Beruflich Dokumente

Kultur Dokumente

Accord Capital Equities Corporation: Outlook For Week XXIV - June 13 To 17 - TD 114-118

Hochgeladen von

JC CalaycayOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Accord Capital Equities Corporation: Outlook For Week XXIV - June 13 To 17 - TD 114-118

Hochgeladen von

JC CalaycayCopyright:

Verfügbare Formate

ACCORD CAPITAL EQUITIES CORPORATION

GF EC-058B East Tower, PSE Center, Exchange Road, Ortigas Center, Pasig City, PHILIPPINES 1605 (632)687-5071 (trunk)

Outlook for Week XXIV_June 13 to 17_TD 114-118

1 of 2 WEEKLY MARKET STATS UPDATE:

CATEGORY ACTIVITY [YTD DAILY AVERAGES] M EASURE NET VOLUM E NET VALUE ISSUES TRADED TRADES FOREIGN (BUY) FOREIGN (SELL) FOREIGN (NET) AD Line %K STO(14,3) %D (STO(14,3,3) RSI(14) EM A(10) EM A(50) EM A(150) VALUE 2,834,409,774 4,484,687,751.92 172 14,955 2,178,934,273.73 2,048,279,430.89 130,654,842.84 -763.00 34.87 39.84 45.43 4,251.82 4,214.95 4,062.37 PREVIOUS W EEK 2,869,558,588 4,528,503,861.29 173 15,012 2,200,096,898.49 2,063,140,628.27 136,956,270.22 -677.00 82.46 71.56 54.45 4,280.36 4,209.79 4,050.23 CHANGE% -1.22% -0.97% -0.58% -0.38% -0.96% -0.72% -4.60% 12.70% -57.71% -44.33% -16.56% -0.67% 0.12% 0.30% END-DEC2010 1,637,867,112 4,603,800,556.27 N/A N/A 1,972,980,083.85 1,752,691,290.38 220,288,793.48 -508.00 95.12 72.13 56.61 4,149.40 4,119.42 3,839.39 CHANGE% 73.05% -2.59% N/A N/A 10.44% 16.86% -40.69% 50.20% -63.34% -44.77% -19.75% 2.47% 2.32% 5.81%

INDICATORS

PHILIPPINE MARKET STATS LAST WEEK% PSEI 4,219.58 -1.82 ALL 2,979.87 -1.35 FIN 946.61 -1.63 IND 7,168.87 -0.38 HDG 3,468.57 -1.98 PRO 1,500.50 -2.33 SVC 1,505.12 -2.27 M&O 18,315.38 -2.70 WORLD MARKETS INDEX LAST WEEK% DOW 11,951.90 -1.64 S&P 1,270.98 -2.24 NASDAQ 2,643.73 -3.26 FTSE 100 5,765.80 -1.52 DAX 7,069.90 -0.55 CAC 40 3,805.09 -2.20 MSCI APEX 50 874.02 -3.16 TOPIX 817.38 0.10 NIKKEI 225 9,514.44 0.23 HANGSENG 22,420.40 -2.31 SHANGHAI 2,705.14 -0.84 TAIEX 8,837.82 -2.30 KOSPI 2,046.67 -3.16 S&P/ASX 200 4,562.10 -0.46 ALL ORDINARIES 4,634.90 -0.68 NZ50 3,490.63 -0.69 SET 1,020.37 -3.54 JCI 3,787.65 -1.47 BSESN 18,268.50 -0.59 Straits Times 3,078.35 -2.14 KLCI 1,556.19 -0.23 HO CHI MINH 445.00 0.36 INDEX

THIS WEEK'S BACKDROP:

YTD% 0.44 -0.88 -1.55 -0.72 2.36 -5.18 -5.36 31.32 YTD% 3.23 1.06 -0.34 -2.27 2.25 0.01 0.91 -9.06 -6.98 -2.67 -3.67 -1.50 -0.21 -3.86 -4.37 5.49 -1.20 2.27 -10.92 -3.50 2.45 -8.18

IN FOCUS: Global reco-worries raises risk aversion Debts and deficits problems in Greece and the US Multi-week declines in equity prices, major indexes Interest rates Commodity prices fall Corporate goings-on

EAR the halfway mark of the year, global equity markets are reeling from a growing body of evidence that the post-recession clearing once within sight has been clouded. Major stock market indexes extended weekly declines, narrowing year-to-date gains, with fears of a double-dip recession once more rearing its ugly head. This came as poor economic numbers from the US in the prior week continued to be digested in the absence of fresh news and data. This heightening concern has increased investors' aversion to risky assets, with the slower GDP growth seen as reflecting on corporate bottom-lines moving forward. For much of the year-to-date, analysts forecast, which turned cautiously optimistic at the end of last year, have been missed.

PHL IND FRA US GER 1.00 2.00 3.00 4.00 5.00 6.00 7.00

Using the volatility of average monthly returns LDN over the TTM, measured by standard deviation to SIN gauge risk, Philippine stocks top the list of MAL selected indexes comparing the global majors and our peers in the Asean region. The increased AVG RET STDEV uncertainty presented by this measure may have contributed to the market's inability to hold advances, particularly in light of the higher return, lesser risk proposition by neighboring Jakarta Exchange. Last week's action at the local bourse pulled the averages lower. Average volume turnover narrowed by -1.2 percent to a daily pace of 2,834 billion. Value-wise, the squeeze was at a tad lighter, slowing -0.97 percent to php4.485 billion, a level missed in the last eight (8) sessions, even if we include block sale values. Investors have obviously began to take to the sidelines ahead of important data releases GDP in week 22 and inflation last week. Heading into week 24, the market

DISCLAIMER: THE MATERIAL CONTAINED IN THIS PUBLICATION IS FOR INFORMATION PURPOSES ONLY. IT IS NOT TO BE REPRODUCED OR COPIED OR MADE AVAILABLE TO OTHERS. UNDER NO CIRCUMSTANCES IS IT TO BE CONSIDERED AS AN OFFER TO SELL OR A SOLICITATION TO BUY ANY SECURITY. WHILE THE INFORMATION HEREIN IS FROM SOURCES WE BELIEVE RELIABLE, WE DO NOT REPRESENT THAT IT IS ACCURATE OR COMPLETE AND IT SHOULD NOT BE RELIED UPON AS SUCH. IN ADDITION, WE SHALL NOT BE RESPONSIBLE FOR AMENDING, CORRECTING OR UPDATING ANY INFORMATION OR OPINIONS CONTAINED HEREIN. SOME OF THE VIEWS EXPRESSED IN THIS REPORT ARE NOT NECESSARILY OPINIONS OF ACCORD CAPITAL EQUITIES CORPORATION ON THE CREDITWORTHINESS OR INVESTMENT PROFILE OF THE COMPANY OR THE INDUSTRIES MENTIONED.

ACCORD CAPITAL EQUITIES CORPORATION

GF EC-058B East Tower, PSE Center, Exchange Road, Ortigas Center, Pasig City, PHILIPPINES 1605 (632)687-5071 (trunk)

Outlook for Week XXIV_June 13 to 17_TD 114-118

2 of 2 will again be on edge until Thursday's Monetary Board meeting. The slower-than-projected Q1 GDP growth makes it untenable for the BSP to adjust the rates higher at this time. However, with inflation already tipping the high-end of the full-year target, a pre-emptive move cannot be ruled out. The overnight rates currently stand at 4.5 percent and 6.5 percent, borrowing and lending, respectively.

SIN FRA GER US 5.00 10.00 15.00 20.00

On the valuation-side, based on the above selection of indexes, Philippine equities are relatively expensive relative to its trailing twelve month earnings. Singapore, which returns substantially lower returns at significantly lower risk than the PSEI, is the cheapest in this lot with a PE of slightly above 10x TTM earnings.

With investors giving more weight to avoiding risk, as evidenced by the decrease in fixed-income yields, local stocks may have to drop a bit more to become attractive PHL propositions to institutional clients. In this context, local shares must return at least 4.4 percent to bring it to par MAL with Malaysia in terms of the risk-reward trade-off. Kuala IND Lumpur stocks provide investors with the most return per unit of risk, statistically speaking. Cetris paribus, with index resistance at 4,250, the 4.4 percent return will result from a pick-up at the 4,070-line. Alternatively, with immediate support at 4,170, the investors should find sufficient thrusts from the fundamentals side to propel the index to 4,350 to satisfy the return requirement.

LDN

200 0

-200

-400

-600

-800

-1000

-1200

-1400

The ADL's drop to its lowest level in the last two years makes the first supposition, a drop past the 4,170 a more likely occurrence. The declines in five of the last six sessions, where losers romped over gainers by -101 points, pulled the measure to a year-to-date value of -763, -12.7 percent lower than the previous week's close. Index advances unsupported by a broad support from the number of issues rising or a sustained positive breadth will be short-lived and will eventually lead to quick-profit taking.

The PSEi is currrently trading in a narrow 40-point range between the 10pdEMA and 50pdEMA. The underlying measures of momentum and direction are generally pointing to a neutral sideways action with a slight negative bias. The medium-term line has lost the steepness in its slope and has turned almost flat, even as the longer-term (150pdEMA) line sustains an optimistic direction moving forward. The debates on whether the glitches we are encountering at the moment are of a temporary or a permanent nature will keep the markets volatile, as investors bet on every direction, reacting to short-term stories. As has been mentioned on top, the index' immediate range is between 4,170 and 4,250. We are closely watching the downside, with a breach of the lower end raising the possibility of a retracement to the 4,070-4,100 range.

DISCLAIMER: THE MATERIAL CONTAINED IN THIS PUBLICATION IS FOR INFORMATION PURPOSES ONLY. IT IS NOT TO BE REPRODUCED OR COPIED OR MADE AVAILABLE TO OTHERS. UNDER NO CIRCUMSTANCES IS IT TO BE CONSIDERED AS AN OFFER TO SELL OR A SOLICITATION TO BUY ANY SECURITY. WHILE THE INFORMATION HEREIN IS FROM SOURCES WE BELIEVE RELIABLE, WE DO NOT REPRESENT THAT IT IS ACCURATE OR COMPLETE AND IT SHOULD NOT BE RELIED UPON AS SUCH. IN ADDITION, WE SHALL NOT BE RESPONSIBLE FOR AMENDING, CORRECTING OR UPDATING ANY INFORMATION OR OPINIONS CONTAINED HEREIN. SOME OF THE VIEWS EXPRESSED IN THIS REPORT ARE NOT NECESSARILY OPINIONS OF ACCORD CAPITAL EQUITIES CORPORATION ON THE CREDITWORTHINESS OR INVESTMENT PROFILE OF THE COMPANY OR THE INDUSTRIES MENTIONED.

4 n a J 8 1 n a J 1 b e F 5 1 b e F 1 r a M 5 1 r a M 9 2 r a M 2 1 r p A 6 2 r p A 0 1 y a M 4 2 y a M 7 n u J 1 2 n u J 5 l u J 9 1 l u J 2 g u A 6 1 g u A 0 3 g u A 3 1 p e S 7 2 p e S 1 t c O 5 2 t c O 8 v o N 2 v o N 6 c e D 0 2 c e D 3 n a J 7 1 n a J 1 3 n a J 4 1 b e F 8 2 b e F 4 1 r a M 8 2 r a M 1 r p A 5 2 r p A 9 y a M 3u 2J -n y a M 6 -

Das könnte Ihnen auch gefallen

- The Investment Trusts Handbook 2024: Investing essentials, expert insights and powerful trends and dataVon EverandThe Investment Trusts Handbook 2024: Investing essentials, expert insights and powerful trends and dataBewertung: 2 von 5 Sternen2/5 (1)

- The Sector Strategist: Using New Asset Allocation Techniques to Reduce Risk and Improve Investment ReturnsVon EverandThe Sector Strategist: Using New Asset Allocation Techniques to Reduce Risk and Improve Investment ReturnsBewertung: 4 von 5 Sternen4/5 (1)

- Market Balance - Daily For August 10, 2011Dokument2 SeitenMarket Balance - Daily For August 10, 2011JC CalaycayNoch keine Bewertungen

- WEEK 48 - DAILY - Post December 3, 2010Dokument1 SeiteWEEK 48 - DAILY - Post December 3, 2010JC CalaycayNoch keine Bewertungen

- Market Balance - Daily For August 11, 2011Dokument3 SeitenMarket Balance - Daily For August 11, 2011JC CalaycayNoch keine Bewertungen

- Accord Capital Equities Corporation: Outlook For Week XXV - June 21 To 24 - TD 119-122Dokument3 SeitenAccord Capital Equities Corporation: Outlook For Week XXV - June 21 To 24 - TD 119-122JC CalaycayNoch keine Bewertungen

- Market Notes May 3 TuesdayDokument2 SeitenMarket Notes May 3 TuesdayJC CalaycayNoch keine Bewertungen

- DAILY - June 14-15, 2011Dokument2 SeitenDAILY - June 14-15, 2011JC CalaycayNoch keine Bewertungen

- DISCLOSURES February 7 MondayDokument2 SeitenDISCLOSURES February 7 MondayJC CalaycayNoch keine Bewertungen

- Weekly Market Commentary 02232015Dokument4 SeitenWeekly Market Commentary 02232015dpbasicNoch keine Bewertungen

- Stock Market Daily For August 17, 2010Dokument1 SeiteStock Market Daily For August 17, 2010JC CalaycayNoch keine Bewertungen

- Weekly Xxvix - July 18 To 22, 2011Dokument2 SeitenWeekly Xxvix - July 18 To 22, 2011JC CalaycayNoch keine Bewertungen

- February 17-18, 2011 - UpdateDokument3 SeitenFebruary 17-18, 2011 - UpdateJC CalaycayNoch keine Bewertungen

- Technical Format With Stock 24.09Dokument4 SeitenTechnical Format With Stock 24.09Angel BrokingNoch keine Bewertungen

- Weekly Market Commentary 06-27-2011Dokument2 SeitenWeekly Market Commentary 06-27-2011Jeremy A. MillerNoch keine Bewertungen

- More easing to come - Fidelity's August 2012 Investment Clock analysisDokument4 SeitenMore easing to come - Fidelity's August 2012 Investment Clock analysisJean Carlos TorresNoch keine Bewertungen

- Daily Technical Report: Sensex (17214) / NIFTY (5227)Dokument4 SeitenDaily Technical Report: Sensex (17214) / NIFTY (5227)Angel BrokingNoch keine Bewertungen

- JPM Weekly MKT Recap 10-15-12Dokument2 SeitenJPM Weekly MKT Recap 10-15-12Flat Fee PortfoliosNoch keine Bewertungen

- Weekly Trends: Earnings To The RescueDokument4 SeitenWeekly Trends: Earnings To The RescuedpbasicNoch keine Bewertungen

- Market Analysis Nov 2022Dokument12 SeitenMarket Analysis Nov 2022Muhammad SatrioNoch keine Bewertungen

- Technical Format With Stock 17.09Dokument4 SeitenTechnical Format With Stock 17.09Angel BrokingNoch keine Bewertungen

- JPM Weekly MKT Recap 10-1-12Dokument2 SeitenJPM Weekly MKT Recap 10-1-12Flat Fee PortfoliosNoch keine Bewertungen

- EdisonInsight February2013Dokument157 SeitenEdisonInsight February2013KB7551Noch keine Bewertungen

- WEEK 39 - September 27 To October 1, 2010Dokument2 SeitenWEEK 39 - September 27 To October 1, 2010JC CalaycayNoch keine Bewertungen

- Schroder Australian Smaller Companies Fund: February 2013Dokument2 SeitenSchroder Australian Smaller Companies Fund: February 2013qweasd222Noch keine Bewertungen

- Ing Philippine Equity Fund A Unit Investment Trust Fund of ING Bank N.V. Philippine Branch (Trust Department)Dokument1 SeiteIng Philippine Equity Fund A Unit Investment Trust Fund of ING Bank N.V. Philippine Branch (Trust Department)sunjun79Noch keine Bewertungen

- Daily Technical Report: Sensex (17521) / NIFTY (5317)Dokument4 SeitenDaily Technical Report: Sensex (17521) / NIFTY (5317)Angel BrokingNoch keine Bewertungen

- Lane Asset Management Stock Market Commentary March 2012Dokument6 SeitenLane Asset Management Stock Market Commentary March 2012Edward C LaneNoch keine Bewertungen

- JPM Weekly MKT Recap 10-08-12Dokument2 SeitenJPM Weekly MKT Recap 10-08-12Flat Fee PortfoliosNoch keine Bewertungen

- JPM Weekly MKT Recap 5-14-12Dokument2 SeitenJPM Weekly MKT Recap 5-14-12Flat Fee PortfoliosNoch keine Bewertungen

- Technical Report 24th October 2011Dokument5 SeitenTechnical Report 24th October 2011Angel BrokingNoch keine Bewertungen

- Valuations Suggest Extremely Overvalued MarketDokument9 SeitenValuations Suggest Extremely Overvalued Marketstreettalk700Noch keine Bewertungen

- Weekly Forex Report 4 February 2013: WWW - Epicresearch.CoDokument6 SeitenWeekly Forex Report 4 February 2013: WWW - Epicresearch.Coapi-196234891Noch keine Bewertungen

- July Monthly LetterDokument3 SeitenJuly Monthly LetterTheLernerGroupNoch keine Bewertungen

- JPM Weekly MKT Recap 8-13-12Dokument2 SeitenJPM Weekly MKT Recap 8-13-12Flat Fee PortfoliosNoch keine Bewertungen

- Week 46 - Disclosures Update - November 17, 2010Dokument2 SeitenWeek 46 - Disclosures Update - November 17, 2010JC CalaycayNoch keine Bewertungen

- Daily Technical Report: Sensex (16719) / NIFTY (5068)Dokument4 SeitenDaily Technical Report: Sensex (16719) / NIFTY (5068)Angel BrokingNoch keine Bewertungen

- JPM Weekly MKT Recap 9-10-12Dokument2 SeitenJPM Weekly MKT Recap 9-10-12Flat Fee PortfoliosNoch keine Bewertungen

- Equity Market Prediction For The Week 21 To 25 MayDokument8 SeitenEquity Market Prediction For The Week 21 To 25 MayTheequicom AdvisoryNoch keine Bewertungen

- JPM Weekly Commentary 01-16-12Dokument2 SeitenJPM Weekly Commentary 01-16-12Flat Fee PortfoliosNoch keine Bewertungen

- Spring 2014 HCA Letter FinalDokument4 SeitenSpring 2014 HCA Letter FinalDivGrowthNoch keine Bewertungen

- JPM Weekly Commentary 01-09-12Dokument2 SeitenJPM Weekly Commentary 01-09-12Flat Fee PortfoliosNoch keine Bewertungen

- JPM Weekly MKT Recap 5-21-12Dokument2 SeitenJPM Weekly MKT Recap 5-21-12Flat Fee PortfoliosNoch keine Bewertungen

- File 1Dokument10 SeitenFile 1Alberto VillalpandoNoch keine Bewertungen

- Doshi Capital Fund Returns +41.2% YTDDokument2 SeitenDoshi Capital Fund Returns +41.2% YTDados1984Noch keine Bewertungen

- Technical Format With Stock 18.09Dokument4 SeitenTechnical Format With Stock 18.09Angel BrokingNoch keine Bewertungen

- Technical Report 15th March 2012Dokument5 SeitenTechnical Report 15th March 2012Angel BrokingNoch keine Bewertungen

- JPM Weekly Market Recap October 10, 2011Dokument2 SeitenJPM Weekly Market Recap October 10, 2011everest8848Noch keine Bewertungen

- JPM Weekly MKT Recap 9-24-12Dokument2 SeitenJPM Weekly MKT Recap 9-24-12Flat Fee PortfoliosNoch keine Bewertungen

- Technical Format With Stock 14.09Dokument4 SeitenTechnical Format With Stock 14.09Angel BrokingNoch keine Bewertungen

- The GIC Weekly Update November 2015Dokument12 SeitenThe GIC Weekly Update November 2015John MathiasNoch keine Bewertungen

- Investment Commentary: Market and Performance SummaryDokument20 SeitenInvestment Commentary: Market and Performance SummaryCanadianValueNoch keine Bewertungen

- Market Analysis Aug 2023Dokument17 SeitenMarket Analysis Aug 2023nktradzNoch keine Bewertungen

- Market Notes - Food SroDokument2 SeitenMarket Notes - Food SroJC CalaycayNoch keine Bewertungen

- DAILY - July 22-25, 2011Dokument1 SeiteDAILY - July 22-25, 2011JC CalaycayNoch keine Bewertungen

- Technical Format With Stock 01.10Dokument4 SeitenTechnical Format With Stock 01.10Angel BrokingNoch keine Bewertungen

- The Weekly Market Update For The Week of April 13, 2015.Dokument2 SeitenThe Weekly Market Update For The Week of April 13, 2015.mike1473Noch keine Bewertungen

- June 10 Update - Correct VersionDokument2 SeitenJune 10 Update - Correct Versionmike1473Noch keine Bewertungen

- Technical Format With Stock 16.11.2012Dokument4 SeitenTechnical Format With Stock 16.11.2012Angel BrokingNoch keine Bewertungen

- Security Bank - UITF Investment ReportDokument2 SeitenSecurity Bank - UITF Investment ReportgwapongkabayoNoch keine Bewertungen

- Weekly Xxxi - August 1 To 5, 2011Dokument2 SeitenWeekly Xxxi - August 1 To 5, 2011JC CalaycayNoch keine Bewertungen

- DAILY - June 21-22, 2011Dokument1 SeiteDAILY - June 21-22, 2011JC CalaycayNoch keine Bewertungen

- Market Notes - Month Review (June 2011)Dokument2 SeitenMarket Notes - Month Review (June 2011)JC CalaycayNoch keine Bewertungen

- Market Notes July 22 FridayDokument1 SeiteMarket Notes July 22 FridayJC CalaycayNoch keine Bewertungen

- Weekly Report XXX - July 25 To 29, 2011Dokument2 SeitenWeekly Report XXX - July 25 To 29, 2011JC CalaycayNoch keine Bewertungen

- DAILY - July 22-25, 2011Dokument1 SeiteDAILY - July 22-25, 2011JC CalaycayNoch keine Bewertungen

- Market Notes Mining atDokument2 SeitenMarket Notes Mining atJC CalaycayNoch keine Bewertungen

- Weekly Xxvix - July 18 To 22, 2011Dokument2 SeitenWeekly Xxvix - July 18 To 22, 2011JC CalaycayNoch keine Bewertungen

- DAILY - June 16-17, 2011Dokument1 SeiteDAILY - June 16-17, 2011JC CalaycayNoch keine Bewertungen

- The Philippine Stock Exchange - PseDokument2 SeitenThe Philippine Stock Exchange - PseJC CalaycayNoch keine Bewertungen

- Weekly Xxviii - July 11 To 15, 2011Dokument2 SeitenWeekly Xxviii - July 11 To 15, 2011JC CalaycayNoch keine Bewertungen

- DAILY - June 22-23, 2011Dokument1 SeiteDAILY - June 22-23, 2011JC CalaycayNoch keine Bewertungen

- Market Notes June 22 WednesdayDokument2 SeitenMarket Notes June 22 WednesdayJC CalaycayNoch keine Bewertungen

- Daily - June 10, 2011 - End of WeekDokument2 SeitenDaily - June 10, 2011 - End of WeekJC CalaycayNoch keine Bewertungen

- Market Notes June 17 FridayDokument1 SeiteMarket Notes June 17 FridayJC CalaycayNoch keine Bewertungen

- Market Notes - Food SroDokument2 SeitenMarket Notes - Food SroJC CalaycayNoch keine Bewertungen

- Daily - June 7-8, 2011Dokument3 SeitenDaily - June 7-8, 2011JC CalaycayNoch keine Bewertungen

- Market Notes MwideDokument2 SeitenMarket Notes MwideJC CalaycayNoch keine Bewertungen

- DAILY - June 14-15, 2011Dokument2 SeitenDAILY - June 14-15, 2011JC CalaycayNoch keine Bewertungen

- Market Notes - June 6, 2011 - MondayDokument2 SeitenMarket Notes - June 6, 2011 - MondayJC CalaycayNoch keine Bewertungen

- Weekly Report - June 6-10, 2011Dokument2 SeitenWeekly Report - June 6-10, 2011JC CalaycayNoch keine Bewertungen

- Weekly Report - Xxii - May 30 To June 3, 2011Dokument4 SeitenWeekly Report - Xxii - May 30 To June 3, 2011JC CalaycayNoch keine Bewertungen

- Weekly Report - Xxi - May 23 To 27, 2011Dokument3 SeitenWeekly Report - Xxi - May 23 To 27, 2011JC CalaycayNoch keine Bewertungen

- DAILY - May 17-18, 2011Dokument2 SeitenDAILY - May 17-18, 2011JC CalaycayNoch keine Bewertungen

- DAILY - May 16-17, 2011Dokument1 SeiteDAILY - May 16-17, 2011JC CalaycayNoch keine Bewertungen

- Market Notes May 17 TuesdayDokument2 SeitenMarket Notes May 17 TuesdayJC CalaycayNoch keine Bewertungen

- Investment in Secondary Market, Transaction Procedure and IndexDokument30 SeitenInvestment in Secondary Market, Transaction Procedure and IndexChintan JoshiNoch keine Bewertungen

- Iso10383 MicDokument45 SeitenIso10383 MicAn PhungNoch keine Bewertungen

- Landis Group N.V, (A) : July 1, 2001Dokument30 SeitenLandis Group N.V, (A) : July 1, 2001thanhNoch keine Bewertungen

- STA Guide - 2016Dokument3 SeitenSTA Guide - 2016luis antonioNoch keine Bewertungen

- Mid-Norfolk Times April 2010Dokument32 SeitenMid-Norfolk Times April 2010Julian HornNoch keine Bewertungen

- Investors' Awareness About Investment in Stock Market: Dr. K. BanumathyDokument9 SeitenInvestors' Awareness About Investment in Stock Market: Dr. K. BanumathyFathimaNoch keine Bewertungen

- What Is Meant by Book BuildingDokument2 SeitenWhat Is Meant by Book BuildingParul PrasadNoch keine Bewertungen

- Testing Significance of MeanDokument23 SeitenTesting Significance of MeanRajniNoch keine Bewertungen

- Ing: 3M Co - Oferta de CanjeDokument6 SeitenIng: 3M Co - Oferta de CanjePablo AlloNoch keine Bewertungen

- Fundamental Equity Analysis & Analyst Recommendations - STOXX Large 200 Index ComponentsDokument401 SeitenFundamental Equity Analysis & Analyst Recommendations - STOXX Large 200 Index ComponentsQ.M.S Advisors LLCNoch keine Bewertungen

- MLB 150 ACCSDokument11 SeitenMLB 150 ACCSok na ata toNoch keine Bewertungen

- Outlier DataDokument65 SeitenOutlier DataAmbar WatiNoch keine Bewertungen

- ASX Index - Options PDFDokument2 SeitenASX Index - Options PDFZolo ZoloNoch keine Bewertungen

- Important Bin For CCDokument2 SeitenImportant Bin For CCRozanawati Shanty100% (4)

- S and P - Google Search PDFDokument1 SeiteS and P - Google Search PDFArouetNoch keine Bewertungen

- Research Paper On FIIDokument7 SeitenResearch Paper On FIIchitkarashellyNoch keine Bewertungen

- Executive SummaryDokument41 SeitenExecutive SummaryAnonymous CgJjQiCu5ANoch keine Bewertungen

- Jurnal Emi19718Dokument15 SeitenJurnal Emi19718Joksa UnitedNoch keine Bewertungen

- Project KMMLDokument95 SeitenProject KMMLJijo ThomasNoch keine Bewertungen

- Stock Exchange Scam in IndiaDokument61 SeitenStock Exchange Scam in IndiaAshish Thakkar67% (3)

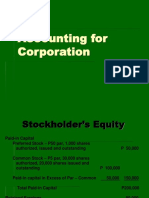

- Accounting For CorporationDokument11 SeitenAccounting For CorporationMaricar D. VillarazaNoch keine Bewertungen

- PEG Ratio - What It Is and How To Calculate ItDokument4 SeitenPEG Ratio - What It Is and How To Calculate ItPatacoNoch keine Bewertungen

- Quiz Questionsdocx PRDokument7 SeitenQuiz Questionsdocx PRJulian CheezeNoch keine Bewertungen

- Swing Trading OrigDokument127 SeitenSwing Trading OrigMohsen's Channel100% (5)

- Artko Capital 2019 Q2 LetterDokument7 SeitenArtko Capital 2019 Q2 LetterSmitty WNoch keine Bewertungen

- Real Estate Investing - A Beginner's GuideDokument10 SeitenReal Estate Investing - A Beginner's GuideMAK- 47Noch keine Bewertungen

- Stocks and Shares WordDokument2 SeitenStocks and Shares WordIvan VranićNoch keine Bewertungen

- About NSE Equities MarketDokument4 SeitenAbout NSE Equities MarketSushobhan DasNoch keine Bewertungen

- Mining in Indonesia - May 2018, 10th EditionDokument172 SeitenMining in Indonesia - May 2018, 10th EditionUus AfiniNoch keine Bewertungen

- CHP - 9 - Industrial Securities MarketDokument10 SeitenCHP - 9 - Industrial Securities MarketNandini JaganNoch keine Bewertungen