Beruflich Dokumente

Kultur Dokumente

Application of Neural Networks in Financial

Hochgeladen von

Stenly Brejk MaximOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Application of Neural Networks in Financial

Hochgeladen von

Stenly Brejk MaximCopyright:

Verfügbare Formate

Application of Neural Networks in Financial

Data Mining

Defu Zhang, Qingshan Jiang, Xin Li

AbstractThis paper deals with the application of a well-known

neural network technique, multi-layer back-propagation (BP) neural

network, in financial data mining. A modified neural network

forecasting model is presented, and an intelligent mining system is

developed. The system can forecast the buying and selling signs

according to the prediction of future trends to stock market, and

provide decision-making for stock investors. The simulation result of

seven years to Shanghai Composite Index shows that the return

achieved by this mining sys-tem is about three times as large as that

achieved by the buy and hold strategy, so it is advantageous to apply

neural networks to forecast financial time series, the different investors

could benefit from it.

Keywordsdata mining, neural network, stock forecasting.

I. INTRODUCTION

N

EURAL networks are a class of generalized nonlinear

nonparametric models inspired by studies of the human

brain. Their main advantage is that they can approximate any

nonlinear function to an arbitrary degree of accuracy with a

suitable number of hidden units [1]. Neural networks get their

intelligence from learning process, and then this intelligence

makes them have the capability of auto-adaptability, association

and memory to perform certain tasks. For a more detailed

description of neural networks, the interested readers are

referred to the papers in [2, 3, 4].

Financial forecasting is of considerable practical interest.

Due to neural networks can mine valuable information from a

mass of history information and be efficiently used in financial

areas, so the applications of neural networks to financial

forecasting have been very popular over the last few years [5, 6,

7, 8, 9, 10]. Some researches [11, 12] show that neural networks

performed better than conventional statistical approaches in

financial forecasting and are an excellent data mining tool.

However, a large number of published researches only pay

attention to giving the experimental simulating results and

seldom give detailed description from modeling to forecasting

to trading, and say nothing of giving their critical techniques. In

addition, despite neural networks have many advantages,

however, they still meet some problems, for example,

overfitting and poor explanation capability and so on. Although

many researchers pay special attention to avoid those problems,

the result is still dissatisfactory. In this paper, all mentioned

above will be further investigated.

Manuscript received November 3, 2004. This work was supported in part by

Xiamen University under Grant X01122.

D. F. Zhang is with the Department of Computer Science, 361005, Fujian,

China (Tel: 0086-0592-5918207; fax: 0086-0592-2183502; e-mail: dfzhang@

xmu.edu.cn).

Though the efficient market hypothesis [13], which is

currently the most popular view on market behavior, states that

no mining system can achieve consistently average returns

exceeding the average returns of the market indices as a whole.

However, many research results have shown that the mining

system based on neural networks can outperform market if it is

properly designed [14]. In this paper, the theory of neural

networks is briefly discussed, and a neural network model to

forecast future trends of stock time series is researched. Some

improved strategies are presented. At last, an intelligent mining

system is developed. The simulation results to Shanghai

Composite Index show that neural networks can be applied to

make profit for different investors.

II. FINANCIAL TIME SERIES FORECASTING

A time series is a sequence of vectors

, where x represents

past value which varies with the time

) , , , , , (

1 2

=

t t i t n t t

x x x x X

i t

t , such as stock price. One

of the aims in the paper is to predict the future trends on the base

of past price patterns . It can be formally stated as follows:

find a function , so that:

t

X

R R F

n

:

~

) , , , , , (

1 2

=

t t i t n t t

x x x x F x ,

~

where

t

x is a predict value.

1

~

+ t

x can be predicted after x

t

~

is

predicted based on the following function

)

~

, , , , , , (

~

1 2 ) 1 ( 1 t t t i t n t t

x x x x x F x

+

= .

~ ~ ~

Similarly,

1 3 2

, , ,

+ + + d t t t

x x x can be predicted. The neural

networks of performing prediction are to approximate F . The

trained network is then used to predict the price of future

days.

d

It is well known that stock market is nonlinear dynamical

system, and is affected mainly by factors like interest rates,

inflation, economic growth, political situation and so on.

Although there is correlation, dependency and interaction

between these factors is obvious, their relation is rather difficult

to express in mathematical function, for example F . So

forecasting financial markets is a really challenging task. It is

well known that the closing price of stock market is one of the

most important factors and includes a lot of useful information,

so the closing price time series is selected to predict the future

trends of stock market.

World Academy of Science, Engineering and Technology 1 2005

136

III. INTELLIGENT MINING SYSTEM

Constructing an intelligent mining system often involves the

choice of forecasting model and trading strategies. The

feed-forward networks are the most widely used architecture

because they offer good generalization abilities and are readily

to implement. Although it may be difficult to determine the

optimal network architecture and network parameters, these

networks still show very good performance when trained

appropriately. Therefore, the feed-forward network with three

layers is selected to model for forecasting task. While neural

network forecasting models often involve the choices of an

appropriate architecture and training parameters. In detail, this

intelligent system can be stated as follows.

A. Designed Strategies

After the structure and learning method of network are

determined, we must consider network factors that significantly

impact the performance of neural networks. These factors

include the processing for the data, the size of input and hidden

layers, the learning rate, the momentum factor, the initial weight,

the error function and so on. Designing those factors is an art,

some design strategies have been widely discussed [4,11,15],

but the corresponding questions of error function and data

processing and overfitting have not been adequately

investigated. The designed strategies in this paper are presented

below.

Due to the nonlinearity inherent in stock market, the error

function is unlikely to be globally convex and can have many

local minima. In addition, the trend of up and down in the stock

market is very important for making profits, so a penalizing

coefficient o is integrated into the error function in order to

make prediction more effective:

2

1

)

~

(

2

1

t t

N

t

x x MSE =

=

o

where

>

=

else

x x x x if

t t t t

o

2

0 ) )(

~

(

1 1

, ) 1 , 0 ( e .

It denotes that, if the predicted direction is the same as the

real direction, o is given a smaller constant, otherwise o is

given a bigger constant, namely, the incorrect predicted

directions are penalized more heavily than the correct predicted

directions.

In the process of modeling neural networks, the data is

usually preprocessed before training in order to make network

more effective [4]. Due to the activation function in this paper is

a sigmoid function that squashes input data to [0,1], so the real

stock data used by this paper that varies from 250 to 2300 will

not be useful. In order to make fitting range not saturate, in this

paper, all the patterns are scaled in [0.1,0.9].

Generally, the output data cannot be directly used to predict, it

must be postprocessed, namely using the inverse of the

preprocessing transformation.

Just like other non-parameter model, modeling neural

networks still meet overfitting problem. When a network is

trained excessively, Overfitting occurs. Due to overfitting

memorized excessively the training patterns, it leads to poor

generalization of neural networks. Although many methods are

tried to avoid this problem, the result is still not satisfactory. A

more effective way that can test whether or not a network is

overfitting to set aside some training patterns as part of a testing

patterns. In this paper, several other ways are presented to avoid

overfitting. First, the training patterns are trained randomly by

given times so that the stop criterion is met. In addition, in the

process of forecast step by step, the presented mining system

does not train every day, but retrain every given days, namely,

every given days, neural networks are retrained with the latest

closing price.

B. Trading Strategies

After the neural network forecasting model is developed, the

network is trained to forecast future trend. However, our interest

is not only to construct a forecasting model, but also to make

money. Although neural networks have powerful learning and

nonlinear mapping capabilities, they are lack of explanation

capability. The investors can only trust output of neural

networks blindly, so a trading strategy must be considered to

avoid the poor explanation capability of neural networks. In fact,

whether the forecasting model is effective or not in real world, it

must be tested by the trading strategies. Thus the forecasting

model can give us valuable suggestions for our investment

decision-making. The presented trading strategy is follows:

trend Down and R R

R R

if Sell

if Buy

Signs

ST SP

BT BP

<

>

=

where is the return of predict buying and can be

calculated as

BP

R

1

1

0

)

~

( max

+

< s

=

t

t i t

d i

BP

x

x x

R , is the return of

predict selling and can be calculated as

SP

R

1

1

0

)

~

( min

< s

=

t

t i t

SP

x

x

R

Down

d i

x

trend

, and are constant.

BT

R

ST

R

denotes the trend in the past two days is down

and it can be computed by the smoothing methods, for example,

moving average, kernel smoothing. The presented forecasting

model can tell us when to buy or sell the stock according to the

presented trading strategies.

IV. PERFORMANCE EVALUATION

As mentioned before, the error function is the difference

between the computed output and the desired target, so it is

often used as an evaluation rule. In this paper, the adopted

evaluation function is as follows

. 1 , , 1 , 0 |,

~

|

1

) (

1

= =

+ +

=

d i x x

M

i E

i t i t

M

t

~

It is noted that where

i t

x

+

is the predict value, is the real

closing price, and

i t

x

+

M is the number of trading days in total

predict period. E denotes the average absolute error of the

th day in total predict period.

) i (

i

World Academy of Science, Engineering and Technology 1 2005

137

In the financial application of neural network forecasting

model, making money is the most important goal, and then it lies

on the trend accuracy of the forecasting model, so the trend

accuracy is a most important evaluation criterion in evaluating

the performance of forecasting model [16]. In this paper, the

trend accuracy in direction (TAD) is used to measure the

performance of the mining system. The trend accuracy can be

computed as follows:

% 100 ) (

1

=

=

M

D

i TAD

M

j

ji

where

e

>

=

+ +

) , 0 [ ,

0

0 ) )(

~

( 1

1 1

d i

else

x x x x if

D

t i t t i t

ji

~

where

i t

x

+

is the predict value in the th trading day. i

In addition, the number of total trading (NTT), the number of

buying (NB), the number of selling (NS), the number of

profitable trading over the total selling trading (NPT), the

success rates of selling among the total number of selling (SRS)

are calculated for evaluating the mining system.

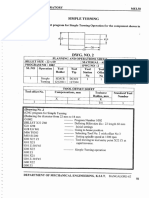

V. SIMULATION RESULTS

The presented mining system was implemented in C++ for

Dos on a PC. The performance of this system was evaluated by

trading the Shanghai Composite Index from June 1995 to June

2003. The training patterns in this paper are the closing price of

500 trading days from 1993. The parameters are designed as

follows: , 5 , 20 = = m n , 30 , 5 . 0 , 01 . 0 = = = d n

. 5 . 0 , 025 . 0 , 04 . 0 = = =

ST BT

R R The initial weights

and thresholds are randomly set in [-0.5, 0.5]. All the training

patterns are selected randomly to train network about 15000

times, the process is repeated until the stop criteria is met. The

trained network predicts the closing price of future 30 days, and

then the training period is moved forward one trading day.

error) training the Min(all * 1.2 error aining current tr the >

is the stop criteria. The network is retained every 150 days. The

comparisons between the predict value and the real value can be

seen in Fig. 1. The comparisons of returns between the mining

system and the buy and hold strategy can be seen in Fig. 2. All

returns were calculated after taking the actual transaction costs

for each transaction into consideration, namely the transaction

costs for buying and selling is 1% respectively. Other statistics

can be seen in Table 1.

Table 1. Other statistics about the intelligent mining system

NTT NB NS NPT SRS

29 15 14 12 85.71%

Fig. 1. The comparisons between the predict value and the real

value

Fig. 2. Comparisons of returns between mining system and buy

and hold strategy

VI. CONCLUSION

The average trend accuracy is 56.3% over 30 days, the

success rate of selling is 85.71% from Table 1, although some

opportunities cannot be captured by this system, a missed

opportunity to profit does not mean lost money. From Fig. 2, it

can know that the presented mining system perform better in

bear market than in bull market, it denotes that the mining

system have better capability of controlling risk.

For Fig. 2, the return achieved by the mining systemis 6, and

the return achieved by the buy and hold strategy is 1.64. The

former is three times as large as the latter. So the mining system

is superior to the buy and hold strategy. The result of mining

Shanghai Composite Index in the period from using the

presented system was encouraging. This mining system can be

actual application and is most efficient for combinational

investment. In addition, the presented strategies avoid

effectively the overfitting and poor explanation problem. The

future work is to strive for making the system more adaptive to

the application and applying the system to other market indices

and individual stock.

World Academy of Science, Engineering and Technology 1 2005

138

REFERENCES

[1] Hornik K., Stinchcombe M. and White H., Multilayer feedforward

networks are universal approximators, Neural Networks, vol. 2, no. 5,

pp. 359366, 1989

[2] Hertz J. Krogh A. and Palmer R.G., Introduction to the theory of

neurocomputing, Addi-son-Wesley, Reading, MA (1991)

[3] Zurada J.M., An introduction to artificial neural networks systems, St.

Paul: West Publishing (1992)

[4] Smith K.A, Palaniswami M and Krishnamoorthy M., Neural techniques

for combinatorial opti-misation with applications, IEEE Transactions

on Neural Networks (1998) 9:13011318

[5] Widrow, B. Rumelhart, D.E. and Lehr, M.A., Neural networks:

applications in industry, business and science, Communications of the

ACM (1994) 37(3): 93105

[6] Refenes A.P,(ed.), Neural network in the capital markets, John Wiley&

Sons Ltd (1995)

[7] Gately, E, Neural networks for financial forecasting, New York: Wiley

(1996)

[8] Kate A.Smith, Jatinder N.D. Gupta, neural networks in business:

techniques and applications for the operations researcher, Computers &

Operations Research (2000) 27:10231044

[9] J. T. Yao, C. L. Tan and H.-L. Poh, Neural networks for technical

Analysis: A study on KLCI, International Journal of Theoretical and

Applied Finance (1999) 2(2): 221241

[10] Y.S.Abu-Mostafa, A.F. Atiya, M. Magdon-Ismail, and H. White, Neural

networks in finan-cial engineering, IEEE Transactions on Neural

Networks (2001) 12(4): 653656

[11] E.Schoneburg, Stock prediction using neural network: A project report,

Neurocomputing, (1990) 12(1): 1227

[12] Refenes,A.N., A.Zapranis, and G. Francis, Stock performance modeling

using neural net-work: A comparative study with regression models,

Neural Network (1994) 5: 961970

[13] B. G. Malkiel, A random walk down wall street, Norton, New York, NY

(1990)

[14] Zahedi, F, Intelligence Systems for Business. Expert Systems With

Neural Networks, Wodsworth Publishing Inc. (1993)

[15] 15. Rudolph, S: On Topology, Size and Generalization of Non-linear

Feed-Forward Neural Networks. Neurocomputing (1997) 16(1): 122

[16] Yao, J.T., H. L. Poh, Equity forecasting: a case study on the KLSE

index, Neural Networks in Financial Engineering. Proceedings of 3rd

International Conference On Neural Networks in the Capital Markets, Oct

1995, London, A. N. Refenes, Y. Abu-Mostafa, J. Moody and A.

Weigend (Eds.), World Scientific (1996) 341353.

World Academy of Science, Engineering and Technology 1 2005

139

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hack FB Online) 2 Minutes Using Our Site #WL5P2Rw7A7Dokument4 SeitenHack FB Online) 2 Minutes Using Our Site #WL5P2Rw7A7Jhon Dave SarmientoNoch keine Bewertungen

- 001-65209 AN65209 Getting Started With FX2LPDokument27 Seiten001-65209 AN65209 Getting Started With FX2LPanacer55Noch keine Bewertungen

- Chapter 5 - EthernetDokument76 SeitenChapter 5 - EthernetfathaniaffNoch keine Bewertungen

- Chapter 24 MiscellaneousSystemsDokument17 SeitenChapter 24 MiscellaneousSystemsMark Evan SalutinNoch keine Bewertungen

- Review Problems SolutionsDokument6 SeitenReview Problems SolutionsDimitrios PanaNoch keine Bewertungen

- Basic Oop (College File)Dokument61 SeitenBasic Oop (College File)CSD Naman SharmaNoch keine Bewertungen

- TEK SAP 08 SodtwareArch ShowfilesDokument42 SeitenTEK SAP 08 SodtwareArch Showfilesapi-3759021Noch keine Bewertungen

- FDL-3 BOM Auto TailDokument2 SeitenFDL-3 BOM Auto TailRafael ReisNoch keine Bewertungen

- The Information Schema - MySQL 8 Query Performance Tuning - A Systematic Method For Improving Execution SpeedsDokument12 SeitenThe Information Schema - MySQL 8 Query Performance Tuning - A Systematic Method For Improving Execution SpeedsChandra Sekhar DNoch keine Bewertungen

- CNC Turning Programming Exellent ExplainationDokument29 SeitenCNC Turning Programming Exellent ExplainationschrienerNoch keine Bewertungen

- Microsoft Office Excel 2003 Intermediate III: Formulas and WorksheetsDokument8 SeitenMicrosoft Office Excel 2003 Intermediate III: Formulas and Worksheetssantosha00Noch keine Bewertungen

- Another DataGridView PrinterDokument20 SeitenAnother DataGridView PrinterprakashprakashNoch keine Bewertungen

- Facility Validation Theory Practice and Tools PDFDokument2 SeitenFacility Validation Theory Practice and Tools PDFRodneyNoch keine Bewertungen

- Sinfar, Surveying AssignmentDokument81 SeitenSinfar, Surveying Assignmentmuhammathusinfar01Noch keine Bewertungen

- Xtronic Org Circuit Amplifier Audio Amplifier Potency Tda729Dokument10 SeitenXtronic Org Circuit Amplifier Audio Amplifier Potency Tda729ANTONIO PEREZNoch keine Bewertungen

- Oracle Database Cloud Cookbook With Oracle Enterprise Manager 13c Cloud ControlDokument559 SeitenOracle Database Cloud Cookbook With Oracle Enterprise Manager 13c Cloud ControlSavo100% (4)

- 100r Pin120 Id Tec KoreaDokument2 Seiten100r Pin120 Id Tec KoreaSohail HanifNoch keine Bewertungen

- Personnel Protection Unit Test/Charge Systems: Technical Specification Collision Awareness SystemDokument3 SeitenPersonnel Protection Unit Test/Charge Systems: Technical Specification Collision Awareness SystemAbhinandan PadhaNoch keine Bewertungen

- Hydra Big TutorialDokument49 SeitenHydra Big TutorialMicke OlofssonNoch keine Bewertungen

- Reit Series Inverter Use R Manual: PrefaceDokument23 SeitenReit Series Inverter Use R Manual: PrefaceYongki Adi Pratama PutraNoch keine Bewertungen

- PowerMaxPlus Install Guide English DE5467IP3Dokument32 SeitenPowerMaxPlus Install Guide English DE5467IP3Armando AriasNoch keine Bewertungen

- EIS & SM English Question 09.08.2022Dokument9 SeitenEIS & SM English Question 09.08.2022Planet ZoomNoch keine Bewertungen

- Libro Complementos de Fisica PDFDokument184 SeitenLibro Complementos de Fisica PDFnandovebe Velandia beltranNoch keine Bewertungen

- DS-7600NI-I2/P Series NVR: Key FeatureDokument5 SeitenDS-7600NI-I2/P Series NVR: Key FeatureFabian BonillaNoch keine Bewertungen

- PT. Daya Mulia Turangga: Riko Wahyu DarusmanDokument1 SeitePT. Daya Mulia Turangga: Riko Wahyu DarusmanAinur Bamol NamsembilanNoch keine Bewertungen

- Financial Intelligence Centre South AfricaDokument1 SeiteFinancial Intelligence Centre South AfricaShahab UllahNoch keine Bewertungen

- PHILIPS Laser MFDDokument86 SeitenPHILIPS Laser MFDbladimir77Noch keine Bewertungen

- Beckhoff Main Catalog 2021 Volume2Dokument800 SeitenBeckhoff Main Catalog 2021 Volume2ipmcmtyNoch keine Bewertungen

- Simlab Section 9 - Mesh CleanupDokument19 SeitenSimlab Section 9 - Mesh Cleanupvandamme789Noch keine Bewertungen