Beruflich Dokumente

Kultur Dokumente

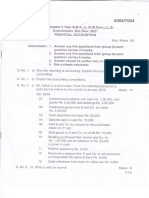

Question Paper Accounting (3702) : January 2004: Answer Any Two From The Four Questions Given Below

Hochgeladen von

Raveendra KJ0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

37 Ansichten16 SeitenAnswer any two from the four questions given below: 2 x 20 = 40. The plant and machinery account of a company had a debit balance of Rs.2,18,700 on 1st Jan.,2003. In 2003 it was decided to change the method of charging full year's depreciation every year on diminishing balance system @ 10%.

Originalbeschreibung:

Originaltitel

3702

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

DOC, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenAnswer any two from the four questions given below: 2 x 20 = 40. The plant and machinery account of a company had a debit balance of Rs.2,18,700 on 1st Jan.,2003. In 2003 it was decided to change the method of charging full year's depreciation every year on diminishing balance system @ 10%.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

37 Ansichten16 SeitenQuestion Paper Accounting (3702) : January 2004: Answer Any Two From The Four Questions Given Below

Hochgeladen von

Raveendra KJAnswer any two from the four questions given below: 2 x 20 = 40. The plant and machinery account of a company had a debit balance of Rs.2,18,700 on 1st Jan.,2003. In 2003 it was decided to change the method of charging full year's depreciation every year on diminishing balance system @ 10%.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 16

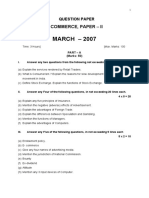

Question Paper

Accounting (3702): January 2004

Section A

Answer any two from the four questions given below: 2 × 20 = 40

1. Following transactions took place in the business of a trader for the month of January 2003.

Jan. 1. Cash in hand Rs.500.

2. Overdraft with bank Rs.4,000.

3. Introduced cash Rs.10,000 as further capital of which Rs.5,000 is deposited into

bank.

5. Sold goods for cash Rs.4,000.

7. Purchased goods for cash Rs.4,500 of which Rs.2,500 was paid by cheques.

10. Paid Rs.2,750 by cheques to B and discount received Rs.100.

11. Received Rs.3,000 from P in full settlement of Rs.3,250.

12. Paid commission in cash Rs.200.

15. Drew cheques for personal use Rs.1,000.

16. Cash deposited into bank Rs.5,000.

18. Rent paid by cheque Rs.1,000.

20. Cash withdrawn Rs.1,000 and paid for stationery.

25. Collected from A deposited into bank Rs.2,000

26. Dividends received by cheque Rs.500.

a. Prepare three column cash book and find out the balance as on January 31, 2003.

b. Write a note on Imprest System of cash book.

c. Distinguish accounting and book keeping.

(10 + 5 + 5 = 20 marks) <Answer>

2. P draws a bill on Q for 3 months for Rs.10,000 which Q accepts on January 01, 2003. P

endorses the bill in favour of R. Before maturity Q approaches P with a request that the bill be

renewed for a further period of 3 months at 18%interest per annum. P pays the sum to R on the

due date. And agrees to the proposal of Q. The second bill is duly met on the due date.

a. Pass journal entries in the books of P.

b. Distinguish between the Bills of Exchange & Promissory Note.

c. Explain the types of accommodation bills.

(10 + 5 + 5 = 20 marks) <Answer>

3. The plant and machinery account of a company had a debit balance of Rs.2,18,700 on 1st

Jan.,2003. The company was incorporated in 2000 and has been following the practice of

charging full year’s depreciation every year on diminishing balance system @ 10%. In 2003 it

was however, decided to change the method from Reducing Balance to Straight-line method.

With retrospective effect from 2000 and to give effect of the change while preparing final

accounts. For the year ended December 31, 2003 the rate of depreciation remains the same as

before. In 2003, a new machine were purchased at a cost of Rs.60,000. All other machines were

acquired in 2000.

a. Prepare Plant account from 2000 – 2003.

b. Explain the term Depreciation and why it is needed?

c. Write a note on account sales.

(10 + 5 + 5 = 20 marks) <Answer>

4. P, Q and R are partners sharing profits and losses in the ratio of 2:2:1. The balance sheet on December 31, 2002 is

as follows:

Liabilities Rs. Assets Rs.

Creditors 3,000 Cash 3,000

P 7,500 Sundry Debtors 1,950

Q 3,000 Less: Provision 450 1,500

R 1,500 Stock 3,000

Furniture 7,500

15,000 15,000

They decided to dissolve the business and assets realized as follows:

Furniture Rs.6,750

Stock Rs.3,390

Debtors Rs.1,350

Creditors Rs.2,850

Expenses on realization Rs. 90

a. Show the necessary ledger accounts on dissolution of firm.

b. Explain the rule in Garner vs. Murray’s case.

c. State the legal provisions for the settlement of accounts on dissolution of firm as per

section 48 of the Partnership Act, 1932.

(10 + 5 + 5 = 20 marks) <Answer>

Section B

Answer any two from the three questions given below: 2 × 10 = 20

5. a. Rectify following errors and prepare the Suspense account.

1. A purchase of Rs.500 from A has been entered in sales book. However A’s account

has been correctly credited.

2. An old furniture sold for Rs.840 has been entered in the sales account as Rs.480.

3. A cheque of Rs.3,456 received from A after allowing him a discount of Rs.19 was

endorsed to B in full settlement of Rs.3,475. The cheque was finally dishonoured but

no entries were passed in the books.

4. Goods of the value Rs.450 returned by A were entered in the purchase book and

passed there from to B as Rs.540.

5. Rs.11,690 paid for repairs of buildings was debited to building account as Rs.11,960.

b. What do you mean by Consignment and distinguish it from sales.

(5 + 5 = 10 marks) <Answer>

6. a. A firm maintains a provision for bad debts at 5% and a provision for discount at 2% on

total debtors. From the following particulars write up the provision and reserve

account.

Balance on April 01,2000

Provision for bad debts Rs.4,500

Provision for discount on debtors Rs.4,000

Total debtors were

On March 31, 2001- Rs.1,00,000 after writing off bad debts of Rs.2,500 and allowing

Discount of Rs.3,000

On March 31, 2002-Rs.60,000 after writing off bad debts of Rs.1,500 and discount of

Rs1,750.

b. State the legal provisions regarding the utilization of “Securities Premium”.

(5 + 5 = 10 marks) <Answer>

7. a. What are the limitations of Financial Statement Analysis?

b. A company forfeited 250 shares of Rs.10 each issued at a premium of 10% for the non-

payment of first call of Rs.2 and final call of Rs.3. Out of these, the company reissued 100

shares at a discount of 10 percent.

(5 + 5 = 10 marks) <Answer>

Section C

Answer any two from the four questions given below: 2 × 20 = 40

8. The following is the trial balance of A as on December 31, 2002.

Particulars Dr. Rs. Cr. Rs.

Purchases 15,000 -

Debtors 20,000 -

Interest earned - 400

Salaries 3,000 -

Sales - 32,100

Purchase returns - 500

Wages 2,000 -

Rent 1,500 -

Sales returns 1,000 -

Bad debts written off 700 -

Capital - 12,000

Creditors - 10,000

Drawings 2,400 -

Provision for bad debts - 600

Printing and stationery 800 -

Insurance 1,200 -

Opening stock 5,000 -

Office expenses 1,200 -

Furniture and Fittings 2,000 -

Accumulated depreciation - 200

55,800 55,800

Prepare a Trading, Profit and Loss account for the year ended December 31, 2002 and also the

balance sheet as on that date after making the following adjustments.

a. a.Depreciate furniture and fittings by 10% on original cost.

b. b. Make a provision for doubtful debts at equal to 5% of debtors.

c. c.Salaries for the month of December amounting to Rs.300 was unpaid which must be

provided for. The balance in the account includes Rs.200 paid in advance.

d. d. Insurance prepaid to the extent of Rs.200.

e. e.Provide Rs.800 for office expenses.

f. f. Stock valued at Rs.600 was put by A to his personal use.

g. g. Closing stock was valued at Rs.6,000.

(20 marks) <Answer>

9. On March 31, 2003 the cash book of Thin Ltd. Showed a credit balance of Rs.14,370 at bank.

The following further information is available:

a. a. Cheques worth Rs.58,000 were deposited in the bank before march 27, 2003but it

appears from the bank passbook that cheques worth Rs.49,000 only had been credited

before March 31, 2003.

b. b. A cheque of Rs.2,000 debited by the bank on March 02, 2003, was not issued by the

firm.

c. c. Cheques for Rs.42,000 were issued during the month of March, out of which two

cheques for Rs.7,650 were presented on April 03, 2003 the remaining having been paid in

March itself.

d. d. The cashier of the firm misappropriated a sum of Rs.3,500 by passing a fictitious

entry as cash deposited in bank on March 02, 2003.

e. e. The passbook showed that the bank had collected Rs.650 as an interest on

Government securities.

f. f. The bank had charged interest Rs.170 and bank charges of Rs.50. there was no entry

in the cash book for the charges, interest etc.

g. g. It was found that the total of the credit side of the bank column in the cashbook on

March 24, 2003 was Rs.360 short.

h. h. An amount of Rs.2,500 was debited by bank for payment of premium as per standing

instructions.

i. i. A bill for Rs.1,500 was retired by SBI under a rebate of Rs.75 but full amount of the

bill was credited in bank column of the cashbook.

Prepare a Bank Reconciliation Statement as on March 31, 2003.

(20 marks) <Answer>

10. Prepare Balance sheet from the following details as on March 31, 2003.

Fixed Assets Rs.5,00,000 ; Working capital Rs.3,00,000 ; Current ratio is 2:1 ; Gross profit

ratio is 25%, Debtors velocity 1.5 months ; Creditors velocity 2 months ; Fixed assets to

turnover ratio 4:1 ; Stock velocity ratio 2 months ; Net profit ratio is 5% ; Capital gearing ratio

is 1:1 ; and Reserves to profits is 2/3.

(20 marks) <Answer>

11. A of Agra consigned goods to C of Chennai for sale at invoice price or over. Goods costing

Rs.30,000 were consigned to C which were invoiced at cost plus 25% profit C was entitled to a

commission of 3% on invoice price and 20% of any surplus price realized.

A paid Rs.1,875 for freight and Rs.625 for insurance. C has paid Rs.1,000 as landing charges

and Rs.2,500 for selling and godown expenses on receiving the consignment. He send an

account sales showing that 4/5 of the consignment was sold at Rs.37,500. C sent a bank draft

for the amount due from him.

Show the necessary ledger accounts in the books of A with working notes.

(20 marks) <Answer>

END OF QUESTION PAPER

Suggested Answers

Accounting (3702): January 2004

Section A

1. Three-column cash Book

Dt Particulars l. Dis. Bank Cash Dt. Particulars l.f Dis. Bank cash

03 f. All 03 Rec.

Jan To balance b/d Jan

1 To capital 500 1 By balance b/d 4000

3 To cash 10000 3 By bank c 5000

3 To sales C 5000 7 By purchases 2500 2000

5 To P’s a/c 4000 10 By B’s a/c 100 2750

11 To cash 250 3000 12 By commission 200

16 To bank 5000 15 By drawings 1000

20 To A’s a/c C 1000 16 By bank c 5000

25 To cash 2000 18 By rent 1000

25 To dividends C 2000 20 By cash c 1000

25 20 By stationery 1000

500 25 By bank c 2000

31 By balance c/d 250 5300

250 12500 20500 100 12500 20500

b. Petty Cash Book

The Petty Cash Book is nothing but a separate Cash Book, which records small payments on accounts

of expenses like carriage, cartage, postage, refreshment to customers etc. If all these small transactions are

recorded in the Cash Book, it will consume a lot of time and will be inconvenient for the posting clerk. Therefore,

petty cashier is appointed by the business to make payment of all such petty expenses in the Petty Cash Book.

The Petty Cashier works under the supervision of the Chief Cashier. The Petty Cash Book is usually maintained

on the basis of Imprest system. In this system, the Chief Cashier advances a fixed amount to the Petty Cashier at

the beginning of the period to meet petty cash expenses. He submits his accounts at the end of the period and the

Chief Cashier after examining his accounts gives him a fresh advance equivalent to the amount spent by him

during the period. The amount so advanced to him is termed as “Imprest”.

The amounts received by the petty cashier from the main cashier are entered on the debit side

of Petty Cash Book and payments on the credit side of the Petty Cash Book. Every small

payment is entered twice on the credit side; one in the total payments column and second in

one of the analytical amount columns. The periodic total of each column is posted to the

expenses accounts concerned, while the total payments column serves to find out the balance

of cash with the petty cashier. The Petty Cash Book contains a number of analytical columns

for grouping the various expenses under a few classifications, which facilitates the subsequent

posting into general ledger.

c. Welsch and Anthony have distinguished between book-keeping and accountancy as follows”

some people confuse book-keeper with an accountant and bookkeeping with accounting. In

effect they confuse one of the minor parts with the whole of accounting. It tantamount to

comparing the simple administration of first aid with the complex practice of medicine by the

physician. Book-keeping is the routine and clericals side of accounting and requires only

minimal knowledge of the accounting model. A book-keeper records the repetitive and the

uncomplicated transactions in most businesses and may maintain the simple records of very

small business. In contrast , the accountant is professional, competent in the design of

information design of information systems, analysis of complex economic events,

interpretative and analytical processes, reporting, financial advising, and management

consulting’.

Book-keeping is the science of recording in books of accounts all those business transactions

that result in transfer of money or money’s worth. Book-keeping is recording of the financial

transactions of a business in a systematic manner so that information can be obtained any

time .On the other hand Accounting is concerned with the design of the system of records, the

preparation of reports based on the accounting records, it also involves interpretation of the

data and communicating the results to the person who are interested in information. The work

of an accountant involves directing and reviewing the work of the book-keepers, therefore the

accountants must possess higher knowledge as compared to the book-keepers

< TOP >

2. a. Journal Entries in the books of P.

Date Particulars Lf Dr.Rs Cr.Rs

1/1/03 Bills receivable a/c……………….Dr 10,000

To Q’s a/c 10,000

[Being bill accepted by Q]

,, R’s a/c……………………………Dr 10,000

To Bills receivable a/c 10,000

[Being bill endorsed to his creditor R]

4/4/03 Q’s a/c…………………………..Dr 10,000

To R’s a/c 10,000

[Being endorsed bill cancelled]

R’s a/c………………………….Dr 10,000

,, To Bank a/c 10,000

[Being amount paid to R]

Bills receivable a/c…………….Dr 10,450

,, To Q’s a/c 10,000

To Interest a/c 450

[Being new bill accepted by Q in lieu of

cancellation of bill together with 18%

7/7/03 interest] 10,450

Bank a/c……………………….Dr 10,450.

To Bills Receivable a/c

[Being the new bill met on the due date]

b. Difference between Bills of exchange and Promissory Note:

Bills of Exchange Promissory Note

It is drawn by the seller. It is drawn by the purchaser

It is an order to make payment It is a promise to make payment

It involves three parties , the It involves two parties , namely, the promiser

drawer , the acceptor and the (or maker) and promise ( or payee)

payee

To be effective, it must be It does not need acceptance

accepted

Drawer and payee can be the same Maker and payee cannot be the same person

person

Acceptor is required to make Drawer or maker is required to make payment

payment on due date . In case of on due date.

default, drawer is liable to pay the

amount to payee.

c. Accommodation Bills may be of three types;

(i) When only the drawer is only accommodated through the bill:

For Example; Mr. Samuel needed some funds. He approached to Mr. Kumar to accept his

bill of Rs. 30,000 on 1-2-2002. Mr. Kumar accommodated Mr. Samuel and accepted the

bill payable after three

months on 2-2-2002. Mr. Samuel got the bill discounted @ 11% p.a. Thus he got Rs.

29,195, as bank charged discount Rs.805. On the due date 2-5-2002 Mr. Samuel paid

Rs.30,000 to Mr. Kumar. Mr. Kumar paid the money to bank in settlement of the bill.

(ii) When both the parties (the drawer and the drawee) are accommodated through a single

bill:

For Example; Bimal and Ashok were in need of funds of Rs.10,000 each. Bimal drew a

bill on Ashok on 1.2.2002.payable after three months for Rs.21,365 which Ashok

accepted. Bimal got the bill discounted on 1.2.2002 @ 14% p.a. The bank charged

discount Rs.1,365 and Bimal got net amount of Rs.20,000 and Bimal paid Rs.10,000 to

Ashok.They have to bear the discount equally. On the due date Bimal paid Ashok

Rs.10,000 plus Rs. 682 i.e., Rs.10,682. Ashok met the bill.

(iii) When both the parties are accommodated through a single book.

Manoj and Saroj were in need of funds. Manoj needs Rs. 20,000 and Saroj Rs. 25,000.

Manoj drew a bill for three months bill of Rs. 20,780 on Saroj on 1.2.2002. On the next

date he got the bill discounted @16%p.a.Thus he got Rs.20,000. Similarly Saroj drew a

three months bill of Rs. 26,950 on Manoj on 1.2.2002. On the next date he also got the bill

discounted @ 16% p.a. Thus he got Rs. 25,000.

On the due date 2.5.2002 the parties had to settle their dues. Manoj had to pay Rs. 20,780 to Saroj

and saroj had to pay Rs. 26,950 to Manoj. In other words, saroj could pay Rs. 6,170 to Manoj.

Thereafter, Saroj paid Rs.20,780 and Manoj paid Rs. 26,950 to bank to settle the liabilities for bill

on the due date

< TOP >

3.

a.

Plant and Machinery Account

Date Particulars Lf Rs Date Particulars Lf Rs

2000 2000

1/1 To bank 300000 31/12 By depreciation 30,000

,, By balance c/d 2,70,000

3,00,000 3,00,000

2001 2001

1/1 To balance b/d 2,70,000 31/12 By depreciation 27,000

,, By balance c/d 2,43,000

2002 2,70,000 2,70,000

1/1 To balance b/d 2002

2,43,000

31/12 By depreciation

24,300

,, By balance c/d

2,43,000 2,18,700

2003 2,43,000

1/1 To balance b/d 2003

2,18,700 36,000

To bank 31/12 By depreciation

60,000 8,700

,, By profit & loss

2,34,000

By balance c/d

2,78,700 2,78,700

2004

2,34,000

1/1 To balance b/d

Working Notes:

Cost of Plant & Machinery on 1st January 2000

Rs.2,18,700 x 100 /90 x 100 /90 = Rs.3,00,000

Amount transferred to Profit & loss account on depreciation charged:

Straight line method for 3 years Rs.90,000

Less: Depreciation under WDV for 3 years 81,300

(30,000 + 27,000 + 24,300) --------

Depreciation to be charged 8,700.

b. Acquisition of fixed asset for the purpose of producing goods and services is in the nature of

Capital Expenditure. These fixed assets are used for many years in the business, as the result

of this, its value decreases with the passage of time. The value of fixed assets used for the

purpose of generating incomes must be recovered in an accounting year to find out the real

profit made by the concern. The portion of cost of fixed asset allocated in one accounting year

is called depreciation In Simple term, Depreciation may be defined as reduction in the value

of assets due to wear and tear. Or it is permanent, gradual and continuing decrease in the book

value of the asset.

According to IASC “depreciation is the allocation of the depreciable amount of an asset over

its estimated useful life. Depreciation for the accounting period is charged to income either

directly or indirectly”.

According to Spicer and Pegler , depreciation may be defined as, “ The measure of

exhaustion of the effective life of an asset from any cause during a given period.”

According to Pickles, “Depreciation is the per meant and continuing diminution in the

quality , quantity or value of an asset.”

From the above definitions, it can be concluded that depreciation is a gradual decrease in the

value of an asset from any cause and does not involve payment of money to any third party, it

is nevertheless an accounting entry in the books. Depreciation is the acquisition cost of an

asset (less the expected salvage value ) spread over the economic life of that asset. The

purpose of charging depreciation over the economic life of the asset is to match the cost of the

asset over the period for which revenue is earned by using the asset. Being an expenditure it is

charged to Profit and loss account

Need for providing depreciation.:

Every business enterprise needs a suitable depreciation policy to depreciate its fixed asset.

Basic objective of providing depreciation is to ascertain the profit or loss correctly, to have a

true and fair view of Balance sheet, but the most important is to provide the necessary amount

for replacing the asset at the end of its useful life. The charging of depreciation is important

because of following reasons;

1. To allocate the depreciable cost of the asset over its estimated useful life.

2. To ascertain the correct profit or loss of the concern for the period.

3. To reveal or present a true and fair financial position in the Balance Sheet.

4. To provide fund for replacement of asset

5. To compute tax liability as depreciation is a chargeable expense of the profit and loss a/c

and thereby save the tax payable on profits.

6. To have an approximately .idea for selling the used asset in the second-hand market.

7. It is useful for determining the product cost for managerial decisions.

c. An account sales is a statement prepared and sent by the consignee giving the details of quality

and quantity of goods sold by him, the gross proceed realized and the balance of amount that is

due to the consignor after deducting the expenses incurred by the consignee on consignment of

goods, commission (ordinary + del-credere) payable to the consignee and the advance if any

paid by the consignee from the gross sale proceeds. This is send to the consignor to enable him

to record the consignee’s expenses; consignee’s commission and the total sales proceed of

goods consigned. The account sales is prepared in the following way

Account sales of 100 cases sold by Sanjay of Surat for the account and at the risk of Ahmed of

Aurangabad.

Particulars Rs

Gross proceed of sales

Less: consignee’s Expenses

Consignee’s Commission

Less: Advance if any

Balance of amount sent by draft/ bill/ cash

E.& O.E Sanjay of Surat

Consignee

< TOP >

4. a. Realisation Account

Particulars Rs Particulars Rs

To sundry assets: By creditors 3,000

Sundry debtors 1,950 By provision for bad 450

Stock 3,000 debts

Furniture 7,500 By cash: 1,350

To cash: Sundry debtors 3,390

Creditors 2,850 Stock 6,750

Realization expenses 90 Furniture

By loss transferred to 180

capital a/cs: P 180

Q 90

15,390 R

15,390

Partner’s Capital Account.

P Q R P Q R

To realization 180 180 90 By balance 7,500 3,000 1,500

To cash 7320 2820 1410 b/d

7500 3,000 1500 7,500 3,000 1,500

Cash Account

Rs Rs

To balance b/d 3,000 By realization 2,940

To realization a/ 11,490 By P’s account 7,320

By Q’s account 2,820

By R’s account 1,410

14,490 14,490

b. Garner Vs Murray’s case.

On the dissolution of the firm, if any of the partner’s capital account is showing a debit

balance, it means that he has to pay that amount to the firm.. But if a partner is adjudicated as

insolvent and owes some money to firm, then the firm can recover such amount from the

private estate of such a partner. The term Insolvent refers to a person who is unable to pay his

debts to the firm. This unpaid amount is loss or deficiency to the firm. The loss arising on

account of insolvency of a partner is a capital loss for the firm and should be borne by the

solvent partner’s in proportion to their capital. Before Garner Vs Murray’s case decision, such

deficiency was considered as ordinary loss, which was shared by the partner’s in their profit

sharing ratio. But the Garner Vs Murray’s case gave the following rules:

The solvent partners has to bring their share of realization loss in cash,

In the absence of any agreement to the contrary, the deficiency of insolvent partner should be

borne by the solvent partners in proportion to their capital as appearing in the balance sheet

before dissolution of firm or the capital amount before debiting the realization loss. While

determining the capital ratios of the partners, a distinction has to be made whether the capitals

of the partners are fixed or fluctuating.

(a) If the capital accounts of the partners are fixed, then deficiency of insolvent partner is to

be borne by the solvent partners in fixed capital ratio before making the adjustments for

accumulated profits or losses, reserves, interest on capital and drawings. All these adjustments

are made in the current account of the partner. For ascertaining the deficiency of the insolvent

partner, the balance of insolvent partner’s current account is transferred to his capital account.

This deficiency of the insolvent partner is apportioned to the current accounts of the solvent

partners in fixed capital ratio. The accounting entry for settling the insolvent partner’s

deficiency is :

Solvent Partner’s Current a/c……………….Dr

To Insolvent Partner’s Capital a/c.

b. If the capital accounts of the partners are fluctuating, then the insolvent partners

deficiency will be borne by the solvent partners in the ratio of the balance of capital

accounts after adjusting the balances appearing in the Balance sheet (such as profit & loss

a/c, general reserve, debit balance of profit & loss a/c etc.) but before adjusting the

realization profit or loss. Realisation loss is not considered because of the Garner Vs

Murray’s case rule i.e. the deficiency of the insolvent partner is to be borne by the solvent

partners in their capital ratio as appears before the dissolution of the firm. The accounting

entry for settling the deficiency of the insolvent partner is :

Solvent Partner’s capital a/c………………..Dr

To Insolvent Partner’s capital a/c.

c. SETTLEMENT OF ACCOUNTS ON DISSOLUTION

Section 48 and 55 of the partnership Act deals with modes or rules for the settlement of

accounts on the dissolution of the firm. The section say that “ in settling the accounts of a

firm after dissolution, the following rules shall subject to the agreement be observed”.

(1) (1) As per section 48(a), Losses, including deficiencies, of capital, shall be paid

first out of profits, next out of capital, and lastly, if necessary , by the partners

individually in the proportion in which they are entitled to share profits

(2) (2) As per section 48(b), the assets of the firm, including any sums of money

contributed by the partners to make up deficiencies of capital, shall be applied in the

following order :

(a) (a) in paying the debts of the firm to third parties.

(ii) (ii) in paying to each partner rate ably, what is due to him from

the firm for advances as distinguished from capital

(iii) (iii) in paying to each partner rate ably what is due to him on

account of capital,

(iv) (iv) the residue, if any shall be divided among the partners in the

proportion in which they were entitled to share profits.

(3) (3) As per section 55 the goodwill shall be included in the assets and may be

sold either separately or along with other property of the firm. A partner may thus

make an agreement with the buyer of the goodwill that he will not carry on any

business similar to that of the firm for a specified period or within specified local

limits. However, such an agreement is valid if the restrictions imposed are reasonable.

In simple words, the amount available from the sale of business asset should be first used for paying

expenses which are incurred for collecting debt and selling the asset, secondly be used for paying

outside liabilities, then partner’s loan if any and lastly the partner’s capital.

Payment of Firm’s Debt and Private Debts.

The assets of the firm are first applied for payment of firm’s debt and surplus, if any, is

paid to the partner’s in proportion to their ratio. In same way, the private property of the

partners is first applied towards the payment of their private debt and surplus, if any, is

handed over to the firm if it needs to pay its debt.

< TOP >

5. a. Rectifying Entries

Date Particulars Lf Dr.Rs Cr.Rs

1. Purchases a/c…………….Dr 500

Sales a/c…………………Dr 500

To Suspense a/c 1,000

[Being rectification of purchases

wrongly entered in sales]

2. Sales a/c…………………..Dr 480

Suspense a/c………………Dr 360

To Old Furniture a/c 840

[Being rectification of sale of furniture

wrongly entered in sales]

3. A’s a/c…………………….Dr 3,475

Discount received a/c…….Dr 19

To B’s a/c 3,475

To Discount allowed a/c 19

[Being rectification of dishonour of

cheque received from A]

Sales return’s a/c…………Dr 450

4. B’s a/c……………………Dr 540

To A’s a/c 450

To Purchases a/c 450

To Suspense a/c 90

[Being A’s sales return entered in

purchased and also to a/c of B]

Repairs a/c…………………Dr 11,690

Suspense a/c……………….Dr

5 To Buildings a/c 270 11,960

[Being11,690 paid as repairs entered in

building a/c as Rs.11,960]

Suspense Account

Rs Rs

To old furniture 360 By purchases 500

To buildings 270 By sales 500

To balance c/d 460 By B’s a/c 90

1,090 1,090

b. When a shipment of goods sold by a manufacturer or wholesale dealer to an agent to be sold by him on

commission basis, on the risk and account of the manufacturer is known as consignment. The person who sends

the goods to the agent to be sold by him on commission basis is called the consignor. The person to whom the goods

are sent for sale on commission basis is called consignee. When the consignment of goods to the consigner it is

termed as outward consignment and when the consignment is to the consignee it is called inward consignment. When

goods are consigned to the agent or the consignee, it cannot be treated as a sale. They will be treated as sales only

when the consignee sells them.

The following points distinguishes consignment from sales:

Consignment and Sale:

Consignment Sale

The legal ownership of goods remains with The legal ownership of goods sold is

the consignor till the goods are sold by the transferred to the purchaser of goods.

consignee. The relationship between seller and buyer

The relationship between consignor and is that of a creditor and debtor.

consignee is that of principal and agent. The expenses incurred after sale of goods

The expenses incurred by the consignee in are borne by the purchaser.

connection with the consignment are Return of goods not possible.

usually borne by the consignor. No account sale is required to be submitted

Return of goods is possible if the goods are by the purchaser to the seller.

not sold by the consignee. The seller has nothing to do with the unsold

The consignee is required to submit goods of the buyer.

account sales to the consignor periodically. The risk attached to the goods sold is

The unsold goods with the consignee will transferred to the purchaser of goods.

be treated as stock of the consignor.

The risk attached to the goods consigned

lies with the consignor till the consignee

sells the goods.

< TOP >

6. a. Provision for Bad Debts Account

Dt Rs Dt Rs

200

1 To bad debts 2,500 1/4/00 By balance b/d 4,500

31/3 To balance c/d 5,000 31/3/01 By profit & loss 3,000

,, 7,500 7,500

200 To bad debts 1,500 1/4/01 By balance b/d 5,000

2 To profit & loss 500

31/3 To balance c/d 3,000

,, 5,000 5,000

Provision for Discount on Debtors Account

Date Rs Date Particulars Rs

2001

31/3 To discount 3,000 1/4/00 By balance b/d 4000

,, allowed 1,900 31/3/01 By profit & loss 900

To balance c/d 4,900 4,900

2002

31/3 1,750 1/4/01 By balance b/d 1,900

,, To discount 1,140 31/3/02 By profit & loss 990

allowed

2,890 2,890

To balance c/d

b. When the shares are issued at a price, which is above the par value of the share, then it is said to be issued at a

premium. According to Section 78 of Companies Act, the amount of share premium received by a company must

be credited to a separate account called as Share Premium Account. The capital account must show only the

nominal value received on the shares.

Share Premium account can be utilized in the following ways:

1. 1. Unissued shares can be issued as fully paid bonus shares.

2. 2. To write-off preliminary expenses.

3. 3. To write-off commission or discount account.

4. 4. To provide for the premium payable on the redemption of preference shares or

debentures of the company

< TOP >

7. a. The term Financial Statement includes two statement –

(1) (1) Income Statement,

(2) (2) Position Statement,

The income statement is nothing but Profit and Loss account that is prepared by the concern

at the end of the accounting period to know the profit earned or loss suffered by the concern in

that specified period. Position statement is the Balance Sheet prepared by the concern to know

its financial position on a specified date. The statement of Retained earning is another name

for Profit and Loss Appropriation account which shows the appropriation /utilization of the

profits of the company. A schedule gives full detail of fixed assets, current assets etc.which are

shown in the balance sheet. Other statement includes Funds Flow Statement and Cash Flow

Statement. Funds flow statement shows the source of fund and application of funds along with

the changes in the working capital for a specified period. Cash flow statement is a statement

prepared to show the inflow and outflow of the cash.

Analysis of Financial Statements is a process of analyzing the relationship between the various

components of financial statement in order to have better understanding of performance of

firm. Critical examination of accounting information provided by the financial statement is

known as Analysis.

Limitations of Financial Statement Analysis

1. 1. The financial statements are historical in nature. Such inferences are not helpful in

forecast and planning for the future.

2. 2. Financial statement analysis should not be considered as judgments or conclusion.

3. 3. As the financial statement analysis depends on financial statements, its reliability also

depends on reliability of financial statement.

4. 4. Different user may give different interpretation from the same financial statement.

5. 5. Changes in the price level reduce the validity of the financial statement analysis.

6. 6. It does not facilitate inter-firm comparison.

Das könnte Ihnen auch gefallen

- Notice To Cease and Desist RedactDokument2 SeitenNotice To Cease and Desist Redactmellowjohnny100% (15)

- Sample Paper For See Acc Xi - 1Dokument6 SeitenSample Paper For See Acc Xi - 1Piyush JNoch keine Bewertungen

- Corporate Accounting - I Semester ExaminationDokument7 SeitenCorporate Accounting - I Semester ExaminationVijay KumarNoch keine Bewertungen

- Bcom NotesDokument91 SeitenBcom NotesJ RajputNoch keine Bewertungen

- Mid Sem 1sem Exam Paper Oct2015Dokument26 SeitenMid Sem 1sem Exam Paper Oct2015angel100% (1)

- CU Leaked Paper Financial Accounting-IDokument5 SeitenCU Leaked Paper Financial Accounting-Idarindainsaan420Noch keine Bewertungen

- Mock-Iv AccountsDokument6 SeitenMock-Iv AccountsAnsh UdainiaNoch keine Bewertungen

- Class 11 Accounts Half Yearly SPDokument9 SeitenClass 11 Accounts Half Yearly SPRakesh AgarwalNoch keine Bewertungen

- Paper II Financial Accounting IIDokument7 SeitenPaper II Financial Accounting IIPoonam JainNoch keine Bewertungen

- Financial Accounting and Cost Management and Management Control Paper MBADokument8 SeitenFinancial Accounting and Cost Management and Management Control Paper MBAPriyank SaxenaNoch keine Bewertungen

- Commerce First YearDokument7 SeitenCommerce First Yearravulapallysona93Noch keine Bewertungen

- Sample Question Paper IN AccountancyDokument7 SeitenSample Question Paper IN AccountancyRahul TyagiNoch keine Bewertungen

- Bcom 3 Sem Corporate Accounting 1 21100518 Mar 2021Dokument5 SeitenBcom 3 Sem Corporate Accounting 1 21100518 Mar 2021abin.com22Noch keine Bewertungen

- Inter May, 2008Dokument4 SeitenInter May, 2008M JEEVARATHNAM NAIDUNoch keine Bewertungen

- Class 11 Final MTSSDokument7 SeitenClass 11 Final MTSSPranshu AgarwalNoch keine Bewertungen

- June, 2004 Q.PDokument4 SeitenJune, 2004 Q.PM JEEVARATHNAM NAIDUNoch keine Bewertungen

- March, 2007 QuestionssDokument4 SeitenMarch, 2007 QuestionssM JEEVARATHNAM NAIDUNoch keine Bewertungen

- SEM III - Advanced Accounting (EM)Dokument4 SeitenSEM III - Advanced Accounting (EM)Abdul MalikNoch keine Bewertungen

- APER-1: Fundamental of Accountancy Page No: 9-100: June 2001, FOA/FoundationDokument92 SeitenAPER-1: Fundamental of Accountancy Page No: 9-100: June 2001, FOA/FoundationtheabhishekdahalNoch keine Bewertungen

- MBA I Semester Supplementary Examinations December/January 2018/19Dokument2 SeitenMBA I Semester Supplementary Examinations December/January 2018/19Chandra SekharNoch keine Bewertungen

- Jorpati, Kathmandu Pre-Board Examination-2077 Subject: Principles of Accounting II Grade: XII Time: 3 Hrs FM: 100 PM: 32Dokument3 SeitenJorpati, Kathmandu Pre-Board Examination-2077 Subject: Principles of Accounting II Grade: XII Time: 3 Hrs FM: 100 PM: 32Abin DhakalNoch keine Bewertungen

- 1 Accounting Equation UniqueDokument3 Seiten1 Accounting Equation UniqueSohan AgrawalNoch keine Bewertungen

- Fundamentals of Accounting 2019Dokument4 SeitenFundamentals of Accounting 2019sreehari dineshNoch keine Bewertungen

- Faculty of Commerce: Code No. 10001Dokument4 SeitenFaculty of Commerce: Code No. 10001Madasu BalnarsimhaNoch keine Bewertungen

- Ednovate CAF Accounts UT 1 QDokument3 SeitenEdnovate CAF Accounts UT 1 QROCKYNoch keine Bewertungen

- Fa 66Dokument7 SeitenFa 66shreya yadavNoch keine Bewertungen

- 12 2006 Accountancy 2Dokument5 Seiten12 2006 Accountancy 2Akash TamuliNoch keine Bewertungen

- AccountancyDokument8 SeitenAccountancypraveenpv7Noch keine Bewertungen

- 1bba FOA Prep QPDokument2 Seiten1bba FOA Prep QPSuhail AhmedNoch keine Bewertungen

- Faculty of Commerce & Business Management 6234/11Dokument28 SeitenFaculty of Commerce & Business Management 6234/11Vishu DcpNoch keine Bewertungen

- XI Acc 3Dokument4 SeitenXI Acc 3Bhumika ShaldarNoch keine Bewertungen

- 11 QP Final (2021-22)Dokument4 Seiten11 QP Final (2021-22)Flick OPNoch keine Bewertungen

- Co 2101Dokument3 SeitenCo 2101PRIYA LAKSHMANNoch keine Bewertungen

- 12 2006 Accountancy 1Dokument5 Seiten12 2006 Accountancy 1Akash TamuliNoch keine Bewertungen

- Question BankDokument21 SeitenQuestion BankIan ChanNoch keine Bewertungen

- Accounts Mock - 29178435Dokument6 SeitenAccounts Mock - 29178435mopibam555Noch keine Bewertungen

- Dissolution of Partnership Additional Questions 50 To 53Dokument6 SeitenDissolution of Partnership Additional Questions 50 To 53Ayan NaikNoch keine Bewertungen

- MQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Dokument5 SeitenMQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Rohit SoodNoch keine Bewertungen

- June, 2004 Q.P JRDokument4 SeitenJune, 2004 Q.P JRM JEEVARATHNAM NAIDUNoch keine Bewertungen

- Financial Accounting Punjab University: Question Paper 2010Dokument4 SeitenFinancial Accounting Punjab University: Question Paper 2010ZeeShan IqbalNoch keine Bewertungen

- Class XI Practice PaperDokument4 SeitenClass XI Practice PaperAyush MathiyanNoch keine Bewertungen

- Attempt Any Four Questions. All Questions Carry Equal MarksDokument3 SeitenAttempt Any Four Questions. All Questions Carry Equal MarksVishwas Srivastava 371Noch keine Bewertungen

- Topic Wise Test Accounting From Incomplete RecordsDokument4 SeitenTopic Wise Test Accounting From Incomplete RecordsChinmay GokhaleNoch keine Bewertungen

- Karnataka Ist PUC Accountcancy Sample Question Paper 4 PDFDokument4 SeitenKarnataka Ist PUC Accountcancy Sample Question Paper 4 PDFNeha BaligaNoch keine Bewertungen

- LHU8Q Olopr DaisyAcountXIDokument35 SeitenLHU8Q Olopr DaisyAcountXIDido MuczNoch keine Bewertungen

- Paper 1Dokument19 SeitenPaper 1GianNoch keine Bewertungen

- MGUSDE 2265: B.B.A. Degree Examination, May/June 2005Dokument99 SeitenMGUSDE 2265: B.B.A. Degree Examination, May/June 2005Johanna LiNoch keine Bewertungen

- Xi Accounting Set 4Dokument8 SeitenXi Accounting Set 4aashirwad2076Noch keine Bewertungen

- FND Partnership QuestionDokument3 SeitenFND Partnership QuestionShweta BhadauriaNoch keine Bewertungen

- Inter-II QP 2008Dokument4 SeitenInter-II QP 2008M JEEVARATHNAM NAIDUNoch keine Bewertungen

- 5627Dokument8 Seiten5627MS 7Noch keine Bewertungen

- Accounts Paper Class 11 Sem 1 2019Dokument4 SeitenAccounts Paper Class 11 Sem 1 2019samarthj.9390Noch keine Bewertungen

- 11-Acc PP1Dokument11 Seiten11-Acc PP1adityatiwari122006Noch keine Bewertungen

- Accountancy - 2020 - Set - 8Dokument34 SeitenAccountancy - 2020 - Set - 8Saurav PandeyNoch keine Bewertungen

- Accounting VacationDokument28 SeitenAccounting VacationPro NdebeleNoch keine Bewertungen

- AC PaperDokument2 SeitenAC Paperpiyush kumarNoch keine Bewertungen

- AFH Important QuestionDokument6 SeitenAFH Important Questionmanassadashiv013Noch keine Bewertungen

- B.SC & Bca Degree Examination: Fourth SemesterDokument11 SeitenB.SC & Bca Degree Examination: Fourth SemesterStudents Xerox ChidambaramNoch keine Bewertungen

- 1e710c6f-4b3e-4b03-943f-11430d867f0e-Dokument30 Seiten1e710c6f-4b3e-4b03-943f-11430d867f0e-angela antoniaNoch keine Bewertungen

- Dbb1202 - Financial AccountingDokument5 SeitenDbb1202 - Financial AccountingVansh JainNoch keine Bewertungen

- When Money Destroys Nations - How Hyperinflation Ruined Zimbabwe, How Ordinary People Survived, and Warnings For Nations That Print Money (PDFDrive)Dokument190 SeitenWhen Money Destroys Nations - How Hyperinflation Ruined Zimbabwe, How Ordinary People Survived, and Warnings For Nations That Print Money (PDFDrive)Délcio CostaNoch keine Bewertungen

- Clarical New ClarificationDokument2 SeitenClarical New Clarificationmevrick_guyNoch keine Bewertungen

- Bahasa Inggeris Peralihan Akhir Tahun Tahun Paper 2 2014Dokument5 SeitenBahasa Inggeris Peralihan Akhir Tahun Tahun Paper 2 2014Nazurah Eryna100% (2)

- User Manual Oracle FLEXCUBE Direct Banking Retail InquiriesDokument39 SeitenUser Manual Oracle FLEXCUBE Direct Banking Retail Inquiriesasafoabe4065Noch keine Bewertungen

- AGENCY, Doctrine of Apparent Authority GR 227990Dokument2 SeitenAGENCY, Doctrine of Apparent Authority GR 227990Gerard LeeNoch keine Bewertungen

- Deposit SlipDokument2 SeitenDeposit SlipLalit PardasaniNoch keine Bewertungen

- On Buy Back of ShareDokument30 SeitenOn Buy Back of Shareranjay260Noch keine Bewertungen

- Wire TransferDokument20 SeitenWire TransfernomaanahmadshahNoch keine Bewertungen

- Defining General Options AddendumDokument16 SeitenDefining General Options AddendumchinnaNoch keine Bewertungen

- Hapter EST ANK: Ultiple Choice QuestionsDokument19 SeitenHapter EST ANK: Ultiple Choice QuestionsMalinga LungaNoch keine Bewertungen

- Order FormDokument1 SeiteOrder FormFirasNoch keine Bewertungen

- Comparison of Shariah Concepts in Am Met Lifetakaful and Other Takaful SchemesDokument4 SeitenComparison of Shariah Concepts in Am Met Lifetakaful and Other Takaful SchemesIman JasminNoch keine Bewertungen

- Events HappeningsDokument18 SeitenEvents HappeningsTikuk LeeNoch keine Bewertungen

- Priya KapilDokument93 SeitenPriya KapilaamritaaNoch keine Bewertungen

- Honda FinanceDokument90 SeitenHonda FinanceHarish MauryaNoch keine Bewertungen

- Why You Must Become A Channel Partner For Payupaisa?: Redefining Payments, Simplifying LivesDokument14 SeitenWhy You Must Become A Channel Partner For Payupaisa?: Redefining Payments, Simplifying LivesashiNoch keine Bewertungen

- BDO Vs RepublicDokument2 SeitenBDO Vs RepublicAngel Phyllis PriasNoch keine Bewertungen

- Hindu Marriage Registration-User Manual For Online Citizen - Ver 1.0Dokument10 SeitenHindu Marriage Registration-User Manual For Online Citizen - Ver 1.0Pudeti RaghusreenivasNoch keine Bewertungen

- 2 - Globalization of World EconomicsDokument12 Seiten2 - Globalization of World EconomicsMargie Musngi ValerioNoch keine Bewertungen

- CG Alias - AnswDokument2 SeitenCG Alias - AnswMohamad YusofNoch keine Bewertungen

- Joshua P. Salce Bsabm Case Digest 6Dokument2 SeitenJoshua P. Salce Bsabm Case Digest 6Joshua P. SalceNoch keine Bewertungen

- Microfinancing: Rossane TanDokument35 SeitenMicrofinancing: Rossane TanJacob CarniceNoch keine Bewertungen

- G.R. No. 159709Dokument6 SeitenG.R. No. 159709Delsie FalculanNoch keine Bewertungen

- Nasik To ThaneDokument1 SeiteNasik To ThaneAlok ThakkarNoch keine Bewertungen

- GL Account Balance QueryDokument5 SeitenGL Account Balance QueryKhalil ShafeekNoch keine Bewertungen

- Sale, Lease and Credit Agreements 2009Dokument3 SeitenSale, Lease and Credit Agreements 2009qanaqNoch keine Bewertungen

- RBS & Faysal BankDokument13 SeitenRBS & Faysal BankOmer MirzaNoch keine Bewertungen

- Avania Inn of Santa HotelDokument1 SeiteAvania Inn of Santa Hoteler_atunugoraiNoch keine Bewertungen

- A Joint Development Between S R Jindal Group & Prestige GroupDokument2 SeitenA Joint Development Between S R Jindal Group & Prestige GroupSampath Kumar RNoch keine Bewertungen