Beruflich Dokumente

Kultur Dokumente

US Internal Revenue Service: 11660897

Hochgeladen von

IRS0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

23 Ansichten7 SeitenThe IRS is issuing temporary regulations pertaining to the earned income credit. The text of those temporary regulations also serves as the text of these proposed regulations. A public hearing on these proposed regulations is scheduled for October 21, 1998. Submissions may be hand delivered between the hours of 8 a.m. And 5 p.m.

Originalbeschreibung:

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThe IRS is issuing temporary regulations pertaining to the earned income credit. The text of those temporary regulations also serves as the text of these proposed regulations. A public hearing on these proposed regulations is scheduled for October 21, 1998. Submissions may be hand delivered between the hours of 8 a.m. And 5 p.m.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

23 Ansichten7 SeitenUS Internal Revenue Service: 11660897

Hochgeladen von

IRSThe IRS is issuing temporary regulations pertaining to the earned income credit. The text of those temporary regulations also serves as the text of these proposed regulations. A public hearing on these proposed regulations is scheduled for October 21, 1998. Submissions may be hand delivered between the hours of 8 a.m. And 5 p.m.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 7

[4830-01-u]

DEPARTMENT OF THE TREASURY

Internal Revenue Service

26 CFR Part 1

[REG-116608-97]

RIN 1545-AV61

EIC Eligibility Requirements

AGENCY: Internal Revenue Service (IRS), Treasury.

ACTION: Notice of proposed rulemaking by cross-reference

to temporary regulations and notice of public hearing.

SUMMARY: In the Rules and Regulations section of this issue

of the Federal Register, the IRS is issuing temporary

regulations pertaining to the eligibility requirements for

certain taxpayers denied the earned income credit (EIC) as a

result of the deficiency procedures. The text of those

temporary regulations also serves as the text of these

proposed regulations. This document also provides notice of

a public hearing on these proposed regulations.

DATES: Written comments must be received by September 23,

1998. Requests to speak (with outlines of oral comments) at

a public hearing scheduled for Wednesday, October 21, 1998,

must be received by September 30, 1998.

ADDRESSES: Send submissions to: CC:DOM:CORP:R

(REG-116608-97), room 5228, Internal Revenue Service, POB

7604, Ben Franklin Station, Washington, DC 20044.

Submissions may be hand delivered between the hours of 8

a.m. and 5 p.m. to: CC:DOM:CORP:R (REG-116608-97), Courier’s

- 2 -

Desk, Internal Revenue Service, 1111 Constitution Avenue,

NW., Washington, DC. Alternatively, taxpayers may submit

comments electronically via the Internet by selecting the

"Tax Regs" option on the IRS Home Page, or by submitting

comments directly to the IRS Internet site at

http://www.irs.ustreas.gov/prod/tax_regs/comments.html. The

public hearing will be held in room 2615, Internal Revenue

Building, 1111 Constitution Avenue, NW., Washington, DC

20224.

FOR FURTHER INFORMATION CONTACT: Concerning the

regulations, Karin Loverud, 202-622-6060; concerning

submissions or the hearing, LaNita VanDyke, 202-622-7190

(not toll-free numbers).

SUPPLEMENTARY INFORMATION:

Paperwork Reduction Act

The collection of information contained in this notice

of proposed rulemaking has been submitted to the Office of

Management and Budget for review in accordance with the

Paperwork Reduction Act of 1995 (44 U.S.C. 3507(d)).

Comments on the collection of information should be sent to

the Office of Management and Budget, Attn: Desk Officer for

the Department of the Treasury, Office of Information and

Regulatory Affairs, Washington, DC 20503, with copies to the

Internal Revenue Service, Attn: IRS Reports Clearance

Officer, T:FP, Washington, DC 20224. Comments on the

- 3 -

collection of information should be received by August 24,

1998. Comments are specifically requested concerning:

Whether the proposed collection of information is

necessary for the proper performance of the functions of the

Internal Revenue Service, including whether the information

will have practical utility;

The accuracy of the estimated burden associated with

the proposed collection of information (see below);

How the quality, utility, and clarity of the

information to be collected may be enhanced;

How the burden of complying with the proposed

collection of information may be minimized, including

through the application of automated collection techniques

or other forms of information technology; and

Estimates of capital or start-up costs and costs of

operation, maintenance, and purchase of services to provide

information.

The collection of information in this proposed

regulation is in §1.32-3. This information is required

to conform with the statute and to permit the taxpayer to

claim the EIC. This information will be used by the IRS to

determine whether the taxpayer is entitled to claim the EIC.

The collection of information is mandatory. The likely

respondents are individuals.

The burden is reflected in the burden of Form 8862.

- 4 -

An agency may not conduct or sponsor, and a person is

not required to respond to, a collection of information

unless it displays a valid control number assigned by the

Office of Management and Budget.

Books or records relating to a collection of

information must be retained as long as their contents may

become material in the administration of any internal

revenue law. Generally, tax returns and tax return

information are confidential, as required by 26 U.S.C. 6103.

Background

The temporary regulations published in the Rules and

Regulations section of this issue of the Federal Register

add §1.32-3T to the Income Tax Regulations.

The text of those temporary regulations also serves as

the text of these proposed regulations. The preamble to the

temporary regulations explains the temporary regulations.

Special Analyses

It has been determined that this notice of proposed

rulemaking is not a significant regulatory action as defined

in EO 12866. Therefore, a regulatory assessment is not

required. It also has been determined that section 553(b)

of the Administrative Procedure Act (5 U.S.C. chapter 5)

does not apply to these regulations.

It is hereby certified that these regulations will not

have a significant economic impact on a substantial number

- 5 -

of small entities. This certification is based upon the

fact that the underlying statute applies only to

individuals. Therefore, a Regulatory Flexibility Analysis

under the Regulatory Flexibility Act (5 U.S.C. chapter 6) is

not required.

Pursuant to section 7805(f) of the Internal Revenue

Code, this notice of proposed rulemaking will be submitted

to the Chief Counsel for Advocacy of the Small Business

Administration for comment on its impact on small business.

Comments and public hearing

Before these proposed regulations are adopted as final

regulations, consideration will be given to any written

comments (a signed original and eight copies) that are

submitted timely (in the manner described in the ADDRESSES

portion of this preamble) to the IRS. All comments will be

available for public inspection and copying.

A public hearing has been scheduled for Wednesday,

October 21, 1998, at 10 a.m., in room 2615, Internal Revenue

Building, 1111 Constitution Avenue, NW., Washington, DC.

Because of access restrictions, visitors will not be

admitted beyond the building lobby more than 15 minutes

before the hearing starts.

The rules of §601.601(a)(3) apply to the hearing.

Persons that have submitted written comments by

September 23, 1998, and want to present oral comments at the

hearing must submit, not later than September 30, 1998, an

- 6 -

outline of the topics to be discussed and the time to be

devoted to each topic. A period of 10 minutes will be

allotted to each person for making comments.

An agenda showing the scheduling of the speakers will

be prepared after the deadline for receiving outlines has

passed. Copies of the agenda will be available free of

charge at the hearing.

Drafting Information

The principal author of these proposed regulations is

Karin Loverud, Office of the Associate Chief Counsel

(Employee Benefits and Exempt Organizations), IRS. However,

other personnel from the IRS and the Treasury Department

participated in their development.

List of Subjects in 26 CFR Part 1

Income taxes, Reporting and recordkeeping requirements.

Proposed Amendments to the Regulations

Accordingly, 26 CFR part 1 is proposed to be amended as

follows:

PART 1--INCOME TAXES

Paragraph 1. The authority citation for part 1

continues to read in part as follows:

Authority: 26 U.S.C. 7805 * * *

- 7 -

Par. 2. Section 1.32-3 is added to read as follows:

§1.32-3 Eligibility Requirements.

[The text of this proposed section is the same as the

text of §1.32-3T published elsewhere in this issue of the

Federal Register].

Deputy Commissioner of Internal Revenue

Das könnte Ihnen auch gefallen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDokument71 SeitenTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- US Internal Revenue Service: 2290rulesty2007v4 0Dokument6 SeitenUS Internal Revenue Service: 2290rulesty2007v4 0IRSNoch keine Bewertungen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Objectives Report To Congress v2Dokument153 Seiten2008 Objectives Report To Congress v2IRSNoch keine Bewertungen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Data DictionaryDokument260 Seiten2008 Data DictionaryIRSNoch keine Bewertungen

- 2008 Credit Card Bulk Provider RequirementsDokument112 Seiten2008 Credit Card Bulk Provider RequirementsIRSNoch keine Bewertungen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- MIDWIFE1115ra Tugue e PDFDokument9 SeitenMIDWIFE1115ra Tugue e PDFPhilBoardResultsNoch keine Bewertungen

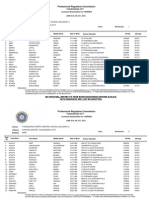

- Brigada-Certificate YENGKO 2018Dokument35 SeitenBrigada-Certificate YENGKO 2018Je RebanalNoch keine Bewertungen

- GEOD0814Dokument23 SeitenGEOD0814angelomercedeblogNoch keine Bewertungen

- June - July 2012 Nurse Licensure Examination Room Assignment (Pagadian City)Dokument50 SeitenJune - July 2012 Nurse Licensure Examination Room Assignment (Pagadian City)jamieboyRNNoch keine Bewertungen

- MAPEH042011 IloiloDokument7 SeitenMAPEH042011 IloiloCoolbuster.NetNoch keine Bewertungen

- 6th Pay Commission Salary and Arrears Calculator IndiaDokument41 Seiten6th Pay Commission Salary and Arrears Calculator Indiaanon-793202100% (13)

- Zamboanga ELEM 0 PDFDokument210 SeitenZamboanga ELEM 0 PDFPhilBoardResultsNoch keine Bewertungen

- Department of Labor: JC DirectoryDokument32 SeitenDepartment of Labor: JC DirectoryUSA_DepartmentOfLabor100% (1)

- ELEM0814 JoloDokument73 SeitenELEM0814 JoloangelomercedeblogNoch keine Bewertungen

- June 2012 NLE Room Assignment (TUGUEGARAO) - WWW - PinoyRN.co - NRDokument80 SeitenJune 2012 NLE Room Assignment (TUGUEGARAO) - WWW - PinoyRN.co - NRlylesantosNoch keine Bewertungen

- Professional Teachers 09-2018 Room Assignment - Baguio (Secondary)Dokument439 SeitenProfessional Teachers 09-2018 Room Assignment - Baguio (Secondary)PRC Baguio100% (11)

- NLE0514ra Zamboanga 052014Dokument69 SeitenNLE0514ra Zamboanga 052014TheSummitExpressNoch keine Bewertungen

- December 2011 NLE Room Assignment in ManilaDokument872 SeitenDecember 2011 NLE Room Assignment in ManilaRnspeakcomNoch keine Bewertungen

- MINING0818 Baguio jh18 PDFDokument4 SeitenMINING0818 Baguio jh18 PDFPhilBoardResultsNoch keine Bewertungen

- Ceb Let Fil0317Dokument18 SeitenCeb Let Fil0317PRC Board0% (1)

- Aircraft Accident Investigation: The Uk Overseas TerritoriesDokument72 SeitenAircraft Accident Investigation: The Uk Overseas TerritoriesLex Nunes FPireauxNoch keine Bewertungen

- Weekly PNP Good Deeds November 10, 2019Dokument16 SeitenWeekly PNP Good Deeds November 10, 2019Markee Micu Dela CruzNoch keine Bewertungen

- Purok ManggahanDokument2 SeitenPurok ManggahanFret Ramirez Coronia RNNoch keine Bewertungen

- RA-091430 - PALAWAN - Secondary (Social Studies) - Palawan - 9-2019 PDFDokument43 SeitenRA-091430 - PALAWAN - Secondary (Social Studies) - Palawan - 9-2019 PDFPhilBoardResultsNoch keine Bewertungen

- Top 10 Best Intelligence Agencies in The World 2015Dokument16 SeitenTop 10 Best Intelligence Agencies in The World 2015M Faiq FaheemNoch keine Bewertungen

- Steno D 1609Dokument7 SeitenSteno D 1609raoshekhaNoch keine Bewertungen

- Complete Palace LettersDokument1.282 SeitenComplete Palace LettersThe Guardian88% (8)

- Notice: Customhouse Broker License Cancellation, Suspension, Etc.Dokument2 SeitenNotice: Customhouse Broker License Cancellation, Suspension, Etc.Justia.comNoch keine Bewertungen

- Professional Regulation Commission: Licensure Examination For Teachers SECONDARY - MAJOR IN MATHEMATICS Region 8Dokument10 SeitenProfessional Regulation Commission: Licensure Examination For Teachers SECONDARY - MAJOR IN MATHEMATICS Region 8NonoyTaclinoNoch keine Bewertungen

- RA NURSES ZAMBO June2017 PDFDokument39 SeitenRA NURSES ZAMBO June2017 PDFPhilBoardResultsNoch keine Bewertungen

- The Most Secret List of Soe Agents: BDokument209 SeitenThe Most Secret List of Soe Agents: BeliahmeyerNoch keine Bewertungen

- Manila: Professional Regulation CommissionDokument18 SeitenManila: Professional Regulation CommissionPhilBoardResultsNoch keine Bewertungen

- Attorney General TIP Report FY2017Dokument220 SeitenAttorney General TIP Report FY2017GlennKesslerWPNoch keine Bewertungen

- PT0217ra e PDFDokument32 SeitenPT0217ra e PDFPhilBoardResultsNoch keine Bewertungen

- Dinagat Islands - MunDokument13 SeitenDinagat Islands - MunireneNoch keine Bewertungen