Beruflich Dokumente

Kultur Dokumente

TA 4665 PAK Power Transmission Enhancement Project - Pakistan

Hochgeladen von

Javed RashidOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

TA 4665 PAK Power Transmission Enhancement Project - Pakistan

Hochgeladen von

Javed RashidCopyright:

Verfügbare Formate

TA 4665 PAK Power Transmission Enhancement Project - Pakistan

Final Report

Submitted to: Asian Development Bank & National Transmission and Despatch Company Submitted by: British Power International

November 2008

Power Transmission Enhancement Project

Document Status

Title

Power Transmission Enhancement Project

Reference

ADB Project Reference - TA 4665 - PAK ADB Contract Reference COCS 60-087

Issue Date

: :

1.0 10 November 2008 PAK4665_DFR_001_ Final_Report_v1.0FINAL

Electronic Doc Ref :

Authorisation

Name Mohammed Tahir Khan Rune Stroem Geoff Stott Position NTDC Project Director ADB Project Officer BPI Quality Manager Signed Date

History

Issue Date 1.0 0.3 0.2 0.1 10 November 2008 26 November 2007 08 November 2007 14 July 2007 Author(s) Bill Slegg Bill Slegg Bill Slegg Javed Rashid Reviewer Glen Chapman Tony Evans Tony Evans Bill Slegg Description Final for issue Draft for issue to ADB and NTDC Second draft First draft

Final Report TA 4665 PAK

Issue 1.0 10 November 2008

Power Transmission Enhancement Project

CONTENTS

1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. EXECUTIVE SUMMARY ................................................................................ 1 PURPOSE ...................................................................................................... 4 BACKGROUND .............................................................................................. 4 SCOPE ........................................................................................................... 5 PROJECT MANAGEMENT ............................................................................ 5 PROJECT PLAN AND TIMETABLE ............................................................... 7 SECTOR OVERVIEW .................................................................................... 7 ANALYSIS OF SUB-PROJECTS ................................................................. 13 FINANCIAL ANALYSIS ................................................................................ 25 ECONOMIC ANALYSIS ............................................................................... 27 ENVIRONMENTAL IMPACT ASSESSMENT............................................... 33 RESETTLEMENT AND LAND ACQUISITION.............................................. 34 OVERVIEW OF THE MULTI-TRANCHE FINANCE FACILITY .................... 37 LIST OF ABBREVIATIONS AND SHORT FORMS USED ........................... 39 COPYRIGHT AND WARRANTIES ............................................................... 41

TABLES

Table 1: Table 2: Table 3: Table 4: Table 5: Table 6: Table 7: Table 8: Table 9: A list of the sub-projects together with their associated deliverable supporting studies and other relevant documentation......................................... 3 The three major phases of the PPTA .................................................................. 6 Equipment procured for NTDC ............................................................................ 7 Total Power Demand and Projections (MW) for 20062010 ............................. 10 National Power Generation Investment Plan (MW)........................................... 11 Total Investment Requirement, 2006-2017 ....................................................... 12 Financing Plan................................................................................................... 12 Summary of the sub-projects comprising Tranche 1 ......................................... 14 Single conductor cost estimate assumptions .................................................... 24

Table 10: Twin Bundled conductor cost estimate assumptions......................................... 24 Table 11: Sub-Project Cost Estimates for Tranche 1 ($million)......................................... 26 Table 12: Willingness-to-Pay Estimates ............................................................................ 28 Table 13: LRMC estimates of capacity and energy........................................................... 28 Table 14: LRMC estimates at 500kV and 220kV............................................................... 29 Table 15: Summary of Sub-projects Economic Analysis................................................... 31 Table 16: Economic Analysis of Multi Tranche Facility ..................................................... 32 Table 17: Comparison of Pakistans LAA and ADB Resettlement Policy.......................... 36

Final Report TA 4665 PAK

ii

Issue 1.0 10 November 2008

Power Transmission Enhancement Project

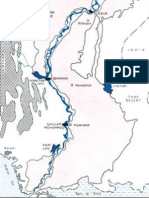

FIGURES Figure 1: Map showing the location of each of the sub-projects comprising Tranche 1 ... 19 APPENDICES

Note:

The Appendices to this Report are bound in two separate volumes: Appendices 1 to 16 in Volume 1; and Appendices 17 - 25 in Volume 2.

- Sub-project Number 1 - Transformer Extension at Tarbela 500kV - Sub-project Number 2 - Transformer Extension at Mangla 220kV - Sub-project Number 3 - Transformer Extension at Lahore 500kV - Sub-project Number 4 - Mardan 220kV Double Circuit Transmission Line - Sub-project Number 5 - Transformer Extension at Gatti 500kV - Sub-project Number 6 - Transformer Extension at Multan 500/220kV - Sub-project Number 7 - Transformer Extension at Bannu 220kV - Sub-project Number 8 - Transformer Extension at Yousafwala 220kV - Sub-project Number 9 - Transformer Extension at Bahawalpur 220kV

Appendix 1 Appendix 2 Appendix 3 Appendix 4 Appendix 5 Appendix 6 Appendix 7 Appendix 8 Appendix 9

Appendix 10 - Sub-project Number 10 - Transformer Extension at Ludewala 220kV Appendix 11 - Sub-project Number 11 - Transformer Extension at Hala Road, Hyderabad 220kV Appendix 12 - Sub-project Number 12 - Transformer Augmentation at Islamabad University 220kV Appendix 13 - Sub-project Number 13 - Transformer Extension at Sheikh Mohammadi Peshawar 500kV Appendix 14 - Sub-project Number 14 - Transformer Extension at Muzaffargarh 500kV Appendix 15 - Sub-project Number 15 - Bandala New 220kV Grid Station Appendix 16 - Sub-project Number 16 - Static VAR Compensation at New Kot Lakhpat 220kV Appendix 17 - Sub-project Number 17 - Transformer Extension at Gakhar 220/132kV Appendix 18 - Sub-project Number 18 - Transformer Augmentation at New Kot Lakhpat 220kV Appendix 19 - Sub-project 19 - Wapda Town New 220kV Grid Station Appendix 20 - Technical Justification/Analysis of Sub-projects of Tranche 1 Appendix 21 - Version B - Land Acquisition and Resettlement Framework (LARF) Appendix 22 - Bandala Grid Station Extension and 220kV Transmission Line Appendix 23 - Mardan Line Bay Extension and 220kV Transmission Line Appendix 24 - Wapda Town Grid Substation Land Acquisition Due Diligence Report Appendix 25 - Wapda town Grid Substation and 220kV In/Out Transmission Line

Final Report TA 4665 PAK

iii

Issue 1.0 10 November 2008

Power Transmission Enhancement Project

1.

EXECUTIVE SUMMARY

1. The Federal Government of Pakistan (GoP) has set ambitious targets for growth of the countrys GDP which has a knock-on effect on the demand for, and consumption of, electricity. In line with these targets demand for electricity is expected to increase by around 12% per annum over the next five years. 2. The Pakistan transmission system has suffered from under investment for several years and is already inadequate for the demand placed upon it. There is little or no spare capacity on transmission lines, many transformers are overloaded and frequent power outages occur due to transmission system constraints. The reliability of the system will further deteriorate as demand is added incrementally. Furthermore, expensive plant failures with long return-to-service periods can be expected unless this situation is addressed urgently. 3. The Government of Pakistan has an agreement in principle with the Asian Development Bank (ADB) to support the necessary infrastructure development to achieve its power sector targets. 4. ADB appointed British Power International (the Consultant) to work alongside the National Transmission and Despatch Company (NTDC) to: identify the existing constraints of the transmission system; develop suitable network projects to remove those constraints; and provide capacity for the projected demand. The Consultant was appointed under a Project Preparatory Technical Assistance (PPTA) to present identified transmission development requirements in a form suitable for ADB to fund. This includes a technical, financial and economic evaluation of the projects, and importantly an assessment of the environmental and social impacts that each project will have. 5. The project started on the contracted date, 12 June 2006. 6. In view of the later than expected award of the contract ADB asked the Consultant to deliver the PPTA as a fast-track assignment, reducing the elapsed time of the project plan to meet the timescale agreed between the Government of Pakistan (GoP) and the Bank for processing this loan and enabling funded projects to start. This fast-track delivery required some rearrangement of the commitments of the Consultants team and a reschedule of work, so that some international consulting input was delivered out of country. This was achieved through flexibility on behalf of the Bank and the Consultant. 7. A project plan and work schedule were prepared to ensure delivery of the project to meet the ADB loan processing programme. The schedule was ambitious but was achieved. A framework was developed to ensure that risks were identified and managed, thereby giving more certainty that the project would be delivered to time, cost and quality. The project met all targets. 8. The Consultant adopted a method of working which is believed to have been instrumental in maximising the participation of counterpart staff and others with an interest in NTDC. Weekly briefing notes were prepared and weekly review meetings were held with NTDC to discuss progress, resulting in a free and informal exchange of information. This approach made it possible to meet tight deadlines and culminated in approval of the Facility. This approach also made it possible for the loan to be processed within the required timescale. 9. ADB subsequently signed a long term financing facility with the GoP, for onward lending to the NTDC for development of the national transmission network. The funding from ADB is expected to be released in three tranches under an umbrella agreement known as the Multi-tranche Finance Facility (MFF). As sub-projects are prepared for

Final Report TA 4665 PAK 1 Issue 1.0 10 November 2008

Power Transmission Enhancement Project

each tranche a Periodic Financing Request (PFR) will be prepared and release of the tranche of funding will be enabled. 10. Full technical studies including load flow analysis and where appropriate short circuit level and stability studies were carried out to support the inclusion of each identified subproject. The technical studies confirmed that for each subproject the proposals were technically valid and beneficial to the national transmission system. The full detailed technical report has already been delivered to ADB and NTDC and was used in the GoP documentation to support the expenditure under the facility. For completeness it is also included as Appendix 20 to this Final Report. 11. During the course of the PPTA the Consultant, with NTDC, developed a final list of 19 sub-projects for inclusion in Tranche 1. A technical feasibility summary of each sub-project was prepared along with environmental and resettlement plans as appropriate for approval by ADB. All documentation required for overall loan processing and for sub-projects to be included in tranche 1 was submitted to ADB to allow loan processing to proceed. 12. Tranche 1 was approved in December 2006 and work began immediately under a direct agreement with NTDC to develop sub-projects for tranche 2. 13. A list of the sub-projects together with their associated deliverable supporting studies and other relevant documentation under the PPTA is given in Table 1 on the following page. It should be noted that each type of study was not required for every project.

Final Report TA 4665 PAK

Issue 1.0 10 November 2008

Power Transmission Enhancement Project

Table 1: A list of the sub-projects together with their associated deliverable supporting studies and other relevant documentation

Sub-Project System Study Detailed Appendix Number LARP IEE 1 2 3 4 & 23 5 6 7 8 9 10 11 12 13 14 15 & 22 16 17 Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N N N N N N N N N N Y N N N N Y N N N N N N N N N N N N N N N N N Y Y N N Y N N N N N N N N N N N N N N N N N N N N Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Due Diligence Study Tender Package Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y

Summary Feasibility Study

Transformer extension at Tarbela 500kV

Transformer extension at Mangla 220kV

Transformer extension at Lahore 500kV

Line bay extension at Mardan 220kV and allied transmission line

Transformer extension at Gatti 500kV

220/132kV transformer extension at Multan 500/220kV

Transformer extension at Bannu 220kV

Transformer extension at Yousafwala 220kV

Transformer extension at Bahawalpur 220kV

10

Transformer extension at Ludewala 220kV

11

Transformer extension at Hala Road, Hyderabad 220kV

12

Transformer augmentation at Islamabad University 220kV

13

Transformer extension at Sheikh Mohammadi-Peshawar 500kV

14

Transformer extension at Muzaffargarh 500kV

15

New grid station Bandala 220kV and allied transmission line

16

Static VAR Compensator at New Kot Lakhpat 220kV

17

Transformer extension at Gakhar 220kV

18

Transformer augmentation at New Kot Lakhpat 220kV

19

New grid station Wapda Town 220kV and allied transmission line

18 19, 24 & 25

Final Report TA 4665 PAK

Issue 1.0 10 November 2008

Bill of Quantities

No.

Name

Power Transmission Enhancement Project

2.

PURPOSE

14. This draft Final Report is submitted by British Power International in fulfilment of the terms of reference (ToR) for this PPTA which required the Consultant to produce a Final Report on completion of the project. Specifically, this Report is required to document all reports and analysis performed to comply with the ToR. The technical assistance resulted in approval of the project by both ADB and NTDC, the client. The associated loan was approved by ADB in December 2006. The loan has since been declared effective.

3.

BACKGROUND

15. The Federal Government of Pakistan announced, in its Medium Term Development Plan for 20052010, ambitious economic development plans with aggressive targets for GDP growth of 8% per annum. Applying a conventionally accepted multiplier to this growth rate implies an increase in power demand of 12% per annum, with still greater increases in energy consumption. Even with the more conservative estimates of load growth that may be experienced in reality this equates to an increase in power requirements of around 1,000MW per annum. Based on the most recent experience, albeit that these are mainly snapshot views, this number could potentially double. 16. The power sector is central to the current and future prosperity of Pakistan through the supply of low-cost electricity to domestic customers throughout the country and its capacity to stimulate commercial and industrial development. The development and operation of thermal and hydro power resources is being addressed by a number of agencies, which are having some success in promoting private sector investment in thermal and hydro power plants and renewable energy sources. However, the effective export of power from all of the existing generating stations, and connection of the stations to be commissioned in future, is vested in the relatively young National Transmission and Despatch Company (NTDC), which has sole responsibility for the transmission network. 17. NTDC inherited the transmission assets at operating voltages of 500kV and 220kV from the Water and Power Development Authority (WAPDA) at a time when the capacity of the transmission system to handle the existing power flow demands was stretched and the condition of the network had suffered through years of inadequate maintenance and under investment. 18. This PPTA prepared for approval of the $800 million Multi-Tranche Finance Facility (MFF), a relatively new instrument of the ADB. The PPTA resulted in delivery and disbursement of a major loan (800 M$ MFF) from the ADB to the Government of Pakistan, for onward lending to NTDC to enable it to upgrade and extend the transmission network to address the constraints that exist and to expand the capacity and coverage of the network to address the Governments development plan, including the new hydro and thermal generation in the development phase and potential connection of renewable energy sources, each with its own operational issues. 19. The loan, which is of the ADB Multi-tranche Finance Facility (MFF) type, is to be used to finance a number of transmission sub-projects identified by NTDC and then developed and prioritised jointly with the Consultant. Three tranches of loan funding are envisaged for the MFF. The first tranche is to address identified projects to reinforce, augment and expand the existing transmission network to cope with existing generation capacity and current demand profiles by removal of constraints and system risks. Included with this first tranche will be sub-projects to export power from IPPs being

Final Report TA 4665 PAK 4 Issue 1.0 10 November 2008

Power Transmission Enhancement Project

commissioned during the period. Also, importantly, the first tranche covers the necessary implementation support for all three tranches of the loan. The overall value of the loan is flexible and the split between the three tranches is not fixed. The tranches are not, of necessity, entirely sequential and may overlap based upon the technically, financially and economically justified portfolio of sub-projects that also meet the requirements of the various agencies in terms of environmental impact and social issues.

4.

SCOPE

20. The scope of this PPTA, is summarised by a number of key documents and exchanges of information. Prime is the contract for consultancy services, the ToR, together with the amendments agreed with ADB as part of the Inception mission during the week commencing 12 June 2006. We are also grateful for the guidance given by senior staff from the Executing Agency (EA). Other documents provide information and guidance but where there are potential differences of interpretation, we have relied upon these prime sources.

5.

5.1

PROJECT MANAGEMENT

Project Team and Deadlines

21. During negotiations to finalise the detail of the ToR and resolve any contractual matters, it was agreed that the project would begin by 12 June 2006. The advance team of the Consultant arrived in Lahore that day and met with ADB. 22. Due to the long period between submission of the proposal and mobilisation, two team members had become committed elsewhere and were unavailable for the start of the project. Replacements were agreed and approved by ADB for the International Environmental and Resettlement Specialists prior to mobilisation; Dr Kay Halm and Ms Jean Williams respectively. 23. Due to the compressed timescale of the project and the unusually short timescale between contract signing and mobilisation, some of the international team members were unable to mobilise to meet the requested timescale. Consequently the advance team fielded by the Consultant consisted of Bill Slegg and Ejaz Khan, UK Project Director and Country Director of BPI respectively, to carry out the inception meetings with ADB and the executing agency. 24. Domestic team members mobilised during the week commencing 12 June and International team members from 19 June with the arrival of Transmission Specialist and Team Leader Bob McGee. 25. The compressed timescale of the project meant that the domestic Transmission Expert could not complete his full six months of input without causing a delay to project completion. The domestic Transmission Engineering role was therefore divided into two parts by recruiting an additional domestic transmission expert to ensure timely assessment and delivery of the engineering elements of the project. Apart from coordinating the timing of inputs in the shortened project delivery period, no other resourcing issues that would impact on this TA were envisaged. 26. During the course of the TA the Team Leader suffered a period of personal ill health and ill health amongst his close family which required changes to the work programme and team input. This caused disruption to the programme but two additional international team members travelled to Lahore to support the project at a critical stage. 27. The Consultant had assigned additional home office support to the team to deal with ongoing logistics and report production to allow the project team to focus on the

Final Report TA 4665 PAK 5 Issue 1.0 10 November 2008

Power Transmission Enhancement Project

necessary analysis for presentation to the ADB mission in August 2006. consequence a rebalance of input between team members became necessary.

As a

28. The timing of the inputs was further complicated by the requirement for the major input to the PPTA coinciding with international peak holiday periods. 29. Whilst all activities progressed in parallel to some extent, there were three major phases to the PPTA, each with concentrated activity to match the ADB loan development process as shown in Table 2.

Table 2: The three major phases of the PPTA

ADB Milestone

Completion Date

Main Work Components Technical selection of most suitable subprojects for MFF tranche 1 funding. Financial and economic appraisal of each possible sub-project, ranking and prioritisation Support to NTDC in preparation of single, overall PC-1 Document for transmission enhancement. Methodology document for assessing and ranking each Completion of PPTA to draft Final Report stage, completion of input to ADBs RRP document

Fact Finding Mission and Aide Memoire

15 August 2006

Management Review Meeting

21 September 2006

ADB Board meeting with loan approval scheduled on agenda.

21 December 2006

30. Despite the constraints of the tight schedules and other matters, the ToR have been complied with and the task requirements have been completely fulfilled within each discipline. The Consultants met all deadlines and delivered all inputs culminating in approval of the loan, subsequent loan signing and, finally, the loan being declared effective by ADB.

5.2

Logistics

31. Logistically NTDC, the Executing Agency, was required to provide the Consultants team with suitably serviced office space together with transport for necessary field trips. The office space was provided and was suitable for delivery of the TA, although the Consultant had to purchase relatively minor items of additional equipment to enable progress. In the event, the requirement for transport for field visits was minimal as the sub-projects were mainly extensions and augmentations, so did not require extensive field work. 32. The contract with ADB called for the procurement of equipment for NTDC and this is set out in Table 3 on the next page. The equipment required by NTDC was procured in accordance with ADB procedures, and a handover certificate to NTDC obtained.

Final Report TA 4665 PAK

Issue 1.0 10 November 2008

Power Transmission Enhancement Project

Table 3: Equipment procured for NTDC

Quantity 1 1 1 1 1 1 1

Item/Description CISCO Router CISCO Switch HP Colour Laser Jet printer HP Scan Jet Scanner Sony DCR - TRV285 Digital recorder Hand held Garmin GPS Acer / IBM Laptop computer

6.

PROJECT PLAN AND TIMETABLE

33. The high level plan for the project was prepared, presented in the Inception Report and used as the prime project management document, ensuring that the interrelationships and target dates for outputs were met. The only significant deviation from the work plan included in the contract signed between ADB and the Consultant was the agreed intention to bring forward the programme plan to complete the bulk of the work by the end of September 2006, rather than during December as described in the contract.

7.

7.1

SECTOR OVERVIEW

Sector Assessment

34. Pakistans power sector is undergoing tremendous challenges in supporting the Governments strategy of increasing electricity supply to its urban and rural population, and overall economic growth. The key challenges are: (i) lack of generation capacity, (ii) constraints on the transmission and distribution systems; (iii) financial management and sustainability of the sector entities; and (iv) instituting proper corporate governance structures for the successor companies. 35. To address these challenges the Government has approved power sector policies and strategies, and instituted action plans to (i) ensure independent regulation of the power sector; (ii) complete the unbundling of the Water and Power Development Authority (WAPDA), establish four generation companies (GENCOs), eight distribution companies (DISCOs) and the National Transmission and Despatch Company (NTDC); (iii) start the power sector privatization program; and (iv) evaluate and optimize the fuel sources of the power sector to ensure energy security and minimize overall tariff requirements. 36. The power sector, a key infrastructure provider, will need to increase its capacity to sustain higher economic growth targets expressed in the Medium Term Development Framework 2005-2010 (MTDF), and thereby assist in the implementation of the poverty reduction strategy of the Government. Currently, about 45% of Pakistans population has no access to electricity from the national grid. Existing bottlenecks in the power transmission network are expected to result in significant system capacity shortfalls, which in turn could restrict the GDP growth by almost 0.8% in FY2008. 37. Transmission and distribution losses in the Pakistan power system amounted to 25% in 2005. More specifically in the transmission system, these high losses are caused by the excess load on the transmission lines and at substations. Total transmission losses are 7.5% including the secondary transmission system losses; the primary

Final Report TA 4665 PAK 7 Issue 1.0 10 November 2008

Power Transmission Enhancement Project

system losses are about 3.0%. Due to aging, overloading and lack of proper maintenance, the transmission system is unreliable and at times runs on the brink of stability with a risk of collapse. The system needs immediate rehabilitation, augmentation, and expansion to provide services to meet its consumer demands and system security requirements. Accordingly, safe and reliable transmission of electricity remains a major challenge in Pakistan.

7.2

Sector Policy

38. In 2000, the Government unveiled the Vision 2025 Program which advocated accelerated development of new generation facilities in the country. The policy statement of 2000 was revised in 2002, putting greater reliance on indigenous fuel sources: hydropower, thermal generation using local coal reserves or local gas supplies, and renewable technologies. The 2002 Power Policy as amended in 2004 embodies the current policy for increasing the countrys power generation capacity and encompasses private, public and private/public models of project implementation. In the power sector, as described in the MTDF, there is an ambitious investment program to achieve a consistent 8% annual growth in GDP.

7.3

Sector Strategy

39. Implementation of the Governments power sector strategy has three main outcomes: (i) sector reforms to create an enabling environment for a higher level of private sector participation, (ii) increased capacity building in all sector organizations including strategic areas, such as financial management, efficiency improvement, clean development mechanism, and project management, and (iii) completion of large infrastructure development projects in generation, transmission and distribution. 40. The high growth in electricity demand currently being experienced in Pakistan is very clearly putting the existing power transportation infrastructure under severe stress and the need to invest in additional primary transmission facilities in the country is clearcut. This created the need for a transmission sector development roadmap; a comprehensive plan that specifies the details of system renovation and expansion. The objective of the roadmap is to show how a reliable and high quality power supply can be delivered to the rising number of industrial, commercial, agricultural and domestic customers. The roadmap is consistent with the Governments poverty reduction strategy that targets increased level of economic activity and it will aim to achieve the following outcomes: (i) improved power system efficiency; (ii) quality power supply through improved system reliability and stability; (iii) expanded geographic coverage of power supply; and (iv) affordable electricity, by bringing hydroelectric and coal fired thermal energy to load centres.

7.4

Sector Issues

41. Pakistans transmission system faces three major challenges: (i) the heavy power flow through the 500kV system, (ii) a shortage of supply capacity for the 220kV system, and (iii) high transmission losses, caused partly by very high reactive power requirements (a quality concern). Hydropower plants are located mainly in the northern parts of the country and the thermal plants are primarily located in the south. There is a heavy power flow from north to south during summer when hydropower generation is high, and heavy flow from south to north in winter when hydropower generation is low.

Final Report TA 4665 PAK

Issue 1.0 10 November 2008

Power Transmission Enhancement Project

42. According to Government estimates, electricity demand in Pakistan is forecast to grow by 8%1 annually during 2005-2015. To meet this increasing demand, it is estimated that in each year Pakistan would require an additional 2,000MWs, or thereabouts, which would need to pass through the transmission system. Substantial investments are required to strengthen the transmission system to (i) urgently address current shortfalls, (ii) transmit power generated by additional power plants, and (iii) supply electricity to meet the growing demand. 43. The mismatch between the location of demand and the source of supply on the existing power system is creating a considerable need for primary network investments. Current peak energy and capacity shortfalls are, to some extent, the consequence of shortages and bottlenecks in the national network. Primary network constraints cause inefficiencies for consumers, such as high levels of un-served energy demand or investment in costly self or captive generation which extract a significant economic and financial rent. Export competitiveness, for example, of the textile sector, is eroded by high electricity costs and unreliable supplies. Meanwhile, demand growth is forecast to continue unabated. 44. The currently installed generation capacity (excluding the Karachi Electricity Supply Company) amounts to 17,405MW. The available generation capacity is less, at around 13,000MW because of de-rating elements, such as: (i) the hydropower plants being dependent upon reservoir capacity and hence rainfall, reservoir silting and irrigation priorities, (ii) an ageing whole-generation portfolio being subject to rating limitations, increased maintenance requirements, and (iii) forced outage expectations. 45. The immediate concern is the capacity of the transmission network to transmit the present available generation output to load centres. The recorded maximum transmission system demand of 13,051MW in summer 2006 is believed to represent the system at full capacity. This peak was a constrained maximum demand based on the capacity of the transmission network and it has been estimated that at that time there was some 800MW of unsatisfied demand. Even with constrained demand, sections of the transmission network are known to be running periodically above rating limits, thereby increasing further the risk of forced transmission outages that could have lengthy restoration times.

7.5

National Transmission and Despatch Company

46. As the sole transmission company in Pakistan, NTDCs role is to (i) maintain and upgrade the current system, (ii) plan, design, and implement system expansions, and (iii) operate the system dispatch of generation according to system requirements and transmission license conditions, for smooth transmission of electricity from GENCOs to DISCOs countrywide. The company took over the properties, rights, assets obligations and liabilities of 220kV and 500kV grid stations, transmission lines and network owned by WAPDA under the Business Transfer Agreement of 1 March 1999. 47. In terms of human resources, the transition of staff from WAPDA to NTDC has been completed. The transfer of assets and liabilities has also been substantially completed. Independent financial statements have been prepared and audited, as per its license, for the last two years of NTDCs operations. The consolidated NTDC financial statements currently include the CPPA operations and the transmission functions. In the future, NTDC will be responsible for transmission only. A separation of the accounts

1 Pakistans historical GDP growth/power demand ratio is 1.3. Internationally accepted elasticity of GDP/power demand for developing countries is 1.5. The Mission noted to the Government that in order to sustain consistent 8% GDP growth, the power demand growth projection would be at 10-12%. Final Report TA 4665 PAK 9 Issue 1.0 10 November 2008

Power Transmission Enhancement Project

related to the two business functions will have to take place at the time of legal separation of the CPPA functions. The Chart of Accounts and computerization of the accounting system (which is ongoing) will allow for regulatory accounting necessary for tariff submissions for the separated entities. 48. Although NTDC has been unbundled legally from WAPDA, its financial independence has yet to reach the level expected and that which is required of an autonomous corporation. WAPDA currently bills and collects the transmission wheeling charges from DISCOs2. NTDC must make requests for funds to WAPDA for most of its payment needs. This prevents the financial independence of NTDC. In addition, it also adds additional procedures and inefficiency into NTDCs and WAPDAs financial operations. Furthermore, NEPRAs determination and the Governments notification of the transmission tariff enable NTDC to charge DISCOs directly. 49. Financing from outside sources will be required in order to carry out the investments necessary for an efficient transmission system, especially for the large investments related to the new generation plants. It will be difficult for the current financial arrangement to attract large amounts especially from commercial sources since NTDC does not control or have access to the cash flow from the DISCOs. There has been discussion as to whether or not billing should be done by NTDC or by CPPA. For the financial independence of NTDC, the Missions view is that NTDC should directly bill and collect charges from the DISCOs. The separation of billing for transmission and power will also prepare the company for collecting revenues from bulk power consumers when they come into the picture.

7.6

Investment Plan Power Sector

50. Pakistans economic recovery after a period of recession and stagnation has been strong in recent years, with current nominal GDP growth rates exceeding 7% per annum. Economic growth based on energy-intensive sectors such as manufacturing has led to rapidly escalating total energy demand. The nationwide power demand is projected to grow at 12% during 20062010 and increase from 15,500MW in 2005-2006 to 21,500MW in 2009-2010. Sector-wide and total power demand projections are provided in Table 4.

Table 4: Total Power Demand and Projections (MW) for 20062010

Year 2006 2007 2008 2009 2010

Domestic 7,199 7,585 8,127 8,737 9,531

Commercial Agriculture 1,216 1,251 1,312 1,354 1,408 1,763 1,820 1,893 1,979 2,079

Industrial 5,891 6,481 7,252 8,181 9,267

Others 1,035 1,086 1,159 1,243 1,341

Total 15,500 16,600 17,900 19,600 21,500

Source: Planning Commission, Government of Pakistan

51. The MTDF also provides a long-term investment plan. In addition to the expansion of renewable energy generation by 9,700MW, the thermal power generation capacity, i.e., coal, oil, and gas, needs to be expanded by almost 99,000MW by 2030 as shown in Table 5 on the next page.

2 NTDC receives payment directly from KESC for transmission services. Under the current, procedure even this is transferred to WAPDA for disbursement upon request of NTDC. Final Report TA 4665 PAK 10 Issue 1.0 10 November 2008

Power Transmission Enhancement Project

Table 5: National Power Generation Investment Plan (MW)

Renewable Current capacity MW % of total Net additions Total 2006-30 Comprising 20062010 20112015 20162020 20212025 20262030 Y2030

(current + net additions)

Hydro 6,460 33.1%

Coal

Oil

Gas 5,940 30.4%

Nuclear 400 2.0%

Total 19,540 100.0%

180 0.9%

160 6,400 0.8% 32.8%

9,520 26,200 19,750 700 800 1,470 2,700 3,850 1,260 7,570 4,700 5,600 7,070 900 3,000 4,200 5,400 6,250

1,360 77,820 160 4,860 300 7,550 300 12,560 300 22,490 300 30,360 7,760 83,760 4.8% 51.5%

8,400 143,050 0 900 1,500 2,000 4,000 7,880 20,120 24,730 38,490 51,830

9,700 32,660 19,910 6.0% 20.1% 12.2%

8,800 162,590 5.4% 100.0%

% of total

Source: Planning Commission, Government of Pakistan.

52. The need for increased investment in the primary network to accommodate future generation additions is well understood. The case for primary network expansion rests on the mismatch between the location of the power generation potential in the north (hydroelectric), south (coal) and west (imported gas) and the deficit load centres (i.e. deficit in local or proximity generation as compared to local demand). The development of hydroelectric potential in the north and of coal resources in the south reflects the Governments policy of reliance on indigenous resources. Power generation based on imported gas has been necessitated by the accelerated utilization of domestic gas reserves. Investment Plan Power Transmission Sector 53. The total investment requirement for NTDC by 2016 is estimated at $3.9 billion. The urgent and immediate transmission system rehabilitation and augmentation plan for 2007-2011 totals $915 million (32 transformers, 775km of lines). Investments for 20122016 will mainly facilitate the evacuation from new generation plants as per the least cost power generation plan. The transmission investment plan covers 62 transformers, 4,415 kilometres (km) of lines, three Static Var Compensators (SVCs), and 19 new grid stations. Table 6 on the next page sets out the investment required between 2006-07 and 2016-17 on a year-by-year basis.

Final Report TA 4665 PAK

11

Issue 1.0 10 November 2008

Power Transmission Enhancement Project

Table 6: Total Investment Requirement, 2006-2017

USD Millions 2006-2007 2007-2008 2008-2009 2009-2010 2010-2011 2011-2012 2012-2013 2013-2014 2014-2015 2015-2016 2016-2017 Total 91 177 176 301 487 682 508 612 612 216 3,862

Line (km) 30 40 146 186 1,431 282

Transformers 15 9 9 2 18 6

SVC

New Grid Stations 3 3 2 8 3

2,300 4,415

3 62 3 19

Note: components have been included in the year commissioned and investment amount according to disbursement each year.

Financing Plan 54. As described above, the total investment requirement of NTDC in the period 2006-2017 is almost $3.9 billion, which requires financing. The financing plan for the investment program is envisioned to be a combination of funds from NTDC, ADB, cofinanciers and commercial sources. It was agreed that NTDC would provide at least 20% from its own resources and that ADB could fund up to 80% of the total amount for each tranche. The Financing Plan is set out in Table 7.

Table 7: Financing Plan

Program

Requested

Total Facility USD Million Share USD Million Share Asian Development Bank 800 21% 1,200 31% Co-financiers 1,995 52% 1,595 41% NTDC 1,067 28% 1,067 28% Total 3,862 100% 3,862 100%

7.7

The Facility

55. The proposed Facility, and in particular the Investment Program, is part of the long term investment program for energy security. It is also a part of the power sector program, and more specifically the power transmission development program of GoP. The proposed ADB intervention will finance investments in power transmission, defined as sub-projects, including 500kV and 220kV transmission lines, 500kV and 220kV substations, and any associated facilities related to the operation of the power transmission system.

Final Report TA 4665 PAK

12

Issue 1.0 10 November 2008

Power Transmission Enhancement Project

7.8

Facility Details

56. The maximum financing available under the Facility is eight hundred million US Dollars ($800,000,000). The Facility is intended to finance parts of the overall transmission investment program from ADBs ordinary capital resources, through individual loans (tranches) for specified sub-projects. Based on the extensive investment program of NTDC, the Government requested an increase in the maximum financing amount to $1.2 billion, which was fully supported by the Mission. Tranche 1 funding amounts to two hundred and twenty six million US Dollars ($226,000,000), with NTDCs contribution to be twenty six million US Dollars ($26,000,000). The Government also requested that ADB considered funding the project support components, amounting to ten million US dollars ($10,000,000), from its ADF resources, as these components are non-revenue earning in nature. These requests were accepted by ADB and a $10.0 million support component was agreed to and provided. 57. The size of each tranche of the facility will be not less than $150 million. Tranche 1 was approved by ADB in December 2006, and Tranche 2 was presented to ADB for approval in November 2007. Subsequent tranches will be presented when subprojects have been identified and analysed. Work is expected to start on Tranche 3 in January 2008. 58. As agreed between the GoP and ADB, the utilization period under the Facility expires on 31 December 2016. The closing date for submission of the periodic financing requests (PFRs) under the Facility will be 31 December 2013. There was also a loan condition that the utilization period would lapse twelve months from the date of approval of the Facility by ADB if the first Loan Agreement under the Facility had not been signed and made effective. This condition was satisfied with Tranche 1 becoming effective.

8.

8.1

ANALYSIS OF SUB-PROJECTS

General

59. The early priority of the PPTA (June and July 2006) was to carry out sufficient analysis of the sub-projects proposed to be in a position to report to ADB during the August fact finding mission that the proposals were justified on a technical, financial and economic basis. It was important to be able to confirm that the sub-projects proposed had identified and measurable benefit to NTDC and that they were appropriately prioritised to address known system constraints and operating conditions. The focus was on rehabilitation, augmentation and expansion of the existing NTDC network. 60. An initial list of 18 sub-projects was presented by NTDC. The list of subprojects was subsequently reviewed and, in light of the Consultants analysis and recommendations, a further sub-project was added. This revised, final list of 19 subprojects was agreed with ADB and is presented in summary form in Table 8 on the next page. Their various locations within Pakistan are shown in the sketch map in Figure 1 which follows Table 8. The Feasibility Summary of each sub-project as presented to ADB are shown at Appendices 1-19. Appendix 20 further details the loading requirements for each site where a sub-project is proposed, and includes load flow studies for the with and without scenarios in each case.

Final Report TA 4665 PAK

13

Issue 1.0 10 November 2008

Power Transmission Enhancement Project

Table 8: Summary of the sub-projects comprising Tranche 1

Transmission line (MVA) Foreign No. of lines Transformer capacity Technical justification Cost estimates (in $ Million) Local Total Length of each line (km) Expected year of commissioning

No.

Subproject

Substation

Transformer Extension at Tarbela 500 kV 1x237 2007-08

Tarbela

Without extension, existing Transformers get overloaded in case of outage of S/C 500 kV TarbelaRewat or outage of a Gen. Unit at Tarbela 220 kV

9.59

3.46

13.05

Transformer Extension at Mangla 220 kV 1x138 2007-08

Mangla

Without extension, existing Transformers get overloaded in case of outage of S/C 220 kV ManglaGhkhar or outage of a Gen. Unit at Mangla 132 kV

3.74

1.42

5.16

3 1 600

Transformer Extension at Lahore 500 kV 2007-08

Lahore

Without extension, the existing transformers get overloaded

9.62

3.59

13.21

Line Bay Extension at Mardan and Allied Transmission Line D/C from looping point to Mardan 1 30 2006-07

Mardan (only Line Bay Extension)

The existing Tarbela-Mardan 220 kV D/C does not meet N-1 criteria in case proposed hydro IPPs feeding into Mardan do not materialize. If loop In/Out is not applied, trip of one circuit overloads other circuit.

5.17

2.25

7.42

5 1 450

Transformer Extension at Gatti 500 kV

Gatti

2007-08

Without extension, the existing transformers get overloaded

8.94

3.26

12.20

Transformer Extension at Multan 500/220 kV 3x160

Multan

2007-08

It will relieve the existing 220/132 kV substations of Piranghaib, M-Garh and will replace/delay Multan Ind. from Tranche-2

10.01

3.86

13.87

Transformer Extension at Bannu 220 kV

Bannu

1x160

2007-08

Without extension, the N-1 criteria is violated; gets 55 % overloaded. With extension, N-1 criteria is fulfilled

3.42

1.33

4.75

Final Report TA 4665 PAK

14

Issue 1.0 10 November 2008

Power Transmission Enhancement Project

No. (MVA) Foreign

Subproject

Substation

Transmission line Local

No. of lines

Length of each line (km)

Transformer capacity

Technical justification

Cost estimates (in $ Million) Total

Expected year of commissioning

Transformer Extension at Yousafwala 220 kV 1x160 2007-08

Yousafwala

Without extension, the N-1 criteria is violated at this substation and 132 kV network emanating from Yousafwala, Kassowal and Vehari. With extension, N-1 criteria is fulfilled at this substation and 132 kV network

3.42

1.33

4.75

9 1x160 2007-08

Transformer Extension at Bahawalpur 220 kV

Bahawalpur

3.42

1.33

4.75

10 1 160

Transformer Extension at Ludewala 220 kV 2007-08

Ludewala

Without extension, the substation crosses its installed capacity, the N1 criteria is violated at 132 kV network emanating from Yousafwala, Kassowal and Vehari. With extension, N-1 criteria is fulfilled at this substation and 132 kV network Without extension, existing two transformers get overloaded. With extension, no overloads at Ludewala 220/132 kV S/S and also fulfils N-1 criteria

3.42

1.33

4.75

11 1 160

Transformer Extension at Hyderabad 220 kV

Hala Road

2007-08

Without extension, The N-1 criteria is violated at this substation and132 kV network emanating from Hala Rd. With extension, N-1 criteria is fulfilled at this substation and 132 kV network

3.42

1.33

4.75

Final Report TA 4665 PAK

15

Issue 1.0 10 November 2008

Power Transmission Enhancement Project

No. (MVA) Foreign

Subproject

Substation

Transmission line Local

No. of lines

Length of each line (km)

Transformer capacity

Technical justification

Cost estimates (in $ Million) Total

Expected year of commissioning

12 2 250

Augmentation of Islamabad 220 kV 2007-08

Islamabad University

The existing 220 kV grid station at Islamabad University feeds the secondary network of the Islamabad load cntre. The present installed capacity is 2X160 MVa , 220/132 kV power transformers. The proposed augmentation would raise the installed capacity from 320 MVA to 500 MVA thereby meeting the growing demand of the area. This enhance installed capacity would also give relief to the other 220 kV grid stations of the area as there additional demand would also be shared by Islamabad University grid station.

5.41

1.77

7.18

1 2007-08

450

13

Transformer Extension at Peshawar 500 kV

Peshawar

Without extension, N-1 criteria is violated during high water (HW) season. With extension, N-1 criteria is fulfilled during HW season

10.51

3.90

14.41

600 2007-08

14

Transformer Extension at Muzaffargarh 500 kV

Muzaffargarh

Without extension, the new power available from KAPCO cannot be evacuated maintaining N-1 criteria. With extension, N-1criteria is fulfilled for evacuation of new Gen of KAPCO injected into M-Garh. To keep fault currents within the rated limits of existing equipment, the link between Phase-1 and Phase-2 should normally be open 2 x 160 2008-09

10.51

3.90

14.41

Bandala Gatti K.S.K D/C In/Out at Bandala 1 5

15

New 220 kV Bandala Grid Station with Transmission Line

(Near Shahkot)

Without 220/132 kV Substation, NTBD 220/132 kV S/S gets overloaded and 132 kV network gets stressed

23.01

10.64

33.65

Final Report TA 4665 PAK

16

Issue 1.0 10 November 2008

Power Transmission Enhancement Project

No. (MVA) Foreign

Subproject

Substation

Transmission line Local

No. of lines

Length of each line (km)

Transformer capacity

Technical justification

Cost estimates (in $ Million) Total

Expected year of commissioning

16

Static Var Compensator 2008-09

Lahore

Without SVC, the system faces voltage instability leading to system collapse. Exact Size and location within Lahore ring has to be determined by detailed studies

27.89

6.07

33.96

17

Transformer Extension at Gakhar 220 kV 1*160 2007-08

Gakhar

Gakhar 220 kV is a source of supply for large areas of Gujranwala, Sialkot and Gujrat districts. It has a significant growth rate and the current capacity may not adequately meet this growing demand. The studies for year 2007-08 indicate that if Gujranwala 500 kV which is in the current plan does not materialize as per schedule, Gakhar transformers would be over loaded beyond permissible limits and N-I criterion would not hold while with the addition of a new transformer this criterion holds good.

3.21

1.22

4.43

18

Augmentation at New Kot Lakhpat 220 kV 3*250

Lahore

2007-08

The existing capacity of the substation is 3*160 MVA A loading of 109% was observed during 2005-06. The augmentation of the existing transformers from 160 MVA to 250 MVA each would enhance the installed capacity by 270 MVA and the studies reveal that the loading in 2007-08 i.e. the year of commissioning, would be to the tune of 82%. The situation with new grid station at WAPDA Town in future years would further improve. Without this augmentation the loading on existing transformers is to be much beyond the recently observed loading and may entail load shedding.

8.12

2.66

10.78

Final Report TA 4665 PAK

17

Issue 1.0 10 November 2008

Power Transmission Enhancement Project

No. (MVA) Foreign Without 220/132 kV Substation Overloads at other 220/132 kV substations of Lahore ring

Subproject

Substation

Transmission line Local

No. of lines

Length of each line (km)

Transformer capacity

Technical justification

Cost estimates (in $ Million) Total

Expected year of commissioning

19 LahoreNKLPT to be In and out 2 With 220/132 kV Substation Overloads at other grid stations of the area removed: N-1 criteria fulfilled 10 3*160 2008-09 N-1 criteria is violated at other 220/132 kV substations of Lahore ring

New 220 kV WAPDA Town Grid Station with Transmission line

Lahore

24.98

11.79

36.77

Subtotal (Equipment cost, Civil Works and Erection, Consulting Services, Physical Contingencies, Administration Charges, Environment/Resettlement Cost, IDC, Inland Transportation, Insurance etc.) Price Contingency Tranche Contingency TOTAL

177.81 2.26 22.6 202.67

66.44 4.05 8.4 78.89

244.25 6.31 31.00 281.56

Final Report TA 4665 PAK

18

Issue 1.0 10 November 2008

Power Transmission Enhancement Project

Figure 1: Map showing the location of each of the sub-projects comprising Tranche 1

Final Report TA 4665 PAK

19

Issue 1.0 10 November 2008

Power Transmission Enhancement Project

8.2

Technical

System studies

61. Prior to commencement of the PPTA the National Transmission and Dispatch Company (NTDC) of Pakistan, had assessed its needs and priorities and had many plans for capacity additions to their network. ADB engaged British Power International (BPI) to provide technical assistance in preparing the projects (PPTA). The domestic and international teams put together by BPI worked closely with the counterparts in NTDC to help with technical studies and in preparation of the sub-projects to a standard suitable for approval by the ADB. 62. The identification of sub-projects was followed by detailed load flow studies. These studies firstly looked at the system to verify the justification of the urgent subprojects proposed by NTDC. Secondly, detailed analysis was carried out to determine the technical feasibility of the proposed sub-projects and estimate the incremental benefits arising from the proposed intervention on the sub-project level. Appendix 20 presents the load flow studies and the description of the sub-projects. 63. The 500kV and 220kV network in Pakistan has been under severe stress for many years. The transmission lines and the transformers have been running over and above their installed capacities, with little or no margin in their capacities to withstand any disturbances. This fragile network has faced many partial and some total blackouts during recent years. ADB came forward to help to finance the enhancement of the transmission capacity of the 500kV and 220kV network, which is the back-bone of the entire National Grid of Pakistan. 64. Detailed technical analysis has been carried out by the PPTA team for the technical appraisal and justification of the sub-projects identified by NTDC. Nineteen sub-projects were prepared for Tranche 1, after fulfilling the technical, economic, financial, environmental and resettlement criteria to be fully eligible for approval by ADB. The technical analysis determined the scope of work of the sub-projects for cost estimates and evaluated MW benefits to convert to financial benefits.

8.3

Methodology

65. A reasonable growth rate of demand was derived for the specific conditions of each sub-project. NTDC provided actual readings of loads on 500/220kV and 220/132kV substations on a quarterly basis for the last five years. The load forecast prepared by the relevant DISCO was also taken into consideration. Historical growth from recorded data and future trends shown in DISCO's forecasts were jointly considered to apply a growth rate on a case-by-case basis rather than applying a uniform growth rate globally. The nature of substations, i.e. feeding the area loads or evacuating the generation of a power plant, were also kept in view. Future generation evacuation requirements were also supplied by the NTDC. 66. An analysis of load against capacity, by future projections of loads using growth rates specific to a particular sub-project, was carried out to identify the year when the capacity additions would be required. This analysis gave a good indicator of loading and overloading of existing facilities, with or without the addition of new capacities. 67. Load flow analysis was then carried out for the identified year when the addition of new capacity would be required, making use of the data files supplied by NTDC. The load and capacity spreadsheet analysis and the load flow results confirmed generally the requirement for capacity addition.

Final Report TA 4665 PAK

20

Issue 1.0 10 November 2008

Power Transmission Enhancement Project

68. In some cases, due to specific reasons, short-circuit analysis and transient stability analysis were also carried out. For example, the short-circuit rating violations at Muzaffargarh 220kV bus bars, required the connections to be reconfigured for the addition of third transformer of 500/220kV. In addition, detailed transient voltage stability studies were carried out for determining the need, the location and the size of the SVC in the Lahore area.

8.4

General Observations and Recommendations

69. Based on the studies carried out for the 19 sub-projects of Tranche 1 the PPTA team has the following observations and recommendations: R1. NTDC should upsize the ratings of the transformers for new grid stations; the suggested sizes are as follows: 500/220kV: 220/132kV: 750MVA bank using 250MVA single phase units 250MVA; multiples of two in sub-urban and multiples of three in densely populated areas

R2. The short circuit ratings and continuous ratings should also be up-rated for the breaker bays and bus bars of new grid stations as follows: 500kV with power plants 500kV at load centres 220kV 132kV 63kA (2,500A continuous) 50kA (3,150A continuous) 50kA (3,150A continuous) 40kA (3,150A continuous)

R3. There is need to expedite a program of installation of shunt capacitor banks at 132kV and 11kV levels; this is essential to compensate for the large reactive power flows that would otherwise occur on the 220kV and 500kV networks. The capacitor banks should be designed with detuning reactors, probably with current limiting reactors too, to avoid resonance of odd harmonics and in-rush currents respectively. R4. The (N-1) planning criteria should be applied at the planning stage as required by the NEPRA Grid Code for transmission lines, inter-bus transformers, biggest generating unit, and towers for overhead lines (at least for the overhead line going out of a power plant). R5. The Planning Department of NTDC should revive its own load forecasting activity and constantly update the demand forecast on a yearly basis using state of the art software employing econometric and statistical techniques. R6. Install Dynamic System Monitors (DSM) at all 500kV and 220kV grid stations to record the post-fault dynamic behaviour of the system. R7. Tune the dynamic data of generators, exciters, governors, stabilizers and motor loads (especially air-conditioning loads) in the system to enable realistic modelling of dynamic simulation runs, especially for a system collapse and post-mortem analysis. DSM records are a big help in this regard. R8. The power deficit of an area drives the transmission requirement, which in turn is dependent upon the load forecast of the area and the generation located in the proximity of the area. There is uncertainty on both counts and there may be a requirement to study such scenarios. In performing such studies account must taken of security standards and transmission network capacity.

Final Report TA 4665 PAK

21

Issue 1.0 10 November 2008

Power Transmission Enhancement Project

8.5

Cost Estimates & Composite PC-1 Proposal

70. NTDC had submitted two PC-1 documents covering sub-projects at Gatti and Lahore. They also had prepared a PC-1 document for sub-projects at Mardan. The Consultant assisted NTDC in preparation of PC1s for the entire MFF facility. This was titled as the Concept Paper: Power Transmission Enhancement Project, which included a PCI covering all the 19 sub-projects.

8.6

Basis of Cost Estimates

71. The projects identified under Tranche 1 can be categorized in the following manner. Transformer Extensions of 500kV Grid stations; Transformer Extensions of 220kV Grid stations; Line Bay Extensions, New Grid Stations and Transmission lines; Single Conductor Double Circuit transmission line; and Twin Bundled Double Circuit transmission line. 72. The final list of projects which was mutually agreed consisted of: Four new 220/132kV Grid stations; Five 500/220kV transformer extensions; Nine 220/132kV transformer extensions; and One Static Var Compensator (SVC) at New Kot Lakhpat. 73. New grid stations originally planned for Toba Tek Sing and Okara were deferred to Tranche 2 and the transformer extension at Gakhar 220kV and an augmentation at New Kot Lakh Pat were added in their place. Also, the proposed transformer extension at Islamabad University 220kV was also modified to augmentation of the existing transformers there. 74. The feasibility of all these sub-projects was established by carrying out load flow and contingency studies. The cost estimates were prepared on the basis of the latest contract awards for the procurement of similar or equivalent equipment and material together with the necessary works by NTDC. A brief description of the various categories of the projects follows in the paragraphs below: 75. 500kV Transformer Extensions: Lahore 500kV; Gatti 500kV; Muzaffargarh 500kV; Peshawar 500kV; Tarbela 500kV. Lahore and Muzaffargarh have similar 500/220kV transformer bank size i.e. 3 x 200MVA whereas one transformer bank at Gatti and Peshawar is 3 x 150MVA. The latest contract award available was for 3 x 200MVA capacity, thereby allowing the cost (after applying the necessary escalation) for the transformers at Lahore and Muzaffargarh to be worked out. However, for 3 x 150MVA bank, the contract available was quite old and its price brought to the current level was higher than the 3 x 200MVA bank price. Assuming an 80% base cost and 20% variable or proportional cost, the 3 x 200MVA bank prices were used and it was observed that the two prices were quite close. Therefore, for estimation purposes, the same prices were assumed for the two banks. The same assumption was used at Tarbela where the transformer bank size is 3 x 79MVA, so the cost for the new bank to be added was worked out using this method. The civil works and erection cost has been assumed as 10% of the cost of the main equipment which, in addition to the cost of the transformer, includes the transformer bay material. This assumption is based upon the

Final Report TA 4665 PAK 22 Issue 1.0 10 November 2008

Power Transmission Enhancement Project

experience of similar current and recent projects. The transformer bay material requirement has been worked out in line with the existing grid station configuration. 76. 220kV Transformer Extensions: Mangla; Multan; Bannu; Yusafwala; Bahawalpur; Ludewala; Hyderabad; and Gakhar. The majority of existing 220/132kV transformers at grid stations are critically loaded. Load flow analysis identified a number of grid stations requiring the addition of new transformers. This study also determined the number of transformers to be installed at each grid station to ensure a reliable supply to customers, current and future. 77. To determine the civil works and erection costs past experience on similar projects and recent contract awards have been utilized. The cost of civil works and erection at this voltage level remains within 20% of the cost of the equipment. It should be noted that for the extension at Mangla, cable provision on both 132kV as well as 220kV side has been included. 78. 220kV Transformer Augmentations; Islamabad University 220kV and New Kot Lakhpat 220kV. In addition to the extensions the existing 220/132kV, 160MVA transformers at Islamabad and New Kot Lakhpat will be replaced by 250MVA transformers. This augmentation will increase the capacity of these grid stations to meet the growing demand of the areas. 79. 250MVA three phase power transformers have never been purchased by WAPDA/NTDC. In order to work out a realistic cost, a fixed cost and proportional variable cost methodology was used which implied a 15-20% cost increase. Meanwhile NTDC, being in the process of preparing of a pro forma PC-I for the Tranche I subproject, approached Siemens to provide a budgetary cost for a 250MVA transformer. Siemens suggested an increase of 25-30% to the cost of 160MVA transformer. For estimation purposes in our cost estimate, an increase of 25% to the cost of a 160MVA transformer has been assumed for the cost of a 220/132kV 250MVA transformer. 80. Gas Insulated Switchgear (GIS) Grid stations: Two GIS grid stations at WAPDA Town and Bandala have been proposed in the Tranche I sub-projects. Keeping in view the fact that future extension and expansion at a GIS grid station is not an easy proposition, the scope has been taken accordingly. At both Bandala and WAPDA Town, 3 x 160MVA transformers have been included and accordingly matching 132kV bays have been assumed. The cost estimates for these grid stations have been based upon prices calculated for Islamabad University. These prices have been adjusted to the current international trend for prices of such grid stations. 81. Transmission lines: Existing transmission lines are to be tapped3 or looped4 to provide connections for new grid stations. The transmission lines that are to be tapped or looped in and out are of two different design types, single and double conductor: For the Mardan Extension, one circuit of the 220kV Brotha-Shahibagh twin bundled double circuit line (which is already under construction) will be diverted In and Out at Mardan. This will include a 30km long 220kV twin bundled double circuit transmission line from the looping point to the existing Mardan 220kV grid station.

Tapped means taking a single connection from an existing line to the new substation. This is the cheapest approach and is adequate in many instances. Looped means splitting an existing circuit and turning both ends into the new substation. This in-out arrangement is more expensive but provides greater flexibility and in some cases is necessary for operational reasons.

Final Report TA 4665 PAK

23

Issue 1.0 10 November 2008

Power Transmission Enhancement Project

A similar situation exists for Wapda Town 220kV GIS grid station. Existing 220kV twin bundled double circuit transmission line will be made In and Out at Wapda Town for its feed. For this purpose twin bundled double circuit line will be constructed from the looping point to Wapda Town grid station. For Bandala the line from the looping point is to be of single conductor configuration as the existing line will be tapped is of this configuration. 82. The assumptions regarding overhead line fittings that were made while preparing the cost estimates are set out in Tables 9 and 10:

Table 9: Single conductor cost estimate assumptions

Single Conductor Double Circuit Transmission Line: Average span length: 400 meters Insulator string type Insulator strength (kN) Suspension Tension Towers Type Normal (EA) Light angle (ED) Heavy angle (EG) Dampers Phase conductor Earth wire 2 stockbridge dampers per phase per span 2 stockbridge dampers per span Average weight (Ton) 10.25 13.28 14.83 80 100 Number of insulators/assembly 15 15x2

Table 10: Twin Bundled conductor cost estimate assumptions

Twin Bundled Conductor Double Circuit Transmission Line: Average span length: 360 meters Insulator string type Insulator strength (kN) Suspension Tension Towers Type Normal (EA) Light angle (EG) Heavy angle (JKD) Dampers Phase conductor Earth wire 5 spacer dampers per phase per span 2 stockbridge dampers per span Average weight (Ton) 9.7 14.0 24.9 100 100 Number of insulators/assembly 15 15x2

Final Report TA 4665 PAK

24

Issue 1.0 10 November 2008

Power Transmission Enhancement Project

9.

FINANCIAL ANALYSIS

83. Financial analysis of each sub-project was carried out and the Financial Internal Rate of Return (FIRR) of each sub-project was calculated. Financial analysis of the MFF and Tranche 1 as a whole was also carried out to justify the investment in financial terms. 84. In the early part of the PPTA the Consultant carried out financial analysis to ensure that the sub-projects that were identified as technically feasible were also financially feasible, so that this could be reported to the ADB fact finding mission in August 2006. The financial analysis of each sub-project, in the event that it reflected an improvement to the existing system, presented a with and without project analysis of projected cash flows. Where the sub-project was entirely new or an addition to the system only, the with project scenario was relevant. This analysis was carried out in accordance with the ADB Guidelines, Financial Management and Analysis of Projects and Guidelines for the Financial Governance and Management of Investment Projects. All assumptions relating to the preparation of projected cash flows were set out clearly. 85. Once the sub-projects had been accepted in principle by the ADB mission, their project costs were further refined and the assumptions for cash flows were reviewed. The end result was a project cost estimate, prepared using COSTAB software depicting all project components and sub-components, separating foreign exchange and local currency costs, including physical and price contingencies, interest during construction and other financing charges. Table 11 on the next page shows the cost estimates for each sub-project in Tranche 1. A financing plan was also prepared setting out ADB, GoP and other sources of funding. A financial internal rate of return (FIRR) was presented for each sub-project and the project as whole. Sensitivity analysis was carried out on key variables. Based on the terms and conditions of the sources of funding, a weighted average cost of capital (WACC) for the project was also computed.

Final Report TA 4665 PAK

25

Issue 1.0 10 November 2008

Power Transmission Enhancement Project

Table 11: Sub-Project Cost Estimates for Tranche 1 ($million)

Sub-project No

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19

Name

Transformer extension at Tarbela 500kV Transformer extension at Mangla 220kV Transformer extension at Lahore 500kV Line Bay extension at Mardan 220kV and allied transmission line Transformer extension at Gatti 500kV 220kV transformer extension at Multan 500/220kV Transformer extension at Bannu 220kV Transformer extension at Yusafwala 220kV Transformer extension at Bahawalpur 220kV Transformer extension at Ludewala 220kV Transformer extension at Hyderabad Hala Rd 220kV Augmentation at Islamabad University220kV Transformer extension at Peshawar 500kV Transformer extension at Muzaffargarh 500Kv New Grid Station Bandala 220 kV and allied transmission line Static Var Compensator at New Kot Lakhpat Transformer extension at Gakhar 220kV Augmentation at New Kot Lakhpat 220kV New Grid Station Wapda Town 220kV and allied transmission line Totals

Foreign Exchange

9.59 3.74 9.62 5.17 8.94 10.01 3.42 3.42 3.42 3.42 3.42 5.41 10.51 10.51 23.01 27.89 3.21 8.12 24.98

Local Currency

3.46 1.42 3.59 2.25 3.26 3.86 1.33 1.33 1.33 1.33 1.33 1.77 3.90 3.90 10.64 6.07 1.22 2.66 11.79

Total

13.05 5.16 13.21 7.42 12.20 13.87 4.75 4.75 4.75 4.75 4.75 7.18 14.41 14.41 33.65 33.96 4.43 10.78 36.77

177.81

66.44

244.25

86. The second major aspect of the financial analysis was the assessment of the financial management capacity and sustainability of the NTDC. To this end the most recent financial statements of NTDC were examined as to suitability of accounting policies adopted vis a vis Generally Accepted Accounting Practice (GAAP) and International Accounting Standards (IAS). A questionnaire was completed by the Consultant to obtain information on corporate governance issues, management and staff, other accounting and financial aspects such as preparation of budgets and long term forecasts, staffing of the finance department, and internal control aspects. Reports of the external auditor were examined for any deficiencies highlighted in financial reporting and internal control. Where an Internal Audit Programme was available, this was examined to ascertain the extent of reliance that could be placed on the financial statements. Based on this examination the Consultant proposed measures to strengthen financial management. A time bound action plan was also included. 87. In concurrence with the assessment of the financial statements and the financial management function, the Consultant also reviewed the power tariff structure to

Final Report TA 4665 PAK 26 Issue 1.0 10 November 2008

Power Transmission Enhancement Project

determine whether or not the true cost of supply was being adequately recovered or, alternatively, subsidised in a transparent manner. The viability of the tariff structure was tested by preparing projected financial statements over a 10 year period for the NTDC, taking into account the costs and benefits of the proposed sub-projects.

10.

10.1

ECONOMIC ANALYSIS

Economic Analysis:

88. Economic analysis methodology was prepared and each sub-project was analysed together with the whole MFF and Tranche 1. The economic feasibility of the sub-projects, Tranche 1 and MFF was established clearly and unambiguously. 89. Economic costs used in the study have been expressed in United States Dollars at 2006 prices. Non-tradable inputs were converted to economic prices using an estimated Standard Conversion Factor of 0.9. Capital costs included physical contingencies, but excluded taxes, price contingencies and financial charges during construction.

10.2

Estimation of Benefits

90. The project will deliver incremental output. Incremental output meets increased demand for electricity and has been valued using consumers estimated willingness-topay (WTP). For the incremental part of the output, the benefits of the overall project and of the individual sub-projects have been based on prevailing tariffs, including consumer surplus (assigned to primary transmission) and for the non-incremental part of the output, benefits have been based on resource cost savings. Given the scale of the proposed project, no attempt was made to value environmental or any other external benefits.

10.3

Incremental Consumption Valued at Willingness-to-Pay

91. Willingness-to-pay (WTP) for incremental consumption was estimated by comparing the current price of electricity with the price of alternative sources of energy. The fundamental concept is that consumers would be willing to pay a proportion of the difference between what they currently have to pay for an alternative source of energy and the amount they would actually have to pay for incremental units of electricity. A semi-log electricity demand function is generally assumed in estimating WTP, but a lack of primary energy consumption data prevents an accurate calculation in this instance. A conservative view has therefore been taken that the consumer surplus is given by 50% of the difference between the electricity tariff and the cost of alternative energy sources. 92. Due to the fact that the primary and secondary transmission grids are peakconstrained, it has been assumed that the bulk of incremental consumption will be in the residential sector. Residential consumers typically use kerosene lamps for reserve lighting when grid-supplied electricity is unavailable (constrained-off), as these represent the next best viable alternative from an economic perspective. The economic life-cycle cost of kerosene lamps is approximately Rs 27.11/kWh. 93. In the commercial, industrial and agricultural sectors, diesel generators are typically employed to provide back-up electricity when grid supplied electricity is constrained-off. Thus, diesel generators were assumed to be the next best alternative, at an estimated life-cycle cost of Rs. 10.73/kWh, Rs. 11.07/kWh and Rs. 10.24/kWh for each of the three sectors respectively. 94. Table 12 on the next page shows the willingness-to-pay estimates for incremental consumption that were calculated for each consumer sector using these

Final Report TA 4665 PAK

27

Issue 1.0 10 November 2008

Power Transmission Enhancement Project

costs of alternative energy sources and the marginal tariffs. It should be noted that these WTP estimates use current fuel prices but the customer data itself relates to past periods when fuel prices were at much lower levels. Therefore it was not considered appropriate to use the weighted average WTP of Rs 12.11/kWh for this analysis. As an alternative, lower estimates of WTP based on an oil price of US$45 and US$30 were calculated, reducing the unit benefit value for all incremental output to Rs. 9.89/kWh and Rs. 7.67/kWh respectively. The Consultants opted to use the US$30 oil price estimate for this analysis.

Table 12: Willingness-to-Pay Estimates

SECTOR Residential Agricultural Commercial Industrial Weighted average

WTP (Rs/kWh) 13.82 10.73 11.07 10.24 12.11