Beruflich Dokumente

Kultur Dokumente

Share Tips Expert Commodity Report 11042011

Hochgeladen von

Hardeep YadavOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Share Tips Expert Commodity Report 11042011

Hochgeladen von

Hardeep YadavCopyright:

Verfügbare Formate

’

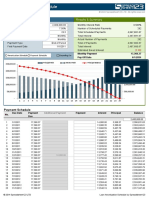

Daily Commodity Market Update as on Monday, April 11, 2011

PRECIOUS METALS COMPLEX

NAME OPEN HIGH LOW CLOSE % CNG

MCX

GOLD 21355 21459 21345 21412 0.32 Bullion rose climbed to a new record level in global

SILVER 59421 60888 59421 60483 1.65 markets as concerns over accelerating inflation, financial

SPOT $ turmoil in Europe and fighting in Libya bolstered their

GOLD 1474.7 1476.35 1471.2 1473.85 -0.06 demand as a safe haven.

SILVER 40.98 41.59 40.92 41.48 1.57

PLATINUM 1810.5 1806.5 1803.75 1808.74 0.14

ENERGY COMPLEX

NAME OPEN HIGH LOW CLOSE % CNG

MCX

Crude oil ended higher as a decline in the dollar spurred a

CRUDE 4974 5098 4974 5030 1.31 broad rally in commodities. Fears of prolonged supply

N.GAS 178.9 179 176.4 177.9 -0.67 outages in Libya persisted as fighting raged in the North

African oil producer. Natural gas continued their slide as

SPOT $ strong production is expected to overwhelm tepid spring

demand.

CRUDE 110.32 113.18 110.11 112.79 2.238941

BASEMETAL COMPLEX

NAME OPEN HIGH LOW CLOSE % CNG

MCX

COPPER 440 3

440.3 445 15

445.15 439 55

439.55 443 15

443.15 0 71

0.71 Base metals rose as reports signaling continued economic

ZINC 111.15 115.5 111.15 113.4 2.07 expansion fed speculation global growth will sustain

NICKEL 1220 1246.5 1217.6 1233.5 1.24 demand for industrial metals.

LEAD 127.8 135.35 127.65 131.85 3.15

ALUMINIUM 119.2 122 119.15 120 0.71

LME LME STOCK

COPPER 9900 9930 9885 9899.75 0.05 COPPER 1800 444175

ZINC 2520 2545 2515 2528 0.12 ZINC 1150 735975

NICKEL 27550 2717 27550 27800 1 NICKEL -528 121224

LEAD 2870 2875 2845 2860 0.32 LEAD -575 277550

ALUMINIUM 2710 2875 2705 2714.75 0.18 ALUMINIUM -2700 4581775

GLOBAL MARKETS UPDATE

SENSEX NIFTY NASDAQ S&P NYSE DOW JON NIKKEI SHICOM KOREA HKFE $ INDEX

19382.91 5805.4 2321.18 1328.17 8483.94 12380.05 9715.34 3053.24 2122.47 24419.13 74.92

-0.34 -0.74 -0.5 -0.4 -0.06 -0.24 -0.54 0.82 -0.26 0.09 -0.06

Strictly for private circulation www.sharetipsexpert.com Page No. 1

OPEN

21355

HIGH

21459

FUTURE

LOW

21345

CLOSE

21412

% CNG

0.32

VOLUME

X GOLD F

3721

OI

10878

RE CNG

68

INTRADAY LEVELS

MCX

Gold rose as a weaker dollar, the prospect of a U.S. government shutdown and inflation worries

lift d precious

lifted i metals

t l iin a b

broad

d commodities

diti rally.

ll G Gold

ld was sett ffor its

it biggest

bi t weekly

kl gain

i in

i four

f PP

P.P. 21405

months, drawing support from renewed euro zone sovereign debt fears amid Portugal's financial SUP 1 RES 1

crisis and inflation jitters as crude oil and corn hit new highs this week. With the expected future

21352 21466

inflation being higher in this low interest rate environment, investors are more inclined to have some

contributions to commodities as an inflation hedge. Main buyer India, which is the midst of the busy SUP 2 RES 2

wedding season, was on the sidelines after prices surged to a record.Now support for the gold MCX 21291 21519

is seen at 21352 and below could see a test of 21291. Resistance is now likely to be seen at 21466, SUP 3 RES 3

a move above could see prices testing 21519.

21238 21580

OPEN

59421

TURE

HIGH

60888

LOW

59421

LVER FUT

CLOSE

60483

% CNG

1.65

VOLUME

16707

OI

16136

MCX SIL

RE CNG

999

INTRADAY LEVELS

Silver continued its relentless record-breaking journey on the strength of hectic speculative trading

P.P. 60264

and encouraging global cues. Silver prices were also got support as a surge in oil and other

commodity prices threatens to bolster already rising inflation. The gold-to-silver ratio fell to a 28- SUP 1 RES 1

year low near 36 on Friday. One would expect silver to outperform in this environment because it 59640 61107

bears a higher

g risk than ggold on a volatility

y basis. IShares Silver Trust said its holdings

g hit another SUP 2 RES 2

record at 11,242.89 tonnes by April 8 from 11,192.80 tonnes on April 7. Now support for the silver is

58797 61731

seen at 59640 and below could see a test of 58797. Resistance is now likely to be seen at 61107, a

move above could see prices testing 61731. SUP 3 RES 3

58173 62574

Strictly for private circulation www.sharetipsexpert.com Page No. 2

OPEN

4974

HIGH

X CRUDE FUTURE

E

5098

LOW

4974

CLOSE

5030

% CNG

1.31

VOLUME

12221

OI

17311

RE CNG

66

INTRADAY LEVELS

Crude oil ended higher as a decline in the dollar spurred a broad rally in commodities. Fears of

MCX

PP

P.P. 5034

prolonged supply outages in Libya persisted as fighting raged in the North African oil producer.

Worries about possible supply cuts in the wider Middle East were unabated with protests flaring SUP 1 RES 1

across the Arab world. Worries over OPEC supplies offset demand worries exacerbated by a 7.4- 4970 5094

magnitude earthquake struck Japan, which is recovering from last month's devastating quake and SUP 2 RES 2

tsunami that crippled a nuclear power plant and damaged some refineries. Now support for the

4910 5158

crude is seen at 4970 and below could see a test of 4910. Resistance is now likely to be seen at

5094, a move above could see prices testing 5158. SUP 3 RES 3

4846 5218

OPEN

440.3

TURE

HIGH

445.15

LOW

439.55

PPER FUT

CLOSE

443.15

% CNG

0.71

VOLUME

10483

OI

17931

MCX COP

RE CNG

3.15

INTRADAY LEVELS

Copper ended up as the dollar weakened and investor demand for the metal increased with inflation

P.P. 442.6

fears mounting. Copper scrap arrivals into China are likely to rise in late April and May after

importers placed more spot orders in the past month as domestic stocks fell. But a big 4.8 percent SUP 1 RES 1

withdrawal in copper inventories in warehouses monitored by the Shanghai Futures Exchange 440.1 445.7

pointed to healthier demand p

p prospects

p into the seasonally

y better second q quarter. Copper

pp has SUP 2 RES 2

touched a low of Rs 439.55 a kg after opening at Rs 440.3, and last traded at Rs443.15.For today

437.0 448.2

market is looking for the support at 440.1, a break below could see a test of 437 and where as

resistance is now likely to be seen at 445.7, a move above could see prices testing 448.2. SUP 3 RES 3

434.5 451.3

Strictly for private circulation www.sharetipsexpert.com Page No. 3

OPEN

111.15

HIGH

115.5

FUTURE

LOW

111.15

CLOSE

113.4

% CNG

2.07

VOLUME

CX ZINC F

5394

OI

7040

RE CNG

2.35

INTRADAY LEVELS

Zinc climbed on optimism

p global

g economic growth

g will sustain demand for industrial metals.

PP

P.P. 113

113.4

4

MC

Zinc shortages predicted for around the middle of the decade due to mine closures are likely

to be less acute than feared as miners rush to bring new projects on-stream to benefit from SUP 1 RES 1

soaring prices for co-product silver. Zinc yesterday we have seen that market has moved 111.2 115.6

2.07%. Market has opened at 111.15 & made a low of 111.15 versus the day high of 115.5. SUP 2 RES 2

The total volume for the day was at 5394 lots and the open interest was at 7040.Now support 109.0 117.7

for the zinc is seen at 111.2 and below could see a test of 109. Resistance is now likely to be

SUP 3 RES 3

seen at 115.6, a move above could see prices testing 117.7.

106.9 119.9

OPEN

1220

TURE

HIGH

1246.5

LOW

1217.6

CKEL FUT

CLOSE

1233.5

% CNG

1.24

VOLUME

6489

OI

7281

MCX NIC

RE CNG

15.3

INTRADAY LEVELS

Nickel yesterday traded with the positive node and settled 1.24% up at 1233.5 supported by a

P.P. 1233

firming trend in the global markets amid increased offtake by alloy-makers. For a period of one week

the prices are expected to register decent results for its investors. Some support had been seen SUP 1 RES 1

from the LME stock also which came down by -528mt, the total stock at LME is now at 121224mt. 1219 1247

Nickel has touched a low of Rs 1217.6 a kg g after opening

p g at Rs.1220,, and last traded at Rs SUP 2 RES 2

1233.5.For today market is looking for the support at 1218.6, a break below could see a test of

1204 1261

1203.6 and where as resistance is now likely to be seen at 1247.5, a move above could see prices

testing 1261.4. SUP 3 RES 3

1190 1276

Strictly for private circulation www.sharetipsexpert.com Page No. 4

URE

OPEN

119.2

HIGH

ALUMINIUM FUTU

122

LOW

119.15

CLOSE

120

% CNG

0.71

VOLUME

1275

OI

1957

RE CNG

0.85

INTRADAY LEVELS

Russia exported 533,300 metric tons of aluminum in January-February, 4.9% more than in the

MCX A

PP

P.P. 120

120.4

4

corresponding period last year, the federal customs service reported. Aluminium yesterday traded

with the positive node and settled 0.71% up at 120. Some support had been seen from the LME SUP 1 RES 1

stock also which came down by -2700mt, the total stock at LME is now at 4581775mt. In yesterday's 118.8 121.6

trading session aluminium has touched the low of 119.15 after opening at 119.2, and finally settled SUP 2 RES 2

at 120. For today's session market is looking to take support at 118.8, a break below could see a

117.5 123.2

test of 117.5 and where as resistance is now likely to be seen at 121.6, a move above could see

prices testing 123.2. SUP 3 RES 3

115.9 124.5

OPEN

UTURE

178.9

HIGH

179

LOW

176.4

T.GAS FU

CLOSE

177.9

% CNG

-0.67

VOLUME

2127

OI

15646

RE CNG

MCX NAT

-1.2

INTRADAY LEVELS

Natural gas continued their slide as strong production is expected to overwhelm tepid spring

demand. Temperatures are expected to trend warmer than normal through much of the eastern two- P.P. 177.8

thirds of the U.S. into early next week with mostly average seasonal weather thereafter, likely

leaving little demand for heating or cooling. With the arrival of spring's dip in weather-driven gas

SUP 1 RES 1

needs, the market has turned its attention to the robust North American production that is widely 176.5 179.1

M

expected to quickly replenish U.S. inventories. The number of rigs drilling for natural gas in the U.S. SUP 2 RES 2

fell by two this week to 889, the first decline in three weeks. Natural Gas yesterday we have seen 175.2 180.4

that market has moved -0.67%. Market has opened at 178.9 & made a low of 176.4 versus the day

SUP 3 RES 3

high of 179. The total volume for the day was at 2127 lots and the open interest was at 15646.Now

support for the Natural Gas is seen at 176.5 and below could see a test of 175.2. Resistance is now 173.9 181.7

Strictly for private circulation www.sharetipsexpert.com Page No. 5

ACTIVE SPREAD UPDATE

DAILY SPREAD IN GOLD - MCX DAILY SPREAD IN SILVER - MCX

MONTH RATE JUNE AUG OCT MONTH RATE MAY JULY SEPT

JUNE 21412 300 630 MAY 60483 961 1899

AUG 21712 330 JULY 61444 938

OCT 22042 SEPT 62382

Spread between Gold JUN & AUG contracts yesterday Spread between Silver MAY & JUL contracts yesterday

ended at 300, we have seen yesterday that the gold ended at 961, we have seen yesterday that the silver

market had traded with a positive node and settled 0.32% market had traded with a positive node and settled

up. Spread yesterday traded in the range of 293 - 304. 1.65% up. Spread yesterday traded in the range of 862 -

1177.

DAILY SPREAD IN CRUDE - MCX DAILY SPREAD IN COPPER - MCX

MONTH RATE APRIL MAY JUNE MONTH RATE APRIL JUNE

APRIL 5030 57 106 APRIL 443.15 6.1

MAY 5087 49 JUNE 449.25

JUNE 5136

Spread between crude MAR & APR contracts yesterday Spread between copper APR & JUN contracts yesterday

MARKET

ended at 57, we have seen yesterday that the crude ended at 6.1, we have seen yesterday that the copper

market had traded with a positive node and settled 1.31% market had traded with a positive node and settled

up. Spread yesterday traded in the range of 57 - 125. 0.71% up. Spread yesterday traded in the range of 5.95 -

6.2.

DAILY SPREAD IN ZINC - MCX DAILY SPREAD IN NICKEL - MCX

SPREAD M

MONTH RATE APRIL MAY MONTH RATE APRIL MAY

APRIL 113.4 1.2 APRIL 1233.5 8.1

MAY 114.6 MAY 1241.6

Spread between zinc APR & MAY contracts yesterday Spread between nickel APR & MAY contracts yesterday

ended at 1.2, we have seen yesterday that the zinc ended at 8.10, we have seen yesterday that the nickel

market had traded with a positive node and settled 2.07% market had traded with a positive node and settled

up. Spread yesterday traded in the range of 1 - 1.3. 1.24% up. Spread yesterday traded in the range of 7.50 -

8.4.

S

DAILY SPREAD IN NAT. GAS - MCX DAILY SPREAD IN MENTHOL - MCX

MONTH RATE APRIL MAY MONTH RATE APRIL MAY

APRIL 177.9 4.8 APRIL 1047.1 -58.8

MAY 182.7 MAY 988.3

Spread between natural gas APR & MAY contracts Spread between menthol oil APR & MAY contracts

yesterday ended at 4.80, we have seen yesterday that the yesterday ended at -58.80, we have seen yesterday that

natural gas market had traded with a negative node and the menthol oil market had traded with a positive node

settled -0.67% down. Spread yesterday traded in the and settled 0.32% up. Spread yesterday traded in the

range of 4.7 - 5. range of -58.8 to -57.4.

Strictly for private circulation www.sharetipsexpert.com Page No. 6

DAY TIME CURRENCY DATA Forecast Previous

AL

12:15pm EUR French Industrial Production m/m 0.005 0.01

ONOMICA

1:30pm EUR Italian Industrial Production m/m 0.014 -0.015

2:45pm USD FOMC Member Dudley Speaks 0 0

DATA

8:30pm USD FOMC Member Evans Speaks 0 0

9:00pm EUR Buba President Weber Speaks 0 0

9:45pm USD FOMC Member Yellen Speaks 0 0

Mon 0 0 0 0 0

0 0 0 0 0

ECO

0 0 0 0 0

0 0 0 0 0

0 0 0 0 0

0 0 0 0 0

0 0 0 0 0

ANRPC members, representing 92% of global rubber production, back in February forecast output will reach 9.7

million tons. Association of production of natural rubber (ANRPC) estimates the global rubber output in 2011 will

reach 10.06 million tons, higher than expected 9.7 million tons brought before a do. Trong announced recently,

ANRPC said total global rubber output this year will be higher than 6.2% compared to 9.47 million tonnes the

previous season. Source countries increased by expanding the area of cultivation, plus more capacity for latex,

approximately 43 kg per hectare. ANRPC members, representing 92% of global rubber production, back in February

forecast output will reach 9.7 million tons. Rubber production in Thailand, accounting for 34% of total global

production, forecast at 3.43 million tons, 5.5% higher than last year, thanks to the area reached 110,000 hectares.

ANRPC members include Thailand, Indonesia, Malaysia, Cambodia, China, India, Ivory Coast, Philippines, Singapore,

Sri Lanka and Vietnam. The members account for 92% of total exports and 48% of total world demand for rubber.

SE

Natural rubber prices are now down 12% compared with a record of over 6 per kg in February due to economic

U CAN US

worries by escalating violence in the Middle East and natural disasters in Japan.

Japan

Expecting bumper wheat production in most states, government agencies are targeting procurement of 26.3 million

tonnes (mt) of the foodgrain against the 22.5 mt collected last year. Senior Food Corporation of India (FCI) officials

said the early comparative figures may vary due to various reasons but they expect to achieve the target

comfortably. Of the 26.3 mt, a substantial 21.2 mt is estimated to be lifted from Punjab (10.7 mt), Haryana (6.5 mt)

EWS YOU

and Uttar Pradesh (4 mt). Punjab and Haryana, which contribute close to 70 per cent to the national pool of wheat,

are likely to increase their contribution this year. Gujarat and Madhya Pradesh were the first to start the process by

March-end followed by Uttar Pradesh and Haryana. In Punjab, wheat procurement was supposed to start on April 1

but there will be a delay following late arrivals. Over the past week, agencies have purchased 434,000 tonnes of

wheat from centres across India under the decentralised procurement scheme, against the 763,000 tonnes in the

corresponding period last year. Punjab, which had contributed 10.2 mt to the central pool last year, is expected to

make an additional contribution of 500,000 tonnes. Haryana is expected to add 200,000 tonnes more to the national

pool over last year’s 6.3 million tonnes to 6.5 million tonnes.

NE

Indian federal bond yields edged lower in afternoon trade on Friday as traders bet on bullish cut-offs at the auction of

the new 10-year and 7-year papers to be auctioned as a part of the 120-billion-rupee bond sale. The government is

selling 120 billion rupees ($2.7 billion) of bonds on Friday, kicking off its borrowing programme for the 2011/12 fiscal

year. India may sell the new 10-year bond maturing in 2021 at 7.85 percent, the 7-year paper at 7.87 percent and

the 8.30 percent 2040 bonds at 8.38 percent. However, some traders said they are now expecting the 10-year paper

to be sold at around 7.82

7.82-7.83

7.83 percent levels. the yield on the most-actively

most actively traded 8.13 percent, 2022 bond was

down 1 basis point at 8.04 percent while the second-most traded 8.08 percent, 2022 bond was steady at 8.05

percent. * The less liquid 7.80 percent 2020 bond, the previous benchmark, was down 1 basis point at 7.96 percent.

Strictly for private circulation www.sharetipsexpert.com Page No. 3

Contact us

CARROTINVESTMENT

Plot no 36, Sector 23, Gurgaon, Haryana (INDIA)

Work Tel#: Fax No:

Mobile Tel#:

E-Mail: carrotinvestment@gmail.com URL: http://www.sharetipsexpert.com

Disclaimer

The report and calls made herein are for general information purpose and report contains only the viewpoints. We make no

representation or warranty regarding the correctness, accuracy or completeness of any information, and are not responsible for

errors of any kind even though we have taken utmost care in obtaining the information from sources which are believed to be

reliable, which are publicly available. The information contained herein is strictly confidential and is meant for the intended

recipients. Any alteration, transmission, photocopied distribution in part or in whole or reproduction of any form of the

information without prior consent of SHARETIPSEXPERT GROUP is prohibited. The information and data are derived from the

source that are deemed & believed to be reliable and the calls are based on the theory of Technical Analysis. Neither the

company nor itsit employees

l are responsible

ibl ffor the

th ttrading

di P

Profit(es)

fit( ) & loss(es)

l ( ) arising

i i due

d tto th

the ttrader.

d Th

The commodities

diti and

d

derivatives discussed and opinions expressed in this report may not be suitable for all investors falling under different categories

and jurisdictions. All futures trading entail significant risk, which should be fully understood prior to trading.

Strictly for private circulation www.sharetipsexpert.com Page No. 4

Das könnte Ihnen auch gefallen

- Loan Amortization Calculator BestDokument11 SeitenLoan Amortization Calculator BestHenok mekuriaNoch keine Bewertungen

- 27 Feb 2021 - (Free) ..A3v3uiegdac - Zw11zbd5fwwadgzwhhaadg5yb2h0axwcaxidahmedaubcgehcwr0bqdwaqz2bh0bahoiDokument4 Seiten27 Feb 2021 - (Free) ..A3v3uiegdac - Zw11zbd5fwwadgzwhhaadg5yb2h0axwcaxidahmedaubcgehcwr0bqdwaqz2bh0bahoiSindhu Ramlall100% (1)

- Share Tips Expert Commodity Report 07042011Dokument8 SeitenShare Tips Expert Commodity Report 07042011Hardeep YadavNoch keine Bewertungen

- Share Tips Expert Commodity Report 08042011Dokument8 SeitenShare Tips Expert Commodity Report 08042011Hardeep YadavNoch keine Bewertungen

- Share Tips Expert Commodity Report 01042011Dokument8 SeitenShare Tips Expert Commodity Report 01042011Hardeep YadavNoch keine Bewertungen

- Share Tips Expert Commodity Report 24032011Dokument8 SeitenShare Tips Expert Commodity Report 24032011Hardeep YadavNoch keine Bewertungen

- Share Tips Expert Commodity Report 18042011Dokument8 SeitenShare Tips Expert Commodity Report 18042011Hardeep YadavNoch keine Bewertungen

- Share Tips Expert Commodity Report 06042011Dokument8 SeitenShare Tips Expert Commodity Report 06042011Hardeep YadavNoch keine Bewertungen

- Share Tips Expert Commodity Report 23032011Dokument8 SeitenShare Tips Expert Commodity Report 23032011Hardeep YadavNoch keine Bewertungen

- Share Tips Expert Commodity Report 29032011Dokument8 SeitenShare Tips Expert Commodity Report 29032011Hardeep YadavNoch keine Bewertungen

- Share Tips Expert Commodity Report 27042011Dokument8 SeitenShare Tips Expert Commodity Report 27042011Hardeep YadavNoch keine Bewertungen

- Share Tips Expert Commodity Report 13042011Dokument8 SeitenShare Tips Expert Commodity Report 13042011Hardeep YadavNoch keine Bewertungen

- Share Tips Expert Commodity Report 31032011Dokument8 SeitenShare Tips Expert Commodity Report 31032011Hardeep YadavNoch keine Bewertungen

- Share Tips Expert Commodity Call Report 15042011Dokument8 SeitenShare Tips Expert Commodity Call Report 15042011Hardeep YadavNoch keine Bewertungen

- Share Tips Expert Commodity Report 21042011Dokument8 SeitenShare Tips Expert Commodity Report 21042011Hardeep YadavNoch keine Bewertungen

- Commodity TipsDokument8 SeitenCommodity TipsHardeep YadavNoch keine Bewertungen

- Share Tips Expert Commodity Report 28032011Dokument8 SeitenShare Tips Expert Commodity Report 28032011Hardeep YadavNoch keine Bewertungen

- Free Commodity Trading Tips 27-12-2010Dokument8 SeitenFree Commodity Trading Tips 27-12-2010Hardeep Yadav100% (1)

- Share Tips Expert Commodity Report 30032011Dokument8 SeitenShare Tips Expert Commodity Report 30032011Hardeep YadavNoch keine Bewertungen

- Share Tips Experts Commodity Report As On 29042011Dokument8 SeitenShare Tips Experts Commodity Report As On 29042011Hardeep YadavNoch keine Bewertungen

- Share Tips Expert Commodity Report 04042011Dokument8 SeitenShare Tips Expert Commodity Report 04042011Hardeep YadavNoch keine Bewertungen

- Metals - January 31 2018Dokument1 SeiteMetals - January 31 2018Tiso Blackstar GroupNoch keine Bewertungen

- Markets and Commodity Figures: MetalsDokument1 SeiteMarkets and Commodity Figures: MetalsTiso Blackstar GroupNoch keine Bewertungen

- Metals - February 27 2019Dokument1 SeiteMetals - February 27 2019Tiso Blackstar GroupNoch keine Bewertungen

- Metals - June 26 2018Dokument1 SeiteMetals - June 26 2018Tiso Blackstar GroupNoch keine Bewertungen

- Markets and Commodity Figures: MetalsDokument1 SeiteMarkets and Commodity Figures: MetalsTiso Blackstar GroupNoch keine Bewertungen

- Markets and Commodity Figures: MetalsDokument1 SeiteMarkets and Commodity Figures: MetalsTiso Blackstar GroupNoch keine Bewertungen

- Metals - January 15 2019Dokument1 SeiteMetals - January 15 2019Tiso Blackstar GroupNoch keine Bewertungen

- Metals - October 18 2017Dokument1 SeiteMetals - October 18 2017Tiso Blackstar GroupNoch keine Bewertungen

- Metals - February 28 2018Dokument1 SeiteMetals - February 28 2018Tiso Blackstar GroupNoch keine Bewertungen

- Metals - October 2 2018Dokument1 SeiteMetals - October 2 2018Tiso Blackstar GroupNoch keine Bewertungen

- Metals - January 21 2019Dokument1 SeiteMetals - January 21 2019Tiso Blackstar GroupNoch keine Bewertungen

- Metals - September 26 2018Dokument1 SeiteMetals - September 26 2018Tiso Blackstar GroupNoch keine Bewertungen

- Metals - February 23 2018Dokument1 SeiteMetals - February 23 2018Tiso Blackstar GroupNoch keine Bewertungen

- Metals - September 12 2018Dokument1 SeiteMetals - September 12 2018Tiso Blackstar GroupNoch keine Bewertungen

- Metals - February 22 2018Dokument1 SeiteMetals - February 22 2018Tiso Blackstar GroupNoch keine Bewertungen

- Metals - April 12 2018Dokument1 SeiteMetals - April 12 2018Tiso Blackstar GroupNoch keine Bewertungen

- Metals - July 27 2018Dokument1 SeiteMetals - July 27 2018Tiso Blackstar GroupNoch keine Bewertungen

- Metals - June 28 2018Dokument1 SeiteMetals - June 28 2018Tiso Blackstar GroupNoch keine Bewertungen

- Markets and Commodity Figures: MetalsDokument1 SeiteMarkets and Commodity Figures: MetalsTiso Blackstar GroupNoch keine Bewertungen

- Metals - October 24 2018Dokument1 SeiteMetals - October 24 2018Tiso Blackstar GroupNoch keine Bewertungen

- Metals - September 27 2018Dokument1 SeiteMetals - September 27 2018Tiso Blackstar GroupNoch keine Bewertungen

- Metals - July 25 2018Dokument1 SeiteMetals - July 25 2018Tiso Blackstar GroupNoch keine Bewertungen

- Metals PDFDokument1 SeiteMetals PDFTiso Blackstar GroupNoch keine Bewertungen

- Metals - July 11 2018Dokument1 SeiteMetals - July 11 2018Tiso Blackstar GroupNoch keine Bewertungen

- Metals - October 25 2018Dokument1 SeiteMetals - October 25 2018Tiso Blackstar GroupNoch keine Bewertungen

- Metals - February 26 2018Dokument1 SeiteMetals - February 26 2018Tiso Blackstar GroupNoch keine Bewertungen

- Markets and Commodity Figures: MetalsDokument1 SeiteMarkets and Commodity Figures: MetalsTiso Blackstar GroupNoch keine Bewertungen

- Metals - July 31 2018Dokument1 SeiteMetals - July 31 2018Tiso Blackstar GroupNoch keine Bewertungen

- Metals - March 11 2019Dokument1 SeiteMetals - March 11 2019Tiso Blackstar GroupNoch keine Bewertungen

- Liberty - March 31 2019Dokument1 SeiteLiberty - March 31 2019Anonymous 7A1d7fjj3Noch keine Bewertungen

- Metals - July 6 2018Dokument1 SeiteMetals - July 6 2018Tiso Blackstar GroupNoch keine Bewertungen

- Metals - February 18 2019Dokument1 SeiteMetals - February 18 2019Tiso Blackstar GroupNoch keine Bewertungen

- Metals - February 27 2018Dokument1 SeiteMetals - February 27 2018Tiso Blackstar GroupNoch keine Bewertungen

- Markets and Commodity Figures: MetalsDokument1 SeiteMarkets and Commodity Figures: MetalsTiso Blackstar GroupNoch keine Bewertungen

- Metals - August 15 2018Dokument1 SeiteMetals - August 15 2018Tiso Blackstar GroupNoch keine Bewertungen

- Metals - February 14 2018Dokument1 SeiteMetals - February 14 2018Tiso Blackstar GroupNoch keine Bewertungen

- Metals - January 22 2019Dokument1 SeiteMetals - January 22 2019Tiso Blackstar GroupNoch keine Bewertungen

- Metals - July 30 2018Dokument1 SeiteMetals - July 30 2018Tiso Blackstar GroupNoch keine Bewertungen

- Metals - February 12 2018Dokument1 SeiteMetals - February 12 2018Tiso Blackstar GroupNoch keine Bewertungen

- Metals - January 16 2017Dokument1 SeiteMetals - January 16 2017Tiso Blackstar GroupNoch keine Bewertungen

- Understanding Lightning and Lightning Protection: A Multimedia Teaching GuideVon EverandUnderstanding Lightning and Lightning Protection: A Multimedia Teaching GuideNoch keine Bewertungen

- Share Tips Experts Commodity Calls Report As On 10052011Dokument3 SeitenShare Tips Experts Commodity Calls Report As On 10052011Hardeep YadavNoch keine Bewertungen

- Share Tips Expert Calls Report 06052011Dokument3 SeitenShare Tips Expert Calls Report 06052011Hardeep YadavNoch keine Bewertungen

- Share Tips Expert Calls Report 04052011Dokument3 SeitenShare Tips Expert Calls Report 04052011Hardeep YadavNoch keine Bewertungen

- Sharetips Weekly Economical Data For 9-13 MayDokument6 SeitenSharetips Weekly Economical Data For 9-13 MayHardeep YadavNoch keine Bewertungen

- Commodity TipsDokument8 SeitenCommodity TipsHardeep YadavNoch keine Bewertungen

- Share Tips Expert Calls Report 02052011Dokument3 SeitenShare Tips Expert Calls Report 02052011Hardeep YadavNoch keine Bewertungen

- Share Tips Experts Commodity Report As On 29042011Dokument8 SeitenShare Tips Experts Commodity Report As On 29042011Hardeep YadavNoch keine Bewertungen

- Share Tips Expert Commodity Call Report 15042011Dokument8 SeitenShare Tips Expert Commodity Call Report 15042011Hardeep YadavNoch keine Bewertungen

- Share Tips Expert Commodity Report 27042011Dokument8 SeitenShare Tips Expert Commodity Report 27042011Hardeep YadavNoch keine Bewertungen

- Share Tips Expert Commodity Calls Report 31032011Dokument3 SeitenShare Tips Expert Commodity Calls Report 31032011Hardeep YadavNoch keine Bewertungen

- Share Tips Expert Calls Report 29042011Dokument3 SeitenShare Tips Expert Calls Report 29042011Hardeep YadavNoch keine Bewertungen

- Share Tips Expert Commodity Report 21042011Dokument8 SeitenShare Tips Expert Commodity Report 21042011Hardeep YadavNoch keine Bewertungen

- Share Tips Expert Commodity Report 13042011Dokument8 SeitenShare Tips Expert Commodity Report 13042011Hardeep YadavNoch keine Bewertungen

- Share Tips Expert Commodity Calls Report 04042011Dokument3 SeitenShare Tips Expert Commodity Calls Report 04042011Hardeep YadavNoch keine Bewertungen

- Share Tips Expert Commodity Calls Report 05042011Dokument3 SeitenShare Tips Expert Commodity Calls Report 05042011Hardeep YadavNoch keine Bewertungen

- Share Tips Expert Commodity Calls Report 06042011Dokument3 SeitenShare Tips Expert Commodity Calls Report 06042011Hardeep YadavNoch keine Bewertungen

- Share Tips Expert Commodity Report 04042011Dokument8 SeitenShare Tips Expert Commodity Report 04042011Hardeep YadavNoch keine Bewertungen

- Share Tips Expert Commodity Report 06042011Dokument8 SeitenShare Tips Expert Commodity Report 06042011Hardeep YadavNoch keine Bewertungen

- Share Tips Expert Commodity Report 28032011Dokument8 SeitenShare Tips Expert Commodity Report 28032011Hardeep YadavNoch keine Bewertungen

- Share Tips Expert Commodity Calls Report 30032011Dokument3 SeitenShare Tips Expert Commodity Calls Report 30032011Hardeep YadavNoch keine Bewertungen

- Share Tips Expert Commodity Report 31032011Dokument8 SeitenShare Tips Expert Commodity Report 31032011Hardeep YadavNoch keine Bewertungen

- Share Tips Expert Commodity Report 30032011Dokument8 SeitenShare Tips Expert Commodity Report 30032011Hardeep YadavNoch keine Bewertungen

- Share Tips Expert Commodity Calls Report 24032011Dokument3 SeitenShare Tips Expert Commodity Calls Report 24032011Hardeep YadavNoch keine Bewertungen

- Share Tips Expert Commodity Report 29032011Dokument8 SeitenShare Tips Expert Commodity Report 29032011Hardeep YadavNoch keine Bewertungen

- BO Temporary KeysDokument5 SeitenBO Temporary Keysamanblr12Noch keine Bewertungen

- Revised RFBT Quizzer On Special Laws New TopicsDokument48 SeitenRevised RFBT Quizzer On Special Laws New Topicslairekk onyotNoch keine Bewertungen

- Importance of Productivity Measurement: Factors That Affect ProductivityDokument3 SeitenImportance of Productivity Measurement: Factors That Affect ProductivityrajatNoch keine Bewertungen

- Elemental Realty - Top 10 Real Estate Entrepreneurs - 2020' - Mr. Arun Kumar Aleti, CEODokument1 SeiteElemental Realty - Top 10 Real Estate Entrepreneurs - 2020' - Mr. Arun Kumar Aleti, CEOAkhila AdusumilliNoch keine Bewertungen

- The Company/ KEO's BIM Roles: High High HighDokument1 SeiteThe Company/ KEO's BIM Roles: High High HighGamini KodikaraNoch keine Bewertungen

- Estimate: Saad Akhtar 8447291097 Place of Supply: TAMIL NADUDokument1 SeiteEstimate: Saad Akhtar 8447291097 Place of Supply: TAMIL NADUSaad AkhtarNoch keine Bewertungen

- Script - Opportunities in A RecessionDokument4 SeitenScript - Opportunities in A RecessionMayumi AmponNoch keine Bewertungen

- Cebu Technological University: Main CampusDokument2 SeitenCebu Technological University: Main CampusLeonard Patrick Faunillan BaynoNoch keine Bewertungen

- Ch6 Risk Aversion and Capital Allocation To Risky AssetsDokument28 SeitenCh6 Risk Aversion and Capital Allocation To Risky AssetsAmanda Rizki BagastaNoch keine Bewertungen

- GAP Model On Mac Donald's: Presented by Group No: 3Dokument20 SeitenGAP Model On Mac Donald's: Presented by Group No: 3Dipesh KotechaNoch keine Bewertungen

- Assignment-2 Public Procurement: 1. Part ADokument13 SeitenAssignment-2 Public Procurement: 1. Part AAtisha RamsurrunNoch keine Bewertungen

- Answers To QuestionsDokument8 SeitenAnswers To QuestionsElie YabroudiNoch keine Bewertungen

- Cost Volume Profit Analysis Cost Accounting 2022 P1Dokument6 SeitenCost Volume Profit Analysis Cost Accounting 2022 P1jay-an DahunogNoch keine Bewertungen

- 2022 SASI BrochureDokument16 Seiten2022 SASI BrochureRicheng ChangNoch keine Bewertungen

- ICS ProjectDokument22 SeitenICS Projectauf haziqNoch keine Bewertungen

- Consumer Preference Towards Different Branded Sports ShoesDokument11 SeitenConsumer Preference Towards Different Branded Sports ShoesAnushka KharatNoch keine Bewertungen

- RFU-STR-060 Validity of CertificatesDokument13 SeitenRFU-STR-060 Validity of CertificatesmmajznerNoch keine Bewertungen

- Practice Exam - Part 3: Multiple ChoiceDokument4 SeitenPractice Exam - Part 3: Multiple ChoiceAzeem TalibNoch keine Bewertungen

- MDG Goal 1Dokument2 SeitenMDG Goal 1black_belter789Noch keine Bewertungen

- Lecture 2 (Linking HR With Strategy - Chapter 2Dokument18 SeitenLecture 2 (Linking HR With Strategy - Chapter 2extra fileNoch keine Bewertungen

- Minimum Wages Act - 1948Dokument8 SeitenMinimum Wages Act - 1948Shaji Mullookkaaran100% (3)

- ExpandedAppendixChapter12 PDFDokument4 SeitenExpandedAppendixChapter12 PDFfunam2Noch keine Bewertungen

- Conventions of A TV ADDokument8 SeitenConventions of A TV ADDamiano88Noch keine Bewertungen

- Startegic Managemnt Assignment 1Dokument16 SeitenStartegic Managemnt Assignment 1Syeda ZehraNoch keine Bewertungen

- Activity 2Dokument2 SeitenActivity 2Zin DelNoch keine Bewertungen

- ReportDokument10 SeitenReportJames SoongNoch keine Bewertungen

- Open Letter To LMN ChairmanDokument4 SeitenOpen Letter To LMN ChairmanMessina04Noch keine Bewertungen

- PDIL Enq Spec For Non Plant Building HURL G-207Dokument721 SeitenPDIL Enq Spec For Non Plant Building HURL G-207Tusar KoleNoch keine Bewertungen