Beruflich Dokumente

Kultur Dokumente

Ar 08-09

Hochgeladen von

Sujita NaharOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Ar 08-09

Hochgeladen von

Sujita NaharCopyright:

Verfügbare Formate

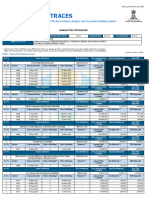

SHREE CEMENT LIMITED

SHREE CEMENT LIMITED

Regd. Office : Bangur Nagar, Beawar-305901, Distt Ajmer (Rajasthan)

Regd. Office : Bangur Nagar, Beawar-305901, Distt Ajmer (Rajasthan)

AUDITED FINANCIAL RESULTS

FOR THE QUARTER AND YEAR ENDED ON 31ST MARCH, 2009

S.N.

PARTICULARS

a.

b.

Net Sales

Other Operating Income

Total

Expenditure

a. (Increase)/Decrease in Stock in trade and work in

progress

b. Consumption of Raw Materials

c.

Purchase of traded goods

d.

Employees cost

e.

f.

Depreciation

Power & Fuel

Quarter ended

31.03.2009

(Audited)

Quarter ended

31.03.2008

(Audited)

SEGMENT REPORTING

Rs. in Lac

Year ended

31.3.2008

(Audited)

Year ended

31.3.2009

(Audited)

80,620.29

543.80

81,164.09

66,249.55

174.77

66,424.32

271,502.02

2,555.18

274,057.20

210,911.80

2,030.39

212,942.19

399.16

3,151.43

962.74

903.18

6,608.11

5,699.91

24,613.31

21,098.97

203.30

161.44

652.47

618.56

S.N.

PARTICULARS

Quarter ended Quarter ended

31.03.2009

31.03.2008

(Audited)

(Audited)

Year ended

31.3.2009

(Audited)

Rs. in lac

Year ended

31.3.2008

(Audited)

Segment Revenue (Net Sales)

a. Cement

b. Power

76,189.49

21,894.64

66,249.55

14,080.03

263,438.83

53,693.81

210,911.80

32,420.98

Total

Less: inter Segment Revenue

98,084.13

17,463.84

80,329.58

14,080.03

317,132.64

45,630.62

243,332.78

32,420.98

Net Sales

80,620.29

66,249.55

271,502.02

210,911.80

30,450.76

Segment Results (Profit before interest, exceptional items and tax)

2,853.11

2,189.69

10,387.43

7,360.43

a.

Cement

12,699.12

748.13

47,267.64

5,468.79

13,754.65

18,670.01

10,729.67

20,538.70

60,581.11

47,875.86

36,723.12

b.

Power

15,443.88

6,116.24

29,763.64

9,728.76

Total

28,143.00

6,864.37

77,031.28

40,179.52

Freight on Inter-unit Clinker Transfer

Freight & Selling Expenses

Other Expenses

Total

Profit from Operations before Other Income, Interest

& Exceptional Items (1-2)

Other Income

2,717.29

14,749.77

6,278.79

53,032.97

28,131.12

2,055.36

12,047.93

4,848.32

59,553.76

6,870.56

8,065.61

45,927.70

25,235.29

196,964.36

77,092.84

3,491.39

35,976.93

18,498.25

172,546.69

40,395.50

Less: (a) Interest

(b) Exceptional items

(c) Other Unallocable expenditure /

(income)

2,177.56

831.31

(1,136.80)

2,541.90

(1,366.06)

7,443.18

3,093.05

(5,795.99)

5,329.64

3,888.46

(5,869.50)

Profit before Tax

26,270.93

5,688.53

72,291.04

36,830.92

1,148.68

1,359.87

5,734.43

5,653.52

Profit before Interest & Exceptional Items (3+4)

29,279.80

8,230.43

82,827.27

46,049.02

102,240.21

84,313.37

102,240.21

84,313.37

2,177.56

2,541.90

7,443.18

5,329.64

b.

Power

22,461.34

9,839.43

22,461.34

9,839.43

27,102.24

5,688.53

75,384.09

40,719.38

c.

Unallocated capital employed

145,915.47

106,197.55

145,915.47

106,197.55

270,617.02

200,350.35

270,617.02

200,350.35

831.31

3,093.05

3,888.46

26,270.93

5,688.53

72,291.04

36,830.92

1,453.11

3,392.10

13,686.98

12,265.32

1,254.17

(1,811.11)

807.12

(1,471.60)

Net Profit from Ordinary Activities after tax (9-10)

Extraordinary Items (net of tax expense)

23,563.65

-

4,107.54

-

57,796.94

-

26,037.20

-

13

Net Profit (11-12)

23,563.65

4,107.54

57,796.94

26,037.20

14

3,483.72

3,483.72

3,483.72

3,483.72

15

Paid up Equity Share Capital (Face value Rs. 10 per

share)

Reserves

117,517.97

63,796.81

16

Earnings per share (EPS) (Rs.) -

g.

h.

i.

3

4

5

6

Interest

Profit after Interest but before Exceptional Items (5-6)

Exceptional items

-

Assets Constructed at Others' Premises W/Off

Profit from Ordinary Activities before tax (7-8)

10

Tax expense

- Current and Fringe Benefit Tax

-

11

12

17

18

Deferred Tax

(a)

-

Segment Capital Employed

a. Cement

Total

Cash

86.94

60.18

227.18

207.94

Basic & Diluted

67.64

11.79

165.91

74.74

12,050,413

34.59%

12,639,468

36.28%

12,050,413

34.59%

12,639,468

36.28%

Public Shareholding

Number of shares

Percentage of shareholding

Promoters and Promoter Group Shareholding

Notes:

The above results were taken on record at the meeting of the Board of Directors held on 28th April,

2009.

The Company is primarily engaged in the business of production and sale of cement. Company sells its

surplus power generated from captive power plants to external parties. Accordingly, the Company has

two primary business segments, namely Cement and Power (used mainly for captive consumption),

which in the context of Accounting Standard 17 on "Segment Reporting" constitute reportable segments.

The Board has declared Interim dividend @ Rs. 5 per share and also recommended Final Dividend of

Rs. 5 per share on Equity Share of Rs. 10/- each for the year 2008-09.

There were no investors' complaints pending at the beginning & at close of the quarter. The Company

has received & resolved 4 investors' complaints during the current quarter.

During the quarter ended 31st March, 2009, Company has completed and started trial production from

its 1.0 MTPA Clinkerisation Unit (Unit-VII) at Bangur City, Ras.

Figures for previous period have been regrouped wherever necessary.

Place : Kolkata

Date :28th April, 2009

Pledged/ Encumbered

Number of Shares

Percentage of shares (as a % of the total

shareholding of promoters and promoter group)

Percentage of shares (as a % of the total share

capital of the Company)

(b)

-

Non-encumbered

Number of shares

Percentage of shares (as a % of the total

shareholding of promoters and promoter group)

Percentage of shares (as a % of the total share

capital of the Company)

Cement Production in lac ton

By order of the Board

( B.G. Bangur)

Nil

-

Nil

-

22,786,812

100.00%

22,786,812

100.00%

65.41%

65.41%

23.03

19.57

77.65

Executive Chairman

63.37

For details e-mail at : bhandaria@shreecementltd.com

Visit us on www.shreecementltd.com

Das könnte Ihnen auch gefallen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument7 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Dokument9 SeitenStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Lakson Tobbaco Company 2008Dokument7 SeitenLakson Tobbaco Company 2008Farqaleet KianiNoch keine Bewertungen

- Voltas 2019 Balance SheetDokument16 SeitenVoltas 2019 Balance SheetAbhishekNoch keine Bewertungen

- 2009-10 Annual ResultsDokument1 Seite2009-10 Annual ResultsAshish KadianNoch keine Bewertungen

- Everest Industries Limited: Investor Presentation 29 April 2011Dokument12 SeitenEverest Industries Limited: Investor Presentation 29 April 2011vejendla_vinod351Noch keine Bewertungen

- Savita Oil (Qtly 2009 06 30)Dokument2 SeitenSavita Oil (Qtly 2009 06 30)Karl_23Noch keine Bewertungen

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument7 SeitenStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- FY11 - Investor PresentationDokument11 SeitenFY11 - Investor Presentationcooladi$Noch keine Bewertungen

- Corrected Financial Results For The Period Ended March 31, 2016 & June 30, 2016 (Result)Dokument4 SeitenCorrected Financial Results For The Period Ended March 31, 2016 & June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Pakistan Synthetics Limited: Condensed Interim Balance Sheet (Unaudited)Dokument8 SeitenPakistan Synthetics Limited: Condensed Interim Balance Sheet (Unaudited)mohammadtalhaNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Ashok Leyland Limited Regd. Office:1 Sardar Patel Road, Guindy, Chennai - 600 032Dokument2 SeitenAshok Leyland Limited Regd. Office:1 Sardar Patel Road, Guindy, Chennai - 600 032Kumaresh SalemNoch keine Bewertungen

- Financial Results For December 31, 2015 (Result)Dokument3 SeitenFinancial Results For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Updates On Financial Results For Sept 30, 2015 (Result)Dokument4 SeitenUpdates On Financial Results For Sept 30, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Q3 Results 201112Dokument3 SeitenQ3 Results 201112Bishwajeet Pratap SinghNoch keine Bewertungen

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For Sept 30, 2015 (Standalone) (Result)Dokument2 SeitenFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument8 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Attempt All Questions: Summer Exam-2009 Performance Measurement Duration: 3 Hrs. Marks-100Dokument15 SeitenAttempt All Questions: Summer Exam-2009 Performance Measurement Duration: 3 Hrs. Marks-100GENIUS1507Noch keine Bewertungen

- An Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Dokument1 SeiteAn Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Muralis MuralisNoch keine Bewertungen

- Limited: Under and (Listing andDokument5 SeitenLimited: Under and (Listing andgaurav chaudharyNoch keine Bewertungen

- 2008 2009 - 31 Mar 2009Dokument3 Seiten2008 2009 - 31 Mar 2009Nishit PatelNoch keine Bewertungen

- Savita Oil (Qtly 2009 09 30)Dokument2 SeitenSavita Oil (Qtly 2009 09 30)Karl_23Noch keine Bewertungen

- Steel Industry: A Project ReportDokument13 SeitenSteel Industry: A Project ReportVijendra SinghNoch keine Bewertungen

- Financial Reporting (S-501) : Stage-5 / Professional IIIDokument4 SeitenFinancial Reporting (S-501) : Stage-5 / Professional IIIIrfanNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- SEBI Results Mar13Dokument2 SeitenSEBI Results Mar13Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- IFCI Dec09Dokument3 SeitenIFCI Dec09nitin2khNoch keine Bewertungen

- Standalone Financial Results For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Assignment I - Ashapura Minechem LimitedDokument8 SeitenAssignment I - Ashapura Minechem LimitedSibika GadiaNoch keine Bewertungen

- Result Q-1-11 For PrintDokument1 SeiteResult Q-1-11 For PrintSagar KadamNoch keine Bewertungen

- Case Study On Standard Costing and Variance AnalysisDokument1 SeiteCase Study On Standard Costing and Variance AnalysisSoumendra Roy100% (1)

- Tata Motors: AccumulateDokument5 SeitenTata Motors: AccumulatepaanksNoch keine Bewertungen

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Sebi MillionsDokument2 SeitenSebi MillionsNitish GargNoch keine Bewertungen

- Tata Steel: Abhijit Samanta International School of Business & Media KolkataDokument13 SeitenTata Steel: Abhijit Samanta International School of Business & Media KolkataForhanul AlamNoch keine Bewertungen

- Audited Result 2010 11Dokument2 SeitenAudited Result 2010 11Priya SharmaNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument6 SeitenStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Abbott UnauditedFinancialMar2011Dokument2 SeitenAbbott UnauditedFinancialMar2011Ghanshyam AhireNoch keine Bewertungen

- Avt Naturals (Qtly 2011 03 31) PDFDokument1 SeiteAvt Naturals (Qtly 2011 03 31) PDFKarl_23Noch keine Bewertungen

- Results Q1FY11 12Dokument1 SeiteResults Q1FY11 12rao_gsv7598Noch keine Bewertungen

- Q 2 Financial Results 18Dokument13 SeitenQ 2 Financial Results 18bhupendra investorNoch keine Bewertungen

- UntitledDokument122 SeitenUntitledteam eliteNoch keine Bewertungen

- Particulars 3 Months Ended 31.03.2009 3 Months Ended 31.03.2008 Year Ended 31.03.2009 Audited Year Ended 31.03.2008 AuditedDokument5 SeitenParticulars 3 Months Ended 31.03.2009 3 Months Ended 31.03.2008 Year Ended 31.03.2009 Audited Year Ended 31.03.2008 AuditedDhanya R KarthaNoch keine Bewertungen

- Standalone Financial Results For June 30, 2016 (Result)Dokument1 SeiteStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Dokument16 SeitenStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For December 31, 2015 (Result)Dokument2 SeitenFinancial Results For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Annual 2009 - 10: Held On Friday, July 2, 2010 at MumbaiDokument14 SeitenAnnual 2009 - 10: Held On Friday, July 2, 2010 at Mumbaijuggy1812Noch keine Bewertungen

- Financial Results & Limited Review For Sept 30, 2014 (Result)Dokument5 SeitenFinancial Results & Limited Review For Sept 30, 2014 (Result)Shyam SunderNoch keine Bewertungen

- GRP LTD (Gujarat Reclaim) Annual Report 12-13Dokument76 SeitenGRP LTD (Gujarat Reclaim) Annual Report 12-13bhavan123Noch keine Bewertungen

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Avt Naturals (Qtly 2010 03 31) PDFDokument1 SeiteAvt Naturals (Qtly 2010 03 31) PDFKarl_23Noch keine Bewertungen

- Financial Results & Limited Review For Dec 31, 2012 (Result)Dokument3 SeitenFinancial Results & Limited Review For Dec 31, 2012 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Dokument9 SeitenStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Form A For March 31, 2016 (Result)Dokument8 SeitenStandalone Financial Results, Form A For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Complete Engines, Part Engines & Engine Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryVon EverandComplete Engines, Part Engines & Engine Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Form 26ASDokument10 SeitenForm 26ASdhaval.shahNoch keine Bewertungen

- Nagaland WB Claim FormDokument2 SeitenNagaland WB Claim FormnileshNoch keine Bewertungen

- Question 1: Ias 8 Policies, Estimates & Errors: Page 1 of 3Dokument3 SeitenQuestion 1: Ias 8 Policies, Estimates & Errors: Page 1 of 3Bagudu Bilal GamboNoch keine Bewertungen

- Assessment 1 - Written or Oral QuestionsDokument7 SeitenAssessment 1 - Written or Oral Questionswilson garzonNoch keine Bewertungen

- Ella Lyman Cabot Trust Question ListDokument2 SeitenElla Lyman Cabot Trust Question ListAdeyemi Oluwaseun JohnNoch keine Bewertungen

- Rdo 007 Abra - DO4897 3Dokument21 SeitenRdo 007 Abra - DO4897 3jendelyn r. barbadilloNoch keine Bewertungen

- Reliance Individual Mediclaim Policy ScheduleDokument1 SeiteReliance Individual Mediclaim Policy ScheduleKoushik Dutta38% (13)

- IT Declaration Form For Let Out PropertyDokument5 SeitenIT Declaration Form For Let Out PropertySUPRIYANoch keine Bewertungen

- EinDokument1 SeiteEinruovzuffNoch keine Bewertungen

- TABL2751 2016-2 Tutorial Program FinalDokument25 SeitenTABL2751 2016-2 Tutorial Program FinalAnna ChenNoch keine Bewertungen

- PT Prudential Life Assurance Payslip February 2021: ConfidentialDokument1 SeitePT Prudential Life Assurance Payslip February 2021: ConfidentialVenysunny KusnadiNoch keine Bewertungen

- IT-AE-36-G04 - Quick Guide On How To Complete The ITR12 Return For Individuals - External Guide PDFDokument23 SeitenIT-AE-36-G04 - Quick Guide On How To Complete The ITR12 Return For Individuals - External Guide PDFscribdtulasi100% (1)

- PAY SLIP ExcelDokument26 SeitenPAY SLIP Excelhitesh nandawaniNoch keine Bewertungen

- Taxation Audio LecturesDokument2 SeitenTaxation Audio LecturesClarisse Ann MirandaNoch keine Bewertungen

- Payments in Lieu of TaxesDokument52 SeitenPayments in Lieu of TaxesLincoln Institute of Land PolicyNoch keine Bewertungen

- Contoh Analisis DU PONTDokument1 SeiteContoh Analisis DU PONThilda yatiNoch keine Bewertungen

- G.R. Nos. 134587Dokument8 SeitenG.R. Nos. 134587Ann ChanNoch keine Bewertungen

- Agri Dhamaka Poster April 2024Dokument2 SeitenAgri Dhamaka Poster April 2024astropragya11Noch keine Bewertungen

- Profit or Loss From Business: Schedule C (Form 1040) 09Dokument2 SeitenProfit or Loss From Business: Schedule C (Form 1040) 09Braeylnn bookerNoch keine Bewertungen

- Salary Slip - Quess)Dokument1 SeiteSalary Slip - Quess)gamersingh098123Noch keine Bewertungen

- Assignment 1 Outline and Guideline UpdateDokument3 SeitenAssignment 1 Outline and Guideline UpdateĐan Nguyễn PhươngNoch keine Bewertungen

- Corporate Accounting AssignmentDokument5 SeitenCorporate Accounting AssignmentMd.Mahmudul HasanNoch keine Bewertungen

- Denis Martin Jacobo - RESEARCHDokument73 SeitenDenis Martin Jacobo - RESEARCHjupiter stationeryNoch keine Bewertungen

- Pioma Plastics Company Cash Flow Statement For The Year Ended July 31 Amount in Rs. Amount in Rs. Cash Flow From Operating ActivitiesDokument4 SeitenPioma Plastics Company Cash Flow Statement For The Year Ended July 31 Amount in Rs. Amount in Rs. Cash Flow From Operating ActivitiesPrajwal PaiNoch keine Bewertungen

- 211010-015-051233 - 16413193 GST BillDokument1 Seite211010-015-051233 - 16413193 GST BillPratik DiyoraNoch keine Bewertungen

- Tax Invoice: Original For RecipientDokument3 SeitenTax Invoice: Original For RecipientS V ENTERPRISESNoch keine Bewertungen

- Income From Other SourcesDokument15 SeitenIncome From Other SourcesPranav ParmarNoch keine Bewertungen

- GJCPP5643 H: Income Tax Department Govt. of IndiaDokument1 SeiteGJCPP5643 H: Income Tax Department Govt. of Indiaswathi100% (1)

- Economics Project On Government Budget - Class 12 CBSE: Nawaf Gantare 16-21 Minutes ContentsDokument15 SeitenEconomics Project On Government Budget - Class 12 CBSE: Nawaf Gantare 16-21 Minutes ContentsAham sinha100% (2)

- Year-End Adjustment NewDokument27 SeitenYear-End Adjustment NewKyrzen Novilla0% (1)