Beruflich Dokumente

Kultur Dokumente

China Strategy - JPMorgan (090709)

Hochgeladen von

Thomas YeungOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

China Strategy - JPMorgan (090709)

Hochgeladen von

Thomas YeungCopyright:

Verfügbare Formate

Asia Pacific Equity Research

07 September 2009

China Strategy

Where to find the next ten-baggers

Chinas past ten-baggers mostly in the manufacturing space: In the past 15 years of development in Chinas stock market, we have seen the price of many Chinese stocks, such as China Mobile (941 HK), Anhui Conch (914 HK), Lenovo (992 HK), and Sichuan Changhong Electric (600839 CH), go up by 10-15x. Most of these companies are in the manufacturing space, against the backdrop of China seizing the opportunity from WTO accession to develop itself into a global manufacturing giant over the past 15 years. Notably, these companies share prices shared one thing in commonthey booked significant gains during the period of low penetration and strong secular growth. Chinas future ten-baggers most likely to be in the consumer space: For long-term investors who can ride through the market volatility, we have identified a number of sectors with a low penetration rate and strong secular growth which may breed the next ten-baggers. Interestingly, all of these are consumer-related sectors, against the backdrop of Chinas mission of shifting its growth engine from fixedasset investment and manufacturing-dominated exports to domestic consumption. Four sectors likely to breed Chinas next ten-baggers: After screening different sectors for their penetration rate and growth potential, we identify four sectors with a low penetration rate and strong secular growth: internet, tissue and diaper, natural gas, and automobiles. We believe the leading companies in these sectors, such as Baidu/Netease/Alibaba, Hengan, Beijing Enterprise/Xinao Gas/Hongkong China Gas, and DongFeng Motor, will offer good long-term opportunities.

China: Top picks

Mkt cap Avg. daily EPS Y/Y growth (%) turnover (US$MM) (US$MM) 09E 10E 11,405 582.8 41.5 51.5 5,348 86.7 26.2 39.2 13,394 28.6 80.1 39.3 6,961 13.4 49.7 9.5 1,680 4.1 17.9 15.6 5,642 10.1 -4.9 16.9 15,485 14.2 12.7 -3.6 9,116 26.1 17.7 15.0 P/E (x) 09E 53.1 19.5 50.1 25.2 16.8 20.2 25.2 13.1 10E 35.0 14.0 36.0 23.0 14.6 17.3 26.1 11.4 P/BV (x) 09E 16.1 4.8 9.6 6.0 2.0 1.1 3.8 2.4 10E 10.5 3.5 7.4 5.6 1.7 1.1 3.5 2.0 ROE (%) 09E 37.2 28.5 21.5 27.3 12.6 5.8 15.2 20.2 10E 36.5 28.9 23.3 25.6 12.7 6.4 13.7 19.5 Div. yield (%) 09E 0.0 0.0 0.0 2.4 2.1 1.6 1.9 1.1 10E 0.0 0.0 0.0 2.7 2.4 1.9 2.1 1.5

China Frank Li

AC

(852) 2800-8511 frank.m.li@jpmorgan.com

Peng Chen

(852) 2800-8507 peng.p.chen@jpmorgan.com

Lan Deng

(852) 2800-8520 lan.x.deng@jpmorgan.com J.P. Morgan Securities (Asia Pacific) Limited

China: The sectors that still have low penetration rates

2006 Internet (users per capita) Tissue (Kg per capita) Natural gas (% of population) Automobile (vehicles per 1,000 persons) 2007 2008 US

10.3% 15.9% 22.4% 75.0% 2.5 6.3% 2.7 7.7% 2.95 23+

N/A 60%+

19.9

24.2

29.2 1200

Source: CEIC, J.P. Morgan.

Baidu.com Netease Alibaba.com Limited Hengan International Group Ltd Xinao Gas Beijing Enterprises Holdings Limited Hong Kong & China Gas DongFeng Motor Co., Ltd

Rec OW N N N OW OW N OW

Ticker BIDU US NTES US 1688.HK 1044.HK 2688.HK 0392.HK 0003.HK 0489.HK

Source: Bloomberg and J.P. Morgan estimates. Prices and valuations are as of 4 September 2009.

See page 17 for analyst certification and important disclosures, including non-US analyst disclosures.

J.P. Morgan does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision.

Frank Li (852) 2800-8511 frank.m.li@jpmorgan.com

Asia Pacific Equity Research 07 September 2009

Investment summary

Long-term investors are always looking for ten-baggers, with the aim of riding through market volatility with a portfolio of stocks that can rise multifold. In the past 15 years of development in Chinas stock market, we have seen the price of many Chinese stocks, such as China Mobile (941 HK), Anhui Conch (914 HK), Lenovo (992 HK), and Sichuan Changhong Electric (600839 CH), going up by 1015x. Most of these companies are in the manufacturing space, against the backdrop of China seizing the opportunity from WTO accession to develop itself into a global manufacturing giant over the past 15 years. Notably, these companies share prices shared one thing in commonthey booked significant gains during the period of low penetration and strong secular growth. For long-term investors who can ride through market volatility, we have identified a number of sectors with a low penetration rate and strong secular growth which may breed the next ten-baggers. Interestingly, are all consumer-related sectors, against the backdrop of Chinas mission of shifting its growth engine from fixed-asset investment and manufacturing-dominated exports to domestic consumption. Historical evidence suggests that investors will be rewarded if they manage to accumulate certain industry leaders when these companies expand their business rapidly in a low-penetration market and benefit from the strong secular growth. Whatever the market volatility, these stocks should be able to consistently outperform the market as long as there is a low penetration rate and strong secular growth. After our historical case study, we identify four sectors with a low penetration rate and strong secular growth: internet, tissue and diaper, natural gas, and automobiles. We believe the leading companies in the above sectors, such as Baidu/Netease/Alibaba, Hengan, Beijing Enterprise/Xinao Gas/Hong Kong China Gas, and DongFeng Motor, will offer good long-term opportunities.

Historical case study

Past experience suggests that investors would reap good returns if they could identify at an early stage an industry leader that enjoys very strong growth in a market with a low penetration rate. The investment case appears to be even stronger if the leader itself is an industry consolidator. The past 15 years of development in the Chinese stock market have given us plenty of examples, the three most persuasive of which are China Mobile (941 HK), Lenovo (992 HK), and Sichuan Changhong Electric (600839 CH). Their share prices all booked large gains during the periods in which they expanded their businesses rapidly in a low-penetration market. (1) China Mobile (941 HK) It can be seen that the mobile-phone penetration rate (in terms of the number of mobile-phone subscribers per capita) in China more than doubled from 2002 to 2006, as a result of a combination of rising household disposable income and falling handset costs in China. The penetration rate rose from a low level of 16% in 2002 to 36% by the end of 2006, surpassing the global average of 35.7% for the first time since this statistic became available.

2

Frank Li (852) 2800-8511 frank.m.li@jpmorgan.com

Asia Pacific Equity Research 07 September 2009

Being the market leader, China Mobile took advantage of the strong growth of mobile-phone users in China during these five years, expanding its customer base from 100 million subscribers in mid-2002 to break the 300 million subscriber milestone by the end of 2006, which translated into a 25% CAGR. On the back of this strong subscriber increase, China Mobiles revenue CAGR accelerated to an average of 25% in 2002-2006 from less than 16% in the previous five years. In addition, China Mobile managed to keep its net margin above 20% despite the expenditure on upgrading its national distribution network. Riding this trend of strong growth in a low-penetration market, China Mobile saw its share price rise over 500% from HK$22 in early 2002 to above HK$120 as of mid2007, outperforming H-shares by more than 60% during the time. This is even more notable if we take into consideration the large market cap of China Mobile. In June 2007, China Mobile surpassed HSBC, becoming the largest listed company by market value at the Hong Kong Stock Exchange.

Figure 1: Mobile-phone penetration rate in China and China mobiles revenue growth since 2002

%

Penetration rate more than doubled from 2002 40% 35% 30% 25% 20% 15% 10% 5% 0% to 2006 28% 16% 21% 23% 36% 31% 26% 21% 27% 25%

2002

2003

2004

2005

2006

Penetration rate of Mobile subscribers (mobile-phone subscriber per capita)

Source: CEIC, J.P. Morgan.

rev enue grow th for China mobile

Figure 2: China Mobiles subscribers from 2001 to 2006

Million persons

350 300 250 200 150 100 50 0

301.2 246.7 136.6 166.1 204.3

104.4

2001

2002

2003

2004

2005

2006

The number of China Mobile's subscribers

Source: J.P. Morgan telecoms team.

Frank Li (852) 2800-8511 frank.m.li@jpmorgan.com

Asia Pacific Equity Research 07 September 2009

Table 1: China Mobile kept its net margin above 20% in 2002-2006

China Mobile NP margin

Source: Company data.

2002 25%

2003 22%

2004 22%

2005 22%

2006 22%

Figure 3: China Mobile and H - shares performance in the past 10 years

160 140 120 100 80 60 40 20 0 D ec /01 D ec /02 D ec /03 D ec /04 D ec /05 D ec /06 D ec /07 D ec /08 Apr/02 Apr/03 Apr/04 Apr/05 Apr/06 Apr/07 Apr/08 Aug/02 Aug/03 Aug/04 Aug/05 Aug/06 Aug/07 Aug/08 Apr/09

China mobile surged more than 5 times from early 2002 to 2007, outperformming H-shares by over 60% during the period.

8000 7000 6000 5000 4000 3000 2000 1000 0

CHINA MOBILE LTD (LHS)

Source: Bloomberg.

HSCEI INDEX (RHS)

(2) Lenovo (992 HK) The computer penetration rate in China (in terms of possession of computer per household) experienced a dramatic increase from 1998 to 2002, from 3.8% in 1998 to 20.6% in 2002, boosted by the first computer boom in China, which arose from increasing household wealth and city dwellers realization of the importance of computers. The low computer penetration and the subsequent boom in computer demand in China provided a golden opportunity for Lenovo, the biggest domestic PC producer and service provider, to make a foray into the personal computer business and boost its revenue. From 1998 to 2002, Lenovo had achieved a CAGR of 50% in its revenue, and strengthened its dominant profile in China, with its market share increasing from low teens to over 20% by the end of 2002. This significant business expansion helped Lenovos share price rise to HK$12 in early 2000 from less than HK$1 in 1998. While the burst of the tech bubble snapped this remarkable two-year rally and sent the price down by the end of 2002, Lenovo still outperformed H shares by a sizeable margin of more than 500% in the period from 1998 to 2002, giving a significant return to investors who had identified this opportunity in Chinas computer sector at its low-penetration-and-strong-seculargrowth stage.

Frank Li (852) 2800-8511 frank.m.li@jpmorgan.com

Asia Pacific Equity Research 07 September 2009

Figure 4: Computer penetration rate in China and Lenovos revenue growth from 1998 to 2005

60.0 50.0 40.0 30.0 20.0 10.0 1998 1999 2000 2001 2002 2003 2004 2005 Possession of computer per 100 Urban Household (LHS)

Source: CEIC, J.P. Morgan.

107%

Penetration rate rose from 3.8% to 20.6% from 98% 50% 1998 to 2002 56% 27.8 20.6 9.4 13.0 -23% -3% 41.5 33.1 15% -3%

125% 100% 75% 50% 25% 0% -25% -50%

3.8

5.9

rev enue grow th for Lenov o (RHS)

Figure 5: Lenovos and H shares performance in 1998-2002

16 14 12 10 8 6 4 2 0 Aug/93 Aug/94

Lenov o

H share

10000 8000 6000 4000 2000 0

Aug/95

Aug/96

Aug/97

Aug/98

Aug/99

Aug/00

Aug/01

Source: Bloomberg.

(3) Sichuan Changhong Electric (600839 CH) Similar to the above two examples, the share price of Sichuan Changhong, the Ashare listed TV producer, rose more then 10x from Rmb2 in early 1995 to over Rmb25 by mid-1997. The low penetration in Chinas color TV sector and resultant strong secular growth for color TV producers was the decisive factor in Sichuan Changhongs stellar performance during that period, in our view. From the chart below, it can be seen that color TVs penetration rate among Chinas urban households rose from a low level of 14.3% per urban household in 1993 to 35.9% in 1999, reflecting the strong demand for color TV along with urban households rising wealth and appetite for a higher quality of life. Benefiting from this strong secular growth, Sichuan Changhong Electric was able to raise its revenue notably from 1994 to 1997.

Aug/02

5

Frank Li (852) 2800-8511 frank.m.li@jpmorgan.com

Asia Pacific Equity Research 07 September 2009

Figure 6: Color TV sectors penetration rate in urban China and Sichuan Changhongs revenue growth from 1998 to 2000

40.0% 63% 57% 49% 39% 20% 14.3% 19% 19.5% 14.6% 17.3% 7% 10.0% -13% 0.0% 1992 1993 1994 1995 1996 1997 Color TV (unit per urban household*) (LHS) -26% 1998 1999 2000 19.8% 23.4% 29.4% 35.9% 32.1% 70% 60% 50% 40% 30% 20% 10% 0% -10% -20% -30%

30.0%

20.0%

Rev enue grow th for changhong electric(RHS)

Source: CEIC, J.P. Morgan. * Assuming Chinese urban family average of 3.5 people.

Figure 7: Sichuan Changhong Electric A-share performance in the 1990s

Source: Bloomberg.

Identifying potentials winners in sectors with strong secular growth and a low penetration rate

After reviewing the above three case studies, we observe that share price appreciation occurred in leading companies operating in a low-penetration market. We have identified four sectors that currently have a low penetration rate and strong secular growth: internet, tissue and diaper, natural gas, and automobiles. In our view, the leading companies in the above sectors, such as Baidu/Netease/Alibaba, Hengan, Beijing Enterprise/Xinao Gas/Hong Kong China Gas, and DongFeng Motor, will offer good long-term opportunities.

Frank Li (852) 2800-8511 frank.m.li@jpmorgan.com

Asia Pacific Equity Research 07 September 2009

Internet sector: Baidu/Netease/Alibaba While the number of internet users in China at 298 million as of the end of 2008 and ranked No.1 in the world, Chinas internet penetration rate (at 22.4%, in terms of internet users per capita, as of the end of 2008) is still low compared to that of developed countries, such as the US (which has a penetration rate of 75%), Japan (71%), and Korea (65%). Hence, we believe the strong expansion of internet usage will be sustained at least for the next 5-10 years until the internet penetration rate in China catches up with or gets close to that in developed countries. Indeed, lower computer prices, decreasing connection fees, and government support should continue to drive internet growth in China.

Figure 8: China internet penetration rate (internet users per capita)

Source: CNNIC, J.P. Morgan estimates.

Among all internet companies in China, Baidu in the search engine sector, Netease in the online gaming area, and Alibaba in the online business-to-business (B2B) market are our favorites as they are perceived to be positioned well to capture the strong revenue growth in the China internet sector. (a) Baidu: The king in the domestic search market Given that the search market is still at a nascent stage of growththe coverage ratio was only 24% and search advertising as a percentage of total advertising market was 3.3%this market is expected to deliver strong growth of over 40% in the next two years, driven by major positives summarized in the table below, according to our internet analyst, Dick Wei.

Frank Li (852) 2800-8511 frank.m.li@jpmorgan.com

Asia Pacific Equity Research 07 September 2009

Figure 9: China search market forecasts

Avg. Internet users (Mn) Number of search (Bn) Coverage Click through rate Price per click (Rmb) PPC Market (Rmb M) PPC Market (US$ M) Growth rate (Rmb, %) Total Search Market (Rmb M) Total Search Market (US$ M) Growth rate (Rmb, %) Search ad as % of total ad market 2004 87 47 12% 20.0% 0.25 280 34 94% 584 71 304% 0.7% 2005 103 62 14% 21.0% 0.29 506 62 80% 846 103 45% 0.9% 2006 124 82 17% 22.5% 0.34 1,062 134 110% 1,442 182 70% 1.4% 2007 174 123 21% 24.3% 0.40 2,472 328 133% 2,851 378 98% 2.4% 2008 239 161 24% 25.5% 0.44 4,299 623 74% 4,663 676 64% 3.3% 2009E 295 209 26% 25.5% 0.45 6,234 909 45% 6,614 964 42% 4.4% 2010E 348 254 29% 26.2% 0.47 9,039 1318 45% 9,438 1,376 43% 5.3%

Source: CNNIC, J.P. Morgan estimates. Note: Excluding distributor discount.

Table 2: Major drivers for search market growth

(1) Strong growth of Internet usage in China (2) Rise in number of web pages and websites in China (3) More popularity of search engines for information as the number of Chinese websites is growing (4) More popularity of search engines as an advertising channel for small medium enterprises (SME) with limited budget (5) Increasing monetization rate from search traffic

Source: J.P. Morgan.

At the company level, Baidu, which has been consistently gaining significant market share from its major competitors over the past few years, with its current market share at 62%, has become the No.1 search engine in China. Hence, the dominant position in the market could enable the company to tap the strong sector upturn, which would bolster the companys underlying revenue growth.

Figure 10: Baidus market share in China's search market (2007 and 2008)

China Search (Revenue) Market Share 2008

Zhongsou, 0.9% Sogou, 0.9% Yahoo! China, 5.8% Others, 2.4%

China Search Market Share 2007

Sogou, 2.2% Zhongsou, 2.0% Others, 2.1%

Yahoo! China, 11.0%

Google, 27.8%

Baidu, 62.2%

Google, 23.4%

Baidu, 59.3%

Source: Analysys.com.cn

Source: Analysys.com.cn

Frank Li (852) 2800-8511 frank.m.li@jpmorgan.com

Asia Pacific Equity Research 07 September 2009

Figure 11: BaiduNet revenue (i.e. revenue ex-TAC) growth

Source: Company reports, J.P. Morgan internet team.

(b) Netease: A proxy to strong gaming revenue growth While online gaming has experienced a rapid growth in China in the last few years, forming a multi-billion US$ market, online gamings penetration rate in China is still far below that of its peer Asian countries, whose citizens have a similar culture and entertainment habits. As online games are still a low-cost and easily available entertainment option for internet users, we expect continued robust growth of online gaming for the coming years against the backdrop of a low-penetration market in China. Netease, one of the leading online game developers and operators in China, is benefiting from this sectoral upturn and is likely to book very strong revenue growth going forward. Meanwhile, with its more diversified game portfolios (flagship games: Westward Journey 2 and Fantasy Westward Journey 2; small titles: TF, Ghost, and FJ; and newly acquired but yet launched World of Warcraft), strong execution and distribution strength, Netease should continue to gain market share from the smaller companies. These positive drivers should earn the company a higher price in the long term, in our view.

Frank Li (852) 2800-8511 frank.m.li@jpmorgan.com

Asia Pacific Equity Research 07 September 2009

Figure 12: Online game penetration and paying online game penetration in different Asian countries

Online game penetration in different Asian countries

60% 50% 40% 30% 20% 10% 0% 2004 Korea

Source: IDC.

Paying online game penetration in different Asian countries

25% 20% 15% 10% 5% 0%

2005

2006 China

2007

2008

2009 Taiwan

Source: IDC.

2004 Korea

2005

2006 China

2007

2008

2009 Taiwan

Hong Kong

Hong Kong

Table 3: Leading online gaming companies by revenue market share (%)

Company Shanda NetEase Giant Interactive The9 Sohu Perfect World NetDragon Kingsoft Others

2008 23% 19% 12% 13% 10% 5% 11% 3% 3%

Source: Company reports, IDC, J.P. Morgan estimates for companies covered by J.P. Morgan.

(c) Alibaba: A leader in the online business-to-business (B2B) marketplace in China Positioning itself well in the fast-growing online commercial business, Alibaba is perceived to seize the solid long-term business fundamentals and is able to ride the cyclical market upturn. Meanwhile, the increase in value-added service (VAS), upside from closer cooperation with Taobao and rising international revenue should provide an additional earnings boost.

10

Frank Li (852) 2800-8511 frank.m.li@jpmorgan.com

Asia Pacific Equity Research 07 September 2009

Table 4: Internet sector valuation comparable table

Rec N OW N N N N OW OW OW NR NR Ticker 1688.HK BIDU US JRJC US NTES US NINE US SINA US SOHU US VIT US NCTY US 700.HK PWRD US Mkt cap (US$MM) 13,394 11,405 204 5,348 50 1,710 2,346 582 204 29,734 1,959 P/E (x) 09E 10E 50.1 36.0 53.1 35.0 NM 64.5 19.5 14.0 NM 34.4 15.8 20.1 6.2 42.0 14.0 NM 25.0 13.6 15.7 5.8 30.4 11.7 P/BV (x) 09E 10E 9.6 7.4 16.1 10.5 2.0 1.8 4.8 3.5 0.3 3.1 4.1 3.0 0.5 18.0 6.0 0.3 2.6 3.0 2.5 0.4 11.9 3.9 ROE (%) 09E 10E 21.5 23.3 37.2 36.5 -4.9 3.0 28.5 28.9 -2.1 8.8 31.4 15.9 7.5 53.4 53.4 -1.0 11.5 25.8 17.4 7.5 46.5 47.2 Div. yield (%) 09E 10E 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 14.4 0.4 0.0 0.0 0.0 0.0 0.0 0.0 0.5 0.0

Alibaba.com Limited Baidu.com China Finance Online Netease Ninetowns Internet Technology Group Co. Ltd. Sina Corp Sohu.Com VanceInfo Technologies Inc. The9 Limited Tencent Perfect World

Source: Bloomberg and J.P. Morgan estimates. Please note that valuation numbers for Tencent and Perfect World are based on Bloomberg consensus estimates. Price and valuations are as of 4 September 2009.

(2) Tissue and diaper sector: Hengan As the leading Chinese tissue and diaper manufacture, Hengan is benefiting from the rising demand for high-end quality tissue papers, sanitary napkins, and disposable diapers, due to the continued improvement of living standard of domestic consumers. Of the three major products (tissue papers, sanitary napkins and disposable diapers), which comprise 97% of Hengans revenue in 2008, two productstissue and disposable diapersstill have relatively low penetration rates in China (please see Figure 13 and Table 6). While people in China use more sanitary napkins than the global average, the penetration level (around 72%) is still shy of that in developed countries, such as the US (91%).

Figure 13: A low penetration rate in the tissue market

Kg per capita

Tissue consumption per capita (Kg) 5.0 4.5 4.0 3.5 3.0 2.5 2.0 1.5 1.0 0.5 0.0 3.4 Ov er 23kg

1.9

2.1

2.2

2.4

2.6

2.8

2.5

2.7

2.95

2000

2001

2002

2003

2004

2005

2006

2007

2008

World (2008)

North Ammerica (2008)

Source: China National Household Paper Industry Association. J.P. Morgan.

11

Frank Li (852) 2800-8511 frank.m.li@jpmorgan.com

Asia Pacific Equity Research 07 September 2009

Table 5: Low penetration rate and high secular growth for the baby diaper sector in China

Estimated penetration rate (current consumption/estimated potential consumption) China (2008) world (2004) US (2004) Estimated market compound growth rate by volume consumed up to 2010

Source: China National Household Paper Industry Association, company reports.

21.1% 44.0% 96.0% 20.0%

Hence, we believe there is still enough room for Hengan, the market leader, to gain new business and grow its top line without triggering severe margin erosion. Indeed, Hengan has seen its revenue increasing rapidly, and has retained an about 40% gross margin since 2005. Despite the rising competition given the entry of international giants, Hengan maintains its leading market share in China (around 20% for tissue and sanitary napkins and 12% for baby diapers, according to an industry report), due to its strong nationwide distribution network and recognized brand names. Positioning itself well in such a booming market, Hengan should be able to generate attractive returns for investors in the long run.

Figure 14: Hengans gross margin and revenue growth

44% 42% 40% 38% 36% 34% 2006 2007 Gross margin

Source: company reports and J.P. Morgan.

2008 Rev enue grow th

2009E

Table 6: Tissue Paper sector valuation comparable table

Rec N NR Ticker 1044.HK 3331 HK Mkt cap (US$MM) 6,961 622 P/E (x) 09E 10E 25.2 23.0 16.6 14.3 P/BV (x) 09E 10E 6.0 5.6 2.5 2.2 ROE (%) 09E 10E 27.3 25.6 16.3 16.5 Div. yield (%) 09E 10E 2.4 2.7 1.5 1.7

Hengan International Group Ltd Vinda International Holdings *

Source: Bloomberg and J.P. Morgan estimates. Please note that valuation data for Vinda international is based on Bloomberg consensus estimates. Prices and valuations are as of 4 September 2009.

(3) The natural gas sector: Beijing Enterprise/Xinao gas/Hong Kong China Gas Another area with strong secular growth and low penetration lies in the natural gas sector, which has a very low penetration rate in China, leaving room for gas demand upside potential. The latest available statistics (as of the end of 2007) shows that only 101.9 million people, out of Chinas total population of 1.32 billion, had access to natural gas in 2007. This translates into a penetration rate of only 7.7% in China as of the end of 2007.

12

Frank Li (852) 2800-8511 frank.m.li@jpmorgan.com

Asia Pacific Equity Research 07 September 2009

Meanwhile, cross-country comparison tells us that the per-capita natural gas consumption level in China is by far below that in developed economies such as the US and Korea (Figure 16), and natural gas does not account for a meaningful share of total primary energy consumption in China (3% ), versus the US (25%) and Korea (14%) (Figure 17). Hence, we believe the natural gas sector in China is still at an early stage of development, with plenty of secular growth opportunities emerging both from increasing penetration with more people becoming gas consumers and the pick-up in per-capita consumption levels.

Figure 15: A low penetration rate in natural gas sector in China

% of population having access o natural gas

10.00% 8.00% 6.00% 4.00% 2.00% 0.00% 1996

Source: CEIC.

7.7% 5.4% 4.3% 1.3% 1.5% 1.8% 2.0% 2.5% 2.9% 3.3% 6.3%

1.2%

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

Figure 16: Cross-country/city comparison of natural gas consumption levels (2007)

1,000 800 600 400 200 USA S. Korea China Beijing NG cons (indus+pow er) (in m3 per US$1000 GDP RHS) Per cap NG consump (resi+comm) (in m3 / capita LHS) 83% 0% 100% 0% 35 30 25 20 15 10 5 -

Source: CEIC, BP, BJ Government Statistics. % figures represent % of natural gas sourced domestically.

13

Frank Li (852) 2800-8511 frank.m.li@jpmorgan.com

Asia Pacific Equity Research 07 September 2009

Figure 17: Natural gas as a percentage of total energy consumption

60% 50% 40% 30% 20% 10% 0%

Ge US rm an Au y str ali a Ja pa n Fr an S. ce Ko re a

P/E (x) 09E 10E 16.8 14.6 30.1 26.2 20.2 17.3 25.2 26.1 P/BV (x) 09E 10E 2.0 1.7 4.7 4.1 1.1 1.1 3.8 3.5

Ru ss ia

Source: BP.

Within this sector, we like three leading companiesBeijing Enterprise, Xinao Gas, and Hong Kong China Gas: (a) Beijing Enterprises: Being the largest natural gas supplier with annual gas sales more than 4 billion cubic meters, Beijing Enterprises has strong long-term growth prospects, especially given its leverage to the projected strong gas demand upside in Beijing, in our view. Also, the company is in a strong cash position, which should make it well equipped for further industry consolidation. (b) Xinao Gas: With only a 20-25% penetration rate, Xinao Gas has significant room for further growth. In addition, experienced management with a quality execution track record has helped the company establish itself in the China city gas sector among its listed peers, in our view. (c) Hong Kong & China Gas: Hong Kong & China Gas should benefit from its China operations which will increasingly become a key driver of its future earnings growth. We believe it is likely to spin off its China operations, and this might well serve as a catalyst for its share price.

Table 7: Gas sector valuation comparable table

Rec OW NR OW N Ticker 2688.HK 1193.HK 0392.HK 0003.HK Mkt cap (US$MM) 1,680 1,298 5,642 15,485 ROE (%) 09E 10E 12.6 12.7 16.3 16.8 5.8 6.4 15.2 13.7 Div. yield (%) 09E 10E 2.1 2.4 0.9 1.1 1.6 1.9 1.9 2.1

Xinao Gas China Resources Gas Beijing Enterprises Holdings Limited Hong Kong & China Gas

Source: Bloomberg and J.P. Morgan estimates. Please note that valuation numbers for CRG are based on Bloomberg consensus estimates. Prices and valuations are as of 4 September 2009.

(4) Automobile sector: DongFeng Motor While the total number of Chinas passenger vehicles is the largest in the world, the penetration rate in China is very low, at 29.2 per 1,000 persons as of 2008. The mature markets such as the US, Europe and Japan already have high penetration rates, and therefore offer less growth potential. Chinas passenger vehicles market is increasingly being driven by first-time buyers in tier-two and tier-three cities. Despite its already massive size, the passenger vehicle market still offers a lot of growth potential in the next five to ten years, due to its low penetration rate and large pool of potential buyers.

14

U Ca K na da

HK Ch ina

Frank Li (852) 2800-8511 frank.m.li@jpmorgan.com

Asia Pacific Equity Research 07 September 2009

Figure 18: ChinaPenetration rate of cars (number of passenger vehicles per 1,000 persons)

Source: CEIC, J.P. Morgan.

Table 8: Car penetration rate in European countries and US (units/per 1000 persons)

Source: Data for Europe is based on ACEA and J.P. Morgan estimates, while US data is based on Wardsauto and J.P. Morgan estimates. *Europe car penetration rate is based on car possession per one thousand population while car penetration rate in US is based on car possession rate per one thousand driving age population which represent around 75% of the population.

That said, the passenger vehicle sector has been rather cyclical, with growth in the car market witnessing rather high volatility in the previous two cycles. Chinas first auto boom occurred in 2003 when the sale of domestically made sedans rose a significant 79% due to the breakout of demand in tier-one cities. Chinas auto sector experienced stellar performance in 2003. Then, when a large part of the pent-up demand in tier-one cities was unleashed, the car market experienced a two-year consolidation period (2004 and 2005), and the sales growth of domestically made sedans slowed down from 79% in 2003 to 17% and 20% in 2004 and 2005, respectively. During the downturn of 2004 and 2005, Chinas auto stocks on average lost 70% of their value. It was not until 2006 that the second boom kicked off on the breakout of car demand in tier-two cities. During the second auto boom, many auto stocks went up 2-3x again. Yet in April 2008, the auto sector started to lose steam again, wiping 70% off the share prices of most auto names during its cyclical downturn from April 2008 to January 2009. In early 2009, Chinas third auto boom kicked off on the breakout of car demand in tier three cities, and on the back of a series of supportive policies from Chinese government.

15

Frank Li (852) 2800-8511 frank.m.li@jpmorgan.com

Asia Pacific Equity Research 07 September 2009

While we are positive about the auto sectors medium-term growth, we do not recommend that investors buy Chinas auto names now, given that: (1) their valuations have become a bit stretched after staging a 300-400% rally this year from the trough; and (2) it is uncertain whether the government will renew the preferential vehicle purchase tax cut for small cars at the end of the year, which has been a key driver of car sales this year. We would accumulate China auto stocks when their valuations come down to a more attractive level, and when we become more comfortable with the continued robust sales growth for FY10 if the government can renew in the next two to three months its policy of vehicle purchase tax cut for small cars, which is due to expire at the end of the year. Among all the domestic auto producers, we believe DongFeng Motor (DFM) stands out as being well positioned to ride the coming cyclical upturn, given its leading position in most of its wide range of auto business lines, multi-strategic-partner business model, and competitive product line-ups. DFM has consistently outperformed its peers in both market upturns and downturns. Investors may want to accumulate this name if the share price goes down due to the market volatility or due to the next cyclical downturn.

Table 8: Auto sector valuation comparison

Mkt cap (US$MM) 3492.3 9115.4 430.9 400.5 1784.2 P/E (x) 09E 10E 10.6 9.8 13.1 11.4 93.0 34.9 12.0 10.6 9.7 9.6 P/BV (x) 09E 1.7 2.4 0.5 0.9 1.7 ROE 09E 17% 20% 1% 8% 21% Div. yield (%) 09E 0.0 0.0 0.0 0.0 0.0

Denway Motors DongFeng Motor Co., Ltd. Brilliance China Automotive Great Wall Motor Company Limited Geely Automobile Holdings Ltd

Rec UW OW N N NR

Ticker 203 HK 489 HK 1114 HK 2333 HK 175 HK

Source: Bloomberg, J.P. Morgan estimates. J.P. Morgan estimates for rated stocks, Bloomberg consensus estimates for non-rated stocks. Prices and valuations are as of 4 September 2009.

16

Frank Li (852) 2800-8511 frank.m.li@jpmorgan.com

Asia Pacific Equity Research 07 September 2009

Companies Recommended in This Report (all prices in this report as of market close on 07 September 2009, unless otherwise indicated) Alibaba.com Limited (1688.HK/HK$21.90/Neutral), Baidu.com (BIDU/$329.48 [03-September-2009]/Overweight), Beijing Enterprises Holdings Limited (0392.HK/HK$38.70/Overweight), DongFeng Motor Co., Ltd. (0489.HK/HK$8.36/Overweight), Hengan International Group Ltd (1044.HK/HK$44.30/Neutral), Hong Kong & China Gas (0003.HK/HK$18.32 [04-September-2009]/Neutral), Netease (NTES/$41.32 [03-September-2009]/Neutral), Xinao Gas (2688.HK/HK$12.40 [04-September-2009]/Overweight)

Analyst Certification: The research analyst(s) denoted by an AC on the cover of this report certifies (or, where multiple research analysts are primarily responsible for this report, the research analyst denoted by an AC on the cover or within the document individually certifies, with respect to each security or issuer that the research analyst covers in this research) that: (1) all of the views expressed in this report accurately reflect his or her personal views about any and all of the subject securities or issuers; and (2) no part of any of the research analysts compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed by the research analyst(s) in this report.

Important Disclosures

Market Maker: JPMSI makes a market in the stock of Baidu.com, Netease. Market Maker/ Liquidity Provider: JPMSL and/or an affiliate is a market maker and/or liquidity provider in Alibaba.com Limited, Hengan International Group Ltd. Client of the Firm: Hengan International Group Ltd is or was in the past 12 months a client of JPMSI. Hong Kong & China Gas is or was in the past 12 months a client of JPMSI. Netease is or was in the past 12 months a client of JPMSI. Non-Investment Banking Compensation: An affiliate of JPMSI has received compensation in the past 12 months for products or services other than investment banking from Hong Kong & China Gas.

Important Disclosures for Equity Research Compendium Reports: Important disclosures, including price charts for all companies under coverage for at least one year, are available through the search function on J.P. Morgans website https://mm.jpmorgan.com/disclosures/company or by calling this U.S. toll-free number (1-800-477-0406) Explanation of Equity Research Ratings and Analyst(s) Coverage Universe: J.P. Morgan uses the following rating system: Overweight [Over the next six to twelve months, we expect this stock will outperform the average total return of the stocks in the analysts (or the analysts teams) coverage universe.] Neutral [Over the next six to twelve months, we expect this stock will perform in line with the average total return of the stocks in the analysts (or the analysts teams) coverage universe.] Underweight [Over the next six to twelve months, we expect this stock will underperform the average total return of the stocks in the analysts (or the analysts teams) coverage universe.] The analyst or analysts teams coverage universe is the sector and/or country shown on the cover of each publication. See below for the specific stocks in the certifying analyst(s) coverage universe.

Coverage Universe: Frank Li: Aluminum Corporation of China Limited (2600.HK), Angang Steel Company Limited - A (000898.SZ), Angang Steel Company Limited - H (0347.HK), Baoshan Iron & Steel - A (600019.SS), Brilliance China Automotive (1114.HK), China Coal Energy (1898.HK), China Shenhua Energy (1088.HK), Denway Motors (0203.HK), DongFeng Motor Co., Ltd. (0489.HK), Great Wall Motor Company Limited (2333.HK), Maanshan Iron and Steel - A (600808.SS), Maanshan Iron and Steel - H (0323.HK), Minth Group (0425.HK), Qingling Motors Co (1122.HK), Shandong Weigao Group Medical Polymer Co. Ltd. (8199.HK), Shougang Concord International (0697.HK), Sinotruk (3808.HK), WSP Holdings (WH), Weichai Power (2338.HK), Yanzhou Coal Mining - A (600188.SS), Yanzhou Coal Mining - H (1171.HK), Zijin Mining Group Co Ltd (2899.HK)

17

Frank Li (852) 2800-8511 frank.m.li@jpmorgan.com

Asia Pacific Equity Research 07 September 2009

J.P. Morgan Equity Research Ratings Distribution, as of June 30, 2009 Overweight (buy) 36% 55% 36% 77% Neutral (hold) 46% 56% 52% 72% Underweight (sell) 18% 42% 12% 60%

JPM Global Equity Research Coverage IB clients* JPMSI Equity Research Coverage IB clients*

*Percentage of investment banking clients in each rating category. For purposes only of NASD/NYSE ratings distribution rules, our Overweight rating falls into a buy rating category; our Neutral rating falls into a hold rating category; and our Underweight rating falls into a sell rating category.

Valuation and Risks: Please see the most recent company-specific research report for an analysis of valuation methodology and risks on any securities recommended herein. Research is available at http://www.morganmarkets.com , or you can contact the analyst named on the front of this note or your J.P. Morgan representative. Analysts Compensation: The equity research analysts responsible for the preparation of this report receive compensation based upon various factors, including the quality and accuracy of research, client feedback, competitive factors, and overall firm revenues, which include revenues from, among other business units, Institutional Equities and Investment Banking. Registration of non-US Analysts: Unless otherwise noted, the non-US analysts listed on the front of this report are employees of non-US affiliates of JPMSI, are not registered/qualified as research analysts under NASD/NYSE rules, may not be associated persons of JPMSI, and may not be subject to NASD Rule 2711 and NYSE Rule 472 restrictions on communications with covered companies, public appearances, and trading securities held by a research analyst account.

Other Disclosures

J.P. Morgan is the global brand name for J.P. Morgan Securities Inc. (JPMSI) and its non-US affiliates worldwide. Options related research: If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the Option Clearing Corporations Characteristics and Risks of Standardized Options, please contact your J.P. Morgan Representative or visit the OCCs website at http://www.optionsclearing.com/publications/risks/riskstoc.pdf. Legal Entities Disclosures U.S.: JPMSI is a member of NYSE, FINRA and SIPC. J.P. Morgan Futures Inc. is a member of the NFA. JPMorgan Chase Bank, N.A. is a member of FDIC and is authorized and regulated in the UK by the Financial Services Authority. U.K.: J.P. Morgan Securities Ltd. (JPMSL) is a member of the London Stock Exchange and is authorised and regulated by the Financial Services Authority. Registered in England & Wales No. 2711006. Registered Office 125 London Wall, London EC2Y 5AJ. South Africa: J.P. Morgan Equities Limited is a member of the Johannesburg Securities Exchange and is regulated by the FSB. Hong Kong: J.P. Morgan Securities (Asia Pacific) Limited (CE number AAJ321) is regulated by the Hong Kong Monetary Authority and the Securities and Futures Commission in Hong Kong. Korea: J.P. Morgan Securities (Far East) Ltd, Seoul branch, is regulated by the Korea Financial Supervisory Service. Australia: J.P. Morgan Australia Limited (ABN 52 002 888 011/AFS Licence No: 238188) is regulated by ASIC and J.P. Morgan Securities Australia Limited (ABN 61 003 245 234/AFS Licence No: 238066) is a Market Participant with the ASX and regulated by ASIC. Taiwan: J.P.Morgan Securities (Taiwan) Limited is a participant of the Taiwan Stock Exchange (company-type) and regulated by the Taiwan Securities and Futures Bureau. India: J.P. Morgan India Private Limited is a member of the National Stock Exchange of India Limited and Bombay Stock Exchange Limited and is regulated by the Securities and Exchange Board of India. Thailand: JPMorgan Securities (Thailand) Limited is a member of the Stock Exchange of Thailand and is regulated by the Ministry of Finance and the Securities and Exchange Commission. Indonesia: PT J.P. Morgan Securities Indonesia is a member of the Indonesia Stock Exchange and is regulated by the BAPEPAM. Philippines: J.P. Morgan Securities Philippines Inc. is a member of the Philippine Stock Exchange and is regulated by the Securities and Exchange Commission. Brazil: Banco J.P. Morgan S.A. is regulated by the Comissao de Valores Mobiliarios (CVM) and by the Central Bank of Brazil. Mexico: J.P. Morgan Casa de Bolsa, S.A. de C.V., J.P. Morgan Grupo Financiero is a member of the Mexican Stock Exchange and authorized to act as a broker dealer by the National Banking and Securities Exchange Commission. Singapore: This material is issued and distributed in Singapore by J.P. Morgan Securities Singapore Private Limited (JPMSS) [MICA (P) 132/01/2009 and Co. Reg. No.: 199405335R] which is a member of the Singapore Exchange Securities Trading Limited and is regulated by the Monetary Authority of Singapore (MAS) and/or JPMorgan Chase Bank, N.A., Singapore branch (JPMCB Singapore) which is regulated by the MAS. Malaysia: This material is issued and distributed in Malaysia by JPMorgan Securities (Malaysia) Sdn Bhd (18146-X) which is a Participating Organization of Bursa Malaysia Berhad and a holder of Capital Markets Services License issued by the Securities Commission in Malaysia. Pakistan: J. P. Morgan Pakistan Broking (Pvt.) Ltd is a member of the Karachi Stock Exchange and regulated by the Securities and Exchange Commission of Pakistan. Saudi Arabia: J.P. Morgan Saudi Arabia Ltd. is authorised by the Capital Market Authority of the Kingdom of Saudi Arabia (CMA) to carry out dealing as an agent, arranging, advising and custody, with respect to securities business under licence number 35-07079 and its registered address is at 8th Floor, Al-Faisaliyah Tower, King Fahad Road, P.O. Box 51907, Riyadh 11553, Kingdom of Saudi Arabia.

18

Frank Li (852) 2800-8511 frank.m.li@jpmorgan.com

Asia Pacific Equity Research 07 September 2009

Country and Region Specific Disclosures U.K. and European Economic Area (EEA): Unless specified to the contrary, issued and approved for distribution in the U.K. and the EEA by JPMSL. Investment research issued by JPMSL has been prepared in accordance with JPMSL's policies for managing conflicts of interest arising as a result of publication and distribution of investment research. Many European regulators require that a firm to establish, implement and maintain such a policy. This report has been issued in the U.K. only to persons of a kind described in Article 19 (5), 38, 47 and 49 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (all such persons being referred to as "relevant persons"). This document must not be acted on or relied on by persons who are not relevant persons. Any investment or investment activity to which this document relates is only available to relevant persons and will be engaged in only with relevant persons. In other EEA countries, the report has been issued to persons regarded as professional investors (or equivalent) in their home jurisdiction. Australia: This material is issued and distributed by JPMSAL in Australia to wholesale clients only. JPMSAL does not issue or distribute this material to retail clients. The recipient of this material must not distribute it to any third party or outside Australia without the prior written consent of JPMSAL. For the purposes of this paragraph the terms wholesale client and retail client have the meanings given to them in section 761G of the Corporations Act 2001. Germany: This material is distributed in Germany by J.P. Morgan Securities Ltd., Frankfurt Branch and J.P.Morgan Chase Bank, N.A., Frankfurt Branch which are regulated by the Bundesanstalt fr Finanzdienstleistungsaufsicht. Hong Kong: The 1% ownership disclosure as of the previous month end satisfies the requirements under Paragraph 16.5(a) of the Hong Kong Code of Conduct for persons licensed by or registered with the Securities and Futures Commission. (For research published within the first ten days of the month, the disclosure may be based on the month end data from two months prior.) J.P. Morgan Broking (Hong Kong) Limited is the liquidity provider for derivative warrants issued by J.P. Morgan International Derivatives Ltd and listed on The Stock Exchange of Hong Kong Limited. An updated list can be found on HKEx website: http://www.hkex.com.hk/prod/dw/Lp.htm. Japan: There is a risk that a loss may occur due to a change in the price of the shares in the case of share trading, and that a loss may occur due to the exchange rate in the case of foreign share trading. In the case of share trading, JPMorgan Securities Japan Co., Ltd., will be receiving a brokerage fee and consumption tax (shouhizei) calculated by multiplying the executed price by the commission rate which was individually agreed between JPMorgan Securities Japan Co., Ltd., and the customer in advance. Financial Instruments Firms: JPMorgan Securities Japan Co., Ltd., Kanto Local Finance Bureau (kinsho) No. 82 Participating Association / Japan Securities Dealers Association, The Financial Futures Association of Japan. Korea: This report may have been edited or contributed to from time to time by affiliates of J.P. Morgan Securities (Far East) Ltd, Seoul branch. Singapore: JPMSS and/or its affiliates may have a holding in any of the securities discussed in this report; for securities where the holding is 1% or greater, the specific holding is disclosed in the Important Disclosures section above. India: For private circulation only, not for sale. Pakistan: For private circulation only, not for sale. New Zealand: This material is issued and distributed by JPMSAL in New Zealand only to persons whose principal business is the investment of money or who, in the course of and for the purposes of their business, habitually invest money. JPMSAL does not issue or distribute this material to members of "the public" as determined in accordance with section 3 of the Securities Act 1978. The recipient of this material must not distribute it to any third party or outside New Zealand without the prior written consent of JPMSAL. General: Additional information is available upon request. Information has been obtained from sources believed to be reliable but JPMorgan Chase & Co. or its affiliates and/or subsidiaries (collectively J.P. Morgan) do not warrant its completeness or accuracy except with respect to any disclosures relative to JPMSI and/or its affiliates and the analysts involvement with the issuer that is the subject of the research. All pricing is as of the close of market for the securities discussed, unless otherwise stated. Opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipient of this report must make its own independent decisions regarding any securities or financial instruments mentioned herein. JPMSI distributes in the U.S. research published by non-U.S. affiliates and accepts responsibility for its contents. Periodic updates may be provided on companies/industries based on company specific developments or announcements, market conditions or any other publicly available information. Clients should contact analysts and execute transactions through a J.P. Morgan subsidiary or affiliate in their home jurisdiction unless governing law permits otherwise. Other Disclosures last revised January 30, 2009.

Copyright 2009 JPMorgan Chase & Co. All rights reserved. This report or any portion hereof may not be reprinted, sold or redistributed without the written consent of J.P. Morgan.

19

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- 8 Baal Pool Unblocked For Free BST GameDokument6 Seiten8 Baal Pool Unblocked For Free BST GameAyaan YousifNoch keine Bewertungen

- Why Some Platforms Thrive and Others Don'tDokument11 SeitenWhy Some Platforms Thrive and Others Don'tmahipal singhNoch keine Bewertungen

- Ciw Infographic Alibaba Acquisitions 141006033557 Conversion Gate01Dokument1 SeiteCiw Infographic Alibaba Acquisitions 141006033557 Conversion Gate01Sumit KumarNoch keine Bewertungen

- Alibaba's Founding and Rapid GrowthDokument3 SeitenAlibaba's Founding and Rapid Growthtayyab malikNoch keine Bewertungen

- Alibaba 5Dokument6 SeitenAlibaba 5matamerahNoch keine Bewertungen

- 1:22-cv-05655 - Complaint (PC LLC)Dokument27 Seiten1:22-cv-05655 - Complaint (PC LLC)Sarah BursteinNoch keine Bewertungen

- The Inspiring Life Story of Alibaba Founder JackDokument16 SeitenThe Inspiring Life Story of Alibaba Founder JackdarioimeNoch keine Bewertungen

- Entrepreneurial Case - Soria Zoon HaiderDokument3 SeitenEntrepreneurial Case - Soria Zoon HaiderSoria Zoon HaiderNoch keine Bewertungen

- On China's Alibaba's Five Ps Marketing Strategies: WANG Guo-AnDokument19 SeitenOn China's Alibaba's Five Ps Marketing Strategies: WANG Guo-AnUdaya Choudary100% (3)

- Cepia v Alibaba: US Court Jurisdiction Over Int'l E-Commerce SiteDokument3 SeitenCepia v Alibaba: US Court Jurisdiction Over Int'l E-Commerce SiteAlexanderJankulovNoch keine Bewertungen

- Project For 6th Semester On EcommerceDokument45 SeitenProject For 6th Semester On Ecommercekartikbag67Noch keine Bewertungen

- AI-Powered Warehouse Automation and Logistics at AlibabaDokument16 SeitenAI-Powered Warehouse Automation and Logistics at AlibabaKrutarth PatelNoch keine Bewertungen

- 20140917Dokument24 Seiten20140917កំពូលបុរសឯកាNoch keine Bewertungen

- AlibabaDokument2 SeitenAlibabaXènia Bellet NavarroNoch keine Bewertungen

- Place Order Pay Success Order Complete: The Seller Has Shipped Your OrderDokument2 SeitenPlace Order Pay Success Order Complete: The Seller Has Shipped Your OrderAnika ŠarkaNoch keine Bewertungen

- 360 Degree Rotation Borehole Inspection Camera Borewell Camera - Buy Under Water Camera, Deep Well Camera, Borehole Camera Price Product OnDokument8 Seiten360 Degree Rotation Borehole Inspection Camera Borewell Camera - Buy Under Water Camera, Deep Well Camera, Borehole Camera Price Product OnCristopferENoch keine Bewertungen

- Daraz - LK: Assignment 02Dokument41 SeitenDaraz - LK: Assignment 02mihin.wimalasena100% (4)

- Amazon Financial Report MemoDokument5 SeitenAmazon Financial Report MemoJoy SupanikaNoch keine Bewertungen

- VA 3rd Week NotesDokument9 SeitenVA 3rd Week NotesHasnatNoch keine Bewertungen

- I. Strategic Issues and ProblemDokument1 SeiteI. Strategic Issues and Problemedgaranaya13Noch keine Bewertungen

- Lazada's Business Model CanvasDokument4 SeitenLazada's Business Model Canvasvân trương thị thảoNoch keine Bewertungen

- Introduce About Alibaba Work CultureDokument2 SeitenIntroduce About Alibaba Work CultureChicken House TonkNoch keine Bewertungen

- Forbes - Asia 12 - 2019 PDFDokument112 SeitenForbes - Asia 12 - 2019 PDFM N ZAKINoch keine Bewertungen

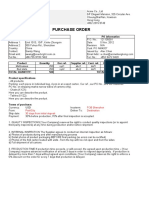

- Purchase Order: Supplier PO InformationDokument2 SeitenPurchase Order: Supplier PO InformationDawson EllisonNoch keine Bewertungen

- Tradekey Brand AuditDokument33 SeitenTradekey Brand AuditKhizer AhmedNoch keine Bewertungen

- E Business StrategyDokument10 SeitenE Business StrategyAnooja Sajeev100% (1)

- The Fifth HorsemanDokument18 SeitenThe Fifth HorsemanFrancesco LontriNoch keine Bewertungen

- AlibabaDokument9 SeitenAlibabaGhanva KhanNoch keine Bewertungen

- Alibaba GroupDokument15 SeitenAlibaba GroupAdam Bin Mat RofiNoch keine Bewertungen

- Ipo of Alibaba: One of The Most Mysterious Ipos in The Tech IndustryDokument16 SeitenIpo of Alibaba: One of The Most Mysterious Ipos in The Tech IndustryAshish VermaNoch keine Bewertungen