Beruflich Dokumente

Kultur Dokumente

Treasury Cash Management

Hochgeladen von

api-787082020 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

75 Ansichten2 SeitenTreasury Cash Management with 12 years experience looking for a Middle Management position.

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

TXT, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenTreasury Cash Management with 12 years experience looking for a Middle Management position.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als TXT, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

75 Ansichten2 SeitenTreasury Cash Management

Hochgeladen von

api-78708202Treasury Cash Management with 12 years experience looking for a Middle Management position.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als TXT, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

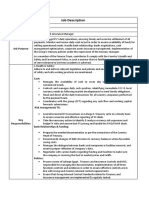

Objective: To secure a position with an organization with a stable environment t

hat will lead to a lasting relationship and enable me to use my experience in ca

sh management, strong problem solving skills, educational background and ability

to work well with people.

EXPERIENCE

MORGAN STANLEY Brooklyn, NY November 2003- February 2009

Cash Management Manager

Managed bank relationships, including negotiating pricing and services

Opened/closed/maintained bank accounts globally. Recently led project to transf

er process aspect of function to Baltimore including training new employees

Developed policies and procedures for account opening/closing process

Tested internal accounts for SWIFT compliance for Travel Rule

Performed client advisory to business units firm-wide on banking products and se

rvices

Dealt with various levels of management both within the firm and external, worke

d with Cash Management counterparts in London and Singapore. Provided training

and support in different areas of cash management operations when needed.

Created cash management structures for new entities, involving evaluating and co

ordinating implementation of new bank services, including acquisitions

Spearheaded project to streamline workflow using a technology based solution and

then trained various business units

Lead project to integrate all cash and securities accounts firm-wide, lead proje

ct for internal/external reconciliation of all bank accounts

Business analyst lead on Remote Deposit implementation

Reviewed and negotiated account related documentation including both external pr

oduct related and internal documentation for authorized signatory powers and cor

porate resolutions

Performed bank compensation analysis

Document SOX controls for compliance Sarbanes Oxley (SOX), section 404

POLO RALPH LAUREN, Lyndhurst, NJ February 1999-November 2002

Corporate Treasury

Cash Management Analyst

Responsible for the maintenance of a $325 million dollar credit line

Invested in Commercial Paper, Money Market Funds, CDs as required; exposure to i

nterest rate swaps, foreign currency exchange and forwards

Performed daily analysis to determine borrowable cash amounts

Maximized the efficient use of liquid assets by conducting break-even analyses

Calculated and analyzed daily cash position and investment activity ($340 millio

n portfolio), repaid debt, effected funds transfers

Consolidated 150 store bank accounts into 10 regional accounts and 20 single sto

re accounts.

Responsible for analyzing bank fees, interest fees, commitment fees and letter o

f credit fees

Created cash forecasts for short and medium term; ensured accurate general accou

nting for daily cash forecasts

Implemented new systems and trained employees

Consolidated cash flows for corporate headquarters and all European subsidiaries

; reported to Senior Management

Managed banking relationships; supervised Treasury/ Cash staff of three

COMPUTER SKILLS

Microsoft Office Suite (Excel, Access, PowerPoint, Outlook, Word), Chase Insight

, Weiland Banking Application, ProComm, Various banking applications such as BN

Y Cash Register Plus, CitiDirect, WellsFargo CEO

EDUCATION

BOSTON UNIVERSITY

Graduate courses in the Science of Management, Rome Italy campus

PACE UNIVERSITY

Bachelor of Business Administration - International Management

CERTIFICATION/TRAINING

*Certified Treasury Professional since 2001 (CTP)

*Attend AMA Seminars regularly for Finance Functions, Cash Management, Foreign E

xchange

*Ongoing training for Treasury products

*Completed Foundations in Project Management Certification from Boston Universit

y 2010

Das könnte Ihnen auch gefallen

- Manager Treasury Operations Settlement in New York NY Resume Bette SmolenDokument3 SeitenManager Treasury Operations Settlement in New York NY Resume Bette SmolenBetteSmolenNoch keine Bewertungen

- Treasury Analyst Cash Manager in Denver CO Resume Linda AzarDokument2 SeitenTreasury Analyst Cash Manager in Denver CO Resume Linda AzarLindaAzarNoch keine Bewertungen

- The Royal British Legion JOB Description: Treasury TeamDokument4 SeitenThe Royal British Legion JOB Description: Treasury TeamIrimia Mihai AdrianNoch keine Bewertungen

- Resume - Eben R PaulDokument2 SeitenResume - Eben R Paulapi-286166863Noch keine Bewertungen

- Internship Report Chap 2Dokument11 SeitenInternship Report Chap 2Faizan MalikNoch keine Bewertungen

- Anand - Talreja 111111111111Dokument10 SeitenAnand - Talreja 111111111111rajputbabitaNoch keine Bewertungen

- Knowledge of Accounts PayableDokument5 SeitenKnowledge of Accounts PayableGirish SonawaneNoch keine Bewertungen

- Saed Hasan CV RevisedDokument4 SeitenSaed Hasan CV RevisedAnonymous gKny1vnc100% (2)

- Work Experience Watiga & Co. (S) Pte LTD: IgnatiusDokument3 SeitenWork Experience Watiga & Co. (S) Pte LTD: IgnatiusankiosaNoch keine Bewertungen

- Resume FinalDokument2 SeitenResume Finalayaan_shaik1025Noch keine Bewertungen

- Treasury Manager or Analyst or Cash MangementDokument3 SeitenTreasury Manager or Analyst or Cash Mangementapi-78120801Noch keine Bewertungen

- CV - Katie Louise WatsonDokument3 SeitenCV - Katie Louise WatsonAnonymous MSqlCbw78Noch keine Bewertungen

- Sbrocco Mike - ResumeDokument2 SeitenSbrocco Mike - Resumeapi-262636043Noch keine Bewertungen

- Ahtasham Khan, Manager Internal Audit Hospitality DivisionDokument4 SeitenAhtasham Khan, Manager Internal Audit Hospitality Divisionmrshami7754Noch keine Bewertungen

- Job Objective Seeking Work As Cash Manager With Company To Advance My Skills and Career inDokument3 SeitenJob Objective Seeking Work As Cash Manager With Company To Advance My Skills and Career inkamrul hasanNoch keine Bewertungen

- Resume 2017 PDFDokument3 SeitenResume 2017 PDFapi-251531233Noch keine Bewertungen

- Treasury Managements SlidesDokument5 SeitenTreasury Managements SlidesSachin PangeniNoch keine Bewertungen

- Basel Measurement Reporting, ENO #230163Dokument2 SeitenBasel Measurement Reporting, ENO #230163yashkanthaliya5Noch keine Bewertungen

- Portfolio Admin or Client Service or Operations or Trade SupportDokument4 SeitenPortfolio Admin or Client Service or Operations or Trade Supportapi-77413512Noch keine Bewertungen

- RE IGNITE 4 Finance JD Financial ReportingDokument2 SeitenRE IGNITE 4 Finance JD Financial ReportingAshwet JadhavNoch keine Bewertungen

- Treasury Manager Back-Office Management: Main Purposes of The FunctionDokument2 SeitenTreasury Manager Back-Office Management: Main Purposes of The FunctionDuma DumaiNoch keine Bewertungen

- Mohammed ImranDokument5 SeitenMohammed ImranMohammed ImranNoch keine Bewertungen

- Job Profile - Programme Accountant ZimbabweDokument4 SeitenJob Profile - Programme Accountant ZimbabweThulani NdlovuNoch keine Bewertungen

- Financial Statement Analysis and ShenanigansDokument4 SeitenFinancial Statement Analysis and ShenanigansHusain LokhandwalaNoch keine Bewertungen

- Resume ChronologicalDokument2 SeitenResume ChronologicalDavid MwewaNoch keine Bewertungen

- Senior Operations Analyst Hedge Funds in Greater New York City Resume Tara AmatoDokument2 SeitenSenior Operations Analyst Hedge Funds in Greater New York City Resume Tara AmatoTaraAmatoNoch keine Bewertungen

- Daniel Deegan CVDokument2 SeitenDaniel Deegan CVapi-604591379Noch keine Bewertungen

- Administrative Manager Executive Assistant in Marysville WA Resume Sharon MoonDokument2 SeitenAdministrative Manager Executive Assistant in Marysville WA Resume Sharon MoonSharonMoonNoch keine Bewertungen

- Raunak Kumar ResumeDokument2 SeitenRaunak Kumar Resumeraunak29Noch keine Bewertungen

- Controller CFO VP Finance in NYC Resume Norman SchwartzDokument2 SeitenController CFO VP Finance in NYC Resume Norman SchwartzNormanSchwartzNoch keine Bewertungen

- Senior Financial Analyst in Washington DC Resume Jacques M Kouta-LopateyDokument2 SeitenSenior Financial Analyst in Washington DC Resume Jacques M Kouta-LopateyJacquesMKoutaLopateyNoch keine Bewertungen

- CIMA Example CV v.2Dokument3 SeitenCIMA Example CV v.2Umair ShamimNoch keine Bewertungen

- BSBA in Financial ManagementDokument4 SeitenBSBA in Financial ManagementJOCELYN NUEVONoch keine Bewertungen

- SVP Client On-Boarding Anti-Money Laundering in New York NY Resume Marc RazzanoDokument2 SeitenSVP Client On-Boarding Anti-Money Laundering in New York NY Resume Marc RazzanoMarcRazzanoNoch keine Bewertungen

- Course Materials BAFINMAX Week6Dokument7 SeitenCourse Materials BAFINMAX Week6emmanvillafuerteNoch keine Bewertungen

- Ahmed BR CV2022Dokument4 SeitenAhmed BR CV2022IMTIAZ AHMADNoch keine Bewertungen

- Senior Project Manager PMP in Chicago IL Resume Chito PerezDokument2 SeitenSenior Project Manager PMP in Chicago IL Resume Chito PerezChitoPerezNoch keine Bewertungen

- Purushotham (5,4)Dokument6 SeitenPurushotham (5,4)anandkrishna2006Noch keine Bewertungen

- Victor Thogode Resume-February 2022Dokument2 SeitenVictor Thogode Resume-February 2022Victor ThogodeNoch keine Bewertungen

- Prashant Sawant MBA CFPDokument3 SeitenPrashant Sawant MBA CFPpsawant77Noch keine Bewertungen

- A Small Resume October 2015Dokument4 SeitenA Small Resume October 2015api-299669834Noch keine Bewertungen

- Jamsheer PoozhitharaDokument4 SeitenJamsheer PoozhitharaJamsheer PoozhitharaNoch keine Bewertungen

- Advert FinancialManager2024Dokument2 SeitenAdvert FinancialManager2024u11082390Noch keine Bewertungen

- Ahmed AbdelsalamDokument6 SeitenAhmed AbdelsalamHatem HusseinNoch keine Bewertungen

- Ali Anwar Ali Shatat 2023Dokument6 SeitenAli Anwar Ali Shatat 2023али шататNoch keine Bewertungen

- JD Freshers Private Equity Fund AccountingDokument3 SeitenJD Freshers Private Equity Fund Accountingakashrawat26Noch keine Bewertungen

- Accountant CV in EnglishDokument6 SeitenAccountant CV in EnglishAbdo HassanNoch keine Bewertungen

- Job Advert Job Reference Job Title Contact EmailDokument2 SeitenJob Advert Job Reference Job Title Contact EmailMarko ShabanofOzzNoch keine Bewertungen

- Conversion Gate02Dokument5 SeitenConversion Gate02pradhan13Noch keine Bewertungen

- Vice President Finance in Philadelphia PA Resume Joanne FelixDokument2 SeitenVice President Finance in Philadelphia PA Resume Joanne FelixJoanneFelixNoch keine Bewertungen

- Job Description: Job Title Location Reporting ToDokument3 SeitenJob Description: Job Title Location Reporting ToSameh MohamedNoch keine Bewertungen

- JOELLA TAYLOR Resume AccountantDokument3 SeitenJOELLA TAYLOR Resume AccountantHARSHANoch keine Bewertungen

- Irrbb JDDokument3 SeitenIrrbb JDbarmanarijit4321Noch keine Bewertungen

- Kim Wolfe Director at Barclays CorporateDokument6 SeitenKim Wolfe Director at Barclays CorporatemeNoch keine Bewertungen

- Tolulope Rabiu's CV Newest OneDokument3 SeitenTolulope Rabiu's CV Newest OnetolusmilesNoch keine Bewertungen

- Athar Latif Updated CVDokument4 SeitenAthar Latif Updated CVHassan ImranNoch keine Bewertungen

- Treasury Management in BankingDokument6 SeitenTreasury Management in BankingSolve AssignmentNoch keine Bewertungen

- Managing Finance: Your guide to getting it rightVon EverandManaging Finance: Your guide to getting it rightNoch keine Bewertungen

- Leverages FinalDokument26 SeitenLeverages FinalVijendra GopaNoch keine Bewertungen

- Complete Checklist On Statutory Audit TaxconceptDokument19 SeitenComplete Checklist On Statutory Audit TaxconceptAbhiyendu AbhishekNoch keine Bewertungen

- Motus Investor Presentation 14 June 2023Dokument65 SeitenMotus Investor Presentation 14 June 2023Ricardo JacobsNoch keine Bewertungen

- NeerajDokument2 SeitenNeerajSheelu SinghNoch keine Bewertungen

- Marshall FRSDokument79 SeitenMarshall FRSMatt BrownNoch keine Bewertungen

- Reviewer Bank To MiningDokument9 SeitenReviewer Bank To MiningMarynissa CatibogNoch keine Bewertungen

- Mr. Anand - Notice To BankDokument13 SeitenMr. Anand - Notice To Bankvaibhav kharbandaNoch keine Bewertungen

- Ifs Cia 3Dokument11 SeitenIfs Cia 3Rohit GoyalNoch keine Bewertungen

- Banking InformationDokument14 SeitenBanking InformationIshaan KamalNoch keine Bewertungen

- 9 Other Cons Reporting IssuesDokument80 Seiten9 Other Cons Reporting IssuesalimithaNoch keine Bewertungen

- Annual Report 2011 2012 Federal BankDokument204 SeitenAnnual Report 2011 2012 Federal Bankshah1703Noch keine Bewertungen

- Chapter 4: Industry Analysis: Banking SectorDokument89 SeitenChapter 4: Industry Analysis: Banking SectorNekta PinchaNoch keine Bewertungen

- NCR NegoSale Batch 15017 020420 PDFDokument11 SeitenNCR NegoSale Batch 15017 020420 PDFSusie SotoNoch keine Bewertungen

- Camella Homes - Gensan - House Models by Real Estate Agent, Debbie R. GuiangDokument15 SeitenCamella Homes - Gensan - House Models by Real Estate Agent, Debbie R. GuiangDebbie Delos Reyes GuiangNoch keine Bewertungen

- Legaspi Vs CelestialDokument5 SeitenLegaspi Vs CelestialLouem GarceniegoNoch keine Bewertungen

- A Study On Npa of Public Sector Banks in India: Sulagna Das, AbhijitduttaDokument9 SeitenA Study On Npa of Public Sector Banks in India: Sulagna Das, AbhijitduttaSunil Kumar PalikelaNoch keine Bewertungen

- MB 2Dokument16 SeitenMB 2Shweta ShrivastavaNoch keine Bewertungen

- What Is A PEST AnalysisDokument13 SeitenWhat Is A PEST AnalysistusharNoch keine Bewertungen

- ChapterDokument7 SeitenChapterAhmed Ezzat AliNoch keine Bewertungen

- Investment Behavior and Investment Preference of InvestorsDokument65 SeitenInvestment Behavior and Investment Preference of InvestorsmithunNoch keine Bewertungen

- Statement 092022 4571Dokument4 SeitenStatement 092022 4571Charles GoodwinNoch keine Bewertungen

- Unit4 (Macro Economics)Dokument21 SeitenUnit4 (Macro Economics)Ravi SDNoch keine Bewertungen

- Equifax Personal Solutions - Credit Reports PDFDokument11 SeitenEquifax Personal Solutions - Credit Reports PDFTara Stewart80% (5)

- Business Transport LoanDokument8 SeitenBusiness Transport LoanJan RootsNoch keine Bewertungen

- Isc Specimen Question Paper Accounts 2014Dokument9 SeitenIsc Specimen Question Paper Accounts 2014BIKASH166Noch keine Bewertungen

- 9.2 - Compounding at Intervals Less Than 1 YearDokument8 Seiten9.2 - Compounding at Intervals Less Than 1 YearKarim GhaddarNoch keine Bewertungen

- Chapter - 1 Introduction To Commercial BankingDokument26 SeitenChapter - 1 Introduction To Commercial BankingMd Mohsin AliNoch keine Bewertungen

- Lecture 9 To 11 TVMDokument92 SeitenLecture 9 To 11 TVMNakul GoyalNoch keine Bewertungen

- A Report of Standard CharteredDokument73 SeitenA Report of Standard CharteredGopal Chandra SahaNoch keine Bewertungen

- Chapter 11: Risk ManagementDokument31 SeitenChapter 11: Risk ManagementKae Abegail GarciaNoch keine Bewertungen