Beruflich Dokumente

Kultur Dokumente

US Internal Revenue Service: f5500sp - 1991

Hochgeladen von

IRSOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

US Internal Revenue Service: f5500sp - 1991

Hochgeladen von

IRSCopyright:

Verfügbare Formate

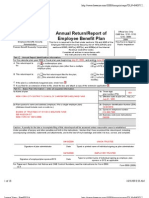

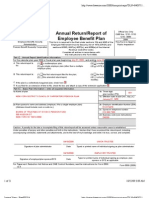

SCHEDULE P Annual Return of Fiduciary OMB No.

1210-0016

(Form 5500) of Employee Benefit Trust

© File as an attachment to Form 5500, 5500-C/R, or 5500EZ.

Department of the Treasury

Internal Revenue Service © For the Paperwork Reduction Notice, see page 1 of the Form 5500 instructions.

For trust calendar year 1991 or fiscal year beginning , 1991, and ending , 19 .

1a Name of trustee or custodian

Please type or print

b Number, street, and room or suite no. (If a P.O. box, see the instructions for Form 5500, 5500-C/R, or 5500EZ.)

c City or town, state, and ZIP code

2 Name of trust

3 Name of plan if different from name of trust

4 Have you furnished the participating employee benefit plan(s) with the trust financial information required

to be reported by the plan(s)? Yes No

5 Enter the plan sponsor’s employer identification number as shown on Form 5500,

5500-C/R, or 5500EZ ©

Under penalties of perjury, I declare that I have examined this schedule, and to the best of my knowledge and belief it is true, correct, and complete.

Signature of fiduciary © Date ©

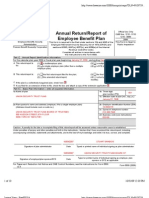

Instructions If the trust or custodial account is used by more

than one plan, file one Schedule P (Form 5500). File it

(Section references are to the Internal Revenue Code.)

as an attachment to one of the participating plan’s

A. Purpose of Form returns/reports. If a plan uses more than one trust or

You may use this schedule to satisfy the requirements custodial account for its funds, file one Schedule P

under section 6033(a) for an annual information return (Form 5500) for each trust or custodial account.

from every section 401(a) organization exempt from tax D. Signature

under section 501(a). The fiduciary (trustee or custodian) must sign this

Filing this form will start the running of the statute of schedule. If there is more than one fiduciary, one of

limitations under section 6501(a) for any trust them, authorized by the others, may sign.

described in section 401(a), which is exempt from tax

E. Other Returns and Forms That May Be

under section 501(a).

Required

B. Who May File (1) Form 990-T.—For trusts described in section

(1) Every trustee of a trust created as part of an 401(a), a tax is imposed on income derived from

employee benefit plan as described in section 401(a). business that is unrelated to the purpose for which the

(2) Every custodian of a custodial account described in trust received a tax exemption. Report such income

section 401(f). and tax on Form 990-T, Exempt Organization Business

Income Tax Return. (See sections 511 through 514 and

C. How To File the related regulations.)

File Schedule P (Form 5500) for the trust year ending (2) Form 1099-R.—If you made payments or

with or within any participating plan’s plan year. Attach distributions to individual beneficiaries of a plan, report

it to the Form 5500, 5500-C/R, or 5500EZ filed by the these payments on Form 1099-R. (See sections 6041

plan for that plan year. and 6047 and the related regulations.)

Schedule P (Form 5500) must be filed only as an (3) Forms 941 or 941E.—If you made payments or

attachment to a Form 5500, 5500-C/R, or 5500EZ. A distributions to individual beneficiaries of a plan, you

separately filed Schedule P (Form 5500) will not be are required to withhold income tax from those

accepted. payments unless the payee elects not to have the tax

withheld. Report any withholding tax on Form 941 or

941E. (See Form 941 or 941E, and Circular E, Pub. 15.)

Cat. No. 13504X Schedule P (Form 5500) 1991

Das könnte Ihnen auch gefallen

- 1040 Exam Prep Module V: Adjustments to Income or DeductionsVon Everand1040 Exam Prep Module V: Adjustments to Income or DeductionsNoch keine Bewertungen

- US Internal Revenue Service: I5500sp - 2003Dokument1 SeiteUS Internal Revenue Service: I5500sp - 2003IRSNoch keine Bewertungen

- US Internal Revenue Service: I5500sp - 2004Dokument1 SeiteUS Internal Revenue Service: I5500sp - 2004IRSNoch keine Bewertungen

- US Internal Revenue Service: f5500sp - 1999Dokument1 SeiteUS Internal Revenue Service: f5500sp - 1999IRSNoch keine Bewertungen

- US Internal Revenue Service: f5500sf - 1997Dokument1 SeiteUS Internal Revenue Service: f5500sf - 1997IRSNoch keine Bewertungen

- Retirement & Pension Plan For NYCDCC Employees 2006Dokument13 SeitenRetirement & Pension Plan For NYCDCC Employees 2006Latisha WalkerNoch keine Bewertungen

- US Internal Revenue Service: f5500sp - 2000Dokument1 SeiteUS Internal Revenue Service: f5500sp - 2000IRSNoch keine Bewertungen

- US Internal Revenue Service: F8453e - 1994Dokument2 SeitenUS Internal Revenue Service: F8453e - 1994IRSNoch keine Bewertungen

- Instructions For Schedule A (Form 990) : Internal Revenue ServiceDokument8 SeitenInstructions For Schedule A (Form 990) : Internal Revenue ServiceIRSNoch keine Bewertungen

- Carpenters Welfare Fund 2006Dokument16 SeitenCarpenters Welfare Fund 2006Latisha WalkerNoch keine Bewertungen

- Instructions For Form 5500-EZ: Annual Return of One-Participant (Owners and Their Spouses) Retirement PlanDokument6 SeitenInstructions For Form 5500-EZ: Annual Return of One-Participant (Owners and Their Spouses) Retirement PlanIRSNoch keine Bewertungen

- US Internal Revenue Service: f5500sf - 1993Dokument1 SeiteUS Internal Revenue Service: f5500sf - 1993IRSNoch keine Bewertungen

- US Internal Revenue Service: f5500 - 2001Dokument4 SeitenUS Internal Revenue Service: f5500 - 2001IRSNoch keine Bewertungen

- US Internal Revenue Service: f5500sf - 1996Dokument1 SeiteUS Internal Revenue Service: f5500sf - 1996IRSNoch keine Bewertungen

- Carpenters Welfare Fund 2007Dokument18 SeitenCarpenters Welfare Fund 2007Latisha WalkerNoch keine Bewertungen

- Instructions For Schedule A (Form 990) : Internal Revenue ServiceDokument8 SeitenInstructions For Schedule A (Form 990) : Internal Revenue ServiceIRSNoch keine Bewertungen

- 2006 Form 5500 Carpenter Pension PlanDokument22 Seiten2006 Form 5500 Carpenter Pension PlanLatisha WalkerNoch keine Bewertungen

- Carpenters Vacation Fund 2006Dokument14 SeitenCarpenters Vacation Fund 2006Latisha WalkerNoch keine Bewertungen

- Carpenters Annuity Fund 2006Dokument20 SeitenCarpenters Annuity Fund 2006Latisha WalkerNoch keine Bewertungen

- Retirement & Pension Plan For NYCDCC Employees 2007Dokument13 SeitenRetirement & Pension Plan For NYCDCC Employees 2007Latisha WalkerNoch keine Bewertungen

- Retirement Plan of Trustees 2007Dokument14 SeitenRetirement Plan of Trustees 2007Latisha WalkerNoch keine Bewertungen

- 2007 Form 5500 Carpenter Pension PlanDokument21 Seiten2007 Form 5500 Carpenter Pension PlanLatisha WalkerNoch keine Bewertungen

- Carpenters Vacation Fund 2007Dokument8 SeitenCarpenters Vacation Fund 2007Latisha WalkerNoch keine Bewertungen

- US Internal Revenue Service: f5500sb - 2003Dokument7 SeitenUS Internal Revenue Service: f5500sb - 2003IRSNoch keine Bewertungen

- Carpenters Annuity Fund 2007Dokument19 SeitenCarpenters Annuity Fund 2007Latisha WalkerNoch keine Bewertungen

- US Internal Revenue Service: f5500cr - 1995Dokument6 SeitenUS Internal Revenue Service: f5500cr - 1995IRSNoch keine Bewertungen

- Attention:: WWW - Efast.dol - GovDokument4 SeitenAttention:: WWW - Efast.dol - GovIRSNoch keine Bewertungen

- US Internal Revenue Service: I1040sf - 2004Dokument6 SeitenUS Internal Revenue Service: I1040sf - 2004IRSNoch keine Bewertungen

- Union Security Trust Fund 2007Dokument10 SeitenUnion Security Trust Fund 2007Latisha WalkerNoch keine Bewertungen

- Change To 2003 Instructions For Form 1099-R and 5498-Guide To Distribution Codes (Box 7)Dokument16 SeitenChange To 2003 Instructions For Form 1099-R and 5498-Guide To Distribution Codes (Box 7)IRSNoch keine Bewertungen

- Instructions For Schedule R (Form 941) : (Rev. June 2021)Dokument3 SeitenInstructions For Schedule R (Form 941) : (Rev. June 2021)Josh JasperNoch keine Bewertungen

- US Internal Revenue Service: I5500sb - 2006Dokument9 SeitenUS Internal Revenue Service: I5500sb - 2006IRSNoch keine Bewertungen

- US Internal Revenue Service: f5500 - 1995Dokument6 SeitenUS Internal Revenue Service: f5500 - 1995IRSNoch keine Bewertungen

- US Internal Revenue Service: f5500cr - 1991Dokument6 SeitenUS Internal Revenue Service: f5500cr - 1991IRSNoch keine Bewertungen

- US Internal Revenue Service: f5500sb - 1999Dokument8 SeitenUS Internal Revenue Service: f5500sb - 1999IRSNoch keine Bewertungen

- US Internal Revenue Service: I1099r 06Dokument15 SeitenUS Internal Revenue Service: I1099r 06IRSNoch keine Bewertungen

- US Internal Revenue Service: f5500 - 2002Dokument6 SeitenUS Internal Revenue Service: f5500 - 2002IRSNoch keine Bewertungen

- Notice To Employee Instructions For Employee: (Continued From The Back of Copy B.)Dokument1 SeiteNotice To Employee Instructions For Employee: (Continued From The Back of Copy B.)redditor1276Noch keine Bewertungen

- Form 5500 Employee Benefit Plan AuditsDokument13 SeitenForm 5500 Employee Benefit Plan AuditsCA Rajendra Prasad ANoch keine Bewertungen

- I1099msc PDFDokument13 SeitenI1099msc PDFAdam SNoch keine Bewertungen

- I1099msc PDFDokument13 SeitenI1099msc PDFAdam SNoch keine Bewertungen

- Instructions For Form 990-EZ: Department of The TreasuryDokument16 SeitenInstructions For Form 990-EZ: Department of The TreasuryIRSNoch keine Bewertungen

- US Internal Revenue Service: I5500ez - 1995Dokument6 SeitenUS Internal Revenue Service: I5500ez - 1995IRSNoch keine Bewertungen

- US Internal Revenue Service: f5500cr - 1997Dokument6 SeitenUS Internal Revenue Service: f5500cr - 1997IRSNoch keine Bewertungen

- Presentation On Issues in ITR 7 Data Filling by TaxpayersDokument14 SeitenPresentation On Issues in ITR 7 Data Filling by Taxpayersbap1986Noch keine Bewertungen

- US Internal Revenue Service: I1040sf - 2003Dokument6 SeitenUS Internal Revenue Service: I1040sf - 2003IRSNoch keine Bewertungen

- Notice To Employee Instructions For Employee: WWW - SSA.govDokument1 SeiteNotice To Employee Instructions For Employee: WWW - SSA.govPiyush AgrawalNoch keine Bewertungen

- US Internal Revenue Service: I1099div 07Dokument3 SeitenUS Internal Revenue Service: I1099div 07IRSNoch keine Bewertungen

- Form 1040 Schedule BDokument1 SeiteForm 1040 Schedule BGwo GwppyNoch keine Bewertungen

- Kaiser Supplemental Savings and Retirement Plan Annual Report Form 5500Dokument37 SeitenKaiser Supplemental Savings and Retirement Plan Annual Report Form 5500James LindonNoch keine Bewertungen

- Instructions For Schedule A (Form 990 or 990-EZ)Dokument10 SeitenInstructions For Schedule A (Form 990 or 990-EZ)IRSNoch keine Bewertungen

- Union Security Trust Fund 2006Dokument10 SeitenUnion Security Trust Fund 2006Latisha WalkerNoch keine Bewertungen

- US Internal Revenue Service: I1040sf - 1998Dokument7 SeitenUS Internal Revenue Service: I1040sf - 1998IRSNoch keine Bewertungen

- US Internal Revenue Service: I5500ez - 2005Dokument9 SeitenUS Internal Revenue Service: I5500ez - 2005IRSNoch keine Bewertungen

- US Internal Revenue Service: f5500sb - 1994Dokument3 SeitenUS Internal Revenue Service: f5500sb - 1994IRSNoch keine Bewertungen

- Retirement Plan of Trustees 2006Dokument13 SeitenRetirement Plan of Trustees 2006Latisha WalkerNoch keine Bewertungen

- W2 InstructionsDokument3 SeitenW2 Instructionswarriorsinrecoveryalex.rNoch keine Bewertungen

- US Internal Revenue Service: I1065sk1 - 2002Dokument11 SeitenUS Internal Revenue Service: I1065sk1 - 2002IRSNoch keine Bewertungen

- US Internal Revenue Service: I5500sb - 2005Dokument9 SeitenUS Internal Revenue Service: I5500sb - 2005IRSNoch keine Bewertungen

- US Internal Revenue Service: f5500 - 1991Dokument6 SeitenUS Internal Revenue Service: f5500 - 1991IRSNoch keine Bewertungen

- Tratamentul Total Al CanceruluiDokument71 SeitenTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- US Internal Revenue Service: 2290rulesty2007v4 0Dokument6 SeitenUS Internal Revenue Service: 2290rulesty2007v4 0IRSNoch keine Bewertungen

- Tratamentul Total Al CanceruluiDokument71 SeitenTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Objectives Report To Congress v2Dokument153 Seiten2008 Objectives Report To Congress v2IRSNoch keine Bewertungen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDokument71 SeitenTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiDokument71 SeitenTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Credit Card Bulk Provider RequirementsDokument112 Seiten2008 Credit Card Bulk Provider RequirementsIRSNoch keine Bewertungen

- 2008 Data DictionaryDokument260 Seiten2008 Data DictionaryIRSNoch keine Bewertungen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDokument71 SeitenTratamentul Total Al CanceruluiAntal98% (98)

- FW 8 BenDokument1 SeiteFW 8 BenMario Vargas HerreraNoch keine Bewertungen

- Full Download Test Bank For Effective Police Supervision 8th Edition Larry S Miller Harry W More Michael C Braswell 2 PDF Full ChapterDokument36 SeitenFull Download Test Bank For Effective Police Supervision 8th Edition Larry S Miller Harry W More Michael C Braswell 2 PDF Full Chapteralterityfane.mah96z100% (12)

- Procedure Manual - IMS: Locomotive Workshop, Northern Railway, LucknowDokument3 SeitenProcedure Manual - IMS: Locomotive Workshop, Northern Railway, LucknowMarjorie Dulay Dumol67% (3)

- Topic 2Dokument5 SeitenTopic 2Karl Anthony Tence DionisioNoch keine Bewertungen

- ASME B31.5-1994 Addend Refrigeration PipingDokument166 SeitenASME B31.5-1994 Addend Refrigeration PipingFRANCISCO TORRES100% (1)

- Upload 1Dokument15 SeitenUpload 1Saurabh KumarNoch keine Bewertungen

- Case Report Cirilo Paredes V EspinoDokument2 SeitenCase Report Cirilo Paredes V EspinoJordan ProelNoch keine Bewertungen

- Tri-City Times: New Manager Ready To Embrace ChallengesDokument20 SeitenTri-City Times: New Manager Ready To Embrace ChallengesWoodsNoch keine Bewertungen

- KW Branding Identity GuideDokument44 SeitenKW Branding Identity GuidedcsudweeksNoch keine Bewertungen

- Heterosexism and HomophobiaDokument6 SeitenHeterosexism and HomophobiaVictorNoch keine Bewertungen

- Final ReviewDokument14 SeitenFinal ReviewBhavya JainNoch keine Bewertungen

- Nampicuan, Nueva EcijaDokument2 SeitenNampicuan, Nueva EcijaSunStar Philippine NewsNoch keine Bewertungen

- Allied Banking Corporation V BPIDokument2 SeitenAllied Banking Corporation V BPImenforever100% (3)

- Welcome To HDFC Bank NetBankingDokument1 SeiteWelcome To HDFC Bank NetBankingsadhubaba100Noch keine Bewertungen

- (Complaint Affidavit For Filing of BP 22 Case) Complaint-AffidavitDokument2 Seiten(Complaint Affidavit For Filing of BP 22 Case) Complaint-AffidavitRonnie JimenezNoch keine Bewertungen

- Chapter 1Dokument25 SeitenChapter 1Annie Basing-at AngiwotNoch keine Bewertungen

- Performance Appraisal - Butler Supervisor - Club Floor Executive - Club Floor SupervisorDokument6 SeitenPerformance Appraisal - Butler Supervisor - Club Floor Executive - Club Floor SupervisorRHTi BDNoch keine Bewertungen

- Larsen & Toubro LimitedDokument17 SeitenLarsen & Toubro LimitedRæhul SÄlvé100% (3)

- Social Justice Society v. Atienza, JR CASE DIGESTDokument1 SeiteSocial Justice Society v. Atienza, JR CASE DIGESTJuris Poet100% (1)

- Kingsbridge Armory Request For Proposals 2011 FF 1 11 12Dokument54 SeitenKingsbridge Armory Request For Proposals 2011 FF 1 11 12xoneill7715Noch keine Bewertungen

- Aeris Product Sheet ConnectionLockDokument2 SeitenAeris Product Sheet ConnectionLockGadakNoch keine Bewertungen

- Two-Nation TheoryDokument6 SeitenTwo-Nation TheoryAleeha IlyasNoch keine Bewertungen

- Afar Business CombinationDokument16 SeitenAfar Business CombinationAnnie Sta Maria TrinidadNoch keine Bewertungen

- Philippine Laws On WomenDokument56 SeitenPhilippine Laws On WomenElle BanigoosNoch keine Bewertungen

- Eada Newsletter-May-2015 (Proof3)Dokument2 SeitenEada Newsletter-May-2015 (Proof3)api-254556282Noch keine Bewertungen

- Carta de Intencion (Ingles)Dokument3 SeitenCarta de Intencion (Ingles)luz maria100% (1)

- NPGCL - Units in PakistanDokument9 SeitenNPGCL - Units in Pakistanramnadh803181Noch keine Bewertungen

- Track Changes of Doctrine and Covenants Section 8Dokument2 SeitenTrack Changes of Doctrine and Covenants Section 8Bomo NomoNoch keine Bewertungen

- HNC Counselling ApplicationFormDokument3 SeitenHNC Counselling ApplicationFormLaura WalkerNoch keine Bewertungen

- Position Paper in Purposive CommunicationDokument2 SeitenPosition Paper in Purposive CommunicationKhynjoan AlfilerNoch keine Bewertungen

- The Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpVon EverandThe Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpBewertung: 4.5 von 5 Sternen4.5/5 (11)

- Crimes and Cover-ups in American Politics: 1776-1963Von EverandCrimes and Cover-ups in American Politics: 1776-1963Bewertung: 4.5 von 5 Sternen4.5/5 (26)

- The Courage to Be Free: Florida's Blueprint for America's RevivalVon EverandThe Courage to Be Free: Florida's Blueprint for America's RevivalNoch keine Bewertungen

- Power Grab: The Liberal Scheme to Undermine Trump, the GOP, and Our RepublicVon EverandPower Grab: The Liberal Scheme to Undermine Trump, the GOP, and Our RepublicNoch keine Bewertungen

- The Red and the Blue: The 1990s and the Birth of Political TribalismVon EverandThe Red and the Blue: The 1990s and the Birth of Political TribalismBewertung: 4 von 5 Sternen4/5 (29)

- Modern Warriors: Real Stories from Real HeroesVon EverandModern Warriors: Real Stories from Real HeroesBewertung: 3.5 von 5 Sternen3.5/5 (3)

- Stonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonVon EverandStonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonBewertung: 4.5 von 5 Sternen4.5/5 (21)

- The Next Civil War: Dispatches from the American FutureVon EverandThe Next Civil War: Dispatches from the American FutureBewertung: 3.5 von 5 Sternen3.5/5 (47)

- The Deep State: How an Army of Bureaucrats Protected Barack Obama and Is Working to Destroy the Trump AgendaVon EverandThe Deep State: How an Army of Bureaucrats Protected Barack Obama and Is Working to Destroy the Trump AgendaBewertung: 4.5 von 5 Sternen4.5/5 (4)

- Socialism 101: From the Bolsheviks and Karl Marx to Universal Healthcare and the Democratic Socialists, Everything You Need to Know about SocialismVon EverandSocialism 101: From the Bolsheviks and Karl Marx to Universal Healthcare and the Democratic Socialists, Everything You Need to Know about SocialismBewertung: 4.5 von 5 Sternen4.5/5 (42)

- Game Change: Obama and the Clintons, McCain and Palin, and the Race of a LifetimeVon EverandGame Change: Obama and the Clintons, McCain and Palin, and the Race of a LifetimeBewertung: 4 von 5 Sternen4/5 (572)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingVon EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingBewertung: 4.5 von 5 Sternen4.5/5 (97)

- The Magnificent Medills: The McCormick-Patterson Dynasty: America's Royal Family of Journalism During a Century of Turbulent SplendorVon EverandThe Magnificent Medills: The McCormick-Patterson Dynasty: America's Royal Family of Journalism During a Century of Turbulent SplendorNoch keine Bewertungen

- The Invisible Bridge: The Fall of Nixon and the Rise of ReaganVon EverandThe Invisible Bridge: The Fall of Nixon and the Rise of ReaganBewertung: 4.5 von 5 Sternen4.5/5 (32)

- A Short History of the United States: From the Arrival of Native American Tribes to the Obama PresidencyVon EverandA Short History of the United States: From the Arrival of Native American Tribes to the Obama PresidencyBewertung: 3.5 von 5 Sternen3.5/5 (19)

- Witch Hunt: The Story of the Greatest Mass Delusion in American Political HistoryVon EverandWitch Hunt: The Story of the Greatest Mass Delusion in American Political HistoryBewertung: 4 von 5 Sternen4/5 (6)

- The Science of Liberty: Democracy, Reason, and the Laws of NatureVon EverandThe Science of Liberty: Democracy, Reason, and the Laws of NatureNoch keine Bewertungen

- To Make Men Free: A History of the Republican PartyVon EverandTo Make Men Free: A History of the Republican PartyBewertung: 4.5 von 5 Sternen4.5/5 (21)

- Resistance: How Women Saved Democracy from Donald TrumpVon EverandResistance: How Women Saved Democracy from Donald TrumpNoch keine Bewertungen

- Corruptible: Who Gets Power and How It Changes UsVon EverandCorruptible: Who Gets Power and How It Changes UsBewertung: 4.5 von 5 Sternen4.5/5 (45)

- Slouching Towards Gomorrah: Modern Liberalism and American DeclineVon EverandSlouching Towards Gomorrah: Modern Liberalism and American DeclineBewertung: 4 von 5 Sternen4/5 (59)

- Introduction to Negotiable Instruments: As per Indian LawsVon EverandIntroduction to Negotiable Instruments: As per Indian LawsBewertung: 5 von 5 Sternen5/5 (1)

- Ben & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooVon EverandBen & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooBewertung: 5 von 5 Sternen5/5 (2)