Beruflich Dokumente

Kultur Dokumente

US Internal Revenue Service: f8396 - 1994

Hochgeladen von

IRSOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

US Internal Revenue Service: f8396 - 1994

Hochgeladen von

IRSCopyright:

Verfügbare Formate

Form 8396 Mortgage Interest Credit

(For Holders of Qualified Mortgage Credit Certificates Issued by

OMB No. 1545-0930

State or Local Governmental Units or Agencies.)

© See instructions on back.

Department of the Treasury Attachment

Internal Revenue Service © Attach to Form 1040. Sequence No. 53

Name(s) shown on Form 1040 Your social security number

Enter the address of your main home on which the credit is claimed if it is different than the address shown on Form 1040.

Part I Mortgage Interest Credit

1 Interest paid on the certified indebtedness amount. If you and at least one other person held

an interest in the home, enter only your share of the interest paid 1

2 Enter the certificate credit rate shown on your mortgage credit certificate 2 %

3 Multiply line 1 by the percentage on line 2. If line 2 is more than 20%, see instructions for

amount to enter. You must reduce your mortgage interest deduction on Schedule A (Form

1040) by this amount 3

4 Enter any credit carryforward from 1991 (line 18 of your 1993 Form 8396) 4

5 Enter any credit carryforward from 1992 (line 16 of your 1993 Form 8396) 5

6 Enter any credit carryforward from 1993 (line 19 of your 1993 Form 8396) 6

7 Add lines 3 through 6 7

8 Enter the amount from Form 1040, line 40 8

9 Add the amounts from Form 1040, lines 41 and 42, and enter the total 9

10 Subtract line 9 from line 8. If zero or less, enter -0- 10

11 Mortgage Interest Credit. Enter the smaller of line 7 or line 10. See the instructions for the

amount of credit you can claim, and the amount to enter on Form 1040, line 44. Be sure to

check box b on that line 11

Part II Mortgage Interest Credit Carryforward to 1995. (Complete only if line 11 is less than line 7.)

12 Add lines 3 and 4 12

13 Enter the amount from line 7 13

14 Enter the larger of line 11 or line 12 14

15 Subtract line 14 from line 13 15

16 1993 credit carryforward to 1995. Enter the smaller of line 6 or line 15 16

17 Subtract line 16 from line 15 17

18 1992 credit carryforward to 1995. Enter the smaller of line 5 or line 17 18

19 1994 credit carryforward to 1995. Subtract line 11 from line 3. If zero or less, enter -0- 19

Paperwork Reduction Act Notice The time needed to complete and file If you have comments concerning the

We ask for the information on this form this form will vary depending on accuracy of these time estimates or

to carry out the Internal Revenue laws of individual circumstances. The estimated suggestions for making this form

the United States. You are required to average time is: Recordkeeping, 46 simpler, we would be happy to hear from

give us the information. We need it to min.; Learning about the law or the you. You can write to both the IRS and

ensure that you are complying with form, 6 min.; Preparing the form, 42 the Office of Management and Budget

these laws and to allow us to figure and min.; and Copying, assembling, and at the addresses listed in the

collect the right amount of tax. sending the form to the IRS, 20 min. Instructions for Form 1040.

Cat. No. 62502X Form 8396 (1994)

Form 8396 (1994) Page 2

General Instructions If you refinanced the mortgage for paid on your home mortgage, even if

which you had an MCC, and you part of the amount on line 3 is carried

Section references are to the Internal received a reissued MCC, the total forward to 1995.

Revenue Code unless otherwise noted. interest may be entered on line 1 only if Line 11.—You may need to complete

Purpose of Form.—Form 8396 is used the certificate credit rate is the same on Form 6251, Alternative Minimum Tax—

by an individual who holds a qualified each of the certificates. If the certificate Individuals, because the amount from

mortgage credit certificate (MCC) issued credit rates are different, attach a line 24 of that form may limit the amount

by a state or local governmental unit or statement showing the separate of your credit. Use the worksheet below

agency. The individual figures the calculations for lines 1, 2, and 3 for both to see if you need to complete Form

mortgage interest credit allowed for the the original and the reissued MCC. Enter 6251 and to figure the amount of credit

current year and any carryforward to the the combined total on line 3 of the form to enter on Form 1040.

following year. and write “see attached” on the dotted Lines 12 through 19.—If the amount on

Who May Claim the Credit.—You may line. line 11 is less than the amount on line 7,

claim the credit only if you were issued Line 3.—If the certificate credit rate you may have an unused credit to carry

a qualified MCC by a state or local shown on line 2 is more than 20%, do forward to the next 3 tax years or until

governmental unit or agency under a not enter more than $2,000 on line 3. If used, whichever comes first. Because

qualified mortgage credit certificate you have a reissued certificate, the the unused credit can only be carried

program. Certificates issued by the certificate cannot result in an increase in forward for 3 years, you will have to

Federal Housing Administration, the credit that would have otherwise keep track of each year’s unused credit.

Department of Veterans Affairs, and been allowed to you under the existing The current year credit is used first and

Farmers Home Administration, and certificate for any tax year. then the prior year credits, beginning

Homestead Staff Exemption Certificates If you and at least one other person with the earliest prior year.

do not qualify for the credit. The home (other than your spouse if you file a joint If you have any unused credit to carry

to which the certificate relates must be return) held an interest in the home, the forward to 1995, be sure you keep a

your main home and must also be $2,000 limit must be allocated to each copy of the form. You will need this

located in the jurisdiction of the owner in proportion to the interest he or information to figure your credit for

governmental unit that issued the she held. See Pub. 530, Tax Information 1995.

certificate. for First-Time Homeowners, for an Note: If you are subject to the $2,000

Refinanced Mortgage Credit example of how to make the allocation. credit limitation because your certificate

Certificates.—You can refinance your Reduction of Home Mortgage Interest credit rate is more than 20%, no amount

mortgage without losing this Federal on Schedule A (For m 1040).—If you over the $2,000 (or your prorated share

subsidy if the refinancing meets certain itemize your deductions on Schedule A of the $2,000 if you must allocate the

conditions. For details, get Form 8828, (Form 1040), you must subtract the credit) may be carried forward for use in

Recapture of Federal Mortgage Subsidy amount shown on line 3 of Form 8396 a subsequent year.

or see Regulations section 1.25-3T(p). from the total deductible interest you

Related Persons.—If the interest on the Line 11—Worksheet (keep a copy for your records)

mortgage for which the credit certificate

was issued was paid to a related 1. Enter the amount from Form 8396, line 11

person, you cannot claim the credit. 2. Enter the amount from Form 1040, line 22, plus any net operating loss deduction

Recapture of Credit.—If you purchase a and tax-exempt interest from private activity bonds issued after August 7, 1986

home using an MCC, and sell that home Note: If line 2 is more than $150,000 ($112,500 if single or head of household;

within 9 years, you may have to $75,000 if married filing separately) OR you file Schedule C, C-EZ, D, E, or F, of

recapture (repay) a portion of the credit. Form 1040, complete Form 6251 through line 24. Then, complete only lines 5, 8,

For more details, get Pub. 523, Selling 9, and 10 below. Otherwise, go to line 3.

Your Home, and Form 8828. 3. Enter $45,000 ($33,750 if single or head of household; $22,500 if married filing

separately)

Specific Instructions 4. Subtract line 3 from line 2. If zero or less, stop here; enter on Form 1040, line

Line 1.—Enter the interest you paid 44, the amount from line 1 above. Otherwise, go to line 5

during the year on the loan amount 5. Enter the amount from Form 8396, line 10

shown on your mortgage credit

6. Multiply line 4 by 26% (.26)

certificate. In most cases, this will be the

amount shown on Form 1098, Mortgage 7. Subtract line 6 from line 5. If zero or less, enter -0-

Interest Statement, in box 1, or on a Next: If line 7 is equal to or more than line 1 above, stop here; enter the amount

from line 1 on Form 1040, line 44. Otherwise, complete Form 6251 through line

similar statement that you received from

24, and lines 8, 9, and 10 below.

your mortgage holder. The loan amount 8. Enter the amount from Form 6251, line 24

(certified indebtedness amount) shown

on your MCC may be less than your 9. Subtract line 8 from line 5. If zero or less, enter -0-

10. Enter the smaller of line 1 or line 9 here and on Form 1040, line 44. If line 9 is

total mortgage loan. If so, you must the smaller amount, write “AMT” in the left margin next to line 44 and replace

allocate the interest to determine what the amount on Form 8396, line 11, with this line 10 amount. Also check box b

part relates to the amount of the loan on line 44 of Form 1040

covered by the MCC.

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- ABSTRACT OF TITLE PAID FOR IN FULL Discharging Mortgages 2Dokument1 SeiteABSTRACT OF TITLE PAID FOR IN FULL Discharging Mortgages 2jpesNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Kieso 6Dokument54 SeitenKieso 6noortiaNoch keine Bewertungen

- Sps. Dela Cruz V Asian Consumer FactsDokument1 SeiteSps. Dela Cruz V Asian Consumer FactsHyuga NejiNoch keine Bewertungen

- Tratamentul Total Al CanceruluiDokument71 SeitenTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiDokument71 SeitenTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiDokument71 SeitenTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiDokument71 SeitenTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiDokument71 SeitenTratamentul Total Al CanceruluiAntal98% (98)

- US Internal Revenue Service: 2290rulesty2007v4 0Dokument6 SeitenUS Internal Revenue Service: 2290rulesty2007v4 0IRSNoch keine Bewertungen

- 2008 Objectives Report To Congress v2Dokument153 Seiten2008 Objectives Report To Congress v2IRSNoch keine Bewertungen

- 2008 Data DictionaryDokument260 Seiten2008 Data DictionaryIRSNoch keine Bewertungen

- 2008 Credit Card Bulk Provider RequirementsDokument112 Seiten2008 Credit Card Bulk Provider RequirementsIRSNoch keine Bewertungen

- Vbank Statement 2023Dokument2 SeitenVbank Statement 2023kasmarproNoch keine Bewertungen

- Neft Ifsc Code ListDokument702 SeitenNeft Ifsc Code ListlegalamritmalwaNoch keine Bewertungen

- Combinepdf 1 PDFDokument16 SeitenCombinepdf 1 PDFandrea arapocNoch keine Bewertungen

- Inflation, Education, and Your ChildDokument10 SeitenInflation, Education, and Your ChildAR HemantNoch keine Bewertungen

- TRS StockvalDokument2 SeitenTRS StockvalUcok DedyNoch keine Bewertungen

- AFAR - Corp LiqDokument1 SeiteAFAR - Corp LiqJoanna Rose Deciar0% (1)

- Draft Return For ReviewDokument4 SeitenDraft Return For ReviewsajjadNoch keine Bewertungen

- US Internal Revenue Service: p575 - 1997Dokument39 SeitenUS Internal Revenue Service: p575 - 1997IRSNoch keine Bewertungen

- Loan Amortization ScheduleDokument25 SeitenLoan Amortization ScheduleMonica SahamiNoch keine Bewertungen

- Our Lady of Mount Carmel Learning Center, Inc. Tunga, Moalboal, Cebu Payroll Permanent JUNE 1-15, 2016Dokument35 SeitenOur Lady of Mount Carmel Learning Center, Inc. Tunga, Moalboal, Cebu Payroll Permanent JUNE 1-15, 2016Jho Jario TapalesNoch keine Bewertungen

- CIBC Business Bank Account StatementDokument24 SeitenCIBC Business Bank Account StatementJames RossNoch keine Bewertungen

- Summary Box For The Natwest Credit Card: Our Pricing PolicyDokument2 SeitenSummary Box For The Natwest Credit Card: Our Pricing PolicylftmadNoch keine Bewertungen

- Chapter 6 Receivables Additional ConceptsDokument14 SeitenChapter 6 Receivables Additional ConceptsElaiza RegaladoNoch keine Bewertungen

- 2023 10 02 11 04 28jul 23 - 605009Dokument3 Seiten2023 10 02 11 04 28jul 23 - 605009prasannapharaohNoch keine Bewertungen

- Veterinary Services Payment Plan AgreementDokument3 SeitenVeterinary Services Payment Plan AgreementRia KudoNoch keine Bewertungen

- Irs - MBS, Remics Etc.Dokument100 SeitenIrs - MBS, Remics Etc.Master ChiefNoch keine Bewertungen

- Ar Ada NR - 223Dokument4 SeitenAr Ada NR - 223Maliha KansiNoch keine Bewertungen

- Blank Medical Invoice TemplateDokument2 SeitenBlank Medical Invoice Templatemiranda criggerNoch keine Bewertungen

- Fastag StatementDokument2 SeitenFastag StatementvmuthubharathNoch keine Bewertungen

- ACCTGREV1 - 002 Notes Payable and RestructuringDokument2 SeitenACCTGREV1 - 002 Notes Payable and RestructuringRenz Angel M. RiveraNoch keine Bewertungen

- Submitted by - 1. Simran Agarwal 2. Rohit Kumar Singh 3. Rishabh Rajora 4. Hitesh Khandawal 5. Aditi SinghDokument20 SeitenSubmitted by - 1. Simran Agarwal 2. Rohit Kumar Singh 3. Rishabh Rajora 4. Hitesh Khandawal 5. Aditi SinghChirag JainNoch keine Bewertungen

- Cps Tax Form Format For 23-24Dokument11 SeitenCps Tax Form Format For 23-24sr91919Noch keine Bewertungen

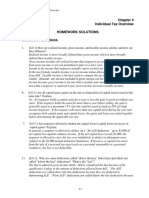

- Homework Chapter 4Dokument10 SeitenHomework Chapter 4ChaituNoch keine Bewertungen

- Kalomo 10101, ZAMBIA 2023/01/12 The Ultimate Account K 1008929 134/1Dokument4 SeitenKalomo 10101, ZAMBIA 2023/01/12 The Ultimate Account K 1008929 134/1Ngosa Davies KundaNoch keine Bewertungen

- Personal Finance Is The Financial Management Which An Individual or A Family Unit Performs To BudgetDokument5 SeitenPersonal Finance Is The Financial Management Which An Individual or A Family Unit Performs To Budgetdhwani100% (1)

- Chapter 3 TCQTDokument14 SeitenChapter 3 TCQTQuốc TháiNoch keine Bewertungen

- Interest Factor TablesDokument32 SeitenInterest Factor TablesChandanSethNoch keine Bewertungen