Beruflich Dokumente

Kultur Dokumente

Compliance Director or Forensic Accountant

Hochgeladen von

api-781067650 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

18 Ansichten3 SeitenCompliance Director, Forensic Accountant with 27 years experience looking for a Middle Management position.

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

TXT, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCompliance Director, Forensic Accountant with 27 years experience looking for a Middle Management position.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als TXT, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

18 Ansichten3 SeitenCompliance Director or Forensic Accountant

Hochgeladen von

api-78106765Compliance Director, Forensic Accountant with 27 years experience looking for a Middle Management position.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als TXT, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

Financial services professional and licensed Certified Public Accountant with ov

er twenty-five years securities industry experience.

Extensive experience with major Federal and FINRA rules pertaining to hedge-fund

, asset management and broker-dealer activities.

Resourceful problem solver with keen analytical strengths. Possess strong writte

n, research, investigative and administrative skills.

NYS CPA License 102278

Possess Series 4, 7, 9, 10, 14, 24, 27, 53, 55 & 63, New York State Notary Publi

c licenses.

* Compliance Management * Accounting * Net Capital and FOCUS Reporting * Auditin

g * Transaction Review and Surveillance * Anti-Money Laundering/Patriot Act * Cu

stomer Protection Rule * Policies/Procedures Implementation * Regulatory Filings

* Annual CEO Certification * Email Surveillance * OATS, TRACE & MSRB Reporting

* Registration & Continuing Education * Sales Literature Review * Fixed-income O

perations Management * Investor Relations

EXPERIENCE:

Airlie Opportunity Capital Management LP

Chief Compliance Officer

October 2007 - Present

- Manage and monitor policies and procedures for the general operation of a hedg

e fund Compliance Program.

- Conduct annual review of Airlie's compliance program in conjunction with IA Ac

t Rule 206(4)-7.

- Promote culture of compliance through on-going communication, periodic seminar

s, news and regulatory updates.

- Function as independent reviewer to ensure compliance issues are evaluated, in

vestigated and resolved.

- Monitor the adherence to the company Code of Ethics and related activities.

- Oversee several executive and management compliance committees instituted for

risk management.

Buchanan Associates

June 2007 - September 2007

Provided accounting, regulatory reporting and compliance advisory services for r

etained clients in the securities industry.

MJ Whitman LLC (Affiliate of Third Avenue Management LLC)

Compliance Officer

September 2004 - May 2007

* Coordinated a comprehensive program to ensure regulatory compliance for a limi

ted-purpose broker-dealer.

* Conducted surveillance of equity and fixed-income transactions done for custom

ers and asset-management affiliate.

* Assisted in the preparation and review of Net Capital computations and FOCUS r

eports.

* Performed a review of affiliate's processes for billing $25 million of managem

ent fees for fiscal year 2006.

* Wrote supervisory procedures and processed regulatory filings.

* Served as primary contact during NASD examinations and inquiries.

* Deputy AML Officer.

Tradition Asiel Securiites Inc.

VP Operations/Compliance

July 1998 - September 2004

* Coordinated a comprehensive program to ensure regulatory compliance for an int

er-dealer broker.

* Directed transaction surveillance, writing of supervisory procedures and prepa

ration of regulatory filings.

* Assisted in the preparation and review of Net Capital computations and FOCUS r

eports.

* Firm's Anti-Money Laundering Officer. Allied member of the NYSE.

* Served as primary contact for all regulatory examinations and inquiries.

* Managed the clearing of a daily volume of $20 billion of repurchase and cash m

arket transactions through the FICC.

* Responsible for transaction processing, daily accounting and reconciliation of

clearance accounts.

* Redesigned back-office workload by recruiting securities processing vendors an

d clearing banks.

* Oversaw money-market, emerging market and MBS trade settlement. Supervised a s

taff of seven.

Sakura Securities (USA) Inc.

AVP Accounting/Operations/Compliance

February 1995 - July 1998

* Supervised daily clearance of $3 billion of government securities and repurcha

se transactions. Managed a staff of three.

* Performed general ledger analysis, month-end closings and journal entries. Pre

pared depreciation schedules.

* Responsible for P & L, financial reporting, cash management, account reconcili

ation, net capital and customer protection computations, FOCUS report preparatio

n, risk management and counterparty credit analysis.

* Coordinated a program to ensure regulatory compliance for a bank-affiliated br

oker-dealer servicing institutional accounts.

Lehman Brothers Inc.

Regulatory Auditor

November 1993 - February 1995

* Designed and supervised compliance audits of NYSE, equity derivatives, financi

al futures, NASDAQ, and government securities trading departments. Delivered fin

dings to senior management.

NASD/FINRA-Dist #10 NY

Govt. Securities Examiner

November 1989 - October 1993

* Oversaw financial and operational examinations of primary dealers in US govern

ment securities and NASDAQ market firms. Trained new employees.

* Analyzed and audited member firms balance sheets, net capital, 15c3-3 computat

ions and FOCUS reports.

Wertheim Schroder & Co. Inc.

Government Securities Trader

April 1986 - March 1989

* Maintained proprietary trading accounts in the zero to two-year note and zero

to three-month bill maturity sectors.

* Executed transactions in mortgage-backed and zero-coupon securities.

* Handled institutional and retail odd-lot orders throughout the yield curve.

Wertheim Schroder & Co. Inc.

Trade Support

January 1985 - April 1986

* Calculated profit and loss, wrote management reports and reconciled clearance

accounts.

* Input trades into back-office system and cleared them through the Fedwire.

Prudential Bache Securities

May 1983 - December 1984

- Conducted P&L analysis for customer accounts subject to arbitration.

- Researched discrepancies in customer's accounts and authorized corrective jour

nal entries.

State University of New York College at Old Westbury

MS, Accounting

St. John's University - Peter J. Tobin College of Business

MBA, Finance

State University of New York at Oswego

BS, Business Administration

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Chapter 2 ProblemsDokument6 SeitenChapter 2 ProblemsYour MaterialsNoch keine Bewertungen

- Week 7 Sex Limited InfluencedDokument19 SeitenWeek 7 Sex Limited InfluencedLorelyn VillamorNoch keine Bewertungen

- Role of Losses in Design of DC Cable For Solar PV ApplicationsDokument5 SeitenRole of Losses in Design of DC Cable For Solar PV ApplicationsMaulidia HidayahNoch keine Bewertungen

- Fss Presentation Slide GoDokument13 SeitenFss Presentation Slide GoReinoso GreiskaNoch keine Bewertungen

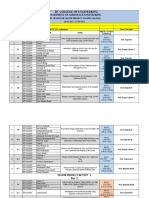

- Review1 ScheduleDokument3 SeitenReview1 Schedulejayasuryam.ae18Noch keine Bewertungen

- Partes de La Fascia Opteva Y MODULOSDokument182 SeitenPartes de La Fascia Opteva Y MODULOSJuan De la RivaNoch keine Bewertungen

- Cisco SDWAN Case Study Large Global WANDokument174 SeitenCisco SDWAN Case Study Large Global WANroniegrokNoch keine Bewertungen

- Monkey Says, Monkey Does Security andDokument11 SeitenMonkey Says, Monkey Does Security andNudeNoch keine Bewertungen

- FMC Derive Price Action GuideDokument50 SeitenFMC Derive Price Action GuideTafara MichaelNoch keine Bewertungen

- QP December 2006Dokument10 SeitenQP December 2006Simon ChawingaNoch keine Bewertungen

- BMOM5203 Full Version Study GuideDokument57 SeitenBMOM5203 Full Version Study GuideZaid ChelseaNoch keine Bewertungen

- Organization and Management Module 3: Quarter 1 - Week 3Dokument15 SeitenOrganization and Management Module 3: Quarter 1 - Week 3juvelyn luegoNoch keine Bewertungen

- Quantitative Methods For Economics and Business Lecture N. 5Dokument20 SeitenQuantitative Methods For Economics and Business Lecture N. 5ghassen msakenNoch keine Bewertungen

- Lesson PlanDokument2 SeitenLesson Plannicole rigonNoch keine Bewertungen

- Hima OPC Server ManualDokument36 SeitenHima OPC Server ManualAshkan Khajouie100% (3)

- 70 Valves SolenoidDokument105 Seiten70 Valves SolenoidrizalNoch keine Bewertungen

- DPSD ProjectDokument30 SeitenDPSD ProjectSri NidhiNoch keine Bewertungen

- E0 UoE Unit 7Dokument16 SeitenE0 UoE Unit 7Patrick GutierrezNoch keine Bewertungen

- SMC 2D CADLibrary English 1Dokument590 SeitenSMC 2D CADLibrary English 1Design IPGENoch keine Bewertungen

- Chemistry: Crash Course For JEE Main 2020Dokument18 SeitenChemistry: Crash Course For JEE Main 2020Sanjeeb KumarNoch keine Bewertungen

- Broken BondsDokument20 SeitenBroken Bondsapi-316744816Noch keine Bewertungen

- 18 June 2020 12:03: New Section 1 Page 1Dokument4 Seiten18 June 2020 12:03: New Section 1 Page 1KarthikNayakaNoch keine Bewertungen

- Business Analytics Emphasis Course GuideDokument3 SeitenBusiness Analytics Emphasis Course Guidea30000496Noch keine Bewertungen

- of Thesis ProjectDokument2 Seitenof Thesis ProjectmoonNoch keine Bewertungen

- MASONRYDokument8 SeitenMASONRYJowelyn MaderalNoch keine Bewertungen

- Existential ThreatsDokument6 SeitenExistential Threatslolab_4Noch keine Bewertungen

- B122 - Tma03Dokument7 SeitenB122 - Tma03Martin SantambrogioNoch keine Bewertungen

- RTDM Admin Guide PDFDokument498 SeitenRTDM Admin Guide PDFtemp100% (2)

- Unit 16 - Monitoring, Review and Audit by Allan WatsonDokument29 SeitenUnit 16 - Monitoring, Review and Audit by Allan WatsonLuqman OsmanNoch keine Bewertungen

- AIA1800 Operator ManualDokument184 SeitenAIA1800 Operator ManualZain Sa'adehNoch keine Bewertungen