Beruflich Dokumente

Kultur Dokumente

Assignment # 01 Auto Saved)

Hochgeladen von

yarrehmanOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Assignment # 01 Auto Saved)

Hochgeladen von

yarrehmanCopyright:

Verfügbare Formate

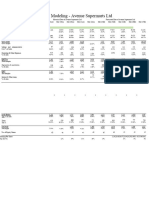

Index Analysis / Vertical Method

20X1

20X2

20X3

20X4

20X1

20X2

20X3

20X4

214.00

93.00

42.00

38.00

100.00%

43.46%

19.63%

17.76%

Receivables

12,313.00

1,569.00

1,846.00

2,562.00

100.00%

12.74%

14.99%

20.81%

Inventories

2,102.00

2,893.00

3,678.00

4,261.00

100.00% 137.63%

174.98%

202.71%

Net fixed asset

2,219.00

2,346.00

2,388.00

2,692.00

100.00% 105.72%

107.62%

121.32%

Total asset

5,748.00

6,901.00

7,954.00

9,553.00

100.00% 120.06%

138.38%

166.20%

Account Payable

1,131.00

1,578.00

1,848.00

2,968.00

100.00% 139.52%

163.40%

262.42%

Notes Payable

500.00

650.00

50.00

750.00

100.00% 130.00%

10.00%

150.00%

Accruals

656.00

861.00

1,289.00

1,743.00

100.00% 131.25%

196.49%

265.70%

Long-term Debt

500.00

800.00

800.00

800.00

100.00% 160.00%

160.00%

160.00%

Common Stock

Retained

earnings

Total Liabilities

& Shareholder's

Equity

200.00

200.00

200.00

200.00

100.00% 100.00%

100.00%

100.00%

2,761.00

2,812.00

3,067.00

3,092.00

100.00% 101.85%

111.08%

111.99%

5,748.00

6,901.00

7,954.00

9,553.00

100.00% 120.06%

138.38%

166.20%

Cash

Prepared By: Yar-Rehman

Registration No:

1432-110030

Submitted To:Sir Mr. Rafi

20X1

20X2

20X3

20X4

Current asset/Current Liabilities

250.00%

200.00%

162.50%

225.00%

Current asset- Inventories/Current Liabilities

100.00%

90.00%

75.00%

100.00%

(5.0 X )

(4.5 X )

3.2 X

(6.0 X )

(4.0 X )

(3.0 X )

(1.71 X )

(4.0 X )

Longterm debt/Longterm debt + Equity

35.00%

40.00%

54.55%

33.00%

Sales - Cost of goods sold/Sales

39.00%

41.00%

40.00%

40.00%

Net Profit after Taxes/Sales

17.00%

15.00%

10.00%

15.00%

Net profit after Taxes - Dividend on Preferred

Stock/Net worth - Par value of preferred Stock

15.00%

20.00%

29.33%

20.00%

Net Income after Tax/Total Assets

15.00%

12.00%

6.67%

12.00%

Sales/Total Assets

(0.9 X )

(.8 X )

0.67 X

(1.0 X )

EBIT/Interest Charges

(5.5 X )

(4.5 X )

(3.67 X )

(5.0 X )

Formulae

S No

1 Current Ratio

2 Acid-test Ratio

3 Receivable Turnover

4 Inventory Turnover

Long-term debt/ Total

5 Capitalization

6 Gross ProfitMargin

7 Net Profit Margin

8 Return on Equity

9 Return on Asset

10 Total Asset Turnover

11 Interest Coverage Ratio

Prepared By:

Registration No:

Submitted To:

Annual Credit Sale/receivables

Cost of goods Sold/Inventory

Yar-Rehman

1432-110030

Sir Mr. Rafi

Index Analysis / Vertical Method

20X0

20X1

20X2

20X0

20X1

20X2

2,307.00

11,310.00

19,648.00

100.00%

490.25%

851.67%

Receivables

70,360.00

85,147.00

118,415.00

100.00%

121.02%

168.30%

Inventories

77,380.00

91,378.00

118,563.00

100.00%

118.09%

153.22%

6,316.00

6,082.00

5,891.00

100.00%

96.30%

93.27%

100.00%

123.86%

167.67%

Cash

Other Current asset

current Asset

Fixed asset, net

Other Longterm Assete

Total Assets

156,563.00 193,917.00 262,517.00

79,187.00

94,652.00

115,461.00

100.00%

119.53%

145.81%

4,695.00

5,899.00

5,491.00

100.00%

125.64%

116.95%

100.00%

122.47%

159.48%

240,445.00 294,468.00 383,469.00

Accounts Payable

35,661.00

37,460.00

62,725.00

100.00%

105.04%

175.89%

Notes Payable

20,501.00

14,680.00

17,298.00

100.00%

71.61%

84.38%

1,105.00

8,132.00

15,741.00

100.00%

735.93%

1424.52%

67,216.00

60,272.00

95,764.00

100.00%

89.67%

142.47%

888.00

1,276.00

4,005.00

100.00%

143.69%

451.01%

Total Liailities

68,104.00

61,548.00

99,769.00

100.00%

90.37%

146.50%

Common Stock

12,650.00

20,750.00

24,150.00

100.00%

164.03%

190.91%

87,730.00

100.00%

185.38%

231.17%

Retained Earning

121,741.00 141,820.00 171,820.00

100.00%

116.49%

141.14%

Total

Shareholder's

Total Liabilities

& Equity

Sharehoilder's Equity

172,341.00 232,920.00 283,700.00

100.00%

135.15%

164.62%

240,445.00 294,468.00 283,469.00

100.00%

122.47%

117.89%

Other Current Liabilities

Current Liabilities

Long-term Debt

Additional Paid in Capital

37,950.00

70,350.00

Index Analysis / Vertical Method

20X0

Net Sale

Cost of Good Sold

Gross Profit

Selling, General & Admin

Expense

Depreciation

Interest Expense

earning Before Taxes

Taxes

Earning after Taxes

20X1

20X2

20X3

323,780.00 375,088.00 479,077.00

148,127.00 184,507.00 223,690.00

175,653.00 190,581.00 255,387.00

100.00%

100.00%

100.00%

115.85%

124.56%

108.50%

147.96%

151.01%

145.39%

131,809.00 140,913.00 180,610.00

100.00%

106.91%

137.02%

100.00%

100.00%

100.00%

100.00%

100.00%

124.61%

79.25%

112.44%

115.48%

110.66%

146.19%

99.59%

179.53%

184.38%

176.67%

7,700.00

1,711.00

34,433.00

12,740.00

21,693.00

20X1

9,595.00

1,356.00

38,717.00

14,712.00

24,005.00

20X2

11,257.00

1,704.00

61,816.00

23,490.00

38,326.00

Das könnte Ihnen auch gefallen

- Alliance Concrete Case ExcelDokument14 SeitenAlliance Concrete Case ExcelKelsey McMillanNoch keine Bewertungen

- Lincoln Electric Itw - Cost Management ProjectDokument7 SeitenLincoln Electric Itw - Cost Management Projectapi-451188446Noch keine Bewertungen

- Solution - Chapter 1Dokument8 SeitenSolution - Chapter 1Nezo Qawasmeh75% (4)

- FM FS For GlobeDokument5 SeitenFM FS For GlobeIngrid garingNoch keine Bewertungen

- Nestle Group Balance Sheet and Income Statement Analysis 2018-2017Dokument7 SeitenNestle Group Balance Sheet and Income Statement Analysis 2018-2017ablay logene50% (2)

- DR Lal Path Labs Financial Model - Ayushi JainDokument45 SeitenDR Lal Path Labs Financial Model - Ayushi JainTanya SinghNoch keine Bewertungen

- Chapter 16Dokument14 SeitenChapter 16Basmah727100% (1)

- Accounting 202 Notes - David HornungDokument28 SeitenAccounting 202 Notes - David HornungAvi Goodstein100% (1)

- Introduction to Corp AccountingDokument15 SeitenIntroduction to Corp Accountingcaleblauredo100% (1)

- Quiz 1 Acco 204 - GonzagaDokument17 SeitenQuiz 1 Acco 204 - GonzagaLalaine Keendra GonzagaNoch keine Bewertungen

- Apple Inc. Financial Statements AnalysisDokument15 SeitenApple Inc. Financial Statements AnalysisDOWLA KHANNoch keine Bewertungen

- Financial Statements For BYCO Income StatementDokument3 SeitenFinancial Statements For BYCO Income Statementmohammad bilalNoch keine Bewertungen

- 04 02 BeginDokument2 Seiten04 02 BeginnehaNoch keine Bewertungen

- High Tire PerformanceDokument8 SeitenHigh Tire PerformanceSofía MargaritaNoch keine Bewertungen

- Financial Model of Dmart - 5Dokument4 SeitenFinancial Model of Dmart - 5Shivam DubeyNoch keine Bewertungen

- Phil HealthDokument9 SeitenPhil Healthlorren ramiroNoch keine Bewertungen

- Aims ErnaDokument6 SeitenAims Ernaerna robiatulNoch keine Bewertungen

- PHILEX - V and H AnalysisDokument8 SeitenPHILEX - V and H AnalysisHilario, Jana Rizzette C.Noch keine Bewertungen

- JanetDokument11 SeitenJanetHassanNoch keine Bewertungen

- 2022 Income Statement and Balance Sheet AnalysisDokument8 Seiten2022 Income Statement and Balance Sheet AnalysisHaxi KhanNoch keine Bewertungen

- Base Case - Financial ModelDokument52 SeitenBase Case - Financial Modeljuan.farrelNoch keine Bewertungen

- Group 4 Financial Analysis and Performance ReviewDokument11 SeitenGroup 4 Financial Analysis and Performance ReviewNguyễn Diệu LinhNoch keine Bewertungen

- Horizontal and Vertical AnalysisDokument3 SeitenHorizontal and Vertical AnalysisJane Ericka Joy MayoNoch keine Bewertungen

- Ratios and financial parameters for 14-Aug-19 and 20-Aug-19Dokument1 SeiteRatios and financial parameters for 14-Aug-19 and 20-Aug-19Aldo Namora SarumpaetNoch keine Bewertungen

- Ratios and financial parameters for 14-Aug-19 and 20-Aug-19Dokument1 SeiteRatios and financial parameters for 14-Aug-19 and 20-Aug-19Aldo Namora SarumpaetNoch keine Bewertungen

- Business FinanceDokument6 SeitenBusiness Financejeonlei02Noch keine Bewertungen

- Asad JuttDokument4 SeitenAsad JuttAsad AliNoch keine Bewertungen

- Reckitt Benckiser Group PLC Balance Sheet Analysis 2014-2018Dokument19 SeitenReckitt Benckiser Group PLC Balance Sheet Analysis 2014-2018EryllNoch keine Bewertungen

- Horizontal SFPDokument17 SeitenHorizontal SFPJanefren Pada EdilloNoch keine Bewertungen

- Panther Tyre Company Balance Sheet 43,100.00 2,018.00 2,019.00 2,020.00 Assets Current Assets Increase or (Decrease)Dokument7 SeitenPanther Tyre Company Balance Sheet 43,100.00 2,018.00 2,019.00 2,020.00 Assets Current Assets Increase or (Decrease)HussainNoch keine Bewertungen

- Financial - Analysis (SCI and SFP)Dokument4 SeitenFinancial - Analysis (SCI and SFP)Joshua BristolNoch keine Bewertungen

- Ratio 2Dokument2 SeitenRatio 2Mae ValenciaNoch keine Bewertungen

- Ratio 2Dokument2 SeitenRatio 2Mae ValenciaNoch keine Bewertungen

- Increase (Decrease) 2019 2018 Amount Percent Sales RevenueDokument6 SeitenIncrease (Decrease) 2019 2018 Amount Percent Sales RevenuewennylynNoch keine Bewertungen

- Apollo Hospitals Enterprise LimitedDokument10 SeitenApollo Hospitals Enterprise LimitedHemendra GuptaNoch keine Bewertungen

- Homeritz Corporation BerhadDokument12 SeitenHomeritz Corporation BerhadAfiq KhidhirNoch keine Bewertungen

- Heg LTDDokument9 SeitenHeg LTDsmitNoch keine Bewertungen

- Ceres Gardening - Case (1) ProfesorDokument1 SeiteCeres Gardening - Case (1) Profesorpeta8805Noch keine Bewertungen

- Zomato ValuationDokument24 SeitenZomato ValuationABHISHEK YADAVNoch keine Bewertungen

- Aliza Rizvi 22010100: Exhibit 8: Assumptions For Discounted Cash Flow AnalysisDokument3 SeitenAliza Rizvi 22010100: Exhibit 8: Assumptions For Discounted Cash Flow AnalysisAliza RizviNoch keine Bewertungen

- Albermarle Financial ModelDokument38 SeitenAlbermarle Financial ModelParas AroraNoch keine Bewertungen

- Account Title 2014 (In ) 2013 (In ) Peso Change Percent Change 2013 (In ) 2012 (In ) Peso Change Perce NT Chan GeDokument4 SeitenAccount Title 2014 (In ) 2013 (In ) Peso Change Percent Change 2013 (In ) 2012 (In ) Peso Change Perce NT Chan GeadsNoch keine Bewertungen

- Vertical FinancieraDokument1 SeiteVertical FinancieraAngel TipismanaNoch keine Bewertungen

- LuxotticaDokument24 SeitenLuxotticaValentina GaviriaNoch keine Bewertungen

- Financial Management Insights of Exide IndustriesDokument10 SeitenFinancial Management Insights of Exide IndustriesAlok ChowdhuryNoch keine Bewertungen

- Vertical and Horizontal Analysis of Financial Statement of A Sole ProprietorshipDokument35 SeitenVertical and Horizontal Analysis of Financial Statement of A Sole ProprietorshipJohn Fort Edwin AmoraNoch keine Bewertungen

- Financial Ration AnalysisDokument14 SeitenFinancial Ration Analysisaq.dhonyNoch keine Bewertungen

- Analisis Lap KeuDokument10 SeitenAnalisis Lap KeuAna BaenaNoch keine Bewertungen

- Pak Electron Limited: BALANCE SHEET - Vertical Analysis (Rupee in Million)Dokument14 SeitenPak Electron Limited: BALANCE SHEET - Vertical Analysis (Rupee in Million)Abdul RehmanNoch keine Bewertungen

- BMP Bav ReportDokument79 SeitenBMP Bav ReportThu ThuNoch keine Bewertungen

- Excel Bav Vinamilk C A 3 Chúng TaDokument47 SeitenExcel Bav Vinamilk C A 3 Chúng TaThu ThuNoch keine Bewertungen

- BMP Bav Report FinalDokument93 SeitenBMP Bav Report FinalThu ThuNoch keine Bewertungen

- Kota Fibres, Ltd. (FIX)Dokument10 SeitenKota Fibres, Ltd. (FIX)Aldo MadonaNoch keine Bewertungen

- Group Members Financial ProjectionsDokument12 SeitenGroup Members Financial ProjectionsManmeet SinghNoch keine Bewertungen

- Marico Financial Model (Final) (Final-1Dokument22 SeitenMarico Financial Model (Final) (Final-1Jayant JainNoch keine Bewertungen

- BF1 Package Ratios ForecastingDokument16 SeitenBF1 Package Ratios ForecastingBilal Javed JafraniNoch keine Bewertungen

- Analisa SahamDokument10 SeitenAnalisa SahamGede AriantaNoch keine Bewertungen

- Airthread ValuationDokument7 SeitenAirthread ValuationAbhinav UtkarshNoch keine Bewertungen

- Retail Petrol Stations 2006-2009 PerformanceDokument30 SeitenRetail Petrol Stations 2006-2009 PerformanceSofía MargaritaNoch keine Bewertungen

- Finacial Position FINALDokument4 SeitenFinacial Position FINALLenard TaberdoNoch keine Bewertungen

- Horizontal and Vertical Analysis of ProfitDokument3 SeitenHorizontal and Vertical Analysis of ProfitIfzal AhmadNoch keine Bewertungen

- Pilipinas Shell Vertical and Horizontal AnalysisDokument7 SeitenPilipinas Shell Vertical and Horizontal Analysismaica G.Noch keine Bewertungen

- PGPF - 01 - 017 - CV - Assignment - 5 - Keshav v1Dokument26 SeitenPGPF - 01 - 017 - CV - Assignment - 5 - Keshav v1nidhidNoch keine Bewertungen

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachVon EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachBewertung: 3 von 5 Sternen3/5 (3)

- Preview of Chapter 1: Financial AccountingDokument109 SeitenPreview of Chapter 1: Financial AccountingHiếu Nguyễn Minh HoàngNoch keine Bewertungen

- Ch01 Beams12ge SMDokument11 SeitenCh01 Beams12ge SMWira MokiNoch keine Bewertungen

- PLJ Volume 55 Fourth Quarter - 02 - Esteban B. Bautista - Rights and Obligations of Stockholders Under The Corporation CodeDokument24 SeitenPLJ Volume 55 Fourth Quarter - 02 - Esteban B. Bautista - Rights and Obligations of Stockholders Under The Corporation CodeCarla GrepoNoch keine Bewertungen

- Tax Rates: Tax Code Sectio N Document Taxable Unit Tax Due Per Unit % of Unit Taxable BaseDokument6 SeitenTax Rates: Tax Code Sectio N Document Taxable Unit Tax Due Per Unit % of Unit Taxable BaseNJPMsmashNoch keine Bewertungen

- CH 11Dokument46 SeitenCH 11kevin echiverriNoch keine Bewertungen

- War22e Ch13Dokument77 SeitenWar22e Ch13tamparddNoch keine Bewertungen

- Question Text: Retained Earnings Retained Earnings Retained Earnings Retained EarningsDokument32 SeitenQuestion Text: Retained Earnings Retained Earnings Retained Earnings Retained EarningsYou're WelcomeNoch keine Bewertungen

- Chapter 10 - Bond Prices and YieldsDokument42 SeitenChapter 10 - Bond Prices and YieldsA_Students100% (3)

- Corporation ReviewerDokument13 SeitenCorporation ReviewerMyka Ann GarciaNoch keine Bewertungen

- Calculate Conversion Prices, Ratios and Values for Convertible BondsDokument4 SeitenCalculate Conversion Prices, Ratios and Values for Convertible BondsGailee VinNoch keine Bewertungen

- Notes in Business Organization Ii: Corporations Atty. Zarah Villanueva-Castro (FEU and San Beda)Dokument31 SeitenNotes in Business Organization Ii: Corporations Atty. Zarah Villanueva-Castro (FEU and San Beda)Cazzandhra BullecerNoch keine Bewertungen

- Bam 241: Business Laws and Regulations Second Periodical ExaminationDokument19 SeitenBam 241: Business Laws and Regulations Second Periodical ExaminationGiner Mabale StevenNoch keine Bewertungen

- Accounting Corp.Dokument4 SeitenAccounting Corp.Rausa MaeNoch keine Bewertungen

- CORPORATION ENTITYDokument20 SeitenCORPORATION ENTITYyotatNoch keine Bewertungen

- Acctg 2.2 Journal Entries - Cs TransactionsDokument4 SeitenAcctg 2.2 Journal Entries - Cs Transactionskim TammyNoch keine Bewertungen

- Law On Corporation Title 2Dokument6 SeitenLaw On Corporation Title 2prey kunNoch keine Bewertungen

- MF Cost of Capital - Practice QuestionsDokument4 SeitenMF Cost of Capital - Practice QuestionsSaad UsmanNoch keine Bewertungen

- BY-LAWS AND MEETINGSDokument25 SeitenBY-LAWS AND MEETINGSGabrielNoch keine Bewertungen

- Learning Objective 13-1: Chapter 13 CorporationsDokument51 SeitenLearning Objective 13-1: Chapter 13 CorporationsMarqaz MarqazNoch keine Bewertungen

- National Exchange Co Vs DexterDokument2 SeitenNational Exchange Co Vs DexterQueenie SabladaNoch keine Bewertungen

- Stockholders' Equity Stockholders' EquityDokument72 SeitenStockholders' Equity Stockholders' EquityMohammed Akhtab Ul HudaNoch keine Bewertungen

- Accounting For CorporationDokument11 SeitenAccounting For CorporationMaricar D. VillarazaNoch keine Bewertungen

- Stice 18e Ch13 SOL FinalDokument56 SeitenStice 18e Ch13 SOL FinalKhôi NguyênNoch keine Bewertungen

- Corporations - Answers To Diagnostic ExerciseseDokument31 SeitenCorporations - Answers To Diagnostic ExerciseseBrent LigsayNoch keine Bewertungen

- 2-1 Accounting ReviewerDokument15 Seiten2-1 Accounting ReviewerJulienne S. RabagoNoch keine Bewertungen

- Robin Corp share transactionsDokument3 SeitenRobin Corp share transactionsDavia ShawNoch keine Bewertungen