Beruflich Dokumente

Kultur Dokumente

2011 LST Exemption

Hochgeladen von

hughesboroOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2011 LST Exemption

Hochgeladen von

hughesboroCopyright:

Verfügbare Formate

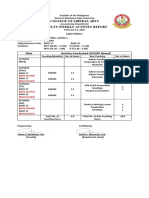

Hughesville Borough

2011 LOCAL SERVICE TAX - EXEMPTION CERTIFICATE

§ A copy of this application for exemption from the Local Services Tax (LST), and all necessary supporting

documents, must be completed and presented to your employer and to the political subdivision levying the Local

Services Tax for the municipality or school district in which you are primarily employed.

§ This application for exemption from the Local Services Tax must be signed, dated, and given to each

employer.

• No exemption will be approved until proper documentation has been received.

PRINT NAME:_______________________________________ SOCIAL SECURITY #:________________________

ADDRESS:_________________________________________ PHONE #:_________________________________

CITY — STATE — ZIP:

REASON FOR EXEMPTION ,

1

MULTIPLE EMPLOYERS: Attach a copy of a current pay statement from your principal employer

that shows the name of the employer, the length of the payroll period and the amount of Local Services Tax withheld.

List all employers on the reverse side of this form. You must notify your other employers of a change in principal

place of employment within two weeks of the change.

2. EXPECTED TOTAL EARNED INCOME AND NET PROFITS FROM ALL SOURCES

WITHIN THE BOROUGH OF HUGHESVILLE WILL BE LESS THAN $12,000: Attach copies of

your last pay statements from all employers or copies of your W-2's from all employers for the prior year. Also submit

copies to your employer(s).

If you are SELF-EMPLOYED, attach a copy of your PA Schedule C, F, or RK-1 for the prior year.

3. ACTIVE DUTY MILITARY EXEMPTION: Attach a copy of your orders directing you to active duty status.

Annual training is not eligible for exemption. You are required to advise your employer and tax office when you

are discharged from active duty status.

4. MILITARY DISABILITY EXEMPTION: Attach a copy of your discharge orders and a statement from the

United States Veterans Administrator documenting your disability. Only 100% permanent disabilities are recognized

for this exemption.

EMPLOYER: Once you receive this Exemption Certificate, you shall not withhold the Local Services Tax for the

portion of the calendar year for which this certificate applies, unless you are otherwise notified or instructed by the

taxpayer or tax collector to withhold the tax. Employer must retain Exemption Certificate.

Tax Office: Hughesville Borough

Address: 147 S. Fifth Street

City, State & Zip: Hughesville, Pa 17737

The municipality is required by law to exempt from the LST employees whose earned income from all sources

(employers and self-employment) in their municipality is less than $12,000.

SIGNATURE:____________________________________________________ DATE:

_______________________________________________________________

For additional information go to www.hughesvilleborough.com or call 570-584-2041

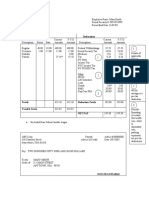

EMPLOYMENT INFORMATION: List all places of employment for the applicable tax year. Please list

your PRIMARY EMPLOYER under #1 and your secondary employers under the other columns. If self-

employed, write "SELF" under employer name column.

1. PRIMARY EMPLOYER 2. 3.

Employer Name

4. 5. 6.

Address

Employer Name

Address 2

Address

Address 2 City, State & Zip

City, State & Zip Municipality

Municipality

Employer Phone

Employer Phone

Start Date Start Date

End Date End Date

Status FT or PT

Status FT or PT

Gross Earnings

Gross Earnings

Das könnte Ihnen auch gefallen

- HERITAGEapplicationform 1Dokument8 SeitenHERITAGEapplicationform 1rapheal jamesNoch keine Bewertungen

- Short Sale Information Packet: Please Send The Completed Packet As Well As All Required DocumentationDokument10 SeitenShort Sale Information Packet: Please Send The Completed Packet As Well As All Required DocumentationSue HudsonNoch keine Bewertungen

- Washington Business License ApplicationDokument4 SeitenWashington Business License ApplicationGreenpoint Insurance ColoradoNoch keine Bewertungen

- 1 Utility Application PacketDokument3 Seiten1 Utility Application Packet568224736Noch keine Bewertungen

- MW 507Dokument2 SeitenMW 507sosureyNoch keine Bewertungen

- Installment Payment Plan Request: No PO Box NumberDokument4 SeitenInstallment Payment Plan Request: No PO Box NumberjackNoch keine Bewertungen

- std686 PDFDokument2 Seitenstd686 PDFnmkeatonNoch keine Bewertungen

- Payroll Newsletter Issue2 WebDokument4 SeitenPayroll Newsletter Issue2 Webapi-239212849Noch keine Bewertungen

- Instructions How To Fill Deed of Indemnity&Affidavit - CC - BPOBLRDokument1 SeiteInstructions How To Fill Deed of Indemnity&Affidavit - CC - BPOBLRrevanthreddyjackson0% (1)

- Personal Information: Applicant Co-ApplicantDokument6 SeitenPersonal Information: Applicant Co-ApplicantDeepti ChaudharyNoch keine Bewertungen

- Police Application Fillable 04282022revisedDokument30 SeitenPolice Application Fillable 04282022revisedMarino DominicciNoch keine Bewertungen

- PNP Es Housing FormDokument3 SeitenPNP Es Housing FormSan Narciso Qppo PcadNoch keine Bewertungen

- Iowa W4Dokument2 SeitenIowa W4ts0m3Noch keine Bewertungen

- Confidential City and County of Honolulu: Application Form T-Rpt100 Tax Year 2018-2019Dokument4 SeitenConfidential City and County of Honolulu: Application Form T-Rpt100 Tax Year 2018-2019Anonymous QlJjisdlLINoch keine Bewertungen

- 2018 Statement of Financial DisclosureDokument4 Seiten2018 Statement of Financial DisclosureAnnie AndersenNoch keine Bewertungen

- w-4 IN PDFDokument2 Seitenw-4 IN PDFAnonymous rPkHXogyNoch keine Bewertungen

- Con-Subcon Application FormDokument2 SeitenCon-Subcon Application Formsabinoromero76Noch keine Bewertungen

- SAL FormDokument4 SeitenSAL FormMark Kevin Plasencia DobleNoch keine Bewertungen

- Used Cars For Sale Offer FormDokument3 SeitenUsed Cars For Sale Offer FormRaymond GabrielNoch keine Bewertungen

- Tax Organizer PDF TemplateDokument4 SeitenTax Organizer PDF Templatepaxosam623Noch keine Bewertungen

- Application For Credit - 2022Dokument4 SeitenApplication For Credit - 2022mancom panglaoNoch keine Bewertungen

- Power of Attorney: Tax Form Instructions: 1. PurposeDokument3 SeitenPower of Attorney: Tax Form Instructions: 1. PurposeNdao86Noch keine Bewertungen

- SSS R5 - AdmiralDokument6 SeitenSSS R5 - AdmiralKaye LadsNoch keine Bewertungen

- ResourceProxy PDFDokument3 SeitenResourceProxy PDFGuerline PhilistinNoch keine Bewertungen

- Personal Finance Application FormatDokument2 SeitenPersonal Finance Application FormatMuhammad Waqas MunirNoch keine Bewertungen

- Application For Registration of Job Contractors-Subcontractors PDFDokument2 SeitenApplication For Registration of Job Contractors-Subcontractors PDFTwinserve JcsNoch keine Bewertungen

- Death Claim Form Under Special Cases (Natural Disaster, Calamities, Bomb Blast) - With 1Dokument2 SeitenDeath Claim Form Under Special Cases (Natural Disaster, Calamities, Bomb Blast) - With 1raviNoch keine Bewertungen

- U-Franchise Prequal FormDokument3 SeitenU-Franchise Prequal FormobaguecNoch keine Bewertungen

- The Following Deposits Are Required To Be Paid by Clients Immediately After Bank EndorsementDokument29 SeitenThe Following Deposits Are Required To Be Paid by Clients Immediately After Bank EndorsementEnrique RiveraNoch keine Bewertungen

- HR Generic Payroll Mergers and Acquisitions Checklist Rev 09 08Dokument11 SeitenHR Generic Payroll Mergers and Acquisitions Checklist Rev 09 08claokerNoch keine Bewertungen

- JK Application FormDokument1 SeiteJK Application FormRonaldo JoseNoch keine Bewertungen

- Contributions Payment Form-SSSDokument6 SeitenContributions Payment Form-SSSrhev63% (8)

- Form 1-200 - Job Applicn FormDokument4 SeitenForm 1-200 - Job Applicn Formmassa.mirabelNoch keine Bewertungen

- MO W-4 Employee's Withholding Certificate: Reset Form Print FormDokument1 SeiteMO W-4 Employee's Withholding Certificate: Reset Form Print FormAmina chahalNoch keine Bewertungen

- Haryana Vidyut Prasaran Nigam LimitedDokument10 SeitenHaryana Vidyut Prasaran Nigam Limitedaloo leoNoch keine Bewertungen

- Individual Income Tax ReturnDokument2 SeitenIndividual Income Tax ReturnMNCOOhioNoch keine Bewertungen

- Small Business Loan Application Form For Individual - Sole - BDODokument2 SeitenSmall Business Loan Application Form For Individual - Sole - BDOjunco111222Noch keine Bewertungen

- Inos Sss Contribution FormDokument6 SeitenInos Sss Contribution FormYeye TanNoch keine Bewertungen

- Certified Payroll Report RequirementsDokument10 SeitenCertified Payroll Report RequirementsRASHID SIKDERNoch keine Bewertungen

- Employee Salary Loan (Esl) Application Form: Borrower InformationDokument4 SeitenEmployee Salary Loan (Esl) Application Form: Borrower Information813 cafeNoch keine Bewertungen

- Abc Loan Guidelines For Bank Staff: Filling Out Loan Application FormsDokument40 SeitenAbc Loan Guidelines For Bank Staff: Filling Out Loan Application FormsjohnNoch keine Bewertungen

- Description: Tags: FP0705AttFAppPNoteStandardDokument18 SeitenDescription: Tags: FP0705AttFAppPNoteStandardanon-23498Noch keine Bewertungen

- Telephone Assistant Plan (TAP) Application: Step 1: Fill Out Information About The ApplicantDokument2 SeitenTelephone Assistant Plan (TAP) Application: Step 1: Fill Out Information About The ApplicantSundeeNoch keine Bewertungen

- Employment Verification Form: The Department of Early Education and Care Subsidized Child CareDokument6 SeitenEmployment Verification Form: The Department of Early Education and Care Subsidized Child CareJessica PotratzNoch keine Bewertungen

- Financial Information Sheet: Bal 1 Bal 2 TTLDokument4 SeitenFinancial Information Sheet: Bal 1 Bal 2 TTLSteve MontroseNoch keine Bewertungen

- RRPDokument50 SeitenRRPjoshiney wilchesNoch keine Bewertungen

- Missouri Form Mo W 4Dokument1 SeiteMissouri Form Mo W 4itargetingNoch keine Bewertungen

- H Homeowner's Information Packet: For Chase CustomersDokument8 SeitenH Homeowner's Information Packet: For Chase CustomersEric WardNoch keine Bewertungen

- 2011 W-2 FAQ'sDokument2 Seiten2011 W-2 FAQ'snako83Noch keine Bewertungen

- Employee's Withholding Exemption and County Status CertificateDokument2 SeitenEmployee's Withholding Exemption and County Status CertificateAparajeeta GuhaNoch keine Bewertungen

- Return of Corpus (Roc) For NTPC SCSB and Ndcps-2007: ChecklistDokument5 SeitenReturn of Corpus (Roc) For NTPC SCSB and Ndcps-2007: ChecklistjvnraoNoch keine Bewertungen

- MW 507Dokument2 SeitenMW 507anon-650325100% (1)

- Customer ApplicationDokument1 SeiteCustomer Applicationchill mainNoch keine Bewertungen

- Economic & Budget Forecast Workbook: Economic workbook with worksheetVon EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNoch keine Bewertungen

- 1040 Exam Prep: Module II - Basic Tax ConceptsVon Everand1040 Exam Prep: Module II - Basic Tax ConceptsBewertung: 1.5 von 5 Sternen1.5/5 (2)

- US Government Economics - Local, State and Federal | How Taxes and Government Spending Work | 4th Grade Children's Government BooksVon EverandUS Government Economics - Local, State and Federal | How Taxes and Government Spending Work | 4th Grade Children's Government BooksNoch keine Bewertungen

- Spring 2012Dokument2 SeitenSpring 2012hughesboroNoch keine Bewertungen

- February 27Dokument1 SeiteFebruary 27hughesboroNoch keine Bewertungen

- March 26Dokument1 SeiteMarch 26hughesboroNoch keine Bewertungen

- January 23, 2012Dokument1 SeiteJanuary 23, 2012hughesboroNoch keine Bewertungen

- March 12Dokument2 SeitenMarch 12hughesboroNoch keine Bewertungen

- November 28Dokument1 SeiteNovember 28hughesboroNoch keine Bewertungen

- January 3Dokument2 SeitenJanuary 3hughesboroNoch keine Bewertungen

- September 26Dokument1 SeiteSeptember 26hughesboroNoch keine Bewertungen

- October 10Dokument2 SeitenOctober 10hughesboroNoch keine Bewertungen

- December 12Dokument2 SeitenDecember 12hughesboroNoch keine Bewertungen

- October 24Dokument1 SeiteOctober 24hughesboroNoch keine Bewertungen

- September 12Dokument2 SeitenSeptember 12hughesboroNoch keine Bewertungen

- LST Q and ADokument4 SeitenLST Q and AhughesboroNoch keine Bewertungen

- July 11Dokument2 SeitenJuly 11hughesboroNoch keine Bewertungen

- Act 44 Drsclosure Fonnn Ron Erumnes Provlollc Pnorrsstonal Senvrcrs Ro Rhe Hue Uesvrlre Bonouch'S Peruslorrr SysrevrDokument7 SeitenAct 44 Drsclosure Fonnn Ron Erumnes Provlollc Pnorrsstonal Senvrcrs Ro Rhe Hue Uesvrlre Bonouch'S Peruslorrr SysrevrhughesboroNoch keine Bewertungen

- August 22Dokument1 SeiteAugust 22hughesboroNoch keine Bewertungen

- August 8Dokument2 SeitenAugust 8hughesboroNoch keine Bewertungen

- June 13Dokument2 SeitenJune 13hughesboroNoch keine Bewertungen

- June 27Dokument1 SeiteJune 27hughesboroNoch keine Bewertungen

- May 9Dokument2 SeitenMay 9hughesboroNoch keine Bewertungen

- March 14Dokument2 SeitenMarch 14hughesboroNoch keine Bewertungen

- Filtros Tecfil - Lista de AplicaçõesDokument2 SeitenFiltros Tecfil - Lista de AplicaçõesJosé SilasNoch keine Bewertungen

- Gross EstateDokument3 SeitenGross EstateShielle AzonNoch keine Bewertungen

- Form W-4 (2013) : Employee's Withholding Allowance CertificateDokument2 SeitenForm W-4 (2013) : Employee's Withholding Allowance Certificateapi-20374706Noch keine Bewertungen

- IL-1040 InstructionsDokument16 SeitenIL-1040 InstructionsRushmoreNoch keine Bewertungen

- F1040es 2020Dokument12 SeitenF1040es 2020Job SchwartzNoch keine Bewertungen

- 0a Federal Reserve Bank Routing NumbersDokument4 Seiten0a Federal Reserve Bank Routing NumbersBob Johnson100% (1)

- e-StatementBRImo 459501040308532 May2023 20230615 102222Dokument3 Seitene-StatementBRImo 459501040308532 May2023 20230615 102222Donni AdvNoch keine Bewertungen

- Estate Tax and Net Distributable EstateDokument7 SeitenEstate Tax and Net Distributable EstateJC100% (1)

- January 3, 2011 PostsDokument168 SeitenJanuary 3, 2011 PostsAlbert L. PeiaNoch keine Bewertungen

- Mortgage AccountsDokument16 SeitenMortgage Accountsvasanth kumarNoch keine Bewertungen

- Masterlist CPA Firms APRIL 30 2018.outputDokument1.602 SeitenMasterlist CPA Firms APRIL 30 2018.outputJanus MariNoch keine Bewertungen

- 1718 Fafsa FlyerDokument1 Seite1718 Fafsa FlyermortensenkNoch keine Bewertungen

- TOP 100 Multinational CompaniesDokument7 SeitenTOP 100 Multinational CompaniesMy FakeNoch keine Bewertungen

- Sample Template eFPS Letter of Intent For Individual TaxpayerDokument1 SeiteSample Template eFPS Letter of Intent For Individual Taxpayerelizabeth costales81% (16)

- Fortune 500 CompaniesDokument1 SeiteFortune 500 CompanieskrishnaprasadpanigrahiNoch keine Bewertungen

- LMS1 FebruaryDokument6 SeitenLMS1 FebruaryAnitas LimmaumNoch keine Bewertungen

- F 1040 VDokument2 SeitenF 1040 Vhottadot730@gmail.comNoch keine Bewertungen

- Mastercard - Google SearchDokument1 SeiteMastercard - Google SearchSky ShieldNoch keine Bewertungen

- File 341Dokument88 SeitenFile 341Rub VersNoch keine Bewertungen

- Pay Stub Template 03 PDFDokument1 SeitePay Stub Template 03 PDFchairgraveyardNoch keine Bewertungen

- List Price Orig Price Dom $/SQFT Date Year Lotsz SQFT BTH BD Map City Address Listing # ActiveDokument1 SeiteList Price Orig Price Dom $/SQFT Date Year Lotsz SQFT BTH BD Map City Address Listing # ActiveDunja GreenNoch keine Bewertungen

- Sbs Secret Lenders Listpdf 2Dokument8 SeitenSbs Secret Lenders Listpdf 2chrisengstrandNoch keine Bewertungen

- AGMAMay 2014Dokument110 SeitenAGMAMay 2014sandy17377Noch keine Bewertungen

- Introduction To Civil Engineering PDFDokument6 SeitenIntroduction To Civil Engineering PDFBarun SarangthemNoch keine Bewertungen

- Calculate New Salary Tax by Ather SaleemDokument2 SeitenCalculate New Salary Tax by Ather SaleemMalikKamranAsifNoch keine Bewertungen

- Form 4029Dokument2 SeitenForm 4029Brett BaldwinNoch keine Bewertungen

- Solution Manual For College Accounting 22nd EditionDokument23 SeitenSolution Manual For College Accounting 22nd EditionMissKellyWilliamsondawe100% (39)

- William Carroll - JAFP 1.8 Paycheck Calculations Student Activity PageDokument1 SeiteWilliam Carroll - JAFP 1.8 Paycheck Calculations Student Activity PageNokowire TVNoch keine Bewertungen

- CP575Notice 1569279055695Dokument2 SeitenCP575Notice 1569279055695jessica messica100% (1)

- Nasdaq 100 IndexDokument9 SeitenNasdaq 100 IndexRenu EsraniNoch keine Bewertungen