Beruflich Dokumente

Kultur Dokumente

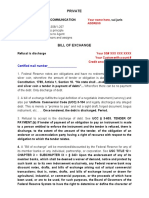

Bill of Exchange

Hochgeladen von

mmmprasajanuOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bill of Exchange

Hochgeladen von

mmmprasajanuCopyright:

Verfügbare Formate

What is a Bill of Exchange?

A Bill of Exchange is one of the key financial instruments in International Trade. The laws regulating Bills of Exchange in different countries come under two different legal spheres of influence: Bills of Exchange Act (1882) - United Kingdom Geneva Conventions of 1930

The Bill of Exchange is defined under these systems as follows: Bill of Exchange Act (1882) - United Kingdom "A Bill of Exchange is an unconditional order in writing, addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand or at a fixed or determinable future time a sum certain in money to or to the order of a specified person, or to bearer". For a list of countries following the 'Bills of Exchange Act' (click here). Convention providing a uniform law for Bills of Exchange and promissory notes (Geneva, 1930) The League of Nations. Under Article 1 of the above convention a Bill of Exchange must contain: 1. The term "Bill of Exchange" inserted in the body of the instrument and expressed in the language employed in drawing up the instrument. 2. An unconditional order to pay a determinate sum of money. 3. The name of the person who is to pay. 4. A statement of the time of payment. 5. A statement of the place where payment is to be made; 6. The name of the person to whom or to whose order payment is to be made; 7. A statement of the date and of the place where the bill is issued; 8. The signature of the person who issues the bill. For a list of countries following the 'Geneva Conventions' (click here). The Parties to a Bill of Exchange: The Drawer - Is the party that issues a Bill of Exchange in an international trade transaction; usually the seller. The Drawee - Is the recipient of the Bill of Exchange for payment or acceptance in an international trade transaction; usually the buyer. The Payee - Is the party to whom the Bill is payable; usually the seller or their bankers.

Legislation for Bills of Exchange:

Most countries have adopted codified laws on Bills of Exchange. The legal codes in such countries have created laws that follow the rules agreed at the Geneva Conventions in order to standardise the control of Bills of Exchange. The United Kingdom Bills of Exchange Act 1882 is the basis for rules governing Bills of Exchange in Ireland, U.K. and Commonwealth countries that were part of the British Empire. These countries follow a common law framework to create and modify statutes. In relation to the most fundamental aspects of a Bill of Exchange the two sets of rules are similar in that both identify the following: A Bill of Exchange is an unconditional order to pay a specific amount of money. The Bill of Exchange must state a particular time of payment. The Bill of Exchange must contain the name of the person who is to pay.

There are, however, certain differences between the Bills of Exchange Act (1882) and the Geneva Convention. In particular the United Kingdom Act sets out fewer formal requirements for example: The term "Bill of Exchange", which is an integral part of the physical Bill according to the Geneva Convention, need not be written on the Bill. Bills can be made payable to 'bearer'. The place and date of issue are also not obligatory parts of the Bill.

The United Nations Commission on International Trade Law (UNCITRAL) is at present trying to harmonise laws through the "United Nations Convention on International Bills of Exchange and International Promissory notes

The function of the Bill of Exchange in International Trade:

The Bill of Exchange performs many functions in international trade including: Facilitates the granting of trade credit in a legal format by permitting payments on agreed future dates. Provides formal evidence of the demand for payment from a seller to a buyer. Provides the seller with access to finance by permitting them to transfer their debts to a bank or other financier by merely endorsing the Bill of Exchange to that bank or financier. Permits the banker or financier to retain a valid legal claim on both the buyer and the seller. In certain circumstances a bank or financier may have a stronger legal claim under a Bill than the party that sold them the debt. Permits a seller to obtain greater security over the payment by enabling a bank to guarantee a drawee's acceptance (guarantee to pay on the due date) by signing or endorsing the Bill. (See Guaranteed Bills of Exchange below) Allows a seller protect their access to the legal system in the event of problems, while providing easier access to that legal system.

How the Bill of Exchange is used in international trade:

A Bill of Exchange can either be payable immediately or at some future date. If a Bill is payable immediately, it is usually issued payable at sight. The term "at sight" means that a buyer should pay once they have sighted the Bill, that is once the demand for payment has been made. If a Bill is payable at some future date, it must facilitate the calculation of the actual due date. For example Bills of Exchange may be drawn payable at 60 days sight, at 60 days from Bill of Lading Date etc.

Banks should be used as agents for the collection of the Bill. Visit our section on Documentary Collections in the Products and Services or Product Diagrams area of this website for further details. Guaranteed Bills of Exchange: To provide greater payment security a seller may look to have a Bill of Exchange guaranteed by a buyer's bank. A guaranteed Bill of Exchange is one drawn on and accepted by the buyer and to which, the buyer's bank has added its guarantee that the Bill will be paid at maturity. The security to a seller comes from a bank giving an undertaking to effect payment on a certain date regardless of the financial standing of a buyer on that date

Advantages of Bills of Exchange:

Companies have used Bills of Exchange for hundreds of years. Their longevity is due to the advantages they provide in a trading transaction. A Bill of Exchange facilitates the granting of trade credit to a buyer. A Bill of Exchange provides a legal acknowledgement that a debt exists. It can provide the seller with access to financing. It can provide easy access to the legal systems in the event of non-payment.

Legal Protection afforded by Bills of Exchange: An advantage for a seller in using a Bill of Exchange is the capability of the Bill of Exchange to provide formal documentary evidence that the demand for payment or acceptance has been made to the buyer. In addition, it may be possible to sue the buyer for non-payment based solely on this documentary evidence. A seller can protect their interests by requesting that a Bill of Exchange be noted or protested for non-payment or non-acceptance. When a Bill is not paid or accepted it is said to have been "dishonoured". Noting: A Bill is noted in order to obtain official evidence that it has been dishonoured. A Notary Public represents the Bill to the drawee for acceptance or payment and minutes on the Bill the reason given for dishonour. Noting is often followed by a formal protest. Protesting: Protesting is a more formal process than noting and results in the production by the Notary Public of a formal deed of protest bearing a notary's seal. This document again provides formal evidence of the presentation of the Bill to the drawee and the reason for dishonour. The protest is accepted by most courts in the world as evidence that a Bill has been dishonoured

Das könnte Ihnen auch gefallen

- Nonprofit Law for Religious Organizations: Essential Questions & AnswersVon EverandNonprofit Law for Religious Organizations: Essential Questions & AnswersBewertung: 5 von 5 Sternen5/5 (1)

- The Fiduciary Formula: 6 Essential Elements to Create the Perfect Corporate Retirement PlanVon EverandThe Fiduciary Formula: 6 Essential Elements to Create the Perfect Corporate Retirement PlanNoch keine Bewertungen

- Ion of Bill of ExchangeDokument11 SeitenIon of Bill of Exchangeshami00992100% (1)

- Bill of ExchangeDokument3 SeitenBill of ExchangeNisot Ihdnag100% (5)

- Promissory Note Template 05Dokument2 SeitenPromissory Note Template 05Smith Siva100% (2)

- Bill of ExchangeDokument1 SeiteBill of ExchangeFreeman Lawyer100% (9)

- Notary Presentment DavitDokument3 SeitenNotary Presentment DavitBruce Taylor0% (1)

- Bankers Acceptance Document for Purchase FinancingDokument2 SeitenBankers Acceptance Document for Purchase Financingcktee77Noch keine Bewertungen

- CDs explainedDokument6 SeitenCDs explainedcha chaNoch keine Bewertungen

- True Av4 Stamp Vs NonsenseDokument1 SeiteTrue Av4 Stamp Vs NonsensemoNoch keine Bewertungen

- Constructive NoticeDokument3 SeitenConstructive NoticeH126 IN5100% (3)

- Adverse Action NoticeDokument2 SeitenAdverse Action NoticeNiko RomeroNoch keine Bewertungen

- IdpDokument6 SeitenIdpexousiallcNoch keine Bewertungen

- Affidavit of Notary Mailing CertificationDokument1 SeiteAffidavit of Notary Mailing CertificationdbtimesNoch keine Bewertungen

- Certificate of Ownership-Auth-TDA Account PDFDokument1 SeiteCertificate of Ownership-Auth-TDA Account PDFrisovi100% (6)

- Tender of PaymentDokument1 SeiteTender of PaymentPatrick Long100% (2)

- Notice of First and Final WarningDokument3 SeitenNotice of First and Final Warningkelzberna100% (1)

- Charge Back Letter No. 1 SAMPLEDokument1 SeiteCharge Back Letter No. 1 SAMPLEJames Thomas100% (1)

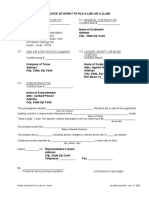

- Claim of LienDokument2 SeitenClaim of Lienj weissNoch keine Bewertungen

- Jans Bonded Promissory NoteDokument1 SeiteJans Bonded Promissory Noteexousiallc100% (1)

- Updated Simpler Process of Securing and AcknowledgementDokument2 SeitenUpdated Simpler Process of Securing and AcknowledgementdkkhairstonNoch keine Bewertungen

- Law of TrustsDokument28 SeitenLaw of TrustsashishNoch keine Bewertungen

- Notice of International Commercial ClaimDokument9 SeitenNotice of International Commercial Claimjoe100% (3)

- Regstered Bonded Promissory NoteDokument2 SeitenRegstered Bonded Promissory NoteAnonymous nYwWYS3ntV94% (17)

- Non-Negotiable Security AgreementDokument3 SeitenNon-Negotiable Security Agreement:Nootau-Sakima Noshi Qaletaqa: EL-Rey © ®™100% (3)

- Criminal Case Closed and Account SettledDokument1 SeiteCriminal Case Closed and Account SettledMichael FociaNoch keine Bewertungen

- 609 Letter 1Dokument1 Seite609 Letter 1Gee PennNoch keine Bewertungen

- IboeDokument2 SeitenIboeHossein ParastehNoch keine Bewertungen

- 1 Certified Promissory NoteDokument5 Seiten1 Certified Promissory NoteLouis100% (8)

- Money Order NoticeDokument2 SeitenMoney Order NoticeFreeMan100% (13)

- Private Document Tender of PaymentDokument2 SeitenPrivate Document Tender of PaymentPennyDoll94% (17)

- Discharge of MortgageDokument1 SeiteDischarge of Mortgagecolimatrade100% (1)

- 7-2 Affidavit of Mailing Notice - Shareholders Special MeetingDokument1 Seite7-2 Affidavit of Mailing Notice - Shareholders Special MeetingDaniel100% (3)

- Affidavit of Service Page 1 of 1Dokument1 SeiteAffidavit of Service Page 1 of 1xantasiaNoch keine Bewertungen

- Conditional Acceptance To ROSSENDALES 2015Dokument2 SeitenConditional Acceptance To ROSSENDALES 2015Nick Ofthe Devon-clan100% (3)

- 0000 AA - 1 Revocation of Power of Attorney WebDokument2 Seiten0000 AA - 1 Revocation of Power of Attorney Weblyocco1Noch keine Bewertungen

- Multiple Presentments Accepted by Secured Party From Franchise Tax Board, CaliforniaDokument7 SeitenMultiple Presentments Accepted by Secured Party From Franchise Tax Board, CaliforniaAnu-Samawaati Eil100% (1)

- Declaration of DomicilDokument1 SeiteDeclaration of DomicilTroy K OistadNoch keine Bewertungen

- Process of Registering An Instrument Affecting Land and BuildingDokument3 SeitenProcess of Registering An Instrument Affecting Land and BuildingDilhara PinnaduwageNoch keine Bewertungen

- Proof of Delivery COVER LETTERDokument1 SeiteProof of Delivery COVER LETTERBen Hill100% (1)

- Statement of Account TemplateDokument2 SeitenStatement of Account TemplateDUTCH551400100% (6)

- Bankers AcceptanceDokument3 SeitenBankers AcceptanceGilner PomarNoch keine Bewertungen

- Statement of AccountDokument2 SeitenStatement of Accounttony100% (6)

- Power of AttorneyDokument2 SeitenPower of Attorneysalim bey100% (1)

- Bankers Acceptance CondensedDokument5 SeitenBankers Acceptance CondensedLuka Ajvar100% (1)

- Notice of Correction for FraudDokument2 SeitenNotice of Correction for FraudJohn DownsNoch keine Bewertungen

- 07 Affidavit Cover LetterDokument2 Seiten07 Affidavit Cover LetterTerry Green100% (3)

- Notice of Intent To File Lien or ClaimDokument2 SeitenNotice of Intent To File Lien or Claimnujahm163967% (3)

- Letter of AdviceDokument2 SeitenLetter of AdviceAndrew100% (6)

- I - Request Regarding A Statement of AccountDokument1 SeiteI - Request Regarding A Statement of AccountJason HenryNoch keine Bewertungen

- Affidavit of Fact Title Dispute To America Sovereign OriginalDokument5 SeitenAffidavit of Fact Title Dispute To America Sovereign OriginalWesley-Keith: Mullings100% (7)

- INTERNATIONAL BILL OF EXCHANGE - OdtDokument1 SeiteINTERNATIONAL BILL OF EXCHANGE - OdtMarsha MainesNoch keine Bewertungen

- AC Affidavit of StatusDokument1 SeiteAC Affidavit of StatusKeke LeBronNoch keine Bewertungen

- Promissory NoteDokument2 SeitenPromissory NoteMaurice Kool Da GrooveNoch keine Bewertungen

- Accepted Offer Addendum-CounterDokument16 SeitenAccepted Offer Addendum-Counterrealestate6199Noch keine Bewertungen

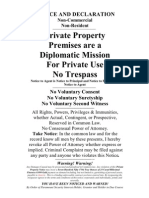

- Legal No Trespassing SignDokument1 SeiteLegal No Trespassing SignFreedomofMindNoch keine Bewertungen

- Super Injunction BookDokument3 SeitenSuper Injunction BookReckless Kobold0% (1)

- Notice Appointment Fiduciary Debtor CreditorDokument2 SeitenNotice Appointment Fiduciary Debtor Creditordouglas jones50% (2)

- James M Stearns JR ResumeDokument2 SeitenJames M Stearns JR Resumeapi-281469512Noch keine Bewertungen

- ICPC Members 24 July 2023Dokument6 SeitenICPC Members 24 July 2023Crystal TsangNoch keine Bewertungen

- Disaster Management Training Program Ethics UNDPDokument65 SeitenDisaster Management Training Program Ethics UNDPTAKI - TAKINoch keine Bewertungen

- Sohan vs. Mohan PlaintDokument6 SeitenSohan vs. Mohan PlaintKarandeep Saund100% (5)

- Reaction Paper On GRP 12Dokument2 SeitenReaction Paper On GRP 12Ayen YambaoNoch keine Bewertungen

- The Legend of Lam-ang: How a Boy Avenged His Father and Won His BrideDokument3 SeitenThe Legend of Lam-ang: How a Boy Avenged His Father and Won His Brideazyl76% (29)

- SYD611S Individual Assignment 2024Dokument2 SeitenSYD611S Individual Assignment 2024Amunyela FelistasNoch keine Bewertungen

- CRPC 1973 PDFDokument5 SeitenCRPC 1973 PDFAditi SinghNoch keine Bewertungen

- Drought in Somalia: A Migration Crisis: Mehdi Achour, Nina LacanDokument16 SeitenDrought in Somalia: A Migration Crisis: Mehdi Achour, Nina LacanLiban SwedenNoch keine Bewertungen

- 20% DEVELOPMENT UTILIZATION FOR FY 2021Dokument2 Seiten20% DEVELOPMENT UTILIZATION FOR FY 2021edvince mickael bagunas sinonNoch keine Bewertungen

- Aqua Golden Mississippi Tbk Company Report and Share Price AnalysisDokument3 SeitenAqua Golden Mississippi Tbk Company Report and Share Price AnalysisJandri Zhen TomasoaNoch keine Bewertungen

- Microsoft Word - I'm Secretly Married To A Big S - Light DanceDokument4.345 SeitenMicrosoft Word - I'm Secretly Married To A Big S - Light DanceAliah LeaNoch keine Bewertungen

- Service Culture Module 2Dokument2 SeitenService Culture Module 2Cedrick SedaNoch keine Bewertungen

- A Research Agenda For Creative Tourism: OnlineDokument1 SeiteA Research Agenda For Creative Tourism: OnlineFelipe Luis GarciaNoch keine Bewertungen

- Teaching C.S. Lewis:: A Handbook For Professors, Church Leaders, and Lewis EnthusiastsDokument30 SeitenTeaching C.S. Lewis:: A Handbook For Professors, Church Leaders, and Lewis EnthusiastsAyo Abe LighthouseNoch keine Bewertungen

- The Indian Navy - Inet (Officers)Dokument3 SeitenThe Indian Navy - Inet (Officers)ANKIT KUMARNoch keine Bewertungen

- KPMG Software Testing Services - GenericDokument24 SeitenKPMG Software Testing Services - GenericmaheshsamuelNoch keine Bewertungen

- Solution Manual For Fundamentals of Modern Manufacturing 6Th Edition by Groover Isbn 1119128692 9781119128694 Full Chapter PDFDokument24 SeitenSolution Manual For Fundamentals of Modern Manufacturing 6Th Edition by Groover Isbn 1119128692 9781119128694 Full Chapter PDFsusan.lemke155100% (11)

- 2024 JanuaryDokument9 Seiten2024 Januaryedgardo61taurusNoch keine Bewertungen

- Book - Social Work and Mental Health - Third Edition (Transforming Social Work Practice) - Learning Matters Ltd. (2008)Dokument192 SeitenBook - Social Work and Mental Health - Third Edition (Transforming Social Work Practice) - Learning Matters Ltd. (2008)All in OneNoch keine Bewertungen

- Interview - Duga, Rennabelle PDokument4 SeitenInterview - Duga, Rennabelle PDuga Rennabelle84% (19)

- 1 292583745 Bill For Current Month 1Dokument2 Seiten1 292583745 Bill For Current Month 1Shrotriya AnamikaNoch keine Bewertungen

- Mind Map All in One PBA-2021-08-20 12-38-51Dokument1 SeiteMind Map All in One PBA-2021-08-20 12-38-51MikosamirNoch keine Bewertungen

- IJBMT Oct-2011Dokument444 SeitenIJBMT Oct-2011Dr. Engr. Md Mamunur RashidNoch keine Bewertungen

- Unique and Interactive EffectsDokument14 SeitenUnique and Interactive EffectsbinepaNoch keine Bewertungen

- IiuyiuDokument2 SeitenIiuyiuLudriderm ChapStickNoch keine Bewertungen

- Araneta v. Gatmaitan, 101 Phil. 328Dokument3 SeitenAraneta v. Gatmaitan, 101 Phil. 328Bibi JumpolNoch keine Bewertungen

- Time Value of Money - TheoryDokument7 SeitenTime Value of Money - TheoryNahidul Islam IUNoch keine Bewertungen

- Introduction To The Appian PlatformDokument13 SeitenIntroduction To The Appian PlatformbolillapalidaNoch keine Bewertungen

- Agreement For Consulting Services Template SampleDokument6 SeitenAgreement For Consulting Services Template SampleLegal ZebraNoch keine Bewertungen