Beruflich Dokumente

Kultur Dokumente

2009 Spring Mid-Term 1 (Sat) - Key

Hochgeladen von

lucashagnessOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2009 Spring Mid-Term 1 (Sat) - Key

Hochgeladen von

lucashagnessCopyright:

Verfügbare Formate

MBA6030 Spring Semester 2009 Sat92 Midterm1 page 1 of 9 MBA 6030 Introduction to Financial Accounting Carlson School of Management

nt Spring Semester 2009 INSTRUCTIONS 1. Enter your name here (print legibly) 2. Enter your student ID number here _________________K_E_Y________________________________________ _________________________________________________________________ Tue91 Wed90 Sat 92 Midterm1 Exam Gordon Leon Duke, PhD exam spf01

3. Circle the class meeting date or section number for which you are registered:

4. Do NOT begin this exam until told. Do NOT open this exam book until told. Everyone will begin at the same time upon the directions of the proctor. You may, however, read these instructions, and count the pages of this exam book. 5. There are 9 pages to this exam including this cover page. If you do not have 9 pages, inform the proctor and another exam book will be given to you. 6. There are 6 problems on this exam. The problems may NOT be equally weighted. Approximate points for each problem are given at the beginning of each problem. Actual points may vary by one or two for scoring purposes. There are a total of 100 possible points. We also give some suggested time budgets for each problem. 7. This exam is closed book and closed notes. 8. The suggested time for this exam is one hour 30 minutes. You may have a little extra time but all exams are due by 7:45 pm. 9. You may NOT keep this exam book. Turn it in at the end of the exam period. 10. Enter all of your responses on this exam book in the spaces provided. You may use the margins and the backs of pages for your calculations, but put your answers in the spaces provided. 11. Carefully compose your responses. Organization and presentation are part of your response and will weigh in the evaluation of your response. 12. You may use a basic calculator, one that does not have programming, communications or text-storage capabilities. Show your intermediate steps so we can give partial credit. 13. We will post any errata and clarifications during the exam. 14. You can take this exam apart provided you staple or clip it back together. There may be staplers or paper clips at the front of the room. 15. Read the CSOM Statement of Academic Misconduct given below and SIGN your name at the bottom of this page as an indication that you have read and understand this statement. You must acknowledge that you have read this statement and that you understand it before you can be given credit for this exam. "The Carlson School defines academic misconduct as any act by a student that misrepresents the student's own academic work or that compromises the academic work of another. Academic misconduct includes but is not limited to: cheating on assignments or examinations, plagiarizing, misrepresenting as one's own work any work by another, submitting the same paper or substantially similar papers to meet the requirements of more than one course without the approval and consent of the instructors, or sabotaging another's work. Within this general definition, however, instructors determine what constitutes academic misconduct in the courses they teach. Students found guilty of academic misconduct face penalties ranging from a grade reduction to suspension from the University." ______________________________________________________________(signed) I have read and do understand the CSOM Statement of Academic Misconduct 16. When you have completed your responses: a. Confirm that your name, id number and section are entered at the top of this page. b. Confirm that you have read the CSOM Statement of Academic Misconduct and signed above. c. Turn in the exam at the front desk. d. Staple exam back together if you have taken it apart. e. Quietly leave the room and the adjoining hallway prior to discussing the exam. f. Lecture on cash flows will begin at 8:00 pm. END OF INSTRUCTIONS DO NOT TURN THIS PAGE UNTIL TOLD -- 1 --

MBA6030 Spring Semester 2009 Sat92 Midterm1 page 2 of 9

1. General journal entries and the spreadsheet view of accounts. (15 points 15 minutes) . (1) Give journal entries for the five transactions below for Brown Company for the month of January. Do not give closing or adjusting journal entries or posting, just the general journal entry to record each economic event. (2) Give the effect of each of the five transactions on the basic accounting equation using the spreadsheet below (similar to homework problems). Give only the transaction. Do not give the cumulative-to-date balances. You will have to supply the column titles. These should be consistent with your account titles used in part (1). You may not need all columns. Note that there are a few beginning balances. There are several ways to make a correct spreadsheet. (3) Give the total of the columns in your spreadsheet. Confirm that the left side equals the right. Note that there are some beginning values in the ledger accounts. January transactions: (a). On 6 Jan 2009, Brown purchases a truck for a price of $8000. Brown gives $1000 in cash and assumes 5 year debt for $7000. The debt carries 9% interest per year on the unpaid balance. Special equipment is installed on the truck for cost an additional $500 during January. Brown pays for this equipment with cash. (b). On 15 Jan 2009, Brown purchases merchandise inventory on credit. The bill is for $800 but if Brown pays within 30 days, then there is a 2% discount. Brown recorded this purchase at gross. (c). On 19 Jan 2009, Brown delivers merchandise to a customer. The customer had previously paid $500 for the merchandise in full. Brown had correctly recorded this as an payment in advance. (Ignore the expense side.) (d). On 26 Jan 2009, Brown pays all of the 15 Jan purchase with cash taking advantage of a 2% discount for prompt payment. (e). On 28 Jan 2009, Brown issues 20 shares of common stock (par value $1) to a vendor who accepts this stock as full payment for an account (receivable to the vendor, payable for Brown) with a balance of $400 (1) Journal Entries date a. 6 Jan 2009 b. 15 Jan 2009 d. 19 Jan 2009 d. 26 Jan 2009 e. 28 Jan 2009 account Truck (A) full cost Cash (A) down on truck plus equipment Long Term Debt (L) Inventory (A) (at gross) Accounts Payable (L) Payment in Advance (L) Sales Revenue (now earned) Accounts Payable (L) Cash (A) Inventory (A) to reduce to equilivant cash Accounts Payable (L) Common Stock at par (OE) Additional Paid In Capital (OE) assets = equities

inventory truck Account payable Advance payment common stock Add'l P.I.C. retained earnings debt

debit 8500 800

credit 1500 7000 800

500 500 800 784 16 400 20 380

(2) Spreadsheet

cash

begin bal. a. b. c. d. e. (3) total

2300 -1500

200 +8500 +800

= = = = = = 8500 =

400 +800

500

1400

50

150 +7000

-500 -800 -400 0 0 20 1420 380 430

+500

-784 16

-16 984

650

7000

9500 verify 9500 = 2. T-Accounts. (15 points 15 minutes) For Green Retail Company and for the month of January: (1) Post the five below economic events to the accounts given below. Do not do adjusting or closing. Just post these five

MBA6030 Spring Semester 2009 Sat92 Midterm1 page 3 of 9

transactions. There are three blank t-accounts which you may need. (2) Compute ending balances, as of 31 Jan 2009, and summarize these in the Trial Balance below. Note that there are a few beginning balances. (a). On 5 Jan 2009, Green pays payroll in cash for $400. A balance of $45 was carried over from Dec 2008 in the account accrued payroll payable liability. (b). On 9 Jan 2009, Green receives cash payment on accounts receivable -- $100 (c). On 15 Jan 2009, Green receives inventory valued at $85 and will pay later. (d). On 17 Jan 2009, a customer purchase a gift card for $20 and pays cash of $20. There is no discount. (e). On 30 Jan 2009, a customer uses the gift card to purchases goods from Green for the amount of $8. The goods had cost Green $4 and were in inventory Record both the revenue and the expense sides of this transaction.

Accounts payable Accounts receivable Cash Common Stock no par Payroll expense

155

110 100 b b d

500 400 100 20 220

Sales revenue

300 a a 355

85

240

Cost of Sales Expense

10

Inventory

300

Retained Earnings Accrued Payroll Payable (L)

355

Customer pay-in-adv gift card (L)

250

300

400

260 a 45

45

c e 4 254

85 20 d 4 381 e 8 408 e 260 0 e 8 12

Unadjusted Preclosing Trial Balances: Accounts Payable Accounts Receivable Accrued Payroll Payable Cash Common Stock (no par) Cost of Sales Expense Inventory Sales Revenue Retained Earnings Payroll expense Gift card payable (L) TOTALS as of 1 Jan 2009 as of 31 Jan 2009 155 240 110 10 45 0 500 220 300 300 250 254 300 381 400 408 260 260 355 12 1160 1160

1220 1220

MBA6030 Spring Semester 2009 Sat92 Midterm1 page 4 of 9

3. Adjusting Entries: (15 points 15 minutes) White Inc. reports once a quarter. The first quarter of Whites fiscal year 2009 began on 1 Nov 2008 and ends on 31 Jan 2009. White has completed regular journal entries for the first quarter, but has not made adjusting entries. Please give the adjusting entries for the first quarter for the events given below. Express each adjusting entry in good journal form. If no adjusting entry is needed, enter a memo explaining why one is not needed. Otherwise, you do not have to give memos, dates or explanations of the journal entries. a. During the quarter, White purchased a delivery truck. The truck cost $44,000. White correctly recorded the purchase but has made no adjusting journal entries for it. White uses a useful life of 5 years after which, White believes that they truck will have no value. White takes a full quarter of depreciation in the quarter of purchase.

Date Accounts Debits Credits

31 Jan 2009

Depreciation expense Accumulated Depreciation One quarter at $2200 per qtr, 20 qtrs

2,200 2,200

b. During Nov 2008, White purchased a one-year fire insurance policy effective 1 Dec 2008 until 30 Nov 2009. The policy cost $2,400 which was paid in cash. White correctly recorded the policy as Prepaid Insurance but has made no adjusting entries for this.

Date Accounts Debits Credits

31 Jan 2009

Insurance Expense for 2months Prepaid Rent Asset (A) for 2 months Only 2 months this quarter, $200 per mo

400 400

c. At the end of the first quarter, 31 Jan 2009, White owes workers for work performed during the quarter but has not paid them in the amount of $2,000. This has not been recorded. Other payroll has been correctly recorded.

Date Accounts Debits Credits

31 Jan 2009

Payroll expense Accured payroll payable (L)

3,000 3,000

d. On 31 Jan 2009, White takes physical count of supplies inventory and finds $5,000 on hand. Last quarters balance sheet showed $8,000 on hand. The ledger shows that White has purchased $12,000 of additional supplies during the quarter and White correctly debited these purchases to the supplies inventory. White policy is to recognize supply expense as an adjusting journal entry at the end of the quarter.

Date Accounts Debits Credits

31 Jan 2009

Supplies expense (RE ) Supplies Inventory (A ) $20,000 available, $5000 left, so $15,000 used

15,000 15,000

e. On 1 Dec 2008, White gives a note payable to First Bank for $8,000 and received $8,000 in cash. The note was correctly recorded on 1 Dec 2008. The note is due after 90 days (1 Mar 2009) and accrues interest at 12% per year.

Date Accounts Debits Credits

31 Jan 2009

Interest Expense (RE ) Interest payable (L ) or Note Payable White owes two month of interest at 1% per mo

160 160

MBA6030 Spring Semester 2009 Sat92 Midterm1 page 5 of 9

4. Miscellaneous issues (15 points 15 minutes) Please resond to these three independent problems: A. On 1 Nov 2008, Orange Company purchased a delivery truck for $60,000 paying cash. Orange debited Miscellaneous Expense and credited cash for $60,000. Orange should have capitalized the cost of the truck. The truck is estimated to have a 5-year useful life and zero salvage value. Orange calculates depreciation on a monthly basis. Give the journal entry to correct this error on 31 Dec 2008. You may give the short or the long versions. Orange is a calendar year reporter.

Date Accounts Debits Credits

31 Dec 2008

Cash Miscellaneous Expense To reverse out error j.e. Truck (A) Cash Depreciation Expense Accumulated Depreciation Truck (2 months at $1,000 per mo.)

30,000 30,000 30,000 30,000 2,000 2,000

B. On 15 Dec 2008, Green Company, a calendar year reporter, declares a cash dividend to shareholders which total $7,000. On 25 Jan 2009, Green disburses the cash to shareholders. Give the journal entries for both dates:

Date Accounts Debits Credits

15 Dec 2008

Retained Earnings (OE) Dividends Payable (L)

7,000 7,000 7,000 7,000

25 Jan 2009

Dividends Payable (L) Cash (A)

C. On 20 Dec 2008, Blue Company sells merchandise to a customer in the amount for $80. The customer charges this to his account with Blue Company. The merchandise had been carried in Blues inventory at a value of $50. Record both the revenue and expense sides of this transaction.

Date Accounts Debits Credits

20 Dec 2008

Accounts Receivable Sales Revenue Cost of Goods Sold Expense Inventory (A)

80 80 50 50

MBA6030 Spring Semester 2009 Sat92 Midterm1 page 6 of 9

5. Financial Statement Preparation. (20 points 20 minutes) Black Retail Sales Company closes its books on 31 January of each year. The adjusted pre-closing trial balance as of 31 Jan 2009 for Black is on the next page. On 22 Dec 2008, Black had declared dividend of $35 but has not disbursed it as of 31 Jan 2009. Part I. What was the beginning balance in Retained Earnings as of 1 Feb 2008?................................. Hint, the trial balance gives the balance as of 31 Jan 2009 after the dividend but before including net income. $315 add back $35 = $350 Part II. Prepare in good form: (a) (b) (c) (d) (e) (f) the closing journal entry for the accounting year below. post the closing entries to the trial balance below. the post-closing trial balance as of 31 Jan 2009 below. a multi-step income statement in good form for year on the next page. the reconciliation of retained earnings for the year on the next page. a balance sheet for Black Company as of 31 Jan 2009 on the next page. $350

(a) closing journal entry

Date 31 Jan 2009 Accounts Debits Credits

Sales Revenue interest revenue Retained Earnings (OE ) Cost of goods sold expense Insurance expense Interest expense Other operating expenses Rent expense tax expense

800 20 45 500 50 130 45 30 20

MBA6030 Spring Semester 2009 Sat92 Midterm1 page 7 of 9

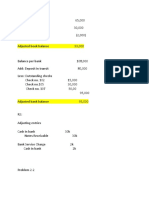

(b) Trial Balances for Black Retail Sales Co. adjusted pre-closing balances debit credit 340 220 240 350 105 40 500 35 20 10 50 130 20 380 880 290 45 80 1130 50 30 315 800 3030 3030 closing entry debit credit

accounts Accounts Payable Accounts Receivable Accumulated Depreciation (Plant and Equip) Additional Paid In Capital Cash Common Stock (par $5) Cost of Good Sold Expense Dividend Payable Income Tax Expense Income Taxes Payable Insurance Expense Interest Expense Interest Revenue Land Long Term Bonds Payable Merchandise Inventory Other Operating Expenses Patents and Other Long-Lived Assets (net) Plant and Equipment (at cost) Prepaid Expenses Rent Expense Retained Earnings Sales Revenue total

(c) post closing balances debit credit 340 220 240 350 105 40 35

500 20 10 50 130 20 380 880 290 45 80 1130 50 30 45 800 820 820 2255 360 2255

(d) Multistep income statement for the fiscal year ending 31 Jan 2009 in good form:

Income Statement for Black Retail Sales for the fiscal year ending 31 Jan 2009 Sales Revenue less Cost of Good Sold Gross Profit less Operating Expenses Insurance Expense Rent Expense Other Operating Expenses Operating Income less Interest Expense add Interest Revenue Income Before Taxes less Income Taxes Net Income $800 (500) $300 $50 $30 45 (125) $175 (130) 20 $65 (20) $45

MBA6030 Spring Semester 2009 Sat92 Midterm1 page 8 of 9

(e) Reconciliation of Retained Earnings for the fiscal year ending 31 Jan 2009 in good form:

Reconciliation of Retained Earnings Retained Earnings 1 Feb 2008 add Net Income less Dividends declared Retained Earnings 31 Jan 2009

$350 45 (35) $360

(f) Balance sheet as of 31 Jan 2009 in good form:

Balance Sheet for Black Retail Sales as of 31 Jan 2009 Assets Current Assets Cash $105 Accounts Receivable 220 Merchandise Inventory 290 Prepaid Expenses (Rent and Insur.) 50 Total Current Assets $665 Non-Current Assets Land $380 Patents other long-lived assets (net) 80 Plant and Equipment (cost) $1,130 less Accumulated Depreciation (240) net Plant and Equipment $890 Total Non-Current Assets 1,350 TOTAL ASSETS $2,015

Current Liabilities Accounts Payable Dividends Payable Income Taxes Payable Total Current Liabilities Non-Current Liabilities Long Term Bonds Payable Total Liabilities Owners' Equity Common Stock par $5 Additional Paid In Capital Retained Earnings Total Owners' Equity TOTAL EQUITIES

$340 35 10 $385 880 $1,265 $40 350 360 750 $2,015

MBA6030 Spring Semester 2009 Sat92 Midterm1 page 9 of 9

6. Essay and Analysis. (20 points 20 minutes) Starbucks (SUBX, NASDAQ), traded for $10.18 per share on Fri 13 Feb 2009 down from a year high of $19.06 but up from the previous day. On Fri 13 Feb 2009, it was reported in CNN/Fortune and other news services that Starbucks planned to begin offering instant coffee within the month. NEW YORK Starbucks which built its business on selling $4 cups of coffee, is to offer customers instant or soluble coffee for less than $1, which it claims tastes as good as the real thing. The Seattle-based retail coffee giant will begin selling an instant variety of coffee, called Starbucks Via, next month at selected stores. Starbucks says it has been working on the product for more than 20-years and claims that Starbucks Via is a soluble version of its fresh brewed coffee, which will be sold in slender packets in store. The instant coffee market is worth around $17bn globally -- Starbucks said its new product offers the struggling firm a significant opportunity. What is the accounting treatment of the cost of developing Via over the 20 years? Starbucks has reported that they hold patents on a special process for making soluble coffee. Is any of this an asset? If not, what is it? REQUIRED: Write a short essay addressing issues in the case above. Presentation and organization will count heavily. Use about 200 well-chosen words. Enter your essay below. Many students find it useful to sketch out an outline before writing. You may continue your essay on the back of this page if needed. This is one students essay. It is taken verbatim without corrections. I have listed some comments beside the essay in the right-hand column. This essay may not have been the best essay. It did receive high marks. Notice the thoroughness of the essay and the preciseness of the comments. Students response Starbucks share price went up because of favorable news and prositive expectations from the investors. The cost of developing Via over the 20 years should be treated as similar costs for Research & Development, thus, as expence [sic.], not an asset. An asset is something of value, that has a high degree of certainty in providing future income for the company. Even though the new is good and the market speculators are pushing the share price up, we do not have the necessary degree of certainty that Via will be an asset to Starbucks by definition. In case Starbucks claim about the patent on special process is true (and is fully registered with the govt, etc), then patent is going to be an asset to Starbucks, the value of which should consist of registration costs, lawyer fees, and other applicable expenses. This will be recorded as a non-current asset, as required by GAAP. {153 words} Instructors comments Good opening It addresses the case and sets up the arguments that follow. Good clear statement of the accounting treatmentj of R&D in general. Patents could have been addressed here also. This paragraph defines assets and argues that R&D is not sufficiently probable to be recorded as a asset. The essay could also define expenses and show that R&D does fit that definition. This paragraph addresses the patent and gets the accounting treatment exactly right. The essay could explain why a patent is recorded as an asset but R&D is not. Overall, the English in this essay is a little awkward but it has very good accounting ideas. It is a strong essay because of the organization, reference to definitions, reference to specifics of the case and it gets the accounting right. The essay is a little short and the extra words could have been put to good use in defining expenses and making a more compete argument about the treatment of patents including contrasting patents with R&D. {end}

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Ind As 2 PDFDokument26 SeitenInd As 2 PDFmanan3466Noch keine Bewertungen

- Ndokwa Salale Resume - AccountantDokument5 SeitenNdokwa Salale Resume - AccountantNdokwaNoch keine Bewertungen

- Doing Business in RPDokument80 SeitenDoing Business in RPRichard BalaisNoch keine Bewertungen

- R12 ReportsDokument176 SeitenR12 ReportsStacey BrooksNoch keine Bewertungen

- Chapter 1 - Page 18Dokument3 SeitenChapter 1 - Page 18Ri Fi100% (1)

- IFRS 9 - Financial InstrumentsDokument14 SeitenIFRS 9 - Financial InstrumentsJayvie Dizon Salvador0% (1)

- Accounts - Module 6 Provisions of The Companies Act 1956Dokument15 SeitenAccounts - Module 6 Provisions of The Companies Act 19569986212378Noch keine Bewertungen

- ABE Plumbing FlowchartDokument1 SeiteABE Plumbing FlowchartRainbow VillanuevaNoch keine Bewertungen

- Chapter 5 SolutionsDokument13 SeitenChapter 5 SolutionsjessicaNoch keine Bewertungen

- Accounting - Questions 010812Dokument4 SeitenAccounting - Questions 010812jhouvanNoch keine Bewertungen

- Arens - Chapter14 AuditingDokument39 SeitenArens - Chapter14 AuditingtableroofNoch keine Bewertungen

- Arun LamsalDokument50 SeitenArun LamsalSmith TiwariNoch keine Bewertungen

- ABC Company Balance Sheet For The Period Ended in PesoDokument41 SeitenABC Company Balance Sheet For The Period Ended in Pesojosh lunarNoch keine Bewertungen

- Case Study Solution 20% - ImpairmentDokument4 SeitenCase Study Solution 20% - ImpairmentSeiniNoch keine Bewertungen

- SDDokument19 SeitenSDNitinNoch keine Bewertungen

- Analisis Penerapan PSAK No.16 Dalam Perlakuan Akuntansi Aset Tetap PerusahaanDokument10 SeitenAnalisis Penerapan PSAK No.16 Dalam Perlakuan Akuntansi Aset Tetap PerusahaanNurlaili RomadhaniNoch keine Bewertungen

- Auditing Theory - Audit ReportDokument26 SeitenAuditing Theory - Audit ReportCarina Espallardo-RelucioNoch keine Bewertungen

- Financial Analysis ProjectDokument11 SeitenFinancial Analysis ProjectCharles TulipNoch keine Bewertungen

- Bank ReconciliationDokument6 SeitenBank Reconciliationclarisse jaramillaNoch keine Bewertungen

- Block 1 MS 035 Unit 1Dokument19 SeitenBlock 1 MS 035 Unit 1akshayvermaNoch keine Bewertungen

- Transformation in Revenue AccountingDokument92 SeitenTransformation in Revenue AccountingTestspotyfireal EsyNoch keine Bewertungen

- 4 Completing The Accounting Cycle PartDokument1 Seite4 Completing The Accounting Cycle PartTalionNoch keine Bewertungen

- Chap 12Dokument44 SeitenChap 12Jehad Selawe100% (1)

- Course Structure - BfiaDokument2 SeitenCourse Structure - BfiaAmity-elearningNoch keine Bewertungen

- Kế Toán Quốc Tế: Select oneDokument8 SeitenKế Toán Quốc Tế: Select oneLoki Luke100% (1)

- Accounting For Local GovernmentDokument6 SeitenAccounting For Local GovernmentEsther AkpanNoch keine Bewertungen

- ch04 SM RankinDokument23 Seitench04 SM RankinSTU DOC100% (2)

- Accounting-Financial Statements of Companies-1653399167327513Dokument37 SeitenAccounting-Financial Statements of Companies-1653399167327513Badhrinath ShanmugamNoch keine Bewertungen

- Zychol Chemicel Corporation Case StudyDokument3 SeitenZychol Chemicel Corporation Case StudyShawon Corleone33% (3)

- Management Acct AssignmentDokument11 SeitenManagement Acct AssignmentYasir ArafatNoch keine Bewertungen