Beruflich Dokumente

Kultur Dokumente

Microequities Deep Value Microcap Fund January 2011 Update

Hochgeladen von

Microequities Pty LtdCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Microequities Deep Value Microcap Fund January 2011 Update

Hochgeladen von

Microequities Pty LtdCopyright:

Verfügbare Formate

MICROEQUITIES ASSET MANAGEMENT

DEEP VALUE MICROCAP FUND UPDATE, JANUARY 2011 PERFORMANCE UPDATE

Dear Investor,

Markets and economy

The world is uncertain place. It’s subject to all sorts of external forces, geopolitical events, weather anomalies and unforseen

events. An objective overview of the history of the last century would provide most observers with a shocking, tumultuous

account of events; the two biggest armed conflicts the world has ever seen, a cold war, a US Presidential assassination, the

Korean War, the Vietnam War, an Oil Crisis, Watergate, the advent of new deadly diseases, Middle East conflicts and a whole

host of destabilising events. But overall it was a pretty good century for equity markets. The average rate of return for the US

between 1921 and 1996 was 8.06%, just a little bit above Australia’s average rate of return 7.78%, the returns comfortably

surpassing other major asset classes such as bonds and property. The last century did see war and upheaval but it also saw a

tremendous transformation of technological advancement, medical developments and structural social changes that made our

society a more prosperous, comfortable and safer place to inhabit. The significance of geopolitical events is not that they are

unpredictable or far impacting; it’s that business goes on, gets done, and will go on despite their habitual, unforeseeable,

regularity.

Microequities Deep Value Microcap Fund returned a positive 1.28% versus the All Ordinaries Accumulation Index positive

0.07% in January; this brings the total return net of fees to 115.27% for the Fund compared to 67.01% for the All Ords

Accumulation.

Despite an indifferent start to 2011 by the Australian market, our Deep Value Microcap Fund has begun on a positive note,

returning 1.28% for the month. With the reporting season set to begin in February, we are looking forward to seeing our

invested companies providing us with tangible evidence of earnings growth. We believe that FY11 should be a period of strong

earnings growth for our portfolio and the first half earnings seasons should validate that view.

Over the last two months, the Microequities Deep Value Microcap Fund has slowly been increasing its stake in an industrial

services business. The business previously worth over $600m, is now a Microcap company, and we believe the market has

erroneously priced the business. Additionally the business should provide a significant turnaround in its operating performance

over the next two years. The risk/reward relationship in this particular business presents us with a highly attractive investment

case. The business currently has a 4.6% weighting in the fund and this will be gradually increased to 7%.

Written by Carlos Gil, Chief Investment Officer.

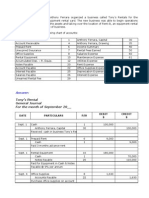

Latest Unit Price

Cash

4.7% 9.5% $2.0874

2.2%

Software & Services

Latest Fund Performance as at

Telecommunications Services

31/01/2011

Hotels Restaurants & Leisure

12.4% 1 Month +1.28%

42.3% Consumer Durables Apparel

3 Month +3.12%

Media

5.9% 6 Month +9.28%

Capital Goods

12 Month +10.69%

11.3% Health Equipment & Services Since

+115.27%

Metals & Mining Inception

1.8% 4.6% (Returns are calculated after all fees

5.2% Comercial Services & Supplies

and expenses and reinvestment of

st distributions)

*Deep Value Portfolio as of 31 of January 2011

Suite 702, 109 Pitt Street Sydney NSW 2000 Office: +61 2 9231 6169 Fax: +61 2 9475 1156 invest@microequities.com.au

Das könnte Ihnen auch gefallen

- Basic Accounting EquationDokument49 SeitenBasic Accounting Equationwhyme_bNoch keine Bewertungen

- IDX 2nd Quarter 2016Dokument157 SeitenIDX 2nd Quarter 2016kid47Noch keine Bewertungen

- Liquidity Ratios: What They Are and How to Calculate ThemDokument4 SeitenLiquidity Ratios: What They Are and How to Calculate ThemLanpe100% (1)

- Joven CampuganDokument8 SeitenJoven CampuganJovenNoch keine Bewertungen

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsVon EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsNoch keine Bewertungen

- The Study of Ratio AnalysisDokument55 SeitenThe Study of Ratio AnalysisVijay Tendolkar100% (2)

- Tony's Rentals General Journal For September 20Dokument17 SeitenTony's Rentals General Journal For September 20Rehan Mehmood63% (8)

- Mini CaseDokument15 SeitenMini CaseSammir Malhotra0% (1)

- Microequities Deep Value Microcap Fund February 2011 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund February 2011 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund April 2011 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund April 2011 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund March 2011 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund March 2011 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund December 2010 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund December 2010 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund August 2010 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund August 2010 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund July 2010 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund July 2010 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Fund Update January 2010Dokument1 SeiteFund Update January 2010Microequities Pty LtdNoch keine Bewertungen

- Fund Update February 10Dokument1 SeiteFund Update February 10Microequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund September 2010 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund September 2010 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund Update Nov 2009 88% Return in 9 MonthsDokument1 SeiteMicroequities Deep Value Microcap Fund Update Nov 2009 88% Return in 9 MonthsMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund Update Dec 2009 89.62% Return in 9 MonthsDokument1 SeiteMicroequities Deep Value Microcap Fund Update Dec 2009 89.62% Return in 9 MonthsMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund Update May 2009Dokument1 SeiteMicroequities Deep Value Microcap Fund Update May 2009Microequities Pty LtdNoch keine Bewertungen

- Allard Growth Fund December 2016Dokument3 SeitenAllard Growth Fund December 2016James HoNoch keine Bewertungen

- Pioneer Funds - Global Ecology FactsheetDokument2 SeitenPioneer Funds - Global Ecology FactsheetzekacNoch keine Bewertungen

- FSISectoralFund MonthlyDokument1 SeiteFSISectoralFund MonthlyVNoch keine Bewertungen

- Microequities Deep Value Microcap Fund Update June 2009Dokument1 SeiteMicroequities Deep Value Microcap Fund Update June 2009Microequities Pty LtdNoch keine Bewertungen

- Viewpdf 2Dokument3 SeitenViewpdf 2gqq68mrnpmNoch keine Bewertungen

- Ishares High Quality Canadian Bond Index Etf (XQB)Dokument4 SeitenIshares High Quality Canadian Bond Index Etf (XQB)ChrisNoch keine Bewertungen

- 2009-04-01 Towards Evidence-Based Public Administration Reform in Viet NamDokument13 Seiten2009-04-01 Towards Evidence-Based Public Administration Reform in Viet NamInternational Consortium on Governmental Financial ManagementNoch keine Bewertungen

- Microequities Deep Value Microcap Fund Update September 2009Dokument1 SeiteMicroequities Deep Value Microcap Fund Update September 2009Microequities Pty LtdNoch keine Bewertungen

- Fund FactsDokument3 SeitenFund FactsraulNoch keine Bewertungen

- consumer-price-index-(cpi)-bulletin-october-2022Dokument2 Seitenconsumer-price-index-(cpi)-bulletin-october-2022K_a_TT_yNoch keine Bewertungen

- National Output Income ExpenDokument40 SeitenNational Output Income ExpenImanthi AnuradhaNoch keine Bewertungen

- BlueChip Fund aims to provide medium to long term capital appreciationDokument1 SeiteBlueChip Fund aims to provide medium to long term capital appreciationPiyushNoch keine Bewertungen

- Diversified Equity FundDokument1 SeiteDiversified Equity FundHimanshu AgrawalNoch keine Bewertungen

- Diversified JulyDokument1 SeiteDiversified JulyPiyushNoch keine Bewertungen

- consumer-price-index-(cpi)-bulletin-september-2022Dokument2 Seitenconsumer-price-index-(cpi)-bulletin-september-2022K_a_TT_yNoch keine Bewertungen

- HDFC Discovery FundDokument1 SeiteHDFC Discovery FundHarsh SrivastavaNoch keine Bewertungen

- Investing in 2020: IndonesiaDokument17 SeitenInvesting in 2020: IndonesiaMohammad IrfandiNoch keine Bewertungen

- NP EX 4 SunriseDokument13 SeitenNP EX 4 SunriseakbarNoch keine Bewertungen

- Philbin Financial GroupDokument13 SeitenPhilbin Financial GroupakbarNoch keine Bewertungen

- Annual Investment Report 2016-17Dokument15 SeitenAnnual Investment Report 2016-17DARSHANNoch keine Bewertungen

- Nominal and Effective Interest Rates: Lecture No. 10 Contemporary Engineering EconomicsDokument24 SeitenNominal and Effective Interest Rates: Lecture No. 10 Contemporary Engineering EconomicsAzmr EdNoch keine Bewertungen

- Consumer Price Index - Mar 21Dokument4 SeitenConsumer Price Index - Mar 21BernewsAdminNoch keine Bewertungen

- Equity Fund: % Top 10 Holding As On 31st March 2019Dokument1 SeiteEquity Fund: % Top 10 Holding As On 31st March 2019Sajith KumarNoch keine Bewertungen

- IR PresentationDokument31 SeitenIR PresentationFilipe AmaroNoch keine Bewertungen

- IR PresentationDokument31 SeitenIR PresentationFilipe AmaroNoch keine Bewertungen

- Consumer Price Index: Annual Inflation Rate +2.8%Dokument4 SeitenConsumer Price Index: Annual Inflation Rate +2.8%BernewsAdminNoch keine Bewertungen

- Allard Growth Fund December 2008 ReportDokument2 SeitenAllard Growth Fund December 2008 ReportJames HoNoch keine Bewertungen

- DINASTI EQUITY FUND 3-YEAR VOLATILITYDokument2 SeitenDINASTI EQUITY FUND 3-YEAR VOLATILITYAhmad RafiqNoch keine Bewertungen

- HDFC Diversified Equity FundDokument1 SeiteHDFC Diversified Equity FundMayank RajNoch keine Bewertungen

- ICICI Global Stable Equity FundDokument11 SeitenICICI Global Stable Equity FundArmstrong CapitalNoch keine Bewertungen

- Services Marketing - Lovelock - Chapter 1Dokument40 SeitenServices Marketing - Lovelock - Chapter 1Mon BabiesNoch keine Bewertungen

- 06 - Aditi Jhanwar IAPM Presentation PDFDokument37 Seiten06 - Aditi Jhanwar IAPM Presentation PDFAditi JhanwarNoch keine Bewertungen

- Financial Results and Key Highlights for September 2017Dokument10 SeitenFinancial Results and Key Highlights for September 2017Umair MoinNoch keine Bewertungen

- Company BrochureDokument14 SeitenCompany BrochurePrashant RautNoch keine Bewertungen

- Financial AnalysisDokument105 SeitenFinancial AnalysisLawa LopezNoch keine Bewertungen

- Infrastructure Is Driving India's Growth. Buckle Up.: Invest in L&T Infrastructure FundDokument2 SeitenInfrastructure Is Driving India's Growth. Buckle Up.: Invest in L&T Infrastructure FundGaurangNoch keine Bewertungen

- Vesuvius PLC - Presentation FY19 - FINAL PDFDokument39 SeitenVesuvius PLC - Presentation FY19 - FINAL PDFPadmaselvan LakshmanarajanNoch keine Bewertungen

- Longleaf Partners Fund Quarterly Report SummaryDokument41 SeitenLongleaf Partners Fund Quarterly Report SummaryTay YisiongNoch keine Bewertungen

- ETF Newsletter - February - 23Dokument20 SeitenETF Newsletter - February - 23Chuck CookNoch keine Bewertungen

- Liberty Medical Group Balance Sheet - Industry Comparison 621111 - Offices of Physicians (Except Mental Health Specialists)Dokument10 SeitenLiberty Medical Group Balance Sheet - Industry Comparison 621111 - Offices of Physicians (Except Mental Health Specialists)throwawayyyNoch keine Bewertungen

- GDP Q022023e4Dokument1 SeiteGDP Q022023e4Ahmed TryNoch keine Bewertungen

- February 2022 CPI ReportDokument4 SeitenFebruary 2022 CPI ReportBernewsAdminNoch keine Bewertungen

- Singapore EconomyDokument11 SeitenSingapore EconomyK60 Nguyễn Thúy HoàNoch keine Bewertungen

- KUBCQ4Newsletter FinalDokument11 SeitenKUBCQ4Newsletter FinalVenkata SubramanianNoch keine Bewertungen

- Enter Your Campus LocationDokument28 SeitenEnter Your Campus LocationRidwaan JaffooNoch keine Bewertungen

- Social Infrastructure and Technology in India: Zinnov Management ConsultingDokument33 SeitenSocial Infrastructure and Technology in India: Zinnov Management ConsultingSanskruti KakadiyaNoch keine Bewertungen

- NWPCap PrivateDebt Q1-2023Dokument2 SeitenNWPCap PrivateDebt Q1-2023zackzyp98Noch keine Bewertungen

- Microequities Deep Value Microcap Fund August 2012 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund August 2012 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities High Income Value Microcap Fund August 2012 UpdateDokument1 SeiteMicroequities High Income Value Microcap Fund August 2012 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund May 2012 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund May 2012 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities High Income Value Microcap Fund March 2012 UpdateDokument1 SeiteMicroequities High Income Value Microcap Fund March 2012 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund July 2012 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund July 2012 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund March 2012 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund March 2012 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund June 2012 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund June 2012 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities High Income Value Microcap Fund July 2012 UpdateDokument1 SeiteMicroequities High Income Value Microcap Fund July 2012 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities High Income Value Microcap Fund June 2012 UpdateDokument1 SeiteMicroequities High Income Value Microcap Fund June 2012 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities High Income Value Microcap Fund May 2012 UpdateDokument1 SeiteMicroequities High Income Value Microcap Fund May 2012 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund April 2012 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund April 2012 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities High Income Value Microcap Fund April 2012 UpdateDokument1 SeiteMicroequities High Income Value Microcap Fund April 2012 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Rising Stars 2012 BookletDokument110 SeitenRising Stars 2012 BookletMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund February 2012 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund February 2012 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund November 2011 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund November 2011 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund December 2011 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund December 2011 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund October 2011 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund October 2011 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund January 2012 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund January 2012 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund September 2011 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund September 2011 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund August 2011 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund August 2011 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund July 2011 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund July 2011 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund June 2011 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund June 2011 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund October 2010 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund October 2010 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund May 2011 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund May 2011 UpdateMicroequities Pty LtdNoch keine Bewertungen

- Microequities Deep Value Microcap Fund November 2010 UpdateDokument1 SeiteMicroequities Deep Value Microcap Fund November 2010 UpdateMicroequities Pty LtdNoch keine Bewertungen

- FDIDokument15 SeitenFDIakriti bawaNoch keine Bewertungen

- Revolution in Egypt Case StudyDokument2 SeitenRevolution in Egypt Case StudyJohn PickleNoch keine Bewertungen

- Npioh, Jurnal Sugandi Maida 594-599Dokument6 SeitenNpioh, Jurnal Sugandi Maida 594-599Nona InnasyaNoch keine Bewertungen

- BKSW PDFDokument3 SeitenBKSW PDFyohannestampubolonNoch keine Bewertungen

- Jerome4 Chapter16 2 PDFDokument36 SeitenJerome4 Chapter16 2 PDFIrsyadul FikriNoch keine Bewertungen

- Shahjalal Islami Bank-Performance AnalysisDokument21 SeitenShahjalal Islami Bank-Performance Analysisraihans_dhk3378100% (4)

- Managerial Accounting Vs Financial AccouDokument11 SeitenManagerial Accounting Vs Financial AccouJermaine Joselle FranciscoNoch keine Bewertungen

- Core - Financial Management 416aDokument24 SeitenCore - Financial Management 416aMuhammad Umair100% (1)

- Do M&a Create ValueDokument12 SeitenDo M&a Create ValueMilagrosNoch keine Bewertungen

- ZIPPO QuestionDokument2 SeitenZIPPO QuestionTlalane HamoreNoch keine Bewertungen

- OECD Policy Paper On Seed and Early Stage Finance 1Dokument82 SeitenOECD Policy Paper On Seed and Early Stage Finance 1BruegelNoch keine Bewertungen

- Individual Assignment Analysis of Adidas' External Environment and ResourcesDokument22 SeitenIndividual Assignment Analysis of Adidas' External Environment and ResourcesYeoh Shin Yee0% (2)

- Feasibility Report - Basic Concepts With ExampleDokument6 SeitenFeasibility Report - Basic Concepts With ExampleShaileshDayaniNoch keine Bewertungen

- Financial Institutions, Markets, & Money, 10 Edition: Power Point Slides ForDokument56 SeitenFinancial Institutions, Markets, & Money, 10 Edition: Power Point Slides Forsamuel debebeNoch keine Bewertungen

- RMC 31 2009Dokument1 SeiteRMC 31 2009Rex Del ValleNoch keine Bewertungen

- FM-financial Statement AnalysisDokument29 SeitenFM-financial Statement AnalysisParamjit Sharma97% (32)

- ICICIDokument33 SeitenICICIRavindra Singh BishtNoch keine Bewertungen

- © The Institute of Chartered Accountants of IndiaDokument13 Seiten© The Institute of Chartered Accountants of Indiajanardhan CA,CSNoch keine Bewertungen

- BCG Economic Value Added Oct1996Dokument2 SeitenBCG Economic Value Added Oct1996anahata2014Noch keine Bewertungen

- Basic: Problem SetsDokument4 SeitenBasic: Problem SetspinoNoch keine Bewertungen

- Modern Advanced Accounting - Assignment 3Dokument12 SeitenModern Advanced Accounting - Assignment 3Anita Kharod ChaudharyNoch keine Bewertungen

- SapmDokument3 SeitenSapmAbhijit GogoiNoch keine Bewertungen