Beruflich Dokumente

Kultur Dokumente

Interest Rates Linked To PLR. 14.02

Hochgeladen von

laxmibiradarOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Interest Rates Linked To PLR. 14.02

Hochgeladen von

laxmibiradarCopyright:

Verfügbare Formate

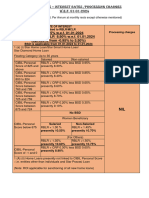

ANNEXURE – 1

AGRICULTURAL ADVANCES – INTEREST RATES

Short-term loans (Crop Loans) i.e. ACC/KCC/Agricultural Gold loans

S. Size of Credit Rates Revised rates

N w.e.f. 05.01.2011 w.e.f. 14.02.2011

o

1. Up to Rs.3.00 lac under interest subvention For crop loans up to a

scheme.(From the date of disbursement / limit of Rs.3.00 lac rate No Change

drawal upto the date of actual repayment or of interest is fixed at

upto the due date fixed by the branch 7.00% p.a. by RBI/

beyond which the outstanding loan Govt. of India under

becomes overdue, whichever is earlier, interest subvention

subject to a maximum period of one year.) scheme.

1. Upto Rs.50,000/- 10.50 %( PLR-3.00) 10.75 %( PLR-3.00)

2. Above Rs.50000/- upto Rs.2.00 lac 11.50 %( PLR-2.00) 11.75 %( PLR-2.00)

3. Above Rs.2.00 lac upto Rs. 3.00 lac 12.25 %( PLR-1.25) 12.50 %( PLR-1.25)

4. Above Rs.3.00 upto Rs.5.00 lac 13.00 %( PLR-0.50) 13.25 %( PLR-0.50)

5. Above Rs.5.00 upto Rs.25.00 lac 14.00 %(PLR+0.50) 14.25 %(PLR+0.50)

6. Above Rs.25.00 lac

Old CRA Model New CRA Model

SBH(AGR-1) SB1 & SB2 13.50%@(PLR) 13.75%@(PLR)

SBH(AGR-2) SB3 to SB5 14.25 %( PLR+0.75) 14.50 %( PLR+0.75)

SBH(AGR-3) SB6 & SB7 14.75 %( PLR+1.25) 15.00 %( PLR+1.25)

SBH(AGR- SB8 to SB16 15.00 %( PLR+1.50) 15.25 %( PLR+1.50)

4,5,6,7,8)

Annexure-2

Agriculture Term Loans

Rates applicable for term loans as repayable in 1- 3 years

S. Size of Credit Rates Revised rates

No w.e.f. w.e.f. 14.02.2011

05.01.2011

1 Up to Rs.50000/- 11.50 %( PLR- 11.75 %( PLR-

2.00) 2.00)

2 Above Rs.50000/- upto Rs.2.00 12.25 %( PLR- 12.50 %( PLR-

lacs 1.25) 1.25)

3 Above Rs.2.00 upto Rs.5.00 13.00 %( PLR- 13.25 %( PLR-

lacs 0.50) 0.50)

4. Above Rs.5.00 upto Rs.25.00 14.00 % 14.25 %

lacs ( PLR+0.50) ( PLR+0.50)

5. Above Rs.25.00 lacs :

Old CRA Model New CRA

Model

A SBH(AGR-1)TL-1 SB1 & SB2 13.50% (@ PLR) 13.75% (@ PLR)

B SBH(AGR-2)TL-2 SB3 to SB5 14.25% 14.50%

(PLR+0.75) (PLR+0.75)

C SBH(AGR-3)TL-3 SB6 & SB7 14.75% 15.00%

( PLR+1.25) ( PLR+1.25)

SBH(AGR-4)TL- SB8 to 15.00% 15.25%

4,5,6,7,8 SB16 ( PLR+1.50) ( PLR+1.50)

Annexure – 2(a)

Agriculture Term Loans

Rates applicable for term loans as repayable in 3 years and above

S. Size of Credit Rates Revised rates

No w.e.f. w.e.f. 14.02.2011

05.01.2011

1 Upto Rs.50000/- 12.00% (PLR- 12.25% (PLR-

1.50) 1.50)

2 Above Rs.50000/- upto Rs.2.00 12.75% (PLR- 13.00% (PLR-

lacs 0.75) 0.75)

3 Above Rs.2.00 upto Rs.5.00 13.50 %(@ 13.75 %(@

lacs PLR) PLR)

4. Above Rs.5.00 upto Rs.25.00 14.50% 14.75%

lacs (PLR+1.00) (PLR+1.00)

5. Above Rs.25.00 lacs :

Old CRA Model New CRA

Model

A SBH(AGR-1)TL-1 SB1 & SB2 14.00% 14.25%

( PLR+0.50) ( PLR+0.50)

B SBH(AGR-2)TL-2 SB3 to SB5 14.75% 15.00%

( PLR+1.25) ( PLR+1.25)

C SBH(AGR-3)TL-3 SB6 & SB7 15.25% 15.50%

( PLR+1.75) ( PLR+1.75)

SBH(AGR-4)TL- SB8 to 15.50% 15.75%

4,5,6,7,8 SB16 ( PLR+2.00) ( PLR+2.00)

Annexure – 3

PACS/FSCS

A. Crop Loans

Sl. Size of Credit Rates Revised rates

No. (For each individual w.e.f. 05.01.2011 w.e.f. 14.02.2011

borrower member as Bank to Society to Bank to Society to

fixed under IMBP vide Society members Society members

HO Cir No. AGR/2007-

08/19 dt. 03.09.2007)

1. Upto Rs.3,00,000/- 5.50% 7.00% No change No change

under interest

subvention scheme(#)

(#)Up to Rs.3.00 lac under interest subvention scheme.(From the date of disbursement / drawal

upto the date of actual repayment or upto the due date fixed by the branch beyond which the

outstanding loan becomes overdue, whichever is earlier, subject to a maximum period of one

year.)

After the due date of repayment of the crop loans for which interest subvention scheme is

applicable & for the other loans which do not come under the purview of the interest

subvention Scheme, the Rate of Interest applicable is as under

Sl. Size of Credit Rates Revised rates

N (For each individual w.e.f. 05.01.2011 w.e.f. 14.02.2011

o. borrower member as Bank to Society to Bank to Society Society to

fixed under IMBP vide Society members members

HO Cir No. AGR/2007-

08/19 dt. 03.09.2007)

1. Upto Rs.50,000/- 9.00 %( PLR- 10.50% 9.25 %( PLR- 10.75%

4.50) 4.50)

2. Over Rs.50,000/- upto 10.00 %( PLR- 11.50% 10.25 %( PLR- 11.75%

Rs.2.00 lac

3.50) 3.50)

3. Over Rs.2.00 lac upto 10.75 %( PLR- 12.25% 11.00 %( PLR- 12.50%

Rs.3.00 lac 2.75) 2.75)

Note: In view of the interest subvention scheme, branches have to credit collection /

recoveries of the society to the same loan account of the season / year for which society

disbursed and recovered the loans from its members.

Annexure – 4

PACS / FSCS

B. Agricultural Term Loans

Rates applicable for term loans as repayable in 1- 3 years

S. Size of Credit Rates Revised rates

N (For each individual i.e. 05.01.2011 weft. 14.02.2011

o. borrower member) Bank to Society Societ Bank to Society Society to

y to member

memb

er

1. Upto Rs.50000/- 10.00% (PLR- 11.50 10.25% (PLR- 11.75 %

3.50) % 3.50)

2 Above Rs.50000/- upto lac 10.75% (PLR- 12.25 11.00% (PLR- 12.50 %

Rs.2.00 lac 2.75) % 2.75)

3. Above Rs.2.00 lac upto 11.50% (PLR- 13.00 11.75% (PLR- 13.25 %

Rs.5.00 lac 2.00) % 2.00)

4. Above Rs.5.00 lac upto 12.50% (PLR- 14.00 12.75% (PLR- 14.25 %

Rs.25.00 lac 1.00) % 1.00)

Annexure – 4(a)

Rates applicable for term loans as repayable in more than 3 years

S. Size of Credit Rates Revised rates

N (For each individual w.e.f. 05.01.2011 w.e.f. 14.02.2011

o. borrower member) Bank to Society Societ Bank to Society Society to

y to member

memb

er

1. Upto Rs.50000/- 10.50 % (PLR- 12.00% 10.75 % (PLR- 12.25%

3.00) 3.00)

2. Above Rs.50000/- upto lac 11.25 % (PLR- 12.75% 11.50 % (PLR- 13.00%

Rs.2.00 lac 2.25) 2.25)

3. Above Rs.2.00 lac upto 12.00 % (PLR- 13.50% 12.25% (PLR- 13.75%

Rs.5.00 lac 1.50) 1.50)

4. Above Rs.5.00 lac upto 13.00 % (PLR- 14.50% 13.25 % (PLR- 14.75%

Rs.25.00 lac 0.50) 0.50)

Annexure – 5

Self Help Groups

Sl. Size of Credit Rates w.e.f. 05.01.2011 Revised rates w.e.f.

No 14.02.2011

1. Upto Rs.2.00 lac to 2.25 below BPLR 2.25 below BPLR

SHGs / VOs i.e.11.25% i.e.11.50%

2. Above Rs.2.00 lac to 1.25 below BPLR 1.25 below BPLR

SHGs / VOs i.e.12.25% i.e.12.50%

Annexure - 6

Scheme for financing Rural Housing – Gram Nivas

Period of loan Rates w.e.f. 05.01.2011 Revised rates w.e.f.

14.02.2011

Floatin Upto 5 years 10.50% (I.e.3.00 below BPLR) 10.75% (I.e.3.00 below

g Rate BPLR)

Above 5 10.50% (I.e.3.00 below BPLR) 10.75% (I.e.3.00 below

years & BPLR)

upto 15 years

Fixed Upto 5 years 13.50% 13.75%

Rate Above 5

years &

upto 15 years

Annexure – 7

For loans against warehouse receipts

Rates w.e.f 05.01.2011 Revised rates w.e.f. 14.05.2011

AG Interest as applicable to crop loans Interest as applicable to crop loans

R which do not come under the which do not come under the purview

purview of Interest Subvention of Interest Subvention Scheme i.e. as

Scheme i.e. as per Annexure - I. per Annexure - I.

C& As applicable to working capital As applicable to working capital

I finance. finance

Annexure - 8

Produce Market Loans

Rates w.e.f. 05.01.2011 Revised rates w.e.f. 14.05.2011

Interest as applicable to crop loans Interest as applicable to crop loans

which do not come under the purview which do not come under the

of Interest Subvention Scheme i.e. as purview of Interest Subvention

per Annexure - I. Scheme i.e. as per Annexure - I.

Annexure - 9

Gramin Bhandaran Yojana / Construction and running of storage facilities

S. Size of Credit Existing rates Revised rates

No w.e.f. w.e.f.

05.01.2011

Old CRA Model New CRA

Model

A SBH(AGR-1)TL-1 SB1 & SB2 11.50% ( PLR- 11.75% ( PLR-

2.00) 2.00)

B SBH(AGR-2)TL-2 SB3 to SB5 11.75% ( PLR- 12.00% ( PLR-

1.75) 1.75)

C SBH(AGR-3)TL-3 SB6 & SB7 11.75% ( PLR- 12.00% ( PLR-

1.75) 1.75)

SBH(AGR-4)TL- SB8 to SB16 15.25% 15.50%

4,5,6,7,8 (PLR+1.75) (PLR+1.75)

Das könnte Ihnen auch gefallen

- Credit Repair Letters To Remove Debt StrawmanDokument75 SeitenCredit Repair Letters To Remove Debt StrawmanRon Mowles98% (215)

- Cases in Financial Management SolutionsDokument2 SeitenCases in Financial Management Solutionscara4smith-3Noch keine Bewertungen

- City & Land Developers, Incorporated - SEC Form 17-A - 26june2020 PDFDokument162 SeitenCity & Land Developers, Incorporated - SEC Form 17-A - 26june2020 PDFFuturamaramaNoch keine Bewertungen

- Interestrate RabdDokument4 SeitenInterestrate RabdPEDDI REDDYNoch keine Bewertungen

- Canara BankDokument8 SeitenCanara BankKrithika SalrajNoch keine Bewertungen

- Boi Service ChargeDokument11 SeitenBoi Service ChargeBharat ChatrathNoch keine Bewertungen

- Annexure I - Schedule of Interest Rates Applicable For Msmes and OthersDokument7 SeitenAnnexure I - Schedule of Interest Rates Applicable For Msmes and Othersnani kannaNoch keine Bewertungen

- Advance Class Notes On InterestDokument7 SeitenAdvance Class Notes On InterestNidhi Sandesh SharmaNoch keine Bewertungen

- InterestRateofRural AgriBusinessDokument4 SeitenInterestRateofRural AgriBusinesssatyanarayana kosuriNoch keine Bewertungen

- MODIFIED Interest Rate 01974 2020 Agri Sector LoansDokument12 SeitenMODIFIED Interest Rate 01974 2020 Agri Sector Loansvenkat2674Noch keine Bewertungen

- Schemes of JK BankDokument8 SeitenSchemes of JK Bankigupta_4Noch keine Bewertungen

- Agri Int Rate WEF 18012017Dokument3 SeitenAgri Int Rate WEF 18012017Altaf AhamedNoch keine Bewertungen

- Interest Rates For Last 10 Yr For Major SME ProductsDokument6 SeitenInterest Rates For Last 10 Yr For Major SME Productssharad1996Noch keine Bewertungen

- 10 Years Int RatesDokument7 Seiten10 Years Int RatesAkshay PandeyNoch keine Bewertungen

- Intt RateDokument15 SeitenIntt Ratecuteyogesh_khandelwal400Noch keine Bewertungen

- Msme Loan - Upto 2lakhs: NF-546 NF-998 NF-588 NF-855 NF-803 NF-482 NF-373 NF-368Dokument4 SeitenMsme Loan - Upto 2lakhs: NF-546 NF-998 NF-588 NF-855 NF-803 NF-482 NF-373 NF-368Santosh KumarNoch keine Bewertungen

- Agri Segment Revised Interest Rates 01.06.2018Dokument3 SeitenAgri Segment Revised Interest Rates 01.06.2018bankingexam.aptitudeNoch keine Bewertungen

- Regulatory Circular RG13-019: To: From: REDokument4 SeitenRegulatory Circular RG13-019: To: From: RERanjan BasuNoch keine Bewertungen

- 6 Loan Products 2015: Co-Op. Societies Individuals Agriculture Agriculture Non Farm Sector Non FarmDokument7 Seiten6 Loan Products 2015: Co-Op. Societies Individuals Agriculture Agriculture Non Farm Sector Non FarmAbhishek ChoudharyNoch keine Bewertungen

- Interest Rates Excel 10.08.2022Dokument20 SeitenInterest Rates Excel 10.08.2022ritenNoch keine Bewertungen

- Revision of Service Charges - DepositDokument10 SeitenRevision of Service Charges - DepositThe QuintNoch keine Bewertungen

- RV 31032010Dokument218 SeitenRV 31032010Shamanth1Noch keine Bewertungen

- Amendment To Service Provider Agreement 1Dokument3 SeitenAmendment To Service Provider Agreement 1myloan partnerNoch keine Bewertungen

- Bank Lending Rates As of 12-01-19Dokument1 SeiteBank Lending Rates As of 12-01-19Uhudhu AhmedNoch keine Bewertungen

- RBI ROI FormatDokument8 SeitenRBI ROI Formatsrinivas.rmbaNoch keine Bewertungen

- PNB Loan Interest Rate 04 - 08 - 2021Dokument9 SeitenPNB Loan Interest Rate 04 - 08 - 2021Somasundaram MuthiahNoch keine Bewertungen

- Personal Account Interest Rate: (Golden Benefits)Dokument4 SeitenPersonal Account Interest Rate: (Golden Benefits)Md Ashikur RahmanNoch keine Bewertungen

- Advances Related Service Charges W.E.F. 01.04.2019 A PDFDokument11 SeitenAdvances Related Service Charges W.E.F. 01.04.2019 A PDFSudhakar BataNoch keine Bewertungen

- Upto 3 Yrs Above 3 Years & Upto 7 Years Upto 3 Yrs Above 3 Years & Upto 7 YearsDokument7 SeitenUpto 3 Yrs Above 3 Years & Upto 7 Years Upto 3 Yrs Above 3 Years & Upto 7 YearsPrateek GuptaNoch keine Bewertungen

- Loan Int RatesDokument4 SeitenLoan Int RatesSteve WozniakNoch keine Bewertungen

- JM Financial - Initiating Coverage On Power Financiers.Dokument73 SeitenJM Financial - Initiating Coverage On Power Financiers.adityasood811731Noch keine Bewertungen

- Oct To Dec: Running Collection (Net) With Above 65% Strike Including BlsDokument3 SeitenOct To Dec: Running Collection (Net) With Above 65% Strike Including BlsSanket MargajNoch keine Bewertungen

- Notice To SB CA OD Account Customer Annexure IIIDokument4 SeitenNotice To SB CA OD Account Customer Annexure IIIratnesh singhNoch keine Bewertungen

- FXD Vs FloatingDokument15 SeitenFXD Vs FloatingVishalNoch keine Bewertungen

- Chartered Accountant Meet Ao Nagpur Welcomes YouDokument15 SeitenChartered Accountant Meet Ao Nagpur Welcomes YouEmmy RoyNoch keine Bewertungen

- Financial Inclusion 15012019Dokument5 SeitenFinancial Inclusion 15012019Joydeep Chatterjee100% (1)

- 023 Sri Oth 04Dokument1 Seite023 Sri Oth 04fert certNoch keine Bewertungen

- Deposit Rate CircularDokument3 SeitenDeposit Rate CircularShaikh Hassan AtikNoch keine Bewertungen

- List of Fixed Deposit Schemes For The Month of January 2013Dokument6 SeitenList of Fixed Deposit Schemes For The Month of January 2013Kalpesh ShahNoch keine Bewertungen

- Club Rules For Agents W.E.F M.Y 2011-2012Dokument9 SeitenClub Rules For Agents W.E.F M.Y 2011-2012mickey4482Noch keine Bewertungen

- Urjit Patel Commitee 2014 - Explained PDFDokument35 SeitenUrjit Patel Commitee 2014 - Explained PDFNarendran MNoch keine Bewertungen

- RBI Format ROI PCDokument8 SeitenRBI Format ROI PCom vermaNoch keine Bewertungen

- MCLR Linked Interest RatesDokument8 SeitenMCLR Linked Interest RatesAjoydeep DasNoch keine Bewertungen

- RETAIL - Interest For Retail Loans - MCLR - Service Charges - From Web On 25082018Dokument12 SeitenRETAIL - Interest For Retail Loans - MCLR - Service Charges - From Web On 25082018Harish YadavNoch keine Bewertungen

- Current and Savings Account Interest Rate: Personal AccountsDokument2 SeitenCurrent and Savings Account Interest Rate: Personal AccountsMd.Rashidul Alam Sorker RifatNoch keine Bewertungen

- RBI Format ROI PCDokument6 SeitenRBI Format ROI PCSandesh ManeNoch keine Bewertungen

- Pls Note That Nre Deposits Are Available Only For Tenors of 1 Year & AboveDokument2 SeitenPls Note That Nre Deposits Are Available Only For Tenors of 1 Year & AboveAburvarajNoch keine Bewertungen

- STC-NMB BANK - May 2020 PDFDokument13 SeitenSTC-NMB BANK - May 2020 PDFaashish koiralaNoch keine Bewertungen

- Int Rate RetailDokument1 SeiteInt Rate RetailPrincy GuptaNoch keine Bewertungen

- RuralSC AnnexureIVforweb SiteDokument2 SeitenRuralSC AnnexureIVforweb SitePrajata GanguliNoch keine Bewertungen

- RBI ROI FormatDokument11 SeitenRBI ROI FormatDevender RajuNoch keine Bewertungen

- SBI Commission Structure W.E.F 01102015Dokument4 SeitenSBI Commission Structure W.E.F 01102015Mahesh V KalbhairavNoch keine Bewertungen

- Revised Schedule of ChargesDokument2 SeitenRevised Schedule of Chargesmayankmehta052Noch keine Bewertungen

- RRB NTPC Recruitment 2019Dokument2 SeitenRRB NTPC Recruitment 2019Pratik KachalwarNoch keine Bewertungen

- RBI Format ROI PC PDFDokument9 SeitenRBI Format ROI PC PDFmohana sundaram pNoch keine Bewertungen

- RATE OF INTEREST FOR AGRICULTURE LOANS2422EnglishDokument3 SeitenRATE OF INTEREST FOR AGRICULTURE LOANS2422EnglishmanojNoch keine Bewertungen

- Interest-Loans-Advance-10-09-2020 BGVB PDFDokument7 SeitenInterest-Loans-Advance-10-09-2020 BGVB PDFKuntal DasNoch keine Bewertungen

- CCP HRD PPFG English 33 1 PDFDokument31 SeitenCCP HRD PPFG English 33 1 PDFGayaprasad VermaNoch keine Bewertungen

- SBI Monthly Average Balance Shortfall PenaltyDokument1 SeiteSBI Monthly Average Balance Shortfall PenaltySERALATHAN KANAGASABAINoch keine Bewertungen

- Penalty For Non-Maintenance of MAB Metro Existing Charges / P.M. Proposed Charges / P.MDokument1 SeitePenalty For Non-Maintenance of MAB Metro Existing Charges / P.M. Proposed Charges / P.MNaresh HedaNoch keine Bewertungen

- Rev MAB PDFDokument1 SeiteRev MAB PDF8962393989Noch keine Bewertungen

- Lao PDR: Accelerating Structural Transformation for Inclusive GrowthVon EverandLao PDR: Accelerating Structural Transformation for Inclusive GrowthNoch keine Bewertungen

- Kulkarni Sarang MilindDokument21 SeitenKulkarni Sarang MilindSarang KulkarniNoch keine Bewertungen

- Busifin Final Period 2021 2022Dokument46 SeitenBusifin Final Period 2021 2022Glenn Mark NochefrancaNoch keine Bewertungen

- Credit Process and Credit Appraisal of A CommercialDokument26 SeitenCredit Process and Credit Appraisal of A CommercialLiza Ahmed100% (2)

- Financial ManagementDokument4 SeitenFinancial ManagementPauline BiancaNoch keine Bewertungen

- Simple Interest and Simple DiscountDokument4 SeitenSimple Interest and Simple DiscountRochelle Joyce CosmeNoch keine Bewertungen

- PBI - Unit 4 & 5Dokument70 SeitenPBI - Unit 4 & 5AdarshPanickerNoch keine Bewertungen

- Chapter 4. Working Capital ManagementDokument21 SeitenChapter 4. Working Capital ManagementHastings Kapala100% (1)

- Risk Action Plan:: Risks Access Risk Score Controls Action Priority Timelines ResponsibleDokument2 SeitenRisk Action Plan:: Risks Access Risk Score Controls Action Priority Timelines ResponsibleSadaf MehmoodNoch keine Bewertungen

- Loan Management of CBL - UshaDokument42 SeitenLoan Management of CBL - UshaMd SalimNoch keine Bewertungen

- Working Capital Management Notes PDFDokument40 SeitenWorking Capital Management Notes PDFBarakaNoch keine Bewertungen

- Ace Designers Limited: Summary of Rated InstrumentsDokument7 SeitenAce Designers Limited: Summary of Rated InstrumentskachadaNoch keine Bewertungen

- Hierarchical Chart BAPCCUL OKDokument1 SeiteHierarchical Chart BAPCCUL OKmunjukinzekaNoch keine Bewertungen

- Arya Financial Services PROPOSAL - OCT - SMCCDokument52 SeitenArya Financial Services PROPOSAL - OCT - SMCCSwarna SinghNoch keine Bewertungen

- Sample Intership Report Nguyen Trac Hoang Viet 1Dokument18 SeitenSample Intership Report Nguyen Trac Hoang Viet 1Lê Ngọc DiệpNoch keine Bewertungen

- Andhra Pradesh Records of Rights in Land and Pattadar Pass Books PDFDokument15 SeitenAndhra Pradesh Records of Rights in Land and Pattadar Pass Books PDFLatest Laws TeamNoch keine Bewertungen

- Meaning and DefinitionDokument43 SeitenMeaning and DefinitionAnonymous x4mrSXNoch keine Bewertungen

- Application FormDokument1 SeiteApplication FormArabea KateNoch keine Bewertungen

- Online PaymentsDokument21 SeitenOnline PaymentsTania StoicaNoch keine Bewertungen

- HSBC Labor Union Vs HSBCDokument13 SeitenHSBC Labor Union Vs HSBCSophiaFrancescaEspinosaNoch keine Bewertungen

- Regulation & Financial Market: Prudential Regulations For Small & Medium Enterprises Financing Fall 2021 IBA - KarachiDokument25 SeitenRegulation & Financial Market: Prudential Regulations For Small & Medium Enterprises Financing Fall 2021 IBA - KarachialiNoch keine Bewertungen

- CMBS IoDokument4 SeitenCMBS IoJGARD33Noch keine Bewertungen

- My Life Without Money - Inter.Dokument3 SeitenMy Life Without Money - Inter.magdalena sosnickaNoch keine Bewertungen

- Bankwest - Land Lending ScenarioDokument2 SeitenBankwest - Land Lending ScenarioTalha FarooqiNoch keine Bewertungen

- 100 Defination of Terms in Business Finance - CDokument8 Seiten100 Defination of Terms in Business Finance - CJudy Ann CapiñaNoch keine Bewertungen

- Practice SetDokument2 SeitenPractice SetFiona MoralesNoch keine Bewertungen

- Vice Ch11petition DeclarationDokument92 SeitenVice Ch11petition DeclarationTHRNoch keine Bewertungen

- FNB Easy AccountDokument34 SeitenFNB Easy AccountdenisdembskeyNoch keine Bewertungen

- Micro Small Med Entpr in India (IIBF) ContentsDokument6 SeitenMicro Small Med Entpr in India (IIBF) ContentsPrashant ShindeNoch keine Bewertungen