Beruflich Dokumente

Kultur Dokumente

US Internal Revenue Service: f8689 - 1994

Hochgeladen von

IRS0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

29 Ansichten2 SeitenIRA deductions, credits, or offsets of local Virgin Islands taxes are included. Include this amount in the total on Form 1040, line 60. Include any uncollected employee social security and Medicare or RRTA tax on golden parachute payments.

Originalbeschreibung:

Originaltitel

US Internal Revenue Service: f8689--1994

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenIRA deductions, credits, or offsets of local Virgin Islands taxes are included. Include this amount in the total on Form 1040, line 60. Include any uncollected employee social security and Medicare or RRTA tax on golden parachute payments.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

29 Ansichten2 SeitenUS Internal Revenue Service: f8689 - 1994

Hochgeladen von

IRSIRA deductions, credits, or offsets of local Virgin Islands taxes are included. Include this amount in the total on Form 1040, line 60. Include any uncollected employee social security and Medicare or RRTA tax on golden parachute payments.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

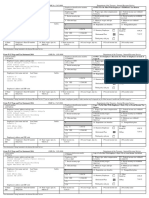

Form 8689 Allocation of Individual Income Tax to

the Virgin Islands

OMB No. 1545-1032

© Attach to Form 1040.

Department of the Treasury Attachment

Internal Revenue Service For calendar year 1994, or fiscal year ending , 19 . Sequence No. 85

Your first name and initial Last name Your social security number

If a joint return, spouse’s first name and initial Last name Spouse’s social security number

Present home address (number and street) Apt. no. City, town or post office, state, and ZIP code

Part I Income From the Virgin Islands

1 Wages, salaries, tips, etc. 1

2 Taxable interest income 2

3 Dividend income 3

4 Taxable refunds, credits, or offsets of local Virgin Islands taxes 4

5 Alimony received 5

6 Business income or (loss) 6

7 Capital gain or (loss) 7

8 Other gains or (losses) 8

9 IRA distributions (taxable amount) 9

10 Pensions and annuities (taxable amount) 10

11 Rental real estate, royalties, partnerships, S corporations, trusts, etc. 11

12 Farm income or (loss) 12

13 Unemployment compensation 13

14 Social security benefits (taxable amount) 14

15 Other income. List type and amount. © 15

16 Add lines 1 through 15. This is your total income © 16

Part II Adjustments to Income From the Virgin Islands

17a Your IRA deduction 17a

b Spouse’s IRA deduction 17b

18 Moving expenses 18

19 One-half of self-employment tax 19

20 Self-employed health insurance deduction (Caution: See instructions.) 20

21 Keogh retirement plan and self-employed SEP deduction 21

22 Penalty on early withdrawal of savings 22

23 Add lines 17a through 22. These are your total adjustments 23

24 Subtract line 23 from line 16. This is your adjusted gross income © 24

Part III Allocation of Tax to the Virgin Islands

25 Enter amount from Form 1040, line 53 25

26 Enter the total of the amounts from Form 1040, lines 47, 50, and 56; any uncollected employee social

security and Medicare or RRTA tax or tax on golden parachute payments included on line 53; and

any amount from Form 5329, Parts II, III, or IV, included on line 51 26

27 Subtract line 26 from line 25 27

28 Enter amount from Form 1040, line 32 28

29 Divide line 24 above by line 28. Enter the result as a decimal (carry to 3 places) 29 3 .

30 Multiply line 27 by line 29. This is your tax allocated to the Virgin Islands. Also, include this amount in the

total on Form 1040, line 60. On the dotted line next to line 60, enter “Form 8689” and show the amount © 30

Part IV Payments of Income Tax to the Virgin Islands

31 Income tax withheld by the Virgin Islands 31

32 1994 estimated tax payments and amount applied from 1993 return 32

33 Amount paid with Form 4868 (extension request) 33

34 Add lines 31 through 33. These are your total payments © 34

35 If line 34 is more than line 30, subtract line 30 from line 34. This is the amount you OVERPAID to the

Virgin Islands © 35

36 Amount of line 35 you want REFUNDED TO YOU © 36

37 Amount of line 35 you want APPLIED TO YOUR 1995 ESTIMATED TAX © 37

38 If line 30 is more than line 34, subtract line 34 from line 30. This is the AMOUNT YOU OWE to the

Virgin Islands 38

For Paperwork Reduction Act Notice, see back of form. Cat. No. 64603D Form 8689 (1994)

Form 8689 (1994) Page 2

Instructions Part I—Income From the Virgin Part II—Adjustments to Income

Section references are to the Internal Islands From the Virgin Islands

Revenue Code. Source of Income.—The rules for Lines 17a and 17b.—Enter the amount of

Paperwork Reduction Act Notice.—We ask determining the source of income are your IRA deduction attributable to

for the information on this form to carry out discussed in detail in sections 861 through compensation or earned income (as defined

the Internal Revenue laws of the United 865. Some general rules are: in section 219(f)(1)) derived from the Virgin

States. You are required to give us the ● The source of wages, salaries, or tips is Islands. To figure this amount: (a) divide the

information. We need it to ensure that you are generally where the services are performed. If total amount of Virgin Islands compensation

complying with these laws and to allow us to you worked both in and outside the Virgin or earned income by the total amount of your

figure and collect the right amount of tax. Islands, include on line 1 only wages, salaries, compensation or earned income, (b) multiply

or tips earned while you were in the Virgin the amount of your IRA deduction by the

The time needed to complete and file this result in (a). Use the same method to figure

form will vary depending on individual Islands.

the amount of your spouse’s IRA deduction

circumstances. The estimated average time ● The source of interest income is generally to enter on line 17b.

is: Recordkeeping, 33 min.; Learning about where the payer is located. For example,

the law or the form, 18 min.; Preparing the interest from a certificate of deposit issued by Line 19.—Enter the amount of your self-

form, 59 min.; and Copying, assembling, a Virgin Islands bank or a Virgin Islands employment tax deduction attributable to

and sending the form to the IRS, 20 min. branch of a U.S. bank is Virgin Islands source self-employment income earned in the Virgin

income. Islands. To figure this amount:

If you have comments concerning the (a) divide the amount of Virgin Islands source

accuracy of these time estimates or ● Generally, dividends are sourced where the self-employment income used to figure the

suggestions for making this form simpler, we paying corporation is incorporated. deduction by the total self-employment

would be happy to hear from you. You can income used to figure the deduction, (b)

write to both the IRS and the Office of ● Taxable refunds, credits, or offsets of local

Virgin Islands income taxes only include multiply the amount of your self-employment

Management and Budget at the addresses tax deduction by the result in (a).

listed in the Instructions for Form 1040. nonmirror code income taxes.

● Alimony received from a person who is a Line 20.—Caution: This deduction expired

Purpose of Form.—If you were a citizen or 12/31/93. If Congress allows the deduction

resident of the United States and you had bona fide resident of the Virgin Islands is

Virgin Islands source income. retroactively for 1994, the IRS will take steps

income from sources in the Virgin Islands or to publicize this action. You cannot take a

income effectively connected with the ● The source of income from the sale of deduction on this line unless it has been

conduct of a trade or business in the Virgin nondepreciable personal property is the allowed by Congress before you file your

Islands, you may owe tax to the Virgin Islands country of the seller’s residence. There is a return.

on that income. Your Virgin Islands tax special rule, however, for U.S. citizens and

liability is a percentage of your U.S. tax resident aliens who sell personal property Enter the amount of your self-employed

liability. Use Form 8689 to figure the amount while maintaining a tax home abroad. Any health insurance deduction attributable to

of U.S. tax allocable to the Virgin Islands. Do gain from such sales may be treated as self-employment income earned in the Virgin

not use this form if you were a bona fide foreign source only if a tax of at least 10% of Islands. To figure this amount:

resident of the Virgin Islands on the last day the gain is paid to a foreign country. Income (a) divide the amount of Virgin Islands source

of the tax year. from the sale of inventory is generally sourced self-employment income used to figure the

where the title to the property passes. deduction by the total self-employment

Credit for U.S. Tax Allocable to the Virgin income used to figure the deduction,

Islands.—You can take a credit on your U.S. The portion of gain from the sale of (b) multiply the amount of your self-employed

return for the U.S. tax allocable to the Virgin depreciable personal property used in a trade health insurance deduction by the result in

Islands only if you paid the tax to the Virgin or business that reflects allowable (a).

Islands. To take the credit, you must depreciation deductions and gain (to the

complete Form 8689 and attach it to your extent of amortization deductions) from the Line 21.—Enter the amount of your Keogh

Form 1040. The credit is claimed on Form sale of intangible property, such as a patent, retirement plan and self-employed SEP

1040, line 60. copyright, trademark, franchise, or similar deduction attributable to self-employment

property, is sourced where the original income earned in the Virgin Islands. To figure

Where To File.—You must file identical tax this amount: (a) divide the amount of Virgin

returns with the United States and the Virgin deductions of the property were sourced. For

depreciable personal property, gain in excess Islands source self-employment income by

Islands. File your original Form 1040 the total amount of your self-employment

(including Form 8689) with the Internal of these depreciation deductions is sourced

as if the property were inventory. For income, (b) multiply the total amount of your

Revenue Service Center, Philadelphia, PA Keogh retirement plan and self-employed

19255. intangible property, gain in excess of

amortization deductions is sourced under the SEP deduction by the result in (a).

File a copy of your Form 1040 (with copies general residence of the seller rule if the Line 22.—Enter the amount of penalties on

of all attachments, forms, and schedules, payments are not contingent on productivity, early withdrawal of savings from accounts in

including Form 8689) with the Virgin Islands use, or disposition of the intangible property, Virgin Islands banks or Virgin Islands

Bureau of Internal Revenue, Lockhart and under the place of use rule for royalties if branches of U.S. banks. The Form 1099-INT

Gardens No. 1-A, Charlotte Amalie, the payments are contingent. See section or, if applicable, Form 1099-OID given to you

St. Thomas, VI 00802. They will accept a 865 for details. by your bank will show the amount of any

copy of your U.S. return and process it as an penalty you were charged because you

original return. ● See section 863(c) for rules on determining

the source of income attributable to withdrew funds from your time savings

If you file a joint return, file it in the transportation services that begin or end in deposit before its maturity.

jurisdiction required for the spouse who had the United States or a U.S. possession. See

the higher adjusted gross income for the tax section 863(d) for rules on income from space Part IV—Payments of Income Tax

year, determined without regard to or ocean activities. to the Virgin Islands

community property laws.

Part of the following types of income Note: Amounts overpaid to the United States

Additional Information.—Pub. 570, Tax derived from a U.S.-owned foreign will not be applied to the amount you owe to

Guide for Individuals With Income From U.S. corporation that has income from U.S. the Virgin Islands. Similarly, amounts overpaid

Possessions, has an example of how to sources may be required to be treated as to the Virgin Islands will not be applied to the

complete Form 8689. You can get it from an U.S. source income. amount you owe to the United States.

IRS Distribution Center. See How To Get

Forms and Publications in the Instructions ● Foreign personal holding company income Penalty for Failure To Furnish

for Form 1040. included in gross income. Information.—If you fail to furnish the

● Subpart F income included in gross information we require, you may have to pay

income. a penalty of $100 for each failure, unless you

can show your failure was due to reasonable

● Interest. cause and not willful neglect. This penalty is

● Dividends. in addition to any criminal penalty provided

by law.

Printed on recycled paper

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Copy B To Be Filed With Employee S FEDERAL Tax Return: See Instructions For Box 12Dokument3 SeitenCopy B To Be Filed With Employee S FEDERAL Tax Return: See Instructions For Box 12memek1123Noch keine Bewertungen

- 2019 Turbo Tax ReturnDokument113 Seiten2019 Turbo Tax Returnjason borneNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- W21225760934 0 PDFDokument2 SeitenW21225760934 0 PDFAnonymous czHLQeLPB4Noch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- File by Mail Instructions For Your Federal Amended Tax ReturnDokument14 SeitenFile by Mail Instructions For Your Federal Amended Tax ReturnRyan MayleNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Instructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDokument72 SeitenInstructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDiego12001Noch keine Bewertungen

- Wage and Tax Statement: OMB No. 1545-0008Dokument4 SeitenWage and Tax Statement: OMB No. 1545-0008jgoldson235Noch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- View Notice ServletDokument4 SeitenView Notice ServletDianca MaxeyNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Individual Inc Tax Exam 1 Study GuideDokument20 SeitenIndividual Inc Tax Exam 1 Study GuideMary Tol100% (1)

- p4491 PDFDokument384 Seitenp4491 PDFcatalin cretuNoch keine Bewertungen

- Tratamentul Total Al CanceruluiDokument71 SeitenTratamentul Total Al CanceruluiAntal98% (98)

- US Internal Revenue Service: 2290rulesty2007v4 0Dokument6 SeitenUS Internal Revenue Service: 2290rulesty2007v4 0IRSNoch keine Bewertungen

- 2008 Objectives Report To Congress v2Dokument153 Seiten2008 Objectives Report To Congress v2IRSNoch keine Bewertungen

- 2008 Data DictionaryDokument260 Seiten2008 Data DictionaryIRSNoch keine Bewertungen

- 2008 Credit Card Bulk Provider RequirementsDokument112 Seiten2008 Credit Card Bulk Provider RequirementsIRSNoch keine Bewertungen

- Kiddie Tax 2021Dokument2 SeitenKiddie Tax 2021Finn KevinNoch keine Bewertungen

- Income Tax Parent Disable Form EFMB1CS - ES2120220303110030WMUDokument5 SeitenIncome Tax Parent Disable Form EFMB1CS - ES2120220303110030WMUDaniel SohNoch keine Bewertungen

- Universal Basic IncomeDokument32 SeitenUniversal Basic IncomeparadoxendazzlingNoch keine Bewertungen

- IRS 1040a Instruction BookDokument92 SeitenIRS 1040a Instruction Bookgalaxian100% (1)

- New York's Beacon NewsDokument24 SeitenNew York's Beacon NewsWalterTMosleyNoch keine Bewertungen

- A Roadmap To Reducing Child PovertyDokument619 SeitenA Roadmap To Reducing Child PovertyLuis Carlos SaraviaNoch keine Bewertungen

- Social Work - EditedDokument8 SeitenSocial Work - EditedKennedy WashikaNoch keine Bewertungen

- p25 PDFDokument1 Seitep25 PDFpenelopegerhardNoch keine Bewertungen

- US Internal Revenue Service: I1040aDokument80 SeitenUS Internal Revenue Service: I1040aIRS100% (1)

- House Hearing, 113TH Congress - Reviewing How Today's Fragmented Welfare System Fails To Lift Up Poor FamiliesDokument99 SeitenHouse Hearing, 113TH Congress - Reviewing How Today's Fragmented Welfare System Fails To Lift Up Poor FamiliesScribd Government DocsNoch keine Bewertungen

- US Internal Revenue Service: I1040 - 1997Dokument84 SeitenUS Internal Revenue Service: I1040 - 1997IRSNoch keine Bewertungen

- Solution Manual For Concepts in Federal Taxation 2018 25th Edition Murphy, HigginsDokument2 SeitenSolution Manual For Concepts in Federal Taxation 2018 25th Edition Murphy, Higginsa882650259Noch keine Bewertungen

- July 2015 Through August 2015Dokument355 SeitenJuly 2015 Through August 2015Jen SabellaNoch keine Bewertungen

- 10.20.22 Letter Gretchen Sierra CTC PRDokument2 Seiten10.20.22 Letter Gretchen Sierra CTC PRMetro Puerto RicoNoch keine Bewertungen

- Tax Year 2013 DeskReferenceGuideDokument8 SeitenTax Year 2013 DeskReferenceGuideMia JacksonNoch keine Bewertungen

- US Internal Revenue Service: I1040 - 1999Dokument117 SeitenUS Internal Revenue Service: I1040 - 1999IRSNoch keine Bewertungen

- LIFT Impact Report 2010Dokument32 SeitenLIFT Impact Report 2010LIFTcommunitiesNoch keine Bewertungen

- SolutionsDokument30 SeitenSolutionsapi-381707267% (3)

- To Public Finance: Mcgraw-Hill/IrwinDokument21 SeitenTo Public Finance: Mcgraw-Hill/IrwinHeap Ke XinNoch keine Bewertungen

- Principles of Economics A Streamlined Approach 3Rd Edition Frank Solutions Manual Full Chapter PDFDokument26 SeitenPrinciples of Economics A Streamlined Approach 3Rd Edition Frank Solutions Manual Full Chapter PDFamandabinh1j6100% (10)

- (Du) 01042023-2019duDokument2 Seiten(Du) 01042023-2019duibrahimNoch keine Bewertungen