Beruflich Dokumente

Kultur Dokumente

Business Week 2

Hochgeladen von

Shakeela BanksOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Business Week 2

Hochgeladen von

Shakeela BanksCopyright:

Verfügbare Formate

Introduction Technology has reduced the distance between business locations.

A computer and the Internet connect companies from one end of the globe to the other. No longer do business professionals have to travel to conduct business face to face. Video conferencing connects businesses throughout the world, and Web conferencing allows businesses to exchange computer screens as though they were in the same boardroom. Hardly a business is formed today without some aspiration of entering the global marketplace. This week we'll explore how businesses enter a global market and what factors exist in the environment that may present challenges or opportunities to their global expansion. After traveling the globe, next week we will examine ethics and the social responsibility of business.

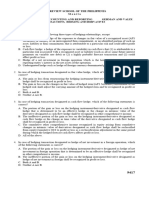

Global Market Strategies With world trade estimated at $13 trillion in 2009, according to World Trade Organization statistics, the potential for growth virtually knows no boundaries. Technology has opened communication channels that enable businesses in different countries to work as partners to deliver products and services to foreign and domestic markets. A company in the United States can employ a company in China, Japan, or India to manufacture its products for distribution in North America, Asia, and Europe. A manufacturer in South Korea can join forces with a U.S. company for sales and service support to increase its presence in North America. The opportunities that exist in the global marketplace span a range of risk and investment that a company or entrepreneur is willing to make. The strategy that offers the least amount of risk is exporting, which is selling products to other countries. Establishing a website can open a company up to the world. Accepting and shipping orders to foreign locations is exporting. Businesses similarly look for opportunities to purchase products from other countries. This is called importing. Often importing results in less expensive or unique products and raw materials that are not available domestically. The degree of investment and the amount of risk increase as a business pursues alternative global market entry strategies. For example, a company may choose to extend to a foreign company the right to manufacture its product, and even to use its trademark, by licensing this right for a fee called a royalty. Food and beverage brands like Coca Cola commonly enter into licensing contracts or agreements. Similarly, franchising is a contractual agreement whereby a company agrees to market and sell the rights to its business name and products and services in a given territory. Fast food restaurants like McDonalds, Burger King, and KFC are examples of franchises. Contract manufacturing enables one company to put its name, brand name, or trademark on a product that is manufactured

by a foreign company. Contract manufacturing allows companies to enter new markets without taking on the risk and start-up cost of building a business in a foreign location. It is responsible for the familiar practice of offshore outsourcing. The computer industry commonly utilizes contract manufacturing to produce personal computers and notebooks, like those of Dell, HP, and IBM. Partnerships help companies enter global markets. A joint venture is a partnership that joins two or more companies to work on a project or process. A strategic alliance is a long-term partnership between two or more companies that are trying to gain a competitive advantage in a particular market. Some partnerships lead to permanent unions, as seen in mergers and acquisitions, or outright purchases of one company by another. Finally, the riskiest form of global business entry strategy, requiring the greatest investment and generating the best possible return, is a foreign direct investment. If a company decides to purchase land, property, and businesses in a foreign country, it is generating a foreign direct investment. Companies like Nestle and Toyota that manufacture and market their products in more than one country are called multinationals.

Comparative Advantage How a country decides what it should produce and make available for export and what it should instead buy from other countries through imports is the foundation for the theory of comparative advantage. If a country produces a product most efficiently and effectively, then it should produce it and export it to other countries. If a country does not effectively and efficiently produce a product, it should import it from other countries. For example, the United States may possess a comparative advantage for software development, but Colombia may have the comparative advantage for growing coffee beans and producing coffee.

Absolute Advantage A country is said to possess an absolute advantage if it has a monopoly on producing a good more efficiently than all other countries. South Africa was a long-time example of an absolute advantage for diamond production, but depletion of natural resources and global competition changed its ranking. Largely due to competition, there are few examples of countries that possess a true absolute advantage in global markets.

Free Trade Even if a nation is able to produce all the products and services that were desired by the people of that nation, other nations will seek to trade with that nation to support their needs. Nations trade with one another because, while

natural resources may be plentiful in one nation, expertise or technology may be unavailable to turn those natural resources into products to satisfy the needs of its people. For these reasons, countries engage in global trade, producing products that countries excel at while buying products needed from other countries through mutually beneficial exchange relationships. When products and services are traded freely or the movement of goods and services among nations occurs without political or economic barriers, free trade exists. In recent year, countries with similar economic goals have come together to form transnational trade groups to facilitate and promote free trade among member nations. One example is the European Union (EU), consisting of 27 member countries and three candidate countries. Another example is the North American Free Trade Agreement (NAFTA), which consists of Canada, Mexico, and the United States.

The Pros and Cons of Free Trade

PROS y The global market contains more than 6.2 billion potential customers for goods and services. Productivity grows when countries produce goods and services in which they have a comparative advantage. Global competition and less-costly imports keep prices down, so inflation does not curtail economic growth. Free trade inspires innovation for new products and keeps firms competitively challenged. Uninterrupted flow of capital gives countries access to foreign investments, which help keep interest rates low. y CONS Domestic workers (particularly in manufacturing-based jobs) can lose their jobs due to increased imports or production shifts to lowwage global markets. Workers may be forced to accept pay cuts from employers, who can threaten to move their jobs to lowercost global markets. Moving operations overseas because of intense competitive pressure often means the loss of service jobs and growing numbers of white-collar jobs. Domestic companies can lose their comparative advantage when competition builds advanced production operations in low-wage countries.

(Nickels, McHugh, & McHugh, Understanding Business, 2010 p. 62)

The success of free trade can be measured by the balance of trade, the total value of a nations exports compared to its imports. Another measure of free trade is the balance of payments, or the money flow into and out of a country from exports and imports. A country is said to have a trade surplus if its exports exceed its imports. A trade deficit occurs when imports exceed exports. Similarly, more money flowing into a country than leaving a country describes a favorable balance of trade. An unfavorable balance of trade exists when more money is flowing out of a country than coming in. The United States, for example, had a trade deficit with China. To better understand the concept of free trade and global trade flow, take a look at the Balance of Payments tutorial.

Balance of Payments Tutorial

Through this tutorial, you will learn about the important relationship between trade imbalances and foreign currency exchange rates. You'll also see how these trade imbalances can be corrected, as well as the possibility that these imbalances will correct themselves as foreign exchange rates react to the imbalance. Click on the link below to view the video. Balance of Payments Estimated Duration: 25 Minutes Note: This video has sound, so make sure you are using a computer with audio capabilities.

Exchange Rate An unfavorable balance of trade cannot occur for long. When a countrys products begin to accumulate due to a decline in demand, the interaction of supply and demand attempts to adjust the growing surplus, forcing a reduction in price. The price a country pays for another countrys products is influenced by the prevailing currency exchange rate. The exchange rate is the value of one nations currency with respect to the currency of other countries. If a country maintains a floating exchange rate, its currency is allowed to fluctuate with the market forces of supply and demand. Exchange rates influence currency valuation and adjust to the market conditions of supply and demand, except in countries with a high degree of government intervention. Currency devaluation is a nations attempt to lower the value of its currency, largely to compete more favorably, especially with its exports. A low value of the U.S. dollar means that a dollar is traded for less value of a foreign currency. Foreign goods are more expensive to the U.S. when the dollar is low, but U.S. goods are less expensive to foreign countries. Currency devaluation can prolong the trade deficit and result in unfavorable balance of payments between countries.

Global Trade Barriers The U.S. Obama Administration announced it will impose a 35% tariff on passenger and light truck tires imported from China. The U.S. tire industry suffered approximately 5,000 lost jobs to Chinese exports. The reaction from China is opposition to the act of trade protectionism. Some believe that China will retaliate by engaging in dumping. In the early 1980s, the Reagan Administration imposed a tariff on imported motorcycles to give U.S.

manufacturer Harley-Davidson an opportunity to change its production methods and become competitive on the world market. These examples demonstrate the governments use of regulations to limit the import of goods and services, known as trade protectionism. A tariff is a tax on imports that makes them more expensive to buy. An import quota limits the number of products by category that a country can import. An embargo is a complete ban on the import or export of a product, stopping all trade with a country. A tariff on imported tires from China raises the price of Chinese tires, allowing the domestic tire manufacturer to compete more favorably in the U.S. A quota restricting the volume of imports from China would result in a shortage of supply from China and consequently an increase in the price of Chinese imports, again allowing the domestic tire to compete more favorably. In 1948, government leaders from 23 nations formed the General Agreement on Tariffs and Trade (GATT). The intention was to reduce restrictions on trade. The World Trade Organization (WTO) was established in 1995 to solve disputes among nations engaged in global trade. The environment of the global marketplace presents challenges to companies hoping to expand across the globe. Factors influencing trade in global markets include socio-cultural forces like language, religion, customs, and values. Other forces are economic and financial, legal and regulatory, physical and environmental (natural).

Offshore Outsourcing Outsourcing is a business practice used to fill the gaps that exist within a company, to gain efficiencies, and to reduce costs or expand business. Outsourcing occurs when one company contracts with another to do some or all of its functions. A commonly outsourced function is payroll. Global markets make outsourcing to foreign countries, or offshore outsourcing, very attractive. The implications of offshore outsourcing can be very important to business growth, both positive growth and negative decline. Offshore outsourcing often results in lower costs primarily due to savings in overhead. Lower costs can translate to lower prices. This relationship is what describes the consistently low prices of Wal-Mart. Offshore outsourcing diverts jobs and employment to the foreign country where production is outsourced. The domestic country loses jobs. Similarly, the domestic country loses control over product quality because it loses the opportunity to affect the production process. Finally, as another company is added to the distribution of goods, communication becomes more complicated. The opportunity to gain greater efficiencies with hopes of becoming more effective drives a companys decision to pursue offshore outsourcing. The global marketplace presents a sea of opportunity for businesses to explore. Faced with challenges presented by an unknown environment, global expansion offers businesses an extraordinary potential for growth. Next week we will examine ethics and the social responsibility of business. What does it mean to do the right thing in business?

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- GCSE RevisionDokument98 SeitenGCSE RevisionflowerkmNoch keine Bewertungen

- Master of Arts (History) (MAH) Term-End Examination December, 2020Dokument6 SeitenMaster of Arts (History) (MAH) Term-End Examination December, 2020MohitNoch keine Bewertungen

- World Trade OrganizationDokument42 SeitenWorld Trade OrganizationPranav ShreeNoch keine Bewertungen

- Strategic Benefits of Global Trade Management SoftwareDokument4 SeitenStrategic Benefits of Global Trade Management SoftwareSileaLaurentiuNoch keine Bewertungen

- WTO & Its Importance For Indian Business: Prof. Arun MishraDokument25 SeitenWTO & Its Importance For Indian Business: Prof. Arun MishraArun MishraNoch keine Bewertungen

- Counter TradeDokument7 SeitenCounter TradeGudiya UpadhyayNoch keine Bewertungen

- Assessing competition in the milk tea shop industryDokument4 SeitenAssessing competition in the milk tea shop industryIan VinoyaNoch keine Bewertungen

- Assignment For Principles of Marketing - Arcadia GroupDokument8 SeitenAssignment For Principles of Marketing - Arcadia Grouprarah123Noch keine Bewertungen

- Assignment Scm202 Sai Narasimhulu - 21067556 - Day 3Dokument3 SeitenAssignment Scm202 Sai Narasimhulu - 21067556 - Day 3SAI NARASIMHULUNoch keine Bewertungen

- Mumbai Resident's Electricity Bill DetailsDokument2 SeitenMumbai Resident's Electricity Bill DetailschetankvoraNoch keine Bewertungen

- Non TariffDokument21 SeitenNon TariffSunil Kumar MahatoNoch keine Bewertungen

- Chap. 18Dokument149 SeitenChap. 18Nguyễn Lê ThủyNoch keine Bewertungen

- Indian Business Ventures AbroadDokument64 SeitenIndian Business Ventures AbroadDeepak SinghNoch keine Bewertungen

- PALOMARIA-MODULE 4 - Consumer MathDokument16 SeitenPALOMARIA-MODULE 4 - Consumer MathALMIRA LOUISE PALOMARIANoch keine Bewertungen

- Current account statement in Saudi RiyalsDokument6 SeitenCurrent account statement in Saudi RiyalsSyedFarhanNoch keine Bewertungen

- Vat On BanksDokument4 SeitenVat On BanksRolando VasquezNoch keine Bewertungen

- Amazon July Seller Credit NoteDokument2 SeitenAmazon July Seller Credit NoteShoyab ZeonNoch keine Bewertungen

- Cambridge International AS & A Level Business - Notes On Unit 4Dokument12 SeitenCambridge International AS & A Level Business - Notes On Unit 4fopabip33Noch keine Bewertungen

- Chapter 5Dokument19 SeitenChapter 5Adda KadhilaNoch keine Bewertungen

- Emerging Trends and Comparative Analysis of Retail in IndiaDokument83 SeitenEmerging Trends and Comparative Analysis of Retail in IndiaSyed Shadab Ali100% (1)

- Examen LOgistica KEY uNSOLVED PDFDokument4 SeitenExamen LOgistica KEY uNSOLVED PDFJuan GarNoch keine Bewertungen

- V R Logistics Profile PDFDokument14 SeitenV R Logistics Profile PDFUmesh TiwariNoch keine Bewertungen

- Unit 11 PDFDokument20 SeitenUnit 11 PDFUMESH MANIHARNoch keine Bewertungen

- Financial Peace University - Member WorkbookDokument153 SeitenFinancial Peace University - Member Workbookkate1mayfield-1100% (1)

- Cryptocurrency BasicsDokument28 SeitenCryptocurrency BasicsAziz hospitalNoch keine Bewertungen

- Afm AssignmentDokument17 SeitenAfm AssignmentHabtamuNoch keine Bewertungen

- What is international trade and its benefitsDokument4 SeitenWhat is international trade and its benefitsanto juaNoch keine Bewertungen

- 9417 - Foreign Currency Transactions Hedging and DerivativesDokument7 Seiten9417 - Foreign Currency Transactions Hedging and Derivativesjsmozol3434qcNoch keine Bewertungen

- The Relationship Between China and PhilippinesDokument2 SeitenThe Relationship Between China and PhilippinesHaji Lizardo LabradorNoch keine Bewertungen

- NCERT SolutionsDokument55 SeitenNCERT SolutionsArif ShaikhNoch keine Bewertungen