Beruflich Dokumente

Kultur Dokumente

Property Service Tax

Hochgeladen von

orangelsrOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Property Service Tax

Hochgeladen von

orangelsrCopyright:

Verfügbare Formate

Central Government vide Notification No.

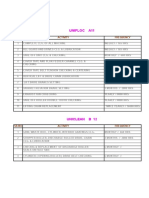

36/2010-ST dated 28th June, 2010 has exempted any consideration received as advance before 1st July,2010 in respect of newly introduced taxable services & services whose scope is expanded (other than taxable services of commercial training or coaching services (Section 65(105)(zzc)) & renting of immovable property services (Section 65(105)(zzzz))) from whole of service tax. Central Government vide Notification No.37/2010-ST dated 28th June, 2010 has amended Notification No.17/2009-ST dated 7th July,2009 whereby refund of service tax to exporter on specified services is extended to services classified U/s. 65(105)(zzm) provided in any airport in respect of export goods. Central Government vide Notification No.38/2010-ST dated 28th June, 2010 has exempted the taxable services of commercial or industrial construction (Section 65(105)(zzq)) provided wholly within the port or other port for construction, repair, alteration and renovation of wharves, quays, docks, stages, jetties, piers & railways from whole of service tax. This exemption is effective from 1st July,2010. Central Government vide Notification No.39/2010-ST dated 28th June, 2010 has inserted 4th proviso to Rule 4A(1) of the Service Tax Rules, 1994 w.e.f. 1st July,2010 whereby in case of taxable service provided by aircraft operator providing service of air transport of passenger, invoice/bill/challan shall include ticket in any form by whatever name called and the same need not contain registration no. of service provider, classification of the service received and address of the service receiver. Central Government vide Notification No.40/2010-ST dated 28th June, 2010 has amended Notification No.1/2006-ST dated 1st March,2006 whereby benefit of abatement is extended to following services rendered in port (Section 65(105)(zn)), other port (Section 65(105)(zzl)) or airport (Section 65(105)(zzm)). This exemption is effective from 1st July,2010. Sr. Name of Taxable Service Section% of Tax payable 65(105) Abatement on % 1) Rent-a-Cab Operator (o) 60 40 2) Erection, Commissioning or Installation (zzd) 67 33 3) Commercial or Industrial Construction (zzq) 67 33 4) Commercial or Industrial Construction rendered by builder or authorized person (zzq) 75 25 5) Construction of Complex (zzzh) 67 33 6) Construction of Complex by builder or authorized person (zzzh) 75 25 7) Transport of Goods by Rail (zzzp) 70 30 All the conditions mentioned in Notification No.1/2006-ST dated 1st March,2006 would apply to above abatements. Central Government vide Notification No.41/2010-ST dated 28th June, 2010 has exempted following taxable services provided wholly within the port/other port/airport from whole of service tax w.e.f 1st July,2010: i) Cargo handling services in relation to agricultural produce or goods intended to be stored in a cold storage. ii) Storage & warehousing services in relation to agricultural produce or any service provided by cold storage. iii) Transport of export goods in an aircraft

iv) Site formation and clearance, excavation and earthmoving and demolition and such other similar activities. Central Government vide Notification No.42/2010-ST dated 28th June, 2010 has exempted the taxable service of commercial or industrial construction (Section 65(105)(zzq)) provided wholly within the airport from whole of service tax w.e.f. 1st July,2010. Central Government vide Notification No.43/2010-ST dated 30th June, 2010 has amended Notification No.13/2008-ST dated 1st March,2008 whereby abatement of 75% available to services of transport of goods by road in a good carriage (Section 65(105)(zzp)) is extended to GTA services rendered within port/other port/airport. Central Government vide Notification No.44/2010-ST dated 20th July, 2010 has amended the Service Tax Return Preparer Scheme, 2009 whereby the age restriction of 35 years for enrolling to act as an Service Tax Return Preparer is done away with. Central Government vide Notification No.45/2010-ST dated 20th July, 2010, in exercise of powers conferred by Section 11C of the Central Excise Act, 1944 read with Section 83 of the Finance Act, 1994, has directed that the service tax payable on taxable services relating to transmission and distribution of electricity provided up to 26th February, 2010 & service tax payable on taxable services relating to distribution of electricity up to 21st June, 2010 which was not being levied in accordance with general trade practice is not required to be paid. Central Government vide Circular No.124/6/2010-TRU dated 29th June,2010 has notified account codes for newly introduced services. Sl. No. Taxable Services Accounting Code

Tax Other Deduct Collection Receipts Refunds (1) (2) (3) (4) (5) 1. Service of promoting, marketing or organizing of games of chance, including lottery, Bingo or Lotto [Section 65(105)(zzzzn)] 00440595 00440596 2. Health service [Section 65 (105) (zzzzo)] 00440598 00440600 3. Service of maintenance of medical records of employees of business entity [Section 65(105)(zzzzp)] 00440601 00440602 4. Service of promoting a brand of goods, services, events, business entities, etc [Section 65(105) (zzzzq)] 00440604 00440605 00440606 5. Service of permitting commercial use or exploitation of any event organized by a person or organization [Section 65 (105) (zzzzr)] 00440607 00440608 6. Service provided by electricity exchange [Section 65(105)(zzzzs)] 00440610 00440611 7. Copyright Services [Section 65(105)(zzzzt)] 00440613 00440615 8. Special service provided by a builder etc, to the

00440597 00440599

00440603

00440609 00440612 00440614

prospective buyers [Section 65(105)(zzzzu)] 00440616 00440617 00440618 i) The sub-head other receipts is meant for interest, penalty, leviable on delayed payment of service tax. ii) The sub-head deduct refunds is not to be used by the assessees, as it is meant for the Revenue/ Commissionerates while allowing refund of tax iii) The accounting codes for Primary Education Cess (00440298) and Secondary Higher Education Cess (00440426) remain unchanged. Central Government vide Letter F.No.332/16/2010-TRU dated 24th May, 2010 has clarified on the issue related to leviability of service tax on construction of residential house by National Building Construction Corporation Ltd. (NBCC) for Central Government officers. In para 2, it is clarified that the definition of residential complex (Section 65(91a)) does not include a complex which is intended for personal use as residence by recipient of service. The term personal use is defined to include permitting the use of complex as residence by another person on rent or without consideration. In para 3, it is further clarified that the residential complex built by NBCC for personal use of Government of India is not leviable to service tax.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Anand's Human Anatomy For Dental Students, 3rd EditionDokument762 SeitenAnand's Human Anatomy For Dental Students, 3rd Editionviaerea100% (4)

- Annex 2.1 Contingency Planning Template SchoolsDokument38 SeitenAnnex 2.1 Contingency Planning Template SchoolsDanica Herealways88% (8)

- UNIT 1 - Materials & Logs Page 1-4-1Dokument4 SeitenUNIT 1 - Materials & Logs Page 1-4-1Naufal ArndoNoch keine Bewertungen

- Introduction To Fire Protection SystemDokument7 SeitenIntroduction To Fire Protection SystemHiei ArshavinNoch keine Bewertungen

- Pantaloon ReportDokument16 SeitenPantaloon ReportHimanshu Rastogi100% (1)

- Minn Kota 2013 CatalogDokument38 SeitenMinn Kota 2013 CatalogsurpriseleftNoch keine Bewertungen

- Design Analysis of Fsae Suspension SystemDokument9 SeitenDesign Analysis of Fsae Suspension SystemRushik KudaleNoch keine Bewertungen

- Caustic Soda Feasibility StudyDokument75 SeitenCaustic Soda Feasibility StudyMarcos Gonzalez50% (2)

- Syllabuis Cdi 2Dokument7 SeitenSyllabuis Cdi 2Hyman Jay BlancoNoch keine Bewertungen

- Role and Responsibilities of Drilling Fluids EngineersDokument22 SeitenRole and Responsibilities of Drilling Fluids EngineersManickam Manthian50% (2)

- 03300Dokument27 Seiten03300uddinnadeemNoch keine Bewertungen

- Container Handling Cranes and Bulk Material Handling EquipmentDokument11 SeitenContainer Handling Cranes and Bulk Material Handling EquipmentJnanam100% (1)

- Owning and Operating Cost BulldozerDokument3 SeitenOwning and Operating Cost BulldozerReynaldoNoch keine Bewertungen

- Technical Submittal For Precast Concrete Low ResDokument119 SeitenTechnical Submittal For Precast Concrete Low ReshmoncktonNoch keine Bewertungen

- In The Neighborhood I: Upn, Pasión Por Transformar VidasDokument24 SeitenIn The Neighborhood I: Upn, Pasión Por Transformar VidasNirvana HornaNoch keine Bewertungen

- Manual de Maquinaria Excabadora KomatsuDokument14 SeitenManual de Maquinaria Excabadora KomatsuJaen Pabel JpNoch keine Bewertungen

- CAR Daily Vehicle Pre Checks InformationDokument6 SeitenCAR Daily Vehicle Pre Checks InformationKhalid AhmedNoch keine Bewertungen

- Ship To Ship (STS) Transfer Operations Plan - BP ShippingDokument68 SeitenShip To Ship (STS) Transfer Operations Plan - BP ShippingLingesh100% (1)

- Overvoltage Protection in Railway ABBDokument32 SeitenOvervoltage Protection in Railway ABBJavierNoch keine Bewertungen

- 2 Maintenance Schdule Blow Room, Carding DecDokument15 Seiten2 Maintenance Schdule Blow Room, Carding DecBHASKAR MITRANoch keine Bewertungen

- English Lesson Day 46 To 50Dokument5 SeitenEnglish Lesson Day 46 To 50Elle MagieNoch keine Bewertungen

- Cesna 172Dokument7 SeitenCesna 172eng13Noch keine Bewertungen

- Cooking Oil DisposalDokument1 SeiteCooking Oil DisposalKorawit Kongsan100% (1)

- Subaru Outback 2023 Quick Reference GuideDokument24 SeitenSubaru Outback 2023 Quick Reference GuideOlegas LesinasNoch keine Bewertungen

- British Series - NG - 0900 PDFDokument50 SeitenBritish Series - NG - 0900 PDFabhaskumar680% (1)

- B5 - 9.5 XP Replacement Parts ListDokument2 SeitenB5 - 9.5 XP Replacement Parts ListGeo MoralesNoch keine Bewertungen

- Steam GeneratorDokument11 SeitenSteam GeneratorElla Jane CabanagNoch keine Bewertungen

- Evaluation of Subgrade Strength and Flexible Pavement Designs ForDokument160 SeitenEvaluation of Subgrade Strength and Flexible Pavement Designs ForAbdullah AhmadNoch keine Bewertungen

- Market Study FormDokument6 SeitenMarket Study FormJc IbarraNoch keine Bewertungen

- Transport PolicyDokument7 SeitenTransport PolicyandeepthiNoch keine Bewertungen