Beruflich Dokumente

Kultur Dokumente

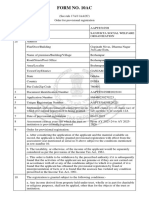

US Internal Revenue Service: I1098c - 2006

Hochgeladen von

IRSOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

US Internal Revenue Service: I1098c - 2006

Hochgeladen von

IRSCopyright:

Verfügbare Formate

Userid: ________ Leading adjust: % ❏ Draft ❏ Ok to Print

PAGER/SGML Fileid: I1098C.SGM (16-Mar-2006) (Init. & date)

Filename: D:\USERS\6mdcb\documents\Epicfiles\I1098C_06.sgm

Page 1 of 2 Instructions for Form 1098-C 14:48 - 16-MAR-2006

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

2006 Department of the Treasury

Internal Revenue Service

Instructions for Form 1098-C

Section references are to the Internal Revenue Code unless otherwise noted.

acknowledgment in calendar year 2006, file Copy A with the

What’s New Internal Revenue Service by February 28, 2007 (April 2, 2007, if

The following changes were made to the 2006 Instructions for filed electronically). See the 2006 General Instructions for

Form 1098-C. Forms 1099, 1098, 5498, and W-2G for more information on

• New boxes 6a, 6b, and 6c have been added to Form 1098-C how to file.

to satisfy new reporting requirements added by the Gulf

Opportunity Zone Act of 2005. The donee is required to state For a contribution of a qualified vehicle with a claimed

whether any goods or services were provided, in whole or in

part, for the donation of a qualified vehicle and, if so, a

! value of not more than $500, do not file Form 1098-C.

CAUTION However, you may use it as the contemporaneous

description and fair market value of both goods and services. If written acknowledgment under section 170(f)(8) by providing

the goods and services consisted of intangible religious the donor with Copy C only. If you use Copy C as such

benefits, then a statement to that effect must also be included. acknowledgment, you must check box 7. In addition, do not

• New box 7 has been added to Form 1098-C to allow this form complete boxes 4a through 5c or enter the donor’s identification

to be used as the contemporaneous written acknowledgment number on the form. You may, but are not required to, enter the

under section 170(f)(8) for a qualified vehicle with a claimed donee’s federal identification number on the form.

value of at least $250 but not more than $500.

Section 6720 Penalties

Reminder Section 6720 imposes penalties on any donee organization that

In addition to these specific instructions, you should also use is required under section 170(f)(12) to furnish an

the 2006 General Instructions for Forms 1099, 1098, 5498, and acknowledgment to a donor if the donee organization

W-2G. Those general instructions include information about: knowingly:

• Backup withholding • Furnishes a false or fraudulent acknowledgment, or

• Magnetic media and electronic reporting requirements • Fails to furnish an acknowledgment in the manner, at the

• Penalties time, and showing the information required by section

• Who must file (nominee/middleman) 170(f)(12).

• When and where to file

• Taxpayer identification numbers Other penalties may apply. See part O in the 2006

• Statements to recipients ! General Instructions for Forms 1099, 1098, 5498, and

• Corrected and void returns CAUTION W-2G.

• Other general topics

An acknowledgment containing a certification described in

You can get the general instructions from the IRS website at box 5a or 5b will be presumed to be false or fraudulent if the

www.irs.gov or by calling 1-800-TAX-FORM (1-800-829-3676). qualified vehicle is sold to a buyer other than a needy individual

(as explained in the instructions for box 5b) without a significant

intervening use or material improvement (as explained in the

Specific Instructions for Form 1098-C instructions for box 5a) within 6 months of the date of the

contribution. If a charity sells a donated vehicle at auction, the

Who Must File IRS will not accept as substantiation an acknowledgment from

the charity stating the vehicle is to be transferred to a needy

File a separate Form 1098-C, Contributions of Motor Vehicles, individual for significantly below fair market value. Vehicles sold

Boats, and Airplanes, with the IRS for each contribution of a at auction are not sold at prices significantly below fair market

qualified vehicle that has a claimed value of more than $500. A value, and the IRS will not treat vehicles sold at auction as

qualified vehicle is any motor vehicle manufactured primarily for qualifying for this exception.

use on public streets, roads, and highways; a boat; or an

airplane. However, property held by the donor primarily for sale The penalty for an acknowledgment relating to a qualified

to customers, such as inventory of a car dealer, is not a vehicle for which box 4a must be checked is the larger of the

qualified vehicle. gross proceeds from the sale or the sales price stated in the

acknowledgment multiplied by 35%. The penalty for an

Contemporaneous Written Acknowledgment acknowledgment relating to a qualified vehicle for which box 5a

If a donor contributes a qualified vehicle to you with a claimed or 5b must be checked is the larger of $5,000 or the claimed

value of more than $500, you must furnish a contemporaneous value of the vehicle multiplied by 35%.

written acknowledgment of the contribution to the donor under

section 170(f)(12) containing the same information shown on Donor’s Identification Number

Form 1098-C. Otherwise, the donor cannot claim a deduction of See part J of the 2006 General Instructions for Forms 1099,

more than $500 for that vehicle. Copy B of Form 1098-C may 1098, 5498, and W-2G for details on requesting the donor’s

be used for this purpose. An acknowledgment is considered identification number. If the donor does not provide an

contemporaneous if it is furnished to the donor no later than 30 identification number, you must check box 7 because the

days after the: acknowledgment will not meet the requirements of section

• Date of the sale, if you are required to check box 4a, or 170(f)(12) and the donor will not be allowed to claim a

• Date of the contribution, if you are required to check box 5a deduction of more than $500 for the qualified vehicle.

or 5b.

Provide the donor with Copies B and C of Form 1098-C or Box 1. Date of Contribution

your own acknowledgment that contains the required Enter the date you received the motor vehicle, boat, or airplane

information. For contributions for which you completed an from the donor.

Cat. No. 39750N

Page 2 of 2 Instructions for Form 1098-C 14:48 - 16-MAR-2006

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Box 2. Make, Model, and Year of Vehicle Material improvements include major repairs and additions

Enter this information in the order stated. For example, that improve the condition of the vehicle in a manner that

enter “Ford Explorer, 2000,” “Piper Cub, 1962,” or “Larson LXI significantly increases the value. To be a material improvement,

210, 2002.” the improvement cannot be funded by an additional payment to

the donee from the donor of the vehicle. Material improvements

Box 3. Vehicle or Other Identification Number do not include cleaning, minor repairs, routine maintenance,

For any vehicle contributed, this number is generally affixed to painting, removal of dents or scratches, cleaning or repair of

the vehicle. For a motor vehicle, the vehicle identification upholstery, and installation of theft deterrent devices.

number is 17 alpha/numeric characters in length. Refer to the

vehicle owner’s manual for the location of the vehicle Box 5b. Vehicle To Be Transferred to a Needy

identification number. For a boat, the hull identification number Individual for Significantly Below Fair Market

is 12 characters in length and is usually located on the Value

starboard transom. For an airplane, the aircraft identification Check box 5b if you intend to sell the vehicle to a needy

number is 6 alpha/numeric characters in length and is located individual at a price significantly below fair market value or

on the tail of a U.S. aircraft. make a gratuitous transfer of the vehicle to a needy individual in

Box 4a. Vehicle Sold in Arm’s Length direct furtherance of your organization’s charitable purpose of

relieving the poor and distressed or underprivileged who are in

Transaction to Unrelated Party need of a means of transportation. Do not enter any amount in

If the vehicle is sold to a buyer other than a needy individual (as box 4c. The donor’s contribution for a sale for this purpose is

explained in the instructions for box 5b) without a significant not limited to the gross proceeds from the sale. Skip this box if

intervening use or material improvement (as explained in the the qualified vehicle has a claimed value of $500 or less.

instructions for box 5a), you must certify that the sale was

made in an arm’s length transaction between unrelated parties. Box 5c. Description of Material Improvements or

Check the box to make the certification. Also complete boxes Significant Intervening Use and Duration of Use

4b and 4c. Skip this box if the qualified vehicle has a claimed

Describe in detail the intended material improvements to be

value of $500 or less.

made by the organization or the intended significant intervening

Box 4b. Date of Sale use and duration of the use by the organization. Skip this box if

If you checked box 4a, enter the date that the vehicle was sold the qualified vehicle has a claimed value of $500 or less.

in the arm’s length transaction. Skip this box if the qualified

vehicle has a claimed value of $500 or less. Box 6a. Checkbox for Whether Donee Provided

Goods and Services in Exchange for the Vehicle

Box 4c. Gross Proceeds Described

If you checked box 4a, enter the gross proceeds from the sale You must check the box to indicate whether you provided

of the vehicle. This is generally the sales price. Do not reduce goods or services to the donor in exchange for the vehicle

this amount by any expenses or fees. Skip this box if the described above.

qualified vehicle has a claimed value of $500 or less.

Box 5a. Vehicle Will Not Be Transferred Before Box 6b. Value of Goods and Services Provided

Completion of Material Improvements or in Exchange for the Vehicle Described

Significant Intervening Use If you checked “Yes” in box 6a, complete box 6b. You must give

a good faith estimate of the value of those goods and services

If you intend to make a significant intervening use of or a including intangible religious benefits. Include the value of any

material improvement to this vehicle, you must check box 5a to goods and services you may provide in a year other than the

certify that the vehicle will not be transferred for cash, other year that the qualified vehicle was donated. Pub. 561,

property, or services before completion of the use or Determining the Value of Donated Property, provides guidance

improvement. Also complete box 5c. Skip this box if the for providing an estimate for the value of goods and services.

qualified vehicle has a claimed value of $500 or less.

To constitute significant intervening use, the organization Box 6c. Description of the Goods and Services

must actually use the vehicle to substantially further the If you checked “Yes” in box 6a, describe in detail the goods and

organization’s regularly conducted activities, and the use must services, including intangible religious benefits, that were

be significant, not incidental. Factors in determining whether a provided to the donor. If the donor received only intangible

use is a significant intervening use include its nature, extent, religious benefits, check the box.

frequency, and duration. For this purpose, use includes

providing transportation on a regular basis for a significant An intangible religious benefit is one that is provided by an

period of time or significant use directly relating to training in organization organized exclusively for religious purposes and

vehicle repair. Use does not include the use of a vehicle to which generally is not sold in a commercial transaction outside

provide training in business skills, such as marketing or sales. the donative context.

Examples of significant use include:

• Driving a vehicle every day for 1 year to deliver meals to Box 7. Checkbox for a Vehicle With a Claimed

needy individuals, if delivering meals is an activity regularly Value of $500 or Less

conducted by the organization. If the vehicle has a claimed value of $500 or less or the donor

• Driving a vehicle for 10,000 miles over a 1-year period to did not provide a taxpayer identification number, you must

deliver meals to needy individuals, if delivering meals is an check box 7. If you check box 7, do not file Copy A with the

activity regularly conducted by the organization. IRS and do not furnish Copy B to the donor.

1098-C-2

Das könnte Ihnen auch gefallen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDokument71 SeitenTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- US Internal Revenue Service: 2290rulesty2007v4 0Dokument6 SeitenUS Internal Revenue Service: 2290rulesty2007v4 0IRSNoch keine Bewertungen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Objectives Report To Congress v2Dokument153 Seiten2008 Objectives Report To Congress v2IRSNoch keine Bewertungen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Data DictionaryDokument260 Seiten2008 Data DictionaryIRSNoch keine Bewertungen

- 2008 Credit Card Bulk Provider RequirementsDokument112 Seiten2008 Credit Card Bulk Provider RequirementsIRSNoch keine Bewertungen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Worldone Enterprises: Billing Address: Shipping AddressDokument1 SeiteWorldone Enterprises: Billing Address: Shipping AddressAmit SinghNoch keine Bewertungen

- Estates and TrustsDokument2 SeitenEstates and TrustsMCNoch keine Bewertungen

- Z Belay ZewudeDokument102 SeitenZ Belay ZewudeamanualNoch keine Bewertungen

- Order Voucher PDFDokument1 SeiteOrder Voucher PDFDnyaneshwar Dattatraya PhadatareNoch keine Bewertungen

- ST Charles Tax AssessmentsDokument613 SeitenST Charles Tax AssessmentscherylwaityNoch keine Bewertungen

- Basic Principles of TaxationDokument33 SeitenBasic Principles of TaxationHenicel Diones San Juan100% (1)

- TP1-W2-S3-R0 Sri Annisa KatariDokument3 SeitenTP1-W2-S3-R0 Sri Annisa Katarisri annisa katariNoch keine Bewertungen

- 44 Depreciation ScheduleDokument6 Seiten44 Depreciation SchedulezydusNoch keine Bewertungen

- Gail & BradDokument2 SeitenGail & BradAbid AliNoch keine Bewertungen

- Local Taxation and Real Property Taxation-SummaryDokument1 SeiteLocal Taxation and Real Property Taxation-SummaryErika Mae LegaspiNoch keine Bewertungen

- Atty. Lock - Updates and Critical Areas in Taxation (2018 Bar Legal Edge) PDFDokument205 SeitenAtty. Lock - Updates and Critical Areas in Taxation (2018 Bar Legal Edge) PDFTraviNoch keine Bewertungen

- Impact of GST On WholesalerDokument20 SeitenImpact of GST On Wholesalerjayesh50% (2)

- Income Statement For Year: 1 Using Absorption Costing ApproachDokument5 SeitenIncome Statement For Year: 1 Using Absorption Costing ApproachMak PussNoch keine Bewertungen

- Form No. 10acDokument2 SeitenForm No. 10acAditya NayakNoch keine Bewertungen

- Payslip June 2019Dokument1 SeitePayslip June 2019shee is silly100% (1)

- Child Benefit - Getting Your Claim Right: Use These Notes To Help YouDokument8 SeitenChild Benefit - Getting Your Claim Right: Use These Notes To Help YouolusapNoch keine Bewertungen

- Enter Per Month AmountDokument7 SeitenEnter Per Month AmountRakesh KumarNoch keine Bewertungen

- Theory and Precatice of GSTDokument3 SeitenTheory and Precatice of GSTakking0146Noch keine Bewertungen

- Fall 2015 Test 3Dokument14 SeitenFall 2015 Test 3Adam MichaelNoch keine Bewertungen

- Pe On Estate TaxDokument25 SeitenPe On Estate TaxErica NicolasuraNoch keine Bewertungen

- Final Examination Income TaxationDokument13 SeitenFinal Examination Income TaxationDanica CailloNoch keine Bewertungen

- Kotak Mahindra Bank Limited Payslip For The Month of AUGUST - 2010Dokument1 SeiteKotak Mahindra Bank Limited Payslip For The Month of AUGUST - 2010Bharat Shahane33% (3)

- Indirect Taxes 1,2,3Dokument34 SeitenIndirect Taxes 1,2,3Welcome 1995Noch keine Bewertungen

- Business Taxation - Semester-4Dokument8 SeitenBusiness Taxation - Semester-4Alina ZubairNoch keine Bewertungen

- Compare and Contrast Four Forms of Business OwnershipDokument2 SeitenCompare and Contrast Four Forms of Business OwnershipAlma McCauleyNoch keine Bewertungen

- Module 1 Financial Planning CalculatorDokument8 SeitenModule 1 Financial Planning CalculatorFeme SorianoNoch keine Bewertungen

- Essentials of Federal Taxation 3rd Edition Spilker Solutions ManualDokument35 SeitenEssentials of Federal Taxation 3rd Edition Spilker Solutions Manualxavialaylacs4vl4100% (26)

- Instructions For Student: CorrectedDokument1 SeiteInstructions For Student: CorrectedBipal GoyalNoch keine Bewertungen

- No 5Dokument4 SeitenNo 5Barbara IgnacioNoch keine Bewertungen

- Q.1 Who Is A Goods Transport Agency (GTA) ?Dokument3 SeitenQ.1 Who Is A Goods Transport Agency (GTA) ?ANoch keine Bewertungen