Beruflich Dokumente

Kultur Dokumente

Indian Pump Industry

Hochgeladen von

prashant_miroliya2000Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Indian Pump Industry

Hochgeladen von

prashant_miroliya2000Copyright:

Verfügbare Formate

Indian pump industry An in depth look

Present Scenario The Indian pump industry is comparatively a mature industry and has a strong manufacturing base. It has large and medium scale manufacturers in the organised sector producing pumps for various applications at all price levels, besides there are hundreds of small scale units in the unorganised sector producing mainly pumps and spares for domestic and agricultural applications. About 12 lakhs pumps are produced every year. Though there are no established figures, the market is believed to be worth about Rs 2000 crore. The Indian manufacturers have always adhered to quality standards. Many companies have obtained the ISO 9000 certification. Some of the indigenously developed achievements include Sodium coolant and primary coolant pumps for nuclear power stations, concrete volute and large sized vertical turbine pumps for irrigation and thermal power stations. The indigenously developed polyester- coated, polypropylene wrapped winding wire for submersible motor is worth appreciation.

Challenges before the Pump Industry Indian manufacturers have to face several obstacles including labour issues and extremely high manufacturing costs on one hand and cheap exports on the other. The imports have been freed. There is a mismatch between the input tariffs for the raw material and the prices at which the pumps are being imported. The pump customer is also more aware and informed today. He is more knowledgeable on pump selection and maintenance and more demanding in his requirement, willing to pay higher price for efficiency and reliability. Constant availability of better pumps for a better price is the challenge the industry faces, the entry of foreign companies is likely to further hit the industry, margins are likely to be thinner as these pumps are priced more competitively with improved technology. Indian manufacturers perceive threats from Chinese and Taiwanese pumps as they may be not durable but cheaper as produced on mass scale.

Low Growth is major cause of Worry The low industrial growth is affecting the pump sector prospects. Reduction in the number of new projects is affecting adversely the growth of industrial application pump companies. Lack of fresh investment in the pump industry is the major cause for worry. Spending on research and development is low and the level of technology is not rising, as it should be. New product models and designs are not very forthcoming. In this period of low growths, a consolidation in the pump industry is expected. The current status of the Indian pump industry is highly fragmented. Large players, therefore view this situation favourably as the possibility of Mergers & Acquisitions is going to increase substantially.

While the leading manufacturers are expected to increase their presence, the medium level will find difficult to survive. Foreign companies will be looking at acquisitions in the Indian market for quick growth.

Innovations - The need of hour The manufacturing of medium technology pumps will have to be considered in India, New product technologies are also coming in to the Indian market. New materials and material coatings are replacing conventional and expensive materials along with improvements in reliability and lifetime of existing pump designs for many fields of application. Indian industry has to adopt new techniques in pump production as implemented in developed countries The pumps will no longer be marketed as a mere hardware item, They will be packaged to provide total solution for customer's specific liquid transfer problems. Skills for providing customer support in terms of application engineering will have to be developed. Information technology will also be exploited to edge over competition. Software programs for pump selection, documentation, spare parts support etc will be made available to customers. Portals for trouble-shooting support will be on net for immediate customer service. As is being done for several products, pumps too will be selected, configured and ordered through websites. Supply chain management through ERP programs will make distribution more effective in terms of costs and availability.

Key growth areas for pumps in India The growth in the pump industry is closely linked to the growth trends in the user industries, even factors like investments and overall economic growth directly influence the pump industry. In a market with low growth rates and few new projects, different trends have been emerging as players use a range of strategies to ensure their survival. The market leader of most of the segments, Kirloskar Brothers Limited has been adapting itself to becoming a project management company. This systems approach is welcomed by the clients who look for complete solution or turn key job by the vendor who can design, install, commission and complete the project.

Agriculture Sector The growth can be envisaged in the Domestic & agriculture sectors - in terms of volumes. In the early years after Independence, Indian economy was basically agrarian. Green revolution prompted a spurt for agricultural monoblocs, sinking of groundwater tables caused spurt for submersible pumps. Although prospects in agriculture sector depend on external factors like monsoon, Over the years, share of agriculture in GDP has also reduced but due to adopting new developments and cash crops by the farmers, their income level has gone up, lower water table and poor irrigation facilities by the

government has encouraged them to go for own water sources, this led to sudden spurt in demand of submersible pumps in the last two decades. About 80 percent requirement of submersible pumps comes from agriculture sector. As a result many companies emerged in the organised sector who produce good quality and efficient pumps. Credit goes to Indian manufacturers for developing field rewindable and hence user friendly, wet motor designs for submersible pumps which can work against vagaries of power supply. but the kits manufactured in the unorganised sector have spoilt the market. These are low efficiency pumps, consume high power and produced locally without paying taxes etc. Traditionally, the customer buys the cheapest product without considering the life cycle cost, efficiencies and reliability. Farmers are attracted towards such pumps for their low price, they are not much concerned for low efficiency as power in most of the states is subsidised to the agriculture sector and rates are fixed for different ratings. Lower initial investment supercedes everything therefore such manufacturers are cornering major market share. It is expected from the Government that some action will be taken up immediately to curb this menace. Such players may not last for long but they end up spoiling the market and hurting the established players.

Residential Segment The domestic segment has seen the entry of a number of multinationals as well as smaller players with new designs and product features. Grundfos has been the most active amongst international players. With its leading technology and product innovations, it is targeting the domestic segment. Population keeps growing, standard of living is becoming more consumptive so demand ought to be growing. A highly attractive segment, the growth rates have gone at 10-12 percent as due to water shortage in urban areas number of private borewells are increasing, pumps for residential applications are having good demand. But again, there is always the lurking threat of the Chinese dumping. Major competition from China on pumps produced in large volumes - the segments of Agriculture & domestic can be affected.

Industrial Scene The industrial segment includes pumps for various water movement and process applications in different industries. These include major areas like chemicals, sugar, fertilizers, paper and pharma. While key sectors like power and pharma have been growing, others like paper and chemicals have been quite stable. The overall segment is growing at around 10 percent annually. Important industry trends such as better water management and conservation and re-use, combined cycle power generation and paper recycling coupled with evertightening, environmental norms, promise a reasonably good potential for pump companies to play a vital role in future. The sewage treatment segment is set to grow at a faster pace. According to survey, Urban water treatment and wastewater treatment equipment market is likely to reach a year -on-year growth rate of about 16 percent by 2005.

Indian companies in the Global market India has been importing pumps in a big way until independence and exports had started with small pumps for irrigation to Africa and Middle East, till 1960 export was very dormant. Export of pumps received a big boost In 1975 when Kirloskar group signed agreement with UK based company. The entire product range in the form of whole units or components were manufactured in India for the world market. This success encouraged manufacturers from U K, U S A and France to sign contracts with other Indian companies to get components or whole units as buyer seller relationship or buy back arrangement with technical collaboration. The globalization of Indian economy has developed keen interest in the International pump community. With the excellent engineering expertise available in the country along with cheap labour, it is not workable to import pumps here and market. Design modifications are always required due to poor power supply and other ground realities. To overcome this, International players are planning to set up a manufacturing base here and cater other markets in South East, Far East, Africa and Middle East and also for buy backs and re-export. Setting up of a joint venture with major foreign equity share is more beneficial and a long term strategy. A number of Indian manufacturers are looking at the export market. Mather and Platt Pumps Limited have won big orders in water and sewage handling in the Gulf countries. KSB AG is using excellent engineering and technical expertise of its Indian subsidiary KSB Pumps Limited as a global sourcing base for selected European markets, particularly for submersible pumps. There are many other companies who are exporting centrifugal, submersible and even special application pumps. Since growth is not forthcoming in India, manufacturers are taking keen interest in exports, where they get better margins. Besides companies in the organised sector, there are several small scale units in various parts of the country who are producing world class castings with excellent machining capabilities as per orders in their hand from developed countries. It is worth mentioning that Indian players often enterprises in reverse engineering at very competitive costs, conversant to English language also gives them slight edge..

Das könnte Ihnen auch gefallen

- Indian Pump Industry OutlookDokument17 SeitenIndian Pump Industry OutlookKI-KC- NAVEDNoch keine Bewertungen

- Pump Industry in India - Overview, Market, Manufacturers, OpportunitiesDokument4 SeitenPump Industry in India - Overview, Market, Manufacturers, OpportunitiesAnkesh RajNoch keine Bewertungen

- COMPLETE Market Feasibility Analysis For Pump ManufacturingDokument13 SeitenCOMPLETE Market Feasibility Analysis For Pump ManufacturingAman BaviskarNoch keine Bewertungen

- In-Plant Training Report On PVC PUMPS PVT LTDDokument54 SeitenIn-Plant Training Report On PVC PUMPS PVT LTDNaveen PV100% (1)

- Suman Report PDFDokument59 SeitenSuman Report PDFBHARATH PNoch keine Bewertungen

- Water Pumps Industry in India: Market Size, Trends, Challenges & CompetitorsDokument62 SeitenWater Pumps Industry in India: Market Size, Trends, Challenges & CompetitorsVishvajithNoch keine Bewertungen

- Kirloskar Brothers LimitedDokument14 SeitenKirloskar Brothers LimitedPrasanjeet DebNoch keine Bewertungen

- A Study of Functions and SWOT at Cheran IndustriesDokument47 SeitenA Study of Functions and SWOT at Cheran IndustriessuganyaNoch keine Bewertungen

- PMSM Drive with Sensorless Control TutorialDokument16 SeitenPMSM Drive with Sensorless Control TutorialTeklu Abebe WoldeNoch keine Bewertungen

- Study of LDPE Hyper Compressor Lubrication: Engineering (Virtual) Internship ProgramDokument17 SeitenStudy of LDPE Hyper Compressor Lubrication: Engineering (Virtual) Internship ProgramchanchalNoch keine Bewertungen

- APL Apollo Stock PitchDokument10 SeitenAPL Apollo Stock Pitchplv360Noch keine Bewertungen

- Deccan PumpsDokument43 SeitenDeccan PumpsManoj KumarNoch keine Bewertungen

- Project On Ingersoll RandDokument16 SeitenProject On Ingersoll RandVikram MandalNoch keine Bewertungen

- India Next Chemical Manufacturing HubDokument28 SeitenIndia Next Chemical Manufacturing Hubagarwal.deepak6688Noch keine Bewertungen

- Motor and Pump in India FinalDokument94 SeitenMotor and Pump in India FinalRumesh Kumar KNoch keine Bewertungen

- Kirloskar Up Upl Uph UptDokument16 SeitenKirloskar Up Upl Uph Uptedward baskaraNoch keine Bewertungen

- Airtech's Production Process and Marketing StrategyDokument75 SeitenAirtech's Production Process and Marketing StrategyMonica ThakurNoch keine Bewertungen

- Type DSM (Thru Bore) : Instructions On Installation Operation and Maintenance For Kirloskar PumpDokument43 SeitenType DSM (Thru Bore) : Instructions On Installation Operation and Maintenance For Kirloskar Pumpkprasad_56900Noch keine Bewertungen

- Sugar Industry ReportDokument47 SeitenSugar Industry ReportTung Bui ThanhNoch keine Bewertungen

- Detailed Project Report: Integrted Grain Based DistilleryDokument53 SeitenDetailed Project Report: Integrted Grain Based DistilleryAditi AgarwalNoch keine Bewertungen

- Profile of Leading Pump Manufacturer C.R.I. PumpsDokument30 SeitenProfile of Leading Pump Manufacturer C.R.I. PumpsAnonymous 8SNpyX100% (1)

- Pump IndustyDokument47 SeitenPump IndustyKonguKarthikNoch keine Bewertungen

- BPCLDokument22 SeitenBPCLn_89nitin100% (4)

- Summer Training Report On GNFCDokument29 SeitenSummer Training Report On GNFCHormazzNoch keine Bewertungen

- Ladoo Making Machine Project ReportDokument18 SeitenLadoo Making Machine Project ReportSanket Malunje50% (2)

- Sugar Mill Short DescriptionDokument2 SeitenSugar Mill Short DescriptionAnindya Vikram SinghNoch keine Bewertungen

- EMIS Insights - India Renewable Energy Sector Report 2021-2022Dokument78 SeitenEMIS Insights - India Renewable Energy Sector Report 2021-2022sushantNoch keine Bewertungen

- Project Report On Ford MotorsDokument69 SeitenProject Report On Ford MotorsshivamNoch keine Bewertungen

- Shubhamfunde Final ProjectDokument45 SeitenShubhamfunde Final Projectshiv infotech100% (2)

- China Screw Air Compressor Market Situation and The Pattern of BrandDokument2 SeitenChina Screw Air Compressor Market Situation and The Pattern of BrandFahad QaiserNoch keine Bewertungen

- Komatsu Versus CaterpillarDokument3 SeitenKomatsu Versus CaterpillarNivetha BaluNoch keine Bewertungen

- Organisational Study On Aglass Manufacturing FirmDokument61 SeitenOrganisational Study On Aglass Manufacturing Firmthis_is_noorNoch keine Bewertungen

- Premium Bike Market in IndiaDokument5 SeitenPremium Bike Market in Indiaarun_gauravNoch keine Bewertungen

- Development & Optimization of a Portable Air ConditionerDokument133 SeitenDevelopment & Optimization of a Portable Air ConditionerSoumyodeep Mukherjee100% (1)

- SintexDokument14 SeitenSintexAyan ChoksiNoch keine Bewertungen

- Raymond ProjectDokument5 SeitenRaymond Projectpratibha bawankuleNoch keine Bewertungen

- Overview of Indian Cement Industry 2010Dokument17 SeitenOverview of Indian Cement Industry 2010shubhav1988100% (2)

- JBMDokument53 SeitenJBMVaibhav Ahlawat100% (1)

- Case 1-1 Local 635: Part A Variable CostsDokument4 SeitenCase 1-1 Local 635: Part A Variable CostsBharat SinghNoch keine Bewertungen

- ReportDokument107 SeitenReportVarun Tyagi100% (1)

- Gujarat Gas: Fundamental AnalysisDokument28 SeitenGujarat Gas: Fundamental AnalysisRaj SethiaNoch keine Bewertungen

- Tata Nano Problem StatementDokument5 SeitenTata Nano Problem StatementKgp BaneNoch keine Bewertungen

- NTPC Business StrategiesDokument13 SeitenNTPC Business Strategiesrsravishankar0% (1)

- Fabrication of Pneumatic Paper Cup MakinDokument28 SeitenFabrication of Pneumatic Paper Cup MakinPatel NikhilNoch keine Bewertungen

- Petrol and Diesel Prices in IndiaDokument11 SeitenPetrol and Diesel Prices in IndiaAnonymous V9Yo41Noch keine Bewertungen

- CompressorDokument26 SeitenCompressorManuel B. Chua100% (2)

- Malabar Cements Internship Report Malabar Cements Internship ReportDokument79 SeitenMalabar Cements Internship Report Malabar Cements Internship ReportrajeevreddyaNoch keine Bewertungen

- MCQs Business EconomicsDokument2 SeitenMCQs Business EconomicsKhalid WaheedNoch keine Bewertungen

- Century Enka Ltd.Dokument12 SeitenCentury Enka Ltd.sanjay chandwaniNoch keine Bewertungen

- SiemensDokument43 SeitenSiemensHinal Mehta0% (1)

- Reliance PetrochemicalsDokument18 SeitenReliance PetrochemicalsManoj ManuNoch keine Bewertungen

- Vanraj TractorsDokument13 SeitenVanraj TractorsSaurabh Srivastava100% (1)

- Main Principles of Pumps Selection. Calculation of PumpsDokument22 SeitenMain Principles of Pumps Selection. Calculation of PumpsJoko Nugroho100% (1)

- Acknowledgement About The Industry Company Profile Certificate of Training Technology Used ConclusionDokument25 SeitenAcknowledgement About The Industry Company Profile Certificate of Training Technology Used ConclusionManoj Kumar MohanNoch keine Bewertungen

- Pumping Up Demand: Sector FocusDokument2 SeitenPumping Up Demand: Sector FocusmeetashNoch keine Bewertungen

- Introduction About Organization and IndustryDokument36 SeitenIntroduction About Organization and IndustryBharath Mahendrakar0% (1)

- An Overview of Indian Pump IndustryDokument3 SeitenAn Overview of Indian Pump IndustryPuneet DixitNoch keine Bewertungen

- Overview of the Indian Pump Industry and its Future Growth ProspectsDokument3 SeitenOverview of the Indian Pump Industry and its Future Growth Prospectspuneet.gaharana7072Noch keine Bewertungen

- Dharani MotorsDokument29 SeitenDharani MotorsManoj Kumar MohanNoch keine Bewertungen

- Valves Market SizeDokument5 SeitenValves Market Sizehimanshu_bjNoch keine Bewertungen

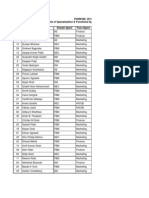

- Choice of SpecialisationDokument5 SeitenChoice of SpecialisationGaurav BagariaNoch keine Bewertungen

- RDA at a GlanceDokument14 SeitenRDA at a GlanceGaurav BagariaNoch keine Bewertungen

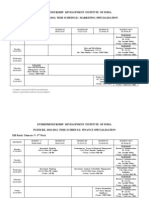

- Entrepreneurship Development Institute of India Pgdm-Be, 2010-2012: Time Schedule: Marketing SpecialisationDokument2 SeitenEntrepreneurship Development Institute of India Pgdm-Be, 2010-2012: Time Schedule: Marketing SpecialisationGaurav BagariaNoch keine Bewertungen

- New Microsoft Office Power Point PresentationDokument1 SeiteNew Microsoft Office Power Point PresentationGaurav BagariaNoch keine Bewertungen

- An Appraisal On The Impact of Financial Planning and Control in The Profitability of An OrganizationDokument156 SeitenAn Appraisal On The Impact of Financial Planning and Control in The Profitability of An OrganizationJamesNoch keine Bewertungen

- Project On DabbawalasDokument51 SeitenProject On DabbawalasemufarmingNoch keine Bewertungen

- Emad Farahzadi MAY2023Dokument3 SeitenEmad Farahzadi MAY2023Kourosh NematyNoch keine Bewertungen

- SBI Life Insurance receipt for Rs. 100,000 premium paymentDokument1 SeiteSBI Life Insurance receipt for Rs. 100,000 premium paymentmanish sharmaNoch keine Bewertungen

- Case Study03Dokument6 SeitenCase Study03Ryan JeeNoch keine Bewertungen

- Web Development Using Wordpress - Unit-1Dokument16 SeitenWeb Development Using Wordpress - Unit-1mekhushal07Noch keine Bewertungen

- Understanding Entrepreneurial Motivation TheoriesDokument31 SeitenUnderstanding Entrepreneurial Motivation TheoriesCid AreNoch keine Bewertungen

- IGCSE Business Definitions GuideDokument11 SeitenIGCSE Business Definitions GuideHibsNoch keine Bewertungen

- IFRS 11 and 12 CPD September 2013Dokument64 SeitenIFRS 11 and 12 CPD September 2013Nicolaus CopernicusNoch keine Bewertungen

- Industrial Visit Report Visit Us at Management - Umakant.infoDokument13 SeitenIndustrial Visit Report Visit Us at Management - Umakant.infowelcome2jungle0% (1)

- TAX Midterm ReviewerDokument10 SeitenTAX Midterm ReviewerCookie MasterNoch keine Bewertungen

- Entrepreneurial Mindset: The Evolution of EntrepreneurshipDokument26 SeitenEntrepreneurial Mindset: The Evolution of EntrepreneurshipCzarina MichNoch keine Bewertungen

- Affidavit repair shop undertakingDokument2 SeitenAffidavit repair shop undertakingZeaNoch keine Bewertungen

- ECEN 5833 Low Power Embedded Design TechniquesDokument4 SeitenECEN 5833 Low Power Embedded Design TechniquesMehul Patel100% (1)

- Funda & BF PTDokument10 SeitenFunda & BF PTReign AlfonsoNoch keine Bewertungen

- MGT201 Presentation by Mozammel AhmedDokument19 SeitenMGT201 Presentation by Mozammel AhmedIsrafil PannaNoch keine Bewertungen

- Jaquard Fabrics FS 19-20Dokument57 SeitenJaquard Fabrics FS 19-20Tarun KumarNoch keine Bewertungen

- Bidding DocumentsDokument82 SeitenBidding DocumentsPalwasha GulNoch keine Bewertungen

- Shrimp Turtle CaseDokument11 SeitenShrimp Turtle Casepoet36Noch keine Bewertungen

- Desktop 10 QA Exam Prep Guide PDFDokument16 SeitenDesktop 10 QA Exam Prep Guide PDFSAPPA NARESHNoch keine Bewertungen

- ACC307 Answer Sheet 2022Dokument4 SeitenACC307 Answer Sheet 2022Gene Justine SacdalanNoch keine Bewertungen

- Annual Report 2019 - NMB Final Rev 8 JuneDokument122 SeitenAnnual Report 2019 - NMB Final Rev 8 JuneThapa NirmalNoch keine Bewertungen

- Group 03 - RUM Comprehensive AssignmentDokument118 SeitenGroup 03 - RUM Comprehensive AssignmentNeil MajumderNoch keine Bewertungen

- Special Services Invoice SummaryDokument1 SeiteSpecial Services Invoice SummaryTQ Home Services100% (1)

- Final Corporate Law and Other Economic Laws MergedDokument300 SeitenFinal Corporate Law and Other Economic Laws MergedRavi RothiNoch keine Bewertungen

- CARP Outline For ClassmatesDokument3 SeitenCARP Outline For ClassmatesAudreyNoch keine Bewertungen

- Water and Wastewater Technology: WATR 100 4.0 Units Wastewater Treatment I WATR 102 4.0 Units Sanitary ChemistryDokument2 SeitenWater and Wastewater Technology: WATR 100 4.0 Units Wastewater Treatment I WATR 102 4.0 Units Sanitary ChemistryTarek Azziz LikhonNoch keine Bewertungen

- Architectural Record 2024-01Dokument124 SeitenArchitectural Record 2024-01ricardoNoch keine Bewertungen

- Foundations of Operations Management Canadian 4th Edition Ritzman Solutions ManualDokument26 SeitenFoundations of Operations Management Canadian 4th Edition Ritzman Solutions ManualMaryMurphyatqb100% (51)

- Canara - Epassbook - 2023-10-10 202024.654466Dokument49 SeitenCanara - Epassbook - 2023-10-10 202024.654466Kamal Hossain MondalNoch keine Bewertungen