Beruflich Dokumente

Kultur Dokumente

Akbl R09

Hochgeladen von

sheikhgi0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

35 Ansichten1 SeiteAKBL's profitability was relatively constrained due to high provisioning, it maintains an adequate capital base. The bank's deposit base witnessed robust growth (23%) while finances increased only moderately.

Originalbeschreibung:

Originaltitel

AKBL_R09

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenAKBL's profitability was relatively constrained due to high provisioning, it maintains an adequate capital base. The bank's deposit base witnessed robust growth (23%) while finances increased only moderately.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

35 Ansichten1 SeiteAkbl R09

Hochgeladen von

sheikhgiAKBL's profitability was relatively constrained due to high provisioning, it maintains an adequate capital base. The bank's deposit base witnessed robust growth (23%) while finances increased only moderately.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

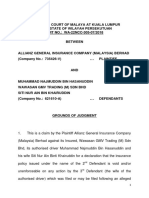

BANKING

The Pakistan Credit Rating Agency Limited

RATINGS (JULY 2010) RATING RATIONALE AND KEY DRIVERS

ASKARI BANK LIMITED (AKBL) The ratings reflect AKBL’s strong parentage and established brand name that help the bank in

maintaining its market standing. Although the bank’s profitability was relatively constrained due to

RATINGS NEW PREVIOUS high provisioning, it maintains an adequate capital base. Nonetheless, adequate collateralization

mitigated, to some extent, the impact of residue provisioning drag on equity. The bank has continued

ENTITY

its focus to improve asset quality by enhancing recovery efforts and strengthening risk management

Long Term AA AA

controls.

Short Term A1+ A1+ The bank’s success in containing material erosion in its asset quality, which may impact its risk

TFCS (Unsecured, subordinated) absorption capacity, would be critical. Meanwhile, timely and effective implementation of the new

core banking system “flexcube” would help in increasing efficiency of operations.

1st Issue

ASSESSMENT

(PKR 1,500mln) AA- AA-

2nd Issue During 2009, AKBL’s deposit base witnessed robust growth (23%) while finances increased only

(PKR 1,500mln) AA- AA- moderately, owing mainly to the bank’s cautious lending strategy due to prevailing economic

conditions in the country. The bank’s fund based exposure is focused towards corporate /

3rd Issue

(PKR 3,000mln) commercial sector (70%), with consumer and SME segments representing 13% and 9%,

AA- AA-

respectively, at end-Dec09. The bank is targeting relatively higher growth in SME segment.

However, overall finances mix is expected to remain concentrated in the corporate / commercial

sector. AKBL’s advances are fairly diversified in various sectors, highest being textile (~18%)

FINANCIAL DATA

followed by chemicals (~5%) and electronic and electrical appliances (4%). Deposit mix remained

PKR (mln)

largely unchanged on YoY basis (Time deposits: 23%, CASA: 77%)

Mar10^ Dec09 Dec08 The banks net interest revenue continued to increase on the back of significant growth in earning

assets, supplemented a slight improvement in spreads. Meanwhile, the contribution of other

Total Assets 268,311 254,327 206,191 operating income remained adequate, benefiting from the bank’s fee-based trade related services.

Equity 14,149 13,142 12,034 The bank’s cost-to-total net revenue further increased mainly on account of significant branch

expansion (end-09: 26 branches; end-08: 50 branches) and technology and infrastructure related

Net Income 328 1,108 386 developments. Meanwhile, comparatively low provisioning expense on account of the FSV benefit –

ROA % 0.5 0.5 0.2

PKR2,814mln, availed by the bank supported the reported profitability.

Equity/Assets

During 1Q10, amalgamation of Askari Leasing Limited (ALL) with and into AKBL has taken place.

% 5.3 5.2 5.8 By virtue of it, the bank strengthened its asset base while issuing new shares to ALL’s shareholders

with a swap ratio of 1:1.83. Meanwhile, during the quarter, the bank managed to limit further

SBP CAR 11.80 11.75 9.22 deterioration in asset quality in its own book, which helped in sustaining its profitability at adequate

^ Based on unaudited results for 3 months ended Mar10 level.

ANALYSTS Going forward, AKBL plans to pursue selective finances growth without compromising the risk

profile of the bank. In this regard, AKBL would target blue chip companies in identified sectors

Ayesha Saleemi while strengthening its foothold in short-term self-liquidating trade related business. Furthermore,

+92 42 35869504

ayesha.saleemi@pacra.com the bank aims to focus on middle-tier commercial and SME business segments. To further

strengthen its deposit mix, the bank would continue to attract low cost deposits benefiting from its

Rana Muhammad Nadeem established brand image.

+92 42 35869504

nadeem@pacra.com The asset quality of the bank has witnessed deterioration beginning from 2007, with NPLs as a

percentage of gross advances rising to 13% at end-Mar10 (end-09: 12%, end-08: 8.4%). The recent

rise is attributed to the merger with ALL, which resulted in additional NPLs of PKR 1,731mln. The

bank has taken several initiatives to arrest the rising trend in the classified portfolio through

TFC ISSUES escalating recovery efforts and introducing new risk management systems and procedures while

Askari Bank issued two unsecured and improving the credit appraisal and monitoring processes.

subordinated TFCs of PKR 1,500mln each

in February 2005 and October 2005 for a

AKBL is in the process of implementing core banking system “Flexcube” and its allied modules

including Oracle Financial, Peoplesoft, and Sieble CRM. The complete implementation of the

tenor of 8 years. The profit payments are

software is expected by end of next year. Effective and timely implementation of the core banking

made semi-annually in arrears, based on 6

software is critical to mitigate operational risks involved, while boosting efficiency.

month KIBOR plus 150bps. The principal

redemption would be in a balloon payment AKBL is currently adequately capitalized. The bank has met its CAR by raising additional tier-2

at the maturity of each instrument in capital, retained earnings which contributes significantly to CAR. Nonetheless, available room for

February and October 2013. further growth is expected to remain limited in the absence of fresh equity.

The bank issued a third unsecured The NPL coverage ratio of the bank has declined (end-09: 71%; end-08: 94%), mainly due to the

subordinated TFCs of PKR 3,000mln for a FSV benefit availed by the bank. Although potential drag on equity is high with net NPL to equity

tenor of 10 years in November 2009. The rising to 39% at end-Dec09, the loans are adequately collateralized limiting significant additional

profit payment is made semi-annually in provisioning requirement.

arrears, based on 6-month KIBOR plus PROFILE

250bps for the first five years afterwhich a AKBL, with a branch network of 227 branches at end-Mar’10, commenced its operations in 1992.

profit rate of 6-month KIBOR plus 295bps AKBL is sponsored by the Army Welfare Trust (AWT), which remains the principal shareholder

will be charged for the remaining term. The with a holding of 50.2% at end-Dec09. AWT has business interests across a wide range of sectors.

issue is structured to redeem major amount AKBL BoD recently inducted various experienced professionals carrying extensive experience in

of principal in four equal semi annual the field of finance, education and IT. Mr. M.R. Mehkari, the President and Chief Executive of

payments after 96 months (i.e. beginning AKBL since 2008, joined the bank in 1992 and carries significant international and domestic

2017). banking experience. The bank’s senior management team comprises experienced professionals.

PACRA has used due care in preparation of this document. Our information has been obtained from sources we consider to be reliable but its accuracy or completeness is not guaranteed. PACRA shall owe no liability

whatsoever to any loss or damage caused by or resulting from any error in such information. None of the information in this document may be copied or otherwise reproduced, stored or disseminated in whole or in part in any

form or by any means whatsoever by any person without PACRA’s written consent. Our reports and ratings constitute opinions, not recommendations to buy or to sell.

Tel: 92 (42) 35869504 Fax: 92 (042) 35830425 www.pacra.com

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Chandru 123Dokument28 SeitenChandru 123MathanNoch keine Bewertungen

- Most Important One Liner Questions and Answers, September 2021 (Part-1)Dokument10 SeitenMost Important One Liner Questions and Answers, September 2021 (Part-1)Anushmi JainNoch keine Bewertungen

- Export Import Management UTS SummaryDokument9 SeitenExport Import Management UTS SummaryRajendra Khalil AfifNoch keine Bewertungen

- Convertible Note Financing Term SheetDokument2 SeitenConvertible Note Financing Term Sheet4natomas100% (1)

- 222Dokument1 Seite222parhNoch keine Bewertungen

- 12-Page Rbs 6 Nations Championship Guide: Bumper Rugby SpecialDokument40 Seiten12-Page Rbs 6 Nations Championship Guide: Bumper Rugby SpecialCity A.M.Noch keine Bewertungen

- Non Resident Account: Tax InvoiceDokument2 SeitenNon Resident Account: Tax InvoiceEmanuelsön Caverä BreezÿNoch keine Bewertungen

- Core Banking System in SBIDokument4 SeitenCore Banking System in SBINilesh Chandra Sinha92% (12)

- Clinton Iraq EmailDokument4 SeitenClinton Iraq EmailandrewperezdcNoch keine Bewertungen

- Fakir Apparels LTD Final Credit ReportDokument5 SeitenFakir Apparels LTD Final Credit Reportfarabi1984Noch keine Bewertungen

- Questions and AnswersDokument20 SeitenQuestions and AnswersJi YuNoch keine Bewertungen

- First Women Bank Ltd. (FWBL) : Unique Credit PoliciesDokument2 SeitenFirst Women Bank Ltd. (FWBL) : Unique Credit PoliciesMIan MuzamilNoch keine Bewertungen

- Assignment BancassuranceDokument10 SeitenAssignment BancassuranceGetrude Mvududu100% (4)

- Role of Marketing in BankingDokument6 SeitenRole of Marketing in Bankingadillawa50% (2)

- Investment Management Services RFPDokument20 SeitenInvestment Management Services RFPbulllehNoch keine Bewertungen

- Invitation For Bids: Office of The Bargarh Municipal Council: BargarhDokument3 SeitenInvitation For Bids: Office of The Bargarh Municipal Council: BargarhANJANI KUMAR SRIWASNoch keine Bewertungen

- Final Presentation Sem2Dokument15 SeitenFinal Presentation Sem2api-380584678Noch keine Bewertungen

- List of Designated Travel AgenciesDokument2 SeitenList of Designated Travel AgenciesRappler100% (3)

- Avendus Capital Raises A New Round of Capital From KKR, Gaja Capital and Yogesh MahansariaDokument2 SeitenAvendus Capital Raises A New Round of Capital From KKR, Gaja Capital and Yogesh MahansariaavendusNoch keine Bewertungen

- General Banking System of IFIC Bank LTDDokument68 SeitenGeneral Banking System of IFIC Bank LTDMd. Monirul IslamNoch keine Bewertungen

- 1allianz PDFDokument26 Seiten1allianz PDFFarah Najeehah ZolkalpliNoch keine Bewertungen

- Capital, Property, and FundsDokument5 SeitenCapital, Property, and FundsRichard Lee Gines100% (1)

- Medieval Adventures CompanyDokument6 SeitenMedieval Adventures Companylouiegoods24100% (2)

- Global & Regional League Tables 2021: Financial AdvisorsDokument39 SeitenGlobal & Regional League Tables 2021: Financial AdvisorsLiam KimNoch keine Bewertungen

- Saura Import and Export Co. vs. DBP, 27 April 1972Dokument3 SeitenSaura Import and Export Co. vs. DBP, 27 April 1972Anjela ChingNoch keine Bewertungen

- Circular Letter No 16 2016 17 OCT FAQs EDPMSDokument4 SeitenCircular Letter No 16 2016 17 OCT FAQs EDPMSShrishailamalikarjunNoch keine Bewertungen

- State Life Internship Report, Usman Ali HCBFDokument134 SeitenState Life Internship Report, Usman Ali HCBFUSMAN254082% (38)

- HsDokument8 SeitenHsBhavya KothariNoch keine Bewertungen

- Regarding PaymentDokument2 SeitenRegarding Paymentbab1235Noch keine Bewertungen

- Chapter 8-1. ProblemsDokument10 SeitenChapter 8-1. Problemsiamjan_101Noch keine Bewertungen