Beruflich Dokumente

Kultur Dokumente

Accounting

Hochgeladen von

Hasan AbbasOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Accounting

Hochgeladen von

Hasan AbbasCopyright:

Verfügbare Formate

Accounting? A comprehensive system for recording and summarizing business transactions.

. process of identifying, measuring, and reporting financial information of an entity is the act of recording and reporting financial transactions, including the origination of thetransaction, its recognition, processing, and summarization in the financial statements. a convincing explanation that reveals basic causes; "he was unable to give a clear accounting for his actions" a system that provides quantitative information about finances accountancy: the occupation of maintaining and auditing records and preparing financialreports for a business a bookkeeper's chronological list of related debits and credits of a business; forms part of a ledger of accounts account: a statement of recent transactions and the resulting balance; "they send me anaccounting every month" Practice Accounts & typesPractice Note? A note written by a lawyer or judge to help explain a legal matter. Contract Note? The first document signed on buying a house is sometimes a Contract Note, instead of aContract of Sale. ... The day that a transaction takes place, the broker sends the client a document detailingthe transaction, including full title of the stock, price, consideration and stamp duty (if applicable). A document sent to a buyer or seller listing details of the transaction. Contract note (also called broker's note) which a broker is required to send to a clientrecording the details of a purchase or sale of shares including the commission payable,the basic charge, the uncertificated securities tax (UST) as well as any other mandatorycharges and the settlement ... Promoter? someone who is an active supporter and advocate showman: a sponsor who books and stages public entertainments The person or company that is promoting the investment. This term has certain legalmeanings under securities law, but is generally used to describe anyone who has avested interest in raising investment capital for a venture, either because they are afounder or because they are being paid a commission on the funds raised. Share? A unit of ownership in an equity or mutual fund. This ownership is represented bya certificate, which names the shareowner and the company or fund. The number of shares a company is authorized to issue is detailed in its corporate charter.Most mutual funds can issue unlimited shares. Certificate evidencing ownership of a fraction of the capital of the company thatissued it. Shares can yield dividends and entitle the holder to vote at generalmeetings. They may be listed on a stock exchange. Also known as a stock or anequity. Haut de page Portfolio Management? The budgetary funding mechanism for all business intelligence projects. It includes all BIprojects and all the reporting and analysis projects ... The processes, practices and specific activities to perform continuous and consistentevaluation, prioritization, budgeting, and finally selection of investments that provide thegreatest value and contribution to the strategic interest of the organization. ...

The aim of Portfolio Management is to achieve the maximum return from a portfolio whichhas been delegated to be managed by an individual manager or financial institution. Themanager has to balance the parameters which define a good investment ie security,liquidity and return. ... management of an entire portfolio of risks with the objective of balancing risks andpreventing their concentration in any country or sector. Portfolio Management is a major responsibility at the corporate level geared at theanalysis of the basic characteristics of the Portfolio of businesses of a firm, in order toassign priorities for resource allocation. ... The portfolio management process involves formulating, modifying and implementing areal estate investment strategy in light of an investor's broader overall investmentobjectives. It also can be defined as the management of several properties owned by asingle entity. ... A business process by which a business unit decides on the mix of active projects,staffing and dollar budget allocated to each project. See also pipeline management. Mutual Funds? A fund that pools the money of its investors to buy a variety of securities. A security that gives small investors access to a well-diversified portfolio of shares,bonds, and other securities. Each shareholder participates in the gain or loss of the fund.Shares are issued and can be redeemed as needed. Pools of investment money, managed by professionals, and invested in a wide range of securities. Unit trust; a common type of collective investment vehicle....more on Mutual funds a professionally managed investment in a group of stocks and/or bonds that are selectedand diversified to meet the stated objective of the fund. One method of spreading risk in equity investments. These funds hold relatively largeownership blocks in many companies and professionally manage the funds entrusted tothem. These are mutually owned funds invested in diversified securities. Shareholders areissued certificates as evidence of their ownership and participate proportionately in theearnings of the fund. Invented in the 1920s, mutual funds are pools of money managed by an investmentcompany or advisor. Different mutual funds have different goals. For example, funds mayseek growth, growth and income, specific market cap sizes, sectors, etc. The fund's investment strategy category as stated in the prospectus. There are more than20 standardized categories. These are open-end funds that are not listed for trading on a stock exchange and areissued by companies which use their capital to invest in other companies. Mutual fundssell their own new shares to investors and buy back their old shares upon redemption. ... A mutual fund is a pooling of investor (shareholder) assets, which is professionallymanaged by an investment company for the benefit of the fund's shareholders. Each fundhas specific investment objectives and associated risk. ... are a method of investing in various underlying investments such as stocks, bonds,mortgages, treasury bills and real estate. Mutual funds provide the advantages of professional investment management, liquidity, investment record keeping anddiversification. ... Typically consist of a group of stocks, bonds, or money-market securities from more thanone source. There are three types income funds )for people who need money to liveon); growth funds (pay low dividends or one works best for investors who can leavemoney in the fund so it can grow over ... Securities Paper certificates (definitive securities) or electronic records (book-entry securities)evidencing ownership of equity (stocks) or debt ... General name for shares and bonds of all types. Shares produce a variable dividend andbonds a fixed interest.

General name for stocks, bonds, or ownership rights, such as options or futures, usuallysold through a broker. The common name for stocks, bonds, mutual funds and other investment vehicles. A general term that covers a variety of interests, including shares of stock, bonds,debentures, and other forms of interest. Bonds, notes, mortgages, or other forms of negotiable or non-negotiable instruments. In general, any evidence of (1) an interest in corporate stock or stock rights or (2) aninterest in any note, bond, debenture or other evidence of indebtedness issued by agovernment or corporation. For certain tax purposes, however, the definition is morelimited. Stocks and bonds that investors may purchase. Stocks pay the investor dividends (or cost him losses) and give him partial ownership in a corporation. Bonds pay the investor aset amount of interest over a certain amount of time. ... The volume of shares traded as a percentage of total shares listed on an exchangeduring a period, usually a day or a year. The same ratio is applied to individual securitiesand the portfolio of individual or institutional investors. this term is used for stocks, shares, debentures, and so on where there is a right toreceive interest or dividends from the investment. A security is a certificate of ownership in an investment. It can be transferred from oneperson to another. Examples include notes, bonds, stocks, futures, contracts or options. A financial instrument which represents a claim over real assets or a future incomestream. Such instruments are usually tradeable. Examples of securities include bonds,bills of exchange, promissory notes, certificates of deposit and shares. Paper assets representing a claim on something of value, such as stocks, bonds,mortgages, etc. these are financial instruments (such as bonds or stocks) that can be traded freely on theopen market. 'Securitization' refers to the pooling of loans or assets for subsequent saleto investors. group term for bonds and equities. It is simply another word for bonds; stock and short-term investments. various assets such as stocks, bonds and money markets that allow holders to participatein earnings, distribution of property or other corporate assets Securities on which a fixed rate of interest is paid each year. Securities refers to stocks, bonds and all related items, including promissory notes,mortgages and insurance policies, if maintained rather than surrendered for cash. A security is a financial asset, such as shares, government stock, debentures and unittrusts. A marketable security is one which can be traded on a stock exchange, such asstocks and shares. ... A large proportion of debt in advanced economies has become securities. Incomeyielding paper is sold in a primary market, which channels funds from surplus to deficitunits. Securities are tradable claims against the deficit unit. General name for all stocks and shares of all types. In common usage, stocks are fixedinterest securities and shares are the rest, although strictly speaking the distinction is thatstock is denominated in money terms. issuance or sale of stocks or bonds, also includes initial public offerings (IPOs) if significant information is included in the article, also includes debt vehicles that aresecurities backed. has the meaning assigned to it in clause (h) of section 2 of the Securities Contracts(regulation ) Act, 1956 (42 of 1956);

The term used for any financial instrument issued by the company and traded on theStock Exchange. Gross Profit & Net Profit GROSS PROFIT = [OPENING STOCK + PURCHASE ( PURCHAS -PURCHASE RETURN) + DIRCET EXPENSES] - [SALES ( SALES -SALES RETURN)+ CLOSING STOCK]. NET PROFIT = [GROSS PROFIT + INCOMES] [EXPENDITURE]GROSS PROFIT INCLUDED THE DIRECT EXPENSES.NET PROFIT INCLUDED ONLY INDIRECT EXPENSES.CALCULATION : 1. NET PROFIT = GROSS PROFIT + ALL INCOMES - ALLEXPENDITURE. 2.GROSS PROFIT = NET PROFIT + ALL EXPENDITURE - ALL INCOMESThe terms Gross Profit and Net Profit are used in accounts and financial forecasts. Gross Profitis often abbreviated as GP and Net Profit as NP. It is important to understand the differencebetween the two. In simple terms, gross profit relates to what you sell, and the profit you makeafter paying for these. Net Profit, is the profit you have left after deducting all costs.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Course: Leading Change For Sustainable Futures Case Study: Electric Vehicles in India Project Submission Template Student Name (Full Name)Dokument15 SeitenCourse: Leading Change For Sustainable Futures Case Study: Electric Vehicles in India Project Submission Template Student Name (Full Name)anju antonyNoch keine Bewertungen

- Chap 009Dokument21 SeitenChap 009Kedia Rama50% (2)

- CH 04Dokument9 SeitenCH 04jaysonNoch keine Bewertungen

- Lecture 1A - Statement of Financial PositionDokument14 SeitenLecture 1A - Statement of Financial PositionGonzalo Jr. RualesNoch keine Bewertungen

- Icaew Mi - WorkbookDokument452 SeitenIcaew Mi - WorkbookDương Ngọc100% (2)

- I HG F Autumn 2018 ApplicationformDokument8 SeitenI HG F Autumn 2018 ApplicationformSnzy DelNoch keine Bewertungen

- ListDokument6 SeitenListImamNoch keine Bewertungen

- MEBS Call Center PH Company OverviewDokument9 SeitenMEBS Call Center PH Company OverviewMEBS PresidentNoch keine Bewertungen

- Food Bill 21-07-23Dokument2 SeitenFood Bill 21-07-23ankit goenkaNoch keine Bewertungen

- 210: Understand How To Communicate With Others Within Building Services EngineeringDokument3 Seiten210: Understand How To Communicate With Others Within Building Services EngineeringGheorghe Ciubotaru50% (4)

- Republic Act No. 10667Dokument5 SeitenRepublic Act No. 10667orionsrulerNoch keine Bewertungen

- Handbook of Value Added Tax by Farid Mohammad NasirDokument15 SeitenHandbook of Value Added Tax by Farid Mohammad NasirSamia SultanaNoch keine Bewertungen

- Post Implementation Review of Project CompletionDokument19 SeitenPost Implementation Review of Project CompletionAmul Shrestha50% (2)

- AWE R15!2!20 1 OfferDefinition V14-Draft-080421-DwDokument289 SeitenAWE R15!2!20 1 OfferDefinition V14-Draft-080421-DwMohsin HabibNoch keine Bewertungen

- Book 1Dokument2 SeitenBook 1Laika DuradaNoch keine Bewertungen

- Higher Education Financing Agency BrochureDokument6 SeitenHigher Education Financing Agency BrochuremidhunnobleNoch keine Bewertungen

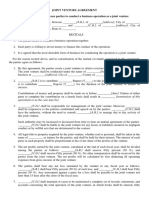

- Joint Venture AgreementDokument2 SeitenJoint Venture Agreementpan RegisterNoch keine Bewertungen

- Sample Questions For 2019-2020 Following Sample Questions Are Provided For The Benefits of Students. They Are Indicative OnlyDokument33 SeitenSample Questions For 2019-2020 Following Sample Questions Are Provided For The Benefits of Students. They Are Indicative OnlyPrathamesh ChawanNoch keine Bewertungen

- NEC Contracts - One Stop ShopDokument3 SeitenNEC Contracts - One Stop ShopHarish NeelakantanNoch keine Bewertungen

- Financial InvestmentDokument7 SeitenFinancial InvestmentGerald de BrittoNoch keine Bewertungen

- The Entrepreneurial Decision Process for Startups ExplainedDokument13 SeitenThe Entrepreneurial Decision Process for Startups ExplainedFe P. ImbongNoch keine Bewertungen

- Job Advert MSDDokument24 SeitenJob Advert MSDRashid BumarwaNoch keine Bewertungen

- Capital Market, Consumption and Investment RelationshipsDokument22 SeitenCapital Market, Consumption and Investment RelationshipsKamran Kamran100% (1)

- What Informal Remedies Are Available To Firms in Financial Distress inDokument1 SeiteWhat Informal Remedies Are Available To Firms in Financial Distress inAmit PandeyNoch keine Bewertungen

- Audithow Com Auditing of Operating ExpensesDokument8 SeitenAudithow Com Auditing of Operating ExpensesMunyaradzi Onismas ChinyukwiNoch keine Bewertungen

- Organisation Study - Project Report For Mba Iii Semester - MG University - Kottayam - KeralaDokument62 SeitenOrganisation Study - Project Report For Mba Iii Semester - MG University - Kottayam - KeralaSasikumar R Nair79% (19)

- Strategic Analysis of United Bank Limited. MS WordDokument39 SeitenStrategic Analysis of United Bank Limited. MS Wordshahid_pak1_26114364100% (2)

- Airport Urbanism Max HirshDokument4 SeitenAirport Urbanism Max HirshMukesh WaranNoch keine Bewertungen

- Ge Is Faced With Jack Welch S Impending Retirement and WhetherDokument1 SeiteGe Is Faced With Jack Welch S Impending Retirement and WhetherAmit PandeyNoch keine Bewertungen

- Manatad - Accounting 14NDokument5 SeitenManatad - Accounting 14NJullie Carmelle ChattoNoch keine Bewertungen