Beruflich Dokumente

Kultur Dokumente

2011 M&a Insights Telecom

Hochgeladen von

Petrus PomerolOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2011 M&a Insights Telecom

Hochgeladen von

Petrus PomerolCopyright:

Verfügbare Formate

www.pwc.

de/de/tmt

Quit

Telecoms M&A Insights

Current information on international mergers and acquisitions in the industry. April 2011

Quit

Home

Preface

Welcome to the 2011 edition of Telecoms M&A Insights from PwC. Here we explore how the recovery of the global financial market impacted telecommunications transactions in 2010 and look at some of the key trends set to shape 2011 and beyond. The appetite for deals among telecommunications companies came back with a vengeance in 2010. After a lacklustre year in 2009, the EMEA deal value significantly increased by 82%, reaching 41.3 billion in 2010. The number of deals considered declined slightly by 3% to a total of 354 in Europe, the Middle East and Africa (EMEA). Despite this strong increase in deal value, the sector is still far below the all-time highs of 2005 and 2006 and has not yet reached the pre-crisis level of 2007. But the momentum looks good and seems set to last. Telecoms operators are optimistic about the future. Mobile broadband usage has finally taken off, supported by fastgrowing smartphone sales. The debt load is manageable given the amount of cash flow coming in, and there are still reserves for high-profile acquisitions in the sector and dividend payments. As in 2009, it was the western European incumbents that shaped the deal market significantly. In particular, Spains Telefonica continued its buying spree in South America and tops our list of major deals in Europe. One key theme that is driving acquisitions is convergence. Having been talked about for more than a decade, convergence is starting to happen for telecommunications companies looking for online media businesses to complement their communication services and diversify their business portfolios. In addition, we find telecommunications companies developing interest in TV broadcasters as the outlook for TV and related revenues continues to be positive. In Germany, the deal landscape differs somewhat from that in the rest of the EMEA region. Deal volume declined by 45% to just 17 deals. The disclosed deal value deteriorated to just 0.6 billion in 2010. However, the deal value in 2009 was driven by two large deals: Liberty Globals acquisition of Unitymedia, and Telefonicas acquisition of HanseNet, both announced towards the end of 2009 and closed in early 2010. Our outlook for 2011 is upbeat as deal volume is likely to reach new highs with the already announced sale of Kabel BadenWrttemberg and T-Mobiles US business. One of our continuing objectives is to maintain a dialogue and build on our relationships with companies throughout the telecoms sector. We hope that this publication will help facilitate this and we look forward to receiving your feedback. If you would like to discuss in more detail any of the topics addressed in this report, please do not hesitate to contact us, or your local PwC team. Werner Ballhaus Technology, Media & Telecommunications Industry Leader, Transactions Dr Arno Wilfert Partner Strategy Group Transactions

Contents

Preface .....................................................................................................................2 Investments in telecoms stocks recovered in 2010 from lows in 2009.......................3 Disclosed deal valueincreased for the first time in five years ....................................4 EMEA buyers were looking for targets to a large extent in Europe............................5 Europe: More high-value deals and increased activity in emerging markets .............6 Germany: M&A market for telecoms appears to reach steady state ...........................7 Telecoms deal hot spot #1: Convergence is gaining momentum in western Europe ............................................8 Telecoms deal hot spot #2: Consolidation of alternative fibre-network operators ...............................................9 Telecoms deal hot spot #3: Deal activity in high-growth countries remains strong ........................................... 10 Contacts ................................................................................................................ 11

PwC Telecoms M&A Insights April 2011 2

Quit

Home

Investments in telecoms stocks recovered in 2010 from lows in 2009

The recovery of technology stocks continued throughout 2010. Telecoms investment still outperformed other sectors, albeit by a small margin There was a great deal of uncertainty as to whether the recovery of financial markets in late spring 2009 was a technical reaction or the beginning of a fundamental trend. With the benefit of hindsight it appears as if equity markets did indeed recover to more appropriate levels. The financial markets bottomed out in March 2009 and experienced a first wave of share price recovery until late 2009. In the spring of 2010 the sovereign debt crisis caused a new round of concern, and European stocks slumped briefly until May 2010, when a joint effort to stabilise the euro was announced. Although telecommunications shares fared better than the broader market, at the end of 2010 they were leading by just 10%. Most telecoms operators have been able to service or roll over their debt. Notable exceptions are Wind Hellas, the fixed and mobile network operator in Greece,

Telecommunications stocks in Europe 110 100 90 Index 80 70 60 50 40 02.01.2008 12.03.2008 23.05.2008 01.08.2008 10.10.2008 19.12.2008 04.03.2009 15.05.2009 24.07.2009 02.10.2009 11.12.2009 23.02.2010 06.05.2010 15.07.2010 23.09.2010 02.12.2010

as well as the regional cable TV operators Tele Columbus and PrimaCom in Germany. They experienced difficulties servicing the debt load and initiated restructuring efforts, which have mostly completed by now. Weather Investments, the owner of Wind Hellas, has been in talks about a merger of its Wind assets with VimpelCom of Russia. This received shareholder support at a special general meeting of VimpelComs shareholders March 2011. Investors in telecommunications stocks outperformed the broader market by some 10% over a period of three years. Despite this lacklustre performance, telecoms stocks were sought after because of their dividend yield profile. Most of the incumbent telecommunications companies in Europe have dividend yields significantly above market interest rates.

EURO STOXX 50 Index (EUR) Source: STOXX Ltd.

EURO STOXX Telecommunications Index (EUR)

PwC

Telecoms M&A Insights April 2011 3

Quit

Home

Disclosed deal value increased for the first time in five years

Deal value in the telecoms sector may have reached its inflection point in 2010.

In 2010, telecoms deal volume in EMEA region was still below the level of 2004, but deal value was up 82%.

Deal activity in the telecoms sector continued to decline, albeit by just 3%. In 2010 we noted 354 deals compared to 365 deals in 2009, which was thus just a minor decline. What is striking, however, is that the disclosed deal value increased by 82% compared to 2009. This development is driven by more high-value deals, most notably the acquisition of Brasilcel by Telefonica of Spain for some 7.5 billion. As the total deal value in our analysis is linked to the number of deals with an actually disclosed deal value, the higher value is driven by more deals that reveal the transaction value. From the 354 deals in 2010, 171 (48%) announced their values, while in 2009 only 127 of 365 deals (35%) did so. The average value of the announced deals increased from 170 million in 2009 to 250 million in 2010.

Telecommunications deal activity in EMEA, 20042010 120 100 Deal value (bn) 80 60 40 20 0 2004 2005 2006 2007 2008 2009 2010 600 500 No. of Deals 400 300 200 100 0

Deal volume Source: Thomson Reuters, mergermarket

PwC

Disclosed deal value

Telecoms M&A Insights April 2011 4

Quit

Home

EMEA buyers were looking for targets to a large extent in Europe

A segmentation of deals per target region illustrates the dominance of Western and Central Eastern Europe compared to other regions. Outside Europe, America was the region were EMEA buyers sought most deals.

EMEA telecoms deals per target region in 2010

Africa 12 America 20 Asia 14 Australia 3

Europe 173

CEE 121

Middle East 11

Source: Thomson Reuters, mergermarket

While most deals targeted companies in Europe, the ten largest deals, with a deal value of more than 1 billion, focused mostly on developing and emerging countries like Brazil, Ukraine and Egypt. The majority of deals, however, are smaller with a value of less than 100 million. As in 2009, most deals were completed in the Russian Federation, where the actual number of deals increased by four to a total of 83. This is a strong lead over the second-most important deal country in the telecommunications sector, which is the UK with 39 deals in 2010.

As we predicted in last years Telecoms M&A Insights, the deal momentum in Russia seems sustainable. Consolidation in the Russian telecoms market is just starting to happen and Russian telecoms companies are using their leverage to acquire companies abroad. VimpelCom has increased its footprint in Ukraine and its shareholders agreed with Orascom about an investment in the Italian and Greek operations of its mobile operator Wind.

PwC

Telecoms M&A Insights April 2011 5

Quit

Home

Europe: More high-value deals and increased activity in emerging markets

In Europe, some 354 deals worth 42 billion were completed in 2010. While the number of deals fell slightly from the previous year (365 transactions), the total value nearly doubled. The disclosed deal value of the top ten deals in the EMEA region increased by 50%, from 17.9 billion to 26.9 billion in 2010. This affirms that high-value deals are back on the agenda, especially given the fact that our table excludes the Unitymedia (Germany) and GVT (Brazil) deals (6.5 billion) which were announced in 2009 but closed in 2010. They were already covered in our 2010 issue of Telecoms M&A Insights. The busiest deal makers were clearly large corporates. Of the top ten deals in Europe, just one involved a private equity company.

Major European deals 2010 Date Sep 10 Apr 10 Jan 10 Oct 10 Oct 10 Apr 10 Jun 10 Mar 10 Value (m) 7,500 3,637 3,377 2,533 2,180 2,110 1,842 1,513 Target Brasilcel NV Kyivstar GSM Egyptian Company for Mobile Services Sunrise Communications AG Dimension Data Holdings PLC Tandberg ASA CenterTelecom Rostelecom (40%) Target country Brazil Ukraine Egypt Switzerland United Kingdom Norway Russia Russia Acquirer Telefonica SA VimpelCom Ltd Orange Participations SA CVC Capital Partners Ltd Nippon Telegraph and Telephone Corporation Cisco Systems Inc Rostelecom Deposit Insurance Agency and Vnesheconombank The Carphone Warehouse Group PLC 012 Smile.Communications Ltd Acquirer country Spain Russia France United Kingdom Japan United States Russia Russia

The biggest deal was the 7.5 billion acquisition of Brasilcel by the Spanish company Telefonica. Telefonica bought a 50% stake in Brasilcel from Portugal Telecom. Russia played an important role in the 2010 market where 83 of the 354 deals took place, which is nearly every fourth deal (23%). This shows that, with the saturation in western European countries, the importance of the CEE region is steadily increasing.

Mar 10 Apr 10

1,355 1,175

TalkTalk Telecom Group PLC Bezeq

United Kingdom Israel

United Kingdom Israel

Source: Thomson Reuters, mergermarket

PwC

Telecoms M&A Insights April 2011 6

Quit

Home

Germany: M&A market for telecoms appears to reach steady state

In Germany, 17 deals with a total value of less then 1 billion were completed in the telecommunications sector in 2010. The decrease in M&A activity in the telecommunications sector continued in 2010, reaching only 552.8 million in total deal value with 17 completed deals. Compared to the 31 deals completed in 2009, this is a decrease of 45% in terms of volume and by 82.5% in terms of value. The low deal value is driven by the large amount of deals with an undisclosed deal value. In 2010, the biggest deal was the acquisition of PrimaCom Management GmbH by the Luxembourg-based financial investor Medfort in July. The cable industry saw various ownership changes in 2010. A total of five cable operators changed their ownership structures, including Libertys acquisition of Unitymedia, which was announced in 2009 and closed in 2010. Two ownership changes were driven by financial distress and one was driven by going public instead of being sold to financial investors. Our conclusion for the German market is that it is reaching a steady state where market consolidation is in its final stage. The only big deal for 2011 is the planned sale of Kabel Baden-Wrttemberg. However, the announced sale of T-Mobiles US business will drive up deal value to new highs in 2011.

Major German deals 2010 Date Jul 10 Jul 10 Dec 15 Aug 10 Feb 10 Dec 10 Sep 20 Mar 10 Mar 24 Aug 10 Value (m) 333 163 124 66 6 3 n/a n/a n/a n/a Target PrimaCom Management GmbH Cinterion Wireless Modules GmbH PTC (3%) Versatel Kabel GmbH Metalink Ltd Wintec AG Mail.com conlinet Holding GmbH Firstgate Holding AG (79.8%) Pepcom GmbH Target country Germany Germany Poland Germany Israel Germany United States Germany Switzerland Germany Acquirer MEDFORT Sarl Gemalto NV Deutsche Telekom AG Chequers Capital Partners SA Lantiq Deutschland GmbH Innovation Group PLC United Internet AG Ventizz Capital Fund IV LP Deutsche Telekom AG STAR Capital Partners Limited Acquirer country Luxembourg Netherlands Germany France Germany United Kingdom Germany Germany Germany United Kingdom

Source: Thomson Reuters, mergermarket

PwC

Telecoms M&A Insights April 2011 7

Quit

Home

Telecoms deal hot spot #1: Convergence is gaining momentum in western Europe

Having been discussed for more than a decade, convergence is gradually happening.

Incumbent telecommunications companies are looking for growth areas in the online media and entertainment sectors.

The declining deal volume in the telecommunications sector signals that intra-industry deals are becoming a rare commodity. Market consolidation is in its final stage, particularly in western European countries. Growth is sluggish as mobile data growth hardly compensates for lost revenues in the voice segment. This leaves telecommunications players with the question as to where future growth will come from. Some incumbents have already started branching out their business into segments which promise higher growth rates. Most incumbents are already active in the online media field, as they have already established and operate internet portals and offer TV access services. However, this was just a first step. In an environment in which the dominant internet technology companies are attacking the share of wallet of fixed and mobile network consumers, operators increasingly want to avoid being labelled the dumb pipe in this area. To do this they will most

PwC

likely start stepping up efforts to acquire businesses in the internet and mobile content space. One particular area that seems to promise good growth potential is the online/mobile gaming segment. Free-to-play games entice users to spend more time online and potentially dispense money for virtual goods. Revenues in this segment proved to be crisis resilient in the past years. Another area that is being monitored is the TV and video segment. Some European telecoms operators have started to acquire TV broadcasters. Telefonica bought a stake in Spains Canal Satellite Digital in 2010. France Telecom bought a 49% stake in the video sharing site Dailymotion. They already own stakes in an online music and an online advertising company. The highly publicised private placement of Facebook has stirred interest in social networking sites. Telefonica bought an 85% stake in Spanish social networking site Tuenti in 2010.

Telecoms M&A Insights April 2011 8

Quit

Home

Telecoms deal hot spot #2: Consolidation of alternative fibre-network operators

With the market consolidation among big telecommunications companies coming to an end, the focus of investors is shifting to alternative tier-two players. In the past years, a range of independent fibre-network operators have emerged across Europe. Some of them independently began seizing opportunities to deploy fibre and offer the network on an open access basis. Others emerged as subsidiaries of municipality-owned utility companies. The latter represent the largest share of these alternative fibre network operators in Europe. Those players had a key advantage: they were able to keep the marginal cost for laying fibre low by using the ducts their parent companies were digging for power, water or sewage services. But they were not limited to the digging plans of their parent companies, rather they were able to lay fibre optic cable at their own discretion as well. Nevertheless, tier-two alternative fibre network operators are increasingly facing a dilemma. They have the fibre in the ground but the demand for fibrebased broadband access is low and mostly limited to business customers and carriers. Additionally, their regional footprint prevents them from reaching the necessary scale to justify the network investments they are incurring. Just a few of these alternative operators are based in large metropolitan areas where they can achieve this type of scale. All other operators are reaching a point where they need to consider strategic options. Some of the ultimate owners of these alternative players are municipalities faced with a challenging financial situation. They regard their telecoms subsidiaries as a potential source of cash and have publicly expressed a willingness to sell such assets. While these assets offer investors state-of-the-art fibre optic networks and attractive rights-of-way in municipalities, the growth scenarios remain unclear. The most obvious source for growth is the residential segment, as the business and carrier segments are already well developed. But for the residential segments, they need to compete with the larger tier-one national fixed network operators. This may be an option once residentialcustomer demand for super-high bandwidth services increases. Still, demand is not expected to pick up for a couple years. In the meantime, investors can start consolidating these assets. A preliminary study conducted by PwC in Germany shows that there are regions in Germany where up to six alternative operators are based in an area with more than 6 million inhabitants. If these operators were to merge, the resulting company would be much more powerful than the individual companies are now. The key challenge facing this type of regional consolidation lies in uniting the owners, who are represented by utility companies and local politicians. Their individual views need to be balanced before any acquisitions can occur. With public finances deteriorating, such talks are likely to start in 2011.

PwC

Telecoms M&A Insights April 2011 9

Quit

Home

Telecoms deal hot spot #3: Deal activity in high-growth countries remains strong

European incumbents continue to strengthen their portfolios with acquisitions in higher-growth countries.

Deal activity in emerging markets, particularly South-East Asia, is expected to increase in 2011.

In last years issue of Telecoms M&A Insights we already predicted that the European incumbents would increase their acquisition efforts in highergrowth countries. Deal activity was already high in CEE and South America, and we are convinced that these two regions will remain the centre of acquisition efforts in the short term. We were disappointed to see that the Middle East did not develop as much as we thought. No major telecommunications deal happened in this region in 2010. Given the current political uncertainty in the area, this is likely to be the case for 2011 as well. Operators that are present in this area will stick to their investments and foreign investors are unlikely to close deals in an uncertain environment. The cash-rich investment vehicles in the Emirates did not emerge as investors into other telecoms companies across the world either. It seems that their investment focus is in other areas, such as resources, energy and industrial production. Sooner or later Africa will become the focus of telecoms deal activity, with most African markets fully liberalised and market consolidation not yet complete. Incumbent operators from the other side of the globe will take advantage of this situation and buy assets in this region. We predict that operators in this region will review their businesses and potentially divest some assets to improve their balance sheets. Besides Africa, we see South-East Asia as another area where deal activity in the telecoms sector should increase as incumbent operators from Europe expand their footprint into this region.

PwC

Telecoms M&A Insights April 2011 10

Quit

Home

Contacts

Werner Ballhaus Technology, Media & Telecommunications Industry Leader, Transactions Tel: +49 211 981-5848 E-mail: werner.ballhaus@de.pwc.com Philip Grindley Transactions Tel: +49 69 9585-3191 E-mail: philip.grindley@de.pwc.com Michael Hartmann M&A Tax Tel: +49 89 5790-6372 E-mail: michael.hartmann@de.pwc.com Eric Hummitzsch Transactions Tel: +49 89 5790-5185 E-mail: eric.hummitzsch@de.pwc.com Eckhard Spth Transactions Tel: +49 89 5790-6415 E-mail: eckhard.spaeth@de.pwc.com Dr Arno Wilfert Strategy Group Tel: +49 69 9585-6289 E-mail: arno.wilfert@de.pwc.com About us Our clients face new challenges, explore interesting ideas and seek expert advice every day. They turn to us for comprehensive support and practical solutions that deliver maximum value. Whether they are a global player, a family business or a public institution, we leverage our full range of skills: experience, industry-specific knowledge, high standards of quality, commitment to innovation and the resources of our expert network in over 150 countries. Building a trusting and cooperative relationship with our clients is particularly important to us the better we know and understand our clients needs, the more strategically we can support them. PwC. 8,700 dedicated people at 28 locations. 1.33 billion in turnover. The leading auditing and consulting firm in Germany.

Fotos: Seite 1, iStockphoto/nyul; Seite 4, iStockphoto/Alexander Kirch; Seite 8, Creatas Images The articles in this publication are for our clients information. Before making any decision or taking any action, you should consult the sources or contacts listed here. This publication may only be reproduced, in whole or in part, with the written permission of the publisher. The opinions reflected here are those of the authors. April 2011 PricewaterhouseCoopers Aktiengesellschaft Wirtschaftsprfungsgesellschaft. All rights reserved. PwC refers to PricewaterhouseCoopers Aktiengesellschaft Wirtschaftsprfungsgesellschaft, which is a member firm of PricewaterhouseCoopers International Limited, each member firm of which is a separate legal entity.

www.pwc.de

Das könnte Ihnen auch gefallen

- Risk Management Presentation April 22 2013Dokument156 SeitenRisk Management Presentation April 22 2013George LekatisNoch keine Bewertungen

- Initiate Business Checking: Your Business and Wells FargoDokument4 SeitenInitiate Business Checking: Your Business and Wells Fargoking Jorex ComedyNoch keine Bewertungen

- Ipsas 24 BudgetDokument2 SeitenIpsas 24 Budgetritunath100% (1)

- OTT Business PlanDokument2 SeitenOTT Business Plansashank70% (1)

- Chapter 11 - Part 1 - Accounting FranchisesDokument13 SeitenChapter 11 - Part 1 - Accounting FranchisesJane Dizon100% (1)

- Business Studies - Exam Paper 1Dokument12 SeitenBusiness Studies - Exam Paper 1Azar100% (1)

- Unit II Methods of Valuing Material IssuesDokument21 SeitenUnit II Methods of Valuing Material IssuesLeemaRosaline Simon0% (1)

- Automatic PaymentsDokument12 SeitenAutomatic PaymentsfinerpmanyamNoch keine Bewertungen

- 4.3.2.5 Elaborate - Determining AdjustmentsDokument4 Seiten4.3.2.5 Elaborate - Determining AdjustmentsMa Fe Tabasa0% (1)

- Managing Business Finance AssignmentDokument21 SeitenManaging Business Finance Assignmentjerrygmathew100% (1)

- Swot Analysis VodafoneDokument3 SeitenSwot Analysis Vodafoneagarwaldia28100% (1)

- The Academy of Economic Studies Entrepreneurship and Business Administration - English TeachingDokument32 SeitenThe Academy of Economic Studies Entrepreneurship and Business Administration - English TeachingElena Nichifor33% (3)

- Brexit: What the Hell Happens Now?: Your Quick GuideVon EverandBrexit: What the Hell Happens Now?: Your Quick GuideBewertung: 4 von 5 Sternen4/5 (10)

- Case Study at Vodafone CompanyDokument9 SeitenCase Study at Vodafone CompanyBezawit TesfayeNoch keine Bewertungen

- Deutsche Telekom Change MGT Case 1Dokument10 SeitenDeutsche Telekom Change MGT Case 1hadiasiddiqui100% (1)

- PWC 10 CentralDokument8 SeitenPWC 10 CentralCozma BogdanNoch keine Bewertungen

- Liquidity Ratio of VodafoneDokument12 SeitenLiquidity Ratio of VodafoneBenjamin Harris100% (1)

- European Telecoms - 1999 02 18Dokument22 SeitenEuropean Telecoms - 1999 02 18Damien ChewNoch keine Bewertungen

- 10 Biggest Telecommunications Companies: #1 AT&T Inc. (T)Dokument5 Seiten10 Biggest Telecommunications Companies: #1 AT&T Inc. (T)Angelica floresNoch keine Bewertungen

- Evaluating Market Consolidation in Mobile CommunicationsDokument56 SeitenEvaluating Market Consolidation in Mobile Communicationsjelisavac17Noch keine Bewertungen

- NTT Docomo 123Dokument34 SeitenNTT Docomo 123pranav.newtonNoch keine Bewertungen

- The Future Is Bright, But Is It Orange?: External EnvironmentDokument7 SeitenThe Future Is Bright, But Is It Orange?: External EnvironmentPhuong Tran-GiaNoch keine Bewertungen

- Eg For Section VDokument3 SeitenEg For Section VSlice LeNoch keine Bewertungen

- Annual Report Accounts 2011Dokument156 SeitenAnnual Report Accounts 2011andre1983Noch keine Bewertungen

- Cellcom Statement AnalysisDokument29 SeitenCellcom Statement AnalysisTom ZivNoch keine Bewertungen

- McKinsey Telecoms. RECALL No. 11, 2010 - Mature MarketsDokument66 SeitenMcKinsey Telecoms. RECALL No. 11, 2010 - Mature MarketskentselveNoch keine Bewertungen

- U.S. Commercial Service, Department of Commerce: Guide To European ICT MarketsDokument130 SeitenU.S. Commercial Service, Department of Commerce: Guide To European ICT Marketslj2bzNoch keine Bewertungen

- VodafoneDokument28 SeitenVodafoneNavaneet Yadav100% (1)

- The Evolution of Voip: A Look Into How Voip Has Proliferated Into The Global Dominant Platform It Is TodayDokument48 SeitenThe Evolution of Voip: A Look Into How Voip Has Proliferated Into The Global Dominant Platform It Is TodayBradley SusserNoch keine Bewertungen

- Winging It: Success Is by No Means Guaranteed For The Big TelcosDokument16 SeitenWinging It: Success Is by No Means Guaranteed For The Big TelcosHuyen BuiNoch keine Bewertungen

- Telecommunications Final PaperDokument41 SeitenTelecommunications Final PaperJessieHaNoch keine Bewertungen

- Top 8 Largest Telecom Companies in The WorldDokument8 SeitenTop 8 Largest Telecom Companies in The WorldmusicNoch keine Bewertungen

- CMS & EMIS Emerging Europe M&a Report 2018-19Dokument78 SeitenCMS & EMIS Emerging Europe M&a Report 2018-19bhaskkarNoch keine Bewertungen

- Iphone Case Study Assignment - MARKET LED ManagementDokument8 SeitenIphone Case Study Assignment - MARKET LED ManagementSebnem KavcinNoch keine Bewertungen

- Main Project of NokiaDokument37 SeitenMain Project of NokiaAnkur JaiswalNoch keine Bewertungen

- Mobile Report Sr07Dokument38 SeitenMobile Report Sr07Yuki MorimotoNoch keine Bewertungen

- Competition Hits Deutsche Telekom: Firms and Markets Mini-CaseDokument4 SeitenCompetition Hits Deutsche Telekom: Firms and Markets Mini-CasemarkNoch keine Bewertungen

- HRM RelianceDokument78 SeitenHRM Reliancemanwanimuki12Noch keine Bewertungen

- Chapter 1Dokument54 SeitenChapter 1Himanshu VyasNoch keine Bewertungen

- Telit2market 05 10Dokument96 SeitenTelit2market 05 10Voicu StaneseNoch keine Bewertungen

- Telecommunications Etfs: Market Capitalization Capitalization Market ValueDokument4 SeitenTelecommunications Etfs: Market Capitalization Capitalization Market ValueMorning古莫宁Noch keine Bewertungen

- Deloite Mobiletrends 2005Dokument3 SeitenDeloite Mobiletrends 2005Sylvia GraceNoch keine Bewertungen

- Case Study GB Mkting 1.Dokument13 SeitenCase Study GB Mkting 1.Raj PaulNoch keine Bewertungen

- Major Industry TrendsDokument3 SeitenMajor Industry TrendsNeeraj MehtaNoch keine Bewertungen

- More For Less: Telcos Will Continue To Stretch The Life of Copper NetworksDokument17 SeitenMore For Less: Telcos Will Continue To Stretch The Life of Copper Networksvignesh_velappanNoch keine Bewertungen

- Omnitel Pronto Italia CaseDokument10 SeitenOmnitel Pronto Italia CaseAnurag GuptaNoch keine Bewertungen

- Omnitel Pronto Full Report On Omnitel Pronto ItaliaDokument8 SeitenOmnitel Pronto Full Report On Omnitel Pronto ItaliaSnehal JoshiNoch keine Bewertungen

- Get Research ResourceDokument6 SeitenGet Research ResourceDan AndreeaNoch keine Bewertungen

- AT&T Buys T-Mobile USADokument3 SeitenAT&T Buys T-Mobile USAslobodanbuljugicNoch keine Bewertungen

- Interim Report January-December 2009Dokument33 SeitenInterim Report January-December 2009palleballeNoch keine Bewertungen

- E.On Ag: Company ProfileDokument11 SeitenE.On Ag: Company Profilenewcastle74Noch keine Bewertungen

- Nureye ASSIGNMENTDokument24 SeitenNureye ASSIGNMENTZeyinA MohammedNoch keine Bewertungen

- An Analysis On DoComoDokument12 SeitenAn Analysis On DoComodisha_11_89Noch keine Bewertungen

- Quantifying The Impact of OTT Communications Services in Western EuropeDokument25 SeitenQuantifying The Impact of OTT Communications Services in Western EuropeRusdiantoMahmudNoch keine Bewertungen

- Vodafone Project DeepsDokument48 SeitenVodafone Project DeepsSingh SurendraNoch keine Bewertungen

- Us Telco Limited MaverickDokument3 SeitenUs Telco Limited MaverickrohitNoch keine Bewertungen

- GCE A Level: A.M. TUESDAY, 11 June 2013 2 HoursDokument8 SeitenGCE A Level: A.M. TUESDAY, 11 June 2013 2 HoursprofoundlifeNoch keine Bewertungen

- Deal Drivers EMEA H1 2010Dokument68 SeitenDeal Drivers EMEA H1 2010Remark, The Mergermarket GroupNoch keine Bewertungen

- The Telecommunications Industry - ForecastDokument8 SeitenThe Telecommunications Industry - ForecastJenny PokorskiNoch keine Bewertungen

- Patricia LeMarechal and Andrew Smith - Industrial Property Grinds Across EuropeDokument4 SeitenPatricia LeMarechal and Andrew Smith - Industrial Property Grinds Across EuropeAnonymous VRspXsmNoch keine Bewertungen

- Spectrum Spats: There Is Simply Not Enough Spectrum To Go RoundDokument21 SeitenSpectrum Spats: There Is Simply Not Enough Spectrum To Go RoundKaran KadabaNoch keine Bewertungen

- VodafoneDokument2 SeitenVodafoneFaiz Ahmed100% (1)

- Telecommunications Reseller Revenues World Summary: Market Values & Financials by CountryVon EverandTelecommunications Reseller Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Wireless Telecommunications Carrier Revenues World Summary: Market Values & Financials by CountryVon EverandWireless Telecommunications Carrier Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Global Innovation: Developing Your Business for a Global MarketVon EverandGlobal Innovation: Developing Your Business for a Global MarketNoch keine Bewertungen

- Wired Telecommunications Carrier Lines World Summary: Market Values & Financials by CountryVon EverandWired Telecommunications Carrier Lines World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Fresh Start', A Big Challenge Facing The Microfinance IndustryDokument4 SeitenFresh Start', A Big Challenge Facing The Microfinance IndustryVinod ChanrasekharanNoch keine Bewertungen

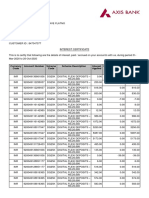

- Interest CertificateDokument2 SeitenInterest CertificatesumitNoch keine Bewertungen

- Governance, Business Ethics, Risk Management and Internal Control ReportingDokument5 SeitenGovernance, Business Ethics, Risk Management and Internal Control ReportingApril Joy ObedozaNoch keine Bewertungen

- FM Project HDFCDokument14 SeitenFM Project HDFCsameer_kiniNoch keine Bewertungen

- DrewDokument2 SeitenDrewmusunna galibNoch keine Bewertungen

- Ratio Analysis at Amararaja Batteries Limited (Arbl) A Project ReportDokument79 SeitenRatio Analysis at Amararaja Batteries Limited (Arbl) A Project Reportfahim zamanNoch keine Bewertungen

- CH 3 Working With Financial StatementsDokument25 SeitenCH 3 Working With Financial StatementsYousaf KhanNoch keine Bewertungen

- Module 5 - Extinguishment of An ObligationDokument19 SeitenModule 5 - Extinguishment of An ObligationCriselyne BernabeNoch keine Bewertungen

- BCG Growth-Share MatrixDokument3 SeitenBCG Growth-Share Matrixabhishek kunalNoch keine Bewertungen

- BPI-OTC Payment of Fee - 1 PDFDokument2 SeitenBPI-OTC Payment of Fee - 1 PDFPhilip Ebersole100% (1)

- UnderstandabilityDokument2 SeitenUnderstandabilityJasmine LeeNoch keine Bewertungen

- Appendix FDokument17 SeitenAppendix FD3 Pajak 315Noch keine Bewertungen

- SLCM Most Important Topics 2022Dokument6 SeitenSLCM Most Important Topics 2022Amit SinghNoch keine Bewertungen

- Junior Accountant RoleDokument1 SeiteJunior Accountant RoleRICARDO PROMOTIONNoch keine Bewertungen

- Foreign Exchange Rate Sheet: Bulletin November 29, 2021Dokument1 SeiteForeign Exchange Rate Sheet: Bulletin November 29, 2021Zeeshan AtharNoch keine Bewertungen

- Fundamentals of Auditing and Assurance Services OverviewDokument8 SeitenFundamentals of Auditing and Assurance Services OverviewSkye LeeNoch keine Bewertungen

- Goa University International Economics Sem V SyllabusDokument3 SeitenGoa University International Economics Sem V SyllabusMyron VazNoch keine Bewertungen

- Module 2 Simple DiscountDokument13 SeitenModule 2 Simple DiscountMhestica MiranoNoch keine Bewertungen

- Statement of AccountDokument7 SeitenStatement of AccountHamza CollectionNoch keine Bewertungen

- AC1025 2012-Principles of Accounting Main EQP and Commentaries AC1025 2012-Principles of Accounting Main EQP and CommentariesDokument69 SeitenAC1025 2012-Principles of Accounting Main EQP and Commentaries AC1025 2012-Principles of Accounting Main EQP and Commentaries전민건Noch keine Bewertungen

- Annual Report 2017 PDFDokument216 SeitenAnnual Report 2017 PDFemmanuelNoch keine Bewertungen

- New FORM 15H Applicable PY 2016-17Dokument2 SeitenNew FORM 15H Applicable PY 2016-17addsingh100% (1)