Beruflich Dokumente

Kultur Dokumente

20p-1sol (4) (1) - 1

Hochgeladen von

Deven MunyalOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

20p-1sol (4) (1) - 1

Hochgeladen von

Deven MunyalCopyright:

Verfügbare Formate

Name: 11

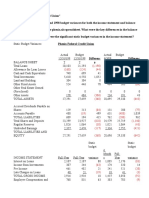

Problem: P20-1, Two-Year Work Sheet and Reconciliation Schedule, File 20p-1

Course: X120C Intermediate Accounting III

Date: Homework #4

Select your name from the pull-down menu; no other input will work. If your name is not on the list or you can't select it use one of the numbered lines

at the end of the list instead. If you use a number you will need to hand-write your name on the hard copy before you turn it in.

Round all amounts in the homework assignment to the nearest dollar [$1], except percentages.

On January 1, 2008, Diana Peter Company has the following defined benefit pension plan balances:

Projected benefits obligation $3,958,700

Fair value of plan assets $4,308,900

The interest (settlement) rate applicable to the plan is 10%. On January 1, 2009, the company amends its pension agreement so that prior service

costs of $534,600 are created. Other data related to the pension plan are as follows:

2008 2009

Service costs $158,500 $164,000

Unrecognized prior service costs amortization 0 87,800

Contributions (funding) to the plan 138,200 185,300

Benefits paid 181,300 285,100

Actual return on plan assets 233,000 255,400

Expected rate of return on assets 5% 8%

Average remaining service life 10 10

Instructions:

(a) Prepare a pension work sheet for the pension plan for 2008 and 2009. Worksheet is in DR-positive, CR-negative format.

DIANA PETER COMPANY

Pension Work Sheet—2008 and 2009

General Journal Entries Memo Record

Accum. Other Comp. Income

Annual Prior Pension Projected

(Gains) / Plan

Items Pension Cash Service Asset / Benefit

Losses Assets

Expense Cost Liabilty Obligation

Balance, Jan. 1, 2008 350,200 (3,958,700) 4,308,900

(a) Service cost 158,500 (158,500)

(b) Interest cost 395,870 (395,870)

(c) Actual return on assets (233,000) 233,000

Problem 20-1 Solution, Page 1 of 2, 11/13/2010, 5:59 PM

Name: 11

Problem: P20-1, Two-Year Work Sheet and Reconciliation Schedule, File 20p-1

Course: X120C Intermediate Accounting III

Date: Homework #4

(d) Unexpected gain / loss 17,555 (17,555)

(e) Funding / Contributions (138,200) 138,200

(f) Benefits Paid 181,300 (181,300)

Journal entry, 12/31/08 338,925 (138,200) 0 (17,555) (183,170)

Balance, Dec. 31, 2008 167,030 (4,331,770) 4,498,800

(f) Prior service cost, 534,600 (534,600)

Revised bal. Jan. 1, 2009 167,030 (4,866,370) 4,498,800

(g) Service cost 164,000 (164,000)

(h) Interest cost 486,637 (486,637)

(i) Actual return (255,400) 255,400

(j) Unexpected gain / loss (104,504) 104,504

(k) Amortization of PSC 87,800 (87,800)

(l) Funding (185,300) 185,300

(m) Benefits Paid 285,100 (285,100)

Journal entry, 12/31/09 378,533 (185,300) 446,800 104,504 (744,537)

Balance, Dec. 31, 2009 446,800 86,949 (577,507) (5,231,907) 4,654,400

(b) As of December 31, 2009, prepare a schedule reconciling the (c) For the year 2010 determine the amount of Unrecognized Net (Gain) or Loss

funded status with the reported liability (accrued pension amortization (if any), using the average remaining service life.

Absolute Greater of:

Reconciliation Schedule—12/31/09 Value

Projected benefit obligation [Col. I] ($5,231,907) Projected benefit obligation [Col. I] $5,231,907 $5,231,907

Fair value of plan assets [Col. J] 4,654,400 Fair value of plan assets [Col. J] 4,654,400

Prepaid / (Accrued) pension cost liability ($577,507) Corridor percentage 10%

(Must equal Column H final amount) Corridor amount 523,191

The (gain) or loss subject to amortization is the amount Accumulated Other Comprehensive Income [Col. G] 86,949

by which absolute value of the gains & losses included in (Gain) or loss subject to amortization, if any (may be zero) $0

[AOCI] exceeds the Corrider amount. If the absolute value Amortization period 10

of AOCI is less than the Corridor amount the (gain) or loss Amortization, if any (may be zero) $0

subject to amortization is zero.

Problem 20-1 Solution, Page 2 of 2, 11/13/2010, 5:59 PM

Das könnte Ihnen auch gefallen

- Global Family Offices SampleDokument13 SeitenGlobal Family Offices Sampledsrkim100% (1)

- Be Advised, The Template Workbooks and Worksheets Are Not Protected. Overtyping Any Data May Remove ItDokument6 SeitenBe Advised, The Template Workbooks and Worksheets Are Not Protected. Overtyping Any Data May Remove ItSalman KhalidNoch keine Bewertungen

- Request Ltr2Bank For OIDsDokument2 SeitenRequest Ltr2Bank For OIDsricetech96% (48)

- BKMSH - Cost SegregationDokument3 SeitenBKMSH - Cost SegregationMojo Creator100% (1)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsVon EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNoch keine Bewertungen

- IGI Insurance CompanyDokument26 SeitenIGI Insurance Companymach!50% (2)

- Introduction To Quantity SurveyingDokument14 SeitenIntroduction To Quantity SurveyingNelson Tapsirul50% (2)

- SAMPLEX A - Obligations and Contracts - Atty. Sta. Maria - Finals 2014Dokument2 SeitenSAMPLEX A - Obligations and Contracts - Atty. Sta. Maria - Finals 2014Don Dela ChicaNoch keine Bewertungen

- 4 Novozymes - Household - Care - Delivering Bioinnovation PDFDokument7 Seiten4 Novozymes - Household - Care - Delivering Bioinnovation PDFtmlNoch keine Bewertungen

- Financial Accounting IFRS Student Mark Plan June 2019Dokument16 SeitenFinancial Accounting IFRS Student Mark Plan June 2019scottNoch keine Bewertungen

- Hercules Poirpt PDFDokument4 SeitenHercules Poirpt PDFsy yusuf73% (11)

- Dea Aul - QuizDokument5 SeitenDea Aul - QuizDea Aulia AmanahNoch keine Bewertungen

- Time Watch Investments 1Q2010 Results 131109Dokument12 SeitenTime Watch Investments 1Q2010 Results 131109WeR1 Consultants Pte LtdNoch keine Bewertungen

- Chap 2Dokument47 SeitenChap 2ADITYA JAIN100% (1)

- Profit&Loss 09 10Dokument1 SeiteProfit&Loss 09 10Rashmin TomarNoch keine Bewertungen

- (A) Hercules Poirot, P.I., Sa Worksheet For The Quarter Ended March 31, 2017Dokument6 Seiten(A) Hercules Poirot, P.I., Sa Worksheet For The Quarter Ended March 31, 2017Erdian MasaNoch keine Bewertungen

- Jet Airways Q1 2008 ResultsDokument2 SeitenJet Airways Q1 2008 ResultsRKMNoch keine Bewertungen

- Strategy Tree for Analyzing Company X RatiosDokument1 SeiteStrategy Tree for Analyzing Company X RatiosGunjan ShahNoch keine Bewertungen

- Aimco Pesticides Limited Unaudited Financial Results for Year Ended June 2008Dokument3 SeitenAimco Pesticides Limited Unaudited Financial Results for Year Ended June 2008manish_khabarNoch keine Bewertungen

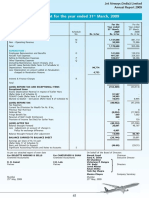

- Profit and Loss Account For The Year Ended 31 March, 2009: ST STDokument2 SeitenProfit and Loss Account For The Year Ended 31 March, 2009: ST STRanjan DasguptaNoch keine Bewertungen

- Catholic Syrian Bank half-year, annual resultsDokument2 SeitenCatholic Syrian Bank half-year, annual resultssaravanan aNoch keine Bewertungen

- Ratio TreeDokument1 SeiteRatio TreensadnanNoch keine Bewertungen

- StrategyExpert's Ratio Tree AnalysisDokument1 SeiteStrategyExpert's Ratio Tree AnalysisLorena YancánNoch keine Bewertungen

- Ratio - TreeDokument1 SeiteRatio - TreeGopinath KrishnanNoch keine Bewertungen

- Ratio TreeDokument1 SeiteRatio Treedarma bonarNoch keine Bewertungen

- Nism Series XV Research Analyst Exam WorkbookDokument53 SeitenNism Series XV Research Analyst Exam WorkbookDhyan MothukuriNoch keine Bewertungen

- BSNL Financial Report 2008Dokument12 SeitenBSNL Financial Report 2008zeeshan shaikhNoch keine Bewertungen

- IFRS Adjustments for Sangana CompanyDokument13 SeitenIFRS Adjustments for Sangana CompanyShakhawatNoch keine Bewertungen

- Asl Marine Holdings LTDDokument28 SeitenAsl Marine Holdings LTDAnonymous Feglbx5Noch keine Bewertungen

- Book-Keeping and Accounts Level 2/series 4 2008 (2006)Dokument14 SeitenBook-Keeping and Accounts Level 2/series 4 2008 (2006)Hein Linn Kyaw100% (2)

- Philab Holdings Corp.: Computation of Retirement ObligationDokument4 SeitenPhilab Holdings Corp.: Computation of Retirement ObligationFSJVVNoch keine Bewertungen

- Final Account of Joint Stock CompanyDokument8 SeitenFinal Account of Joint Stock CompanyanupsuchakNoch keine Bewertungen

- Annual Report 2019 Financial Statements and Notes PDFDokument124 SeitenAnnual Report 2019 Financial Statements and Notes PDFArti AtkaleNoch keine Bewertungen

- Quarter1 2008Dokument2 SeitenQuarter1 2008Raghavendra DevadigaNoch keine Bewertungen

- Answers: Operating Income Changes in Net Operating AssetsDokument6 SeitenAnswers: Operating Income Changes in Net Operating AssetsNawarathna KumariNoch keine Bewertungen

- Tum CompanyDokument4 SeitenTum CompanyNguyen My Khanh (K18 HCM)Noch keine Bewertungen

- Answers - Chapter 6 Vol 2Dokument6 SeitenAnswers - Chapter 6 Vol 2jamflox100% (2)

- FY 2019 Annual Investment Program (AIP) by Program/Project/Activity by SectorDokument27 SeitenFY 2019 Annual Investment Program (AIP) by Program/Project/Activity by Sectornilo biaNoch keine Bewertungen

- Financials - IRDA - PD For June 17Dokument53 SeitenFinancials - IRDA - PD For June 17mtashNoch keine Bewertungen

- SOlution File For FRDokument38 SeitenSOlution File For FRMonirul Islam MoniirrNoch keine Bewertungen

- Nguyen My Khanh - 25 - Mc1802Dokument6 SeitenNguyen My Khanh - 25 - Mc1802Biên KimNoch keine Bewertungen

- First Quarter Financial Statement and Dividend AnnouncementDokument9 SeitenFirst Quarter Financial Statement and Dividend Announcementkelvina_8Noch keine Bewertungen

- Bajaj Directors' ReportDokument10 SeitenBajaj Directors' ReporthotalamNoch keine Bewertungen

- Leverage FormulaDokument2 SeitenLeverage FormulaArpan CHATTERJEENoch keine Bewertungen

- Kingsmen Creatives LTD.: (Company Registration Number: 200210790Z)Dokument17 SeitenKingsmen Creatives LTD.: (Company Registration Number: 200210790Z)jhnkerenNoch keine Bewertungen

- Salary StructureDokument1 SeiteSalary Structureomer farooqNoch keine Bewertungen

- Annex B Barangay Budget Preparation Form No. 1: Budget of Expenditures and Sources of Financing, Fy 2023 Barangay SABAKENDokument17 SeitenAnnex B Barangay Budget Preparation Form No. 1: Budget of Expenditures and Sources of Financing, Fy 2023 Barangay SABAKENalinor omarNoch keine Bewertungen

- Financial Accounting and Reporting: IFRS - 2016 June MSDokument17 SeitenFinancial Accounting and Reporting: IFRS - 2016 June MSMarchella LukitoNoch keine Bewertungen

- AF208 FE S1 2019 Revision Package - QPDokument27 SeitenAF208 FE S1 2019 Revision Package - QPRavinesh Amit PrasadNoch keine Bewertungen

- F 2 Nov 09 Specimen AnswersDokument9 SeitenF 2 Nov 09 Specimen AnswersRobert MunyaradziNoch keine Bewertungen

- Chapter 19 Assignment IAF410 Excel SheetDokument14 SeitenChapter 19 Assignment IAF410 Excel SheetTati AnaNoch keine Bewertungen

- Projet Poulet de ChairDokument9 SeitenProjet Poulet de ChairNKONDOMB EZIONG MÉDARDNoch keine Bewertungen

- Takaful Companies - Overall: ItemsDokument6 SeitenTakaful Companies - Overall: ItemsZubair ArshadNoch keine Bewertungen

- Payroll Answer Scheme (Part B)Dokument3 SeitenPayroll Answer Scheme (Part B)Lilian OngNoch keine Bewertungen

- Quarter1 2010Dokument2 SeitenQuarter1 2010DhruvRathoreNoch keine Bewertungen

- Profit & Loss, Balance Sheet and Cash Flow StatementDokument13 SeitenProfit & Loss, Balance Sheet and Cash Flow Statementshivuch20Noch keine Bewertungen

- Lloyds Banking Group PLC 2017 Q1 RESULTSDokument33 SeitenLloyds Banking Group PLC 2017 Q1 RESULTSsaxobobNoch keine Bewertungen

- MAN ACC ProjectDokument7 SeitenMAN ACC ProjectNurassylNoch keine Bewertungen

- 2020 1 Accounting in Organisations and Society Assignment-3Dokument7 Seiten2020 1 Accounting in Organisations and Society Assignment-3Abs PangaderNoch keine Bewertungen

- Form 1Dokument4 SeitenForm 1Emjhay SwakidaNoch keine Bewertungen

- Financial Accounting Ifrs 4e Chapter 4 SolutionDokument50 SeitenFinancial Accounting Ifrs 4e Chapter 4 SolutionSana SoomroNoch keine Bewertungen

- 中期报告2011614Dokument54 Seiten中期报告2011614yf zNoch keine Bewertungen

- BBA 27 Batch (Section A & C) Advanced Financial Accounting - II (2201)Dokument4 SeitenBBA 27 Batch (Section A & C) Advanced Financial Accounting - II (2201)ahmedxisan179Noch keine Bewertungen

- BSc (Hons) Financial Services (General) Exam QuestionsDokument8 SeitenBSc (Hons) Financial Services (General) Exam Questionspriyadarshini212007Noch keine Bewertungen

- RCOM 4thconsoliated 09-10Dokument3 SeitenRCOM 4thconsoliated 09-10Goutam YenupuriNoch keine Bewertungen

- Capital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisVon EverandCapital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisNoch keine Bewertungen

- Squash StickDokument56 SeitenSquash StickDanah Jane GarciaNoch keine Bewertungen

- Agribusiness Development Program Starts HereDokument6 SeitenAgribusiness Development Program Starts Herepriya singhNoch keine Bewertungen

- Assignment On Banking & InsuranceDokument11 SeitenAssignment On Banking & InsuranceRyhanul IslamNoch keine Bewertungen

- Auditing Chapter 2 Part IIIDokument3 SeitenAuditing Chapter 2 Part IIIRegine A. AnsongNoch keine Bewertungen

- McKinsey On Marketing Organizing For CRMDokument7 SeitenMcKinsey On Marketing Organizing For CRML'HassaniNoch keine Bewertungen

- Presented To: Sir Safdar Hussain Tahir By: M. Fahad Ali G.C. Uni. FaisalabadDokument18 SeitenPresented To: Sir Safdar Hussain Tahir By: M. Fahad Ali G.C. Uni. FaisalabadFahad AliNoch keine Bewertungen

- Solution Manual For Financial Accounting Information For Decisions 9th Edition John WildDokument41 SeitenSolution Manual For Financial Accounting Information For Decisions 9th Edition John WildMadelineShawstdf100% (39)

- SBR Open TuitionDokument162 SeitenSBR Open TuitionpatrikosNoch keine Bewertungen

- The Nature of Staffing: Chapter One Staffing Models and StrategyDokument32 SeitenThe Nature of Staffing: Chapter One Staffing Models and StrategyHasib AhsanNoch keine Bewertungen

- Element of Corporate Governance in Islamic Banks Vs Conventional Banks: A Case StudyDokument7 SeitenElement of Corporate Governance in Islamic Banks Vs Conventional Banks: A Case StudyMaryam EhsanNoch keine Bewertungen

- Republic Act No. 11360: Official GazetteDokument1 SeiteRepublic Act No. 11360: Official GazetteKirk BejasaNoch keine Bewertungen

- Canons of TaxationDokument2 SeitenCanons of Taxationmadeeha_2475% (4)

- Chapter 3 & 4 Banking An Operations 2Dokument15 SeitenChapter 3 & 4 Banking An Operations 2ManavAgarwalNoch keine Bewertungen

- Street Food V/S Restaurant FoodDokument15 SeitenStreet Food V/S Restaurant FoodSakthi SaravananNoch keine Bewertungen

- Liability - Is A Present Obligation Arising From Past Event, The Settlement of WhichDokument5 SeitenLiability - Is A Present Obligation Arising From Past Event, The Settlement of Whichbobo kaNoch keine Bewertungen

- Orange Book 2nd Edition 2011 AddendumDokument4 SeitenOrange Book 2nd Edition 2011 AddendumAlex JeavonsNoch keine Bewertungen

- 2021 Full Year FinancialsDokument2 Seiten2021 Full Year FinancialsFuaad DodooNoch keine Bewertungen

- Genjrl 1Dokument1 SeiteGenjrl 1Tiara AjaNoch keine Bewertungen

- Fina 402 - NotesDokument28 SeitenFina 402 - NotespopaNoch keine Bewertungen

- Review of Related LiteratureDokument3 SeitenReview of Related LiteratureEaster Joy PatuladaNoch keine Bewertungen

- Valuation of BondsDokument7 SeitenValuation of BondsHannah Louise Gutang PortilloNoch keine Bewertungen

- NABARD financing pattern analysisDokument9 SeitenNABARD financing pattern analysisFizan NaikNoch keine Bewertungen

- Chapter 13Dokument31 SeitenChapter 13batataNoch keine Bewertungen