Beruflich Dokumente

Kultur Dokumente

Credit App (Honda)

Hochgeladen von

aron45Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Credit App (Honda)

Hochgeladen von

aron45Copyright:

Verfügbare Formate

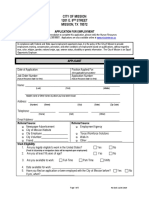

Credit Application for: ™ Retail ™ Lease ™ Balloon

PLEASE PRINT — INCOMPLETE APPLICATIONS WILL NOT BE PROCESSED.

INSTRUCTIONS: (4) If you are married and live in a community property state, or any property that will

You may apply for credit in your name alone, whether or not you are married. secure this credit is located within a community property state, please provide

(1) Please indicate whether you are applying ™ Individually, or ™ With another person. information about your spouse in the “Co-Applicant” section (even if this

(2) Indicate your marital status here only if: application is in your name alone).

a) you live in a community property state (AZ, CA, ID, LA, NM, NV, TX, WA, WI), or Will Applicant(s) be principal driver/operator? ™ YES ™ NO.

b) this is a joint application, or c) this is an application for secured credit. The vehicle being applied for will be used primarily for: (check one)

™ MARRIED ™ UNMARRIED ™ SEPARATED ™ Personal, family or household use. ™ Business, commercial, or agricultural

(3) If you are applying for credit with another person, please complete all sections. purposes, or you are an organization or governmental entity.

APPLICANT INFORMATION

Last Name First Name Middle Birthdate Social Security No.

– –

Address City State Zip How Long: Drivers License No.

Yrs. Mos.

Home Phone Work Phone Mailing Address (if different from Home Address) City State Zip

( ) – ( ) –

Residential Status: ™ Own ™ Rent ™ Buying ™ Parents ™ Other ______________________________________ Monthly Rent/Mtg. Pmt. $

Previous Full Address (If less than 3 years) How Long: E-Mail Address:

Yrs. Mos.

EMPLOYMENT and INCOME INFORMATION: Note - Alimony, child support, or separate maintenance income need not be revealed if you do not choose to have it considered as a basis for repaying this obligation.

Employer Name / ™ Self-Employed Monthly Income: $ Length of Employment Occupation

Other Income: $

Source: Yrs. Mos.

Previous Employer Name Phone Number Length of Employment Occupation

(If less than 3 years)

( ) – Yrs. Mos.

CO-APPLICANT INFORMATION - This Person Is a: ■ Spousal Joint Applicant ■ Joint Applicant ■ Co-signer/Guarantor ■ Non-Applicant Spouse

Last Name First Name Middle Birthdate Social Security No.

– –

Address (If different than Applicant’s) City State Zip How Long: Drivers License No.

47 Woodcrest Dr Yrs. Mos.

Home Phone Work Phone Mailing Address (if different from Home Address) City State Zip

( ) – ( ) –

Residential Status: ™ Own ™ ✔ Rent ™ Buying ™ Parents ™ Other ______________________________________ Monthly Rent/Mtg. Pmt. $

Previous Full Address (If less than 3 years) How Long: E-Mail Address:

Yrs. Mos.

EMPLOYMENT and INCOME INFORMATION: Note - Alimony, child support, or separate maintenance income need not be revealed if you do not choose to have it considered as a basis for repaying this obligation.

Employer Name / ™ Self-Employed Monthly Income: $ Length of Employment Occupation

Other Income: $

Source: Yrs. Mos.

Previous Employer Name Phone Number Length of Employment Occupation

(If less than 3 years)

( ) – Yrs. Mos.

CREDIT and DEBT INFORMATION: If you are married and live in a community property state, or any property that will secure this credit is located in such, the Seller/Lessor

and AHFC* will assume that all assets and income are community property and all debts are community obligations, unless you indicate otherwise on this application.

Bank Reference: Account No.: ™ Checking ™ Savings

Type of Loan: ™ Mortgage Payment: $ _________________ Balance: $ _________________ Creditor: ___________________________________________

Type of Loan: ™ Auto Payment: $ _________________ Balance: $ _________________ Creditor: ___________________________________________

Has any party to this application been the subject, or subject to bankruptcy proceedings? ™ Yes ™ No Explain, if yes. ________________________________________

Has any party to this application ever obtained credit under a different name? ™ Yes ™ No If so, What name? _______________________________________________

Had a vehicle repossessed? ™ Yes ™ No If so, explain: ________________________________________________________________________________________

References

Nearest relative not living with you:

Name Address Phone Relationship to Applicant

( ) –

Please read and sign below: By my signature below, I certify that I have completed this application to obtain credit, and that all information provided by me for this application is true, correct and

complete. I understand and agree that this application and related credit information will be forwarded to AHFC* (or other financial institution if shown below), and AHFC* may be asked to buy

the retail installment contract or lease involved in this transaction. I authorize AHFC* to communicate the reason(s) for action taken on this application to the Dealer named below. I authorize the

Seller/Lessor, and AHFC* (collectively “You”) to make inquiries and obtain information about me as You deem appropriate for the purpose of evaluating this application, and for any update,

renewal, or extension of the credit received, including obtaining credit reports, contacting my credit references and/or my employer, and contacting any person or department about my driving

record. I also authorize You to provide credit information about this transaction to others for the purpose of initiating, monitoring, and other purposes related to this account. I authorize You to

give a copy of this application to anyone who has agreed to pay debts incurred on the basis of this application. If I provided my e-mail address on this application, I agree that any communications

and correspondence to me from any of the parties to this transaction may be effected by e-mail.

700 Van Ness Avenue, Torrance, CA 90501

*AHFC means and includes American Honda Finance Corporation and Honda Lease Trust, _______________________________________________________________________ .

You are notified that your application may be submitted to (Name and Address required): ________________________________________________________________________

Applicant’s Signature _________________________________ Date ______________ Co-Applicant’s Signature _____________________________ Date: _____________

DEALER SECTION

Dealer Name Dealer #: Dealer Contact Person:

Honda/Acura Customer: ™ Yes ™ No Year Make Model # MSRP

AHFC* Customer: ™ Yes ™ No

Loyalty: Term: Invoice Estimated Payments Cap. Cost Red. Adj. Cap. Cost

™ Yes ™ No $

Sales Program: ™ New ™ Used ™ Certified Cash Price: Sales Tax: Cash Down: Trade-In Amount Amount Financed

Miles:

AHFC V-2 CREDIT APP(Rev. 3/02)

STATE NOTICES

California Residents: If married you may apply for a separate account.

Ohio Residents: The Ohio laws against discrimination require that all creditors make credit equally available to all creditworthy customers, and that credit reporting agencies maintain

separate credit histories on each individual request. The Ohio Civil Rights Commission administers compliance with this law.

Married Wisconsin Residents: No agreement, unilateral statement or court decree relating to marital property adversely affects a creditor’s interest unless prior to the time credit is granted

the creditor is furnished a copy of the agreement, statement or decree, or has actual knowledge of the adverse provision. If the credit for which you are applying is granted, your spouse will

also receive notification that credit has been extended to you.

New York, Rhode Island and Vermont Residents: Consumer reports (credit reports) may be obtained in connection with this application. If you request: 1) You will be informed whether or

not consumer reports were obtained; and 2) If consumer reports were obtained, you will be informed of the names and addresses of the consumer reporting agencies (credit bureaus) that

furnished the reports. If this application for credit is approved, you authorize AHFC* to request and use subsequent consumer reports in connection with (a) renewals or extensions of this

credit; (b) reviewing your credit; (c) for the purpose of taking collection action on this extension of credit; or (d) other legitimate reasons associated with this extension of credit.

AHFC V-2 CREDIT APP(Rev. 3/02)

Das könnte Ihnen auch gefallen

- Judicial Affidavit Collection of Sum of MoneyDokument4 SeitenJudicial Affidavit Collection of Sum of Moneypatricia.aniya80% (5)

- Tenant ApplicationDokument2 SeitenTenant Applicationjwt9478Noch keine Bewertungen

- Job Application Form (CFO)Dokument3 SeitenJob Application Form (CFO)Waqas100% (1)

- Loan App 2008Dokument2 SeitenLoan App 2008sandyolkowskiNoch keine Bewertungen

- Credit Application Purchase Lease: Four SquareDokument1 SeiteCredit Application Purchase Lease: Four SquareJhEnny ViLlalobosNoch keine Bewertungen

- Loan AppDokument2 SeitenLoan AppsandyolkowskiNoch keine Bewertungen

- Newyorknyserdaloan CreditapplicationDokument2 SeitenNewyorknyserdaloan CreditapplicationsandyolkowskiNoch keine Bewertungen

- Uniform Residential Loan Application Section 1: Borrower InformationDokument9 SeitenUniform Residential Loan Application Section 1: Borrower InformationHannie NguyenNoch keine Bewertungen

- Uniform Residential Loan Application Section 1: Borrower InformationDokument17 SeitenUniform Residential Loan Application Section 1: Borrower InformationshandilyasamitNoch keine Bewertungen

- Tfgf-Ftf-Ifg - Gg#E - Orh: T.It?M:HDokument8 SeitenTfgf-Ftf-Ifg - Gg#E - Orh: T.It?M:HShujaRehmanNoch keine Bewertungen

- Assignment Form: InstructionsDokument2 SeitenAssignment Form: InstructionsjahgfNoch keine Bewertungen

- Ford Credit: Application Statement (Please Print)Dokument2 SeitenFord Credit: Application Statement (Please Print)khairul ihsanNoch keine Bewertungen

- Rehab AppDokument10 SeitenRehab AppsandyolkowskiNoch keine Bewertungen

- Rental Energy AppDokument2 SeitenRental Energy AppsandyolkowskiNoch keine Bewertungen

- Contact Name: Contact PH: Email:: Please Submit Your Application For Bonding ToDokument2 SeitenContact Name: Contact PH: Email:: Please Submit Your Application For Bonding ToMelanie LejanoNoch keine Bewertungen

- GE Money: Application and Credit Card AgreementDokument8 SeitenGE Money: Application and Credit Card AgreementsewsalesNoch keine Bewertungen

- Business Credit Application: Legal Name: Date of Birth (For Individuals) : DbaDokument2 SeitenBusiness Credit Application: Legal Name: Date of Birth (For Individuals) : DbaSorcerer NANoch keine Bewertungen

- manualRequestForm ActionDokument1 SeitemanualRequestForm ActionMatthew PickettNoch keine Bewertungen

- Mail in Credit Report RequestDokument1 SeiteMail in Credit Report Requestdiversified1Noch keine Bewertungen

- Application Form - New Financial PlanDokument2 SeitenApplication Form - New Financial PlanCamille FreoNoch keine Bewertungen

- Application Form - New Financial PlanDokument2 SeitenApplication Form - New Financial PlanCamille FreoNoch keine Bewertungen

- Why Act Now?: Please Print and Complete The Application in Blue or Black Ink and Return by Mail ToDokument2 SeitenWhy Act Now?: Please Print and Complete The Application in Blue or Black Ink and Return by Mail Tokentut2016Noch keine Bewertungen

- Personal Information: Associate ApplicationDokument4 SeitenPersonal Information: Associate ApplicationRachel ReyNoch keine Bewertungen

- Personal Share ApplicationDokument3 SeitenPersonal Share Applicationbstinson829Noch keine Bewertungen

- Disclosure 423076497Dokument29 SeitenDisclosure 423076497tim.deyton1Noch keine Bewertungen

- City of Mission 1201 E. 8 Street MISSION, TX 78572: Application For EmploymentDokument6 SeitenCity of Mission 1201 E. 8 Street MISSION, TX 78572: Application For EmploymentSebastian MartinezNoch keine Bewertungen

- Annual Credit Report Request Form: Social Security Number: Date of BirthDokument1 SeiteAnnual Credit Report Request Form: Social Security Number: Date of BirthPendi AgarwalNoch keine Bewertungen

- Uniform Residential Loan Application: Section 1: Borrower InformationDokument12 SeitenUniform Residential Loan Application: Section 1: Borrower InformationJuan C100% (1)

- ApplicationDokument2 SeitenApplicationFabian SandovalNoch keine Bewertungen

- Credit Application For CEE Home Improvement Loan Programs: I. Lender InformationDokument3 SeitenCredit Application For CEE Home Improvement Loan Programs: I. Lender InformationsandyolkowskiNoch keine Bewertungen

- Personal Data: ReferencesDokument2 SeitenPersonal Data: ReferencesMambo Lissa & Chef StefNoch keine Bewertungen

- Loan Application Santiago FinancialDokument4 SeitenLoan Application Santiago FinancialJose EspinosaNoch keine Bewertungen

- Application For Occupancy: Form Valid For Georgia Apartment Association Members OnlyDokument4 SeitenApplication For Occupancy: Form Valid For Georgia Apartment Association Members OnlyPatricia WellsNoch keine Bewertungen

- Secure Finance Application - IndividualDokument1 SeiteSecure Finance Application - Individualdon.omar199028100% (1)

- Paint A Brighter Future PFS - 220618 - 074733Dokument1 SeitePaint A Brighter Future PFS - 220618 - 074733Rene AliNoch keine Bewertungen

- Ok Channel Seafood Application FormDokument3 SeitenOk Channel Seafood Application FormJenny CruzNoch keine Bewertungen

- Loan Form 2021 PDFDokument5 SeitenLoan Form 2021 PDFClaribelle MaquilavaNoch keine Bewertungen

- Onlyus AppDokument1 SeiteOnlyus AppbirdeyefinanceNoch keine Bewertungen

- Select/Premier Medical Plan: Application FormDokument6 SeitenSelect/Premier Medical Plan: Application Formadobo sinigangNoch keine Bewertungen

- Online Interview QuestionnaireDokument5 SeitenOnline Interview QuestionnaireKrishnan NatarajanNoch keine Bewertungen

- Credit ApplicationDokument3 SeitenCredit Applicationcharlenealvarez59Noch keine Bewertungen

- Payment Plan Application FormDokument3 SeitenPayment Plan Application FormJojo ArejaNoch keine Bewertungen

- Personal Information Sheet PDFDokument2 SeitenPersonal Information Sheet PDFRonelyn CalimbayanNoch keine Bewertungen

- FBF - ApplicationDokument1 SeiteFBF - ApplicationAnonymous WLOBYKE8NTNoch keine Bewertungen

- Application For MembershipDokument4 SeitenApplication For Membershipapi-675087957Noch keine Bewertungen

- Home Loan Form 2023Dokument6 SeitenHome Loan Form 2023Sitar ComebackNoch keine Bewertungen

- Business Credit App 0Dokument12 SeitenBusiness Credit App 0Kent WhiteNoch keine Bewertungen

- General Information Sheet - Principal Borrower: Credit ApplicationDokument2 SeitenGeneral Information Sheet - Principal Borrower: Credit ApplicationNemir ViluanNoch keine Bewertungen

- School Fees Advance Application Form 2019Dokument4 SeitenSchool Fees Advance Application Form 2019Mary KimberlyNoch keine Bewertungen

- Attention: If You Pay Your Taxes and Insurance Yourself Provide Required Document #2, 3 and 4Dokument5 SeitenAttention: If You Pay Your Taxes and Insurance Yourself Provide Required Document #2, 3 and 4Pedro G. SotoNoch keine Bewertungen

- Questionnaire - PersonalDokument2 SeitenQuestionnaire - PersonalLarah BuhaweNoch keine Bewertungen

- Formulario HoneywellDokument1 SeiteFormulario HoneywellTomas PorrecaNoch keine Bewertungen

- Applicant Information (If More Than One Applicant, Copy Form and Complete For Each)Dokument1 SeiteApplicant Information (If More Than One Applicant, Copy Form and Complete For Each)NoeNoch keine Bewertungen

- Rental Application NEW.1Dokument2 SeitenRental Application NEW.1Tim FergusonNoch keine Bewertungen

- Rental Application CA SafeRentDokument2 SeitenRental Application CA SafeRentMichael SnyderNoch keine Bewertungen

- Co Maker FormDokument1 SeiteCo Maker FormHaul Ing SerbisNoch keine Bewertungen

- Weatherization Loan ApplicationDokument2 SeitenWeatherization Loan ApplicationsandyolkowskiNoch keine Bewertungen

- AIA Philam Life Policy Loan Request FormDokument2 SeitenAIA Philam Life Policy Loan Request Formmercedes bengadoNoch keine Bewertungen

- Motor Vehicle Loan Application Form: (Months)Dokument2 SeitenMotor Vehicle Loan Application Form: (Months)Pam Bisares100% (1)

- Personal Loan ApplicationDokument1 SeitePersonal Loan ApplicationmahavirNoch keine Bewertungen

- Unit 4 Accounting Standards: StructureDokument16 SeitenUnit 4 Accounting Standards: StructurefunwackyfunNoch keine Bewertungen

- Valone v. Michigan Dep't of Treasury, Docket No. 385120 (Mich. Tax Tribunal August 18, 2011)Dokument7 SeitenValone v. Michigan Dep't of Treasury, Docket No. 385120 (Mich. Tax Tribunal August 18, 2011)Paul MastersNoch keine Bewertungen

- Onboarding Guidelines - Non-Funded Training Partner: A. Eligibility CriteriaDokument3 SeitenOnboarding Guidelines - Non-Funded Training Partner: A. Eligibility CriteriaSendhil KumaranNoch keine Bewertungen

- Entrepreneurial Exit As A Critical Component of The Entrepreneurial ProcessDokument13 SeitenEntrepreneurial Exit As A Critical Component of The Entrepreneurial Processaknithyanathan100% (2)

- Invoice 62060270Dokument1 SeiteInvoice 62060270Chandru PrasathNoch keine Bewertungen

- IT Detections From Gross Total Income Pt-1Dokument25 SeitenIT Detections From Gross Total Income Pt-1syedfareed596100% (1)

- Advocacy Strategy ManualDokument53 SeitenAdvocacy Strategy ManualINFID JAKARTA100% (1)

- Discription On Fixation of Assistants in Revised PayDokument47 SeitenDiscription On Fixation of Assistants in Revised Payvadrevusri100% (7)

- 14 Financial Statement Analysis: Chapter SummaryDokument12 Seiten14 Financial Statement Analysis: Chapter SummaryGeoffrey Rainier CartagenaNoch keine Bewertungen

- Lecture Week 14Dokument23 SeitenLecture Week 14XS3 GamingNoch keine Bewertungen

- Three Genious FullDokument4 SeitenThree Genious FullRana JahanzaibNoch keine Bewertungen

- Handout Caltex VS IacDokument4 SeitenHandout Caltex VS IacKazumi ShioriNoch keine Bewertungen

- Case 11-2 SolutionDokument2 SeitenCase 11-2 SolutionArjun PratapNoch keine Bewertungen

- Work On Sheets! Part I (Problem-Solving) : Name: Date: ScoreDokument1 SeiteWork On Sheets! Part I (Problem-Solving) : Name: Date: ScoreDong RoselloNoch keine Bewertungen

- Auditing ProceduresDokument3 SeitenAuditing ProceduresPauNoch keine Bewertungen

- Filing From Bondurant's Landlord, The Sun Marina Valley Development CorporationDokument8 SeitenFiling From Bondurant's Landlord, The Sun Marina Valley Development CorporationStefNoch keine Bewertungen

- Set 2Dokument6 SeitenSet 2Nicco OrtizNoch keine Bewertungen

- Signal Cartel - New Member Orientation GuideDokument28 SeitenSignal Cartel - New Member Orientation GuideIlya ChenskyNoch keine Bewertungen

- Board Resolution Regarding Banking AccountDokument1 SeiteBoard Resolution Regarding Banking AccountGryswolf100% (1)

- Investments FINA-3720 Ligang Zhong: Lectures 12 & 13 (Chapter 18) Equity Evaluation ModelsDokument46 SeitenInvestments FINA-3720 Ligang Zhong: Lectures 12 & 13 (Chapter 18) Equity Evaluation ModelsroBinNoch keine Bewertungen

- Doctrine of Corporate EntityDokument6 SeitenDoctrine of Corporate EntityGen Grajo0% (2)

- MF0015 Question PaperDokument2 SeitenMF0015 Question Paperpj2202Noch keine Bewertungen

- 6 Advanced Accounting 2DDokument3 Seiten6 Advanced Accounting 2DRizky Nugroho SantosoNoch keine Bewertungen

- FINS 3616 Tutorial Questions-Week 3 - AnswersDokument5 SeitenFINS 3616 Tutorial Questions-Week 3 - AnswersJethro Eros PerezNoch keine Bewertungen

- SmartMetalsInvestorKit PDFDokument32 SeitenSmartMetalsInvestorKit PDFhorns2034Noch keine Bewertungen

- Powers of Minnesota State Chartered Banks: A Financial Examinations Division PublicationDokument16 SeitenPowers of Minnesota State Chartered Banks: A Financial Examinations Division PublicationHeyYoNoch keine Bewertungen

- Union Budget 2023 - 2024: A Plenary DiscussionDokument17 SeitenUnion Budget 2023 - 2024: A Plenary DiscussionKAVITHA K SNoch keine Bewertungen

- Introduction To Insurance IndustryDokument64 SeitenIntroduction To Insurance IndustryDhananjay Kumar100% (4)

- Market Outlook 13th January 2012Dokument6 SeitenMarket Outlook 13th January 2012Angel BrokingNoch keine Bewertungen