Beruflich Dokumente

Kultur Dokumente

Introduction To Finance & Accounting

Hochgeladen von

Nur AliyahOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Introduction To Finance & Accounting

Hochgeladen von

Nur AliyahCopyright:

Verfügbare Formate

Introduction to Finance & Accounting

This course provides participants with applied knowledge in the use of accounting and finance data so as to make them aware of the basis on which key financial decisions are made. In particular the course seeks to examine corporate decisions in the context of maximising shareholder value. The course will explore the practical realities of effective financial management reporting system within their organisation; interpret and critically analyse financial results; select and use appropriate financial decision-making tools; contribute to improving the organizations management of working capital; apply best practice business planning, budgeting and control techniques for their departments. The course assumes no previous knowledge of accounting or finance and is ideally suited to supervisors and managers, facilitators and senior staff. AIMS The aims of this course are to: i) ii) iii) iv) v) vi) vii) viii) provide participants with the issues and strategies needed to enhance effective decision making. to understand the importance of different types of costs eg sunk and to illustrate the use the need for cost attribution and the importance pf cost objective. derive breakeven points using various different techniques to understand the concept and techniques of price setting to apply recent innovations in finance to their working environments. develop an understanding of the more important concepts and components in accounting and financial management; provide frameworks to formulate and appraise accounting concepts, strategies and policies; apply these techniques in business situations (both private and public), and understand the interface between financial management and the other functions in an organization.

Audience Executives, Managers and line supervisors who receive management reports but are from a non-financial background. Recent appointees to management positions Accounts staff, who prepares inputs to management information systems, will also benefit.

Course Objectives Upon completion of the training course, participants should be able to: Evaluate different financial strategies. Analyse the companys performance through their departmental performance. Manage their own department more effectively Enhance their decision-making and relation to price setting Evaluate their strengths and weaknesses as a means of assessing the financial performance of an organization. Ability to understand the key ingredients of good budget construction and budgetary control. Course Outline Introduction to accounting and accounting principles. Financial reporting Interpretation and Analysis of Financial Statements Financial Forecasting Working Capital Management Cost Behaviour and cost behaviour Budgeting: profit planning & control Std costing and variance analysis Flexible budgeting & OH cost control Short Term Decision Making The Time Value of Money Capital Appraisal Risk and Rates of Return, Cost of Capital Financial reporting Financial Statement Analysis Cost Concepts and Working Capital Management Short Term Decision Making Capital Appraisal Budgetary Control and Planning Internal Performance Evaluation and Transfer Pricing

Das könnte Ihnen auch gefallen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Lab 4Dokument8 SeitenLab 4valen martaNoch keine Bewertungen

- Final Sheet DCF - With SynergiesDokument4 SeitenFinal Sheet DCF - With SynergiesAngsuman BhanjdeoNoch keine Bewertungen

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDokument29 SeitenPaper - 1: Principles & Practice of Accounting Questions True and FalseMayur bhujadeNoch keine Bewertungen

- Marksheet: Qazi Asif ZameerDokument1 SeiteMarksheet: Qazi Asif ZameerBijak DataNoch keine Bewertungen

- Quiz ReceivablesDokument9 SeitenQuiz ReceivablesJanella PatriziaNoch keine Bewertungen

- Chazpter One Accounting For InventoriesDokument11 SeitenChazpter One Accounting For InventoriesyebegashetNoch keine Bewertungen

- Is Excel Participant - Simplified v2Dokument10 SeitenIs Excel Participant - Simplified v2Aaron Pool0% (2)

- Bir EswarDokument17 SeitenBir EswarVishal BawaneNoch keine Bewertungen

- Exercise Advanced Accounting SolutionsDokument14 SeitenExercise Advanced Accounting SolutionsMiko Victoria Vargas75% (4)

- Bachelor of Science in AccountancyDokument3 SeitenBachelor of Science in Accountancyhershey alexanderNoch keine Bewertungen

- D. Lilly Orchids CompanyDokument4 SeitenD. Lilly Orchids CompanyDexusNoch keine Bewertungen

- Lembar Jurnal Untuk PT. ElminaDokument5 SeitenLembar Jurnal Untuk PT. ElminaMuhammad Alviansyah0% (1)

- ABDC Journal List 11072018Dokument124 SeitenABDC Journal List 11072018Rajdeep SharmaNoch keine Bewertungen

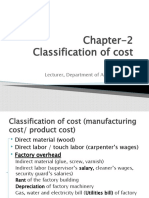

- Chapter 2 (Cost Classification)Dokument13 SeitenChapter 2 (Cost Classification)Najia MuktaNoch keine Bewertungen

- The Revenue CycleDokument11 SeitenThe Revenue Cyclejulia micaelaNoch keine Bewertungen

- 2857 - Accounting For Governmental and Non-Profit Organizations-203203-Chapter 3Dokument70 Seiten2857 - Accounting For Governmental and Non-Profit Organizations-203203-Chapter 3shital_vyas1987Noch keine Bewertungen

- SubjectCodesandSyllabus July2010Dokument69 SeitenSubjectCodesandSyllabus July2010Abhranil GuptaNoch keine Bewertungen

- Equity Method (First Year of Acquisition)Dokument3 SeitenEquity Method (First Year of Acquisition)Angel Chane OstrazNoch keine Bewertungen

- SV - Topic 910 - IAS 8+ IAS 10Dokument17 SeitenSV - Topic 910 - IAS 8+ IAS 10Nguyễn Thị Hà TiênNoch keine Bewertungen

- Uk Examtt Dec22v10Dokument40 SeitenUk Examtt Dec22v10AliNoch keine Bewertungen

- Financial Accounting The Impact On Decision Makers 10th Edition Porter Solutions ManualDokument41 SeitenFinancial Accounting The Impact On Decision Makers 10th Edition Porter Solutions Manualhildabacvvz100% (27)

- Financial Accounting: A Business Process ApproachDokument42 SeitenFinancial Accounting: A Business Process ApproachPeterNoch keine Bewertungen

- Lesson 1 CFASDokument14 SeitenLesson 1 CFASkenneth coronelNoch keine Bewertungen

- Rights & Duties of AuditorDokument9 SeitenRights & Duties of AuditorShilpa Mano0% (1)

- AFARDokument15 SeitenAFARBetchelyn Dagwayan BenignosNoch keine Bewertungen

- Easton, McAnally, Sommers y Zhang. Financial Statement Analysis & Valuation. Módulo 2 - Páginas 2-32 A 2-33 (C, D y E)Dokument2 SeitenEaston, McAnally, Sommers y Zhang. Financial Statement Analysis & Valuation. Módulo 2 - Páginas 2-32 A 2-33 (C, D y E)Rafael Ernesto Ponce PérezNoch keine Bewertungen

- GOFWAHDokument4 SeitenGOFWAHsoniaNoch keine Bewertungen

- Computer An Important System in The Processing of Accounting InformationDokument21 SeitenComputer An Important System in The Processing of Accounting Informationharsh143352100% (1)

- Aue4862 2023 TL 102 0 BDokument133 SeitenAue4862 2023 TL 102 0 BLubabalo MapipaNoch keine Bewertungen

- 9.the Risk Associated With A Company's Survival and Profitability Is Referred To AsDokument2 Seiten9.the Risk Associated With A Company's Survival and Profitability Is Referred To Aslie SielNoch keine Bewertungen