Beruflich Dokumente

Kultur Dokumente

Merger Market Greater China Q12011

Hochgeladen von

Simon Kai T. WongOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Merger Market Greater China Q12011

Hochgeladen von

Simon Kai T. WongCopyright:

Verfügbare Formate

Greater China M&A Roundup Q1 2011

Summary Overview Despite a lack of mega deals this year, M&A activities in Q1 2011 totalled US$ 29.4bn, which is a slight increase of 1.5% compared to Q1 2010. Most notably, there was a 100% increase of deal worth in mid-cap transactions. With only 32 outbound deals worth of US$ 8.7bn in value, this represents a decrease of 70.5% and 31.9% in value and volume respectively compared to Q1 2010. But foreign investments had been the most bullish since Q4 2008, accounting for 48 deals worth of US$ 6.5bn. Industrials & Chemicals continues to be the most active sector with 38 transactions. By value as well, out of the top 5 announced deals in Greater China, 3 deals took place in the Industrials & Chemicals sector. Freshfields Bruckhaus Deringer retained its top spot for legal advisor league tables for Greater China, while Junhe Law Offices came first when the data is limited to China only. M&A Trend Q1 2011

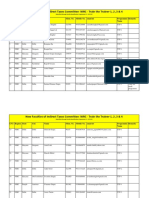

GREATER CHINA (China, Hong Kong, Taiwan, Macau) Financial Adviser League Tables by Value Q1 2011

Rank Q1 2010 2011 7 1 2 2 1 3 11 4 5 6 73 7 8 42 9 10 4 11 5 12 34 13 13= 13= House Morgan Stanley China International Capital Goldman Sachs Citigroup Compass Advisers Royal Bank of Scotland Group Moelis & Company Bank of America Merrill Lynch Haitong Securities Kim Eng Securities JPMorgan GF Securities Bank of China International Guoyuan Securities Huatai United Securities Value ($m) 5,987 5,457 4,083 3,243 2,423 2,000 2,000 1,701 1,696 1,255 1,105 1,073 1,025 1,025 1,025 Deal count 5 6 4 4 1 2 1 1 5 3 2 2 1 1 1 % Value change 92.1% -23.6% -53.0% 73.1% N/A 1,053.7% -79.2% -74.4% 385.8% -

Financial Adviser League Tables by Deal Count Q1 2011

Rank Q1 2010 2011 2 1 1 2 51 3 7 4 4 5 10 6 7 8 32 9 12 10 5 11 23 12 13 14 9 15 House China International Capital Morgan Stanley Haitong Securities Goldman Sachs Citigroup UBS Investment Bank Kim Eng Securities Standard Chartered CITIC Securities Access Capital Somerley China eCapital M&A International Royal Bank of Scotland Group JPMorgan Value ($m) 5,457 5,987 1,696 4,083 3,243 418 1,255 970 816 469 384 246 142 2,000 1,105 Deal count 6 5 5 4 4 4 3 3 3 3 3 3 3 2 2 Count change 0 -2 4 1 0 1 3 3 2 0 -1 1 3 3 -1

Legal Adviser League Tables by Value Q1 2011

Rank Q1 2010 2011 1 1 2 43 3 5 4 17 5 60 6 19 7 8= 8= 8= 15 11 9 12 13= 13= 13= House Freshfields Bruckhaus Deringer Jun He Law Offices Lee and Li Attorneys at Law Simpson Thacher & Bartlett Skadden Arps Slate Meagher & Flom DLA Piper Allen & Overy GKH Law Offices Goldfarb, Levy, Eran, Meiri & Co Herzog, Fox and Neeman Baker & McKenzie Debevoise & Plimpton Selmer Thommessen Wiersholm Value ($m) 4,724 2,740 2,735 2,703 2,608 2,562 2,461 2,423 2,423 2,423 2,396 2,160 2,000 2,000 2,000 Deal count 7 2 4 2 3 3 4 1 1 1 3 1 1 1 1 % Value change -88.6% 685.9% -92.4% -28.7% 1,797.8% -0.7% -58.3% -93.9% -

Legal Adviser League Tables by Deal Count Q1 2011

Rank Q1 2010 2011 1 1 2 2 16 3 13 4 49 5 20 6 7 7 3 8 4 9 41 10 22 11 5 12 15 13 29 14 12 15 House Freshfields Bruckhaus Deringer Jones Day Lee and Li Attorneys at Law Allen & Overy LLinks Law Offices Clifford Chance Skadden Arps Slate Meagher & Flom DLA Piper Baker & McKenzie Sullivan & Cromwell Fangda Partners King & Wood Latham & Watkins Mallesons Stephen Jaques Linklaters Value ($m) 4,724 302 2,735 2,461 1,961 1,726 2,608 2,562 2,396 1,940 1,225 535 514 414 335 Deal count 7 5 4 4 4 4 3 3 3 3 3 3 3 3 3 Count change -9 -8 0 0 3 1 -3 -9 -7 2 0 -4 -1 1 -1

CHINA Financial Adviser League Tables by Value Q1 2011

Rank Q1 2010 2011 2 1 1 2 8 3 4 5= 5= 7 28 8 10 9 5 10 House China International Capital Goldman Sachs Morgan Stanley Compass Advisers Moelis & Company Royal Bank of Scotland Group Bank of America Merrill Lynch Haitong Securities Citigroup GF Securities Value ($m) 4,957 3,697 2,901 2,423 2,000 2,000 1,701 1,696 1,083 1,073 Deal count 5 2 2 1 1 1 1 5 3 2 % Value change -30.6% -55.1% 9.1% 1,053.7% -42.2% -74.4%

Financial Adviser League Tables by Deal Count Q1 2011

Rank Q1 2010 2011 1 1 33 2 3 3 22 4 16 5 7 6 2 7 18 8 9 45 10 House China International Capital Haitong Securities Citigroup CITIC Securities China eCapital Goldman Sachs Morgan Stanley GF Securities Kim Eng Securities Access Capital Value ($m) 4,957 1,696 1,083 816 246 3,697 2,901 1,073 732 417 Deal count 5 5 3 3 3 2 2 2 2 2 Count change -1 4 -1 2 1 0 -2 1 1

www.mergermarket.com 1

Greater China M&A Roundup Q1 2011

Legal Adviser League Tables by Value Q1 2011

Rank Q1 2010 2011 1 29 2 35 3 4= 4= 4= 11 7 7 8 9= 9= 9= House Jun He Law Offices Simpson Thacher & Bartlett DLA Piper GKH Law Offices Goldfarb, Levy, Eran, Meiri & Co Herzog, Fox and Neeman Allen & Overy Skadden Arps Slate Meagher & Flom Selmer Thommessen Wiersholm Value ($m) 2,740 2,703 2,562 2,423 2,423 2,423 2,324 2,280 2,000 2,000 2,000 Deal count 2 2 3 1 1 1 3 2 1 1 1 % Value change 1,007.8% 2,071.2% -6.2% -29.8% -

Legal Adviser League Tables by Deal Count Q1 2011

Rank Q1 2010 2011 1 29 2 35 3 4= 4= 4= 11 7 7 8 9= 9= 9= House Jun He Law Offices Simpson Thacher & Bartlett DLA Piper GKH Law Offices Goldfarb, Levy, Eran, Meiri & Co Herzog, Fox and Neeman Allen & Overy Skadden Arps Slate Meagher & Flom Selmer Thommessen Wiersholm Value ($m) 2,740 2,703 2,562 2,423 2,423 2,423 2,324 2,280 2,000 2,000 2,000 Deal count 2 2 3 1 1 1 3 2 1 1 1 Count change 10 21 0 0 -

HK Financial Adviser League Tables by Value Q1 2011

Rank Q1 2010 2011 8 1 2 2 3 9 4 6 5= 5= 29 7 8= 18 8= 1 8= House China International Capital Goldman Sachs Standard Chartered JPMorgan Deutsche Bank Kim Eng Securities Access Capital Greenhill & Co Macquarie Group Morgan Stanley Value ($m) 2,997 2,883 970 925 523 523 469 457 457 457 Deal count 2 3 3 1 1 1 3 1 1 1 % Value change 608.5% -0.8% 126.7% 7.6% 517.1% 101.3% -85.3%

Financial Adviser League Tables by Deal Count Q1 2011

Rank Q1 2010 2011 4 1 2 9 3 2 4 5 6 6 7 8 12 9 10 House Goldman Sachs Standard Chartered Access Capital Somerley M&A International China International Capital Credit Suisse Ample Capital UBS Investment Bank INCU Corporate Finance Value ($m) 2,883 970 469 384 142 2,997 454 385 196 54 Deal count 3 3 3 3 3 2 2 2 2 2 Count change 1 1 -1 0 1 -

Legal Adviser League Tables by Value Q1 2011

Rank Q1 2010 2011 51 1= 1= 3 3 4 12 5 6 23 7 21 8 9= 43 9= 9= 17 9= House DLA Piper Jun He Law Offices Zhong Lun Law Firm Freshfields Bruckhaus Deringer Skadden Arps Slate Meagher & Flom Allen & Gledhill Clifford Chance Mallesons Stephen Jaques Jincheng, Tongda & Neal King & Wood Morrison & Foerster Richards Butler in association with Reed Smith Value ($m) 2,497 2,497 925 863 608 523 500 414 402 402 402 402 Deal count 1 1 1 5 2 1 2 1 1 1 1 1 % Value change 9,148.1% -97.6% -81.9% -6.7% -59.3% 268.8% -72.1%

Legal Adviser League Tables by Deal Count Q1 2011

Rank Q1 2010 2011 1 1 6 2 17 3 2 4 16 5 19 6= 6= 8 9 15 10 House Freshfields Bruckhaus Deringer Skadden Arps Slate Meagher & Flom Clifford Chance Slaughter and May Linklaters DLA Piper Jun He Law Offices Zhong Lun Law Firm Allen & Gledhill Mallesons Stephen Jaques Value ($m) 863 608 500 369 196 2,497 2,497 925 523 414 Deal count 5 2 2 2 2 1 1 1 1 1 Count change -5 -2 0 -3 0 -1 -1

Cross Border M&A

Deal Value Breakdown Q1 2011

Change Deal Value ($m) Deal count % Value count 14,114 162 33.8% -23 7,059 10 99.6% 5 8,197 5 -9.6% 1 0 0 -100.0% -1 29,370 177 1.5% -18

Deal Size ($m) 5 500m* 501m 1,000m 1,001m 5,000m 5,000m and over Total

www.mergermarket.com 2

Greater China M&A Roundup Q1 2011

Industry Analysis

Sector Financial Services Industrials & Chemicals Energy, Mining & Utilities Media Consumer Real Estate Technology Pharma, Medical & Biotech Transport Construction Telecommunications Business Services Leisure Agriculture Total Value ($m) 8,665 5,839 3,953 1,958 1,804 1,378 1,231 1,054 911 796 637 573 469 103 29,371 2011Q1 market share 29.5% 19.9% 13.5% 6.7% 6.1% 4.7% 4.2% 3.6% 3.1% 2.7% 2.2% 2.0% 1.6% 0.4% Deal count 16 38 21 5 21 8 18 14 7 8 2 11 6 2 177 Value ($m) 8,199 1,973 6,435 47 2,011 3,916 1,284 431 2,333 677 630 692 111 194 28,933 2010Q1 market share 28.3% 6.8% 22.2% 0.2% 7.0% 13.5% 4.4% 1.5% 8.1% 2.3% 2.2% 2.4% 0.4% 0.7% change Deal count 16 37 27 5 27 19 19 12 10 8 2 7 4 2 195 Value (%) 5.7% 195.9% -38.6% 4,066.0% -10.3% -64.8% -4.1% 144.5% -61.0% 17.6% 1.1% -17.2% 322.5% -46.9% 1.5% Deal count 0 1 -6 0 -6 -11 -1 2 -3 0 0 4 2 0 -18

Top Announced Deals Q1 2011

Ann. Date Bidder company 14-Mar-11 Dr Cheng Yu-Tung (Private Investor) Target Company Ping An Insurance (Group) Company of China Ltd (3.44% Stake) Makhteshim Agan Industries Limited (60% Stake) Seller company Buy-side Advisory Sell-side Advisory FA: China International Capital; Goldman Sachs LA: DLA Piper; Jun He Law Offices LA: Goldfarb, Levy, Eran, Meiri & Co.; Herzog, Fox and Neeman; Kirkland & Ellis FA: Morgan Stanley LA: Debevoise & Plimpton; Lee and Li Attorneys at Law FA: Moelis & Company LA: Thommessen; Wiersholm FA: Morgan Stanley LA: Freshfields Bruckhaus Deringer; Clifford Chance Deal Value ($m) 2,497

11-Jan-11 China National Chemical Corporation

FA: Compass Advisers LA: GKH Law Offices; Simpson Thacher & Bartlett American International Group Inc FA: Citigroup LA: Baker & McKenzie; Freshfields Bruckhaus Deringer FA: Royal Bank of Scotland Group LA: Selmer; Skadden Arps Slate Meagher & Flom FA: Bank of America Merrill Lynch LA: Allen & Overy

2,423

12-Jan-11 Ruentex Group; and Pou Chen Corporation

Nan Shan Life Insurance Company Ltd

2,160

11-Jan-11 China National Bluestar (Group) Co Ltd

Elkem AS

Orkla ASA

2,000

1-Feb-11

Wanhua Industrial Group Co BorsodChem Zrt (58% Stake) VCP Vienna; and Permira Ltd

1,701

Notes All data is based on announced transactions over US$ 5m. Deals with undisclosed deal values are included where the targets turnover exceeds US$ 10m. Deals where the stake acquired is less than 30% will only be included if their value is greater than US$ 100m. Activities excluded include property transactions and restructurings where the ultimate shareholders interests are not changed. All data excludes minority stake deals (10% - 30%) where the dominant target geography is Asia-Pacific and the deal value is less than US$ 100m. M&A Trend: Based on the dominant geography of the target company being China, Hong Kong, Taiwan or Macau. Excludes lapsed and withdrawn bids; League Tables: Based on the dominant geography of the target, bidder or seller company being China, Hong Kong, Taiwan or Macau for Greater China tables, and China/Hong Kong for their respective tables. The financial adviser tables exclude lapsed and withdrawn bids and the legal adviser tables include lapsed and withdrawn bids. Previous period changes refer to the time period Q1 2010; Cross Border M&A: Inbound refers to cross border M&A where the dominant geography of the target company is China, Hong Kong, Taiwan & Macau. Outbound refers to cross border M&A where the dominant geography of the bidder company is China, Hong Kong, Taiwan & Macau. Excludes lapsed and withdrawn bids; Deal Value Breakdown: Excludes lapsed and withdrawn bids. Previous period changes refer to the time period Q1 2010. $5m to $500m range includes undisclosed deals; Industry Analysis: Based on the dominant geography of the target company being China, Hong Kong, Taiwan or Macau. Industry sectors represent the primary industry sector of the target company only. Excludes lapsed and withdrawn bids; Top Announced Deals: Based on the dominant geography of the target, bidder or seller company being China, Hong Kong, Taiwan or Macau. Excludes lapsed and withdrawn bids. FA refers to Financial Adviser and LA refers to Legal Adviser. Criteria: http://www.mergermarket.com/pdf/deal_criteria.pdf All data correct as of 13 April 2011.

Contacts PR: Michel Chau michel.chau@mergermarket.com Tel: +852 2158 9706 Deal Submissions: Terre Choi terre.choi@mergermarket.com Tel: +852 2158 9733

www.mergermarket.com 3

Das könnte Ihnen auch gefallen

- Credit Swiss Pitch BookDokument39 SeitenCredit Swiss Pitch BookAmit Soni100% (5)

- Why Moats Matter: The Morningstar Approach to Stock InvestingVon EverandWhy Moats Matter: The Morningstar Approach to Stock InvestingBewertung: 4 von 5 Sternen4/5 (3)

- Process of Trial of Criminal Cases in India (Flow Chart)Dokument1 SeiteProcess of Trial of Criminal Cases in India (Flow Chart)Arun Hiro100% (1)

- Aerospace & Defense, Mergers and Acquisitions Environment, and Company ValuationDokument21 SeitenAerospace & Defense, Mergers and Acquisitions Environment, and Company ValuationAlex HongNoch keine Bewertungen

- Fundamental Analysis - BNY Melon - HimaniDokument8 SeitenFundamental Analysis - BNY Melon - HimaniAnjali Angel ThakurNoch keine Bewertungen

- KKR Investor UpdateDokument8 SeitenKKR Investor Updatepucci23Noch keine Bewertungen

- 2011 Houlihan Lokey PPA Study PDFDokument49 Seiten2011 Houlihan Lokey PPA Study PDFSoloUnico100% (1)

- StratificationDokument91 SeitenStratificationAshish NairNoch keine Bewertungen

- Jes Staley, Investment Bank Chief Executive Officer: February 15, 2011Dokument20 SeitenJes Staley, Investment Bank Chief Executive Officer: February 15, 2011pepecolatanNoch keine Bewertungen

- MinimumEHS Standards For Projects-V3Dokument113 SeitenMinimumEHS Standards For Projects-V3Ammu KuttiyNoch keine Bewertungen

- BCG Private Equity Market AnalysisDokument47 SeitenBCG Private Equity Market Analysisalex.nogueira396100% (1)

- Morning Pack: Regional EquitiesDokument59 SeitenMorning Pack: Regional Equitiesmega_richNoch keine Bewertungen

- Doyle - The Economic System (Wiley, 2005)Dokument407 SeitenDoyle - The Economic System (Wiley, 2005)Febrian Febri100% (1)

- Value Investing: From Graham to Buffett and BeyondVon EverandValue Investing: From Graham to Buffett and BeyondBewertung: 4 von 5 Sternen4/5 (24)

- Api 4G PDFDokument12 SeitenApi 4G PDFAluosh AluoshNoch keine Bewertungen

- General CatalystDokument20 SeitenGeneral CatalystPando DailyNoch keine Bewertungen

- Wall Chart - Drying - How Wood Loses MoistureDokument1 SeiteWall Chart - Drying - How Wood Loses MoistureXihuitl61100% (1)

- Financial Institutions, Valuations, Mergers, and Acquisitions: The Fair Value ApproachVon EverandFinancial Institutions, Valuations, Mergers, and Acquisitions: The Fair Value ApproachNoch keine Bewertungen

- Bakery Interview QuestionsDokument15 SeitenBakery Interview QuestionsKrishna Chaudhary100% (2)

- Piggery BookletDokument30 SeitenPiggery BookletVeli Ngwenya100% (2)

- Quantum PauseDokument5 SeitenQuantum Pausesoulsearch67641100% (2)

- Episode 6: Deductive and Inductive Methods of Teaching: My Learning Episode OverviewDokument10 SeitenEpisode 6: Deductive and Inductive Methods of Teaching: My Learning Episode OverviewJustine Elle Vijar85% (13)

- M&A Trend Report: Q1-Q3 2013: JapanDokument3 SeitenM&A Trend Report: Q1-Q3 2013: JapanKPNoch keine Bewertungen

- Momentum Growth & Value: (F) (F) (F) (F)Dokument3 SeitenMomentum Growth & Value: (F) (F) (F) (F)api-254669145Noch keine Bewertungen

- Knight Capital Group, Inc.: Sandler O'Neill Global Exchange and Brokerage Conference - June 7, 2012Dokument13 SeitenKnight Capital Group, Inc.: Sandler O'Neill Global Exchange and Brokerage Conference - June 7, 2012JohnNoch keine Bewertungen

- Wing Tai Holdings: 2QFY11 Results ReviewDokument4 SeitenWing Tai Holdings: 2QFY11 Results ReviewRaymond LuiNoch keine Bewertungen

- Bluechips Stepped Center Stage Amidst Rallying of IndicesDokument6 SeitenBluechips Stepped Center Stage Amidst Rallying of IndicesRandora LkNoch keine Bewertungen

- Minmetals Land (230 HK) : Making The Right Moves But Doubts LingerDokument4 SeitenMinmetals Land (230 HK) : Making The Right Moves But Doubts LingerChee Siang LimNoch keine Bewertungen

- Ib Newsletter - As of Jun 302011Dokument5 SeitenIb Newsletter - As of Jun 302011Anshul LodhaNoch keine Bewertungen

- 1Q13 Restructuring Advisory ReviewDokument5 Seiten1Q13 Restructuring Advisory ReviewAshish KrishnaNoch keine Bewertungen

- Daily Trade Journal - 11.06.2013Dokument7 SeitenDaily Trade Journal - 11.06.2013Randora LkNoch keine Bewertungen

- Deallogic Global M&a ReviewDokument19 SeitenDeallogic Global M&a ReviewDisel VinNoch keine Bewertungen

- Champion REIT 1H12Dokument53 SeitenChampion REIT 1H12Bryan LiNoch keine Bewertungen

- Mergermarket PDFDokument5 SeitenMergermarket PDFAnonymous Feglbx5Noch keine Bewertungen

- Daily Trade Journal - 07.02Dokument13 SeitenDaily Trade Journal - 07.02ran2013Noch keine Bewertungen

- March11 Vanguard PresentationDokument32 SeitenMarch11 Vanguard Presentationcnvb alskNoch keine Bewertungen

- Most Market Roundup: Daily Technical AnalysisDokument7 SeitenMost Market Roundup: Daily Technical AnalysisBhupendra_Rawa_1185Noch keine Bewertungen

- JPM Weekly Commentary 12-26-11Dokument2 SeitenJPM Weekly Commentary 12-26-11Flat Fee PortfoliosNoch keine Bewertungen

- Q2 2012 OfficeSnapshotDokument2 SeitenQ2 2012 OfficeSnapshotAnonymous Feglbx5Noch keine Bewertungen

- Regulatory Changes: Initiated by SEBIDokument6 SeitenRegulatory Changes: Initiated by SEBINachammai SwaminathanNoch keine Bewertungen

- Philippines: Overall Performance Basic FactsDokument4 SeitenPhilippines: Overall Performance Basic FactsronanvillagonzaloNoch keine Bewertungen

- Daily Trade Journal - 12.07.2013Dokument6 SeitenDaily Trade Journal - 12.07.2013Randora LkNoch keine Bewertungen

- WSJ Jpmfiling0510Dokument191 SeitenWSJ Jpmfiling0510Reza Abusaidi100% (1)

- Preliminary Mergers & Acquisitions Review: Deals IntelligenceDokument10 SeitenPreliminary Mergers & Acquisitions Review: Deals Intelligenceht5116Noch keine Bewertungen

- City DevelopmentsDokument6 SeitenCity DevelopmentsJay NgNoch keine Bewertungen

- Daily Trade Journal - 11.12.2012Dokument13 SeitenDaily Trade Journal - 11.12.2012randoralkNoch keine Bewertungen

- ReportDokument17 SeitenReportMadhur YadavNoch keine Bewertungen

- Daily Trade Journal - 05.03.2014Dokument6 SeitenDaily Trade Journal - 05.03.2014Randora LkNoch keine Bewertungen

- Presentation Duisenberg - 3Dokument43 SeitenPresentation Duisenberg - 3CigdemSahinNoch keine Bewertungen

- Erste - Ipo Workshop Jun 2012Dokument79 SeitenErste - Ipo Workshop Jun 2012kirdan011100% (1)

- Daily Trade Journal - 21.02Dokument12 SeitenDaily Trade Journal - 21.02ran2013Noch keine Bewertungen

- Financial Management: PortfolioDokument22 SeitenFinancial Management: Portfolioapi-100770959Noch keine Bewertungen

- Weekly OverviewDokument4 SeitenWeekly Overviewapi-150779697Noch keine Bewertungen

- Banks 1st Q 2012Dokument36 SeitenBanks 1st Q 2012annawitkowski88Noch keine Bewertungen

- University of Wales and Mdis: Introduction To Accounting (Hk004)Dokument11 SeitenUniversity of Wales and Mdis: Introduction To Accounting (Hk004)Muhd RizdwanNoch keine Bewertungen

- Daily Trade Journal - 05.02Dokument13 SeitenDaily Trade Journal - 05.02ran2013Noch keine Bewertungen

- CapitaMall Trust (CMT) Annual Report 2011Dokument228 SeitenCapitaMall Trust (CMT) Annual Report 2011dr_twiggyNoch keine Bewertungen

- Pitch Book SampleDokument58 SeitenPitch Book SampleThomas Kyei-BoatengNoch keine Bewertungen

- Fundamental Equity Analysis - S&P ASX 100 Members Australia)Dokument200 SeitenFundamental Equity Analysis - S&P ASX 100 Members Australia)Chris HuangNoch keine Bewertungen

- Daily Trade Journal - 30.01Dokument13 SeitenDaily Trade Journal - 30.01ran2013Noch keine Bewertungen

- Derivatives Market 150Dokument27 SeitenDerivatives Market 150kegnataNoch keine Bewertungen

- Ecnm Derivados Financieros OCC Dq112Dokument36 SeitenEcnm Derivados Financieros OCC Dq112Bentejui San Gines MolinaNoch keine Bewertungen

- Investment Banking Landscape India V4Dokument32 SeitenInvestment Banking Landscape India V4Keshav KhannaNoch keine Bewertungen

- IR Presentation AML CommunicationsDokument35 SeitenIR Presentation AML CommunicationsDrSues02Noch keine Bewertungen

- Daily Trade Journal - 31.12Dokument14 SeitenDaily Trade Journal - 31.12ran2013Noch keine Bewertungen

- B2 Table of ContentsDokument6 SeitenB2 Table of Contentsnoel87Noch keine Bewertungen

- Daily Trade Journal - 28.01.2014Dokument6 SeitenDaily Trade Journal - 28.01.2014Randora LkNoch keine Bewertungen

- Daily Market Note: EquitiesDokument7 SeitenDaily Market Note: Equitiesapi-166532035Noch keine Bewertungen

- Bloomberg Q1 2012 M&a Global League TablesDokument39 SeitenBloomberg Q1 2012 M&a Global League TablesMandeep SoorNoch keine Bewertungen

- Marxist Critique On LiberalsDokument17 SeitenMarxist Critique On LiberalsEmman TagubaNoch keine Bewertungen

- Click To Enlarge (The Skeptic's Annotated Bible, Hosea)Dokument11 SeitenClick To Enlarge (The Skeptic's Annotated Bible, Hosea)Philip WellsNoch keine Bewertungen

- Prgm-Sminr Faculties Identified Through FIP NIRCDokument9 SeitenPrgm-Sminr Faculties Identified Through FIP NIRCDonor CrewNoch keine Bewertungen

- SMEC01 CBRS Guide For NBC Reports - v1.1Dokument53 SeitenSMEC01 CBRS Guide For NBC Reports - v1.1phal sovannarithNoch keine Bewertungen

- 2019 - List of Equipment, Tools & MaterialsDokument3 Seiten2019 - List of Equipment, Tools & Materialsreynald manzanoNoch keine Bewertungen

- Biological Activity of Bone Morphogenetic ProteinsDokument4 SeitenBiological Activity of Bone Morphogenetic Proteinsvanessa_werbickyNoch keine Bewertungen

- IX Paper 2Dokument19 SeitenIX Paper 2shradhasharma2101Noch keine Bewertungen

- TV Studio ChainDokument38 SeitenTV Studio ChainKalpesh Katara100% (1)

- Downloaded From Manuals Search EngineDokument29 SeitenDownloaded From Manuals Search EnginehaivermelosantanderNoch keine Bewertungen

- Whether To Use Their GPS To Find Their Way To The New Cool Teen HangoutDokument3 SeitenWhether To Use Their GPS To Find Their Way To The New Cool Teen HangoutCarpovici Victor100% (1)

- Time Value of Money PDFDokument4 SeitenTime Value of Money PDFCalvin SandiNoch keine Bewertungen

- CVT / TCM Calibration Data "Write" Procedure: Applied VehiclesDokument20 SeitenCVT / TCM Calibration Data "Write" Procedure: Applied VehiclesАндрей ЛозовойNoch keine Bewertungen

- Full Download Test Bank For Ethics Theory and Contemporary Issues 9th Edition Mackinnon PDF Full ChapterDokument36 SeitenFull Download Test Bank For Ethics Theory and Contemporary Issues 9th Edition Mackinnon PDF Full Chapterpapismlepal.b8x1100% (16)

- CIR vs. Estate of Benigno P. Toda, JRDokument13 SeitenCIR vs. Estate of Benigno P. Toda, JRMrln VloriaNoch keine Bewertungen

- Jee Mathmatic PaperDokument16 SeitenJee Mathmatic PaperDeepesh KumarNoch keine Bewertungen

- Medical and Health Care DocumentDokument6 SeitenMedical and Health Care Document786waqar786Noch keine Bewertungen

- Physical Medicine Rehabilitation Brochure Bangkok 2020Dokument6 SeitenPhysical Medicine Rehabilitation Brochure Bangkok 2020nur yulia sariNoch keine Bewertungen

- Cu 5 - The Law Enforcement Pillar Part 2Dokument22 SeitenCu 5 - The Law Enforcement Pillar Part 2marygrace.sacbibit.lawNoch keine Bewertungen

- Edu602 Ubd TemplateDokument2 SeitenEdu602 Ubd Templateapi-481192424Noch keine Bewertungen

- Divorce: in The PhilippinesDokument4 SeitenDivorce: in The PhilippinesKidMonkey2299Noch keine Bewertungen

- Dragon Is The Fifth in The 12Dokument3 SeitenDragon Is The Fifth in The 12Waylon CahiligNoch keine Bewertungen