Beruflich Dokumente

Kultur Dokumente

The Arab Spring JPF

Hochgeladen von

BruegelOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

The Arab Spring JPF

Hochgeladen von

BruegelCopyright:

Verfügbare Formate

The Arab Spring : echoes of 1989

By Jean Pisani-Ferry

8 March 2011

(A version of this article was originally published in Le Monde)

In 1989 the wall separating the two halves of Europe suddenly collapsed. Within the space of a few

months, a hitherto seemingly immutable order gave way to commotion and impatience. One

moment the old countries of Europe were paralysed with fear of the unknown and anxiety about

immigration, the next they had seized the opportunity which history was offering them. They

implemented aid programmes, opened trade talks and promised enlargement. Two decades later,

success has proved spectacular. The economic and political transition of former eastern Europe has

been swift and deep, it has – with the dramatic exception of Yugoslavia – been peaceful, and it has

yielded development.

Could a similar – obviously not identical – story unfold for the southern rim of the Mediterranean?

This is the key economic question posed by the Arab Spring. The 500 million EU citizens have 170

million neighbours between Agadir and Port Said sitting on their doorstep and eyeing for prosperity

and democracy. In three of the five countries of the region, they have demonstrated their resolve by

overturning regimes which we had taken to be guarantors of stability. They ask nothing more than

to invest their energies in the recovery of their countries. But if they do not very rapidly have

reason to believe that their situation will get better, this transforming dynamism will become the

dynamism of despair – with all the risks that this implies.

The first priority is jobs. The young people driving the Tunisian and Egyptian revolutions are

massively underemployed. We do not know if the official data is correct (around 30 percent youth

unemployment) but it is clear that these economies were incapable of confronting the

demographic wave of the last decades. Recent growth rates – five to six percent annually in Egypt,

Libya, Tunisia and Morocco – appear high, but they are less impressive in light of the growth in the

working-age population of the order of two-and-a-half percent per year over the last ten years. Even

more growth is needed.

The obstacles are not chiefly macroeconomic. It is true that Egypt is fragile, that public finances

and current-account balances will slump, and that inflation will take off if governments try to

respond to the problems by spending money they have not got. They will need to invest more and

educate better, which will inevitably be costly. And international assistance will certainly need to

be mobilised. But these are not the immediate issues.

The main brake on development lies in their economic institutions. According to the World Bank, a

building permit in Egypt costs three times the average annual income, there are eleven different

steps needed to register a property transaction in Algeria, and Morocco is ranked 154th out of 183

for protection of shareholders against abuse of power by management. These are just a handful of

examples. They all point to economies where development is impeded by burocracy, monopoly

rents – very often as a result of political or family nepotism – and credit market sclerosis.

It is unthinkable to copy and paste the eastern European solution of importing EU legislation with a

© Bruegel 2011 www.bruegel.org 1

view to enlargement. But the current political revolutions also present the chance for economic

emancipation which the EU can support both by giving incentives to economic reform and by

mobilising its development banks.

Europe can exert a more direct impact in trade and mobility policy given its dominant role here.

Today migration is extremely circumscribed. Professional mobility must be allowed without delay.

Free circulation of goods is also limited. As a proportion of GDP, Tunisia trades two times less with

the EU than the Czech Republic, and Morocco four times less than Poland. Not only for goods but for

services too, Europe needs to promote much more than it has so far the adoption of an outsourcing

model in the most labour-intensive segments of the value chain, as Germany has done with great

success – and which in part explains its bounce-back in global markets. While this model entails

job losses in the North, it also preserves jobs by keeping production sites competitive and creates

jobs by paving the way for development of the South.

As French prime minister famously said Mendès-France said, governing is choosing. Europe must

choose either to mobilise help for its neighbours and open up to them, or start recruiting

coastguards and manning the patrol boats.

© Bruegel 2011 www.bruegel.org 2

Das könnte Ihnen auch gefallen

- The great economic crisis in Greece: A journey to discover the Greek economic crisis that started in 2008 and alarmed the world. Its causes and implicationsVon EverandThe great economic crisis in Greece: A journey to discover the Greek economic crisis that started in 2008 and alarmed the world. Its causes and implicationsNoch keine Bewertungen

- Opening Mediterranean Trade and Migration: Jean-Pierre GarsonDokument4 SeitenOpening Mediterranean Trade and Migration: Jean-Pierre GarsonStiven Rivera GoezNoch keine Bewertungen

- Mayur-Eco 2Dokument58 SeitenMayur-Eco 2Tamanna BohraNoch keine Bewertungen

- Fina Groupe Eiffel en 13022014Dokument9 SeitenFina Groupe Eiffel en 13022014BruegelNoch keine Bewertungen

- Economic and Monetary Sovereignty in 21st Century AfricaVon EverandEconomic and Monetary Sovereignty in 21st Century AfricaMaha Ben GadhaNoch keine Bewertungen

- Written Exam - 3.5.21Dokument2 SeitenWritten Exam - 3.5.21bup hrlcNoch keine Bewertungen

- Judt, The Social Question RedivivusDokument24 SeitenJudt, The Social Question RedivivusBenjamin AlexanderNoch keine Bewertungen

- Speech Peg Harvard April 2018Dokument20 SeitenSpeech Peg Harvard April 2018ValeriaNoch keine Bewertungen

- Europe Union and Trade PolicyDokument38 SeitenEurope Union and Trade PolicyCorina BanghioreNoch keine Bewertungen

- MB0037Dokument8 SeitenMB0037Venu GopalNoch keine Bewertungen

- Unemployment 3Dokument3 SeitenUnemployment 3boumannNoch keine Bewertungen

- Migration in The European UnionDokument13 SeitenMigration in The European UnionSorina StoianNoch keine Bewertungen

- The Globalisation in The Security Space: Relationes InternationalesDokument13 SeitenThe Globalisation in The Security Space: Relationes InternationalesAdrian BeteringheNoch keine Bewertungen

- Cautionary Tale Austerity Inequality Europe 120913 Summ enDokument7 SeitenCautionary Tale Austerity Inequality Europe 120913 Summ enLaura Bravo PozoNoch keine Bewertungen

- Special Report On Greece CrisisDokument13 SeitenSpecial Report On Greece CrisisAchintya P RNoch keine Bewertungen

- Short Descrition About GlobalizationDokument4 SeitenShort Descrition About GlobalizationFer LynNoch keine Bewertungen

- Socio-Economic Challenges of GlobalizationDokument4 SeitenSocio-Economic Challenges of GlobalizationIftekhar AhmedNoch keine Bewertungen

- Answer: The Term "Globalization" Has Acquired Considerable Emotive Force. Some View It As Process That IsDokument2 SeitenAnswer: The Term "Globalization" Has Acquired Considerable Emotive Force. Some View It As Process That IsMD RezaNoch keine Bewertungen

- Q1. Write A Note On Globalization.: 1. Trade: Developing Countries As A Whole Have Increased Their Share of World TradeDokument6 SeitenQ1. Write A Note On Globalization.: 1. Trade: Developing Countries As A Whole Have Increased Their Share of World TradeYogesh MishraNoch keine Bewertungen

- We Are All Europeans NowDokument3 SeitenWe Are All Europeans NowAlexander MirtchevNoch keine Bewertungen

- Short Profile of The CountryDokument7 SeitenShort Profile of The CountryЕлизавета ЗайцеваNoch keine Bewertungen

- A Programme of Social and National Rescue For Greece: Costas Lapavitsas and Heiner FlassbeckDokument48 SeitenA Programme of Social and National Rescue For Greece: Costas Lapavitsas and Heiner FlassbeckUlises NoyolaNoch keine Bewertungen

- In The Shadow of ProsperityDokument2 SeitenIn The Shadow of ProsperityAndra MantaNoch keine Bewertungen

- Polytice Assigment. Valentina de Los Ángeles Rojas Garrido.Dokument9 SeitenPolytice Assigment. Valentina de Los Ángeles Rojas Garrido.valentina rojas garridoNoch keine Bewertungen

- Vision VAM 2020 (Essay) Reverse GlobalizationDokument8 SeitenVision VAM 2020 (Essay) Reverse GlobalizationGaurang Pratap SinghNoch keine Bewertungen

- Investment Commentary No. 275 21 March 2011: Real and Illusory DangersDokument8 SeitenInvestment Commentary No. 275 21 March 2011: Real and Illusory DangersttiketitanNoch keine Bewertungen

- Phosphate DerivativesDokument2 SeitenPhosphate Derivativeshumble402Noch keine Bewertungen

- A Cautionary Tale: The True Cost of Austerity and Inequality in EuropeDokument36 SeitenA Cautionary Tale: The True Cost of Austerity and Inequality in EuropeOxfamNoch keine Bewertungen

- Rodrik On GreeceDokument2 SeitenRodrik On GreecearnemelanNoch keine Bewertungen

- Greater Economic IntegrationDokument13 SeitenGreater Economic IntegrationMWhiteNoch keine Bewertungen

- Crissis TNI Privatising - EuropeDokument20 SeitenCrissis TNI Privatising - EuropePipaticoNoch keine Bewertungen

- MacDonald - 2005 - Rethinking Europe's Culture of EntitlementDokument2 SeitenMacDonald - 2005 - Rethinking Europe's Culture of EntitlementAnonymous T5PT3UNoch keine Bewertungen

- The Future of EuroDokument5 SeitenThe Future of EuroQuýt BéNoch keine Bewertungen

- Privatising Europe USING THE CRISIS TO ENTRENCH NEOLIBERALISMDokument20 SeitenPrivatising Europe USING THE CRISIS TO ENTRENCH NEOLIBERALISMNzlWolfNoch keine Bewertungen

- Globalisation Has Faltered - The Global List (The Economist Junio-2018) PDFDokument13 SeitenGlobalisation Has Faltered - The Global List (The Economist Junio-2018) PDFNicolasDiNataleNoch keine Bewertungen

- Portugal's Unnecessary Bailout - Robert Fishman - New York Times, 12-Abr-2011Dokument3 SeitenPortugal's Unnecessary Bailout - Robert Fishman - New York Times, 12-Abr-2011José Ribeiro e CastroNoch keine Bewertungen

- International Trade and BusinessDokument8 SeitenInternational Trade and BusinesssyyleeNoch keine Bewertungen

- Doxiadis at Yale NiarchosDokument20 SeitenDoxiadis at Yale NiarchosGeorge KafentzisNoch keine Bewertungen

- E. Altvater - Scientific Council-ATTAC Germany Mainfesto On The Crisis of The Euro March 2011Dokument12 SeitenE. Altvater - Scientific Council-ATTAC Germany Mainfesto On The Crisis of The Euro March 2011elenakimouNoch keine Bewertungen

- INS Hons - Industrial and Economic Policy 2022 - Final 1.3Dokument11 SeitenINS Hons - Industrial and Economic Policy 2022 - Final 1.3Dawood KroutzNoch keine Bewertungen

- The Contemporary World Module 2Dokument27 SeitenThe Contemporary World Module 2Dan Christian VillacoNoch keine Bewertungen

- Migration Effects On Economic Growth Under The Conditions of The Global CrisisDokument9 SeitenMigration Effects On Economic Growth Under The Conditions of The Global CrisisAlina CatargiuNoch keine Bewertungen

- Europe's World Slippery Slope: Europe's Troubled Future: Europe Still Needs The MigrantsDokument2 SeitenEurope's World Slippery Slope: Europe's Troubled Future: Europe Still Needs The MigrantsLoping LeeNoch keine Bewertungen

- Stacked Cards: Trade and Struggle Against PovertyDokument24 SeitenStacked Cards: Trade and Struggle Against PovertyFrancisco JassoNoch keine Bewertungen

- Communication Skills: The Golden Rule: FranceDokument7 SeitenCommunication Skills: The Golden Rule: FranceGemma CmNoch keine Bewertungen

- Globalization Public Sector Reform and TDokument51 SeitenGlobalization Public Sector Reform and TMastika GebrehiewotNoch keine Bewertungen

- Academic Open Internet JournalDokument58 SeitenAcademic Open Internet Journalali128Noch keine Bewertungen

- Why Europe SleptDokument3 SeitenWhy Europe SleptBisserNoch keine Bewertungen

- Master of Business Administration-MBA Semester 4cDokument15 SeitenMaster of Business Administration-MBA Semester 4cChitra KotihNoch keine Bewertungen

- The Case For Investing in EuropeDokument40 SeitenThe Case For Investing in EuropeYesica Lucia Barca LinaresNoch keine Bewertungen

- In Order To Understand The Recent Surge in Migrants To Spanish Enclaves in MoroccoDokument4 SeitenIn Order To Understand The Recent Surge in Migrants To Spanish Enclaves in MoroccoEmmylou Molito PesidasNoch keine Bewertungen

- 4 Global Contexts: Aims of This ChapterDokument21 Seiten4 Global Contexts: Aims of This ChapterstephjmccNoch keine Bewertungen

- Jean Pisani-Ferry (BRUEGEL and Cercle Des Économistes) July 2005Dokument5 SeitenJean Pisani-Ferry (BRUEGEL and Cercle Des Économistes) July 2005BruegelNoch keine Bewertungen

- PC Sept2005 SocialmodDokument20 SeitenPC Sept2005 SocialmodTejasNoch keine Bewertungen

- Globalization: Historical DevelopmentDokument9 SeitenGlobalization: Historical DevelopmentManisha TomarNoch keine Bewertungen

- Europe - Road - To - IntegrationDokument6 SeitenEurope - Road - To - IntegrationSpiros GanisNoch keine Bewertungen

- Could The Greek Financial Crisis Lead To The End of The EU As We Know It?Dokument4 SeitenCould The Greek Financial Crisis Lead To The End of The EU As We Know It?Harris A. SamarasNoch keine Bewertungen

- PC 2015 10 PDFDokument13 SeitenPC 2015 10 PDFBruegelNoch keine Bewertungen

- WP 2015 07 160715 PDFDokument32 SeitenWP 2015 07 160715 PDFBruegelNoch keine Bewertungen

- PC 2015 09 PDFDokument23 SeitenPC 2015 09 PDFBruegelNoch keine Bewertungen

- PC 2015 06 280415 PDFDokument16 SeitenPC 2015 06 280415 PDFBruegelNoch keine Bewertungen

- Essay NV CMU PDFDokument63 SeitenEssay NV CMU PDFBruegelNoch keine Bewertungen

- Essay NV CMU PDFDokument63 SeitenEssay NV CMU PDFBruegelNoch keine Bewertungen

- The Long Road Towards The European Single Market (English)Dokument36 SeitenThe Long Road Towards The European Single Market (English)poimartiNoch keine Bewertungen

- 141101-Study en PDFDokument255 Seiten141101-Study en PDFBruegelNoch keine Bewertungen

- Blueprint XXIII Web PDFDokument194 SeitenBlueprint XXIII Web PDFBruegelNoch keine Bewertungen

- Ecbop160 en PDFDokument46 SeitenEcbop160 en PDFBruegelNoch keine Bewertungen

- WP 2014 13 PDFDokument25 SeitenWP 2014 13 PDFBruegelNoch keine Bewertungen

- PC 2014 15 PDFDokument14 SeitenPC 2014 15 PDFBruegelNoch keine Bewertungen

- PC 2014 14 PDFDokument11 SeitenPC 2014 14 PDFBruegelNoch keine Bewertungen

- DeliciousDoughnuts Eguide PDFDokument35 SeitenDeliciousDoughnuts Eguide PDFSofi Cherny83% (6)

- Ra 9272Dokument6 SeitenRa 9272janesamariamNoch keine Bewertungen

- Triaxial Shear TestDokument10 SeitenTriaxial Shear TestAfiqah Nu'aimiNoch keine Bewertungen

- PresentationDokument27 SeitenPresentationMenuka WatankachhiNoch keine Bewertungen

- JIS G 3141: Cold-Reduced Carbon Steel Sheet and StripDokument6 SeitenJIS G 3141: Cold-Reduced Carbon Steel Sheet and StripHari0% (2)

- Activity On Noli Me TangereDokument5 SeitenActivity On Noli Me TangereKKKNoch keine Bewertungen

- Apron CapacityDokument10 SeitenApron CapacityMuchammad Ulil AidiNoch keine Bewertungen

- An Evaluation of MGNREGA in SikkimDokument7 SeitenAn Evaluation of MGNREGA in SikkimBittu SubbaNoch keine Bewertungen

- Close Enough To Touch by Victoria Dahl - Chapter SamplerDokument23 SeitenClose Enough To Touch by Victoria Dahl - Chapter SamplerHarlequinAustraliaNoch keine Bewertungen

- Delonghi Esam Series Service Info ItalyDokument10 SeitenDelonghi Esam Series Service Info ItalyBrko BrkoskiNoch keine Bewertungen

- postedcontentadminuploadsFAQs20for20Organization PDFDokument10 SeitenpostedcontentadminuploadsFAQs20for20Organization PDFMohd Adil AliNoch keine Bewertungen

- Quiz 140322224412 Phpapp02Dokument26 SeitenQuiz 140322224412 Phpapp02Muhammad Mubeen Iqbal PuriNoch keine Bewertungen

- Biblical World ViewDokument15 SeitenBiblical World ViewHARI KRISHAN PALNoch keine Bewertungen

- Dermatology Skin in Systemic DiseaseDokument47 SeitenDermatology Skin in Systemic DiseaseNariska CooperNoch keine Bewertungen

- Lieh TzuDokument203 SeitenLieh TzuBrent Cullen100% (2)

- Miguel Augusto Ixpec-Chitay, A097 535 400 (BIA Sept. 16, 2013)Dokument22 SeitenMiguel Augusto Ixpec-Chitay, A097 535 400 (BIA Sept. 16, 2013)Immigrant & Refugee Appellate Center, LLCNoch keine Bewertungen

- Food ResourcesDokument20 SeitenFood ResourceshiranNoch keine Bewertungen

- Man and Historical ActionDokument4 SeitenMan and Historical Actionmama.sb415Noch keine Bewertungen

- B I o G R A P H yDokument17 SeitenB I o G R A P H yRizqia FitriNoch keine Bewertungen

- rp10 PDFDokument77 Seitenrp10 PDFRobson DiasNoch keine Bewertungen

- Algoritm BackTracking EnglezaDokument6 SeitenAlgoritm BackTracking Englezaionutz_67Noch keine Bewertungen

- Fds-Ofite Edta 0,1MDokument7 SeitenFds-Ofite Edta 0,1MVeinte Años Sin VosNoch keine Bewertungen

- Patrick Meyer Reliability Understanding Statistics 2010Dokument160 SeitenPatrick Meyer Reliability Understanding Statistics 2010jcgueinj100% (1)

- Lesson 3 - ReviewerDokument6 SeitenLesson 3 - ReviewerAdrian MarananNoch keine Bewertungen

- BSC HTM - TourismDokument4 SeitenBSC HTM - Tourismjaydaman08Noch keine Bewertungen

- CV & Surat Lamaran KerjaDokument2 SeitenCV & Surat Lamaran KerjaAci Hiko RickoNoch keine Bewertungen

- Clockwork Dragon's Expanded ArmoryDokument13 SeitenClockwork Dragon's Expanded Armoryabel chabanNoch keine Bewertungen

- Promotion-Mix (: Tools For IMC)Dokument11 SeitenPromotion-Mix (: Tools For IMC)Mehul RasadiyaNoch keine Bewertungen

- Business Plan in BDDokument48 SeitenBusiness Plan in BDNasir Hossen100% (1)

- Illustrating An Experiment, Outcome, Sample Space and EventDokument9 SeitenIllustrating An Experiment, Outcome, Sample Space and EventMarielle MunarNoch keine Bewertungen

- The Hotel on Place Vendôme: Life, Death, and Betrayal at the Hotel Ritz in ParisVon EverandThe Hotel on Place Vendôme: Life, Death, and Betrayal at the Hotel Ritz in ParisBewertung: 3.5 von 5 Sternen3.5/5 (49)

- Bind, Torture, Kill: The Inside Story of BTK, the Serial Killer Next DoorVon EverandBind, Torture, Kill: The Inside Story of BTK, the Serial Killer Next DoorBewertung: 3.5 von 5 Sternen3.5/5 (77)

- Hunting Eichmann: How a Band of Survivors and a Young Spy Agency Chased Down the World's Most Notorious NaziVon EverandHunting Eichmann: How a Band of Survivors and a Young Spy Agency Chased Down the World's Most Notorious NaziBewertung: 4 von 5 Sternen4/5 (157)

- The Lost Peace: Leadership in a Time of Horror and Hope, 1945–1953Von EverandThe Lost Peace: Leadership in a Time of Horror and Hope, 1945–1953Noch keine Bewertungen

- Dunkirk: The History Behind the Major Motion PictureVon EverandDunkirk: The History Behind the Major Motion PictureBewertung: 4 von 5 Sternen4/5 (19)

- The Rape of Nanking: The History and Legacy of the Notorious Massacre during the Second Sino-Japanese WarVon EverandThe Rape of Nanking: The History and Legacy of the Notorious Massacre during the Second Sino-Japanese WarBewertung: 4.5 von 5 Sternen4.5/5 (63)

- The Quiet Man: The Indispensable Presidency of George H.W. BushVon EverandThe Quiet Man: The Indispensable Presidency of George H.W. BushBewertung: 4 von 5 Sternen4/5 (1)

- Rebel in the Ranks: Martin Luther, the Reformation, and the Conflicts That Continue to Shape Our WorldVon EverandRebel in the Ranks: Martin Luther, the Reformation, and the Conflicts That Continue to Shape Our WorldBewertung: 4 von 5 Sternen4/5 (4)

- Never Surrender: Winston Churchill and Britain's Decision to Fight Nazi Germany in the Fateful Summer of 1940Von EverandNever Surrender: Winston Churchill and Britain's Decision to Fight Nazi Germany in the Fateful Summer of 1940Bewertung: 4.5 von 5 Sternen4.5/5 (45)

- Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent MoneyVon EverandDigital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent MoneyBewertung: 4 von 5 Sternen4/5 (51)

- The Great Fire: One American's Mission to Rescue Victims of the 20th Century's First GenocideVon EverandThe Great Fire: One American's Mission to Rescue Victims of the 20th Century's First GenocideNoch keine Bewertungen

- Hubris: The Tragedy of War in the Twentieth CenturyVon EverandHubris: The Tragedy of War in the Twentieth CenturyBewertung: 4 von 5 Sternen4/5 (23)

- We Crossed a Bridge and It Trembled: Voices from SyriaVon EverandWe Crossed a Bridge and It Trembled: Voices from SyriaBewertung: 4.5 von 5 Sternen4.5/5 (30)

- Making Gay History: The Half-Century Fight for Lesbian and Gay Equal RightsVon EverandMaking Gay History: The Half-Century Fight for Lesbian and Gay Equal RightsNoch keine Bewertungen

- Reagan at Reykjavik: Forty-Eight Hours That Ended the Cold WarVon EverandReagan at Reykjavik: Forty-Eight Hours That Ended the Cold WarBewertung: 4 von 5 Sternen4/5 (4)

- The Future of Capitalism: Facing the New AnxietiesVon EverandThe Future of Capitalism: Facing the New AnxietiesBewertung: 4 von 5 Sternen4/5 (17)

- Project MK-Ultra: The History of the CIA’s Controversial Human Experimentation ProgramVon EverandProject MK-Ultra: The History of the CIA’s Controversial Human Experimentation ProgramBewertung: 4.5 von 5 Sternen4.5/5 (13)

- Midnight in Chernobyl: The Story of the World's Greatest Nuclear DisasterVon EverandMidnight in Chernobyl: The Story of the World's Greatest Nuclear DisasterBewertung: 4.5 von 5 Sternen4.5/5 (410)

- Desperate Sons: Samuel Adams, Patrick Henry, John Hancock, and the Secret Bands of Radicals Who Led the Colonies to WarVon EverandDesperate Sons: Samuel Adams, Patrick Henry, John Hancock, and the Secret Bands of Radicals Who Led the Colonies to WarBewertung: 3.5 von 5 Sternen3.5/5 (7)

- They All Love Jack: Busting the RipperVon EverandThey All Love Jack: Busting the RipperBewertung: 3.5 von 5 Sternen3.5/5 (30)

- Witness to Hope: The Biography of Pope John Paul IIVon EverandWitness to Hope: The Biography of Pope John Paul IIBewertung: 4.5 von 5 Sternen4.5/5 (58)

- The Pursuit of Happiness: How Classical Writers on Virtue Inspired the Lives of the Founders and Defined AmericaVon EverandThe Pursuit of Happiness: How Classical Writers on Virtue Inspired the Lives of the Founders and Defined AmericaBewertung: 5 von 5 Sternen5/5 (1)

- Knowing What We Know: The Transmission of Knowledge: From Ancient Wisdom to Modern MagicVon EverandKnowing What We Know: The Transmission of Knowledge: From Ancient Wisdom to Modern MagicBewertung: 4 von 5 Sternen4/5 (25)

- Daughters of the Flower Fragrant Garden: Two Sisters Separated by China’s Civil WarVon EverandDaughters of the Flower Fragrant Garden: Two Sisters Separated by China’s Civil WarBewertung: 5 von 5 Sternen5/5 (14)

- The OSS and CIA: The History of America’s Intelligence Community during World War II and the Establishment of the Central Intelligence AgencyVon EverandThe OSS and CIA: The History of America’s Intelligence Community during World War II and the Establishment of the Central Intelligence AgencyBewertung: 4.5 von 5 Sternen4.5/5 (27)

- The Ship of Dreams: The Sinking of the Titanic and the End of the Edwardian EraVon EverandThe Ship of Dreams: The Sinking of the Titanic and the End of the Edwardian EraBewertung: 4.5 von 5 Sternen4.5/5 (38)

- Principles for Dealing with the Changing World Order: Why Nations Succeed or FailVon EverandPrinciples for Dealing with the Changing World Order: Why Nations Succeed or FailBewertung: 4.5 von 5 Sternen4.5/5 (237)

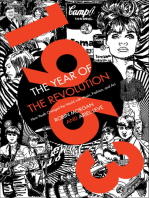

- 1963: The Year of the Revolution: How Youth Changed the World with Music, Fashion, and ArtVon Everand1963: The Year of the Revolution: How Youth Changed the World with Music, Fashion, and ArtBewertung: 4 von 5 Sternen4/5 (5)

- Crossing the Heart of Africa: An Odyssey of Love and AdventureVon EverandCrossing the Heart of Africa: An Odyssey of Love and AdventureBewertung: 4 von 5 Sternen4/5 (26)