Beruflich Dokumente

Kultur Dokumente

FTSE 100 Index Factsheet

Hochgeladen von

Gaurang GuptaOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

FTSE 100 Index Factsheet

Hochgeladen von

Gaurang GuptaCopyright:

Verfügbare Formate

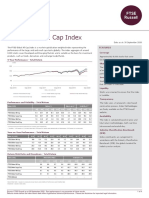

FTSE100 Factsheet-2:FTSE100 27/8/10 13:32 Page 1

FACTSHEET

FTSE 100 INDEX

The FTSE 100 is a market-capitalisation weighted index representing the performance of the 100 largest FEATURES

UK-domiciled blue chip companies, which pass screening for size and liquidity. The index represents

approximately 85.18% of the UK’s market capitalisation and is suitable as the basis for investment • The index is designed for the creation of

products, such as funds, derivatives and exchange-traded funds. The FTSE 100 Index also accounts for derivatives, index tracking funds, ETFs and

7.84% of the world’s equity market capitalisation (based on the FTSE All-World Index as at 28 May 2010). performance benchmarks

FTSE 100 constituents are all traded on the London Stock Exchange’s SETS trading system. • Stocks are free-float weighted to ensure

FTSE 100 INDEX 10-YEAR PERFORMANCE (GBP TOTAL RETURN) that only the investable opportunity set is

150 included within the index

Index rebased (31 May 2000 = 100)

• Stocks are liquidity screened to ensure that

125

the index is tradable

100

• Capital and total return versions are

75 available for this index

50

• The index is calculated in accordance with

the Industry Classification Benchmark (ICB),

00

01

02

03

04

05

06

07

08

09

10

0

0

-2

-2

-2

-2

-2

-2

-2

-2

-2

-2

-2

ay

ay

ay

ay

ay

ay

ay

ay

ay

ay

ay

M

M

a global standard developed in partnership

FTSE 100 Index FTSE All-Share Index with Dow Jones Indexes

Source: FTSE Group, data as at 28 May, 2010

• The indices are managed according to a

FTSE 100 INDEX TOP 10 CONSTITUENTS transparent and public set of index rules,

Constituent ICB Code ICB Sector Net Mkt Cap Weight (%) and overseen by an independent committee

(GBPm) FTSE 100 Index FTSE All-Share of leading market professionals. The

Index Index

HSBC Hldgs 8350 Banks 109,264 8.18 6.97

committee ensures that the rules are

BP 530 Oil & Gas Producers 93,234 6.98 5.94 correctly applied and adhered to. Regular

Vodafone Group 6570 Mobile Telecommunications 72,707 5.44 4.63 index reviews are conducted to ensure that

Royal Dutch Shell A 530 Oil & Gas Producers 64,669 4.84 4.12 a continuous and accurate representation

GlaxoSmithKline 4570 Pharmaceuticals & Biotechnology 60,632 4.54 3.87

of the market is maintained

Rio Tinto 1770 Mining 48,705 3.65 3.10

Royal Dutch Shell B 530 Oil & Gas Producers 47,586 3.56 3.03

AstraZeneca 4570 Pharmaceuticals & Biotechnology 42,344 3.17 2.70

BHP Billiton 1770 Mining 42,220 3.16 2.69

British American Tobacco 3780 Tobacco 40,779 3.05 2.60

Totals 622,139 46.56 39.66

Source: : FTSE Group, data as at 28 May, 2010

FAMILY TREE

FTSE UK Index Series

FTSE All-Share Index FTSE All-Small Index*

FTSE All-Share FTSE 100 Index FTSE SmallCap

Sector Indices Index

FTSE 350 Index

FTSE 250 Index

FTSE 350 FTSE UK 350 FTSE 350 FTSE UK * FTSE All-Small Index

Yield Indices Syle Indices Sector Indices Dividend+ Index

FTSE SmallCap FTSE Fledgling FTSE All Small

Index Index Sector Indices

Benchmark Indices Tradable Indices

FTSE100 Factsheet-2:FTSE100 27/8/10 13:32 Page 2

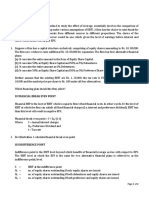

FTSE 100 INDEX ICB INDUSTRY BREAKDOWN INFORMATION

Index Universe

FTSE 100 Index FTSE All-Share Index

ICB Code ICB Industry No of Net Mkt Cap Index Weight No of Net Mkt Cap Index Weight FTSE All-Share Index

Constituents (GBPm) (%) Constituents (GBPm) (%)

0001 Oil & Gas 8 262,299 19.63 26 272,680 17.38 Index Launch

3 January 1984

1000 Basic Materials 12 175,324 13.12 28 186,073 11.86

2000 Industrials 13 62,289 4.66 119 118,196 7.53 Base Date

3000 Consumer Goods 8 162,678 12.18 35 179,547 11.45 30 December 1983

4000 Health Care 4 116,485 8.72 20 119,801 7.64

Base Value

5000 Consumer Services 18 118,502 8.87 93 159,031 10.14

1000

6000 Telecommunications 4 88,029 6.59 9 90,828 5.79

7000 Utilities 8 51,584 3.86 11 55,725 3.55 Investability Screen

8000 Financials 25 286,174 21.42 257 361,373 23.04 Free Float adjusted and liquidity screened

9000 Technology 4 12,774 0.96 32 25,433 1.62

Index Calculation

Totals 104 1,336,138 100.00 630 1,568,687 100.00

Real-time and end-of-day index available. Real-

Source: FTSE Group, data as at 28 May, 2010 time index calculated every 15 seconds

FTSE 100 INDEX 10-YEAR PERFORMANCE DATA End-of-Day Distribution

Index available at 20:00 GMT or BST via FTP

FTSE All-Share FTSE 100 FTSE 250 FTSE 350 FTSE SmallCap and email

Index Index Index Index Index

PI TR PI TR PI TR PI TR PI TR Currency

Returns (%) 1 Month -6.6 -6.2 -6.6 -6.1 -7.0 -6.9 -6.6 -6.2 -7.2 -6.9 GBP & EUR

3 Months -2.3 -1.3 -3.1 -2.0 3.1 4.1 -2.3 -1.3 -1.5 -0.7

Review Dates

6 Months 0.9 2.7 0.0 1.7 8.1 9.6 0.9 2.7 1.1 2.5

March, June, September & December

YTD -3.2 -1.6 -4.1 -2.5 3.5 4.7 -3.2 -1.6 -1.0 0.1

Returns (%pa) 1 Year 18.7 22.9 17.4 21.8 27.3 30.7 18.6 22.9 20.5 23.9 Index Rules

3 Years -8.1 -4.5 -7.8 -4.1 -7.3 -4.6 -7.9 -4.3 -13.0 -10.5 Available at www.ftse.com/uk

5 years 1.5 5.2 0.9 4.7 6.3 9.2 1.6 5.3 -0.6 2.1

Vendor Codes

10 Years -1.2 2.1 -2.0 1.4 4.5 7.4 -1.2 2.1 -1.5 1.1

Available at www.ftse.com/uk

Volatility (%pa)*1 Year 16.2 16.2 16.5 16.5 17.5 17.5 16.4 16.4 12.4 12.4

3 Years 19.6 19.7 19.2 19.3 24.9 25.0 19.5 19.7 27.2 27.2 Factsheet Data

5 Years 16.2 16.3 15.8 15.9 20.8 20.8 16.1 16.2 22.2 22.2

FTSE Group, data as at 28 May, 2010

10 Years 15.5 15.6 15.2 15.2 19.8 19.8 15.4 15.5 21.4 21.3

Historical Data

Sharpe Ratio** 1 Year 1.62 1.82 1.52 1.73 1.97 2.12 1.60 1.80 2.20 2.42 Available from January 1984

3 Years -0.60 -0.40 -0.60 -0.39 -0.44 -0.32 -0.59 -0.39 -0.64 -0.53

5 Years -0.15 0.07 -0.19 0.04 0.10 0.23 -0.15 0.07 -0.20 -0.09

10 Years -0.35 -0.14 -0.41 -0.19 0.01 0.15 -0.35 -0.13 -0.27 -0.15

* Annualised over a year with 252 trading days ** Uses three month LIBOR as the risk free rate

Source: FTSE Group and Thomson Datastream, data as at 28 May, 2010 © FTSE International Limited (“FTSE”) 2010. All rights reserved.

“FTSE®”, “FT-SE®” and “Footsie®” are trade marks of the London

Stock Exchange Plc and The Financial Times Limited and are used by

FTSE 100 INDEX PORTFOLIO CHARACTERISTICS

FTSE under licence. All rights in and to the FTSE 100 Index vest in

FTSE. All information is provided for information purposes only. No

Attribute Value responsibility or liability is accepted by FTSE for any errors, loss or

Number of Constituents 104 liability arising from the use of this publication. Distribution of FTSE

index values and the use of the FTSE Indices to create financial

Net Market Cap (GBPm) 1,336,138 products require a licence from FTSE.

Constituent Sizes (Net Market Cap GBPm)

Average 12,847

Largest 109,264

Smallest 651

Median 4,476

Weight of Largest Constituent (%) 8.18

Top 10 Holdings (% Index Market Cap) 46.56

Source: FTSE Group, data as at 28 May, 2010

FOR FURTHER INFORMATION VISIT WWW.FTSE.COM, EMAIL INFO@FTSE.COM OR CALL YOUR LOCAL FTSE OFFICE:

LONDON +44 (0) 20 7866 1810 BOSTON +1 888 747 FTSE (3873) FRANKFURT +49 (0) 69 156 85 144 HONG KONG +852 2230 5800

BEIJING + 86 10 5864 5277 MADRID +34 91 411 3787 NEW YORK +1 888 747 FTSE (3873) PARIS +33 (0) 1 53 76 82 88

SAN FRANCISCO +1 888 747 FTSE (3873) SYDNEY +61 2 9293 2866 TOKYO +81 3 3581 2811 MILAN +39 02 72426 641

Das könnte Ihnen auch gefallen

- FTSE 100 IndexDokument3 SeitenFTSE 100 IndexThomasNoch keine Bewertungen

- FTSE 100 IndexDokument3 SeitenFTSE 100 IndexThomasNoch keine Bewertungen

- Ukx 20210430Dokument3 SeitenUkx 20210430ThomasNoch keine Bewertungen

- FTSE 100 IndexDokument3 SeitenFTSE 100 IndexThomasNoch keine Bewertungen

- FTSE 100 IndexDokument3 SeitenFTSE 100 IndexhaginileNoch keine Bewertungen

- Eurostoxx 50Dokument3 SeitenEurostoxx 50wilson.tayNoch keine Bewertungen

- FTSE 100 IndexDokument3 SeitenFTSE 100 IndexThomasNoch keine Bewertungen

- FTSE/JSE Top 40 IndexDokument3 SeitenFTSE/JSE Top 40 IndexstochosNoch keine Bewertungen

- FTSE 100 IndexDokument3 SeitenFTSE 100 IndexThomasNoch keine Bewertungen

- FTSE 100 IndexDokument3 SeitenFTSE 100 IndexThomasNoch keine Bewertungen

- FTSE 100 IndexDokument3 SeitenFTSE 100 IndexThomasNoch keine Bewertungen

- FTSE 100 IndexDokument3 SeitenFTSE 100 IndexThomasNoch keine Bewertungen

- FTSE Global All Cap IndexDokument4 SeitenFTSE Global All Cap IndexMichael JoNoch keine Bewertungen

- FTSE 100 IndexDokument3 SeitenFTSE 100 IndexThomasNoch keine Bewertungen

- Hedging Lean Hogs With SpreadDokument4 SeitenHedging Lean Hogs With SpreadAurelio RoblesNoch keine Bewertungen

- 6-Part 1 PDFDokument14 Seiten6-Part 1 PDFAswani B RajNoch keine Bewertungen

- FTSE 100 Minimum Variance IndexDokument2 SeitenFTSE 100 Minimum Variance IndexluisNoch keine Bewertungen

- FTSE 100 IndexDokument3 SeitenFTSE 100 IndexThomasNoch keine Bewertungen

- Nse newsJAN2011Dokument17 SeitenNse newsJAN2011Ally AbdullahNoch keine Bewertungen

- Bmo ZMTDokument2 SeitenBmo ZMTCSGcapNoch keine Bewertungen

- Zechmeister Et Al. 2013 Page 12Dokument1 SeiteZechmeister Et Al. 2013 Page 12Pierre-Cécil KönigNoch keine Bewertungen

- Presentation of UK Retail ClothingDokument15 SeitenPresentation of UK Retail Clothingsaherhcc4686Noch keine Bewertungen

- Ukxusd 20230331Dokument3 SeitenUkxusd 20230331Sultonmurod ZokhidovNoch keine Bewertungen

- Mmce 20220131Dokument3 SeitenMmce 20220131rahulsankla3Noch keine Bewertungen

- The Digital World: COMPSCI 111 SC - Lecture 2Dokument5 SeitenThe Digital World: COMPSCI 111 SC - Lecture 2Свят КаштанNoch keine Bewertungen

- 4uk5 20231031Dokument3 Seiten4uk5 20231031Shahzeb HayatNoch keine Bewertungen

- Honors in Predictive Maintenance (20 Credits)Dokument6 SeitenHonors in Predictive Maintenance (20 Credits)A13Nayan ChandakNoch keine Bewertungen

- Geislms 20240229Dokument5 SeitenGeislms 20240229ANoch keine Bewertungen

- Flyer FinalDokument2 SeitenFlyer FinalRahul SoodNoch keine Bewertungen

- Italy: Graph 1: Total Merchandise Trade, by ValueDokument2 SeitenItaly: Graph 1: Total Merchandise Trade, by ValuebmatNoch keine Bewertungen

- Presentation Motilal Oswal Nifty Microcap 250 Index FundDokument32 SeitenPresentation Motilal Oswal Nifty Microcap 250 Index FundSharwaNoch keine Bewertungen

- Unilever ChartsDokument16 SeitenUnilever ChartsdrketakibhorNoch keine Bewertungen

- DRT 25C: The One For Everything.: Reliable Detection Without Readjustment When Changing ObjectsDokument2 SeitenDRT 25C: The One For Everything.: Reliable Detection Without Readjustment When Changing ObjectsfazalNoch keine Bewertungen

- Oracle Fusion FIN Using Allocations GLDokument30 SeitenOracle Fusion FIN Using Allocations GLSrinivasa Rao AsuruNoch keine Bewertungen

- Instal Guide EclipseDokument18 SeitenInstal Guide EclipseGustavo Adolfo Moreno BeltranNoch keine Bewertungen

- d78b4 Most Factsheet February 2024Dokument60 Seitend78b4 Most Factsheet February 2024final bossuNoch keine Bewertungen

- FTSE Emerging Markets China A Inclusion IndexesDokument5 SeitenFTSE Emerging Markets China A Inclusion IndexesajNoch keine Bewertungen

- Calle 14 de NoviembreDokument1 SeiteCalle 14 de NoviembreJesús girondaNoch keine Bewertungen

- Annual Report 2020Dokument184 SeitenAnnual Report 2020Muhammad HasnainNoch keine Bewertungen

- Presented By: TAUSEEF LADAK SR Manager Equity Sales Taurus Securities LimitedDokument52 SeitenPresented By: TAUSEEF LADAK SR Manager Equity Sales Taurus Securities LimitedNoman AliNoch keine Bewertungen

- Supervision Consultant Contractor Client Project: Al Mairid Development Phase 1 Construction and Maintenance of Road Works Ras Al KhaimahDokument1 SeiteSupervision Consultant Contractor Client Project: Al Mairid Development Phase 1 Construction and Maintenance of Road Works Ras Al KhaimahMalik SeemabNoch keine Bewertungen

- FTSE All-World IndexDokument4 SeitenFTSE All-World IndexVincentNoch keine Bewertungen

- Wisauusd 20231130Dokument3 SeitenWisauusd 20231130sakmsh4Noch keine Bewertungen

- Mitsubishi QDokument31 SeitenMitsubishi QcvdweNoch keine Bewertungen

- Indian Stock Exchanges and How Their Indices Are CalculatedDokument30 SeitenIndian Stock Exchanges and How Their Indices Are CalculatedKirron ThakurNoch keine Bewertungen

- Qms Performance Analysis Report: FM-SP-R10-10-02Dokument2 SeitenQms Performance Analysis Report: FM-SP-R10-10-02Cess AyomaNoch keine Bewertungen

- Mod III GL En4460en00en LabDokument12 SeitenMod III GL En4460en00en LabMiguel OrtizNoch keine Bewertungen

- Honors Syllabus - Textile DesignDokument8 SeitenHonors Syllabus - Textile DesignNagenderNoch keine Bewertungen

- 2018 V1 Dahua Technology (36P) 0130Dokument17 Seiten2018 V1 Dahua Technology (36P) 0130Carlos VargasNoch keine Bewertungen

- Final Porfolio PaperDokument15 SeitenFinal Porfolio PaperDeep DualNoch keine Bewertungen

- FactSheet April2011Dokument4 SeitenFactSheet April2011Sunil SunitaNoch keine Bewertungen

- LVOLDokument2 SeitenLVOLSteven VandewieleNoch keine Bewertungen

- Most Factsheet March 2024Dokument61 SeitenMost Factsheet March 2024Deepak GoyalNoch keine Bewertungen

- Budget Planner 2015Dokument3 SeitenBudget Planner 2015morrisioNoch keine Bewertungen

- Strategy Paper: Enhancing Kse-100 Index To Free Float MethodologyDokument24 SeitenStrategy Paper: Enhancing Kse-100 Index To Free Float MethodologysakiaslamNoch keine Bewertungen

- FTSE Bursa Malaysia KLCIDokument3 SeitenFTSE Bursa Malaysia KLCIHaziq DanielNoch keine Bewertungen

- Molemole Municipality: Name of ContractorDokument1 SeiteMolemole Municipality: Name of ContractoranzaniNoch keine Bewertungen

- FTSE EPRA/NAREIT Developed IndexDokument3 SeitenFTSE EPRA/NAREIT Developed IndexChristo FilevNoch keine Bewertungen

- Ex Rig Action Tracker YANI 104Dokument14 SeitenEx Rig Action Tracker YANI 104Adi RaharjoNoch keine Bewertungen

- 1910dsycp 11600Dokument2 Seiten1910dsycp 11600brandiwinde41Noch keine Bewertungen

- La Salle Charter School: Statement of Assets, Liabilities and Net Assets - Modified Cash BasisDokument5 SeitenLa Salle Charter School: Statement of Assets, Liabilities and Net Assets - Modified Cash BasisF. O.Noch keine Bewertungen

- HLB SME 1form (Original)Dokument14 SeitenHLB SME 1form (Original)Mandy ChanNoch keine Bewertungen

- Form 16Dokument6 SeitenForm 16Pulkit Gupta100% (1)

- Zabala Auto SupplyDokument7 SeitenZabala Auto SupplyLeighsen VillacortaNoch keine Bewertungen

- Ratio Analysis at Amararaja Batteries Limited (Arbl) A Project ReportDokument79 SeitenRatio Analysis at Amararaja Batteries Limited (Arbl) A Project Reportfahim zamanNoch keine Bewertungen

- Chapter 7Dokument6 SeitenChapter 7Pranshu GuptaNoch keine Bewertungen

- PERCENTAGEDokument7 SeitenPERCENTAGEPrakash KumarNoch keine Bewertungen

- FIN221 Chapter 3 - (Q&A)Dokument15 SeitenFIN221 Chapter 3 - (Q&A)jojojoNoch keine Bewertungen

- Escorts LTDDokument34 SeitenEscorts LTDSheersh jainNoch keine Bewertungen

- V. Commissioner of Internal Revenue, RespondentDokument3 SeitenV. Commissioner of Internal Revenue, RespondentJenifferRimandoNoch keine Bewertungen

- Chapter 18Dokument27 SeitenChapter 18jimmy_chou1314100% (1)

- TestDokument14 SeitenTesthonest0988Noch keine Bewertungen

- Arvog Finance Corporate Presentation 2022Dokument9 SeitenArvog Finance Corporate Presentation 2022Dinesh KandpalNoch keine Bewertungen

- Banking RatiosDokument7 SeitenBanking Ratioszhalak04Noch keine Bewertungen

- Tax Saving Schemes On Mutual FundsDokument10 SeitenTax Saving Schemes On Mutual Fundskeshav chandraNoch keine Bewertungen

- CFD Forex Broker Report - 7th EditionDokument75 SeitenCFD Forex Broker Report - 7th EditiongghghgfhfghNoch keine Bewertungen

- Personal Loan Application Form Borang Permohonan Pinjaman PeribadiDokument6 SeitenPersonal Loan Application Form Borang Permohonan Pinjaman PeribadiMohd AzhariNoch keine Bewertungen

- Cost and Benefit Analysis BookDokument361 SeitenCost and Benefit Analysis Book9315875729100% (7)

- ChatGPT 18Dokument2 SeitenChatGPT 18ashaykosare.007Noch keine Bewertungen

- Working Capital and The Financing Decision: Discussion QuestionsDokument35 SeitenWorking Capital and The Financing Decision: Discussion QuestionsBlack UnicornNoch keine Bewertungen

- The 7 Steps To Freedom - by David MacGregorDokument24 SeitenThe 7 Steps To Freedom - by David MacGregorTamás DunavölgyiNoch keine Bewertungen

- Format Laporan Petty CashDokument8 SeitenFormat Laporan Petty CashIchalz NtsNoch keine Bewertungen

- Warren Buffett's Mini Unofficial) BiographyDokument8 SeitenWarren Buffett's Mini Unofficial) Biographydeepak150383Noch keine Bewertungen

- ICICI Pru Signature Online BrochureDokument30 SeitenICICI Pru Signature Online Brochuremyhomemitv2uNoch keine Bewertungen

- AASB 112 Fact SheetDokument4 SeitenAASB 112 Fact SheetCeleste LimNoch keine Bewertungen

- Malaysia and The Global Financial Crisis, The Case of Malaysia As A Plan-Rationality State in Responding The CrisisDokument22 SeitenMalaysia and The Global Financial Crisis, The Case of Malaysia As A Plan-Rationality State in Responding The CrisisErika Angelika60% (5)

- Lembar Jawaban 2-BUKU BESARDokument13 SeitenLembar Jawaban 2-BUKU BESAREnrico Jovian S SNoch keine Bewertungen

- Notes On MicrofinanceDokument8 SeitenNotes On MicrofinanceMapuia Lal Pachuau100% (2)

- Capital Structure Policy I Ebit-Eps Analysis: Page 1 of 2Dokument2 SeitenCapital Structure Policy I Ebit-Eps Analysis: Page 1 of 2Danzo ShahNoch keine Bewertungen