Beruflich Dokumente

Kultur Dokumente

Economics 186 7 Health Insurance Rev

Hochgeladen von

Asdqwr QsdwedrewrOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Economics 186 7 Health Insurance Rev

Hochgeladen von

Asdqwr QsdwedrewrCopyright:

Verfügbare Formate

3/21/2011

Economics 186: Health Economics

7 Health Insurance A.D. Kraft

Outline

Health insurance terminology Economic theory of demand for health insurance Adverse selection Moral hazard

3/21/2011

Terminology

Deductibles Deductible refers to a flat amount that is paid for by consumers before their insurance picks up all or part of the remainder of the price of the service. May be set in number of ways: o May apply to each unit of the service or may be cumulative o May be on an individual or family basis o May be related to family income

Terminology

Deductibles Advantages o May lower transaction costs for small claims, thereby increasing demand for insurance for larger claims o Incentive for people to shop around for insurers Disadvantages o Deterrent to care o May be greater burden on low income families

3/21/2011

Terminology

Deductibles Will either tend to result in greater use of services (similar to a zero price) when a low deductible is used, or if the deductible is high, will make insurance coverage irrelevant The effectiveness of the deductible depends on the size of the deductible, the expected medical expenditures of the family and family income

Terminology

Co-insurance When the third-party payer reimburses the patient for a certain fraction of the price of the service, the arrangement is termed co-insurance. Co-insurance levels can vary by service covered and by family income. Reduces the price of the service while still providing the individual with an incentive to seek out less costly providers. Effectiveness of co-insurance depends on how responsive utilization is to lower prices, i.e., the price elasticity of demand.

3/21/2011

Terminology

Stop loss levels once a patients out-of-pocket expenses reaches a certain amount, then the patient is no longer responsible for additional out-of-pocket payments. Protects the consumer Limits and maximums How much insurance companies are willing to reimburse after which responsibility for care shifts to the patient Protects the insurer from losses

Terminology

Limits and maximums Shifts the cost of very large expenditures, or catastrophic expenses to the patient Since this expenditure meets criteria for insurance risks i.e., large unexpected losses to a small percentage of the population, excluding this part may not be wise To lower the insurance premium, alternative approach would be to use a small deductible for the many families that have small expenditures - less of a financial hardship than a catastrophic expense befalling a small percentage of the population.

3/21/2011

Terminology

Other forms of coverage Insurance contracts may include any or all of the above in various combinations of deductibles, coinsurance and limits. Other aspects of coverage o Pre-existing condition o Salary insurance o Disability benefits

Terminology

Indemnity vs. service benefit Service benefit price to the patient for a stay in the hospital is reimbursed in full to the hospital. o Patients have less incentive to shop around for the less costly provider Indemnity benefit reimburses the patient a predetermined amount for the patients medical costs. o The patient has an incentive to minimize the cost of the illness since they have to advance the money and only a portion is reimbursed.

3/21/2011

Terminology

PhilHealth More of a first peso coverage, with limits and maximums Different ceilings for services, i.e. room and board, diagnostics, drugs, professional fees Case-based payments for some.

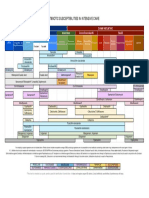

PHIC benefits

UNIFIED MEDICARE BENEFITS For all Members and Dependents under the National Health Insurance Program BENEFITS ROOM AND BOARD Not exceeding 45 days for each member & another 45 days to be shared by his dependents DRUGS & MEDICINES Per single period of confinement a. Ordinary b. Intensive c. Catastrophic X-RAY, LAB, ETC. Per single period of confinement a. Ordinary b. Intensive c. Catastrophic 350 700 0 850 2,000 4,000 1,700 4,000 14,000 1,500 2,500 0 1,700 4,000 8,000 3,000 9,000 16,000 200 300 400 HOSPITAL CATEGORY PRIMARY SECONDARY TERTIARY

3/21/2011

PHIC benefits

UNIFIED MEDICARE BENEFITS For all Members and Dependents under the National Health Insurance Program PROFESSIONAL FEES Per single period of confinement shall not exceed: a. Ordinary General Practitioner Specialist b. Intensive General Practitioner Specialist b. Catastrophic General Practitioner Specialist OTHERS Operating Room a. RVU of 30 and below b. RVU of 31 to 80 c. RVU of 81 and above Surgeon Anesthesiologist Compensable Outpatient Services: Ambulatory surgeries and procedures including dialysis, radiotherapy and chemotherapy TB DOTS 385 0 0 670 1,140 2,160 Maximum of 16,000 Maximum of 5,000 1,060 1,350 3,490 600 1,000 900 1,500 900 1,500 P 150/day for General Practitioner P 250/day for Specialist

600 1,000 900 1,500 900 1,500

600 1,000 900 1,500 900 2,500

Demand for health insurance: theory

Demand for health insurance represents the amount of insurance coverage that a person is willing to buy at different prices (premiums) for health insurance

Negatively sloping demand for insurance - As premiums decrease (i.e., the loading charge decreases) additional insurance coverage will be purchased. Diminishing marginal benefit of insurance coverage - the marginal benefit of increasing the comprehensiveness of insurance declines the more comprehensive the coverage.

3/21/2011

Demand for health insurance: theory

Demand for health insurance

Appropriate amount of insurance -When the marginal benefit of the additional coverage equals the marginal cost of buying that additional coverage Implications of the definition: At positive administrative prices for insurance, the consumer would demand less than 100 percent coverage

Demand for health insurance: theory

Economic theory of insurance Assumption: In the presence of uncertainty, i.e., the uncertainty of illness and consequently, a loss of wealth to pay for it, the individual seeks to maximize expected utility. Two alternative courses of action

Buy insurance - incur a small loss in the form of the

insurance premium Self-insure - facing a small probability of a large loss in the event of illness or the large possibility that a medical loss will not occur.

3/21/2011

Demand for health insurance: theory

Economic theory of insurance

Compare the two alternatives in order to determine which choice provides a higher utility For an individual to buy insurance, she must believe that the marginal utility of wealth is decreasing, additional wealth has lower marginal utility.

Utility and wealth

U3

U2

U1

W1

W2

W3

3/21/2011

Demand for health insurance: theory

Assume the following Loss in the event of illness = $ 8,000 W3 - Initial wealth, assumed to be $ 10,000 W1 -Wealth after the loss = W3 - 8,000 Pure premium = covers the actuarial value of the expected loss. If the probability of the individual requiring medical services costing 8,000 is .025, then the pure premium of the insurance would be .025 x 8,000 = 200 Pure premium is a function of both the size of the expected loss and the probability of occurrence for a large group of people (law of large numbers) W2 wealth level if a person were to buy insurance priced at 200, (200 is a definite loss)

Demand for health insurance: theory

Use expected utility to compare choices. The expected utility is the weighted sum of the utilities of each outcome, with the weights being the probabilities of each outcome. If U1=20, U2=99 and U3=100 Therefore the expected utility of choice b is:

P(U1 ) (1 P)(U 3 ) .025(20) (0.975)(100) 98 o The expected utility of choice a is: U=99 (given) Since the utility level of choice a is higher than the utility level of choice b, then the person will purchase insurance.

10

3/21/2011

Expected utility

B U3 U2 A

U1

W1

W2

W3

Demand for health insurance: theory

Expected utility of choice b is shown by the straight line connecting the two utility levels. The straight line represents expected utility levels for different probabilities of illness occurrence. The lower the probability that the event will occur, the closer is the expected utility to the point farthest to the right on the expected utility curve.

11

3/21/2011

Demand for health insurance: theory

Because the individuals actual utility curve (decreasing marginal utility wrt wealth) is always above the expected utility line (constant marginal utility wrt wealth), the individual will always buy health insurance if it is sold at its actuarially fair value (pure premium). A risk-averse person will prefer to take a certain loss (the premium) rather than accept the uncertainty of loss, even though the expected value of the loss is equal.

Demand for health insurance: theory

Insurance is never sold at its pure premium because of administrative, claims processing and marketing costs. Additional costs are referred to as loading charges, in effect, the price of insurance To determine whether an individual will buy insurance when there are additional costs, we calculate the maximum amount above the pure premium that consumer would be willing to pay for insurance

12

3/21/2011

Demand for health insurance: theory

W3-W2 represents the the pure premium for an 8,000 loss that has a 2.5 % chance of occurring.

Person buying the insurance will be willing to pay an amount above the pure premium that makes the actual utility after the payment of premium = expected utility level.

Demand for health insurance: theory

Point A is the expected utility without insurance. If one draws a straight line from this point to where it crosses the actual utility curve, then at this point B, a persons actual utility level and expected utility are the same. Distance from A to B on the wealth axis determines the amount above the pure premium that a person would be willing to pay for insurance.

13

3/21/2011

WTP additional premium

B U3 U2 F A

U1

W1

W4

W2

W3

Demand for health insurance: theory

At large probabilities and at very small probabilities, a person is willing to pay less over the pure premium than at other more intermediate probabilities.

o High probability of loss, i.e., points closer to W1-With an expected utility level at point E, the pure premium would be W3-W4 which is a large amount, since the probability of loss occurring is high. The amount above the pure premium is the distance EF. o Near certain events (e.g. annual medical or dental checkups, probability = 1) it would be cheaper to self-insure.

14

3/21/2011

Large and small losses

U3 U2

U1

W1

W5

W3

Demand for health insurance: theory

Magnitude of the expected loss also affects the pure premium the person is willing to pay for insurance WTP amount above pure premium is larger for big loss than for small one. o The area between the actual utility curve and the expected utility line is much greater for the large loss than for the small one.

15

3/21/2011

Demand for health insurance: theory

Price-quantity relationship of demand for health insurance Vertical axis - price of insurance = the amount above the pure premium

Horizontal axis- the probability that the event will occur.

Curved line is just the distance between the actual utility

curve and the expected utility line.

Price of insurance is represented by line AA. This line

increases as the probability of the events occurring increases

Price of insurance and quantity demanded

Price of insurance above pure premium

B B A A P1 P2

Probability of event occurring

16

3/21/2011

Demand for health insurance: theory

Price-quantity relationship of demand for health insurance the person is willing to pay for insurance and will buy insurance for events that fall between P1 and P2. The price of insurance is greater than the amount that a person is willing to pay for events that either have a very small probability of occurring or a very high probability of occurring. If the price of insurance were to rise to BB, we would expect the individual to self-insure

Demand for health insurance: theory

Summarizing, the following factors would affect the demand for health insurance How risk-averse the individual Risk averse people have more demand for insurance. The probability of the event occurring The demand for health insurance is lower when the probability of the event occurring are either very low or very high. Magnitude of the loss the larger the magnitude of the loss, the greater will be the amount above the pure premium that the individual is willing to pay the insurer.

17

3/21/2011

Demand for health insurance: theory

Factors, contd Price of insurance the higher the price, the lower the demand

Income of the individual the size of the persons income and wealth will affect the amount above the pure premium that she is willing to pay for health insurance. At both low and high incomes, the marginal utility of income is either relatively high or low, so that persons might prefer to self-insure

Demand for health insurance: theory

Factors that affect the price of insurance Whether a person is part of a group, group prices are lower Reduced prices are because of: o Reductions in administrative costs o Less likelihood of adverse selection Reductions in administrative costs o Administrative and claims processing costs are handled by the group o Lower marketing costs on the part of the insurer

18

3/21/2011

Demand for health insurance: theory

Factors that affect the price of insurance Whether a person is part of a group, group prices are lower Less likelihood of adverse selection, i.e., lower risk of event occurring o Individuals seeking to purchase health insurance may be the ones expecting to use such coverage in the future. o Higher prices charged to individuals leads to a smaller demand for health insurance

Demand for health insurance: theory

Factors that affect the price of insurance Technology Technology has made it possible to treat certain diseases that were previously untreatable, however these technologies are costly. Once a treatment becomes available, there is increased probability that an individual may require such treatment, increasing the demand for health insurance

19

3/21/2011

Demand for health insurance: theory

Factors that affect the price of insurance Technology

At the same time the price of insurance increases, thereby lowering the quantity demanded. Demand for insurance is increased when the latest technology is covered, but the premium increases because the loss is greater.

Demand for health insurance: theory

Factors that affect the price of insurance Technology Reimbursement methods used by insurer to pay for the new technologies o retrospective cost based-payments to hospitals and no out-of-pocket payments by patients o eliminated provider efficiency incentives while providing an incentive to patient and physician to perform the service as long as there were positive marginal benefits, even if benefit were less than resource costs.

20

3/21/2011

Demand for health insurance: theory

Factors that affect the price of insurance Technology

While technology has increased the demand for insurance, insurance has encouraged the growth of technology. The emphasis on cost reduction would therefore change investments in technologies, e.g., substitution of outpatient for inpatient care

Demand for health insurance: theory

Welfare implications

Welfare losses will occur if consumers pay a price for a good that is higher than its marginal benefit situation if all consumers are required to have complete coverage against all of their medical expenses. There are two situations in which the price of insurance will exceed the amount of the pure premium o The first is for medical losses that have a very high or very low probability of occurring o The second is when there are small medical losses.

21

3/21/2011

Demand for health insurance: theory

Welfare implications Mandatory insurance coverage that covers all medical losses, no matter how small or routine and expected, will make some consumers worse off than if they had a choice and could self-insure in those situations.

Adverse Selection and Moral Hazard

Existence of either adverse selection and moral hazard results in less insurance coverage

22

3/21/2011

Adverse Selection

An individual is more knowledgeable about his or health status than an insurance company Insurance companys concern that this difference in information will lead to high-risk groups purchasing insurance based on a lower groups premium is considered as adverse selection

Adverse Selection

Consequences If insurer is unable to identify between low and high risks, premium will reflect average risk of the two groups High risk group will purchase insurance, low risk group will not Result in a biased sample of those who purchase health insurance at a premium that is based on the low risk sample Insurance companies lose money Insurance company would raise its premium to reflect proportionately higher risk individuals but this would result in lower risk individuals dropping out.

23

3/21/2011

Adverse Selection

Illustration: Assume the same utility function and degree of risk aversion Low risk individuals have a .2 chance of getting sick, while those who have high risk = 0.8 Equal number of persons in each group. Pure premium for low-risk= 1,600=8,000*.2 and resulting wealth position is 8,400 Pure premium for high risk =6,400=8,000*.8 and resulting in wealth position 3,600

Adverse selection

E U3 U2 F G

A C

U1

3600

6000

8400

24

3/21/2011

Adverse Selection

AB shows the expected utility of an 8,000 loss. If insurer cannot identify between high and low risk, the pure premium would be based on the average risk of the two populations, i.e., 4,000=8,000*.5 High risk individuals will still purchase insurance because their utility level H is higher than F. Low-risk individuals will not buy insurance because their utility level with insurance H, would be lower than G, which is the maximum amount above the pure premium that they would be willing to pay.

Adverse Selection

Attempts to redress the information imbalance.

Excluding preexisting conditions Require individual to have tests Require minimum period before services are covered Low-risk individuals may signal by their willingness to accept insurance policies that contain high deductibles and co-insurance.

25

3/21/2011

Adverse Selection

Preferred risk selection - Cream skimming

Occurs when insurers receive the same premium for everyone within a group but the risks within the group vary. The insurer then tries to select the low-risk individuals while receiving a premium that is based on the average risk Insurer would be able to increase their profits if they could receive the average premium and attract just the low-risk members of the group

Adverse Selection

Concluding remarks Mandatory coverage or universal coverage insurance would limit adverse selection To limit preferred risk selection, each group should have a risk-adjusted premium so that insurers would not have an incentive to select low-risk groups. Accurate, risk-adjusted premiums would change the nature of insurance competition from risk selection to risk management

26

3/21/2011

Moral Hazard

The presence of some elasticity in the individuals demand curve indicates that the quantities of medical care would respond to prices. Moral hazard - Since insurance lowers the price of medical care, they will consume more care than of they had to pay the entire price themselves

Too much medical care will be consumed. Insurance coverage that reduces the price of care zero results in an inefficient use of resources since individual will continue to consume care until the marginal benefits are equal to marginal costs (=0) This will be at a point where the true marginal costs (the costs of producing those units) are greater than the marginal benefit.

Moral Hazard

Some individuals may be unwilling to purchase insurance policy that provides such extensive coverage.

Greater utilization resulting from having insurance will result in increases in the premium Instead of paying the higher premium, they would prefer to self-insure or purchase less comprehensive policy

27

3/21/2011

Moral Hazard

D1

P1

P(s)

D2

Q1

Q2

Moral Hazard

Illustration: 0.5 probability of getting sick, price of care= 10 per unit Individual with D1: o Will consume Q1 (=100 units) o Pure premium = 500=.5*0 +.5*1,000 Individual with D2: o Will consume Q2 (=200 units) o Pure premium = 1,000=.5*0+.5*2000 Difference in premium may be enough for some individuals to prefer self-insurance Requiring the individual to purchase comprehensive insurance that is the same as the rest of the population will make him worse off.

28

3/21/2011

Moral Hazard

Approaches to limit utilization

Not so successful - Utilization reviews (internal hospital utilization review committees) o none of the participants had an incentive to use the utilization review committee- they were reimbursed by the insurer anyway. More successful - Introduce incentives on the part of the physician or patient o Managed care systems physicians are likely to have an incentive if the organizations expenditures are less than their premium income. o Another incentive approach use deductibles and coinsurance. These allow the patients to bear some of the risks themselves.

Co-insurance

D1 P(s) P1

D2 P2

Q1

Q3

Q2

29

3/21/2011

Moral Hazard

Co-insurance o Pure premium for insurance = utilization level Q2 multiplied by price P1 (multiplied by probability 0.5) o Cost of self insurance would be P1 multiplied by Q1 o Cost an insurance policy with a co-insurance feature that lowered the price to the patient from P1 to P2 would cost (P1-P2) multiplied by utilization level Q3. o The pure premium for this policy would be in between the two other alternatives, might make insurance more attractive to some people.

Moral Hazard

Deductibles

o Using deductibles results either in the consumption of the same amount of care as in the case of no insurance, or in consumption of the same amount of care as in the situation of complete insurance coverage o Without insurance, individual represented by demand curve D1 would consume Q1 units in the event of illness. With complete coverage the same individual will consume Q2.

30

3/21/2011

Moral Hazard

Deductibles o With a deductible, the individual would have to use and pay for Q3 units of medical care(P1 times Q3) before the insurance would pay the medical costs. The additional care would be zero and he would consume Q2 units of care. o If the individual does not consume up to the deductible, it would be as if she has no insurance, i.e., use Q1 units of care. o Whether or not the individual will pay the deductible and then consume up to Q2 units of care depends on whether the excess amount that must be paid for the deductible (area A) is less than the consumers surplus represented by area B.

Deductibles

D1 P(s) P1 A

D2 B Q1 Q3 Q2

31

3/21/2011

Moral Hazard

Existence of moral hazard has two effects:

Price of health insurance is increased because utilization is increased when the consumer does not have to pay anything out of pocket. There is decrease in the demand for health insurance when the insurance premium is increased, because of the previous increase in utilization.

Thus, even if all individuals were risk averse, insurance coverage for 100 percent of all their medical expenses should not be required for all persons.

32

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Isolation and Identification of Bacteria ThesisDokument7 SeitenIsolation and Identification of Bacteria Thesisafbtbegxe100% (2)

- MicroMaxx 3.3 UG ENG P06435-02B e 1 - 1Dokument200 SeitenMicroMaxx 3.3 UG ENG P06435-02B e 1 - 1Waheed MidoNoch keine Bewertungen

- Self Safety 2Dokument10 SeitenSelf Safety 2Angela MacailaoNoch keine Bewertungen

- ICU antibiotic susceptibilities guideDokument1 SeiteICU antibiotic susceptibilities guideFaisal Reza AdiebNoch keine Bewertungen

- Ba - Bacterial Identification Lab WorksheetDokument12 SeitenBa - Bacterial Identification Lab WorksheetFay SNoch keine Bewertungen

- Cyclone Shelter Construction Maintenance and Management Policy 2011Dokument21 SeitenCyclone Shelter Construction Maintenance and Management Policy 2011MAHABUBUR RAHAMANNoch keine Bewertungen

- Spartan Bodyweight WorkoutsDokument102 SeitenSpartan Bodyweight WorkoutsSamir DjoudiNoch keine Bewertungen

- Weeblylp MedicinaDokument18 SeitenWeeblylp Medicinaapi-538325537Noch keine Bewertungen

- Pediatric PharmacotherapyDokument4 SeitenPediatric PharmacotherapyRiriNoch keine Bewertungen

- Remark: (Out Patient Department)Dokument7 SeitenRemark: (Out Patient Department)Tmiky GateNoch keine Bewertungen

- As 2550.5-2002 Cranes Hoists and Winches - Safe Use Mobile CranesDokument8 SeitenAs 2550.5-2002 Cranes Hoists and Winches - Safe Use Mobile CranesSAI Global - APACNoch keine Bewertungen

- Lung Cancer - Symptoms and Causes - Mayo ClinicDokument9 SeitenLung Cancer - Symptoms and Causes - Mayo ClinicTakuranashe DebweNoch keine Bewertungen

- Intro To MycologyDokument8 SeitenIntro To Mycologycamille chuaNoch keine Bewertungen

- Sip Annex 2a Child-Friendly School Survey-3Dokument9 SeitenSip Annex 2a Child-Friendly School Survey-3aimee duranoNoch keine Bewertungen

- L Sit ProgramDokument23 SeitenL Sit Programdebo100% (1)

- 32 Vol4 EpaperDokument32 Seiten32 Vol4 EpaperThesouthasian TimesNoch keine Bewertungen

- SITXWHS001 Assessment 1 (4) Incident ReportDokument7 SeitenSITXWHS001 Assessment 1 (4) Incident Reportpra Deep100% (1)

- MIDDLE ENGLISH TEST HEALTH VOCATIONAL HIGH SCHOOLDokument4 SeitenMIDDLE ENGLISH TEST HEALTH VOCATIONAL HIGH SCHOOLZaenul WafaNoch keine Bewertungen

- Guerbet Customer Success StoryDokument4 SeitenGuerbet Customer Success StoryAshishkul10Noch keine Bewertungen

- Environment in Palestine 1Dokument28 SeitenEnvironment in Palestine 1YOSEF DERDESAWENoch keine Bewertungen

- UPS MaintenanceDokument3 SeitenUPS MaintenancedescslamNoch keine Bewertungen

- Surgery Final NotesDokument81 SeitenSurgery Final NotesDETECTIVE CONANNoch keine Bewertungen

- Rosemont Hill Health CenterDokument14 SeitenRosemont Hill Health CenterMona SahooNoch keine Bewertungen

- Wellness ChallengeDokument2 SeitenWellness ChallengemeganbastianNoch keine Bewertungen

- MMI4804 Quiz 5Dokument16 SeitenMMI4804 Quiz 5Ham Mad0% (1)

- Syllabus ECDO 4225 - Professional Aspects of Nutrition and DieteticsDokument6 SeitenSyllabus ECDO 4225 - Professional Aspects of Nutrition and DieteticsOEAENoch keine Bewertungen

- Nursing Assessment 1Dokument70 SeitenNursing Assessment 1Amira AttyaNoch keine Bewertungen

- Week 6 - LP Modeling ExamplesDokument36 SeitenWeek 6 - LP Modeling ExamplesCharles Daniel CatulongNoch keine Bewertungen

- Diagram Alir Dan Deskripsi Proses: Tugas 4Dokument11 SeitenDiagram Alir Dan Deskripsi Proses: Tugas 4FevitaNoch keine Bewertungen

- Scoring BPSDDokument4 SeitenScoring BPSDayu yuliantiNoch keine Bewertungen