Beruflich Dokumente

Kultur Dokumente

Banc Surance

Hochgeladen von

Snehal SawantOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Banc Surance

Hochgeladen von

Snehal SawantCopyright:

Verfügbare Formate

Bancassurance

‘BANCASSURANCE’ as term itself tells us what does it means. It’s a

combination of the term ‘Bank’ and ‘Insurance’. It means that insurance have

started selling there product through banks. It’s a new concept to Indian market

but it is very widely used in western and developed countries. It is profitable

both to Banks and Insurance companies and has a very bright future to be the

most develop and efficient means of distribution of Insurance product in very

near future.

Insurance company can sell both life and non-life policies through banks.

The share of premium collected by banks is increasing in a decent manner from

the time it was introduce to the Indian market. In India Bancassurance in guide

by Insurance Regulatory and Development Authority Act (IRDA), 1999 and

Reserve Bank of India. All banks and insurance company have to meet

particular requirement to get into Bancassurance business.

It is predicted by experts that in future 90% of share of premium will

come from Bancassurance business only. Currently there are more and more

banking and Insurance Company and venturing into Bancassurance business for

better business prospect in future.

The banking business is also generating more profit by more premium

collected by them and they also receive commission like normal insurance

agent which increase there profits and better reputation for the banks as there

service base also increase and are able to provide more service to customers and

even more customer are attracted toward bank.

It is even profitable for Insurance Company as they receive more and

more sales and higher customer base for the company. And they have to

directly deal with an organization which reduce there pressure to deal with each

customer face to face.

In all Bancassurance has proved to be boom in whole Banking and

Insurance arena.

Jai Hind College 1

Bancassurance

Bancassurance is defined as ‘Selling Insurance products through

banks’. The word is a combination of two words ‘Banc’ and ‘assurance’

signifying that both banking and insurance products and service are provided by

one common corporate entity or by banking company with collaboration with

any particular Insurance company. In concrete terms bancassurance, which is

also known as Allfinanz - describes a package of financial services that can

fulfill both banking and insurance needs at the same time.

Financial Services

Banking Insurance

Bancassurance

Bancassurance

The usage of the word picked up as

banking and insurance companies merged together and banks sought to provide

insurance, in the market which has been liberalized recently.

Jai Hind College 2

Bancassurance

But it is a controversial issue as many

experts feels that this ides gives banking sector too great a control over

financial market in that country. Therefore it has also been restricted in many

countries too.

But, still which countries have permitted

Bancassurance in their market has seen a tremendous boom in that sector. The

share of premium collected by them has increased in constant and decent

manner. This success coincided with a favorable taxation for life insurance

products, as well as with the consumers' growing needs, in terms of middle and

long term savings, which is due to an inadequacy of the pension schemes in

India.

The links between bank and insurance

takes place through various ways (distribution agreements, joint ventures,

creation of a company new company) which gives rise to a complete upheaval

concerning marketing strategies and the setting up of insurance products'

distribution. More and better insurance starts coming in market.

This stream of market has just been

opened very recently for the Indian market and there is lot of development left

to be done by the government and regulatory authority. But this has proven to

be a boom for the Insurance and Banking companies together and both the

different sector of the industry has shown better result and improvement in their

own field due coming of the whole new concept of BANCASSURANCE.

Jai Hind College 3

Bancassurance

Bancassurance in its simplest form is the

distribution of insurance products through a bank’s distribution channels. It is

the provision of insurance and banking products and service through a common

distribution channel or through a common base.

Banks, with their geographical spreading

penetration in terms of customer’s reach of all segments, have emerged as

viable source for the distribution of insurance products. It takes various forms

in various countries depending upon the demography and economic and

legislative climate of that country. This concept gained importance in the

growing global insurance industry and its search for new channels of

distribution.

However, the evolution of bancassurance

as a concept and its practical implementation in various parts of the world, have

thrown up a number of opportunities and challenges.

The concept of bancassurance was

evolved in Europe. Europe leads the world in Bancassurance market penetration

of banks assurance in new life business in Europe which ranges between 30%

in United Kingdom to nearly 70% in France. However, hardly 20% of all

United States banks were selling insurance against 70% to 90% in many

Western European countries. In Spain, Belgium, Germany and France more

than 50% of all new life premiums is generated by banks assurance. In Asia,

Singapore, Taiwan and Hong Kong have surged ahead in Bancassurance then

that with India and China taking tentative step forward towards it. In Middle

East, only Saudi Arabia has made some feeble attempts that even failed to

really take off or make any change in the system.

Jai Hind College 4

Bancassurance

The motives behind bancassurance also

vary. For Banks, it is n means of product diversification and source of

additional fee income. Insurance companies see bancassurance as a tool for

increasing their market penetration and premium turnover. The customer sees

bancassurance as a bonanza in terms of reduced price, high quality products and

delivery at the doorsteps.

With the liberalization of the insurance sector and competition tougher than

ever beore, companies are increasingly trying to come out with better innovations to

stay that one-step ahead.

Progress has definitely been made as can be

seen by the number of advanced products flooding the market today - products with

attractive premiums, unitized products, unit-linked products and innovative riders. But

a hitherto untapped field is the one involving the distribution of these insurance

products.

Currently, insurance agents are still the main

vehicles through which insurance products are sold. But in a huge country like India,

one can never be too sure about the levels of penetration of a product. It therefore

makes sense to look at well-balanced, alternative channels of distribution.

Nationalized insurers are already well

established and have an extensive reach and presence. New players may find it

expensive and time consuming to bring up a distribution network to such

standards. Yet, if they want to make the most of India's large population base

and reach out to a worthwhile number of customers, making use of other

Jai Hind College 5

Bancassurance

distribution avenues becomes a must. Alternate channels will help to bring

down the costs of distribution and thus benefit the customers.

Business generated by Bank in Insurance

90

80

70

60

50

40

30

20

10

0

F r a n cPe o u r t u gS ap la i n U . K S w e d e Un S A I n d i a

Jai Hind College 6

Bancassurance

Market share with in Europe the inventor in

Bancassurance

Jai Hind College 7

Bancassurance

Bancassurance is a very innovative

product in both Banking and Insurance sector. It is supposed to be a WIN –

WIN situation for both banking and insurance industry. There are series of

advantages to all bankers, insurance company and even to customers of banks

and insurance company.

ADVANTAGES TO BANKS:

• Bancassurance is helping banks to achieve one of there very prime

objective of Universal Banking which means providing variety of banking and

other additional services through there medium of banks.

• Bancassurance also helps in increasing there customer bases because of

increase in the variety of service they provide and over that there is also an

increase in the service they provide by the entry of the complete range of new

product from Insurance industry.

• Banks across the world have now realized that offering value added

service like life insurance and non-life insurance and even mediclaim very well

help them meet the expectation of the customers.

• Its even help banks in way providing insurance service gives them a

cutting edge advantage over other banks in personal financial service area

which is get hot every day.

Jai Hind College 8

Bancassurance

• Bancassurance also helps banks who seek in retaining customer loyalty in

way of offering them a vastly expanded and sophisticated range of insurance

product.

• Distribution of Insurance product also help increase of fee based earning

of the banks to a considerable extent. Internationally, fee collected from

insurance activity have contributes significantly to the banks total domestic

retail revenues in other words fee based revenues.

• Fee based selling also help in enhancing the staff productivity level in the

banks. This provides vital help in developing that staff motivation levels in

banks in India.

• Banks can even put more energy into small scale commission customers

which insurance agents tends to avoid because of more hard work in convincing

and lesser returns and if policy collapsed all the commission will also be

withdrawn from agents and his all hard work will go to waste which in its huge

customer base can easily bare.

• For banks it’s even more profitable as there is no lock up of any vital

assets or capital and over that banks receive commission which is total income

revenues for banks.

• Bancassurance also helps banks in optimum utilization of there resources

to there maximum level so that all the asset and capital are utilized in proper

manner and maximum revenues are generated from the business.

Jai Hind College 9

Bancassurance

ADVANTAGES TO INSURANCE COMPANIES:

• Bancassurance helps insurance companies in wide diversification in there

channel of distribution of there products from there primitive technique of

direct sale or sales by there agents for which they have to pay them

commission.

• Bancassurance also allow insurance companies to access the wide and

high quality database of there customer. Which in turn helps in increase the sale

of there companies and revenues for both insurance and banking companies.

• Bancassurance also helps in development of a brand image of insurance

companies which is very helpful in this competitive market and also explore

new horizon of business.

• Bancassurance is very helpful in increasing the sales of the insurance

companies. It like boom for them because there product can now get sold from

wide network of banks branches which bring in enormous amount of revenues

from insurance companies.

• Bancassurance also help insurance companies to achieve a wide

geographical reach with minimum expenditure and time devotion and even

helps in less appointment new agents and staff all over the area.

• Bancassurance helps insurance companies to penetrate the market in

much better way and to a higher extent.

Jai Hind College 10

Bancassurance

• It also helps to insurance companies in a way that sales starts coming

automatically from a wide network of banks instead giving remuneration to

sales agent and setting targets for them and managing each agent of the

companies.

• It also helps banks in a way that they have to now deal with just

corporate entity or bank instead of dealing with thousands of direct selling

agents and managing different accounts for them. Which reduce there staff

requirement and even work pressure on the staff member of the insurance

company.

• The insurance company have to follow a straighten process of processing

because all the information of client have been verified and certified by banks

which makes there work easy and even increase the premium revenue for the

insurance company.

• Bancassurance also helps insurance companies in way that it can now

also concentrate in small policy or smaller premium customer which insurance

agents tends to avoid because of higher risk involve which is now possible

because of banks.

• It also helps insurance company in reducing there direct distribution cost

which in turn helps in increasing profits and revenues for the insurance

companies.

• It helps in development more and better products

Jai Hind College 11

Bancassurance

THE WIN – WIN CONDITION FOR BANKS AND

INSURANCE COMPANIES.

Banks Insurance

• Revenues and channel of

• Customer retention

diversification

• Satisfaction of more

• Quality customer access.

financial need under same roof.

• Establish a low cost

• Revenue diversification

acquisition channel.

• More Profitable resources

• Creation of Brand Image.

utilization.

• Establish sales orientated

• Quicker Geographical reach.

culture.

• Leverage service synergies

• Enrich work environment.

with Bank.

ADVANTAGES OF CUSTOMERS:

Jai Hind College 12

Bancassurance

• As there would be lower distribution cost the customer will be final

benefited as they will now have to pay lower premium rates.

• There would professionally trained executives which will give customer

better understanding of the plan so there would me no hitch in the mind of the

customer regarding the product and he could invest properly which is not

possible by normal insurance agent which are unprofessional and some times

make customers even more confused.

• The customer is also benefited that he is now able to get the wide range

of service under just one roof.

• Customers are now also able to pay there premium to insurance company

through a wide range of medium like different bank branches, ATM’s, kiosks

and many more.

• The customer can also get loans and credit facilities from banks in

security of the insurance policy.

• It improves customer satisfaction of the customer because he is getting he

mostly require for financial planning under one roof and even better service

from banks.

• He even receives tax benefit if he invests his funds properly in any of the

scheme provided by banks on Insurance products which is very helpful.

Jai Hind College 13

Bancassurance

Bancassurance is a WIN – WIN situation

for both Banking and Insurance Industry it is even beneficial even to the

customers but it also has disadvantages:

• One of the very major risk involve in Bancassurance is that

Bancassurance gives a very major hold to the banks in the Indian financial

markets. Which can even be some time misused by banks for there own profits.

For that reasons Bancassurance is also restricted in many country to avoid

banks taking major hold of the financial markets in that particular country.

Even United States at one time restricted Bancassurance but on later stage

special resolutions and bills were passed to make Bancassurance legal in United

States.

• As insurance company have to develop more, better and attractive

products it has to major risk in innovating and making different plans to meet

the customer demand in the market. So the risk factor of the company definitely

increases.

• In India bancassurance is guide by two different regulatory and

governing bodies which makes banks and insurance company very difficult to

meet with there requirement and standards prescribe by them to work and exist

in the market.

• As bancassurance progress there are more small scale investors and

policies takes which has very less premium. In that case there are more chances

Jai Hind College 14

Bancassurance

of default then high end customers. This means more of risk to banks and

Insurance companies then profits.

• The other major problem for banking companies is that staffs at banking

companies are not sale motivated staff so they must be trained in that matter

because the work of insurance is mostly sale oriented.

• There is also a major expense of training bank staff regarding insurance

product because they well oriented with banking product and now the even

have to deal with selling insurance product which completely in itself. So

insurance company have to make banking staff aware of their products and

service and even guide regarding guidance to even make customer convince.

• The other major problem which insurance and banking company facing is

regarding technical incapability to connect all branched and offices under on

network or Wide Area Network (WAN) which make lot of process time and

insufficient to perform at there full capacity.

India has an extensive bank network

established over the years. What Insurance companies have to do is to just take

advantage of the customers' long-standing trust and relationships with banks.

This is a mutually beneficial situation as banks can also expand their range of

Jai Hind College 15

Bancassurance

products on offer to customers, while the insurance company will also earn

profits from the exposure. Another advantage is that banks, with their network

in rural areas, help to fulfill rural and social obligations stipulated by the

Insurance Regulatory and Development Authority (IRDA) recently. Insurance

companies should see bancassurance as a tool for increasing their market

penetration in India. It is also good for the one who sees bancassurance in terms

of reduced price, high quality product and delivery at doorsteps. Everybody is a

winner here. The creation of bancassurance operations has made an important

impact on the financial services industry at large. This is though a new concept

but it has gained a lot of importance in the industry at present and has a great

future.

The other major factor for Bancassurance

form Indian point of view is that India has one of the world highest saving rates

in the world. Around 25% of the Indian GDP goes saving that makes up a

massive insurable market of the world. Above that Indian banking system have

been playing a major role in Indian financial market There are more then

1,00,000 braches strategically located all over India. Above that India have

second largest population of the world which is around 1.5 billion people which

provide banks and insurance company with a huge customer prospect which in

very future can convert into actual customers.

Since 2002, two thirds of the twelve

foreign insurance companies authorized to work in India have already

developed strong partnerships with banks. The Association of Insurers of India

has signed a “bancassurance” agreement with Corporation Bank. Other

Jai Hind College 16

Bancassurance

agreements have also been signed with South Indian Bank, Lord Krishna Bank,

ICICI Bank, etc.

For Bajaj Allianz, for example, a joint

venture between Baja Auto Ltd, the country’s second largest motorcycle

manufacturer, and the German insurance company Allianz AG, bancassurance

represented some 27% of its total new insurance business at the end of October

2004, compared with 17-18% in 2002. This figure is likely to grow further,

following the launch of specific products by Centurion Bank and its agreements

with banks such as Standard Chartered Bank and Syndicate Bank. Aviva has

signed a new bancassurance partnership with Punjab and Sind Bank in pursuit

of its ambition to grow on the Indian market. In 2003, Aviva Life generated

73% of its new business through the banking network.

When the International Director of BNP

Paribas Assurance is asked in which countries Cardiff wants to expand, China

is in the forefront.

INDIAN INVESTMENT INDUSTRY

APPROX US$ 500 BILLION UNDER FUND

MANAGEMENT 2005 – 2006

Jai Hind College 17

Bancassurance

Retirement

Life

Funds

Insurance

14%

18%

70 bln

90 bln

Mutual Funds

10%

50 bln

Banks

Saving

Accounts

Banks Term 30%

Loans 150 bln

28%

140 bln

Bancassurance in its simplest form is the

distribution of insurance products through a bank's distribution channels. In concrete

terms bancassurance, which is also known as Allfinanz - describes a package of

financial services that can fulfill both banking and insurance needs at the same time.

Jai Hind College 18

Bancassurance

It takes various forms in various countries

depending upon the demography and economic and legislative climate of that country.

Demographic profile of the country decides the kind of products bancassurance shall

be dealing in with, economic situation will determine the trend in terms of turnover,

market share, etc., whereas legislative climate will decide the periphery within which

the bancassurance has to operate.

The motives behind bancassurance also

vary. For banks it is a means of product diversification and a source of

additional fee income. Insurance companies see bancassurance as a tool for

increasing their market penetration and premium turnover. The customer sees

bancassurance as a bonanza in terms of reduced price, high quality product and

delivery at doorsteps. Actually, everybody is a winner here.

The creation of bancassurance operations

has a material impact on the financial services industry at large. Banks,

insurance companies and traditional fund management houses are converging

towards a model of global retail financial institution offering a wide array of

products. It leads to the creation of 'one-stop shop' where a customer can apply

for mortgages, pensions, savings and insurance products.

Discovery comes from looking at the

same thing as everyone else but seeing something different. Banks' desire to

increase fee income has them looking at insurance. Insurance carriers and banks

can become part of the vision through strategic partnerships. Now is the time to

Jai Hind College 19

Bancassurance

position your company for the new millennium of insurance product

distribution.

STRENGHT:

Bancassurance can be a sure of fire way

to wider customer base, provides it is made use of sensibility. In India there is

an extensive bank network establishment over the years. Insurance companies

will have take advantage of the customer’s longstanding trust and relationships

with banks. This in mutually beneficial situation as banks can expand the range

of their products on offers to customers and earn more, while the insurance

company profits from the exposure at the banks branches, and the security of

receiving timely payments.

There is a vast untapped potential

waiting to be mined particularly for life insurance products in rural areas. Banks

with their network in rural areas, help to fulfill rural and social obligations as

stipulated by the Insurance Regulatory Development Authority (IRDA).

There are several reasons why bank

should seriously consider bancassurance, the most important of which is

increased returns on assets (ROA). It offers fee – based non – interest income to

the banks without involving in any amount of risk and at the same time does not

require any additional capital.

Jai Hind College 20

Bancassurance

In a country of 1 Billion people, sky is

the limit for personal lines insurance products. There is a vast untapped

potential waiting to be mined particularly for life insurance products. There are

more than 900 Million lives waiting to be given a life cover (total number of

individual life policies sold in 1998-99 was just 91.73 Million).

There are about 200 Million households

waiting to be approached for a householder's insurance policy. Millions of

people traveling in and out of India can be tapped for Overseas Mediclaim and

Travel Insurance policies. After discounting the population below poverty line

the middle market segment is the second largest in the world after China. The

insurance companies worldwide are eyeing on this, why not we preempt this

move by doing it ourselves?

Our other strength lies in a huge pool of

skilled professionals whether it is banks or insurance companies who may be

easily relocated for any bancassurance venture. LIC and GIC both have a good

range of personal line products already lined up; therefore R & D efforts to

create new products will be minimal in the beginning. Additionally, GIC with

4200 operating offices and LIC with 2048 branch offices are almost already

omnipresent, which is so essential for the development of any bancassurance

project.

WEAKNESS:

The success of bancassurance calls for a

paradigm shift in the behavior of the banks, which have to develop marketing

Jai Hind College 21

Bancassurance

skills. Most of the banks lack adequate marketing skills to perform these

additional responsibilities. At the same time, there is a need for banks to be

sensitive to the customer preferences.

Bancassurance could turn out to be an

expensive channel as it requires huge investment in Wide Area Network

(WAN) and Vast Area Network (VAS) to meet the customer’s needs in order to

finalize a sale. Another drawback is the inflexibility of the products that is it

cannot be tailor made as per the requirements of the customers. For Banks

assurance venture to succeed, it is extremely essential to have built flexibility of

the products that is it cannot be tailor made to the requirements of the

customers. For a Bank assurance venture to succeed, it is extremely essential to

have an in built flexibility so as to make the product attractive to the customers.

The IT culture is unfortunately missing

completely in all of the future collaborators i.e. banks, GIC & LIC. A late

awakening seems to have dawned upon but it is a case of too late and too little.

Elementary IT requirement like networking (LAN) is not in place even in the

headquarters of these institutions, when the need today is of Wide Area

Network (WAN) and Vast Area Network (VAN). Internet connection is not

available even to the managers of operating offices.

The middle class population that we are

eyeing at are today overburdened, first by inflationary pressures on their

pockets and then by the tax net. Where is the money left to think of insurance?

Fortunately, LIC schemes get IT exemptions but personal line products from

GIC (mediclaim already has this benefit) like householder, travel, etc. also need

Jai Hind College 22

Bancassurance

to be given tax exemption to further the cause of insurance and to increase

domestic revenue for the country.

Another drawback is the inflexibility of

the products i.e. it can not be tailor made to the requirements of the customer.

For a bancassurance venture to succeed it is extremely essential to have in-built

flexibility so as to make the product attractive to the customer.

OPPORTUNITY:

Bank database is enormous and they

have a wide branch network. Millions of customers become accessible to

Jai Hind College 23

Bancassurance

insurance companies through bank branches. This database has to be churned in

order to position the banks assurance products.

New private sector insurance companies

are yet to become popular. They are in existence for less than five years. In a

short period, to appoint agents all over the country and effectively follow them

would be an uphill task. They are in the process of building brand equity. Tie

up with Banks will help them to boost their image and provide great

opportunity for insurance as in as Banks. In this process is bank will also

benefit.

Customers have more faith in Banks and

they view those Banks as more responsible than individual agents. Moreover,

agents may not be available for further services. But customers can approach

the banks any time and paying the premium is easier with Banks because of

standing instructions.

Banks' database is enormous even though

the goodwill may not be the same as in case of their European counterparts.

This database has to be dissected variously and various homogeneous groups

are to be churned out in order to position the bancassurance products. With a

good IT infrastructure, this can really do wonders.

Other developing economies like

Malaysia, Thailand and Singapore have already taken a leap in this direction

and they are not doing badly. There is already an atmosphere created in the

country for liberalization and there appears to be a political consensus also on

the subject.

Jai Hind College 24

Bancassurance

Therefore, RBI or IRA should have no

hesitation in allowing the marriage of the two to take place. This can take the

form of merger or acquisition or setting up a joint venture or creating a

subsidiary by either party or just the working collaboration between banks and

insurance companies.

% Business

Name of Insurance New Business in

through

co. 2004 - 05

Bancassurance

SBI Life Insurance Rs 482 crore 67

Aviva Life Insurance Rs 192 crore 65

Birla Sun Life Insurance Rs 621 crore 40

HDFC Standard Life Rs 486 crore 37

TATA AIG Life Insurance Rs 300 crore 30

Bajaj Allianz Life Rs 860 crore 25

ICICI Prudential Life Rs 1,580 crore 19

LIC Rs 15,840 crore 1

THREATS:

Even Insurers and banks that seem

ideally suited for a bank assurance partnership can run into problems during

implementation. Success of a bancassurance venture requires change in

approach, thinking and work culture on the part of everybody involved.

Jai Hind College 25

Bancassurance

The most common obstacles to success

are manpower management, lack of sales culture within the banks, non –

involvements by managers, insufficient product promotions, failure to integrate

marketing plans, marginal database expertise, inadequate incentives, a definite

threat of resistance to change, negative attitude towards insurance and unwieldy

marketing strategy.

Success of a bancassurance venture

requires change in approach, thinking and work culture on the part of

everybody involved. Our work force at every level are so well entrenched in

their classical way of working that there is a definite threat of resistance to any

change that bancassurance may set in. Any relocation to a new company or

subsidiary or change from one work to a different kind of work will be resented

with vehemence.

Another possible threat may come from

non-response from the target customers. This happened in USA in 1980s after

the enactment of Garn - St Germaine Act. A rush of joint ventures took place

between banks and insurance companies and all these failed due to the non-

response from the target customers. US banks have now again (since late

1990s) turned their attention to insurance mainly life insurance.

Jai Hind College 26

Bancassurance

The investors in the capital may turn

their face off in case the rate of return on capital falls short of the existing rate

of return on capital. Since banks and insurance companies have major portion

of their income coming from the investments, the return from bancassurance

must at least match those returns. Also if the unholy alliances are allowed to

take place there will be fierce competition in the market resulting in lower

prices and the bancassurance venture may never break-even.

Bancassurance mainly works in three

different ways that’s by Banks providing distribution services for Insurance

companies ,Banks and Insurance companies coming out with a joint Venture

which deals with both insurance and banking products and last by coming up

with a financial services group.

Each different mode of bancassurance

has its own advantages and disadvantages. The most commonly used mode of

Jai Hind College 27

Bancassurance

bancassurance currently is by banks providing distribution services for

insurance company. This mode currently dominates the Indian market and is

less risky for both banks and insurance company.

But across the world now different

modes of bancassurance is also taking up pace to meet with emerging markets

and developing economy all over world. In India only distribution models exist

because to Banks unable and insufficient to take up Joint Venture.

MODEL IN INDIA MODEL IN ASIA

Distribution

Agreements

70%

Distribution Joint

Agreements Venture 15%

30%

Joint Venture Fina ncial

70% Services

15%

THE THREE DEVELOPMENT MODELS

Jai Hind College 28

Bancassurance

SHARE OF DIFFERENT MODELS IN WORLD MARKET

Bancassurance in India is a very new

concept, technically seeing the concept if Bancassurance is only one year old to

the Indian Financial market. In India there are different regulatory bodies for

Jai Hind College 29

Bancassurance

Banks and Insurance Company, for banking sector it is Reserve Bank of India

(RBI) and for insurance sector it is Insurance Regulatory and Development

Authority (IRDA) and bancassurance is combination of both banking and

insurance sector therefore it comes under the preview of both the regulatory

bodies. Each Regulatory has given out detailed guidelines and norms for banks

getting into insurance sector and banks have to compulsory follow it to get

ahead with bancassurance business.

Reserve Banks of India guidelines for

banks entering into insurance sector provide the options for banks to enter in

bancassurance. They are:

1. Joint Venture will be allowed for financially strong Banks wishing to

undertake Insurance Business with risk participation.

2. For Banks which are not able to take up Joint Venture option because not

enough financially strong position, an investment option is made available to

them up to 10% of the net worth of the banks or Rs 50 crore, which ever is

lower, is available.

3. Finally, any commercial banks will be allowed to undertake insurance

business as agent of insurance companies. This will be on a fee basic with no

risk participation. A bank can be agent of only one insurance company and not

multiple companies.

The Insurance Regulatory and

Development Authority (IRDA) issued guidelines and norms for Insurance

Jai Hind College 30

Bancassurance

companies which they have to mandatory follow to enter into bancassurance

business with any banks.

1. Each bank that sells insurance product must have a chief insurance

executive to handle all the insurance activities.

2. All the people involve in selling Insurance product in banks and

insurance companies must compulsory undertake undergo training from

Institution accredited by Insurance Regulatory and Development Authority

(IRDA) and pass examination conducted by the authority to sell insurance

products.

3. Commercial banks, including regional rural banks, co-operative banks

may become agents of just only one insurance company.

4. Banks cannot operate or become broker to any insurance company.

Implementing is a key challenge in

the India because of many government restriction and lengthy and complicated

regulatory guidelines to meet by Banks and Insurance companies.

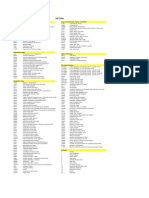

SOME INPORTANT BANCASSURANCE TIE – UPS

Jai Hind College 31

Bancassurance

INSURANCE BANKS

Corporation Bank, Indian

Overseas Banks, Centurion

Bank, Satara District Bank,

LIFE INSURANCE Cooperative Bank, Janata Urban

CORPORATION (LIC) Cooperative Bank, Yeotmal

Mahila Sahkari Bank, Oriental

Bank of Commerce.

The Bank of Rajasthan, Andhra

BIRLA SUN LIFE Bank, Bank of Muscat,

Development Credit Bank,

INSURANCE Deutsche Bank and Catholic

Syrian Bank.

DABUR CGU LIFE Canara Bank, Lakshmi Vilas

INSURANCE COMPANY Bank, American Express Bank,

ABN Amro Bank.

PVT LTD

HDFC STANDARD LIFE Union Bank of India.

INSURANCE CO.

Lord Krishna Bank, ICICI Bank,

ICICI PRUDENTIAL LIFE Bank of India, Citibank,

Allahabad Bank, Federal Bank,

INSURANCE CO. South Indian Bank, Punjab &

Maharashtra co-operative Bank.

NATIONAL INSURANCE City Union Bank.

CO.

Jai Hind College 32

Bancassurance

MET LIFE INDIA Karnataka Banks, The

Dhanalaxmi Bank, Jammu and

INSURANCE CO. Kashmir Bank.

State Bank of India, Associate

SBI INSURANCE CO. Bank

BAJAJ ALLIANZ Krur Vysya Bank, Associate

GENERAL INSURANCE Bank

ROYAL SUNDARAM Standard Chartered Bank, ABN

GENERAL INSURANCE Amro Bank, Citibank, Amex and

Repco Bank

CO.

UNITED INDIA South Indian Bank

INSURANCE CO.

Jai Hind College 33

Bancassurance

The creation of bancassurance operations

has a material impact on the financial services industry at large. Banks,

insurance companies and traditional fund management houses are converging

towards a model of global retail financial institution offering a wide array of

products. It leads to the creation of 'one-stop shop' where a customer can apply

for mortgages, pensions, savings and insurance products.

Discovery comes from looking at the

same thing as everyone else but seeing something different. Banks' desire to

increase fee income has them looking at insurance. Insurance carriers and banks

can become part of the vision through strategic partnerships. Now is the time to

position your company for the new millennium of insurance product

distribution.

The entire banking sector in India has

been looking at this business very carefully. The multinational banks have done

an outstanding job on insurable sales. Three multinational banks are skewing

the results in India because they are in a little bit of a different league in terms

of the levels of business they are generating. Then you have the Indian private

sector banks that are like our partners doing very well. But then you also have

the third category which are your large public sector banks who in my opinion

haven’t done anything nearly consistent with what their potential is and I think

it just goes back to the kind of commitment that banks show towards insurance

sales and how they pursue it from the implementation standpoint and that’s

what is the result. So it will be interesting to see how long this trend will

continue because today the sales are all primarily being made to bank customers

with whom the banks have very significant relationships but their ability to

Jai Hind College 34

Bancassurance

sustain this will depend on whether they can keep generating customers over

and above the ones who are readily sitting there.

Bancassurance, the much talked about

channel of insurance distribution through banks that originated in France and

which has been a success story in Europe is yet to take off here. A number of

insurers have already tied up with banks and some banks have already flagged

off bancassurance through soft launches of select risk products. While reams

have been written about the numerous benefits of bancassurance considering

the wide scale availability of risk products it will enable, rules and regulations

regarding the same are yet to fall in place.

Fee based income:

For banks, bancassurance would mean a

major gain. Since interest rates have been falling and profit on off take of credit

has been low all banks have been able to do is sustain them but not profit much.

Enter bancassurance and fee based income through hawking of risk products

would be guaranteed.

Unique strategies:

Before taking the plunge, banks as also

insurers need to work hard on chalking out strategies to sell risk products

through this channel especially in an emerging market as ours. Through tie-ups

some insurers plan to buy shelf space in banks and sell insurance to those who

volunteer to purchase them. But unless banks set up a trained task force that

will focus on hard-selling risk products, making much headway is difficult

especially with a financial product that is not so easily bought over the counter.

Jai Hind College 35

Bancassurance

Identifying Target audience:

Besides, identifying the target audience

is yet another important aspect. Banks have a large depositor base of corporate

as well as retail clients they can tap. Talking of retail clients the lower end and

middle-income group customers constitute a major chunk that have over a

period of time built a good rapport with the bank staff and thus hold big

potential for bancassurance.

Reduced costs:

While products such as retirement

planning will involve an elaborately worked out plan with the help of a

financial advisor, simple products such as an accident cover in other words pure

risk products will be sold through this channel enabling savings on solicitation

costs of these products. So will insurers pass on a part of the gains on cost

saving (saving on agent training etc) to customers? At present insurers is non-

committal on this one. Also there are no immediate plans to redesign products

to suit the bancassurance channel but banks are gung-ho about cross-selling

products.

Legal issues:

Conversely, the Insurance Regulatory

Development Authority (IRDA) has adopted a cautious approach before

Bancassurance is flagged off. While on the one hand it is an economical

proposition to sell risk products through the numerous bank branches spread

across the country the fact that claim settlement disputes take an unusually long

time in our country is one of the causes for worry. In such a situation will banks

be in a position to fight for the cause of their clients is a major concern? Besides

regulatory authorities for both - banks and insurance companies are different.

Jai Hind College 36

Bancassurance

Moreover, banks may have to part with confidential information about their

clients. Now where should banks draw a line?

By allowing FDI in the insurance

industry to rise to 49%, we would be attracting more global players to invest in

India and also encouraging the growth of existing players. More capital will

also encourage a greater involvement of global partners, and thereby, enhance

product innovation, service quality, infrastructure, and technology standards,

among other things. In order to tap the tremendous potential of the life

insurance industry in India, it is essential to allow greater investment. All of this

will impact the customer positively; who will benefit more if the competition in

the market gets intensified.

It is very well considered fact that now

Bancassurance is here to stay for a long time and there are many developments

expected to happen by both insurance and banking companies and even the

regulatory company have considered that fact and are favorable norms and

guidelines for insurance and banking sector.

Jai Hind College 37

Bancassurance

BUSINESS FROM BANCASSURANCE IN 2001

Business from

other

m edium s 98%

Business from

Bancassurance

2%

2005

Business from

other medium s

94%

Business from

Bancassurance

6%

Predicted 2010

Business from

other m edium

85%

Business from

Bancassurance

15%

Source: IRDA

Jai Hind College 38

Bancassurance

As Bancassurance is a very new concept

to Indian Banking and Insurance sector there are major developments going on

in both Banking and Insurance adjust and adopt this new channel of

distribution. Which has been recognize by both banking and insurance industry

as boom to them So even regulatory authority of Banks and Insurance sector

have also started taking step in development of Bancassurance.

IRDA SETS UP PANNEL FOR BANCASSURANCE:

AMIDST differences between insurance

companies and banks on the modalities of operational sing the system of

bancassurance, the Insurance Regulatory and Development Authority (IRDA)

has decided to constitute a separate sub-committee that would attempt to evolve

a consensus on contentious issues surrounding bancassurance.

The panel on bancassurance is expected

to have representatives from both banks and insurance companies. It would

discuss the changes that should be incorporated in the corporate agency norms

applicable to banks as well as other details such as the payment of agency

commission, according to sources.

Preliminary discussions on the concept of

bancassurance, in which banks take up the marketing and distribution of

insurance products, were held at a high-level meeting here on Thursday

convened by IRDA.

Jai Hind College 39

Bancassurance

Besides the top brass of IRDA,

representatives of the Reserve Bank of India and the Chief Executive Officers

(CEOs) of over a dozen banks and public and private sector insurance

companies attended the meeting.

According to sources, a major sticking

point between banks and insurance companies was the corporate agency norms

for banks. While representatives of the banks tried to push through their case

that a single bank should be allowed to act as the corporate agent for more than

one insurance company, the insurance sector was of the opinion that a corporate

agent should be linked to only one company.

The insurance companies expressed the

view that the relationship between them and their corporate agents was of a

special nature where the company spent a lot of money and time to train the

agent. As such, they argued that an agent should work for a single company

only. ``Why should I train people of a corporate agent and then allow them to

sell the products of another company?'' the CEO of an insurance company said

after the meeting.

He said the view in the insurance sector

was that if banks wished to sell the products of more than one insurance

company, they should take up a broker's license once brokers were allowed as

intermediaries in the insurance sector.

Jai Hind College 40

Bancassurance

However, the banking sector expressed

the view that acting on behalf of a single insurance company would not be

commercially viable for a bank. They felt that in order to generate adequate

volumes so as to offset the cost of deployment of employees for selling

insurance and to provide office space, banks should be allowed to work on

behalf of more than one insurance company.

``The benefit of wide reach that a large

public sector bank can extend far exceeds the business that a single insurance

company can generate for the bank, except perhaps the public sector insurance

companies,'' the Chairman of a bank said.

INCREASING FDI ALLOWANCE LIMIT ON INSURANCE:

Government have showed a very

encouraging interest in increasing the Foreign Direct Investment (FDI) limit to

49% which was till now restricted to just 25%.

Government has taken this decision by

taking into consideration demand of growing insurance market and shortage

insurance company faces meeting with the demand of the market and even

taking into consideration the future development plan of the insurance sector as

a whole.

Jai Hind College 41

Bancassurance

Consider Mr. A. K. Mehta aged 35 he is

married and has 2 children and parents staying with him want to take an

insurance policy but he does not know to whom he can contact regarding that

matter regarding that matter. He doesn’t have any relative or friends who are

agent of any insurance company from whom he can understand and invest in

any good insurance policy.

Fortunately he walks down to his bank

for depositing cheque which he received from his job as salary. Suddenly to his

surprise a bank staff greets him and ask him that is he interested in taking a new

insurance policy which his bank has now started offering. He was relief at a

that for an insurance policy which he was planning to take for a long time but

doesn’t knew where to approach has now been offered at his bank only.

The staff member requested him to come

to his cabin where he dedicated sufficient time and explained the policy to him.

He was now even more surprised that banks have now started offering same

policy like Insurance Company at a same premium rate and very much better

service then normal insurance selling agents which would not provide any

importance to your doubt after you buy the policy and pay your first premium.

But here at banks they were always ready to understand him doubt and solve

with zest. He was shocked by the manner bank are now even allowing him to

pay his premium for insurance policy through different medium like ATM,

Kiosks, Credit Card etc.

Jai Hind College 42

Bancassurance

The policy also offered to him fantastic.

It was like a dream policy he was expected to invest which would safeguard his

future and even secure his family if any unexpected happen and even provided

him life insurance and returns return at later stage of life. The policy was as

follow:

SUM INSSURED IN CASE OF NORMAL DEATH: Rs 15,00,000/-

SUM INSSURED IN CASE OF DEATH BY ACCIDENT: Rs 30,00,000/-

And yearly return of Rs 1,00,000/- after the age of 60 yrs.

This all service at just premium of Rs 20,653/- only per annum.

Mr. A. K. Mehta was really happy with

the policy offered which give him both life security of his life and even give

him regular written after his retirement and he invested his money in this

policy.

This tells us a story of success

bancassurance which will be the boom in the Indian Financial market and even

both banks and insurance company will be profited by it.

Jai Hind College 43

Bancassurance

It is difficult to draft an overall

conclusion on “bancassurance around the world", because as we have seen, the

sector’s level of maturity differs from one country to the next. For this reason,

each country needs to be looked at individually.

Now that we have shared our

observations and thoughts on the emergence of bancassurance and its current

status, it would seem reasonable to ask how bancassurance is likely to develop

in the coming years.

Some countries, where bancassurance

currently plays a relatively minor role, are trying to identify the reasons for this

failure and would now like to develop these activities on a different basis. A

process of rapprochement between banks and insurance companies was

attempted by the so-called “Anglo-Saxon” countries such as the USA, the UK

or Germany, where the bancassurance model never really took off. Through

financial deregulation and/or an understanding of the reasons for this limited

development, the two industries may perhaps be able to establish genuine

alliances.

The high levels of recent economic

growth in certain parts of the world (China, India, etc.) suggests the possibility

that bancassurance may emerge in other countries. This emergence may take

different forms: the integrated model, or simple cooperation. The degree of

integration will depend above all on the local context in each market and the

strategy adopted by the operators. However, these are not the only factors that

will determine whether bancassurance succeeds. Many other elements and

factors are required for a successful convergence.

Jai Hind College 44

Bancassurance

As regards the countries where bank

assurance is the dominant model, mainly the so-called “Latin” countries of

Europe, banking and life assurance would now seem to be two intimately linked

activities, sharing the primary goal of fulfilling a global customer need. The

bancassurance model should therefore continue to gain market share, even if

bancassurance operators have already begun thinking about a possible change

of direction, or at least a shift to new objectives, products and customers.

Thus, after starting out with a mass

distribution rationale and a strong focus on bank customers – i.e. on individuals

– Bancassurance operators are becoming increasingly innovative, and showing

evidence of a willingness and ability to adjust and respond to their customers.

This should enable them to maintain their position, and also to target new

objectives, such as high-net-worth customers, business customers,

professionals, young people, etc.

In terms of products too, bancassurance

operators are diversifying and moving into a new era of more complex life

insurance products, niches previously confined to the traditional channels. The

goal of “mature” bancassurance operators is now to be able to fulfill even the

most specific customer needs.

However, for some years it has also been

clear that a new movement is emerging: bancassurance operators are looking at

property and casualty injury products. In France, Solving International’s annual

survey has shown that the market share of the banks in this segment, especially

Credit Agricole and Credit Mutual, grew between 2001 and 2003 by almost 1%

a year. Just as with life products, and within the same perspective of success,

Jai Hind College 45

Bancassurance

personal injury products are now increasingly designed and sold to fit into an

integrated banking approach.

However, the future of bancassurance is

not predetermined, and operators will need to deal with increasingly tough

competition. For example, to counter the rise in bancassurance, traditional

insurance companies have responded with the invention of Assurbanque and the

launch of their own range of banking products. For the moment, this offensive

is too recent for predictions to be made about its future.

To sum up, in the countries where it is

already well established, bancassurance can still grow in certain market sectors,

while in other parts of the world, it is a matter of starting from scratch.

Bancassurance still has a long way to go!

Jai Hind College 46

Bancassurance

Questionare

Q1) NAME:

AGE:

SINGLE / MARRIED:

DEPENDNT ON PERSON:

CHILDRENS (IF ANY):

Q2) HAVE YOU TAKEN ANY POLICY FROM ANY BANKS?

Q3) HOW MUCH HAVE YOU INVEST IN POLICY TAKEN FROM BANK?

Q4) WERE YOU HAPPY WITH THE SERVICE PROVIDED BY BANK?

Q5) WHAT PERCENT OF YOUR TOTAL SHARE OF INVESTMENT IN

INSURANCE POLICY IN THROUGH BANK?

Q6) DO U HAVE MEDICAL HISTORY OF ILLNESS OR OF ANY KIND?

Q7) ARE U ADDICTED TO ANY THING LIKE SMOKING, DRINKING OR

ANYTHING?

Q8) ARE U WILLING TO CHANGE UR AGENT OR MODE OF

DISTRIBUTION CHANNEL TO BUY ANY INSURANCE PRODUCTS?

Q9) WHAT YOUR ANNUAL INCOME (APPROX)?

Jai Hind College 47

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Label 304409446Dokument1 SeiteLabel 304409446darker111darkNoch keine Bewertungen

- Special Conditions For The 'Schengen Insurance' PolicyDokument1 SeiteSpecial Conditions For The 'Schengen Insurance' Policyfatima amjadNoch keine Bewertungen

- MGEC Final ExamDokument17 SeitenMGEC Final ExamAashiNoch keine Bewertungen

- Module 10 - Income TaxDokument6 SeitenModule 10 - Income TaxLuiNoch keine Bewertungen

- The Chamber in Louth Town Hall: All Future Meetings Will Be Upstairs inDokument24 SeitenThe Chamber in Louth Town Hall: All Future Meetings Will Be Upstairs inapi-110060233Noch keine Bewertungen

- 82 Insular Life V Feliciano (1941)Dokument2 Seiten82 Insular Life V Feliciano (1941)Kenneth BuriNoch keine Bewertungen

- Sap TableDokument82 SeitenSap TableAseem SyedNoch keine Bewertungen

- Magma HDI General InsuranceDokument2 SeitenMagma HDI General Insurancesarath potnuriNoch keine Bewertungen

- Risk ManagementDokument7 SeitenRisk ManagementbacktrxNoch keine Bewertungen

- 07 14 21 Petron Top 100 Stockholders As of June 30 2021 PCOR.Dokument9 Seiten07 14 21 Petron Top 100 Stockholders As of June 30 2021 PCOR.Kelvin Dacasin100% (1)

- Retail BankingDokument71 SeitenRetail Bankingswati_rathourNoch keine Bewertungen

- Pavilion Rental AgreementDokument5 SeitenPavilion Rental AgreementJ. Daniel SpratlinNoch keine Bewertungen

- Finalized Erp Case StudyDokument20 SeitenFinalized Erp Case StudycharuchudliNoch keine Bewertungen

- Investment Declaration Form - FY 2023-24Dokument2 SeitenInvestment Declaration Form - FY 2023-24kunal singhNoch keine Bewertungen

- 201 Great Ideas For Your Small Business Revised & Updated EditionDokument415 Seiten201 Great Ideas For Your Small Business Revised & Updated Editionapi-374530883% (6)

- RiskDokument10 SeitenRiskAmuliya VSNoch keine Bewertungen

- Math 134 Tutorial 8 Annuities Due, Deferred Annuities, Perpetuities and Calculus: First PrinciplesDokument5 SeitenMath 134 Tutorial 8 Annuities Due, Deferred Annuities, Perpetuities and Calculus: First PrinciplesJVA ACCOUNTINGNoch keine Bewertungen

- Consulting Services For Nutrient Source Evaluation and Assessment City of Marco Island Contract 19-033 - Jan. 7, 2020Dokument9 SeitenConsulting Services For Nutrient Source Evaluation and Assessment City of Marco Island Contract 19-033 - Jan. 7, 2020Omar Rodriguez OrtizNoch keine Bewertungen

- IPA Weighing Scale - 100 KGDokument3 SeitenIPA Weighing Scale - 100 KGMystifier ShibinNoch keine Bewertungen

- Dealers Borrowed Vehicle AgreementDokument2 SeitenDealers Borrowed Vehicle AgreementIrina GafitaNoch keine Bewertungen

- OYO Traveller Insurance PlanDokument6 SeitenOYO Traveller Insurance PlanMansi VaishNoch keine Bewertungen

- Auto Insurance Identification Card(s)Dokument4 SeitenAuto Insurance Identification Card(s)sanchez2002Noch keine Bewertungen

- Insurance Case Digests (Part 1)Dokument3 SeitenInsurance Case Digests (Part 1)JohnAlexanderBelderol100% (1)

- Og 23 2203 1801 00005279Dokument16 SeitenOg 23 2203 1801 00005279Mahika PardeshiNoch keine Bewertungen

- Buying A Home 1Dokument12 SeitenBuying A Home 1FlyEngineerNoch keine Bewertungen

- IRS Complaint (Amendment) vs. Maya Rockeymoore Cummings and Center For Global Policy SolutionsDokument32 SeitenIRS Complaint (Amendment) vs. Maya Rockeymoore Cummings and Center For Global Policy SolutionsPeter Flaherty100% (1)

- Interim President COO Employment Agreement - April 23 2018 - DraftDokument5 SeitenInterim President COO Employment Agreement - April 23 2018 - DraftShelby DanielsenNoch keine Bewertungen

- FloridaSeminar (As Of10!12!9)Dokument10 SeitenFloridaSeminar (As Of10!12!9)shanebuczek100% (10)

- OWWA Benefits 1 PDFDokument8 SeitenOWWA Benefits 1 PDFJoshua ClaridadNoch keine Bewertungen

- Video Commissioning AgreementDokument10 SeitenVideo Commissioning AgreementRadenko IvanovicNoch keine Bewertungen