Beruflich Dokumente

Kultur Dokumente

US Internal Revenue Service: f4868 - 1991

Hochgeladen von

IRSOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

US Internal Revenue Service: f4868 - 1991

Hochgeladen von

IRSCopyright:

Verfügbare Formate

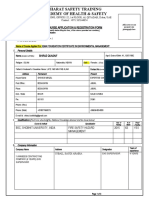

Form 4868

Department of the Treasury

Application for Automatic Extension of Time

To File U.S. Individual Income Tax Return

OMB No. 1545-0188

Internal Revenue Service

Your first name and initial Last name Your social security number

If a joint return, spouse’s first name and initial Last name Spouse’s social security number

Please

Type

Present home address (number, street, and apt. no. or rural route). (If you have a P.O. box, see the instructions.)

or

Print

City, town or post office, state, and ZIP code

Note: File this for m with the Internal Revenue Service Center where you are required to file your income tax retur n, and pay any

amount(s) you owe. This is not an extension of time to pay your tax.

I request an automatic 4-month extension of time to August 17, 1992, to file Form 1040A or Form 1040 for the calendar year 1991

(or if a fiscal year Form 1040 to , 19 , for the tax year ending , 19 ).

1 Total tax liability for 1991. This is the amount you expect to enter on line 27 of Form 1040A, or

line 53 of Form 1040. If you do not expect to owe tax, enter -0- 1

Caution: You MUST enter an amount on line 1 or your extension will be denied. You can estimate

this amount, but be as exact as you can with the infor mation you have. If we later find that your

estimate was not reasonable, the extension will be null and void.

2 Federal income tax withheld 2

3 1991 estimated tax payments (include 1990 overpayment allowed as a credit) 3

4 Other payments and credits you expect to show on Form 1040A or Form 1040 4

5 Add lines 2, 3, and 4 5

6 BALANCE DUE (subtract line 5 from line 1). To get this extension, you MUST pay in full the

balance due with this form. (If line 5 is more than line 1, enter -0-.) © 6

If you expect to owe gift or generation-skipping transfer (GST) tax, complete line 7 (and 8a

or 8b if applicable). Do not include income tax on these lines. (See the instructions.)

7 If you or your spouse plan to file a gift tax return (Form 709 or 709-A) for 1991,

generally due by April 15, 1992, see the instructions and check here

Yourself ©

Spouse © %

8a Enter the amount of gift or GST tax that you are paying with this form 8a

b Enter the amount of gift or GST tax that your spouse is paying with this form 8b

Signature and Verification

Under penalties of perjury, I declare that I have examined this form, including accompanying schedules and statements, and to the best of my knowledge

and belief, it is true, correct, and complete; and, if prepared by someone other than the taxpayer, that I am authorized to prepare this form.

Signature of taxpayer © Date ©

Signature of spouse © Date ©

(If filing jointly, BOTH must sign even if only one had income)

Signature of preparer

other than taxpayer © Date ©

If correspondence regarding this extension is to be sent to you at an address other than that shown above, or to an agent acting

for you, please enter the name of the agent and/or the address where it should be sent.

Name

Please

Type Number and street (or P.O. box number if mail is not delivered to street address)

or

Print City, town or post office, state, and ZIP code

General Instructions The time needed to complete and file

this form will vary depending on individual

suggestions for making this form more

simple, we would be happy to hear from

Paperwork Reduction Act Notice.—We circumstances. The estimated average time you. You can write to both the Internal

ask for the information on this form to is: Recordkeeping, 26 min.; Learning Revenue Service, Washington, DC 20224,

carry out the Internal Revenue laws of the about the law or the form, 11 min.; Attention: IRS Reports Clearance Officer,

United States. You are required to give us Preparing the form, 20 min.; and T:FP; and the Office of Management and

the information. We need it to ensure that Copying, assembling, and sending the Budget, Paperwork Reduction Project

you are complying with these laws and to form to the IRS, 20 min. (1545-0188), Washington, DC 20503. Do

allow us to figure and collect the right If you have comments concerning the not send this form to either of these

amount of tax. accuracy of these time estimates or offices. Instead, see Where To File.

Cat. No. 13141W Form 4868 (1991)

Form 4868 (1991) Page 2

Purpose Alaska, Arizona, California

(counties of Alpine, Amador,

If you and your spouse each filed a

Use Form 4868 to ask for 4 more months to Butte, Calaveras, Colusa, Contra

separate Form 4868, but later file a joint

file Form 1040A or Form 1040. You do not Costa, Del Norte, El Dorado, return for 1991, enter the total paid with the

have to explain why you are asking for the Glenn, Humboldt, Lake, Lassen, two Forms 4868 on the correct line of your

Marin, Mendocino, Modoc, Napa, joint return.

extension. We will contact you only if your Nevada, Placer, Plumas,

request is denied. Sacramento, San Joaquin, Ogden, UT 84201

If you and your spouse jointly filed Form

To get the extra time you MUST:

Shasta, Sierra, Siskiyou, Solano, 4868, but later file separate returns for 1991,

Sonoma, Sutter, Tehama, Trinity, you may enter the total amount paid with

1. Fill in Form 4868 correctly, AND Yolo, and Yuba), Colorado, Idaho,

Montana, Nebraska, Nevada, Form 4868 on either of your separate returns.

2. File it by the due date of your return, AND North Dakota, Oregon, South Or, you and your spouse may divide the

3. Pay ALL of the amount shown on line 6. Dakota, Utah, Washington, payment in any agreed amounts. Be sure

Wyoming

If you already had 2 extra months to file each separate return has the social security

because you were “out of the country” California (all other counties), Fresno, CA 93888

numbers of both spouses.

(explained later) when your return was due, Hawaii

then use this form to ask for an additional 2 Alabama, Arkansas, Louisiana,

Specific Instructions

months to file. Mississippi, North Carolina, Memphis, TN 37501 Name, address, and social security

Do not file Form 4868 if you want the IRS Tennessee number.—Enter your name, address, and

to figure your tax, or are under a court order American Samoa Philadelphia, PA 19255 social security number. If you are married

to file your return by the regular due date. filing a joint return, also enter your spouse’s

Commissioner of Revenue and Taxation

Note: An extension of time to file your 1991 Guam 855 West Marine Drive

name and social security number. If your post

calendar year income tax return also extends Agana, GU 96910 office does not bring mail to your street

the time to file a gift tax return (Form 709 or address and you have a P.O. box, enter your

Puerto Rico (or if excluding box number instead.

709-A) for 1991. income under section 933)

If the automatic extension does not give Philadelphia, PA 19255 Note: If you changed your mailing address

Virgin Islands:

you enough time, you can later ask for Nonpermanent residents after you filed your last return, you should use

additional time. But you’ll have to give a good Form 8822, Change of Address, to notify the

V.I. Bureau of Internal Revenue

reason, and it must be approved by the IRS. Virgin Islands: Lockharts Garden No. 1A IRS of the change. (A new address shown on

To ask for the additional time, you must do Permanent Charlotte Amalie, Form 4868 will not update your record.) To

residents

either of the following: St. Thomas, VI 00802 order Form 8822, call 1-800-TAX-FORM

1. File Form 2688, Application for Additional Foreign country: (1-800-829-3676).

Extension of Time To File U.S. Individual U.S. citizens and those

filing Form 2555 or

Philadelphia, PA 19255 Fiscal year filers.—Below your address,

Income Tax Return. Form 4563 enter the date your 4-month extension will

2. Explain your reason in a letter. Mail it to end and the date your tax year ends.

All A.P.O. and F.P.O. Philadelphia, PA 19255

the address under Where To File. addresses Out of the country.—If you already had 2

File Form 4868 before you file Form 2688 extra months to file because you were a U.S.

or write a letter asking for more time. Only in Filing Your Tax Return citizen or resident and were out of the

cases of undue hardship will we approve your You may file Form 1040A or Form 1040 any country on the due date of your return, write

request for more time without first receiving time before the extension of time is up. But “Taxpayer Abroad” across the top of this

Form 4868. If you need this extra time, ask remember, Form 4868 does not extend the form. For this purpose, “out of the country”

for it early so that you can still file your return time to pay taxes. If you do not pay the means either (1) you live outside the United

on time if your request is not approved. amount due by the regular due date, you will States and Puerto Rico, AND your main place

owe interest. You may also be charged of work is outside the United States and

When To File Form 4868 penalties. Puerto Rico, or (2) you are in military or naval

File Form 4868 by April 15, 1992. If you are service outside the United States and Puerto

Interest.—You will owe interest on any tax

filing a fiscal year Form 1040, file Form 4868 Rico.

not paid by the regular due date of your

by the regular due date of your return. Line 7.—If you or your spouse are also using

return. The interest runs until you pay the tax.

If you had 2 extra months to file your return Even if you had a good reason for not paying the extra 4 months to file a 1991 gift tax

because you were out of the country, file on time, you will still owe interest. return, check whichever box applies on line 7.

Form 4868 by June 15, 1992, for a 1991 However, if your spouse files a separate Form

Late payment penalty.—Generally, the

calendar year return. penalty is 1⁄2 of 1% of any tax (other than 4868, do not check the box for your spouse.

estimated tax) not paid by the regular due Lines 8a and 8b.—Enter the amount you (or

Where To File date. It is charged for each month or part of a your spouse) expect to owe on these lines. If

Mail this form to the Internal Revenue month that the tax is unpaid. The maximum your spouse files a separate Form 4868, enter

Service Center for the place where you live. penalty is 25%. You might not owe this on your form only the total gift tax and GST

If you live in: Use this address: penalty if you have a good reason for not tax you expect to owe. Pay in full with this

paying on time. Attach a statement to your form to avoid interest and penalties. If paying

Ä Ä

return explaining the reason. gift and GST taxes on time would cause you

Florida, Georgia, South Carolina Atlanta, GA 39901 Late filing penalty.—A penalty is usually undue hardship (not just inconvenience),

charged if your return is filed after the due attach an explanation to this form.

New Jersey, New York (New

York City and counties of date (including extensions). It is usually 5% of Your signature.—This form must be signed.

Holtsville, NY 00501

Nassau, Rockland, Suffolk, and the tax not paid by the regular due date for If you plan to file a joint return, both of you

Westchester) each month or part of a month that your should sign. If there is a good reason why

New York (all other counties), return is late. Generally, the maximum penalty one of you cannot, then the other spouse

Connecticut, Maine, Andover, MA 05501 is 25%. If your return is more than 60 days may sign for both. Attach an explanation why

Massachusetts, New Hampshire, late, the minimum penalty will be $100 or the

Rhode Island, Vermont the other spouse cannot sign.

balance of tax due on your return, whichever

Illinois, Iowa, Minnesota, Others who can sign for you.—Anyone with

Kansas City, MO 64999 is smaller. You might not owe the penalty if

Missouri, Wisconsin a power of attorney can sign. But the

you have a good reason for filing late. Attach

following can sign for you without a power of

Delaware, District of Columbia, a full explanation to your return if you file late.

Maryland, Pennsylvania, Philadelphia, PA 19255 attorney:

Virginia

How to claim credit for payment made with

this form.—When you file your return, show ● Attorneys, CPAs, and enrolled agents.

Indiana, Kentucky, Michigan, the amount of any payment (line 6) sent with ● A person in close personal or business

Ohio, West Virginia Cincinnati, OH 45999

Form 4868. Form 1040A filers should include relationship to you who is signing because

Kansas, New Mexico, Austin, TX 73301 the payment on line 28d and write “Form 4868” you cannot. There must be a good reason

Oklahoma, Texas

and the amount paid in the space to the left. why you cannot sign (such as illness or

Form 1040 filers should enter it on line 57. absence). Attach an explanation to the form.

Das könnte Ihnen auch gefallen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDokument71 SeitenTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- US Internal Revenue Service: 2290rulesty2007v4 0Dokument6 SeitenUS Internal Revenue Service: 2290rulesty2007v4 0IRSNoch keine Bewertungen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Objectives Report To Congress v2Dokument153 Seiten2008 Objectives Report To Congress v2IRSNoch keine Bewertungen

- 2008 Data DictionaryDokument260 Seiten2008 Data DictionaryIRSNoch keine Bewertungen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Credit Card Bulk Provider RequirementsDokument112 Seiten2008 Credit Card Bulk Provider RequirementsIRSNoch keine Bewertungen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Weekly Learning PlanDokument2 SeitenWeekly Learning PlanJunrick DalaguitNoch keine Bewertungen

- Online EarningsDokument3 SeitenOnline EarningsafzalalibahttiNoch keine Bewertungen

- Datasheet Qsfp28 PAMDokument43 SeitenDatasheet Qsfp28 PAMJonny TNoch keine Bewertungen

- On CatiaDokument42 SeitenOn Catiahimanshuvermac3053100% (1)

- Getting StartedDokument45 SeitenGetting StartedMuhammad Owais Bilal AwanNoch keine Bewertungen

- Building Program Template AY02Dokument14 SeitenBuilding Program Template AY02Amy JaneNoch keine Bewertungen

- Draft Contract Agreement 08032018Dokument6 SeitenDraft Contract Agreement 08032018Xylo SolisNoch keine Bewertungen

- Sophia Program For Sustainable FuturesDokument128 SeitenSophia Program For Sustainable FuturesfraspaNoch keine Bewertungen

- D - MMDA vs. Concerned Residents of Manila BayDokument13 SeitenD - MMDA vs. Concerned Residents of Manila BayMia VinuyaNoch keine Bewertungen

- Form Three Physics Handbook-1Dokument94 SeitenForm Three Physics Handbook-1Kisaka G100% (1)

- Discover Mecosta 2011Dokument40 SeitenDiscover Mecosta 2011Pioneer GroupNoch keine Bewertungen

- Cancellation of Deed of Conditional SalDokument5 SeitenCancellation of Deed of Conditional SalJohn RositoNoch keine Bewertungen

- Tinplate CompanyDokument32 SeitenTinplate CompanysnbtccaNoch keine Bewertungen

- QA/QC Checklist - Installation of MDB Panel BoardsDokument6 SeitenQA/QC Checklist - Installation of MDB Panel Boardsehtesham100% (1)

- CDKR Web v0.2rcDokument3 SeitenCDKR Web v0.2rcAGUSTIN SEVERINONoch keine Bewertungen

- BST Candidate Registration FormDokument3 SeitenBST Candidate Registration FormshirazNoch keine Bewertungen

- CSEC Jan 2011 Paper 1Dokument8 SeitenCSEC Jan 2011 Paper 1R.D. KhanNoch keine Bewertungen

- Food and Beverage Department Job DescriptionDokument21 SeitenFood and Beverage Department Job DescriptionShergie Rivera71% (7)

- Office Storage GuideDokument7 SeitenOffice Storage Guidebob bobNoch keine Bewertungen

- POST TEST 3 and POST 4, in ModuleDokument12 SeitenPOST TEST 3 and POST 4, in ModuleReggie Alis100% (1)

- QUIZ Group 1 Answer KeyDokument3 SeitenQUIZ Group 1 Answer KeyJames MercadoNoch keine Bewertungen

- Innovations in Land AdministrationDokument66 SeitenInnovations in Land AdministrationSanjawe KbNoch keine Bewertungen

- EXTENDED PROJECT-Shoe - SalesDokument28 SeitenEXTENDED PROJECT-Shoe - Salesrhea100% (5)

- Catalog Celule Siemens 8DJHDokument80 SeitenCatalog Celule Siemens 8DJHAlexandru HalauNoch keine Bewertungen

- P394 WindActions PDFDokument32 SeitenP394 WindActions PDFzhiyiseowNoch keine Bewertungen

- (X-09485) XYLENE RECTIFIED Extra Pure (Mix Isomers)Dokument9 Seiten(X-09485) XYLENE RECTIFIED Extra Pure (Mix Isomers)Bharath KumarNoch keine Bewertungen

- Efs151 Parts ManualDokument78 SeitenEfs151 Parts ManualRafael VanegasNoch keine Bewertungen

- Departmental Costing and Cost Allocation: Costs-The Relationship Between Costs and The Department Being AnalyzedDokument37 SeitenDepartmental Costing and Cost Allocation: Costs-The Relationship Between Costs and The Department Being AnalyzedGeorgina AlpertNoch keine Bewertungen

- CIR Vs PAL - ConstructionDokument8 SeitenCIR Vs PAL - ConstructionEvan NervezaNoch keine Bewertungen

- Mid Term Exam 1Dokument2 SeitenMid Term Exam 1Anh0% (1)