Beruflich Dokumente

Kultur Dokumente

Letter Supporting The Shareholder Protection Act (Final)

Hochgeladen von

Sunlight FoundationOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Letter Supporting The Shareholder Protection Act (Final)

Hochgeladen von

Sunlight FoundationCopyright:

Verfügbare Formate

RE:

Shareholder Protection Act

Dear Member of Congress, We write to you to encourage your support of the Shareholder Protection Act, soon to be introduced by Representative Capuano (MA), and Senators Menendez (NJ) and Blumenthal (CT). Our organizations come from diverse backgrounds, with concerns ranging from constitutional rights to corporate governance to protecting our air and water. We have many different priorities, but we all agree that last years unprecedented Supreme Court decision, Citizens United v. Federal Election Commission, requires a strong response. We are troubled for several reasons by the Supreme Courts decision to give corporations the right under the First Amendment to spend unlimited funds from their corporate treasuries to support or attack candidates. In the electoral arena, this decision has brought a flood of new money into elections, ratcheting up the cost of campaigns and increasing the time and resources needed for fundraising. Spending by outside groups funded largely by corporate interests and intended to influence the 2010 elections was more than four times as high than in 2006, the last mid-term cycle. The ads funded by unaccountable corporate interests fueled massive attacks that compounded the negative tone of campaigns and added to the public cynicism of our elections. In the legislative arena, the mere threat of unlimited corporate political spending gives corporate lobbyists a large new club to wield when lobbying lawmakers, and makes it harder for legislators to vote their conscience. In corporate governance, there are no rules or procedures established in the United States to ensure that shareholders those who actually own the wealth of corporations are informed of, or have the right to approve, decisions on spending their money on politics. The Shareholder Protection Act provides a framework to rein in some of the damage in this troubling, new political landscape. Specifically, the Act would: Mandate prior approval by shareholders for an annual political expenditure budget chosen by the management for a publicly held corporation. Require that each specific corporate political expenditure over a certain dollar threshold be approved by the Board of Directors and promptly disclosed to shareholders and the public. Require that institutional investors inform all persons in their investment funds how they voted on corporate political expenditures. Post on the Securities Exchange Commission web page how much each corporation is spending on elections and which candidates or issues they support or oppose.

American business leaders are concerned about the pressure on business to donate to political campaigns, and the influx of large, undisclosed donations to third party political organizations that are not required to disclose their sources of funding. In a Zogby International poll commissioned by the business-led Committee for Economic Development (CED), two-thirds of business leaders polled agreed with the statement: the lack of transparency and oversight in corporate political

activity encourages behavior that puts corporations at legal risk and endangers corporate reputations. In addition to business leaders, the general public at large believes in transparency and giving shareholders a voice. A SurveyUSA poll commissioned by People for the American Way in February 2010 found that 75% of Americans believe that publicly traded companies should get approval from their shareholders before spending money on an election. Support for shareholder protection was strong across all ideological groups surveyed, with Republicans and those who identified as conservative slightly more likely to support shareholders having a say in their companys political spending (79%) than Democrats and those who identified as liberals (74%). Responsible corporate governance requires the involvement of informed shareholders and is not a partisan issue. We believe that holding management accountable and ensuring that political spending decisions are made transparently and in pursuit of sound business is important for both the market and for democracy. We urge you to support the reasoned response that is the Shareholder Protection Act. Brennan Center Center for Media and Democracy Chesapeake Climate Action Network Citizen Works Citizens for Responsibility and Ethics in Washington Coffee Party USA Common Cause Corporate Accountability International Corporate Ethics International/Business Ethics Network Demos Free Speech for People Friends of the Earth Greenpeace Holy Cross International Justice Office

Illinois Campaign for Political Reform Krull and Company, Peter W. Krull, President & Founder League of Conservation Voters Maryknoll Office for Global Concerns National Consumers League North Caroline Center for Voter Engagement NorthStar Asset Management, Inc. Ohio Citizen Action People for the American Way Progressive States Network Public Campaign Public Citizen Service Employees International Union Social Equity Group, Ron Freund and Duncan Meaney Strategic Counsel on Corporate Accountability, Sanford Lewis Sunlight Foundation U.S. Public Interest Research Group United Food and Commercial Workers West Virginia Citizen Action Wisconsin Democracy Campaign Zevin Asset Management, LLC

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

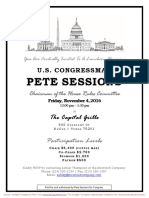

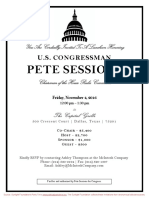

- ReceptionDokument2 SeitenReceptionSunlight FoundationNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Information SessionDokument2 SeitenInformation SessionSunlight FoundationNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

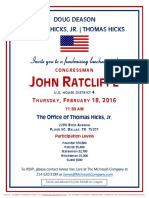

- LuncheonDokument4 SeitenLuncheonSunlight FoundationNoch keine Bewertungen

- FundraiserDokument2 SeitenFundraiserSunlight FoundationNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- FundraiserDokument2 SeitenFundraiserSunlight FoundationNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- FundraiserDokument1 SeiteFundraiserSunlight FoundationNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- LuncheonDokument2 SeitenLuncheonSunlight FoundationNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- ReceptionDokument2 SeitenReceptionSunlight FoundationNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- LuncheonDokument2 SeitenLuncheonSunlight FoundationNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- ReceptionDokument2 SeitenReceptionSunlight FoundationNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- FundraiserDokument2 SeitenFundraiserSunlight FoundationNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- #PromoteOpenData: How Cities Can Use Social Media To Publicize Open Data PolicyDokument14 Seiten#PromoteOpenData: How Cities Can Use Social Media To Publicize Open Data PolicySunlight FoundationNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Improving Hands-On Experimentation Through Model Making and Rapid Prototyping: The Case of The University of Botswana's Industrial Design StudentsDokument6 SeitenImproving Hands-On Experimentation Through Model Making and Rapid Prototyping: The Case of The University of Botswana's Industrial Design StudentsnaimshaikhNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- IPA Digital Media Owners Survey Autumn 2010Dokument33 SeitenIPA Digital Media Owners Survey Autumn 2010PaidContentUKNoch keine Bewertungen

- Q4-ABM-Business Ethics-12-Week-1Dokument4 SeitenQ4-ABM-Business Ethics-12-Week-1Kim Vpsae0% (1)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Tutor InvoiceDokument13 SeitenTutor InvoiceAbdullah NHNoch keine Bewertungen

- MK Slide PDFDokument26 SeitenMK Slide PDFPrabakaran NrdNoch keine Bewertungen

- Feb 1 - ScottDokument17 SeitenFeb 1 - ScottNyannnNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- FORTRESS EUROPE by Ryan BartekDokument358 SeitenFORTRESS EUROPE by Ryan BartekRyan Bartek100% (1)

- 3658 - Implement Load BalancingDokument6 Seiten3658 - Implement Load BalancingDavid Hung NguyenNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- ch09 (POM)Dokument35 Seitench09 (POM)jayvee cahambingNoch keine Bewertungen

- The Distracted Mind - ExcerptDokument15 SeitenThe Distracted Mind - Excerptwamu885Noch keine Bewertungen

- The First Step Analysis: 1 Some Important DefinitionsDokument4 SeitenThe First Step Analysis: 1 Some Important DefinitionsAdriana Neumann de OliveiraNoch keine Bewertungen

- Mis 2023Dokument62 SeitenMis 2023Ana Mae MunsayacNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- MInor To ContractsDokument28 SeitenMInor To ContractsDakshita DubeyNoch keine Bewertungen

- Chapter 5Dokument24 SeitenChapter 5Tadi SaiNoch keine Bewertungen

- Thermal (TE-411,412,413,414,511)Dokument25 SeitenThermal (TE-411,412,413,414,511)nved01Noch keine Bewertungen

- Exposicion Verbos y AdverbiosDokument37 SeitenExposicion Verbos y AdverbiosmonicaNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Breast Cancer ChemotherapyDokument7 SeitenBreast Cancer Chemotherapydini kusmaharaniNoch keine Bewertungen

- Mohd Ali 17: By:-Roll NoDokument12 SeitenMohd Ali 17: By:-Roll NoMd AliNoch keine Bewertungen

- Case Study Diverticulosis PaperDokument12 SeitenCase Study Diverticulosis Paperapi-381128376100% (3)

- Detailed Lesson Plan in PED 12Dokument10 SeitenDetailed Lesson Plan in PED 12alcomfeloNoch keine Bewertungen

- Paper 2Dokument8 SeitenPaper 2Antony BrownNoch keine Bewertungen

- ( (LEAD - FIRSTNAME) ) 'S Spouse Visa PackageDokument14 Seiten( (LEAD - FIRSTNAME) ) 'S Spouse Visa PackageDamon Culbert0% (1)

- Partnership & Corporation: 2 SEMESTER 2020-2021Dokument13 SeitenPartnership & Corporation: 2 SEMESTER 2020-2021Erika BucaoNoch keine Bewertungen

- Book Review Leffel Cateura, Oil Painting SecretsDokument4 SeitenBook Review Leffel Cateura, Oil Painting SecretsAnonymous H3kGwRFiENoch keine Bewertungen

- Domestic ViolenceDokument2 SeitenDomestic ViolenceIsrar AhmadNoch keine Bewertungen

- NAT FOR GRADE 12 (MOCK TEST) Language and CommunicationDokument6 SeitenNAT FOR GRADE 12 (MOCK TEST) Language and CommunicationMonica CastroNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Character Skills Snapshot Sample ItemsDokument2 SeitenCharacter Skills Snapshot Sample ItemsCharlie BolnickNoch keine Bewertungen

- Đại Từ Quan Hệ Trong Tiếng AnhDokument5 SeitenĐại Từ Quan Hệ Trong Tiếng AnhNcTungNoch keine Bewertungen

- Pengaruh Kompetensi Spiritual Guru Pendidikan Agama Kristen Terhadap Pertumbuhan Iman SiswaDokument13 SeitenPengaruh Kompetensi Spiritual Guru Pendidikan Agama Kristen Terhadap Pertumbuhan Iman SiswaK'lala GrianNoch keine Bewertungen

- Definition Environmental Comfort in IdDokument43 SeitenDefinition Environmental Comfort in Idharis hambaliNoch keine Bewertungen