Beruflich Dokumente

Kultur Dokumente

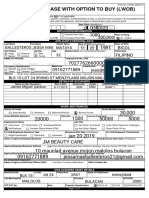

BIR Form No. 1901 (ENCS) - PAGE 2: (To Be Filled Up by BIR)

Hochgeladen von

Basil Maramag CastañoOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

BIR Form No. 1901 (ENCS) - PAGE 2: (To Be Filled Up by BIR)

Hochgeladen von

Basil Maramag CastañoCopyright:

Verfügbare Formate

BIR Form No.

1901 (ENCS)-PAGE 2

Part II Personal Exemptions

24 Civil Status 25 Employment Status of Spouse:

Single/Widow/Widower/Legally Separated (No dependents) Unemployed

Head of the Family Employed Locally

Single with qualified dependent Legally separated with qualified dependent Employed Abroad

Widow/Widower with qualified dependent Benefactor of a qualified senior citizen (RA No. 7432) Engaged in Business/Practice

Married of Profession

26 Claims for Additional Exemptions/ Premium Deductions for husband and wife whose aggregate family income does not exceed P250,000.00 per annum.

Husband claims additional exemption and any premium deductions Wife claims additional exemption and any premium deductions

(Attach Waiver of the Husband)

27 Spouse Information

Spouse Taxpayer Identification Number Spouse Name

27A 27B

Last Name First Name Middle Name

Spouse Employer's Taxpayer Identification Number Spouse Employer's Name

27C 27D

Part III Additional Exemptions

Section A Number and Names of Qualified Dependent Children

28 Number of Qualified Dependent Children

29 Names of Qualified Dependent Children

Last Name First Name Middle Name Date of Birth Mark if Mentally

/ Physically

( MM / DD / YYYY ) Incapacitated

29A 29B 29C 29D 29E

30A 30B 30C 30D 30E

31A 31B 31C 31D 31E

32A 32B 32C 32D 32E

Section B Name of Qualified Dependent Other than Children

Mark if Mentally

Last Name First Name Middle Name Date of Birth / Physically

( MM / DD / YYYY ) Incapacitated

33A 33B 33C 33D 33E

33F Relationship Parent Brother Sister Qualified Senior Citizen

Part IV For Employee With Two or More Employers (Multiple Employments) Within the Calendar Year

34 Type of multiple employments

Successive employments (With previous employer(s) within the calendar year), for late registrants if applicable

Concurrent employments (With two or more employers at the same time within the calendar year)

[If successive, enter previous employer(s); if concurrent, enter secondary employer(s)]

Previous and Concurrent Employments During the Calendar Year

TIN Name of Employer/s

35 Declaration

I declare, under the penalties of perjury, that this form has been made in good faith, verified by me and to the best of my knowledge

and belief is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued

under authority thereof.

TAXPAYER / AUTHORIZED AGENT

(Signature over printed name)

Part V Current Main Employer Information

36 Taxpayer Identification Number 37 RDO Code

(To be filled up by BIR)

38 Employer's Name (Last Name, First Name, Middle Name, if Individual/ Registered Name, if non-Individuals)

39 Employer's Business

Address

40 Zip Code 41 Municipality Code 42 Effectivity Date 43 Date of Certification

(To be filled (Date when Exemption Information is applied) (Date of certification of the accuracy of the

up by the BIR) exemption information)

44 Telephone Number

(MM/ DD/ YYYY) (MM/ DD/ YYYY)

45 Declaration Stamp of BIR Receiving Office

I declare, under the penalties of perjury, that this form has been made in good faith, verified by and Date of Receipt

me and to the best of my knowledge and belief, is true and correct, pursuant to the provisions of the

National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

Attachments Complete?

(To be filled up by BIR)

EMPLOYER / AUTHORIZED AGENT Title / Position of Signatory

(Signature over printed Name) Yes No

ATTACHMENTS: (Photocopy only)

A. For Self-employed/ Professionals/ Mixed Income Individuals

1- Birth Certificate or any document showing name, address 2- Mayor's Permit - if applicable, 3- DTI Certificate of Registration of Business Name

and birth date of the applicant to be submitted prior to the issuance of to be submitted prior to the issuance of

Certificate of Registration Certificate of Registration

B. For Trust -Trust Agreement C. For Estate - Death Certificate of the deceased

NOTE:

1. Update trade name upon receipt of DTI Certificate of Registration of Business Name.

2. Taxpayer should attend the required taxpayers briefing before the release of the BIR Certificate of Registration

POSSESSION OF MORE THAN ONE TAXPAYER IDENTIFICATION NUMBER(TIN) IS CRIMINALLY PUNISHABLE PURSUANT TO THE

PROVISIONS OF THE NATIONAL INTERNAL REVENUE CODE OF 1997, AS AMENDED.

Das könnte Ihnen auch gefallen

- Bir Form 2316 Cy 2021Dokument3 SeitenBir Form 2316 Cy 2021Christ BrazilNoch keine Bewertungen

- Certificate of Compensation Payment/Tax WithheldDokument1 SeiteCertificate of Compensation Payment/Tax WithheldIan Jay BahiaNoch keine Bewertungen

- Bir Form 2316Dokument2 SeitenBir Form 2316Benjie T Madayag100% (1)

- BIR Form2305 April 2017 Updated FormDokument2 SeitenBIR Form2305 April 2017 Updated FormEPIPHANY80% (15)

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDokument1 SeiteKawanihan NG Rentas Internas For Compensation Payment With or Without Tax Withheldjarra andrea jacaNoch keine Bewertungen

- BIR Form 2316Dokument1 SeiteBIR Form 2316edz_ramirez87% (15)

- Bir Form 2305 Etis-1 OnlyDokument2 SeitenBir Form 2305 Etis-1 OnlyNPScribAccount100% (2)

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDokument1 SeiteKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldGeorgia HolstNoch keine Bewertungen

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDokument1 SeiteKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldTrish CalumaNoch keine Bewertungen

- Bir Form 2305Dokument1 SeiteBir Form 2305Ariel AmarilleNoch keine Bewertungen

- BIR Form 2305 ExcelDokument1 SeiteBIR Form 2305 ExcelLester AbadNoch keine Bewertungen

- BIR Form2305Dokument1 SeiteBIR Form2305Gayle Abaya75% (4)

- Application For Registration: BIR Form NoDokument1 SeiteApplication For Registration: BIR Form NoJordan P HunterNoch keine Bewertungen

- Lwob - Application-Form Edited Edited EditedDokument2 SeitenLwob - Application-Form Edited Edited Editedjessamaeballesteros21100% (1)

- 1902 Jul 2021 ENCS - FinalDokument2 Seiten1902 Jul 2021 ENCS - FinalHR SCPCNoch keine Bewertungen

- BirForm PDFDokument2 SeitenBirForm PDFTashnim MagarangNoch keine Bewertungen

- Fill in All Applicable White Spaces. Mark All Appropriate Boxes With An 'X'Dokument4 SeitenFill in All Applicable White Spaces. Mark All Appropriate Boxes With An 'X'Adrian Carl BarbinNoch keine Bewertungen

- Certificate of Compensation Payment/Tax WithheldDokument1 SeiteCertificate of Compensation Payment/Tax WithheldLency FelarcaNoch keine Bewertungen

- Certificate of Update of Exemption and of Employer's and Employee's InformationDokument5 SeitenCertificate of Update of Exemption and of Employer's and Employee's InformationRollyNoch keine Bewertungen

- Bir Form 1902 New VersionDokument2 SeitenBir Form 1902 New Versionchato law officeNoch keine Bewertungen

- Bir Form 1902 Jul 2021 Encs FinalDokument2 SeitenBir Form 1902 Jul 2021 Encs Finalarseniouban510Noch keine Bewertungen

- BIR FORM NO. 2305 Certificate of Update of Exemption and Employers and Employees InformationDokument2 SeitenBIR FORM NO. 2305 Certificate of Update of Exemption and Employers and Employees InformationJeffrey TrazoNoch keine Bewertungen

- 1902 Jul 2021 ENCS - FinalDokument2 Seiten1902 Jul 2021 ENCS - FinalDanielle DavidNoch keine Bewertungen

- BIR1902 FormDokument2 SeitenBIR1902 FormShaira Miwa SantosNoch keine Bewertungen

- TIN Application 1901Dokument7 SeitenTIN Application 1901isabelle.malapad.shsNoch keine Bewertungen

- Application For Registration: BIR Form NoDokument2 SeitenApplication For Registration: BIR Form Noexonyeoshidae 05Noch keine Bewertungen

- 1902 - ItftDokument2 Seiten1902 - ItftMiles Patrick TantiadoNoch keine Bewertungen

- Application For Registration: BIR Form NoDokument2 SeitenApplication For Registration: BIR Form NoChoco LebbyNoch keine Bewertungen

- Application Form For Tin IDDokument3 SeitenApplication Form For Tin IDShanaia BualNoch keine Bewertungen

- BIR Tin Application (Form 1902)Dokument2 SeitenBIR Tin Application (Form 1902)Mara Martinez74% (27)

- Application For Registration: (To Be Filled Out by BIR) DLNDokument2 SeitenApplication For Registration: (To Be Filled Out by BIR) DLNBRF Services IncNoch keine Bewertungen

- 1902 Form 2Dokument2 Seiten1902 Form 2vamvamadelantarNoch keine Bewertungen

- Bir Form 2305Dokument1 SeiteBir Form 2305MacneoNoch keine Bewertungen

- 1902 - Updated Signatory2023Dokument2 Seiten1902 - Updated Signatory2023joshuavillanueva477Noch keine Bewertungen

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDokument2 SeitenKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldGjianne PeñaredondoNoch keine Bewertungen

- Compliance March 2011Dokument600 SeitenCompliance March 2011Manoj SubramaniayamNoch keine Bewertungen

- 2007 2013 Civil LawDokument358 Seiten2007 2013 Civil LawNelia Mae S. VillenaNoch keine Bewertungen

- The Executive BranchDokument18 SeitenThe Executive Branchdhrubo_tara25Noch keine Bewertungen

- Offer Letter - Ericson Project (1) - Stephen Mutunga - UpdatedDokument2 SeitenOffer Letter - Ericson Project (1) - Stephen Mutunga - UpdatedMochama NicksonNoch keine Bewertungen

- Cargo Manifest AbangDokument5 SeitenCargo Manifest AbangFakhrur ZainudinNoch keine Bewertungen

- Unit 1 - Understanding Corporate Social ResponsibilityDokument4 SeitenUnit 1 - Understanding Corporate Social ResponsibilityPeppy Gonzales VillaruelNoch keine Bewertungen

- City of Manila v. Grecia CuerdoDokument1 SeiteCity of Manila v. Grecia CuerdoRostum AgapitoNoch keine Bewertungen

- BÀI TẬP WRITING LÀM TẠI LỚPDokument4 SeitenBÀI TẬP WRITING LÀM TẠI LỚPAnh Nguyễn QuỳnhNoch keine Bewertungen

- Glen Richter Assault CaseDokument1 SeiteGlen Richter Assault CaseErin LaviolaNoch keine Bewertungen

- Contracts - Atty. JMVDLDokument25 SeitenContracts - Atty. JMVDLJmv DeGuzman-LugtuNoch keine Bewertungen

- U of Lucerne ClaimantDokument85 SeitenU of Lucerne Claimantlissettm08Noch keine Bewertungen

- Case Types List - 4Dokument2 SeitenCase Types List - 4Sathish B SathishNoch keine Bewertungen

- 40 Morales v. Paredes, 55 Phil 565 PDFDokument2 Seiten40 Morales v. Paredes, 55 Phil 565 PDFGil Paterno G. MendozaNoch keine Bewertungen

- Seville Between The Atlantic and The Mediterranean, 1248-1492Dokument131 SeitenSeville Between The Atlantic and The Mediterranean, 1248-1492Leonardo FontesNoch keine Bewertungen

- AP2 & AP2A Terms & ConditionsDokument1 SeiteAP2 & AP2A Terms & ConditionsJCNoch keine Bewertungen

- Sexual Assault of Students in Allentown, Pa., Schools ConsentDokument36 SeitenSexual Assault of Students in Allentown, Pa., Schools Consentmary engNoch keine Bewertungen

- Standardized Fidelity Guarantee Insurance PolicyDokument17 SeitenStandardized Fidelity Guarantee Insurance PolicyAnant Shrivastava100% (1)

- Legality of Predatory TowingDokument102 SeitenLegality of Predatory Towingsrogers99Noch keine Bewertungen

- Standard Tender Document For Supply, Installation and Commissioning of Plant and EquipmentDokument85 SeitenStandard Tender Document For Supply, Installation and Commissioning of Plant and EquipmentAccess to Government Procurement Opportunities100% (1)

- Comparative Table Between BNA and Evidence ActDokument13 SeitenComparative Table Between BNA and Evidence ActRaja LingamNoch keine Bewertungen

- Sales of Goods Act, 1930Dokument20 SeitenSales of Goods Act, 1930ohmygodhritikNoch keine Bewertungen

- CMA Ships Application Form Crewform 01aDokument9 SeitenCMA Ships Application Form Crewform 01aNicu ScutaruNoch keine Bewertungen

- Luzon Brokerage v. Maritime BLDG., 86 SCRA 305 (1978Dokument34 SeitenLuzon Brokerage v. Maritime BLDG., 86 SCRA 305 (1978FD BalitaNoch keine Bewertungen

- Sycip, Salazar, Hernandez, Gatmaitan For Petitioners. Quisumbing, Torres & Evangelista For Private-RespondentDokument7 SeitenSycip, Salazar, Hernandez, Gatmaitan For Petitioners. Quisumbing, Torres & Evangelista For Private-RespondentMa Irish BethNoch keine Bewertungen

- Notification Kandla Port Trust Traffic Asst Outdoor Clerk Other PostsDokument7 SeitenNotification Kandla Port Trust Traffic Asst Outdoor Clerk Other PostsSagarLakhwaniNoch keine Bewertungen

- PFS (2ed) Quest #6 - Archaeology in Aspenthar - 25504-2002Dokument1 SeitePFS (2ed) Quest #6 - Archaeology in Aspenthar - 25504-2002James PevelerNoch keine Bewertungen

- Nov 16 DigestDokument8 SeitenNov 16 DigestJessie Marie dela PeñaNoch keine Bewertungen

- Mauricio - People vs. Santos DigestDokument1 SeiteMauricio - People vs. Santos DigestRonnie RimandoNoch keine Bewertungen

- Patrick Reyes V The Queen Patrick Reyes V The QueenDokument31 SeitenPatrick Reyes V The Queen Patrick Reyes V The QueenKéshun WrightNoch keine Bewertungen

- Coa Memorandum-Cem 6,26Dokument3 SeitenCoa Memorandum-Cem 6,26Allyssa GabaldonNoch keine Bewertungen