Beruflich Dokumente

Kultur Dokumente

US Internal Revenue Service: I1099ptr - 2002

Hochgeladen von

IRS0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

15 Ansichten1 SeiteRecent legislation reduced the backup withholding rate. If you mark this box, the IRS will not send you any further notices about this account. You should also use the 2002 General Instructions for Forms 1099, 1098, 5498, and W-2G.

Originalbeschreibung:

Originaltitel

US Internal Revenue Service: i1099ptr--2002

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenRecent legislation reduced the backup withholding rate. If you mark this box, the IRS will not send you any further notices about this account. You should also use the 2002 General Instructions for Forms 1099, 1098, 5498, and W-2G.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

15 Ansichten1 SeiteUS Internal Revenue Service: I1099ptr - 2002

Hochgeladen von

IRSRecent legislation reduced the backup withholding rate. If you mark this box, the IRS will not send you any further notices about this account. You should also use the 2002 General Instructions for Forms 1099, 1098, 5498, and W-2G.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

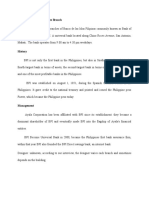

Userid: ________ Leading adjust: 0% ❏ Draft ❏ Ok to Print

PAGER/SGML Fileid: I1099P.sgm ( 7-Nov-2001) (Init. & date)

Page 1 of 1 Instructions for Form 1099-PATR 8:16 - 7-NOV-2001

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

2002 Department of the Treasury

Internal Revenue Service

Instructions for Form

1099-PATR

Section references are to the Internal Revenue Code unless otherwise noted.

incorrect taxpayer identification number (TIN). If you mark this

What’s New for 2002? box, the IRS will not send you any further notices about this

Backup withholding. Recent legislation reduced the backup account.

withholding rate. The backup withholding rate will be 30% for Box 1. Patronage Dividends

reportable payments made in 2002 and 2003.

Enter the total patronage dividends paid in cash (qualified or

An Item To Note “consent” checks), qualified written notices of allocation (face

amount), and other property (except nonqualified written notices

In addition to these specific instructions, you should also use of allocation).

the 2002 General Instructions for Forms 1099, 1098, 5498,

and W-2G. Those general instructions include information Box 2. Nonpatronage Distributions

about: Enter the total nonpatronage distributions paid in cash (qualified

• Backup withholding or “consent” checks), qualified written notices of allocation (face

• Magnetic media and electronic reporting requirements amount), and other property. Do not include nonqualified written

• Penalties notices of allocation. This box applies only to farmers’

• When and where to file cooperatives exempt from tax under section 521.

• Taxpayer identification numbers

• Statements to recipients Box 3. Per-Unit Retain Allocations

• Corrected and void returns Enter the total per-unit retain allocations paid in cash, qualified

• Other general topics per-unit retain certificates (face amount), and other property.

You can get the general instructions from the IRS Web Site

at www.irs.gov or by calling 1-800-TAX-FORM

Box 4. Federal Income Tax Withheld

(1-800-829-3676). Enter backup withholding. For example, persons who have not

furnished their TIN to you in the manner required are subject to

withholding at a 30% rate on payments required to be reported

Specific Instructions for Form in boxes 1, 2, 3, and 5 to the extent such payments are in cash

or qualified check. See Regulations section 31.3406(b)(2)-5 for

1099-PATR more information on backup withholding by cooperatives.

File Form 1099-PATR, Taxable Distributions Received From Box 5. Redemption of Nonqualified Notices and

Cooperatives, for each person to whom the cooperative has

paid at least $10 in patronage dividends and other distributions Retain Allocations

described in section 6044(b) or from whom you withheld any Enter all redemptions of nonqualified written notices of

Federal income tax under the backup withholding rules allocation issued as patronage dividends or nonqualified written

regardless of the amount of the payment. A cooperative notices of allocation issued as nonpatronage allocations

determined to be primarily engaged in the retail sale of goods or (applicable only to farmers’ cooperatives qualifying under

services that are generally for personal, living, or family use of section 521). Also enter nonqualified per-unit retain certificates

the members may ask for and receive exemption from filing issued with respect to marketing.

Form 1099-PATR. See Form 3491, Consumer Cooperative Pass-Through Credits

Exemption Application, for information about how to apply for

this exemption. Report in the appropriate boxes the patron’s share of unused

credits that the cooperative is passing through to the patron:

Report dividends paid on a cooperative’s capital stock on

Form 1099-DIV, Dividends and Distributions. Box 6. (Certain Credits)

Exceptions. You are not required to file Form 1099-PATR for See the TIP below.

payments made to a corporation, a tax-exempt organization, Box 7. Investment Credit

the United States, a state, a possession, or the District of Enter the total investment credit for the patron.

Columbia. Other exceptions may apply. See Regulations

section 1.6044-3(c). Box 8. Work Opportunity Credit

Statements to Recipients Enter the total work opportunity credit for the patron.

If you are required to file Form 1099-PATR, you must provide a Box 9. Patron’s AMT Adjustment

statement to the recipient. For more information about the Enter the total alternative minimum tax (AMT) patronage

requirement to furnish an official form or acceptable substitute dividend adjustment for the patron.

statement to recipients in person or by statement mailing, see If you are passing through other credits, such as the

part H in the 2002 General Instructions for Forms 1099, TIP Indian employment credit, the empowerment zone

1098, 5498, and W-2G. employment credit, or the welfare-to-work credit, use

2nd TIN Not. box 6 or the blank box under boxes 8 and 9. Label the credit.

You may enter an “X” in this box if you were notified by the IRS

twice within 3 calendar years that the payee provided an

Cat. No. 27984F

Das könnte Ihnen auch gefallen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDokument71 SeitenTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- US Internal Revenue Service: 2290rulesty2007v4 0Dokument6 SeitenUS Internal Revenue Service: 2290rulesty2007v4 0IRSNoch keine Bewertungen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Objectives Report To Congress v2Dokument153 Seiten2008 Objectives Report To Congress v2IRSNoch keine Bewertungen

- 2008 Data DictionaryDokument260 Seiten2008 Data DictionaryIRSNoch keine Bewertungen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Credit Card Bulk Provider RequirementsDokument112 Seiten2008 Credit Card Bulk Provider RequirementsIRSNoch keine Bewertungen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Acc117 Group AssignmentDokument15 SeitenAcc117 Group AssignmentMUHAMMAD HIFZHANI AZMANNoch keine Bewertungen

- CFA Research Report - Team APUDokument30 SeitenCFA Research Report - Team APUAnonymous 6A1OAiGidZNoch keine Bewertungen

- Investment Arbitration and Country Risk 1711783556Dokument28 SeitenInvestment Arbitration and Country Risk 17117835568nqcpq9tq9Noch keine Bewertungen

- Full Download Corporate Financial Accounting 13th Edition Warren Solutions ManualDokument35 SeitenFull Download Corporate Financial Accounting 13th Edition Warren Solutions Manualmasonh7dswebb100% (37)

- Risk Assessment Worksheet BlankDokument5 SeitenRisk Assessment Worksheet BlankisolongNoch keine Bewertungen

- SamCERA PE Perf Report Q1 20 SolovisDokument1 SeiteSamCERA PE Perf Report Q1 20 SolovisdavidtollNoch keine Bewertungen

- Quiz 1 2Dokument4 SeitenQuiz 1 2UndebaynNoch keine Bewertungen

- MCX Deepens Its Footprint in The GIFT City (Company Update)Dokument3 SeitenMCX Deepens Its Footprint in The GIFT City (Company Update)Shyam SunderNoch keine Bewertungen

- Cover Cek MaybankDokument2 SeitenCover Cek MaybankArifa HasnaNoch keine Bewertungen

- Patrice R. Barquilla 12 Gandionco Business Finance CHAPTER 2 ASSIGNMENTDokument12 SeitenPatrice R. Barquilla 12 Gandionco Business Finance CHAPTER 2 ASSIGNMENTJohnrick RabaraNoch keine Bewertungen

- Family Trust Q A For Download PDFDokument9 SeitenFamily Trust Q A For Download PDFphil8984Noch keine Bewertungen

- Capital Structure of Banking Companies in IndiaDokument21 SeitenCapital Structure of Banking Companies in IndiaAbhishek Soni43% (7)

- Arthakranti - Anil BokilDokument8 SeitenArthakranti - Anil Bokilvarun4486Noch keine Bewertungen

- Full Pack Pfcea New ProceduresDokument27 SeitenFull Pack Pfcea New Proceduresdirector@bancofinancieroprivadoNoch keine Bewertungen

- Swaps PresentationDokument34 SeitenSwaps PresentationSherman WaltonNoch keine Bewertungen

- 7011 Accounting January 2010Dokument40 Seiten7011 Accounting January 2010raziejazNoch keine Bewertungen

- Hospital Supply, IncDokument3 SeitenHospital Supply, Incmade3875% (4)

- KsebBill 1165411013809Dokument1 SeiteKsebBill 1165411013809Jio CpyNoch keine Bewertungen

- Carrefour Jardines BrochureDokument50 SeitenCarrefour Jardines Brochure4gen_2Noch keine Bewertungen

- Sale and Purchase Agreement OSCAR ALEJANDRO GALVIS SANTIAGODokument6 SeitenSale and Purchase Agreement OSCAR ALEJANDRO GALVIS SANTIAGOTinktas pcsNoch keine Bewertungen

- 4449b8b1-0f05-4bd3-be90-44b82775ee5eDokument2 Seiten4449b8b1-0f05-4bd3-be90-44b82775ee5eFawzar SabirNoch keine Bewertungen

- CH 07Dokument3 SeitenCH 07ghsoub777Noch keine Bewertungen

- Tata Group - M&ADokument24 SeitenTata Group - M&Aankur_khushu66100% (1)

- Bankin and Fin Law Relationship Between Bank and Its CustomersDokument6 SeitenBankin and Fin Law Relationship Between Bank and Its CustomersPersephone WestNoch keine Bewertungen

- Estmt - 2020 08 21Dokument8 SeitenEstmt - 2020 08 21ventas.gopartNoch keine Bewertungen

- IFM M.Com NotesDokument36 SeitenIFM M.Com NotesViraja GuruNoch keine Bewertungen

- Compare Savings Accounts & ISAs NationwideDokument1 SeiteCompare Savings Accounts & ISAs NationwideVivienneNoch keine Bewertungen

- BPI Vito Cruz Chino Roces BranchDokument8 SeitenBPI Vito Cruz Chino Roces BranchKlark Kevin Tatlonghari OrtalezaNoch keine Bewertungen

- Deutsche Finan ExcelDokument6 SeitenDeutsche Finan ExcelAnonymous VVSLkDOAC1Noch keine Bewertungen