Beruflich Dokumente

Kultur Dokumente

How Do You Calculate The Operating Cycle Ratio of A Business - A Knol by Nowmaster Accounting

Hochgeladen von

113322Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

How Do You Calculate The Operating Cycle Ratio of A Business - A Knol by Nowmaster Accounting

Hochgeladen von

113322Copyright:

Verfügbare Formate

5/8/2011

How do you calculate the Operating Cyc

How do you calculate the Operating Cycle ratio of a business?

Calculating the Operating Cycle ratio of a business - Master level

The Operating Cycle ratio of a business is calculated by adding the average number of days where cash is tied up in inventory and accounts receivable and then subtracting the average number of days where bills have not yet been paid.

Please note: This Knol is specifically written for a global audience. It has been written in a style that will produce the best possible multi-language translation outcome. Blue hyper-links takes you to other articles in the series and orange text provides mouse-over definitions.

Operating cycle ratio of a business

Formula for the Operating Cycle ratio of a business

The Operating Cycle of a business is also known as the "Cash Operating Cycle", the "Cash to Cash Cycle", the "Cash Conversion Cycle" or simply the "Cash Cycle". The Operating Cycle ratio is a metric that measures the average duration of time (in days) it takes for a business to turn purchased inventory into cash receipts from its eventual sale. The Operating Cycle ratio is calculated using the following components: Operating Cycle ratio = Inventory days + Receivable days - Unpaid bill days where: Inventory days = Average number of days that cash is locked-up in inventory Receivable days = Average number of days that cash is locked-up in accounts receivables Unpaid bill days = Average number of days where extra cash is available because the business has not yet paid its bills. Note: Credit provided by suppliers becomes additional working capital for the business and so reduces the Operating Cycle ratio.

Calculating the Operating Cycle ratio of a business

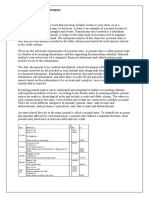

To calculate the Operating Cycle ratio of a business you will need access to information contained in the financial statements. i.e. the Balance Sheet and the Income Statement. For example: Extract from the financial statements - Balance Sheet Account Accounts Receivable

knol.google.com/k//59

1 June 4,000

30 June 6,000

1/2

5/8/2011

How do you calculate the Operating Cyc

Inventory (Raw materials, Work-In-Progress & Finished Goods) Accounts Payable Extract from the financial statements - Income Statement Account Sales Cost of Goods Sold Gross Profit margin

5,000 3,000

3,000 1,000

30 June 10,000 7,000 3,000

To calculate each of the components of the Operating Cycle ratio in the given reporting period (i.e. June with 30 days): Inventory days = Average $ value of inventory / (Cost or Goods Sold / Reporting period days) i.e. ((5,000 + 3,000)/2) / (7,000 / 30) = 4,000 / 233.33 = 17.14 days. This is how many days worth of stock that is held by the business during the period. Receivable days = Average $ value of Accounts receivable / (Sales / Reporting period days) i.e. ((4,000 + 6,000)/2) / (10,000 / 30 days) = 5,000 / 333.33 = 15.00 days. This is the average length of time it takes for customers (debtors) to pay their accounts. Unpaid bill days = Average $ value of Accounts Payable / (Cost or Goods Sold / Reporting period days) = ((3,000 + 1,000)/2) / (7,000 / 30) = 2,000 / 233.33 = 8.57 days. This is the average length of time that the business takes to pay it's bills. So, the Operating Cycle ratio for the example above = 17.14 days + 15.00 days - 8.57 days = 23.57 days. This ratio represents the average number of days that cash is locked up in the non-cash working capital of the business and is unavailable for other investment options. By comparing this metric against previous periods, industry benchmarks or key competitors, you will be able to assess the effectiveness of the working capital management of the business.

Operating Cycle ratio

This knol is part of the collection: Basic accounting concepts Previous (What is the Operating Cycle of a bus... (How do you interpret the Operating C... Next Comments have been disabled on this knol

knol.google.com/k//59

2/2

Das könnte Ihnen auch gefallen

- Types of Financial Ratios: Their Analysis and Interpretation - Penpoin.Dokument17 SeitenTypes of Financial Ratios: Their Analysis and Interpretation - Penpoin.John CollinsNoch keine Bewertungen

- Bookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthVon EverandBookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthNoch keine Bewertungen

- Finance Basics (HBR 20-Minute Manager Series)Von EverandFinance Basics (HBR 20-Minute Manager Series)Bewertung: 4.5 von 5 Sternen4.5/5 (32)

- Analyze financial ratios to evaluate FM222 courseDokument60 SeitenAnalyze financial ratios to evaluate FM222 courseLai Alvarez100% (1)

- Average Age of InventoryDokument10 SeitenAverage Age of Inventoryrakeshjha91Noch keine Bewertungen

- Inventory, Efficiency, and Asset RatiosDokument5 SeitenInventory, Efficiency, and Asset RatiosEzekiel MalazzabNoch keine Bewertungen

- Cash Conversion Cycle (CCC) What Is It, and How Is It CalculatedDokument1 SeiteCash Conversion Cycle (CCC) What Is It, and How Is It Calculatedmscybele xNoch keine Bewertungen

- The Formula To Calculate Days in Inventory Is The Number of Days in The Period Divided by The Inventory Turnover RatioDokument5 SeitenThe Formula To Calculate Days in Inventory Is The Number of Days in The Period Divided by The Inventory Turnover RatioEmba MadrasNoch keine Bewertungen

- Ratio TurnoverDokument63 SeitenRatio TurnoverAkhil PuliNoch keine Bewertungen

- Asset Conversion CycleDokument3 SeitenAsset Conversion CycleobaidobaidNoch keine Bewertungen

- Creating A Successful Financial PlanDokument29 SeitenCreating A Successful Financial PlanSherry MalikNoch keine Bewertungen

- AccountingDokument7 SeitenAccountingMohammad Tariq BashirNoch keine Bewertungen

- OperatingDokument4 SeitenOperatingRico BuenoNoch keine Bewertungen

- Far 3Dokument9 SeitenFar 3Sonu NayakNoch keine Bewertungen

- SHS Business Finance Chapter 3Dokument17 SeitenSHS Business Finance Chapter 3Ji BaltazarNoch keine Bewertungen

- Assignment 1Dokument9 SeitenAssignment 1Yashveer SinghNoch keine Bewertungen

- Financial Statement AnalysisDokument9 SeitenFinancial Statement AnalysisQaisar BasheerNoch keine Bewertungen

- Basic Accounting GuideDokument1 SeiteBasic Accounting GuideKristy Veyna BautistaNoch keine Bewertungen

- Flash Reports DefinitionDokument8 SeitenFlash Reports Definitionca_rudraNoch keine Bewertungen

- CH 15 --Narrative Report-Managing Working CapitalDokument12 SeitenCH 15 --Narrative Report-Managing Working Capitaljomarybrequillo20Noch keine Bewertungen

- Accounting Survival Guide: An Introduction to Accounting for BeginnersVon EverandAccounting Survival Guide: An Introduction to Accounting for BeginnersNoch keine Bewertungen

- 1) Cash Conversion CycleDokument2 Seiten1) Cash Conversion CyclesaramumtazNoch keine Bewertungen

- Chapter 1 - FS AnalysisDokument40 SeitenChapter 1 - FS AnalysisKenneth Bryan Tegerero Tegio100% (2)

- What Is The Formula For Creditor DaysDokument9 SeitenWhat Is The Formula For Creditor DaysKathir HaiNoch keine Bewertungen

- Thesis Accounts PayableDokument2 SeitenThesis Accounts PayableMarife Arellano AlcobendasNoch keine Bewertungen

- Understanding Financial Statements (Review and Analysis of Straub's Book)Von EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Bewertung: 5 von 5 Sternen5/5 (5)

- FIN701 Final Exam Cash Conversion CycleDokument24 SeitenFIN701 Final Exam Cash Conversion Cycleankita chauhanNoch keine Bewertungen

- Research Paper On Account ReceivableDokument7 SeitenResearch Paper On Account Receivableafeazleae100% (1)

- Financial Analysis ComponentsDokument6 SeitenFinancial Analysis Componentskyrian chimaNoch keine Bewertungen

- Write financial plan under 40 charsDokument6 SeitenWrite financial plan under 40 charsGokul SoodNoch keine Bewertungen

- Cash Conversion CycleDokument6 SeitenCash Conversion CycleJohn SamonteNoch keine Bewertungen

- Unit Two: Managing Cash and Marketable SecuritiesDokument31 SeitenUnit Two: Managing Cash and Marketable SecuritiesmeseleNoch keine Bewertungen

- Corporate FinanceDokument7 SeitenCorporate Financeaditya prakashNoch keine Bewertungen

- Management Accounting Jargons/ Key TerminologiesDokument11 SeitenManagement Accounting Jargons/ Key Terminologiesnimbus2050Noch keine Bewertungen

- Accounting ResearchDokument12 SeitenAccounting ResearchAhmed HamdyNoch keine Bewertungen

- What is Financial Accounting and BookkeepingVon EverandWhat is Financial Accounting and BookkeepingBewertung: 4 von 5 Sternen4/5 (10)

- Lesson 10 Improving Cash FlowDokument38 SeitenLesson 10 Improving Cash FlowPaulinaNoch keine Bewertungen

- Financial Decision AnalysisDokument10 SeitenFinancial Decision AnalysisGyanendra SinghNoch keine Bewertungen

- Oracle Financial Analytics InsightsDokument9 SeitenOracle Financial Analytics InsightsRamesh KuppusamyNoch keine Bewertungen

- MMPC-04 2022-23Dokument8 SeitenMMPC-04 2022-23Rajni KumariNoch keine Bewertungen

- Accounting DefinitionsDokument5 SeitenAccounting DefinitionsAli GoharNoch keine Bewertungen

- Dibin K K Assistant ProfessorDokument69 SeitenDibin K K Assistant ProfessorKartika Bhuvaneswaran NairNoch keine Bewertungen

- Accounting Transactions at Ocial's Machine ShopDokument14 SeitenAccounting Transactions at Ocial's Machine ShopKleint Tadem OcialNoch keine Bewertungen

- Financial AccountingDokument46 SeitenFinancial Accountingarjunmba119624Noch keine Bewertungen

- Bookeeping EntrepDokument71 SeitenBookeeping EntrepJanelle Ghia RamosNoch keine Bewertungen

- Financial Ratio AnalysisDokument42 SeitenFinancial Ratio Analysisfattiq_1Noch keine Bewertungen

- Financial Accounting & AnalysisDokument5 SeitenFinancial Accounting & AnalysisSourav SaraswatNoch keine Bewertungen

- Business Metrics and Tools; Reference for Professionals and StudentsVon EverandBusiness Metrics and Tools; Reference for Professionals and StudentsNoch keine Bewertungen

- Working Capital Operating CycleDokument3 SeitenWorking Capital Operating CycleRatish NairNoch keine Bewertungen

- ACCTG Module - Unit 4 Adjusting The AccountsDokument8 SeitenACCTG Module - Unit 4 Adjusting The AccountsMary Lou SouribioNoch keine Bewertungen

- Cash Operating CycleDokument2 SeitenCash Operating CycleAyman RamyNoch keine Bewertungen

- Fakruddin (Financial Accounting Analysis L)Dokument21 SeitenFakruddin (Financial Accounting Analysis L)mohammad fakhruddinNoch keine Bewertungen

- The Accounting PeriodDokument3 SeitenThe Accounting PeriodEnusah AbdulaiNoch keine Bewertungen

- 277 Financial Statement As Management ToolDokument8 Seiten277 Financial Statement As Management ToolkandriantoNoch keine Bewertungen

- ASF Assignment by Kainat KumariDokument12 SeitenASF Assignment by Kainat KumariNoorNoch keine Bewertungen

- Apollo Tyres Fights High Rubber CostsDokument5 SeitenApollo Tyres Fights High Rubber Costs113322Noch keine Bewertungen

- NAFTA Myth Versus FactDokument2 SeitenNAFTA Myth Versus Fact113322Noch keine Bewertungen

- New Microsoft Office Word 97 - 2003 DocumentDokument10 SeitenNew Microsoft Office Word 97 - 2003 Document113322Noch keine Bewertungen

- NAFTADokument37 SeitenNAFTA113322Noch keine Bewertungen

- Week 4 CasesDokument181 SeitenWeek 4 CasesMary Ann AmbitaNoch keine Bewertungen

- Diagram Illustrating The Globalization Concept and ProcessDokument1 SeiteDiagram Illustrating The Globalization Concept and ProcessAnonymous hWHYwX6Noch keine Bewertungen

- Present Tense Exercises. Polish A1Dokument6 SeitenPresent Tense Exercises. Polish A1Pilar Moreno DíezNoch keine Bewertungen

- Military Divers ManualDokument30 SeitenMilitary Divers ManualJohn0% (1)

- Building Materials Alia Bint Khalid 19091AA001: Q) What Are The Constituents of Paint? What AreDokument22 SeitenBuilding Materials Alia Bint Khalid 19091AA001: Q) What Are The Constituents of Paint? What Arealiyah khalidNoch keine Bewertungen

- Pharmacology of GingerDokument24 SeitenPharmacology of GingerArkene LevyNoch keine Bewertungen

- Natural Science subject curriculumDokument15 SeitenNatural Science subject curriculum4porte3Noch keine Bewertungen

- Instafin LogbookDokument4 SeitenInstafin LogbookAnonymous gV9BmXXHNoch keine Bewertungen

- Financial Management-Capital BudgetingDokument39 SeitenFinancial Management-Capital BudgetingParamjit Sharma100% (53)

- Georgetown University NewsletterDokument3 SeitenGeorgetown University Newsletterapi-262723514Noch keine Bewertungen

- AIX For System Administrators - AdaptersDokument2 SeitenAIX For System Administrators - Adaptersdanielvp21Noch keine Bewertungen

- ISO 9001 internal audit criteria and examples guideDokument22 SeitenISO 9001 internal audit criteria and examples guideMukesh Yadav100% (2)

- Magnetic Suspension System With Electricity Generation Ijariie5381Dokument11 SeitenMagnetic Suspension System With Electricity Generation Ijariie5381Jahnavi ChinnuNoch keine Bewertungen

- The Ethics of Sexual Reorientation What Should Clinicians and Researchers DoDokument8 SeitenThe Ethics of Sexual Reorientation What Should Clinicians and Researchers DoLanny Dwi ChandraNoch keine Bewertungen

- 5 Whys Analysis SheetDokument3 Seiten5 Whys Analysis SheetAjay KrishnanNoch keine Bewertungen

- Ferret Fiasco: Archie Carr IIIDokument8 SeitenFerret Fiasco: Archie Carr IIIArchie Carr III100% (1)

- WSP - Aci 318-02 Shear Wall DesignDokument5 SeitenWSP - Aci 318-02 Shear Wall DesignSalomi Ann GeorgeNoch keine Bewertungen

- Group Handling - Pre Registration Activity: Submited To-Submitted byDokument12 SeitenGroup Handling - Pre Registration Activity: Submited To-Submitted byharshal kushwahNoch keine Bewertungen

- The 4Ps of Labor: Passenger, Passageway, Powers, and PlacentaDokument4 SeitenThe 4Ps of Labor: Passenger, Passageway, Powers, and PlacentaMENDIETA, JACQUELINE V.Noch keine Bewertungen

- Managing Remuneration MCQDokument5 SeitenManaging Remuneration MCQlol100% (1)

- Method Statement Soil NailedDokument2 SeitenMethod Statement Soil NailedFa DylaNoch keine Bewertungen

- 5E Lesson PlanDokument3 Seiten5E Lesson PlanSangteablacky 09100% (8)

- 52 Codes For Conscious Self EvolutionDokument35 Seiten52 Codes For Conscious Self EvolutionSorina LutasNoch keine Bewertungen

- Grammar Level 1 2013-2014 Part 2Dokument54 SeitenGrammar Level 1 2013-2014 Part 2Temur SaidkhodjaevNoch keine Bewertungen

- College Management System Micro-ProjectDokument27 SeitenCollege Management System Micro-ProjectNatashaNoch keine Bewertungen

- Meesho FDokument75 SeitenMeesho FAyan khanNoch keine Bewertungen

- APFC Accountancy Basic Study Material For APFCEPFO ExamDokument3 SeitenAPFC Accountancy Basic Study Material For APFCEPFO ExamIliasNoch keine Bewertungen

- Eng9 - Q3 - M4 - W4 - Interpret The Message Conveyed in A Poster - V5Dokument19 SeitenEng9 - Q3 - M4 - W4 - Interpret The Message Conveyed in A Poster - V5FITZ100% (1)

- Terrestrial EcosystemDokument13 SeitenTerrestrial Ecosystemailene burceNoch keine Bewertungen