travel away from home within 2006–41 may not use, for that individual,

graphs (b)(2) and (c) of § 1.274–5, pro- CONUS and/or OCONUS, as the case may the special transportation industry rates

vided the employee or self-employed indi- be, during the calendar year. Similarly, an provided in this section 4.04 until January

vidual substantiates the elements of time, employee or self-employed individual that 1, 2008. Similarly, a taxpayer who used

place, and business purpose of the travel uses either (or both) of these special rates the special transportation industry rates

for that day (or partial day) in accordance must use the special rate(s) for all amounts during the first 9 months of calendar year

with those regulations. See section 6.05(1) computed pursuant to section 4.03 of this 2007 to substantiate the amount of an in-

of this revenue procedure for rules related revenue procedure for travel away from dividual’s travel expenses may not use,

to the application of the limitation under home within CONUS and/or OCONUS, as for that individual, the federal M&IE rates

§ 274(n) to amounts determined under this the case may be, during the calendar year. until January 1, 2008.

section 4.03. See section 4.05 of this rev- See section 4.04(6) of this revenue proce- .05 Optional method for incidental ex-

enue procedure for a method for substanti- dure for transition rules. penses only deduction. In lieu of using

ating incidental expenses that may be used (4) Periodic rule. A payor described in actual expenses in computing the amount

by employees or self-employed individu- section 4.04(1) of this revenue procedure allowable as a deduction for ordinary and

als who do not pay or incur meal expenses. may compute the amount of the em- necessary incidental expenses paid or in-

.04 Special rules for transportation in- ployee’s expenses that is deemed substan- curred for travel away from home, employ-

dustry. tiated under section 4.02 of this revenue ees and self-employed individuals who do

(1) In general. This section 4.04 ap- procedure periodically (not less frequently not pay or incur meal expenses for a calen-

plies to (a) a payor that pays a per diem than monthly), rather than daily, by com- dar day (or partial day) of travel away from

allowance only for meal and incidental ex- paring the total per diem allowance paid home may use, for each calendar day (or

penses for travel away from home as de- for the period to the sum of the amounts partial day) the employee or self-employed

scribed in section 4.02 of this revenue pro- computed either at the federal M&IE individual is away from home, an amount

cedure to an employee in the transportation rate(s) for the localities of travel, or at the computed at the rate of $3 per day for any

industry, or (b) an employee or self-em- special rate described in section 4.04(3), CONUS or OCONUS locality of travel.

ployed individual in the transportation in- for the days (or partial days) the employee This amount will be deemed substantiated

dustry who computes the amount allow- is away from home during the period. for purposes of paragraphs (b)(2) and (c)

able as a deduction for meal and incidental (5) Examples. of § 1.274–5, provided the employee or

expenses for travel away from home in ac- (a) Example 1. Taxpayer, an employee in the self-employed individual substantiates the

cordance with section 4.03 of this revenue transportation industry, travels away from home on elements of time, place, and business pur-

business within CONUS on 17 days (including par-

procedure. tial days) during a calendar month and receives a per

pose of the travel for that day (or partial

(2) Transportation industry defined. diem allowance only for meal and incidental expenses day) in accordance with those regulations.

For purposes of this section 4.04, an em- from a payor that uses the special rule under sec- See section 4.03 of this revenue procedure

ployee or self-employed individual is in tion 4.04(3) of this revenue procedure. The amount for a method that may be used by em-

the transportation industry only if the em- deemed substantiated under section 4.02 of this rev- ployees or self-employed individuals who

enue procedure is equal to the lesser of the total per

ployee’s or individual’s work (a) is of the diem allowance paid for the month or $884 (17 days

pay or incur meal expenses. The method

type that directly involves moving people at $52 per day). authorized by this section 4.05 may not

or goods by airplane, barge, bus, ship, (b) Example 2. Taxpayer, a truck driver employee be used by payors that use section 4.01,

train, or truck, and (b) regularly requires in the transportation industry, is paid a “cents-per- 4.02, or 5.01 of this revenue procedure, or

travel away from home which, during mile” allowance that qualifies as an allowance paid by employees or self-employed individu-

under a flat rate or stated schedule as defined in sec-

any single trip away from home, usually tion 3.03 of this revenue procedure. Taxpayer travels

als who use the method described in sec-

involves travel to localities with differ- away from home on business for 10 days. Based on tion 4.03 of this revenue procedure. See

ing federal M&IE rates. For purposes the number of miles driven by Taxpayer, Taxpayer’s section 6.05(4) of this revenue procedure

of the preceding sentence, a payor must employer pays an allowance of $500 for the 10 days for rules related to the application of the

determine that an employee or a group of of business travel. Taxpayer actually drives for 8 limitation under § 274(n) to amounts de-

days, and does not drive for the other 2 days Taxpayer

employees is in the transportation indus- is away from home. Taxpayer is paid under the peri-

termined under this section 4.05.

try by using a method that is consistently odic rule used for transportation industry employers

applied and in accordance with reasonable and employees in accordance with section 4.04(4) of SECTION 5. HIGH-LOW

business practice. this revenue procedure. The amount deemed substan- SUBSTANTIATION METHOD

(3) Rates. A taxpayer described in sec- tiated is the full $500 because that amount does not

exceed $520 (ten days away from home at $52 per

tion 4.04(1) of this revenue procedure may day).

.01 In general. If a payor pays a per

treat $52 as the federal M&IE rate for any diem allowance in lieu of reimbursing ac-

October 15, 2007 812 2007–42 I.R.B.

tual lodging, meal, and incidental expenses tion method may be used in lieu of the as if it were the federal per diem rate for

incurred or to be incurred by an employee per diem substantiation method provided the locality of travel. For purposes of ap-

for travel away from home and the payor in section 4.01 of this revenue procedure, plying the high-low substantiation method

uses the high-low substantiation method but may not be used in lieu of the meal and and the § 274(n) limitation on meal ex-

described in this section 5 for travel within incidental expenses only per diem substan- penses (see section 6.05(3) of this revenue

CONUS, the amount of the expenses that tiation method provided in section 4.02 of procedure), the amount of the high and low

is deemed substantiated for each calendar this revenue procedure. rates that is treated as paid for meals is

day is equal to the lesser of the per diem .02 Specific high-low rates. Except as $58 for a high-cost locality and $45 for any

allowance for that day or the amount com- provided in section 5.06 of this revenue other locality within CONUS.

puted at the rate set forth in section 5.02 of procedure, the per diem rate set forth in this .03 High-cost localities. The following

this revenue procedure for the locality of section 5.02 is $237 for travel to any “high- localities have a federal per diem rate of

travel for that day (or partial day, see sec- cost locality” specified in section 5.03 of $194 or more, and are high-cost localities

tion 6.04 of this revenue procedure). Ex- this revenue procedure, or $152 for travel for all of the calendar year or the portion of

cept as provided in section 5.06 of this rev- to any other locality within CONUS. The the calendar year specified in parentheses

enue procedure, this high-low substantia- high or low rate, as appropriate, applies under the key city name:

Key City County or other defined location

Arizona

Phoenix/Scottsdale Maricopa

(January 1-March 31)

Sedona City Limits of Sedona

(March 1-April 30)

California

Napa Napa

Palm Springs Riverside

(January 1-April 30)

San Diego San Diego

San Francisco San Francisco

Santa Barbara Santa Barbara

Santa Monica City limits of Santa Monica

South Lake Tahoe El Dorado

(December 1-March 31)

Yosemite National Park Mariposa

Colorado

Aspen Pitkin

(December 1-April 30)

Crested Butte/Gunnison Gunnison

(December 1-March 31)

Silverthorne/Breckenridge Summit

(December 1-March 31)

Steamboat Springs Routt

(December 1-February 29)

Telluride San Miguel

(October 1-March 31)

Vail Eagle

District of Columbia

Washington, D.C. (also the cities of Alexandria, Falls Church, and Fairfax, and the counties of Arlington and Fairfax, in

Virginia; and the counties of Montgomery and Prince George’s in Maryland) (See also Maryland and Virginia)

2007–42 I.R.B. 813 October 15, 2007

Key City County or other defined location

Florida

Fort Lauderdale Broward

(October 1-April 30)

Fort Walton Beach/De Funiak Springs Okaloosa and Walton

(June 1-July 31)

Key West Monroe

Miami Miami-Dade

(October 1-February 29)

Naples Collier

(February 1-March 31)

Palm Beach Boca Raton, Delray Beach, Jupiter, Palm

(January 1-March 31) Beach Gardens, Palm Beach, Palm Beach

Shores, Singer Island and West Palm Beach

Stuart Martin

(February 1-March 31)

Illinois

Chicago Cook and Lake

Maryland

(For the counties of Montgomery and Prince George’s,

see District of Columbia)

Baltimore City Baltimore

Cambridge/St. Michaels Dorchester and Talbot

(April 1-August 31)

Ocean City Worcester

(June 1-August 31)

Massachusetts

Boston/Cambridge Suffolk, City of Cambridge

Martha’s Vineyard Dukes

(July 1-August 31)

Nantucket Nantucket

Nevada

Incline Village/Crystal Bay/Reno/Sparks Washoe

(June 1-August 31)

New Hampshire

Conway Caroll

(July 1-August 31)

New York

Floral Park/Garden City/Glen Cove/Great Neck/Roslyn Nassau

Manhattan The Boroughs of Manhattan, Brooklyn, the

Bronx and Staten Island

Queens Queens

Saratoga Springs/Schenectady Saratoga and Schenectady

(July 1-August 31)

Tarrytown/White Plains/New Rochelle/Yonkers Westchester

Pennsylvania

Philadelphia Philadelphia

October 15, 2007 814 2007–42 I.R.B.

Key City County or other defined location

Rhode Island

Jamestown/Middletown/Newport Newport

(October 1-November 30 and

February 1-September 30)

Providence Providence

Utah

Park City Summit

(January 1-March 31)

Virginia

(For the cities of Alexandria, Falls Church, and Fairfax, and the counties of Arlington and Fairfax, see District of Columbia)

Loudon County Loudon

Virginia Beach City of Virginia Beach

(June 1-August 31)

Washington

Seattle King

Wisconsin

Lake Geneva Walworth

(June 1-September 30)

.04 Changes in high-cost localities. ities: New Orleans, Louisiana and Lake Proc. 2006–41 for an employee during the

The list of high-cost localities in section Placid, New York. first 9 months of calendar year 2007 must

5.03 of this revenue procedure differs from .05 Specific limitation. continue to use the high-low substantiation

the list of high-cost localities in section (1) Except as provided in section method for the remainder of calendar year

5.03 of Rev. Proc. 2006–41 (changes 5.05(2) of this revenue procedure, a 2007 for that employee. A payor described

listed by key cities). payor that uses the high-low substanti- in the previous sentence may use the rates

(1) The following localities have ation method with respect to an employee and high-cost localities published in sec-

been added to the list of high-cost lo- must use that method for all amounts paid tion 5 of Rev. Proc. 2006–41, in lieu of

calities: Sedona, Arizona; Napa, Cal- to that employee for travel away from the updated rates and high-cost localities

ifornia; Palm Springs, California; San home within CONUS during the calendar provided in section 5 of this revenue proce-

Diego, California; Yosemite National year. See section 5.06 of this revenue dure, for travel on or after October 1, 2007,

Park, California; Silverthorne/Brecken- procedure for transition rules. and before January 1, 2008, if those rates

ridge, Colorado; Incline Village/Crystal (2) With respect to an employee de- and localities are used consistently during

Bay/Reno/Sparks, Nevada; Conway, New scribed in section 5.05(1) of this revenue this period for all employees reimbursed

Hampshire; Tarrytown/White Plains/New procedure, the payor may reimburse ac- under this method.

Rochelle/Yonkers, New York; Loudon tual expenses or use the meal and inci-

County, Virginia; Virginia Beach, Vir- dental expenses only per diem substan- SECTION 6. LIMITATIONS AND

ginia; and Lake Geneva, Wisconsin. tiation method described in section 4.02 SPECIAL RULES

(2) The portion of the year for which of this revenue procedure for any travel

the following are high-cost localities has away from home, and may use the per .01 In general. The federal per diem

been changed: Santa Barbara, Califor- diem substantiation method described in rate and the federal M&IE rate described in

nia; Crested Butte/Gunnison, Colorado; section 4.01 of this revenue procedure for section 3.02 of this revenue procedure for

Steamboat Springs, Colorado; Telluride, any OCONUS travel away from home. the locality of travel will be applied in the

Colorado; Vail, Colorado; Fort Laud- .06 Transition rules. A payor who used same manner as applied under the Federal

erdale, Florida; Miami, Florida; Palm the substantiation method of section 4.01 Travel Regulations, 41 C.F.R. Part 301–11

Beach, Florida; Cambridge/St. Michaels, of Rev. Proc. 2006–41 for an employee (2007), except as provided in sections 6.02

Maryland; Ocean City, Maryland; Nan- during the first 9 months of calendar year through 6.04 of this revenue procedure.

tucket, Massachusetts; Jamestown/Mid- 2007 may not use the high-low substanti- .02 Federal per diem rate. A receipt

dletown/Newport, Rhode Island; and Park ation method in section 5 of this revenue for lodging expenses is not required in de-

City, Utah. procedure for that employee until January termining the amount of expenses deemed

(3) The following localities have been 1, 2008. A payor who used the high-low substantiated under section 4.01 or 5.01 of

removed from the list of high-cost local- substantiation method of section 5 of Rev. this revenue procedure. See section 7.01

of this revenue procedure for the require-

2007–42 I.R.B. 815 October 15, 2007

ment that the employee substantiate the allowed under the Federal Travel Regula- dental expenses, in accordance with sec-

time, place, and business purpose of the tions). tion 4 or 5 of this revenue procedure, and

expense. .05 Application of the appropriate such amounts are treated as paid under an

.03 Federal per diem or M&IE rate. A § 274(n) limitation on meal expenses. Ex- accountable plan, any additional payment

payor is not required to reduce the federal cept as provided in section 6.05(4), all or with respect to those expenses is treated

per diem rate or the federal M&IE rate for part of the amount of an expense deemed as paid under a nonaccountable plan, is

the locality of travel for meals provided in substantiated under this revenue procedure included in the employee’s gross income,

kind, provided the payor has a reasonable is subject to the appropriate limitation un- is reported as wages or other compensa-

belief that meal and incidental expenses der § 274(n) (see section 2.02 of this tion on the employee’s Form W–2, and

were or will be incurred by the employee revenue procedure) on the deductibility of is subject to withholding and payment of

during each day of travel. food and beverage expenses. employment taxes. Similarly, if an em-

.04 Proration of the federal per diem or (1) If an amount for meal and incidental ployee or self-employed individual com-

M&IE rate. Pursuant to the Federal Travel expenses is computed pursuant to section putes the amount allowable as a deduction

Regulations, in determining the federal per 4.03 of this revenue procedure, the tax- for meal and incidental expenses for travel

diem rate or the federal M&IE rate for payer must treat that amount as an expense away from home in accordance with sec-

the locality of travel, the full applicable for food and beverages. tion 4.03 or 4.04 of this revenue procedure,

federal M&IE rate is available for a full (2) If a per diem allowance is paid only no other deduction is allowed to the em-

day of travel from 12:01 a.m. to 12:00 for meal and incidental expenses, the payor ployee or self-employed individual with

midnight. The method described in sec- must treat an amount equal to the lesser of respect to those expenses. For example,

tion 6.04(1) of this revenue procedure must the allowance or the federal M&IE rate for assume an employee receives a per diem

be used for purposes of determining the the locality of travel for each day (or partial allowance from a payor for lodging, meal,

amount deemed substantiated under sec- day, see section 6.04 of this revenue pro- and incidental expenses, or for meal and

tion 4.03 or 4.05 of this revenue procedure cedure) as an expense for food and bever- incidental expenses, incurred while travel-

for partial days of travel away from home. ages. ing away from home and such amounts are

For purposes of determining the amount (3) If a per diem allowance is paid for treated as paid under an accountable plan.

deemed substantiated under section 4.01, lodging, meal, and incidental expenses for During that trip, the employee pays for din-

4.02, 4.04, or 5 of this revenue procedure each calendar day (or partial day) the em- ner for the employee and two business as-

for partial days of travel away from home, ployee is away from home at a rate equal to sociates. The payor reimburses as a busi-

either of the following methods may be or in excess of the federal per diem rate for ness entertainment meal expense the meal

used to prorate the federal M&IE rate to the locality of travel, the payor must treat expense for the employee and the two busi-

determine the federal per diem rate or the an amount equal to the federal M&IE rate ness associates. Because the payor also

federal M&IE rate for the partial days of for the locality of travel for each calendar pays a per diem allowance to cover the cost

travel: day (or partial day) as an expense for food of the employee’s meals, the amount paid

(1) The rate may be prorated using the or beverages. by the payor for the employee’s portion of

method prescribed by the Federal Travel (4) If a per diem allowance is paid for the business entertainment meal expense

Regulations. Currently the Federal Travel lodging, meal, and incidental expenses for is treated as paid under a nonaccountable

Regulations allow three-fourths of the ap- each calendar day (or partial day) the em- plan, is reported as wages or other com-

plicable federal M&IE rate for each partial ployee is away from home at a rate less pensation on the employee’s Form W–2,

day during which the employee or self-em- than the federal per diem rate for the lo- and is subject to withholding and payment

ployed individual is traveling away from cality of travel, the payor must: of employment taxes.

home in connection with the performance (a) treat an amount equal to the federal .07 Related parties. Sections 4.01 and

of services as an employee or self-em- M&IE rate for the locality of travel for 5 of this revenue procedure do not apply if

ployed individual. The same ratio may be each calendar day (or partial day) or, if a payor and an employee are related within

applied to prorate the allowance for inci- less, the amount of the allowance, as an the meaning of § 267(b), but for this pur-

dental expenses described in section 4.05 expense for food or beverages; or pose the percentage of ownership interest

of this revenue procedure; or (b) treat an amount equal to 40 percent referred to in § 267(b)(2) is 10 percent.

(2) The rate may be prorated using any of the allowance as an expense for food or

method that is consistently applied and in beverages. SECTION 7. APPLICATION

accordance with reasonable business prac- (5) If an amount for incidental expenses

tice. For example, if an employee travels is computed under section 4.05 of this rev- .01 If the amount of travel expenses is

away from home from 9 a.m. one day to enue procedure, none of the amount so deemed substantiated under the rules pro-

5 p.m. the next day, a method of proration computed is subject to limitation under vided in section 4 or 5 of this revenue pro-

that results in an amount equal to two times § 274(n) on the deductibility of food and cedure, and the employee substantiates to

the federal M&IE rate will be treated as beverage expenses. the payor the elements of time, place, and

being in accordance with reasonable busi- .06 No double reimbursement or deduc- business purpose of the travel for that day

ness practice (even though only one and a tion. If a payor pays a per diem allowance (or partial day) in accordance with para-

half times the federal M&IE rate would be in lieu of reimbursing actual lodging, meal, graphs (b)(2) and (c) (other than subpara-

and incidental expenses, or meal and inci- graph (2)(iii)(A) thereof) of § 1.274–5, the

October 15, 2007 816 2007–42 I.R.B.

employee is deemed to satisfy the adequate § 1.274–5(f)(2)(i). Assuming that the re- procedure) on meal and entertainment

accounting requirements of § 1.274–5(f) maining requirements for an accountable expenses provided in § 274(n) and the

as well as the requirement to substantiate plan provided in § 1.62–2 are satisfied, that 2-percent floor on miscellaneous itemized

by adequate records or other sufficient ev- portion of the allowance is treated as paid deductions provided in § 67.

idence for purposes of § 1.274–5(c). See under an accountable plan, is not reported .06 An employee who pays or incurs

also § 1.62–2(e)(1) for the rule that in order as wages or other compensation on the em- amounts for meal expenses and does not

to satisfy the substantiation requirement of ployee’s Form W–2, and is exempt from receive a per diem allowance for meal and

an accountable plan, an arrangement must the withholding and payment of employ- incidental expenses may deduct an amount

require business expenses to be substanti- ment taxes. See § 1.62–2(c)(2) and (c)(4). computed pursuant to section 4.03 of this

ated to the payor within a reasonable pe- .04 An employee is required to include revenue procedure only as an itemized de-

riod of time. in gross income only the portion of the per duction. This itemized deduction is sub-

.02 An arrangement providing per diem diem allowance received from a payor that ject to the appropriate limitation on meal

allowances will be treated as satisfying the exceeds the amount deemed substantiated and entertainment expenses provided in

requirement of § 1.62–2(f)(2) of return- under the rules provided in section 4 or 5 § 274(n) and the 2-percent floor on miscel-

ing amounts in excess of expenses if the of this revenue procedure if the employee laneous itemized deductions provided in

employee is required to return within a substantiates the business travel expenses § 67. See section 7.07 of this revenue pro-

reasonable period of time (as defined in covered by the per diem allowance in ac- cedure for the treatment of an employee

§ 1.62–2(g)) any portion of the allowance cordance with section 7.01 of this revenue who does not pay or incur amounts for

that relates to days of travel not substan- procedure. See § 1.274–5(f)(2)(ii). In ad- meal expenses and does not receive a per

tiated, even though the arrangement does dition, the excess portion of the allowance diem allowance for incidental expenses.

not require the employee to return the por- is treated as paid under a nonaccountable .07 An employee who does not pay or

tion of the allowance that relates to days plan, is reported as wages or other compen- incur amounts for meal expenses and does

of travel substantiated and that exceeds sation on the employee’s Form W–2, and not receive a per diem allowance for in-

the amount of the employee’s expenses is subject to withholding and payment of cidental expenses may deduct an amount

deemed substantiated. For example, as- employment taxes. See § 1.62–2(c)(3)(ii), computed pursuant to section 4.05 of this

sume a payor provides an employee an ad- (c)(5), and (h)(2)(i)(B). revenue procedure only as an itemized de-

vance per diem allowance for meal and in- .05 If the amount of the expenses that duction. This itemized deduction is sub-

cidental expenses of $250, based on an an- is deemed substantiated under the rules ject to the 2-percent floor on miscellaneous

ticipated 5 days of business travel at $50 provided in section 4.01, 4.02, or 5 of this itemized deductions provided in § 67. See

per day to a locality for which the fed- revenue procedure is less than the amount section 7.06 of this revenue procedure for

eral M&IE rate is $39, and the employee of the employee’s business expenses for the treatment of an employee who pays or

substantiates 3 full days of business travel. travel away from home, the employee incurs amounts for meal expenses and does

The requirement to return excess amounts may claim an itemized deduction for the not receive a per diem allowance for meal

is treated as satisfied if the employee is amount by which the business travel ex- and incidental expenses.

required to return within a reasonable pe- penses exceed the amount that is deemed .08 A self-employed individual who

riod of time (as defined in § 1.62–2(g)) the substantiated, provided the employee sub- pays or incurs meal expenses for a calen-

portion of the allowance that is attribut- stantiates all the business travel expenses dar day (or partial day) of travel away from

able to the 2 unsubstantiated days of travel (not just the excess over the federal per home may deduct an amount computed

($100), even though the employee is not diem rate), includes on Form 2106, “Em- pursuant to section 4.03 of this revenue

required to return the portion of the al- ployee Business Expenses,” the deemed procedure in determining adjusted gross

lowance ($33) that exceeds the amount of substantiated portion of the per diem al- income under § 62(a)(1). This deduction

the employee’s expenses deemed substan- lowance received from the payor, and in- is subject to the appropriate limitation on

tiated under section 4.02 of this revenue cludes in gross income the portion (if any) meal and entertainment expenses provided

procedure ($117) for the 3 substantiated of the per diem allowance received from in § 274(n).

days of travel. However, the $33 excess the payor that exceeds the amount deemed .09 A self-employed individual who

portion of the allowance is treated as paid substantiated. See § 1.274–5(f)(2)(iii). does not pay or incur meal expenses for

under a nonaccountable plan as discussed However, for purposes of claiming this a calendar day (or partial day) of travel

in section 7.04 of this revenue procedure. itemized deduction with respect to meal away from home may deduct an amount

.03 An employee is not required to in- and incidental expenses, substantiation of computed pursuant to section 4.05 of this

clude in gross income the portion of a the amount of the expenses is not required revenue procedure in determining adjusted

per diem allowance received from a payor if the employee is claiming a deduction gross income under § 62(a)(1).

that is less than or equal to the amount that is equal to or less than the amount .10 If a payor’s reimbursement or

deemed substantiated under the rules pro- computed under section 4.03 of this rev- other expense allowance arrangement ev-

vided in section 4 or 5 of this revenue pro- enue procedure minus the amount deemed idences a pattern of abuse of the rules of

cedure if the employee substantiates the substantiated under sections 4.02 and 7.01 § 62(c) and the regulations thereunder,

business travel expenses covered by the of this revenue procedure. The itemized all payments under the arrangement will

per diem allowance in accordance with deduction is subject to the appropriate be treated as made under a nonaccount-

section 7.01 of this revenue procedure. See limitation (see section 2.02 of this revenue able plan. See § 1.62–2(k) and Rev. Rul.

2007–42 I.R.B. 817 October 15, 2007

2006–56. Thus, these payments are in- ated for the period under section 4.02 of employee on or after October 1, 2007, with

cluded in the employee’s gross income, this revenue procedure (after applying sec- respect to travel away from home on or af-

are reported as wages or other compen- tion 4.04(4) of this revenue procedure), ter October 1, 2007. For purposes of com-

sation on the employee’s Form W–2, and is subject to withholding and payment of puting the amount allowable as a deduc-

are subject to withholding and payment employment taxes no later than the first tion for travel away from home, this rev-

of employment taxes. See § 1.62–2(c)(3), payroll period following the payroll pe- enue procedure is effective for meal and

(c)(5), and (h)(2), and section 8.06 of this riod in which the excess is computed. See incidental expenses or for incidental ex-

revenue procedure. § 1.62–2(h)(2)(i)(B)(4). penses only paid or incurred on or after Oc-

.05 For example, assume that an em- tober 1, 2007.

SECTION 8. WITHHOLDING AND ployer pays an employee a per diem

PAYMENT OF EMPLOYMENT TAXES allowance under an arrangement that SECTION 10. EFFECT ON OTHER

otherwise meets the requirements of an DOCUMENTS

.01 The portion of a per diem al- accountable plan to cover business ex-

lowance, if any, that relates to the days penses for meals and lodging for travel Rev. Proc. 2006–41 is superseded.

of business travel substantiated and that away from home at a rate of 120 percent

exceeds the amount deemed substantiated of the federal per diem rate for the local- DRAFTING INFORMATION

for those days under section 4.01, 4.02, or ities to which the employee travels. The

5 of this revenue procedure is treated as employer does not require the employee The principal author of this revenue

paid under a nonaccountable plan and is to return the 20 percent by which the re- procedure is Jeffrey T. Rodrick of the Of-

subject to withholding and payment of em- imbursement for those expenses exceeds fice of Associate Chief Counsel (Income

ployment taxes. See § 1.62–2(h)(2)(i)(B). the federal per diem rate. The employee Tax and Accounting). For further infor-

.02 In the case of a per diem allowance substantiates 6 days of travel away from mation regarding this revenue procedure,

paid as a reimbursement, the excess de- home: 2 days in a locality in which the contact Mr. Rodrick at (202) 622–4930

scribed in section 8.01 of this revenue pro- federal per diem rate is $160 and 4 days (not a toll-free call).

cedure is subject to withholding and pay- in a locality in which the federal per diem

ment of employment taxes in the payroll rate is $120. The employer reimburses

period in which the payor reimburses the the employee $960 for the 6 days of travel 26 CFR 601.204: Changes in accounting periods and

expenses for the days of travel substanti- away from home (2 x (120% x $160) + 4 in methods of accounting.

ated. See § 1.62–2(h)(2)(i)(B)(2). x (120% x $120)), and does not require (Also Part I, §§ 442, 898; 1.442–1.)

.03 In the case of a per diem allowance the employee to return the excess payment

paid as an advance, the excess described of $160 (2 days x $32 ($192-$160) + 4 Rev. Proc. 2007–64

in section 8.01 of this revenue procedure days x $24 ($144-$120)). For the payroll

is subject to withholding and payment of period in which the employer reimburses

employment taxes no later than the first SECTION 1. PURPOSE

the expenses, the employer must withhold

payroll period following the payroll period and pay employment taxes on $160. See

in which the days of travel with respect section 8.02 of this revenue procedure. This revenue procedure modifies a

to which the advance was paid are sub- .06 If a per diem allowance arrange- scope provision and one of the terms and

stantiated. See § 1.62–2(h)(2)(i)(B)(3). If ment has no mechanism or process to conditions under which the Internal Rev-

some or all of the days of travel with re- determine when an allowance exceeds the enue Service grants approval of requests

spect to which the advance was paid are amount that may be deemed substantiated by corporations for changes in annual ac-

not substantiated within a reasonable pe- and the arrangement routinely pays al- counting periods filed under Rev. Proc.

riod of time and the employee does not re- lowances in excess of the amount that may 2006–45, 2006–45 I.R.B. 851. Specifi-

turn the portion of the allowance that re- be deemed substantiated without requiring cally, this revenue procedure modifies the

lates to those days within a reasonable pe- actual substantiation of all the expenses or scope provision regarding a corporation

riod of time, the portion of the allowance repayment of the excess amount, the fail- that exits a consolidated group. See sec-

that relates to those days is subject to with- ure of the arrangement to treat the excess tion 4.02(13) of Rev. Proc. 2006–45. In

holding and payment of employment taxes allowances as wages for employment tax addition, this revenue procedure modifies

no later than the first payroll period follow- purposes causes all payments made under the terms and conditions relating to record-

ing the end of the reasonable period. See the arrangement to be treated as made un- keeping and book conformity in the case of

§ 1.62–2(h)(2)(i)(A). der a nonaccountable plan. See Rev. Rul. a controlled foreign corporation (“CFC”)

.04 In the case of a per diem allowance 2006–56. that has a majority U.S. shareholder year

only for meal and incidental expenses for (as defined in § 898(c)(3) of the Internal

travel away from home paid to an em- SECTION 9. EFFECTIVE DATE Revenue Code) and that is changing to

ployee in the transportation industry by a a one-month deferral year described in

payor that uses the rule in section 4.04(4) This revenue procedure is effective for § 898(c)(2) or to a 52–53-week taxable

of this revenue procedure, the excess of per diem allowances for lodging, meal and year that references such one-month de-

the per diem allowance paid for the pe- incidental expenses, or for meal and inci- ferral year. See section 6.02 of Rev. Proc.

riod over the amount deemed substanti- dental expenses only, that are paid to an 2006–45.

October 15, 2007 818 2007–42 I.R.B.

SECTION 2. BACKGROUND U.S. shareholder year and that is chang- a 52–53-week taxable year that references

ing to a one-month deferral year or to a such one-month deferral year.

.01 Section 442 and § 1.442–1(a) of the 52–53-week taxable year that references

Income Tax Regulations generally provide such one-month deferral year. SECTION 4. MODIFICATIONS

that a taxpayer that wants to change its .08 With respect to the terms and condi-

annual accounting period and use a new tions of change under Rev. Proc. 2006–45, .01 Section 4.02(13) is modified to

taxable year must obtain the approval of section 6.02(1) of that revenue procedure read as follows: “Corporation that exits

the Commissioner. generally requires that a corporation com- a consolidated group. A corporation that

.02 Section 1.442–1(b)(2) provides that pute its income and keep its books and ceases to be a member of a consolidated

a change in annual accounting period will records (including financial statements group and wants to change its annual ac-

be approved only if the taxpayer agrees and reports to creditors) on the basis of counting period during the consolidated

to the Commissioner’s prescribed terms, the requested taxable year. That section group’s taxable year in which the cor-

conditions, and adjustments for effecting further requires that the books and records poration ceases to be a member of the

the change. of the corporation be closed as of the last consolidated group. For purposes of the

.03 Rev. Proc. 2006–45 provides the day of the first effective year and that the prior sentence, the consolidated group’s

exclusive procedures for certain corpora- corporation conform the accounting pe- taxable year is determined without regard

tions to obtain automatic approval of the riod used for financial statement purposes to a change in the consolidated group’s an-

Commissioner to change their annual ac- and reports to creditors concurrently. nual accounting period. A corporation that

counting periods. .09 The Service has determined that in ceases to be a member of a consolidated

.04 Section 4.02(13) of Rev. Proc. the case of a CFC changing to a one-month group must continue to use the annual ac-

2006–45 excludes from the scope of the deferral year or to a 52–53-week taxable counting period of the consolidated group,

revenue procedure a corporation that year that references such one-month defer- unless the corporation receives approval

ceases to be a member of a consolidated ral year, the CFC is not required to issue under Rev. Proc. 2002–39 to change its