Beruflich Dokumente

Kultur Dokumente

Heho

Hochgeladen von

Sehrish Saleem QureshiOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Heho

Hochgeladen von

Sehrish Saleem QureshiCopyright:

Verfügbare Formate

Annual Report Analysis

Hero Honda Motors Ltd

Another good year

BSE Code 500182 Company background

NSE Code HEROHONDA Hero Honda Motors Ltd (HHML), established in 1984, is a joint venture between

Bloomberg Code HH@IN Hero Group, the world’s largest bicycle manufacturers and the Honda Motor Company

Market Cap Rs110bn of Japan. Today it is the world’s largest two-wheeler manufacturer. Hero Group

CMP Rs553 belongs to the Munjal family and came into existence in 1956. It manufactured bicycle

52week H/L 597/320

components in the early 1940’s and later became the world’s largest bicycle

Face Value Rs2

manufacturer.

Share Holding Pattern HHML manufactures a range of motorcycles with brands like CD Dawn, Splendor,

Shareholding pattern (%) Passion, CBZ, Karizma and Ambition. It is the market leader in two-wheelers and its

Government 55.0 Splendor range of bikes is the largest selling motorcycle in the country.

Institutional 32.4

Public 11.2

Others 1.4 Industry scenario

The two-wheeler industry thrives in developing countries especially in densely populated

countries like India. With income levels rising, customers are opting for entry-level

Share Price Chart motorcycles than scooters. The two-wheeler industry grew 11.6% yoy to 5.64mn

units in FY04 from 5.05mn units in FY03. The share of motorcycles in total two-

wheeler sales continues to improve (76.6% from 74.4% in 2002-03) while that of

geared scooters continues to be on the decline.

In terms of volumes, two-wheelers constitute nearly 80% of the vehicles produced in

India. However, in value terms, they account for 25% approximately of the total

vehicle production. HHML is the market leader followed by Bajaj Auto and TVS

Motors, in that order.

Table: Market share in motorcycles

(%) FY04 FY03

HHML 48 44

Bajaj Auto 24 24

TVS Motor 16 18

Yamaha 6 8

Others 6 6

Source: SIAM

In two-wheelers, HHML’s market share stood at 37% during FY04. In the premium

segment, the company enjoyed a 14% market share for the same period.

December 22, 2004 1

Annual Report Analysis

Higher volumes, lower realizations

HHML registered a 14.4% yoy growth in net sales to Rs58.3bn in FY04, similar to

the growth rate achieved in FY03. The key difference however, was the significant

fall in realizations in FY04 compared to FY03. While volumes increased by 23.4%

yoy in FY04, net realizations declined by 7.4% yoy during the same period.

Chart: HHML sale volumes and growth

2,500 50

2,070

2,000 1,678 40

1,425

1,500 30

1,030

1,000 762 20

500 10

- 0

FY00 FY01 FY02 FY03 FY04

Volumes ('000's) Growth in sales

LHS – Volumes in 000’s, RHS – Volume growth (%)

Source: Company data

The company launched 5 new models in FY04 to increase its share in the motorcycle

market. CD Dawn in April 2003, Karizma in May, Passion Plus in September 2003,

Splendor+ in October 2003 and Ambition 135 in January 2004. The company sold

over a million units of its Splendor range and 0.5mn units of CD Dawn in FY04. The

company enjoys a customer base of nearly 10mn.

FY04 witnessed export growth of 72% yoy mainly led by success of new models.

CD Dawn, Splendor+ and Passion Plus led to increase in exports by 87%. Besides

providing support services to Sri Lanka, Bangladesh and Columbia, the company

established its presence in new markets like Sierra Leone and Philippines for

motorcycles and components respectively.

Operating profit growth 14.9%, OPM at 16.6%

The company was able to marginally improve its operating margins by 7bps to 16.6%

in FY04 in spite of increase in steel prices and other input costs. The 104bps increase

in raw material cost was offset by a 108bps decline in other expenditure. The lower

other expenditure was due to reduction in advertising and revenue spends by the

company in FY04, which declined by 12.3% yoy. In contrast, raw material cost

increase was a result of a 7.3% yoy rise in cost of steel sheets and 15.3% yoy rise in

cost of components in FY04. Change in sales mix too contributed to higher raw

material cost.

December 22, 2004 2

Annual Report Analysis

Significant additions to investment portfolio

HHML added Rs3.7bn to its investment portfolio in FY04, a 31.2% yoy growth

from FY03. This has been the trend for the company in the last few years. HHML has

been adding over Rs4bn on an average in the last three years, witnessing a CAGR of

78.8% from FY01 to FY04.

Table: HHML’s Investment portfolio (As on March 31, 2004)

(Rs mn) FY04 FY03

Non-trade

Unquoted

MF Debt 550 -

MF MIP 5,961 -

MF Liquid 926 1,940

Quoted

MF Equity - 105

Quoted

Equity shares 738 -

Unquoted

Equity shares 18 -

Quoted

Bonds 1,613 -

Trade

Unquoted

Equity shares 35 35

Source: Annual report

The company recorded 67.2% yoy increase in its other income, which stood at

Rs1.8bn in FY04 compared to Rs1.1bn in FY03. Investments in mutual funds and

quoted bonds resulted in the high other income component for the company. Other

income accounted for an EPS of Rs9 before tax during the period under review. This

resulted in high incremental PBIDT growth of 20.8% yoy.

Another year of net interest earnings

HHML continues being a zero debt company in FY04. The company has unsecured

loans to the tune of Rs1.7bn on account of sales tax deferment from the State

Government of Haryana, which resulted in an interest payment of Rs17mn in FY04.

The company earned a net interest of Rs13.5mn compared to Rs10.2mn in FY03.

December 22, 2004 3

Annual Report Analysis

Capacity expansion and R&D expenses

HHML added to its gross fixed assets at a higher rate compared to sales growth. The

company utilized Rs500mn for expansion of its manufacturing facilities in FY04.

Depreciation charged for the year was marginally on the higher side as the company

follows a straight-line method of depreciation.

Table: HHML’s capacity and production information

FY04 FY03

Installed capacity (Units) 2,250,000 1,800,000

Actual production (Units) 2,064,698 1,680,277

Utilization rates (%) 91.8 93.3

Motorized two-wheelers with 350cc engine capacity

Source: Annual report

The company has two plants, one at Dharuhera and the other at Gurgaon. The

Dharuhera plant manufactures CD 100, CD 100ss and CD Dawn motorcycles while

the Gurgaon plant manufactures the others. Splendor is manufactured at both the

plants.

Chart: HHML’s productivity index (Units)

350

288

300

233

250 202 192

200 168 175

131 150

150 119 124

100

50

0

FY00 FY01 FY02 FY03 FY04

Dharuhera Gurgaon

FY99 – Base year (100)

Source: Annual report

By making additional investments in flexible CNC machines and automation, the

capacity at these plants is now in a position to increase its production levels.

Table: HHML’s R&D spend

(Rs mn) FY04 FY03 yoy (%)

Capital 74.3 15.6 376.3

Recurring 93.3 69.7 33.9

Total 167.6 85.3 96.5

Source: Annual report

December 22, 2004 4

Annual Report Analysis

Efficient working capital management

During the year, the company initiated a new receivables policy, which helped bring

down the debtor levels. Debtors declined by 69% yoy to Rs438mn in FY04, resulting

in debtor days falling to 2.7 days during the same period compared to 10.1 days in

FY03.

Inventories declined by 6.3% yoy to Rs1,882mn, which resulted in lower inventory

days at 11.8 days in FY04, compared to 14.4 days in FY03. This follows the

company’s trend of consistently lowering the proportion of inventories in total assets

over the years, shown in the chart below.

Chart: HHML’s inventory trend

2,050 30.0

2,000

25.0

1,950

20.0

1,900

1,850 15.0

1,800

10.0

1,750

1,700 5.0

1,650 0.0

FY01 FY02 FY03 FY04

Value (Rs mn) % of total assets

LHS – Inventory (Rs mn), RHS – Inventory as % of total assets (%)

Source: India Infoline Research

The only anomaly was the increased levels of loans and advances during the year.

FY04 witnessed huge increase in loans and advances by 117.4% yoy to Rs2.4bn

compared to a 20.7% yoy decline in FY03. These were on account of advances

recoverable to the tune of Rs2,246.6mn, which increased from the previous year

level of Rs981.4mn. This was partly on account of inter-corporate deposits given by

the company during the year.

Creditor days increased to 68.5 days in FY04 compared to 54.3 days in FY03.

Creditors grew by 44.2% yoy to Rs10.9bn in FY04 due to the healthy reputation

enjoyed by the company. On account of this, the company continued to enjoy a

negative working capital during the year.

December 22, 2004 5

Annual Report Analysis

Healthy cash flow from operations

HHML’s cash from operations rose by 29% yoy to Rs10.7bn in FY04 compared to

Rs8.3bn in FY03. The company funds their expansion from this cash and does not

need to raise any external loans for the purpose. The net profit margin increased to

12.5% during FY04, higher by 110bps compared to FY03.

Chart: HHML’s rising net profit margin (NPM)

8,000 13.0

7,000 12.0

6,000 11.0

5,000 10.0

4,000 9.0

3,000 8.0

2,000 7.0

FY01 FY02 FY03 FY04

Net Profit NPM

LHS – Net profit (Rs mn), RHS – NPM (%)

Source: India Infoline research

Dividend percentage hiked once again

Continuing with the trend of increasing the dividend percentage paid each year, HHML

declared 500% final dividend to add to the 500% interim dividend during the year.

This took the total dividend tally to 1000% in FY04, which translates into Rs20 per

equity share for the year.

Table: HHML’s dividend record

FY01 FY02 FY03 FY04

Total dividend# (Rs mn) 660 3,497 4,055 4,505

Dividend (%) 150 850 900 1,000

Payout ratio (x) 27 76 70 62

# Including corporate dividend tax

Source: Company data, India Infoline Ltd

Key ratios

FY00 FY01 FY02 FY03 FY04

ROCE (%) 45.1 54.5 86.7 89.0 81.8

RONW (%) 43.3 39.2 67.5 67.4 64.0

EVA (Rs mn)* 1,190 1,550 3,740 4,810 5,690

Market Capitalization (Rs mn) 38,740 28,160 66,700 37,580 97,970

WACC (%)** 17.5 15.9 12.3 11.3 13.9

* Economic Value Added

** Weighted Average Cost of Capital

Source: Company data, India Infoline Ltd

December 22, 2004 6

Annual Report Analysis

Outlook

During the year, HHML renewed its technical collaboration with Honda Motor

Corporation of Japan for another 10 years up to 2014. This will give HHML access

to Honda’s technology for another 10 years for developing new products. HHML

plans to launch two motorcycles in FY05 and a scooter with the technology provided

by Honda.

Growing competition, price undercutting, rising steel prices and other input costs

continue to pose a threat. Reduction in import duties for imports could also pose a

threat for the higher end bikes.

The company mentions in the annual report that the next three years for the two-

wheeler industry are positive but volatile. The company is planning to further increase

its capacity to meet the growing demand for motorcycles. It is considering setting up

a third plant for its products.

December 22, 2004 7

Annual Report Analysis

Income statement

Period to FY01 FY02 FY03 FY04

(Rs in mn) (12) (12) (12) (12)

Net Sales 31,687 44,627 50,976 58,310

Operating expenses (27,670) (38,009) (42,560) (48,644)

Operating profit 4,017 6,617 8,415 9,667

Other income 221 852 1,082 1,809

PBIDT 4,238 7,469 9,497 11,475

Interest (25) (15) (17) (17)

Depreciation (443) (510) (634) (733)

Profit before tax (PBT) 3,770 6,944 8,846 10,725

Tax (1,301) (2,315) (3,038) (3,441)

Profit after tax (PAT) 2,469 4,629 5,808 7,283

Balance sheet

Period to FY01 FY02 FY03 FY04

(Rs mn) (12) (12) (12) (12)

Sources

Share Capital 399 399 399 399

Reserves 5,893 6,458 8,211 10,989

Net Worth 6,292 6,858 8,610 11,388

Loan Funds 665 1,164 1,343 1,747

Total 6,957 8,022 9,953 13,135

Uses

Gross Block 6,147 7,045 7,863 9,169

Accd Depreciation (1,798) (2,235) (2,784) (3,458)

Net Block 4,349 4,811 5,079 5,711

Capital WIP 190 97 92 177

Total Fixed Assets 4,539 4,907 5,171 5,888

Investments 2,882 7,258 11,930 15,651

Total Current Assets 3,792 5,267 4,774 5,097

Total Current Liabilities (4,457) (9,512) (11,929) (13,501)

Net Working Capital (665) (4,245) (7,155) (8,404)

Miscellaneous expenditure 202 102 7 -

Total 6,957 8,022 9,953 13,135

December 22, 2004 8

Annual Report Analysis

Cash flow statement

Period FY02 FY03 FY04

Year to (Rs mn) 03/02 03/03 ’03/04

Net profit before tax and extraordinary items 6,944 8,846 10,725

Depreciation 510 634 733

Interest expense 15 17 17

Operating profit before working capital changes 7,469 9,497 11,475

Add: changes in working capital

(Inc)/Dec in

(Inc)/Dec in sundry debtors (574) (418) 977

(Inc)/Dec in inventories 202 (226) 127

Inc/(Dec) in sundry creditors 3,192 739 3,352

Inc/(Dec) in other current liabilities 1,863 1,678 (1,780)

Net change in working capital 4,682 1,773 2,676

Cash from operating activities 12,151 11,270 14,151

Less: Income tax (2,315) (3,038) (3,441)

Misc expenditure w/off 100 95 7

Net cash from operating activities 9,937 8,327 10,717

Cash Profit 9,937 8,327 10,717

Cash flows from investing activities

(Inc)/Dec in fixed assets (879) (897) (1,451)

(Inc)/Dec in Investments (4,376) (4,672) (3,721)

Net cash from investing activities (5,255) (5,569) (5,172)

Cash flows from financing activities

Inc/(Dec) in debt 500 178 404

Direct add/(red) to reserves (567) (0) 0

Interest expense (15) (17) (17)

Dividends (3,497) (4,055) (4,505)

(Inc)/Dec in loans & advances (464) 290 (1,299)

Net cash used in financing activities (4,043) (3,604) (5,417)

Net increase in cash and cash equivalents 639 (846) 128

Cash at start of the year 451 1,090 243

Cash at end of the year 1,090 243 371

December 22, 2004 9

Annual Report Analysis

Key ratios

FY01 FY02 FY03 FY04

(12) (12) (12) (12)

Per share ratios

EPS (Rs) 12.4 23.2 29.1 36.5

Div per share 3.0 17.0 18.0 20.0

Book value per share 31.5 34.3 43.1 57.0

Valuation ratios

P/E 0.0 0.0 0.0 14.1

P/BV 0.0 0.0 0.0 9.0

EV/sales 0.0 0.0 0.0 1.8

EV/ PBIT 0.1 0.0 0.1 9.7

EV/PBIDT 0.1 0.0 0.1 9.1

Profitability ratios

OPM (%) 12.68 14.83 16.51 16.58

PAT (%) 7.8 10.4 11.4 12.5

ROCE 54.5 86.7 89.0 81.8

RONW 39.2 67.5 67.4 64.0

Liquidity ratios

Current ratio 0.9 0.6 0.4 0.4

Debtors days 4.9 8.2 10.1 2.7

Inventory days 22.9 14.6 14.4 11.8

Creditors days 42.1 56.0 54.3 68.5

Leverage ratios

Debt / Total equity 0.11 0.17 0.16 0.15

Component ratios

Raw material 109.5 69.4 68.09 69.12

Staff cost 5.2 3.8 3.22 3.19

Other expenditure 19.6 12.0 12.19 11.11

Payout ratios

Dividend Payout Ratio 26.7 75.5 69.8 61.9

Published in December 2004. © India Infoline Ltd 2003-4.

India Infoline Ltd. All rights reserved.Regd. Off: 24, Nirlon Complex, Off W E Highway, Goregaon(E)

Mumbai-400 063. Tel.: +(91 22)5677 5900 Fax: 2685 0585.

This report is for information purposes only and does not construe to be any investment, legal or taxation

advice. It is not intended as an offer or solicitation for the purchase and sale of any financial instrument. Any

action taken by you on the basis of the information contained herein is your responsibility alone and India

Infoline Ltd (hereinafter referred as IIL) and its subsidiaries or its employees or directors, associates will not be

liable in any manner for the consequences of such action taken by you. We have exercised due diligence in

checking the correctness and authenticity of the information contained herein, but do not represent that it is

accurate or complete. IIL or any of its subsidiaries or associates or employees shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in

this publication. The recipients of this report should rely on their own investigations. IIL and/or its subsidiaries

and/or directors, employees or associates may have interests or positions, financial or otherwise in the securities

mentioned in this report.

December 22, 2004 10

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- TIA Tax Effective Restructuring For SMEsDokument9 SeitenTIA Tax Effective Restructuring For SMEsShamir GuptaNoch keine Bewertungen

- Chapter 3 Problem I - Cost MethodDokument5 SeitenChapter 3 Problem I - Cost MethodJIL Masapang Victoria ChapterNoch keine Bewertungen

- KU MBA Syllabus 2013Dokument4 SeitenKU MBA Syllabus 2013Vinod JoshiNoch keine Bewertungen

- Region IX, Zamboanga Peninsula Burgos ST., Molave, Zamboanga Del Sur 7023 Tel No. (062) 2251 507/ School ID No. 303797Dokument7 SeitenRegion IX, Zamboanga Peninsula Burgos ST., Molave, Zamboanga Del Sur 7023 Tel No. (062) 2251 507/ School ID No. 303797Charlyn CastroNoch keine Bewertungen

- Amalgamation of FirmsDokument22 SeitenAmalgamation of FirmsShridhar Kaligotla75% (4)

- Ramo 1-00Dokument121 SeitenRamo 1-00Jaime II LustadoNoch keine Bewertungen

- Cma2 Ch2 Mgmt@DuDokument16 SeitenCma2 Ch2 Mgmt@DuGosaye AbebeNoch keine Bewertungen

- IAS 16: Property Plant and Equipment Objective of IAS 16Dokument5 SeitenIAS 16: Property Plant and Equipment Objective of IAS 16Joseph Gerald M. ArcegaNoch keine Bewertungen

- FA1 Chapter 1 EngDokument21 SeitenFA1 Chapter 1 EngYong ChanNoch keine Bewertungen

- TS Grewal Solutions Class 12 Accountancy Volume 1 Chapter 7 - Dissolution of Partnership FirmDokument17 SeitenTS Grewal Solutions Class 12 Accountancy Volume 1 Chapter 7 - Dissolution of Partnership FirmMayank Garange100% (1)

- 1NFRS1 First Time Adoption of NFRSDokument27 Seiten1NFRS1 First Time Adoption of NFRSAnkit Jung RayamajhiNoch keine Bewertungen

- TS Cash FlowDokument4 SeitenTS Cash FlowVansh GoelNoch keine Bewertungen

- Key Technical Questions For Finance InterviewsDokument27 SeitenKey Technical Questions For Finance InterviewsSeb SNoch keine Bewertungen

- Review 105 - Day 3 Theory of AccountsDokument13 SeitenReview 105 - Day 3 Theory of Accountschristine anglaNoch keine Bewertungen

- Analysis of Financial Statement and Cash FlowDokument16 SeitenAnalysis of Financial Statement and Cash Flowa_hamza100% (1)

- Chart of Accounts Explanation QuickBooks Online DownloadDokument15 SeitenChart of Accounts Explanation QuickBooks Online DownloadMark Lobo100% (1)

- Question and Answer - 3Dokument31 SeitenQuestion and Answer - 3acc-expertNoch keine Bewertungen

- Abm Investama TBK - Bilingual - 31 - March - 2021 - ReleasedDokument224 SeitenAbm Investama TBK - Bilingual - 31 - March - 2021 - Releasedriska fitasaptyanaNoch keine Bewertungen

- C12 Partnerships PDFDokument49 SeitenC12 Partnerships PDFKristian Paolo De LunaNoch keine Bewertungen

- DEBENTURES - SolutionsDokument7 SeitenDEBENTURES - Solutionssaiteja surabhiNoch keine Bewertungen

- Assets Liabilities and EquityDokument2 SeitenAssets Liabilities and EquityArian Amurao50% (2)

- Digi Malay Co SofpDokument1 SeiteDigi Malay Co SofpCherry BlasoomNoch keine Bewertungen

- Cash FlowDokument5 SeitenCash FlowgarhgelhNoch keine Bewertungen

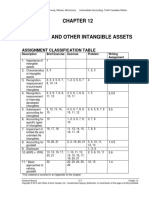

- Assignment Classification Table: Description Brief Exercise Exercise Problem Writing AssignmentDokument104 SeitenAssignment Classification Table: Description Brief Exercise Exercise Problem Writing AssignmentAbdifatah AbdilahiNoch keine Bewertungen

- Cabatan SC109Dokument5 SeitenCabatan SC109xylynn myka cabanatanNoch keine Bewertungen

- Midterm Examination in Fundamentals of Accountancy Business Ang Management 2Dokument1 SeiteMidterm Examination in Fundamentals of Accountancy Business Ang Management 2Joan Mae Angot - VillegasNoch keine Bewertungen

- Engineering Workshop - SubcontractingDokument16 SeitenEngineering Workshop - Subcontractingnav2ed100% (1)

- SLHT Genmath Week6 EditedDokument6 SeitenSLHT Genmath Week6 EditedR TECHNoch keine Bewertungen

- Annual Report 2008-Abbott PakistanDokument76 SeitenAnnual Report 2008-Abbott PakistanBassanio BrokeNoch keine Bewertungen

- Group - 3 - Assignment (Term Paper)Dokument13 SeitenGroup - 3 - Assignment (Term Paper)Biniyam YitbarekNoch keine Bewertungen