Beruflich Dokumente

Kultur Dokumente

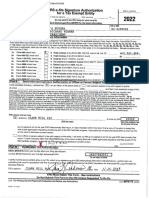

US Internal Revenue Service: f5074 - 1999

Hochgeladen von

IRSOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

US Internal Revenue Service: f5074 - 1999

Hochgeladen von

IRSCopyright:

Verfügbare Formate

Form 5074 (Rev.

12-99) Page 2

Where to file. Attach this form to your income tax return. Additional information. For more details, see Pub. 570, Tax

Then, use this chart to see where to file. Guide for Individuals With Income From U.S. Possessions. To

get Pub. 570, see Quick and Easy Access to Tax Help and

IF, at the end of the tax THEN file that jurisdiction’s Forms in the Instructions for Form 1040.

year you were a tax return with the...

resident of...

Paperwork Reduction Act Notice. We ask for the

The United States Internal Revenue Service Center information on this form to carry out the Internal Revenue

Philadelphia, PA 19255 laws of the United States. You are required to give us the

information. We need it to ensure that you are complying

Guam Department of Revenue and Taxation with these laws and to allow us to figure and collect the right

Government of Guam amount of tax.

P.O. Box 23607

GMF, GU 96921 You are not required to provide the information requested

on a form that is subject to the Paperwork Reduction Act

CNMI Division of Revenue and Taxation unless the form displays a valid OMB control number. Books

Commonwealth of the Northern or records relating to a form or its instructions must be

Mariana Islands retained as long as their contents may become material in

P.O. Box 5234, CHRB the administration of any Internal Revenue law. Generally, tax

Saipan, MP 96950

returns and return information are confidential, as required by

section 6103.

● If you are a citizen but were not a resident of one of these

jurisdictions at the end of your tax year, file your income tax The time needed to complete and file this form will vary

return with the jurisdiction of which you are a citizen. depending on individual circumstances. The estimated

● If filing jointly, file your return in the jurisdiction of the average time is:

spouse with the higher adjusted gross income (without Recordkeeping 2 hr., 57 min.

regard to community property laws) for the tax year. Learning about the

law or the form 8 min.

Sources of income. The rules for determining the sources of Preparing the form 49 min.

income are discussed in detail in sections 861 through 865. Copying, assembling, and

Penalty for failure to furnish information. If you do not sending the form to the IRS 17 min.

furnish the information we require, you may have to pay a If you have comments concerning the accuracy of these

penalty of $100 for each failure unless you can show your time estimates or suggestions for making this form simpler,

failure was due to reasonable cause and not willful neglect. we would be happy to hear from you. See the Instructions

This penalty is in addition to any criminal penalty provided by for Form 1040.

law.

This Section for IRS Use Only

33 Income tax reported on tax return. Include any recapture of education credits 33

34 Credit for child and dependent care expenses 34

35 Credit for the elderly or the disabled 35

36 Child tax credit 36

37 Education credits 37

38 Adoption credit 38

39 Foreign tax credit 39

40 Other credits 40

41 Add lines 34 through 40 41

42 Subtract line 41 from line 33. If the result is zero or less, enter -0- 42

43 Alternative minimum tax 43

44 Tax on IRAs, other retirement plans, and MSAs 44

45 Other Chapter 1 taxes. Include any tax from Form 4970 45

46 Taxes to be allocated. Add lines 42 through 45 䊳 46

Guam CNMI

47 Divide the amount on page 1, line 27, by the adjusted gross income

reported on Form 1040. Enter the result as a decimal (rounded to

at least three places) 47 . 47 .

48 Tax allocated to Guam or the CNMI. Multiply line 46 by line 47 48 48

49 Enter the amount from page 1, line 32 49 49

50 Net tax due. Subtract line 49 from line 48 50 50

Form 5074 (Rev. 12-99)

Das könnte Ihnen auch gefallen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2019 W-2 Gregorio MartinezDokument2 Seiten2019 W-2 Gregorio Martinezporhj perraNoch keine Bewertungen

- Universal Declaration of Human RightsDokument36 SeitenUniversal Declaration of Human RightsJanine Regalado100% (4)

- Laura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyDokument144 SeitenLaura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyGabe KaminskyNoch keine Bewertungen

- RTMF 990Dokument49 SeitenRTMF 990Craig MaugerNoch keine Bewertungen

- NEBOSH IGC IG1 Course NotesDokument165 SeitenNEBOSH IGC IG1 Course NotesShagufta Mallick100% (13)

- US Internal Revenue Service: I1040 - 1993Dokument88 SeitenUS Internal Revenue Service: I1040 - 1993IRSNoch keine Bewertungen

- Sanogo 2019 TFDokument40 SeitenSanogo 2019 TFbassomassi sanogoNoch keine Bewertungen

- Lululemon Sample Case AnalysisDokument49 SeitenLululemon Sample Case AnalysisMai Ngoc PhamNoch keine Bewertungen

- Scan 0001Dokument11 SeitenScan 0001Kimmie3050% (2)

- Fext 2022-04-17 1650241773772 PDFDokument2 SeitenFext 2022-04-17 1650241773772 PDFFera PetersonNoch keine Bewertungen

- US Navy Course NAVEDTRA 14342 - Air Traffic ControllerDokument594 SeitenUS Navy Course NAVEDTRA 14342 - Air Traffic ControllerGeorges100% (4)

- 1040 Exam Prep: Module I: The Form 1040 FormulaVon Everand1040 Exam Prep: Module I: The Form 1040 FormulaBewertung: 1 von 5 Sternen1/5 (3)

- Labor Relations LawsDokument20 SeitenLabor Relations LawsREENA ALEKSSANDRA ACOPNoch keine Bewertungen

- Sample PANDokument5 SeitenSample PANArmie Lyn Simeon100% (1)

- Az 203 PDFDokument337 SeitenAz 203 PDFViktors PetrinaksNoch keine Bewertungen

- Tratamentul Total Al CanceruluiDokument71 SeitenTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiDokument71 SeitenTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiDokument71 SeitenTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiDokument71 SeitenTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiDokument71 SeitenTratamentul Total Al CanceruluiAntal98% (98)

- Guidelines and Instruction For BIR Form No. 1701: - Who Shall File? - When and Where To File and PayDokument5 SeitenGuidelines and Instruction For BIR Form No. 1701: - Who Shall File? - When and Where To File and Payromeojr sibullasNoch keine Bewertungen

- US Internal Revenue Service: I4720 - 1993Dokument8 SeitenUS Internal Revenue Service: I4720 - 1993IRSNoch keine Bewertungen

- US Internal Revenue Service: I4720 - 1994Dokument8 SeitenUS Internal Revenue Service: I4720 - 1994IRSNoch keine Bewertungen

- IRS E-File Signature Authorization For Form 1041: Employer Identification NumberDokument2 SeitenIRS E-File Signature Authorization For Form 1041: Employer Identification NumberJerry MandorNoch keine Bewertungen

- US Internal Revenue Service: I8841 - 1993Dokument2 SeitenUS Internal Revenue Service: I8841 - 1993IRSNoch keine Bewertungen

- US Internal Revenue Service: I4720 - 1996Dokument8 SeitenUS Internal Revenue Service: I4720 - 1996IRSNoch keine Bewertungen

- 1702 RTsasaDokument4 Seiten1702 RTsasaEysOc11Noch keine Bewertungen

- US Internal Revenue Service: f2210f - 1995Dokument2 SeitenUS Internal Revenue Service: f2210f - 1995IRSNoch keine Bewertungen

- US Internal Revenue Service: I1120f - 1996Dokument17 SeitenUS Internal Revenue Service: I1120f - 1996IRSNoch keine Bewertungen

- US Internal Revenue Service: f8404 - 2003Dokument2 SeitenUS Internal Revenue Service: f8404 - 2003IRSNoch keine Bewertungen

- Request For Abatement of InterestDokument3 SeitenRequest For Abatement of InterestShannanAdamsNoch keine Bewertungen

- Documents (942,202212311058, F99NEE)Dokument2 SeitenDocuments (942,202212311058, F99NEE)LertoraNoch keine Bewertungen

- Instructions For Form 940: Internal Revenue ServiceDokument4 SeitenInstructions For Form 940: Internal Revenue ServiceIRSNoch keine Bewertungen

- US Internal Revenue Service: I5329 - 1996Dokument5 SeitenUS Internal Revenue Service: I5329 - 1996IRSNoch keine Bewertungen

- US Internal Revenue Service: I1120ric - 1996Dokument12 SeitenUS Internal Revenue Service: I1120ric - 1996IRSNoch keine Bewertungen

- Guidelines 1701 June 2013 ENCS PDFDokument4 SeitenGuidelines 1701 June 2013 ENCS PDFGil PinoNoch keine Bewertungen

- Instructions For Form 940: Internal Revenue ServiceDokument4 SeitenInstructions For Form 940: Internal Revenue ServiceIRSNoch keine Bewertungen

- Instructions For PIT Form V5Dokument1 SeiteInstructions For PIT Form V5awlachewNoch keine Bewertungen

- BIR Form No. 1700 (Nov. 2011) GuideDokument1 SeiteBIR Form No. 1700 (Nov. 2011) GuideEllen Grace MadriagaNoch keine Bewertungen

- US Internal Revenue Service: I1040c - 1995Dokument6 SeitenUS Internal Revenue Service: I1040c - 1995IRSNoch keine Bewertungen

- 17 5402ezbkDokument64 Seiten17 5402ezbkPhylicia MorrisNoch keine Bewertungen

- B4 Nov MSDokument13 SeitenB4 Nov MSCerealis FelicianNoch keine Bewertungen

- Instructions For Form 990-T: Paperwork Reduction Act NoticeDokument16 SeitenInstructions For Form 990-T: Paperwork Reduction Act NoticeIRSNoch keine Bewertungen

- Corporation Returns. - Requirements Final Adjustment ReturnDokument3 SeitenCorporation Returns. - Requirements Final Adjustment ReturnDevilleres Eliza DenNoch keine Bewertungen

- Notice To Employee Instructions For Employee: WWW - SSA.govDokument1 SeiteNotice To Employee Instructions For Employee: WWW - SSA.govPiyush AgrawalNoch keine Bewertungen

- US Internal Revenue Service: f5329 - 1995Dokument2 SeitenUS Internal Revenue Service: f5329 - 1995IRSNoch keine Bewertungen

- DR0112X 2023Dokument7 SeitenDR0112X 2023y.zdrazhevskayaNoch keine Bewertungen

- US Internal Revenue Service: I1040c - 1996Dokument6 SeitenUS Internal Revenue Service: I1040c - 1996IRSNoch keine Bewertungen

- US Internal Revenue Service: F1040esn - 2004Dokument5 SeitenUS Internal Revenue Service: F1040esn - 2004IRSNoch keine Bewertungen

- US Internal Revenue Service: F2106ez - 1996Dokument2 SeitenUS Internal Revenue Service: F2106ez - 1996IRSNoch keine Bewertungen

- 1402 Gain On Transfer SharesDokument2 Seiten1402 Gain On Transfer SharesMaddahayota CollegeNoch keine Bewertungen

- 1702-MX June 2013 GuidelinesDokument4 Seiten1702-MX June 2013 GuidelinesvicsNoch keine Bewertungen

- US Internal Revenue Service: f2210f - 1996Dokument2 SeitenUS Internal Revenue Service: f2210f - 1996IRSNoch keine Bewertungen

- US Internal Revenue Service: f8453p - 2001Dokument2 SeitenUS Internal Revenue Service: f8453p - 2001IRSNoch keine Bewertungen

- US Internal Revenue Service: I1120f - 1993Dokument20 SeitenUS Internal Revenue Service: I1120f - 1993IRSNoch keine Bewertungen

- Instructions For Form CT-1: Internal Revenue ServiceDokument4 SeitenInstructions For Form CT-1: Internal Revenue ServiceIRSNoch keine Bewertungen

- BJ005 Self Assessment Tax Return 05.04.2023 - For ApprovalDokument23 SeitenBJ005 Self Assessment Tax Return 05.04.2023 - For ApprovalT5.COMNoch keine Bewertungen

- US Internal Revenue Service: I1120rei - 1996Dokument12 SeitenUS Internal Revenue Service: I1120rei - 1996IRSNoch keine Bewertungen

- Weekly Tax Table: Pay As You Go (PAYG) WithholdingDokument12 SeitenWeekly Tax Table: Pay As You Go (PAYG) Withholdingwawen03Noch keine Bewertungen

- US Internal Revenue Service: I2210 - 1996Dokument5 SeitenUS Internal Revenue Service: I2210 - 1996IRSNoch keine Bewertungen

- Instructions For Form 940: Pager/SgmlDokument8 SeitenInstructions For Form 940: Pager/SgmlIRSNoch keine Bewertungen

- US Internal Revenue Service: f5329 - 2004Dokument2 SeitenUS Internal Revenue Service: f5329 - 2004IRSNoch keine Bewertungen

- Statement For Claiming Exemption From Withholding On Foreign Earned Income Eligible For The Exclusion(s) Provided by Section 911Dokument2 SeitenStatement For Claiming Exemption From Withholding On Foreign Earned Income Eligible For The Exclusion(s) Provided by Section 911douglas jonesNoch keine Bewertungen

- 2301 Turnover Tax Declaration FormDokument3 Seiten2301 Turnover Tax Declaration FormMaddahayota College100% (1)

- US Internal Revenue Service: I1120ric - 1993Dokument12 SeitenUS Internal Revenue Service: I1120ric - 1993IRSNoch keine Bewertungen

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDokument4 SeitenEmployer's Annual Federal Unemployment (FUTA) Tax ReturnFrancis Wolfgang UrbanNoch keine Bewertungen

- Instructions For Form 1045 (2021) - Internal Revenue ServiceDokument36 SeitenInstructions For Form 1045 (2021) - Internal Revenue ServiceDr. Varah SiedleckiNoch keine Bewertungen

- Form 1040-ES: Purpose of This PackageDokument12 SeitenForm 1040-ES: Purpose of This PackageBill ChenNoch keine Bewertungen

- US Internal Revenue Service: I1041 - 1990Dokument18 SeitenUS Internal Revenue Service: I1041 - 1990IRSNoch keine Bewertungen

- US Internal Revenue Service: fw4s - 1994Dokument2 SeitenUS Internal Revenue Service: fw4s - 1994IRSNoch keine Bewertungen

- U.S. Corporation Income Tax Declaration For An IRS E-File ReturnDokument1 SeiteU.S. Corporation Income Tax Declaration For An IRS E-File ReturnSrinivas GopalanNoch keine Bewertungen

- US Internal Revenue Service: 2290rulesty2007v4 0Dokument6 SeitenUS Internal Revenue Service: 2290rulesty2007v4 0IRSNoch keine Bewertungen

- 2008 Objectives Report To Congress v2Dokument153 Seiten2008 Objectives Report To Congress v2IRSNoch keine Bewertungen

- 2008 Credit Card Bulk Provider RequirementsDokument112 Seiten2008 Credit Card Bulk Provider RequirementsIRSNoch keine Bewertungen

- 2008 Data DictionaryDokument260 Seiten2008 Data DictionaryIRSNoch keine Bewertungen

- Istqb Agile Tester Learning Objectives SingleDokument3 SeitenIstqb Agile Tester Learning Objectives SingleSundarNoch keine Bewertungen

- Q1 LAS 4 FABM2 12 Week 2 3Dokument7 SeitenQ1 LAS 4 FABM2 12 Week 2 3Flare ColterizoNoch keine Bewertungen

- Material Submission Form Register - STR (20210929)Dokument1 SeiteMaterial Submission Form Register - STR (20210929)HoWang LeeNoch keine Bewertungen

- Intermediate Algebra Functions and Authentic Applications 5th Edition Jay Lehmann Solutions ManualDokument31 SeitenIntermediate Algebra Functions and Authentic Applications 5th Edition Jay Lehmann Solutions Manualchiliasmevenhandtzjz8j100% (32)

- C10G - Hardware Installation GD - 3 - 12 - 2014Dokument126 SeitenC10G - Hardware Installation GD - 3 - 12 - 2014Htt Ếch CốmNoch keine Bewertungen

- RICS APC Candidate Guide-Aug 2015-WEB PDFDokument24 SeitenRICS APC Candidate Guide-Aug 2015-WEB PDFLahiru WijethungaNoch keine Bewertungen

- GTA TaxonomyDokument12 SeitenGTA Taxonomyalvaropiogomez1Noch keine Bewertungen

- Intructional Tools With The Integration of TechnologyDokument44 SeitenIntructional Tools With The Integration of TechnologyAlwyn SacandalNoch keine Bewertungen

- Pre-Interview Fresh Graduate Programs PDFDokument5 SeitenPre-Interview Fresh Graduate Programs PDFDimas Kusuma AndanuNoch keine Bewertungen

- Ass2 mkt1009Dokument11 SeitenAss2 mkt1009thang5423Noch keine Bewertungen

- Crew Body Temp: Arrival ArrivalDokument1 SeiteCrew Body Temp: Arrival ArrivalАлександр ГриднёвNoch keine Bewertungen

- FPO Policy-1Dokument96 SeitenFPO Policy-1shashanksaranNoch keine Bewertungen

- T8 B20 NEADS Trip 2 of 3 FDR - Transcript - NEADS Rome NY - DRM 2 - Dat 2 - PG 1-83 - Color-CodedDokument83 SeitenT8 B20 NEADS Trip 2 of 3 FDR - Transcript - NEADS Rome NY - DRM 2 - Dat 2 - PG 1-83 - Color-Coded9/11 Document ArchiveNoch keine Bewertungen

- Ruling The CountrysideDokument9 SeitenRuling The Countrysiderajesh duaNoch keine Bewertungen

- Numerical Simulation of Turbulent Flow Over Surface Mounted Obstacles With Sharp Edges and CornersDokument19 SeitenNumerical Simulation of Turbulent Flow Over Surface Mounted Obstacles With Sharp Edges and CornersHelen ChoiNoch keine Bewertungen

- Books Confirmation - Sem VII - 2020-2021 PDFDokument17 SeitenBooks Confirmation - Sem VII - 2020-2021 PDFRaj Kothari MNoch keine Bewertungen

- HSE - Made Gde PanduDokument3 SeitenHSE - Made Gde Pandurezki_WSNoch keine Bewertungen

- The Dell Direct Model: What It Means For Customers (Users) : - ProsDokument12 SeitenThe Dell Direct Model: What It Means For Customers (Users) : - ProsAbhinandan MattelaNoch keine Bewertungen

- Map of The 110 and 220 KV Power Transmission Line and Substation Ulaanbaatar City " Ikh Toirog " ProjectDokument10 SeitenMap of The 110 and 220 KV Power Transmission Line and Substation Ulaanbaatar City " Ikh Toirog " ProjectAltanochir AagiiNoch keine Bewertungen

- BBBB - View ReservationDokument2 SeitenBBBB - View ReservationBashir Ahmad BashirNoch keine Bewertungen

- 10 BDDDokument39 Seiten10 BDDEliana NaviaNoch keine Bewertungen

- Account Statement 060922 051222Dokument51 SeitenAccount Statement 060922 051222allison squad xXNoch keine Bewertungen

- 1st Activity in EthicsDokument2 Seiten1st Activity in EthicsAleiah Jane Valencia AlverioNoch keine Bewertungen

- AmeloblastomaDokument4 SeitenAmeloblastomaMarïsa CastellonNoch keine Bewertungen