Beruflich Dokumente

Kultur Dokumente

Olm Page38 20110518

Hochgeladen von

OutlookMagazine0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

5K Ansichten1 SeiteCOVER STORY EQUITY-LINKED SAVING SCHEMES (ELSS) Only few posted healthy returns despite no redemption pressure on the fund manager for three years. Selective mid-cap exposure boosted returns, which exceeded those from largeand mid-cap equity funds.

Originalbeschreibung:

Originaltitel

olm_page38_20110518

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCOVER STORY EQUITY-LINKED SAVING SCHEMES (ELSS) Only few posted healthy returns despite no redemption pressure on the fund manager for three years. Selective mid-cap exposure boosted returns, which exceeded those from largeand mid-cap equity funds.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

5K Ansichten1 SeiteOlm Page38 20110518

Hochgeladen von

OutlookMagazineCOVER STORY EQUITY-LINKED SAVING SCHEMES (ELSS) Only few posted healthy returns despite no redemption pressure on the fund manager for three years. Selective mid-cap exposure boosted returns, which exceeded those from largeand mid-cap equity funds.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

COVER STORY

EQUITY-LINKED SAVING SCHEMES (ELSS)

Only few posted healthy returns despite no redemption pressure on the fund manager for three years

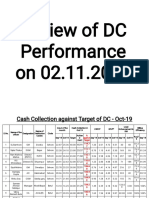

SCHEME NAME OLM CORPUS NAV (`) RETURNS (%) EXPENSE

RATING (` CR) 1-YEAR 3-YEAR 5-YEAR RATIO (%) *

Fidelity Tax Advantage 1,173.30 22.46 18.75 15.51 15.82 2.00

HDFC Taxsaver 2,823.02 232.91 13.24 15.28 12.15 1.86

Franklin India Taxshield 796.63 212.91 13.91 13.43 12.13 2.14

HDFC Long Term Advantage 917.87 139.01 16.76 13.09 10.07 2.07 Five-year return of

1,251.55 140.93 10.67 14.97 10.18 2.00 15.82 per cent is the

ICICI Prudential Taxplan

highest in the category

Reliance Tax Saver (ELSS) 2,070.93 21.13 12.88 14.66 9.63 1.88

Religare Tax Plan 242.55 17.46 10.93 12.54 NA 2.49

Birla Sun Life Tax Relief 96 1,488.72 11.18 2.47 4.67 NA 1.96

DSP BlackRock Tax Saver 859.19 16.93 8.17 10.28 NA 2.08

HSBC Tax Saver Equity 102.09 14.59 5.80 11.44 NA 2.34

SBI Magnum Tax Gain Scheme 93 5,413.99 60.07 3.93 5.56 10.41 1.81

SBI Tax Advantage-Series 1 713.01 11.73 0.09 5.46 NA 2.13

Sundaram Taxsaver 1,446.50 43.26 5.17 9.09 11.50 1.96

Tata Tax Saving 135.97 46.91 9.91 7.46 7.49 2.43

Birla Sun Life Tax Plan 142.99 13.99 8.87 5.54 NA 2.41

Kotak Taxsaver 530.76 18.42 7.64 4.07 7.20 2.22

UTI Equity Tax Savings Plan 488.45 40.21 7.26 5.48 6.11 2.27

Principal Personal Taxsaver 619.84 96.42 6.65 3.38 9.37 2.19

Principal Tax Savings 266.74 74.70 1.72 -3.03 3.83 2.33

* Expense ratio is the latest available on 31 March 2011 NA: Not applicable as scheme is less than 5 years old NAV, fund size and returns as on 31 March 2011

Returns less than a year are absolute, else CAGR Table sorted alphabetically in each star rating category Source: ICRA Online and Outlook Money Research

EQUITY-MODERATE ALLOCATION (0-75%)

Selective mid-cap exposure boosted returns, which exceeded those from large- and mid-cap equity funds

SCHEME NAME OLM CORPUS NAV (`) RETURNS (%) EXPENSE

RATING (` CR) 1-YEAR 3-YEAR 5-YEAR RATIO (%) *

HDFC Balanced 238.78 54.83 16.17 16.87 13.68 2.15

HDFC Prudence 5,808.18 213.90 17.50 18.75 17.53 1.82

Birla Sun Life 95 391.65 313.71 13.22 15.77 15.21 2.33

Canara Robeco Balance 177.81 60.31 9.99 12.20 11.50 2.39 Largest scheme

in the category;

Reliance RSF-Balanced 843.38 21.92 6.45 17.40 16.28 2.17 one of the best

DSP BlackRock Balanced 748.25 66.14 10.33 12.38 14.17 2.08 performers with

FT India Balanced 265.83 49.39 9.15 9.24 11.89 2.35 17.53 per cent

Sundaram Balanced 130.21 49.30 11.19 9.70 10.14 0.49 return in the

last five years.

Tata Balanced 277.48 82.48 8.49 11.71 12.98 2.50

UTI Balanced 979.50 80.73 8.83 10.07 9.77 1.88

ICICI Prudential Balanced 263.95 46.49 12.16 7.64 8.69 2.30

One of the

Kotak Balance 55.38 22.36 7.70 7.43 8.99 2.50 oldest schemes in

SBI Magnum Balanced 485.41 50.51 4.23 7.49 9.94 2.26 the category,

Birla Sun Life Freedom 82.41 32.77 0.43 2.58 5.53 2.44 launched in 1999

Escorts Opportunities 130.94 27.62 4.94 -1.17 1.86 2.50

* Expense ratio is the latest available on 31 March 2011 NAV, fund size and returns as on 31 March 2011 Returns less than a year are absolute, else CAGR

Table sorted alphabetically in each star rating category Source: ICRA Online and Outlook Money Research

[ 38 ] O U T L O O K M O N E Y 1 8 M AY 2 0 1 1

Das könnte Ihnen auch gefallen

- Principal Personal Tax Saver Fund Rating and PerformanceDokument6 SeitenPrincipal Personal Tax Saver Fund Rating and PerformanceksrygNoch keine Bewertungen

- ValueResearchFundcard HDFCEquity 2012jul30Dokument6 SeitenValueResearchFundcard HDFCEquity 2012jul30Rachit GoyalNoch keine Bewertungen

- Kotak 50 Regular Plan Fund Rating and Performance SummaryDokument4 SeitenKotak 50 Regular Plan Fund Rating and Performance SummaryrdhNoch keine Bewertungen

- BNP Paribas Midcap Fund Rating: High Risk, Below Average ReturnDokument4 SeitenBNP Paribas Midcap Fund Rating: High Risk, Below Average ReturnChiman RaoNoch keine Bewertungen

- Fundcard: Aditya Birla Sun Life Tax Relief 96Dokument36 SeitenFundcard: Aditya Birla Sun Life Tax Relief 96Deepak VaswaniNoch keine Bewertungen

- HDFC EquityDokument6 SeitenHDFC EquityDarshan ShettyNoch keine Bewertungen

- ValueResearchFundcard SBIBluechipFund 2017jan27 PDFDokument4 SeitenValueResearchFundcard SBIBluechipFund 2017jan27 PDFcaptjas9886Noch keine Bewertungen

- Axis Long Term Equity FundDokument4 SeitenAxis Long Term Equity FundChittaNoch keine Bewertungen

- ValueResearchFundcard DSPBlackRockMicroCapFund RegularPlan 2017mar14Dokument4 SeitenValueResearchFundcard DSPBlackRockMicroCapFund RegularPlan 2017mar14Rahul AnandNoch keine Bewertungen

- Fundcard: Franklin India Smaller Companies FundDokument4 SeitenFundcard: Franklin India Smaller Companies FundChiman RaoNoch keine Bewertungen

- Fundcard: Franklin India Taxshield FundDokument4 SeitenFundcard: Franklin India Taxshield FundvinitNoch keine Bewertungen

- ValueResearchFundcard BirlaSunLifeFrontlineEquity 2011apr20Dokument6 SeitenValueResearchFundcard BirlaSunLifeFrontlineEquity 2011apr20Venkatesh VijayakumarNoch keine Bewertungen

- Fundcard: ICICI Prudential Bluechip FundDokument4 SeitenFundcard: ICICI Prudential Bluechip FundChittaNoch keine Bewertungen

- Fundcard: Axis Long Term Equity FundDokument4 SeitenFundcard: Axis Long Term Equity FundARUN JACOB 1827606Noch keine Bewertungen

- ValueResearchFundcard RelianceGrowth 2010dec30Dokument6 SeitenValueResearchFundcard RelianceGrowth 2010dec30Maulik DoshiNoch keine Bewertungen

- ValueResearchFundcard CanaraRobecoEquityTaxSaver 2010dec27Dokument6 SeitenValueResearchFundcard CanaraRobecoEquityTaxSaver 2010dec27Prakash SainiNoch keine Bewertungen

- Fundcard: Tata India Tax Savings FundDokument4 SeitenFundcard: Tata India Tax Savings FundKrishnan ChockalingamNoch keine Bewertungen

- Value Research Fundcard - Invesco India Growth Fund - 2018 Mar 24Dokument4 SeitenValue Research Fundcard - Invesco India Growth Fund - 2018 Mar 24hotalamNoch keine Bewertungen

- Common Sized Balance Sheet As at 31st December, 2018: Acc LimitedDokument6 SeitenCommon Sized Balance Sheet As at 31st December, 2018: Acc LimitedVandita KhudiaNoch keine Bewertungen

- Ar Fy11Dokument132 SeitenAr Fy11Raj WorkNoch keine Bewertungen

- Laporan Harian: Senin, 26 Juli 2021Dokument6 SeitenLaporan Harian: Senin, 26 Juli 2021hendro RukytoNoch keine Bewertungen

- ValueResearchFundcard ICICIPrudentialFocusedBluechipEquityFund 2017dec18Dokument4 SeitenValueResearchFundcard ICICIPrudentialFocusedBluechipEquityFund 2017dec18santoshk.mahapatraNoch keine Bewertungen

- Prakash PipesDokument10 SeitenPrakash Pipespaulgaurab999Noch keine Bewertungen

- Review of DC Performance On 02.11.2019Dokument21 SeitenReview of DC Performance On 02.11.2019Subhash DhakarNoch keine Bewertungen

- Petro Chemi ExcelDokument3 SeitenPetro Chemi ExcelshreejaNoch keine Bewertungen

- Chevron Financial Data BloombergDokument48 SeitenChevron Financial Data BloombergShardul MudeNoch keine Bewertungen

- Fundcard: Axis Long Term Equity FundDokument4 SeitenFundcard: Axis Long Term Equity FundprashokkumarNoch keine Bewertungen

- Godrej IndustriesDokument5 SeitenGodrej Industriesshashank sagarNoch keine Bewertungen

- Fundcard: Axis Bluechip FundDokument4 SeitenFundcard: Axis Bluechip FundChittaNoch keine Bewertungen

- State Bank of India: Key Financial Ratios - in Rs. Cr.Dokument4 SeitenState Bank of India: Key Financial Ratios - in Rs. Cr.zubairkhan7Noch keine Bewertungen

- United Breweries Holdings LimitedDokument7 SeitenUnited Breweries Holdings Limitedsalini sasiNoch keine Bewertungen

- VERTICAL LIABILITIES 1Dokument4 SeitenVERTICAL LIABILITIES 1NL CastañaresNoch keine Bewertungen

- Key Financial Ratios of UCO Bank - in Rs. Cr.Dokument19 SeitenKey Financial Ratios of UCO Bank - in Rs. Cr.anishbhattacharyyaNoch keine Bewertungen

- RatiosDokument2 SeitenRatiosnishantNoch keine Bewertungen

- Financial Results For The Quarter Ended December 31, 2022: by Bps BpsDokument3 SeitenFinancial Results For The Quarter Ended December 31, 2022: by Bps BpsSurekha ShettyNoch keine Bewertungen

- Kingstone Educational Institute Balance SheetDokument1 SeiteKingstone Educational Institute Balance Sheetdhimanbasu1975Noch keine Bewertungen

- Canara Robeco Emerging Equities Fund - Direct Plan Rating: High Risk, High ReturnDokument4 SeitenCanara Robeco Emerging Equities Fund - Direct Plan Rating: High Risk, High ReturnChittaNoch keine Bewertungen

- FM WK 5 PmuDokument30 SeitenFM WK 5 Pmupranjal92pandeyNoch keine Bewertungen

- 58 Annual Report 2009-2010 Performance Profile: Assets & Provision For Diminution in InvestmentDokument4 Seiten58 Annual Report 2009-2010 Performance Profile: Assets & Provision For Diminution in InvestmentKartheek DevathiNoch keine Bewertungen

- MaricoDokument13 SeitenMaricoRitesh KhobragadeNoch keine Bewertungen

- Reliance Tax Saver Fund Rating Performance Risk ReturnDokument6 SeitenReliance Tax Saver Fund Rating Performance Risk ReturnKumar DeepanshuNoch keine Bewertungen

- Kingston Educational Institute: Ratio AnalysisDokument1 SeiteKingston Educational Institute: Ratio Analysisdhimanbasu1975Noch keine Bewertungen

- Nifty Junior BeES Fund Rating and Performance AnalysisDokument6 SeitenNifty Junior BeES Fund Rating and Performance AnalysisGNoch keine Bewertungen

- Reliance Tax Saver (ELSS) Fund Rating: High Return, Above Average PerformanceDokument4 SeitenReliance Tax Saver (ELSS) Fund Rating: High Return, Above Average PerformanceKrishnan ChockalingamNoch keine Bewertungen

- 3.01. Particulars Year of Operation 1 2 3 4 5: The IRR For The Project Is 27.4%, Average ROI Is 86% and Average DSCR IsDokument1 Seite3.01. Particulars Year of Operation 1 2 3 4 5: The IRR For The Project Is 27.4%, Average ROI Is 86% and Average DSCR Isk.g.thri moorthyNoch keine Bewertungen

- Omaxe Ltd. Executive Summary under 40 charactersDokument2 SeitenOmaxe Ltd. Executive Summary under 40 charactersShreemat PattajoshiNoch keine Bewertungen

- CISS Commercial Breakup SheetDokument3 SeitenCISS Commercial Breakup SheetPradeep PanigrahiNoch keine Bewertungen

- Ronak L & Yash FADokument9 SeitenRonak L & Yash FAronakNoch keine Bewertungen

- Table 4.4 Common Size Balance Sheet Statement: 45 Source ComputedDokument1 SeiteTable 4.4 Common Size Balance Sheet Statement: 45 Source ComputedManoj KumarNoch keine Bewertungen

- Annual Accounts 2021Dokument11 SeitenAnnual Accounts 2021Shehzad QureshiNoch keine Bewertungen

- Trend AnalysisDokument5 SeitenTrend Analysisabbas ali100% (1)

- Matrukrupa Travells: Bunglow No 4, Janta Society, Jamnagar - 361006Dokument1 SeiteMatrukrupa Travells: Bunglow No 4, Janta Society, Jamnagar - 361006JIGNA NAKARNoch keine Bewertungen

- Trent Balance SheetDokument2 SeitenTrent Balance SheetregelNoch keine Bewertungen

- Value Research: FundcardDokument6 SeitenValue Research: Fundcardsim_godeNoch keine Bewertungen

- L&T Midcap Fund - Direct Plan Rating: Low Risk, High ReturnDokument4 SeitenL&T Midcap Fund - Direct Plan Rating: Low Risk, High ReturnreachrajatNoch keine Bewertungen

- Vodafone Idea Limited: Consolidated Balance Sheet of Vodafone For 5 YearsDokument5 SeitenVodafone Idea Limited: Consolidated Balance Sheet of Vodafone For 5 YearsDeepak ChaharNoch keine Bewertungen

- JM Daily - 23 Aug - DebtDokument373 SeitenJM Daily - 23 Aug - DebtPravin SinghNoch keine Bewertungen

- QT Company AssignmentDokument21 SeitenQT Company AssignmentAISHWARYA MADDAMSETTYNoch keine Bewertungen

- Axis Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of Axis Bank - BSE: 532215, NSE: AXISBANKDokument2 SeitenAxis Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of Axis Bank - BSE: 532215, NSE: AXISBANKr79qwkxcfjNoch keine Bewertungen

- Schaum's Outline of Basic Business Mathematics, 2edVon EverandSchaum's Outline of Basic Business Mathematics, 2edBewertung: 5 von 5 Sternen5/5 (1)

- RESULTS of Elections July 2, 2018 PDFDokument4 SeitenRESULTS of Elections July 2, 2018 PDFOutlookMagazineNoch keine Bewertungen

- RESULTS of Elections July 2, 2018 PDFDokument4 SeitenRESULTS of Elections July 2, 2018 PDFOutlookMagazineNoch keine Bewertungen

- Fortis Hospital NPPADokument16 SeitenFortis Hospital NPPAFactlyNoch keine Bewertungen

- Aarushi VerdictDokument273 SeitenAarushi VerdictOutlookMagazine88% (8)

- Road Accidents Due To Speed-BreakersDokument2 SeitenRoad Accidents Due To Speed-BreakersOutlookMagazineNoch keine Bewertungen

- Complete Supreme Court Judgement in Right To Privacy CaseDokument547 SeitenComplete Supreme Court Judgement in Right To Privacy CaseNDTVNoch keine Bewertungen

- Ramachandra Guha's Letter To Vinod RaiDokument7 SeitenRamachandra Guha's Letter To Vinod RaiOutlookMagazineNoch keine Bewertungen

- New Doc 2018-06-27 13.50.28 - 20180627135317Dokument8 SeitenNew Doc 2018-06-27 13.50.28 - 20180627135317OutlookMagazineNoch keine Bewertungen

- Supreme Court Notice To Centre and CBI On Petition Seeking SIT Probe Into Judge-Fixing RacketDokument7 SeitenSupreme Court Notice To Centre and CBI On Petition Seeking SIT Probe Into Judge-Fixing RacketOutlookMagazineNoch keine Bewertungen

- Invite To Former VPDokument2 SeitenInvite To Former VPOutlookMagazineNoch keine Bewertungen

- Election Commission On Credibility of EVMsDokument9 SeitenElection Commission On Credibility of EVMsOutlookMagazineNoch keine Bewertungen

- E Ahamed Family Statement FINAL PDFDokument1 SeiteE Ahamed Family Statement FINAL PDFOutlookMagazineNoch keine Bewertungen

- Former VP Hamid Ansari's Speech in KozhikodeDokument4 SeitenFormer VP Hamid Ansari's Speech in KozhikodeOutlookMagazineNoch keine Bewertungen

- Sahayak PetitionDokument38 SeitenSahayak PetitionOutlookMagazine100% (1)

- Supreme Court of India Judgment in Triple Talaq CaseDokument395 SeitenSupreme Court of India Judgment in Triple Talaq CaseIndia TVNoch keine Bewertungen

- PayPal Trademark Opposition of PayTMDokument14 SeitenPayPal Trademark Opposition of PayTMOutlookMagazineNoch keine Bewertungen

- J.F Ribiero's Letter To Devendra FadnavisDokument1 SeiteJ.F Ribiero's Letter To Devendra FadnavisOutlookMagazineNoch keine Bewertungen

- Leaked Conversation Between Mathew Samuel and Angel AbrahamDokument2 SeitenLeaked Conversation Between Mathew Samuel and Angel AbrahamOutlookMagazineNoch keine Bewertungen

- Full Text of Cyrus Mistry's Letter To Tata BoardDokument5 SeitenFull Text of Cyrus Mistry's Letter To Tata BoardSwarajya100% (7)

- Naveen Patnaik's Letter To TRAIDokument1 SeiteNaveen Patnaik's Letter To TRAIOutlookMagazineNoch keine Bewertungen

- Letter of SolidarityDokument5 SeitenLetter of SolidarityOutlookMagazineNoch keine Bewertungen

- List of Porn Websites Banned in IndiaDokument9 SeitenList of Porn Websites Banned in IndiaThe Indian Express83% (6)

- Internet Licensing and Net NeutralityDokument23 SeitenInternet Licensing and Net NeutralityOutlookMagazineNoch keine Bewertungen

- Letter To Amit ChaudhuriDokument2 SeitenLetter To Amit ChaudhuriOutlookMagazineNoch keine Bewertungen

- NHMRC Statement HomeopathyDokument2 SeitenNHMRC Statement HomeopathyOutlookMagazineNoch keine Bewertungen

- 62nd National Film Awards 2014Dokument17 Seiten62nd National Film Awards 2014OutlookMagazineNoch keine Bewertungen

- Section 66A JUdgment PDFDokument123 SeitenSection 66A JUdgment PDFLive Law80% (5)

- Resignation-Letter 4 20150219Dokument1 SeiteResignation-Letter 4 20150219OutlookMagazineNoch keine Bewertungen

- Railway Budget Speech 2015-16 (English)Dokument53 SeitenRailway Budget Speech 2015-16 (English)FirstpostNoch keine Bewertungen

- Risk and Return Analysis of Stocks: A Literature ReviewDokument15 SeitenRisk and Return Analysis of Stocks: A Literature ReviewNitesh TripathyNoch keine Bewertungen

- FA - Quiz1 - Answers - All VersionDokument22 SeitenFA - Quiz1 - Answers - All VersionAgANoch keine Bewertungen

- Quality Auto-ProblemDokument3 SeitenQuality Auto-ProblemdianamarievalenzuelaNoch keine Bewertungen

- 50 Flats Housing Project Financial AnalysisDokument17 Seiten50 Flats Housing Project Financial AnalysisPuneet Singh Dhani25% (4)

- 05 CAPM - ADokument73 Seiten05 CAPM - AHaoyang Pazzini YeNoch keine Bewertungen

- Jiranna Healthcare AnalysisDokument8 SeitenJiranna Healthcare AnalysisEllen MarkNoch keine Bewertungen

- Deepak Nitrite balance sheet analysisDokument1 SeiteDeepak Nitrite balance sheet analysisBhaktaNoch keine Bewertungen

- SWIFT Webinar:: How To Reduce Post-Trade Costs in FXDokument15 SeitenSWIFT Webinar:: How To Reduce Post-Trade Costs in FXDev GogoiNoch keine Bewertungen

- CCI - Guidelines For ValuationDokument13 SeitenCCI - Guidelines For Valuationsujit0577Noch keine Bewertungen

- Questions - Risk and Return - IIDokument3 SeitenQuestions - Risk and Return - IIRuchitha PrakashNoch keine Bewertungen

- Cfap6 Audit Past Papers and AnswersDokument148 SeitenCfap6 Audit Past Papers and AnswersZareen AbbasNoch keine Bewertungen

- A Capsule Summary of The Wave PrincipleDokument8 SeitenA Capsule Summary of The Wave PrincipleomkarnadkarniNoch keine Bewertungen

- Value Investing - Aswath DamodaranDokument43 SeitenValue Investing - Aswath Damodaranapi-3821333100% (1)

- Quiz 1 Solution Chapter 1 and 3Dokument9 SeitenQuiz 1 Solution Chapter 1 and 3Saadat ShaikhNoch keine Bewertungen

- Statement of Financial Position As at 31st December 2013Dokument5 SeitenStatement of Financial Position As at 31st December 2013Joseph KanyiNoch keine Bewertungen

- Research Proposal Impact of Capital Structure On Firms Performance FinalDokument29 SeitenResearch Proposal Impact of Capital Structure On Firms Performance FinalTennyson MudendaNoch keine Bewertungen

- RRHIS A1.1.0 CFS1219 Robinsons Retail Holdings IncDokument98 SeitenRRHIS A1.1.0 CFS1219 Robinsons Retail Holdings Incherrera.angelaNoch keine Bewertungen

- Chap 4Dokument5 SeitenChap 4tienpham19893172Noch keine Bewertungen

- Project of Merger AcquisitionDokument65 SeitenProject of Merger AcquisitionPreetishRSuvarnaNoch keine Bewertungen

- Statement of Cash Flow IllustrationDokument2 SeitenStatement of Cash Flow IllustrationjiiNoch keine Bewertungen

- Black's ModelDokument4 SeitenBlack's ModelAdityaPandhareNoch keine Bewertungen

- Receivable Financing - Exercise 2Dokument1 SeiteReceivable Financing - Exercise 2Anne Marieline BuenaventuraNoch keine Bewertungen

- Sample ComputationDokument9 SeitenSample ComputationJhao Mico TamayoNoch keine Bewertungen

- Sol. Man. - Chapter 7 - Notes (Part 1)Dokument13 SeitenSol. Man. - Chapter 7 - Notes (Part 1)natalie clyde matesNoch keine Bewertungen

- CSI FormulasDokument8 SeitenCSI Formulasgrz7gtqq9bNoch keine Bewertungen

- Persistent Annual Report 2022Dokument2 SeitenPersistent Annual Report 2022Ashwin GophanNoch keine Bewertungen

- Paper1 FR PP All Attempts Nov22Dokument334 SeitenPaper1 FR PP All Attempts Nov22mayur.goyalNoch keine Bewertungen

- Daftar Nama Akun PT JayatamaDokument2 SeitenDaftar Nama Akun PT Jayatamastriii906Noch keine Bewertungen

- Acctg 9a Midterm Exam CH 9 15 CabreraDokument4 SeitenAcctg 9a Midterm Exam CH 9 15 CabreraDonalyn BannagaoNoch keine Bewertungen

- 2021 - QR1 - Invictus ReportDokument61 Seiten2021 - QR1 - Invictus Reporthomesimp_1971Noch keine Bewertungen