Beruflich Dokumente

Kultur Dokumente

Balance of Payments

Hochgeladen von

Bhanu Pratap Singh0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

44 Ansichten9 SeitenA balance of payments is an accounting record of all monetary transactions between a country and the rest of the world. Transactions include payments for the country's exports and imports of goods, services, and financial capital, as well as financial transfers. The BOP summarises international transactions for a specific period, usually a year, and is prepared in a single currency, typically the domestic currency for the country concerned.

Originalbeschreibung:

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenA balance of payments is an accounting record of all monetary transactions between a country and the rest of the world. Transactions include payments for the country's exports and imports of goods, services, and financial capital, as well as financial transfers. The BOP summarises international transactions for a specific period, usually a year, and is prepared in a single currency, typically the domestic currency for the country concerned.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

44 Ansichten9 SeitenBalance of Payments

Hochgeladen von

Bhanu Pratap SinghA balance of payments is an accounting record of all monetary transactions between a country and the rest of the world. Transactions include payments for the country's exports and imports of goods, services, and financial capital, as well as financial transfers. The BOP summarises international transactions for a specific period, usually a year, and is prepared in a single currency, typically the domestic currency for the country concerned.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 9

Balance of payments

A balance of payments (BOP) sheet is an accounting record of all

monetary transactions between a country and the rest of the world.

These transactions include payments for the country's exports and

imports of goods, services, and financial capital, as well as financial

transfers. The BOP summarises international transactions for a specific

period, usually a year, and is prepared in a single currency, typically the

domestic currency for the country concerned. Sources of funds for a

nation, such as exports or the receipts of loans and investments, are

recorded as positive or surplus items. Uses of funds, such as for imports

or to invest in foreign countries, are recorded as a negative or deficit

item.

Kindleberger says: “Balance of payments is a systematic record of all

economic transactions between the residents of the reporting country and

the residents of foreign countries during a given period of time”

In the words of Benham, ”Balance of payments of a country is a record

of the monetary transactions over a period with the rest of the world”

Balance of payments account has the following

features:

(a)It is a systematic record of all economic transactions between one

country and the rest of the world.

(b)It includes all the transactions visible as well as invisible.

(c)It relates to a period of time.Generally,it is an annual statement.

(d)In the accounting sense, total credits and debits in the balance of

payments statement always balance each other.

(e)When receipts are equal to payments, the balance of payments is in

equilibrium: when receipts are greater than payments,ther is surplus in

the balance of payments:when payments are greater than receipts,there

is deficit in the balance of payments.

Structure of balance of payment:-(1)current account

(2)capital account.

Current account

The balance of payments measures all flows of money between a country

and the rest of the world. The current account records the movements of

all goods and services into and out of the country. The capital account

measures all capital flows carried out by individuals, firms and

governments (usually for investment purposes).

The current Account:-The current account of balance of payments includes

the following iteams:-

1.Merchandise:-Export and imports of goods form the visible account and

have a dominant position in the curent account part of balance of

payments.Exports constitute the credit side and imports the debit side.

2.Government Transactios:-Government transactions refer to the

expenditure incurred by a government for the upkeep of its organisations

a broad.Such payments as are received by a government from abroad

constitute the credit iteam and made to other governments form form the

debit iteam.

3.Travel:-Travel is an invisible item in the balance of payments.travel may

be for reasons of business,education,health,international conventions or for

pleasures.Expenditure by foreign tourists in our country forms the credit

item and expenditure by our tourists abroad constitutes the debits item in

our balance of payment.

The capital account

The Capital account measures all the short term and long term monetary

transactions between a country and the rest of the world. Generally, these

flows of money are associated with saving and investment, but speculation

has become a big part of the account in recent years.

The main iteams of capital accounts are:-

(1)Private Loans:-Foreign loans received by the private sector is a credit

item and foreign loans repaid by the private sector is a debit item.

(2)Movement in Banking capital.Inflow of banking capital excluding the

central bank(credit iteam);and outflow of banking capital excluding the

central bank(debit iteam)

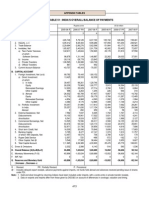

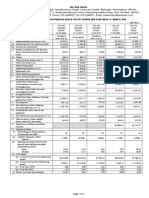

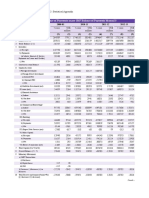

Statement 1 : INDIA'S OVERALL BALANCE OF PAYMENTS

( US $ million)

April-June 2010 P April-June 2009 PR January-March

Item Credit Debit Net Credit Debit Net Credit Debit

1 2 3 4 5 6 7 8 9

A.CURRENT ACCOUNT

- -

34,19 25,63

I. MERCHANDISE 53,726 87,920 4 39,164 64,799 5 52,419 83,91

20,46 21,18

II.INVISIBLES (a+b+c) 42,725 22,263 2 37,616 16,435 1 42,845 24,35

10,05 10,37

a) Services 26,116 16,059 7 21,322 10,949 3 26,942 18,89

i) Travel 2,950 2,261 689 2,297 2,035 262 3,403 2,63

ii) Transportation 3,097 3,134 -37 2,490 2,777 -287 3,100 3,57

iii) Insurance 404 310 94 387 314 73 421 32

iv) G.n.i.e. 94 143 -49 100 103 -3 116 15

10,32

v) Miscellaneous 19,571 10,211 9,360 16,048 5,720 8 19,901 12,19

of which

12,08 10,61

Software Services 12,655 575 0 11,004 391 3 14,297 30

- -

Business Services 4,819 5,902 1,083 2,586 3,872 1,286 3,818 5,57

Financial Services 1,228 1,404 -176 1,116 928 188 1,103 1,51

Communication Services 325 241 84 418 312 106 245 38

13,05 12,87

b) Transfers 13,754 700 4 13,344 470 4 13,216 64

i) Official 59 115 -56 46 110 -64 126 14

13,11 12,93

ii) Private 13,695 585 0 13,298 360 8 13,090 50

- -

c) Income 2,855 5,504 2,649 2,950 5,016 2,066 2,686 4,81

- -

i) Investment Income 2,628 5,042 2,414 2,723 4,665 1,942 2,455 4,32

ii) Compensation of Employees 227 462 -235 227 351 -124 231 49

-

110,18 13,73 - 108,2

Total Current Account (I+II) 96,451 3 2 76,780 81,234 4,454 95,264

B. CAPITAL ACCOUNT

14,38

1. Foreign Investment (a+b) 52,635 44,880 7,755 48,422 34,033 9 49,315 37,35

a) Foreign Direct Investment (i+ii) 8,569 5,419 3,150 9,797 3,676 6,121 7,912 4,71

i. In India 8,275 2,302 5,973 9,672 926 8,746 7,588 2,47

Equity 5,991 2,278 3,713 7,290 900 6,390 5,353 1,51

Reinvested Earnings 2,166 0 2,166 2,020 - 2,020 2,020

Other Capital 118 24 94 362 26 336 215 96

- -

ii. Abroad 294 3,117 2,823 125 2,750 2,625 324 2,24

- -

Equity 294 1,914 1,620 125 2,053 1,928 324 91

Reinvested Earnings 0 271 -271 - 271 -271 - 27

Other Capital 0 932 -932 - 426 -426 - 1,06

b) Portfolio Investment 44,066 39,461 4,605 38,625 30,357 8,268 41,403 32,63

In India 43,972 39,320 4,652 38,602 30,332 8,270 41,169 32,49

of which FIIs 42,858 39,320 3,538 38,559 30,332 8,227 41,023 32,49

ADRs/GDRs 1,114 - 1,114 43 - 43 146

Abroad 94 141 -47 23 25 -2 234 14

10,58 -

2.Loans (a+b+c) 24,696 14,110 6 12,920 14,746 1,826 24,439 18,47

a) External Assistance 3,090 754 2,336 821 725 96 1,577 74

i) By India 14 20 -6 13 105 -92 13 10

ii) To India 3,076 734 2,342 808 620 188 1,565 63

b) Commercial Borrowings (MT<) 4,521 1,850 2,671 1,973 2,432 -459 5,026 4,88

i) By India 185 243 -58 244 333 -89 297 38

ii) To India 4,336 1,607 2,729 1,729 2,099 -370 4,729 4,49

-

c) Short Term to India 17,085 11,506 5,579 10,126 11,589 1,463 17,836 12,84

i) Suppliers' Credit >180days & Buyers'

Credit 15,579 11,506 4,073 10,126 9,590 536 15,396 12,84

-

ii) Suppliers' Credit up to180 days 1,506 - 1,506 - 1,999 1,999 2,440

-

3. Banking Capital (a+b) 16,747 12,742 4,005 15,577 18,943 3,366 14,207 15,10

-

a) Commercial Banks 16,745 12,718 4,027 15,577 18,704 3,127 14,195 15,10

-

i) Assets 3,263 2,558 705 4,368 6,946 2,578 3,531 4,70

ii) Liabilities 13,482 10,160 3,322 11,209 11,758 -549 10,664 10,39

of which : Non-Resident Deposits 11,254 10,133 1,121 11,172 9,354 1,818 9,665 10,21

b) Others 2 24 -22 - 239 -239 12

4. Rupee Debt Service - 16 -16 - 23 -23 - 7

- -

5. Other Capital 1,206 5,151 3,945 177 5,332 5,155 2,263 3,11

18,38

Total Capital Account (1 to 5) 95,284 76,899 5 77,096 73,077 4,019 90,224 74,13

C. Errors & Omissions - 912 -912 550 - 550 - 94

191,73 187,99 154,42 154,31 185,48 183,3

D. Overall Balance 5 4 3,741 6 1 115 7

(Total Current Account, Capital

Account

and Errors & Omissions (A+B+C))

-

E. Monetary Movements (i+ii) - 3,741 3,741 - 115 -115 - 2,14

i) I.M.F. - - - - - - -

-

ii) Foreign Exchange Reserves - 3,741 3,741 - 115 -115 - 2,14

( Increase - / Decrease +)

of which: SDR allocation - - - - - - -

P : Preliminary. PR: Partially Revised.

Why does the Balance of payment always Balances?

In the accounting sense, the balance of payments of a country is always in

equilibrium.The statement of balance of payments is prepared in terms of

credits and debits based on the system of double-entry-book-keeping.In the

double-entry system,each transaction gives rise to two equal entries;a credit

entry and a debit entry.Thus the sum of all credits equals the sum of all debits.

Current account balance + Capital account balance + net

errors and omissions = 0

Here errors and omissions simply reflect mistakes. Assuming no

mistakes are made, then the formula will look like this.

Current account + Capital account = 0, hence Current

account = Capital account.

In other words, if a country has a deficit on the current account

(more imports than exports) then it must have an equal and

opposite surplus on the capital account (and vice versa).

Disequilibrium in the balance of payments:-

Normally balance of payments of a country should be in equilibrium i.e

imports and exports or goods and services should be equal.But in reality

it is not so.Disequilibrium often arises in the balance of

payments.Balance of payments may be unfavourable when ther is excess

of imports over exports.The capital account is used to settle the

imbalance in the current account through changes in the international

flows of fund .

Ther are mainly four types of disequilibrium in the the balance of

payments

(a)cyclical disequilibrium:-cyclical disequilibrium is caused by countries

having different cyclical patterns of income, or the same income pattern

with different income elasticities or idenical income pattens and income

elasticities by different price elasticities.these factors bring changes in

the terms of trade as well as the volume of trade which causes a deficit

or surplus in the balance of payment

(b) Secular Disequilibrium:

Sometimes, the balance of payments diequilibrium persists fora long

time because of certain secular trends in the economy.For instance, in a

developed country, the disposable income isgenerally very high and,

therefore, the aggregate demand, too, isvery high. At the same time,

production costs are very highbecause of the higher wages. This

naturally results in higherprices. These two factors - high aggregate

demand and higherdomestic prices may result in the imports being much

higherthan the exports.

(c) Structural Disequilibrium:

Structual changes in the economy may also cause balance of

payments disequilibrium. Such structural changes include the

development of alternative sources of supply, the development

of better substitutes, the exhaustion of productive resources, the

changes in transport routes and costs, etc.

(d)Fundmental Disequilibrium:-The term fundamental

disequilibrium has been originally used by the I.M.F to indicate

a persistent, long tem disequilibrium in a countries balance of

payments .Fundamental disequilibrium is caused by such factors

as particularly lead to chronic deficit in the balance of payments.

IMPORTANCE OF BALANCE OF PAYMENT:-

The BOP accounts provide an extremely useful data for the

economic analysis of the country’s weakness and strength

as a partner in international trade.

BOP reveals the changes in the composition and magnitude

of foreign trade.

BOP also provides indications of future repercussions of

country’s past trade performances. Given today's economic woes,

developing an understanding of macroeconomics is critical for the savvy trader. Balance of

payments is one of the most important elements of understanding a nation's fiscal health and

its ability to acquire capital. The balance of payments data is very much like a cash flow

statement for an individual company. Unlike the balance of trade, the balance of payments

reflects only how and by what degree capital is flowing in and out of a nation

The main causes of fundamental disequilibrium are

(1)Excessive internal demand for foreign goods. (2)poor

competitiv strength of the countrys exports in the world market,

(3)Excessive capital outflow.

Das könnte Ihnen auch gefallen

- The Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaVon EverandThe Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaNoch keine Bewertungen

- No. 42: India's Overall Balance of Payments: Current StatisticsDokument6 SeitenNo. 42: India's Overall Balance of Payments: Current StatisticsReuben RichardNoch keine Bewertungen

- Equity Valuation: Models from Leading Investment BanksVon EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNoch keine Bewertungen

- Balance of PaymentsDokument12 SeitenBalance of PaymentsVipulNoch keine Bewertungen

- Appendix Table 8: India'S Overall Balance of PaymentsDokument1 SeiteAppendix Table 8: India'S Overall Balance of PaymentsPandu PrasadNoch keine Bewertungen

- Exports and Imports of Goods & Services Data for PakistanDokument1 SeiteExports and Imports of Goods & Services Data for PakistanMarium KhalilNoch keine Bewertungen

- Of Which Software Services Business Services Financial Services Communication ServicesDokument3 SeitenOf Which Software Services Business Services Financial Services Communication Servicescapt-cool-chillerNoch keine Bewertungen

- Balance of Payments: Group 12 Dilip K Ahmed Mudassar P B Atul Pal Jacob GeorgeDokument16 SeitenBalance of Payments: Group 12 Dilip K Ahmed Mudassar P B Atul Pal Jacob Georgeatulpal112Noch keine Bewertungen

- Pakistan Balance of PaymentsDokument94 SeitenPakistan Balance of PaymentsHamzaNoch keine Bewertungen

- Trade and PaymentsDokument17 SeitenTrade and PaymentsmazamniaziNoch keine Bewertungen

- Bop PDFDokument1 SeiteBop PDFLoknadh ReddyNoch keine Bewertungen

- Exports and Imports of Goods & Services: R R P P PDokument1 SeiteExports and Imports of Goods & Services: R R P P PSikander025Noch keine Bewertungen

- ' in LakhsDokument53 Seiten' in LakhsParthNoch keine Bewertungen

- Balance Sheet For Group and SegmentsDokument2 SeitenBalance Sheet For Group and Segmentstry6y6hmhbNoch keine Bewertungen

- Audited Financial Results For The Quarter and Financial Year Ended 31st March 2021Dokument12 SeitenAudited Financial Results For The Quarter and Financial Year Ended 31st March 2021Abhilash ABNoch keine Bewertungen

- National Stock Exchange of India LimitedDokument2 SeitenNational Stock Exchange of India LimitedAnonymous DfSizzc4lNoch keine Bewertungen

- PAKistan Balancepayment BPM6Dokument2 SeitenPAKistan Balancepayment BPM6Faisal JalalNoch keine Bewertungen

- TABLE 8.1 SUMMARY BALANCE OF PAYMENTSDokument16 SeitenTABLE 8.1 SUMMARY BALANCE OF PAYMENTSAhsan Ali MemonNoch keine Bewertungen

- Fy2023 Analysis of Revenue and ExpenditureDokument24 SeitenFy2023 Analysis of Revenue and ExpenditurePutri AgustinNoch keine Bewertungen

- 3.1 Federal Government Revenue Receipts: ReceiptDokument57 Seiten3.1 Federal Government Revenue Receipts: ReceiptBisma SiddiquiNoch keine Bewertungen

- Fourth Quarter 2021 Financial ResultsDokument12 SeitenFourth Quarter 2021 Financial ResultsWinnie LaraNoch keine Bewertungen

- NPI TW IV 2017Dokument20 SeitenNPI TW IV 2017Hayyin Nur AdisaNoch keine Bewertungen

- WIL-Result-30 06 2020Dokument4 SeitenWIL-Result-30 06 2020Ravi Kiran MeesalaNoch keine Bewertungen

- JBIL Reports Q3 FY23 ResultsDokument10 SeitenJBIL Reports Q3 FY23 ResultsRaghav HNoch keine Bewertungen

- Afr Q4fy20Dokument8 SeitenAfr Q4fy20Abhilash ABNoch keine Bewertungen

- IEX Standalone and Consolidated Unaudited Financial Results For The Quarter & Half Year Ended September 30, 2021Dokument13 SeitenIEX Standalone and Consolidated Unaudited Financial Results For The Quarter & Half Year Ended September 30, 2021seena_smile89Noch keine Bewertungen

- NDTV Q2-09 ResultsDokument8 SeitenNDTV Q2-09 ResultsmixedbagNoch keine Bewertungen

- LVB Audited Financials 31032019Dokument9 SeitenLVB Audited Financials 31032019Maran VeeraNoch keine Bewertungen

- Tab 52Dokument4 SeitenTab 52Šöbíķá RáņčíNoch keine Bewertungen

- Albert David Results Dec 2019Dokument3 SeitenAlbert David Results Dec 2019Puneet367Noch keine Bewertungen

- Financial Results Consolidated Q2 FY 2023 2024Dokument10 SeitenFinancial Results Consolidated Q2 FY 2023 2024surendran naiduNoch keine Bewertungen

- Audited Financial Results and Other Matters: Enduring ValueDokument23 SeitenAudited Financial Results and Other Matters: Enduring ValueSai KishoreNoch keine Bewertungen

- CaplinPoint Q3FY22Dokument45 SeitenCaplinPoint Q3FY22Ranjan PrakashNoch keine Bewertungen

- Instructions To Candidates:: A. The Following Is The Summary of The Financial Statements of TENAGA NASIONAL BerhadDokument7 SeitenInstructions To Candidates:: A. The Following Is The Summary of The Financial Statements of TENAGA NASIONAL BerhadyshazwaniNoch keine Bewertungen

- Data For Financial AnalysisDokument8 SeitenData For Financial AnalysisPriyanshu SinghNoch keine Bewertungen

- Ec XT 049Dokument13 SeitenEc XT 049วริศรา หล้าแดงNoch keine Bewertungen

- ICICI form-nl-7-operating-expenses-scheduleDokument2 SeitenICICI form-nl-7-operating-expenses-scheduleSatyamSinghNoch keine Bewertungen

- Summary Balance of Payments As Per BPM6 - October 2020Dokument2 SeitenSummary Balance of Payments As Per BPM6 - October 2020Jamal QamarNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- ICICI Financial StatementsDokument9 SeitenICICI Financial StatementsNandini JhaNoch keine Bewertungen

- 2022 04 Q4-2022 PR2-New-roomDokument10 Seiten2022 04 Q4-2022 PR2-New-roomTejpal SainiNoch keine Bewertungen

- Audited Financial Results For The Quarter and Year Ended March 31, 2023Dokument6 SeitenAudited Financial Results For The Quarter and Year Ended March 31, 2023vikaspawar78Noch keine Bewertungen

- City of Fort St. John - 2023-2027 Operating BudgetDokument30 SeitenCity of Fort St. John - 2023-2027 Operating BudgetAlaskaHighwayNewsNoch keine Bewertungen

- Kci-Ufr Q3fy11Dokument1 SeiteKci-Ufr Q3fy11Shashi PandeyNoch keine Bewertungen

- Balancepayment BPM6Dokument2 SeitenBalancepayment BPM6Aliza IshraNoch keine Bewertungen

- XLS EngDokument11 SeitenXLS EngHarshit AroraNoch keine Bewertungen

- Knitware Ms FormatDokument29 SeitenKnitware Ms FormatMD. Borhan UddinNoch keine Bewertungen

- Tata Motors Limited reports loss of Rs 4,871 crore in Q4 FY20Dokument10 SeitenTata Motors Limited reports loss of Rs 4,871 crore in Q4 FY20Anil Kumar AkNoch keine Bewertungen

- (Lacs) Statement of Standalone Unaudited Results For The Quarter Ended March 31, 2013Dokument4 Seiten(Lacs) Statement of Standalone Unaudited Results For The Quarter Ended March 31, 2013Ravi AgarwalNoch keine Bewertungen

- TCL Consolidated Sebi Results 31 December 2022Dokument3 SeitenTCL Consolidated Sebi Results 31 December 2022Ravi Kumar KodiyalaNoch keine Bewertungen

- 3 Statement Financial Analysis TemplateDokument14 Seiten3 Statement Financial Analysis TemplateCười Vê LờNoch keine Bewertungen

- Form I - Balaji Enterprises Financial Statements 2021-22 and 2022-23 ProjectionsDokument13 SeitenForm I - Balaji Enterprises Financial Statements 2021-22 and 2022-23 ProjectionsGEETHA PNoch keine Bewertungen

- Income Statement For Group and SegmentsDokument1 SeiteIncome Statement For Group and Segmentstry6y6hmhbNoch keine Bewertungen

- Devyani International Q3 ResultsDokument9 SeitenDevyani International Q3 ResultsSaurabh AggarwalNoch keine Bewertungen

- Cerro de Pasco Resources Subsidiaria del Peru S.A.C. Financial Statements Sep 2022 and Dec 2021Dokument13 SeitenCerro de Pasco Resources Subsidiaria del Peru S.A.C. Financial Statements Sep 2022 and Dec 2021Jhoel Jasser Salas AngelesNoch keine Bewertungen

- UIP-V-' ..: Tomorrow's Solutions TodayDokument12 SeitenUIP-V-' ..: Tomorrow's Solutions Todaysayantan.astrologerNoch keine Bewertungen

- Summary of Pakistan's Balance of Payments for July-September FY20Dokument2 SeitenSummary of Pakistan's Balance of Payments for July-September FY20javedNoch keine Bewertungen

- ADB Annual Report Volume 1 Main ReportDokument122 SeitenADB Annual Report Volume 1 Main ReportadipradanaNoch keine Bewertungen

- SeintimationOUTCOME 17052021125653Dokument25 SeitenSeintimationOUTCOME 17052021125653Aniket VermaNoch keine Bewertungen

- 2010 q3 Telenor Financials - tcm28 56699Dokument23 Seiten2010 q3 Telenor Financials - tcm28 56699nemejebatNoch keine Bewertungen

- StrategicDokument1 SeiteStrategicBhanu Pratap SinghNoch keine Bewertungen

- Techniques For SequencingDokument5 SeitenTechniques For SequencingBhanu Pratap SinghNoch keine Bewertungen

- Highlights of Union Budget 2011Dokument3 SeitenHighlights of Union Budget 2011Bhanu Pratap SinghNoch keine Bewertungen

- SebiDokument3 SeitenSebiBhanu Pratap SinghNoch keine Bewertungen

- SebiDokument3 SeitenSebiBhanu Pratap SinghNoch keine Bewertungen

- Ethical Responsibilty of A BusinessDokument26 SeitenEthical Responsibilty of A BusinessBhanu Pratap SinghNoch keine Bewertungen

- ThesisDokument18 SeitenThesisapi-29776055293% (15)

- Fundamentals and Applications of Renewable Energy by Mehmet Kanoglu, Yunus Cengel, John CimbalaDokument413 SeitenFundamentals and Applications of Renewable Energy by Mehmet Kanoglu, Yunus Cengel, John CimbalaFrancesco Nocera100% (1)

- Safety interlock switches principlesDokument11 SeitenSafety interlock switches principlesChristopher L. AlldrittNoch keine Bewertungen

- Automatizari Complexe - Laborator Nr. 4: Wind (M/S)Dokument1 SeiteAutomatizari Complexe - Laborator Nr. 4: Wind (M/S)Alexandru AichimoaieNoch keine Bewertungen

- Determining Total Impulse and Specific Impulse From Static Test DataDokument4 SeitenDetermining Total Impulse and Specific Impulse From Static Test Datajai_selvaNoch keine Bewertungen

- Fact Sheet Rocket StovesDokument2 SeitenFact Sheet Rocket StovesMorana100% (1)

- DEFCON ManualDokument13 SeitenDEFCON Manualbuyvalve100% (1)

- 272 Concept Class Mansoura University DR Rev 2Dokument8 Seiten272 Concept Class Mansoura University DR Rev 2Gazzara WorldNoch keine Bewertungen

- OPIM101 4 UpdatedDokument61 SeitenOPIM101 4 UpdatedJia YiNoch keine Bewertungen

- PB Engine Kappa EngDokument20 SeitenPB Engine Kappa EngOscar AraqueNoch keine Bewertungen

- Dewatering Construction Sites Below Water TableDokument6 SeitenDewatering Construction Sites Below Water TableSOMSUBHRA SINGHANoch keine Bewertungen

- Dubai Healthcare Providers DirectoryDokument30 SeitenDubai Healthcare Providers DirectoryBrave Ali KhatriNoch keine Bewertungen

- Product Data: Airstream™ 42BHC, BVC System Fan CoilsDokument40 SeitenProduct Data: Airstream™ 42BHC, BVC System Fan CoilsMaxmore KarumamupiyoNoch keine Bewertungen

- Corena s2 p150 - Msds - 01185865Dokument17 SeitenCorena s2 p150 - Msds - 01185865Javier LerinNoch keine Bewertungen

- BIU and EU functions in 8086 microprocessorDokument12 SeitenBIU and EU functions in 8086 microprocessorDaksh ShahNoch keine Bewertungen

- Forms of Business Organization: Sole Proprietorship, Partnership, Corporation, CooperativesDokument17 SeitenForms of Business Organization: Sole Proprietorship, Partnership, Corporation, CooperativesSanti BuliachNoch keine Bewertungen

- FC Bayern Munich Marketing PlanDokument12 SeitenFC Bayern Munich Marketing PlanMateo Herrera VanegasNoch keine Bewertungen

- MTS Material Testing SolutionsDokument34 SeitenMTS Material Testing SolutionskarthegreNoch keine Bewertungen

- Part 9. Wireless Communication Towers and Antennas 908.01 Purpose and IntentDokument12 SeitenPart 9. Wireless Communication Towers and Antennas 908.01 Purpose and IntentjosethompsonNoch keine Bewertungen

- Easyjet Group6Dokument11 SeitenEasyjet Group6Rishabh RakhechaNoch keine Bewertungen

- Bid Document PDFDokument125 SeitenBid Document PDFAzharudin ZoechnyNoch keine Bewertungen

- 2 - Nested IFDokument8 Seiten2 - Nested IFLoyd DefensorNoch keine Bewertungen

- Serras Tilted Arc Art and Non Art Senie in Art Journal 1989Dokument6 SeitenSerras Tilted Arc Art and Non Art Senie in Art Journal 1989api-275667500Noch keine Bewertungen

- Congress Policy Brief - CoCoLevyFundsDokument10 SeitenCongress Policy Brief - CoCoLevyFundsKat DinglasanNoch keine Bewertungen

- STS Chapter 5Dokument2 SeitenSTS Chapter 5Cristine Laluna92% (38)

- RS-RA-N01-AL User Manual of Photoelectric Total Solar Radiation TransmitterDokument11 SeitenRS-RA-N01-AL User Manual of Photoelectric Total Solar Radiation TransmittermohamadNoch keine Bewertungen

- MSDS Metafuron 20 WPDokument10 SeitenMSDS Metafuron 20 WPAndi DarmawanNoch keine Bewertungen

- Enhancing reliability of CRA piping welds with PAUTDokument10 SeitenEnhancing reliability of CRA piping welds with PAUTMohsin IamNoch keine Bewertungen

- Assignment 2 - p1 p2 p3Dokument16 SeitenAssignment 2 - p1 p2 p3api-31192579150% (2)

- English 8-Q3-M3Dokument18 SeitenEnglish 8-Q3-M3Eldon Julao0% (1)