Beruflich Dokumente

Kultur Dokumente

Analysis of Financial Statements

Hochgeladen von

Kumudha DeviOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Analysis of Financial Statements

Hochgeladen von

Kumudha DeviCopyright:

Verfügbare Formate

ANALYSIS OF FINANCIAL STATEMENTS

COMPARATIVE STATEMENT COMMON SIZE STATEMENT

Income Statement

Balance Sheet

Income statement

Balance Sheet

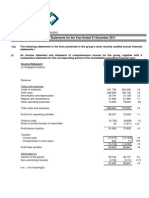

COMPARATIVE INCOME STATEMENT

Particulars Sales Less:- Sales Returns Net Sales Less:- Cost Of Goods Sold Gross Profit Less:- Operating Expenses Administration Expenses Selling Expenses Office Expenses Distribution Expenses Operating Profit Less:- Non Operating Expenese Interest Income Tax Finance Expense Goodwill Written off Net Profit Previous Year XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX Current Year XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX Increase / Decrease Amount % XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Particulars

COMPARATIVE BALANCE SHEET Previous Current Year Year

Increase / Decrease Amount %

Assets:Current Assets (stock, debtors, prepaid expenses, cash, bank, bills receivable) Total Current Assets (A) Fixed Assets Total Fixed Assets (B) Total Assets (A + B) Liabilities & Capital:Current Liabilities (creditors, bills payable, outstanding expense) Total Current Liabilities (D) Long Term Liabilities (Debentures, mortgage loan, public debt) Total Long Term Liabilities (E) Capital & Reserves (share capital & Reserves) Total Share holders Funds (F) Total Liabilities & Capital (D+E+F)

XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX

COMPARATIVE INCOME STATEMENT

Particulars Sales Less:- Sales Returns Net Sales Less:- Cost Of Goods Sold Gross Profit Less:- Operating Expenses Administration Expenses Selling Expenses Office Expenses Distribution Expenses Operating Profit Less:- Non Operating Expenese Interest Income Tax Finance Expense Goodwill Written off Net Profit Previous Year (amt) XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX Previous Year (%) XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX Current Year (amt) XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX Current Year (%) XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Particulars

COMPARATIVE BALANCE SHEET Previous Previous Year (amt) Year (%)

Current Year (amt)

Current Year (%)

Assets:Current Assets (stock, debtors, prepaid expenses, cash, bank, bills receivable) Total Current Assets (A) Fixed Assets Total Fixed Assets (B) Total Assets (A + B) Liabilities & Capital:Current Liabilities (creditors, bills payable, outstanding expense) Total Current Liabilities (D) Long Term Liabilities (Debentures, mortgage loan, public debt) Total Long Term Liabilities (E) Capital & Reserves (share capital & Reserves) Total Share holders Funds (F) Total Liabilities & Capital (D+E+F)

XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX

Questions for Working out:1) The income statements of a company are given for the years ending on 31st December 2008 and 2009. Re-arrange the figures in a comparative form and study the profitability position of the concern:Particulars 2008 2009 Net sales 7,85,000 9,00,000 Cost of goods sold 4,50,000 5,00,000 Operating expenses:General & administration expense 70,000 72,000 Selling expense 80,000 90,000 Non-operating expenses:Interest paid 25,000 30,000 Income tax 70,000 80,000 2) From the following balance sheets of X Ltd,. You are required to prepare sheet:Balance Sheet as on 31st December Liabilities 2007 2008 Assets Equity Share Capital 4,00,000 4,00,000 Land & Building Preference Share capital 3,00,000 3,00,000 Plant & Machinery Reserves 2,00,000 2,45,000 Stock 8% Debentures 1,00,000 1,50,000 Debtors Bills Payable 50,000 75,000 Cash Sundry Creditors 2,50,000 3,50,000 13,00,000 15,20,000 a comparative balance

2007 4,00,000 4,00,000 2,00,000 2,00,000 1,00,000 13,00,000

2008 3,70,000 4,10,000 3,00,000 3,00,000 1,40,000 15,20,000

3) Following is the P & L A/c of Shekar Fibres Ltd., for the year ending 31 / 12 / 2006 and 2007. Your are required to prepare common size income statement:Particulars 2006 2007 Gross Sales 7,25,000 8,15,000 Less:- Sales Returns 25,000 15,000 Net sales 7,00,000 8,00,000 Cost of goods sold 5,95,000 6,15,000 Operating expenses:General & administration expense 23,000 24,000 Selling expense 12,700 12,500 Non-operating expenses 1,750 1,940 Other incomes 1,200 8,050 4) From the following balance sheets of X Ltd,. You are required to prepare sheet:Balance Sheet as on 31st December Liabilities 2008 2009 Assets Share capital 2,00,000 2,50,000 Fixed Assets Reserves 80,000 1,00,000 Investments Debentures 1,00,000 80,000 Stock Creditors 70,000 95,000 Debtors Bills Payable 50,000 75,000 Bills receivable Bank 5,00,000 6,00,000 a comparative balance

2008 1,00,000 50,000 65,000 80,000 95,000 1,10,000 5,00,000

2009 1,20,000 60,000 75,000 90,000 1,05,000 1,50,000 6,00,000

Das könnte Ihnen auch gefallen

- Constructive Acctg. Report..... SINGLE ENTRY and ERROR CORRECTIONDokument39 SeitenConstructive Acctg. Report..... SINGLE ENTRY and ERROR CORRECTIONHoney LimNoch keine Bewertungen

- Chapter 23 - Worksheet and SolutionsDokument21 SeitenChapter 23 - Worksheet and Solutionsangelbear2577Noch keine Bewertungen

- CH 01 Review and Discussion Problems SolutionsDokument11 SeitenCH 01 Review and Discussion Problems SolutionsArman BeiramiNoch keine Bewertungen

- Analysis of Financial StatementDokument9 SeitenAnalysis of Financial StatementSums Zubair MoushumNoch keine Bewertungen

- 6.3.1 EditedDokument47 Seiten6.3.1 EditedPia Angela ElemosNoch keine Bewertungen

- Cash Flows Statement Indirect MethodDokument2 SeitenCash Flows Statement Indirect MethodMary100% (1)

- AaaaamascpaDokument12 SeitenAaaaamascpaRichelle Joy Reyes BenitoNoch keine Bewertungen

- The Red Marks Contain Instructions. To View The Tips, Place Cursor in That CellDokument15 SeitenThe Red Marks Contain Instructions. To View The Tips, Place Cursor in That Cellsiddharthzala0% (1)

- Account AssignmentDokument10 SeitenAccount Assignmentmaulik18755Noch keine Bewertungen

- St-2 Net Income and Cash Flow: Chapter 3 Part II Homework SolutionsDokument13 SeitenSt-2 Net Income and Cash Flow: Chapter 3 Part II Homework SolutionsGianfranco SpatolaNoch keine Bewertungen

- Trend AnlysisDokument7 SeitenTrend AnlysisPradnya HingeNoch keine Bewertungen

- Final Accounts/ Financial StatementsDokument53 SeitenFinal Accounts/ Financial Statementsrachealll100% (1)

- BVA CheatsheetDokument3 SeitenBVA CheatsheetMina ChangNoch keine Bewertungen

- Statement of Change in Financial Position-5Dokument32 SeitenStatement of Change in Financial Position-5Amit SinghNoch keine Bewertungen

- Practical Problems Cfa AdditionalDokument2 SeitenPractical Problems Cfa AdditionalMonish ShresthaNoch keine Bewertungen

- Cash Flow StatementDokument28 SeitenCash Flow StatementJaan Sonu100% (2)

- Ch02 P14 Build A Model (3) - SolutionDokument2 SeitenCh02 P14 Build A Model (3) - SolutiongnoctunalNoch keine Bewertungen

- Financial StatementsDokument10 SeitenFinancial StatementsSergei DragunovNoch keine Bewertungen

- Model Questions For The ExamDokument9 SeitenModel Questions For The ExamPapp ZsofiaNoch keine Bewertungen

- Statement of Cash FlowsDokument10 SeitenStatement of Cash FlowsJelwin Enchong BautistaNoch keine Bewertungen

- Projected FinancingDokument5 SeitenProjected FinancingPastor GaeNoch keine Bewertungen

- Elpl 2009 10Dokument43 SeitenElpl 2009 10kareem_nNoch keine Bewertungen

- SMCH 12Dokument101 SeitenSMCH 12FratFool33% (3)

- Chapter 31 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Dokument44 SeitenChapter 31 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNoch keine Bewertungen

- SGXQAF2011 AnnouncementDokument18 SeitenSGXQAF2011 AnnouncementJennifer JohnsonNoch keine Bewertungen

- Financial Management Solved ProblemsDokument50 SeitenFinancial Management Solved ProblemsAnonymous RaQiBV75% (4)

- QuestionsDokument68 SeitenQuestionsTrickdady BonyNoch keine Bewertungen

- Financial Reporting & Analysis Mock Test For Mid Term ExaminationDokument6 SeitenFinancial Reporting & Analysis Mock Test For Mid Term ExaminationTanuj AroraNoch keine Bewertungen

- Financial Ratio Analysis, Exercise and WorksheetDokument4 SeitenFinancial Ratio Analysis, Exercise and Worksheetatiqahrahim90Noch keine Bewertungen

- Format of Profit and Loss and Other Comprehensive StatementDokument5 SeitenFormat of Profit and Loss and Other Comprehensive StatementIleo AliNoch keine Bewertungen

- Working Backward To Cash Receipts and DisbursementsDokument8 SeitenWorking Backward To Cash Receipts and DisbursementsHarsha ThejaNoch keine Bewertungen

- Exhibit 6.3 Margin Money For Working CapitalDokument12 SeitenExhibit 6.3 Margin Money For Working Capitalanon_285857320Noch keine Bewertungen

- Presentation On Analysis of Financial Statement and Ratio AnalysisDokument23 SeitenPresentation On Analysis of Financial Statement and Ratio AnalysisRONANKI VIJAYA KUMARNoch keine Bewertungen

- FFS & CFSDokument15 SeitenFFS & CFSNishaTripathiNoch keine Bewertungen

- Ratio AnalysisDokument113 SeitenRatio AnalysisNAMAN SRIVASTAV100% (1)

- Statement of Cash FLowsDokument44 SeitenStatement of Cash FLowsNeerunjun HurlollNoch keine Bewertungen

- Accy 517 HW PB Set 1Dokument30 SeitenAccy 517 HW PB Set 1YonghoChoNoch keine Bewertungen

- LBO Analysis TemplateDokument11 SeitenLBO Analysis TemplateBobby Watkins75% (4)

- Accounting Newport IndustryDokument10 SeitenAccounting Newport IndustryAlexander Quizana AguirreNoch keine Bewertungen

- Five Years Summarized Financial Projection Is Shown Below:: 8. Accounting PotentialsDokument5 SeitenFive Years Summarized Financial Projection Is Shown Below:: 8. Accounting PotentialsRumiAhmedNoch keine Bewertungen

- 2-Financial Statements, Depreciation and Cash FlowDokument6 Seiten2-Financial Statements, Depreciation and Cash FlownoortiaNoch keine Bewertungen

- AC550 Course ProjectDokument2 SeitenAC550 Course ProjectPhuong Dang0% (2)

- Preparing The Statement of Cash Flows-Indirect MethodDokument11 SeitenPreparing The Statement of Cash Flows-Indirect MethodMelvin ZefanyaNoch keine Bewertungen

- Ratio Analysis AssignmentDokument4 SeitenRatio Analysis AssignmentMark Adrian ArellanoNoch keine Bewertungen

- Cashflowstatement IMPDokument30 SeitenCashflowstatement IMPAshish SinghalNoch keine Bewertungen

- Equity ValuationDokument2.424 SeitenEquity ValuationMuteeb Raina0% (1)

- Cash and Accrual BasisDokument36 SeitenCash and Accrual BasisHoney LimNoch keine Bewertungen

- ACCT5101Pretest PDFDokument18 SeitenACCT5101Pretest PDFArah OpalecNoch keine Bewertungen

- Presented By:-: Ankur GuptaDokument26 SeitenPresented By:-: Ankur GuptaRohit AgarwalNoch keine Bewertungen

- Chapter 4 AnswersDokument4 SeitenChapter 4 Answerscialee100% (2)

- K P I T Cummins Infosystems Limited: Financials (Standalone)Dokument8 SeitenK P I T Cummins Infosystems Limited: Financials (Standalone)Surabhi RajNoch keine Bewertungen

- Accounting - The Ultimate TemplateDokument8 SeitenAccounting - The Ultimate TemplateNatashaZaNoch keine Bewertungen

- Marking Scheme: Section ADokument8 SeitenMarking Scheme: Section Aaegean123Noch keine Bewertungen

- HorngrenIMA14eSM ch16Dokument53 SeitenHorngrenIMA14eSM ch16Piyal HossainNoch keine Bewertungen

- Financial Statements, Cash Flows, and TaxesDokument31 SeitenFinancial Statements, Cash Flows, and Taxesjoanabud100% (1)

- Financial Forecasting: SIFE Lakehead 2009Dokument7 SeitenFinancial Forecasting: SIFE Lakehead 2009Marius AngaraNoch keine Bewertungen

- Accounting and Finance Formulas: A Simple IntroductionVon EverandAccounting and Finance Formulas: A Simple IntroductionBewertung: 4 von 5 Sternen4/5 (8)

- Accounting Cycle Exercises IDokument58 SeitenAccounting Cycle Exercises IEnsuida HafiziNoch keine Bewertungen

- ACC 680 Module Three HomeworkDokument2 SeitenACC 680 Module Three HomeworkJeirel RuizNoch keine Bewertungen

- IE Chapter 3 - ProjectDokument56 SeitenIE Chapter 3 - Project10-12A1- Nguyễn Chí HiếuNoch keine Bewertungen

- Colgate Ratio Analysis SolvedDokument17 SeitenColgate Ratio Analysis SolvedrekhabawaNoch keine Bewertungen

- Tool Type Have? Completed Questions Score %Dokument12 SeitenTool Type Have? Completed Questions Score %Ramona FrandesNoch keine Bewertungen

- Cash Flow AnalysisDokument6 SeitenCash Flow AnalysisRaghav IssarNoch keine Bewertungen

- Project Report - JGB JCB Works and ServiDokument10 SeitenProject Report - JGB JCB Works and Servinatraj kumarNoch keine Bewertungen

- Deloitte-A Roadmap To Accounting For Income Taxes (Nov2011)Dokument505 SeitenDeloitte-A Roadmap To Accounting For Income Taxes (Nov2011)mistercobalt3511Noch keine Bewertungen

- UE305 Lecture No 25 and 26 - 85112Dokument36 SeitenUE305 Lecture No 25 and 26 - 85112Mustaeen DarNoch keine Bewertungen

- CE On Quasi-ReorganizationDokument1 SeiteCE On Quasi-ReorganizationalyssaNoch keine Bewertungen

- Internship 3Dokument30 SeitenInternship 3Sumithra K - Kodaikanal centerNoch keine Bewertungen

- HOBA - Advance AccountingDokument113 SeitenHOBA - Advance AccountingChristine Joy Estropia67% (3)

- FAR.3405 PPE-Acquisition and Subsequent ExpendituresDokument6 SeitenFAR.3405 PPE-Acquisition and Subsequent ExpendituresMonica GarciaNoch keine Bewertungen

- Cma Inter G2 Account & Audit MTP SolutionDokument30 SeitenCma Inter G2 Account & Audit MTP SolutionGeethika KesavarapuNoch keine Bewertungen

- Acct 2021 CH 2 Completion of The WorksheetDokument20 SeitenAcct 2021 CH 2 Completion of The WorksheetAlemu BelayNoch keine Bewertungen

- Investment - Intermediate Accounting IIDokument114 SeitenInvestment - Intermediate Accounting IIAngelaa RengkungNoch keine Bewertungen

- Part LL PRELIM EXAMDokument3 SeitenPart LL PRELIM EXAMJovyl InguitoNoch keine Bewertungen

- GEN009 ENHANCEMENT SUBJECT FOR ACC107 Activity 2Dokument11 SeitenGEN009 ENHANCEMENT SUBJECT FOR ACC107 Activity 2Sky CloudNoch keine Bewertungen

- CH 01Dokument50 SeitenCH 01coopernicuzNoch keine Bewertungen

- Karnataka Water RulesDokument114 SeitenKarnataka Water RulesNaman VermaNoch keine Bewertungen

- Tire Repair-Shop-Business-Plan-ExampleDokument30 SeitenTire Repair-Shop-Business-Plan-ExampleEstherlee ThompsonNoch keine Bewertungen

- Non-Current Assets Held For SaleDokument20 SeitenNon-Current Assets Held For Salerj batiyegNoch keine Bewertungen

- Strategic Human Resource Management (MHRM 612-2) Strategic Human Resource Management (MHRM 612-2)Dokument12 SeitenStrategic Human Resource Management (MHRM 612-2) Strategic Human Resource Management (MHRM 612-2)endaleNoch keine Bewertungen

- Pas 8Dokument1 SeitePas 8Ella MaeNoch keine Bewertungen

- Financial Analysis of Bajaj AutoDokument30 SeitenFinancial Analysis of Bajaj AutoParas GuptaNoch keine Bewertungen

- Q1 Week 3 Kinder ModuleDokument16 SeitenQ1 Week 3 Kinder ModuleMjane Dacaymat HandisanNoch keine Bewertungen

- ICAEW Vietnam Accounting Course Notes Print Version 2021Dokument298 SeitenICAEW Vietnam Accounting Course Notes Print Version 2021LisaNoch keine Bewertungen

- Chapter 5 Discussion QuestionsDokument1 SeiteChapter 5 Discussion Questionscarmen yuNoch keine Bewertungen

- 409 NDokument154 Seiten409 NJesus SalamancaNoch keine Bewertungen

- Quiz On Partnership DissolutionDokument4 SeitenQuiz On Partnership Dissolution이삐야Noch keine Bewertungen