Beruflich Dokumente

Kultur Dokumente

New Ratio

Hochgeladen von

ammuambikaOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

New Ratio

Hochgeladen von

ammuambikaCopyright:

Verfügbare Formate

Q.1. What is meant by accounting ratios? How are they useful?

Answer: A relationship between various accounting figures, which are connected with each other, expressed in mathematical terms, is called accounting ratios. According to Kennedy and Macmillan, "The relationship of one item to another expressed in simple mathematical form is known as ratio." Robert Anthony defines a ratio as "simply one number expressed in terms of another." Accounting ratios are very useful as they briefly summarise the result of detailed and complicated computations. Absolute figures are useful but they do not convey much meaning. In terms of accounting ratios, comparison of these related figures makes them meaningful. For example, profit shown by two-business concern is Rs. 50,000 and Rs. 1,00,000. It is difficult to say which business concern is more efficient unless figures of capital investment or sales are also available. Analysis and interpretation of various accounting ratio gives a better understanding of the financial condition and performance of a business concern. Q.2. What do you mean by ratio analysis? What are the advantages of such analysis? Also point out the limitations of ratio analysis. Answer: Ratio analysis is one of the techniques of financial analysis to evaluate the financial condition and performance of a business concern. Simply, ratio means the comparison of one figure to other relevant figure or figures. According to Myers, " Ratio analysis of financial statements is a study of relationship among various financial factors in a business as disclosed by a single set of statements and a study of trend of these factors as shown in a series of statements." Advantages and Uses of Ratio Analysis There are various groups of people who are interested in analysis of financial position of a company. They use the ratio analysis to workout a particular financial characteristic of the company in which they are interested. Ratio analysis helps the various groups in the following manner: 1. To workout the profitability: Accounting ratio help to measure the profitability of the business by calculating the various profitability ratios. It helps the management to know about the earning capacity of the business concern. In this way profitability ratios show the actual performance of the business. 2. To workout the solvency: With the help of solvency ratios, solvency of the company can be measured. These ratios show the relationship between the liabilities and assets. In case external liabilities are more than that of the assets of the company, it shows the unsound position of the business. In this case the business has to make it possible to repay its loans. 3. Helpful in analysis of financial statement: Ratio analysis help the outsiders just like

4.

5. 6.

7.

8.

creditors, shareholders, debenture-holders, bankers to know about the profitability and ability of the company to pay them interest and dividend etc. Helpful in comparative analysis of the performance: With the help of ratio analysis a company may have comparative study of its performance to the previous years. In this way company comes to know about its weak point and be able to improve them. To simplify the accounting information: Accounting ratios are very useful as they briefly summarise the result of detailed and complicated computations. To workout the operating efficiency: Ratio analysis helps to workout the operating efficiency of the company with the help of various turnover ratios. All turnover ratios are worked out to evaluate the performance of the business in utilising the resources. To workout short-term financial position: Ratio analysis helps to workout the shortterm financial position of the company with the help of liquidity ratios. In case short-term financial position is not healthy efforts are made to improve it. Helpful for forecasting purposes: Accounting ratios indicate the trend of the business. The trend is useful for estimating future. With the help of previous years ratios, estimates for future can be made. In this way these ratios provide the basis for preparing budgets and also determine future line of action.

Limitations of Ratio Analysis In spite of many advantages, there are certain limitations of the ratio analysis techniques and they should be kept in mind while using them in interpreting financial statements. The following are the main limitations of accounting ratios: 1. Limited Comparability: Different firms apply different accounting policies. Therefore the ratio of one firm can not always be compared with the ratio of other firm. Some firms may value the closing stock on LIFO basis while some other firms may value on FIFO basis. Similarly there may be difference in providing depreciation of fixed assets or certain of provision for doubtful debts etc. 2. False Results: Accounting ratios are based on data drawn from accounting records. In case that data is correct, then only the ratios will be correct. For example, valuation of stock is based on very high price, the profits of the concern will be inflated and it will indicate a wrong financial position. The data therefore must be absolutely correct. 3. Effect of Price Level Changes: Price level changes often make the comparison of figures difficult over a period of time. Changes in price affects the cost of production, sales and also the value of assets. Therefore, it is necessary to make proper adjustment for pricelevel changes before any comparison. 4. Qualitative factors are ignored: Ratio analysis is a technique of quantitative analysis and thus, ignores qualitative factors, which may be important in decision making. For example, average collection period may be equal to standard credit period, but some debtors may be in the list of doubtful debts, which is not disclosed by ratio analysis. 5. Effect of window-dressing: In order to cover up their bad financial position some companies resort to window dressing. They may record the accounting data according to the convenience to show the financial position of the company in a better way. 6. Costly Technique: Ratio analysis is a costly technique and can be used by big business houses. Small business units are not able to afford it.

7. Misleading Results: In the absence of absolute data, the result may be misleading. For example, the gross profit of two firms is 25%. Whereas the profit earned by one is just Rs. 5,000 and sales are Rs. 20,000 and profit earned by the other one is Rs. 10,00,000 and sales are Rs. 40,00,000. Even the profitability of the two firms is same but the magnitude of their business is quite different. 8. Absence of standard university accepted terminology: There are no standard ratios, which are universally accepted for comparison purposes. As such, the significance of ratio analysis technique is reduced.

Q.3. Classify the various profitability ratios. Also explain the meaning, method of calculation and objective of these ratios. Answer: Classification of various profitability ratios: a. b. c. d. e. Gross Profit Ratio (CBSE Outside Delhi 2001, Delhi 2002) Net Profit Ratio Operating Net Profit Ratio Operating Ratio (CBSE Outside Delhi 2001) Return on Investment or Return on Capital Employed (CBSE 1998, 2000, Outside Delhi 2001) f. Return on Equity (CBSE 1999) g. Earning Per Share (CBSE Outside Delhi 2001) Meaning, Objective and Method of Calculation: a. Gross Profit Ratio: Gross Profit Ratio shows the relationship between Gross Profit of the concern and its Net Sales. Gross Profit Ratio can be calculated in the following manner: Gross Profit Ratio = Gross Profit/Net Sales x 100 Where Gross Profit = Net Sales Cost of Goods Sold Cost of Goods Sold = Opening Stock + Net Purchases + Direct Expenses Closing Stock And Net Sales = Total Sales Sales Return Objective and Significance: Gross Profit Ratio provides guidelines to the concern whether it is earning sufficient profit to cover administration and marketing expenses and is able to cover its fixed expenses. The gross profit ratio of current year is compared to previous years ratios or it is compared with the ratios of the other concerns. The minor change in the ratio from year to year may be ignored but in case there is big change, it

must be investigated. This investigation will be helpful to know about any departure from the standard mark-up and would indicate losses on account of theft, damage, bad stock system, bad sales policies and other such reasons. However it is desirable that this ratio must be high and steady because any fall in it would put the management in difficulty in the realisation of fixed expenses of the business. b. Net Profit Ratio: Net Profit Ratio shows the relationship between Net Profit of the concern and Its Net Sales. Net Profit Ratio can be calculated in the following manner: Net Profit Ratio = Net Profit/Net Sales x 100 Where Net Profit = Gross Profit Selling and Distribution Expenses Office and Administration Expenses Financial Expenses Non Operating Expenses + Non Operating Incomes. And Net Sales = Total Sales Sales Return Objective and Significance: In order to work out overall efficiency of the concern Net Profit ratio is calculated. This ratio is helpful to determine the operational ability of the concern. While comparing the ratio to previous years ratios, the increment shows the efficiency of the concern. c. Operating Profit Ratio: Operating Profit means profit earned by the concern from its business operation and not from the other sources. While calculating the net profit of the concern all incomes either they are not part of the business operation like Rent from tenants, Interest on Investment etc. are added and all non-operating expenses are deducted. So, while calculating operating profit these all are ignored and the concern comes to know about its business income from its business operations. Operating Profit Ratio shows the relationship between Operating Profit and Net Sales. Operating Profit Ratio can be calculated in the following manner: Operating Profit Ratio = Operating Profit/Net Sales x 100 Where Operating Profit = Gross Profit Operating Expenses Or Operating Profit = Net Profit + Non Operating Expenses Non Operating Incomes And Net Sales = Total Sales Sales Return Objective and Significance: Operating Profit Ratio indicates the earning capacity of the concern on the basis of its business operations and not from earning from the other sources. It shows whether the business is able to stand in the market or not. d. Operating Ratio: Operating Ratio matches the operating cost to the net sales of the

business. Operating Cost means Cost of goods sold plus Operating Expenses. Operating Ratio = Operating Cost/Net Sales x 100 Where Operating Cost = Cost of goods sold + Operating Expenses Cost of Goods Sold = Opening Stock + Net Purchases + Direct Expenses Closing Stock Operating Expenses = Selling and Distribution Expenses, Office and Administration Expenses, Repair and Maintenance. Objective and Significance: Operating Ratio is calculated in order to calculate the operating efficiency of the concern. As this ratio indicates about the percentage of operating cost to the net sales, so it is better for a concern to have this ratio in less percentage. The less percentage of cost means higher margin to earn profit. e. Return on Investment or Return on Capital Employed: This ratio shows the relationship between the profit earned before interest and tax and the capital employed to earn such profit. Return on Capital Employed = Net Profit before Interest, Tax and Dividend/Capital Employed x 100 Where Capital Employed = Share Capital (Equity + Preference) + Reserves and Surplus + Long-term Loans Fictitious Assets Or Capital Employed = Fixed Assets + Current Assets Current Liabilities Objective and Significance: Return on capital employed measures the profit, which a firm earns on investing a unit of capital. The profit being the net result of all operations, the return on capital expresses all efficiencies and inefficiencies of a business. This ratio has a great importance to the shareholders and investors and also to management. To shareholders it indicates how much their capital is earning and to the management as to how efficiently it has been working. This ratio influences the market price of the shares. The higher the ratio, the better it is. f. Return on Equity: Return on equity is also known as return on shareholders investment. The ratio establishes relationship between profit available to equity shareholders with equity shareholders funds. Return on Equity = Net Profit after Interest, Tax and Preference Dividend/Equity Shareholders Funds

x 100 Where Equity Shareholders Funds = Equity Share Capital + Reserves and Surplus Fictitious Assets Objective and Significance: Return on Equity judges the profitability from the point of view of equity shareholders. This ratio has great interest to equity shareholders. The return on equity measures the profitability of equity funds invested in the firm. The investors favour the company with higher ROE. g. Earning Per Share: Earning per share is calculated by dividing the net profit (after interest, tax and preference dividend) by the number of equity shares. Earning Per Share = Net Profit after Interest, Tax and Preference Dividend/No. Of Equity Shares Objective and Significance: Earning per share helps in determining the market price of the equity share of the company. It also helps to know whether the company is able to use its equity share capital effectively with compare to other companies. It also tells about the capacity of the company to pay dividends to its equity shareholders.

NEXT A. Financial Statements

1.0 Introduction

Accounting is defined as an information system receiving its input from various financial transactions, processing these transactions and giving as output the financial statements and other reports that will enable the users to make suitable decision dealing with business and economic entities. The records of the transactions are summarized into two major statements known as 'financial statements' or 'final accounts'. They comprise of:

a) Balance sheet, which shows the financial position of the concern, by listing out all the assets and properties that the concern owns and the amount it owes to others and b) Profit and Loss Account (or Income Statement) which shows the various sources of income and the different heads of expenditure. The difference between the income and expenditure is the profit made by the concern.

2.0 Balance sheet

The final accounts, which are the ultimate output of accounting, are studied not only by the management, but also by outsiders who have something to do with the concern. Statutorily, companies are required to publish their final accounts. These statements are therefore available to anyone who wants to know about the financial position of the company. The form in which a company should prepare its balance sheet is given below.

Table 1: A Typical Balance Sheet Liabilities Share capital Reserves and surplus Secured loans Unsecured loans Miscellaneous expenditure Current liabilities provisions and Profit (loss) and loss account Assets Fixed assets Investments Current assets, loans and advances

2.1. Liabilities

2.1.1 Share Capital

A share is the unit into which the capital of the company is divided. The value for which each share is divided is known as the face value or nominal value of the share. At the time of incorporating company, the promoters take a futuristic look and decide on the maximum capital that the company may require during its life time. This amount will be included in the capital clause of the Memorandum of Association which they file with the Registrar of Companies.

The amount mentioned in the capital clause of the Memorandum of Association of the company is known as the authorized or nominal capital of the company. Authorized capital is the maximum that the company can raise as share capital during its life time.

As and when need arises, and to the extent required, the directors of the company may issue shares to the public. The face value of the shares offered to the public is known as the issued capital of the company. Of the issued capital that portion which has been actually taken up by the public is known as the subscribed capital of the company. Not

the entire money on the shares issued may be required to be paid by the subscribers. The portion of the subscribed capital which the company has called upon the shareholders to pay is the called-up capital of the company. There may be defaulters in paying the calls made by the company. Of the amount called up by the company the amount actually paid by the shareholders is the paid-up capital of the company.

Shares are of two types: (i) equity shares, and (ii) preference shares. The equity shareholders are the real owners of the company; they elect the board of directors to carry on the day-to-day management of the company. The dividend paid on equity shares is not fixed, but will depend upon the profits made by the company and the recommendations of the board of directors. Preference shares carry a specified rate of dividend. In the event of liquidation they will be repaid in priority to equity shareholders, but after all outside creditors are paid.

2.1.2. Reserves and Surplus

A portion of the profits is distributed as dividend to shareholders and the balance is retained in the business in the form of reserves. In ultimate analysis, reserves belong to shareholders. Therefore, the total amount due to the shareholders (or owner's funds) constitutes the capital and reserves. The presence of sizeable reserves in a balance sheet is a plus point as it adds to the financial strength of the company. Different reserves may be created by the company to meet specific purposes.

2.1.3. Secured Loan

These represent borrowings by the company against charging of its specific assets. Details regarding debentures, loans and advances from banks, loans and advances from subsidiaries and loans from directors are to be shown separately. The banker should carefully study the item and verify the extent to which the assets of the company are charged to creditors; this will help him to estimate the assets that are available to him as security.

2.1.4. Unsecured Loans

These include borrowings of the company without creation of any charge on its assets. The Companies Act requires that borrowings in the form of fixed deposits, loans and advances from subsidiaries and borrowings from banks should be shown separately. As regards bank borrowings details of short-term borrowings that are due for repayment not later than one year from the date of balance sheet are required to be shown separately.

2.1.5. Current Liabilities and Provisions

Current liabilities include short-term liabilities of the company, other than borrowings. Of the current liabilities, sundry creditors require closer study. The banker should see if they bear a reasonable proportion to the total purchases. Provisions such as provision for taxes should be scrutinized to verify if adequate provision has been made.

2.2. Assets

2.2.1. Fixed Assets

Fixed assets are of two types: (i) Tangible fixed assets and (ii) Intangible fixed assets. Tangible fixed assets include permanent assets like land, buildings, plant and machinery. Intangible fixed assets include items like goodwill, patents and trademarks.

2.2.2. Investment

Instead of keeping excess cash idle, it may be invested in good short-term investments and thus earn interest. The following definitions given in the Companies Act may be noted:

i) ii)

Quoted investment: It means an investment as respects which there has been granted a quotation or permission to deal on a recognized stock exchange. Trade investment: It means an investment by a company in the shares or debentures of another company, not being its subsidiary, for the purpose of promoting the trade or business of the first company.

2.2.3. Current Assets, Loans and Advances

Important among the items falling under this category is discussed below.

Stock in trade: This item includes (a) raw materials, (b) stock in process, (c) consumables stores and spares, and (d) finished goods. The stock in trade is valued at cost or market price, whichever is lower. This is also known as inventory.

Receivables: This item includes book debts and bills receivable. This represents the total amount due from the customers of the concern for credit sales made to them. The Companies Act requires the companies to show debts outstanding for more than six months separately from other debts.

Loans and advances: The company may advance to other companies with which it has business relations, its subsidiary or sister concerns and to its staff.

2.2.4. Miscellaneous Expenditure

This includes items of deferred revenue expenditure and other items of expenditure which are written off over a period of time. Deferred revenue expenditure is a revenue expenditure of huge amount (e.g., advertisement campaign on launching a new product) whose benefit is expected to be received over a period of time. Total expenditure incurred is initially treated as an asset and shown in the balance sheet. Every year a portion of the expenditure is written off against profits.

3.0. Profit and Loss Account (P&L Account Statement)

Profit or Loss incurred by a company during a year or accumulated over the past years is shown under this item. It can be followed in two ways. (1) T type account statement and another one is called as (2) Vertical type account statement. In the earlier type Income is plotted in right side and expenditure on the left side. In the latter type net sales have to be recorded first and cost of items next in vertical fashion. The difference gives gross profit. Profit leads to increase owners equity of the company. A typical P&L Account Statement shows flow of Statements or Financial performance of the company. Where as the Balance sheet is a static statement or shows cumulative financial performance (snapshot of actual financial position).P&L statement contains information pertain to reserve fund, dividend paid, corporate tax, operation expenses, and cost of sales based on total sales income. For business organizations this statement is called as Profit and Loss account. For the Non- profit organizations, it is called as income and expenditure statement.

B. Ratio Analysis

1.0 Introduction

The most prevalent method of analyzing a balance sheet is through ratio analysis. The ratio analysis can be for a single year or it may extend to more than one year. The ratios can also be compared with similar ratios of others concerns to make a comparative study.

y First, all ratios will be worked out for each year and each set of comparable items. y The ratios worked out will be put in the context of a trend over several years. y They will be compared with similar companies/ standard ratios.

i)

for the year concerned, and

ii) Over a period of time.

Any number of ratios can be prepared by comparing any two figures available in the balance sheet or profits and loss account or both. But to serve its purpose, the figures compared should be meaningful, having a link between them, and should satisfy the needs of the person who analysis the financial statements.

Ratios are also classified differently on different bases. The mostly used one is the financial classification under which the ratios are broadly divided into the following five classes:

y y y y

Liquidity ratios concerned with the short term solvency of the concern or its ability to meet financial obligation on their due dates. Activity ratios concerning efficiency of management of various assets by the concern. Leverage ratios concerning stake of the owners in the business in relation to outside borrowings or long term solvency. Coverage ratios concerned with the ability of the company to meet fixed commitments such as interest on term loans and dividend on preference shares and Profitability ratios concerned with the profitability of the concern.

2.0 Liquidity Ratio

2.1. Current Ratio

The ratio is worked out by dividing the current assets of the concern by its current liabilities.

Current Ratio

Current ratios indicate the relation between current assets and current liabilities. Current liabilities represent the immediate financial obligations of the company. Current assets are the sources of repayment of current liabilities. Therefore, the ratio measures the capacity of the company to meet financial obligation as and when they arise. Textbooks claim a ratio of 1.5 to 2 is ideal; bit in practice this is rarely achieved. This ratio is also known as working capital ratio.

2.2. Acid Test Ratio

Acid Test Ratio =

Quick assets represent current assets excluding stock and prepaid expenses. Stock is excluded because it is not immediately realizable in cash. Prepaid expenses are excluded because they cannot be realized in cash.

One of the defects of current ratio is that it does not measure accurately to meet financial commitments as and when they arise. This is because the current assets include also items that are not easily realizable, such as stock. The acid test ratio is a refinement of current ratio and is calculated to measure the ability of the company to meet the liquidity requirements in the immediate future. A minimum of 1: 1 is expected which indicates that the concern can fully meet its financial obligations. This also called as Liquid ratio or Quick ratio.

3.0. Activity Ratios

3.1. Debtors Velocity

Debtors Velocity

It is expressed in number of days; (Or)

(* 52 if result require in number of weeks)

The ratio obtained should be compared with that of other similar units. If the ratio of the company being studied is greater (say, 10 weeks as against 6 weeks for the industry), it indicates that the company is allowing longer than the usual credit periods. This may be justified in the case of new companies or existing companies entering into new ventures because initially they may have to extend longer credits to capture the market. In other cases, the position needs a deeper study; it is possible that many unrealizable and long pending items are included in debtors. The companys collection machinery may need gearing up. The chances of larger bad debts are imminent.

3.2. Creditors velocity

Creditors Velocity When the opening balance of creditors and the figure of credit purchases are not available, the ratio can be computed as follows.

A high ratio as compared to that obtaining in the industry (e.g., 12 weeks as compared to 8 weeks for the industry) may mean that:

y y y

The company in unable to pay its debts and is therefore taking longer than usual time to pay its creditors ; or The company is enjoying good reputation in the market and therefore the suppliers are extending more credit ; or The company may be a near-monopoly consumer and the supplier is agreeable to the credit terms dictated by the company.

Reversely, a lower ratio would mean any of the following:

y y

The company has a comfortable financial position and is paying off the creditors promptly ; or The creditors may offer discount on early payments to avail of which the company is paying early. The company may do so provided the cost of borrowing is less than the discount offered ; or

y y

The company does not enjoy good reputation in the market and its creditors have restricted credits ; or The suppliers may be monopolists dictating terms to the company.

The real reason should be found by going into the facts of individual cases. This ratio should be studied along with the debtors velocity and current ratio to judge the real situation.

3.3. Inventory Velocity

Inventory Turnover

The ratio is usually expressed as number of times the stock has turned over. Inventory management forms the crucial part of working capital management. As a major portion of the bank advance is for the holding of inventory, a study of the adequacy of abundance of the stocks held by the company in relation to its production needs requires to be made carefully by the bank.

A higher ratio may mean (higher turnover or less holding periods):

y y

The stocks are moving well and there is efficient inventory management ; or The stocks are purchased in small quantities. This may be harmful if sufficient quantities are not available for production needs; secondly, buying in small quantities may increase the cost.

Contrarily, a lower ratio (i.e.., lower turnover of longer holding period may be an index of (1) Accumulation of large stocks not commensurate with production requirements, (2) A reflection of inefficient inventory management or over-valuation of stocks for balance sheet purposes ; or Stagnation in sales, if stocks comprise mostly finished goods.

3.4. Working Capital Turnover

Working Capital Turnover

The use of this ratio is two fold. First, it can be used to measure the efficiency of the use of working capital in the unit. Secondly, it can be used as a base for measuring the requirements of working capital for an expected increase in sales. 3.5. Current Assets Turnover Ratio

The ratio is calculated to ascertain the efficiency of use of current assets of the concerns. With an increase in sales, current assets are expected to increase. However, an increase in the ratio shows that current assets turned over faster resulting in higher sales for a given investment in current assets. Higher ratio is generally an index of better efficiency and profitability of the concern. This ratio gives a general impression about the adequacy of working capital in reaction to sales.

3.6. Fixed Assets Turnover Ratio

The ratio shows the efficiency of the concern in using its fixed assets. Higher ratios indicate higher efficiency because every rupee invested in fixed assets generates higher sales. A lower ratio may indicate inefficiency of assets. It may also be indicative of under utilizations or non-utilization of certain assets. Thus with the help of this ratio, it is possible to identify such underlined or unutilized assets and arrange for their disposal.

4.0 Leverage Ratio

4.1. Debt-Equity Ratio

Debt-Equity Ratio

This is a measure of owners stake in the business. The proprietors may desire more of funds to be from borrowings because it carries two main advantages. First, their stake in the venture is reduced and correspondingly their risk also. Secondly, interest on borrowings is allowed as expenditure in computing taxable profits but not dividend shares. The tax is computed on the profits before any dividend is declared. But a considerable contribution from the proprietors is necessary from the creditors point of view to sustain the interest of the proprietors in the venture and also as a margin of safety of the creditors. Besides, excessive liabilities tend to cause insolvency.

Generally a ratio of 2: 1 (i.e., 2 units of debt for 1 unit of equity) is considered normal, but in certain cases relaxations are allowed.

4.2. Total-Indebtedness Ratio

Total Indebted Ratio

This ratio should be watched for a period of 3 to 5 years to see its trend, if declining or decreasing. A declining trend in the ratio is a welcome sign as it shows that the company is augmenting its own sources of funds by ploughing back profits or by reducing its dependence on outside borrowing by repaying them. On the other hand, an increasing trend in the ratio should be carefully looked into by the banker. Similar to the debtequity ratio, there is no standard single ratio of total indebtedness that can be applied to all industries. But a ratio of 4: 1 is considered normal. This ratio supplements the information supplied by the debt-equity ratio. A company may have declining debt-

equity ratio but the total outside liabilities may not decrease because of increased borrowing on short term. This will be revealed by the present ratio. 4.3. Proprietary Ratio

Proprietary Ratio

This ratio indicates the general financial strength of the concern. It is a test of the soundness of the financial structure of the concern. The ratio is of great significance to creditors since it enables them to find out the proportion of shareholders funds in the total investment in the business. In case of companies which depend entirely on owned funds and have no outside liabilities, the ratio will be 100%. A high ratio is welcome to the creditors because it secures their position by providing a high margin of safety. A ratio above 50% is generally considered safe for creditors.

5.0. Coverage Ratios

5.1. Interest Coverage Ratio

Interest Coverage Ratio

Since, EBIT is calculated after depreciation, it can be added back to arrive at the total funds available for payment of interest. The formula can be modified as follows.

Interest Coverage Ratio

Higher the ratio, better is the coverage. The firm may not fail on its commitments to pay interest even if profits fall substantially.

5.2. Preference Dividend Coverage Ratio

Preference Dividend Coverage Ratio

Higher ratio indicates better coverage.

6.0. Profitability Ratios

6.1. Gross Profit Ratio

Gross Profit Ratio

A comparison with the standard ratio for the industry will reveal a picture of the profitability of the concern. Also the ratio may be worked out for a few years and compared to verify if a steady ratio is maintained.

6.2. Net Profit Ratio

Net Profit Ratio

This ratio serves a similar purpose as, and is used in conjunction with, the gross profit ratio.

6.3. Return on Investment

This ratio measures the profits of the concern as a percentage of the total investment made. However, both the important terms involved, viz., profit and investment, have been interpreted in various ways and hence the formula used for this ratio also varies widely. We shall adopt the formula

Return on Investments

For the purpose of this ratio, the operating profit is calculated by adding back to net profit: (1) Interest paid on the long term borrowings and debentures; (2) Abnormal and non-recurring losses; (3) Intangible assets written off. Similarly, from the net profit abnormal and non-recurring gains are deducted. The idea is to get profit generated out of total investments made.

The ratio of return on investment is an important ratio in computing the profitability of the concern. It computes the profitability as against profits. A company may maintain the profits at absolute value every y ear but its efficiency lies in maintaining the same percentage of profit as compared to the total investment made. When one wants to analyze an increase or decrease in the rate of return, it can be done by further analysis of the ratio. Profit is decided by the rapidity with which sales are made (turnover) and the margin of profit on sales. Therefore the ratio can be calculated also as:

Return on Investments (Margin) (Turnover)

Profit can be increased by increasing the margin or increasing the turnover. A further analysis of the different components that enter into the above will pinpoint the factors that contributed to the increase of decrease in profits.

Return on investment is also known as Return on Capital Employed. Capital employed is used to mean the total investment in the unit, i.e., total assets.

6.4. Return on Proprietors funds

Return on Proprietors Funds

This ratio serves the requirements of the shareholders specially to know the return on their investments in the business.

Return on net worth, Return on shareholders Funds.

6.5. Earnings/ Share

Earnings per share

The numerator indicates the funds available for distribution as dividend to equity share holders. As the name indicates the ratio indicates the earnings made by the company per equity share. A comparison with the ratio for similar companies will indicate whether the company is using its capital effectively or not.

6.5. Dividend / Share

Dividend per share

Not all the earnings available for distribution are declared as dividend of the company. This ratio indicates the actual amount declared as dividend by the company.

6.6. Dividend Payout Ratio

Dividend payout ratio

This ratio indicates the actual dividend paid to the shareholders. It throws light on the dividend policies of the company.

6.7. Price Earnings Ratio

Price Earnings Ratio

(Earnings per share

A higher price earnings ratio as compared to that of other companies shows higher confidence the company enjoys with the public. This ratio is also used by the investors to know whether the shares of the company are undervalued or overvalued. Based on this fact they would decide to purchase the shares at the particular price or not. For instance, suppose the market price of the shares of the Company A is Rs. 80 when it earnings per share is Rs. 10. (The price earnings ratio of the company is 8.) The price earnings ratio of other companies is 9. Based on the general price earnings ratio, the market price of the shares of Company A should be (Rs. 10 ) Rs. 90. The shares of Company A are undervalued since they are quoted at Rs. 80.

6.8. Dividend Yield Ratio

Dividend Yield Ratio

Yield is the actual return for the shareholders on the investment. The dividend is declared on the face value of shares. Thus 20% dividend declared on a share of the face value of Rs. 10 would fetch Rs. 2 as dividend. But, if the shareholder has acquired the share from the market for Rs. 40, the actual yield will be

Dividend Yield Ratio 6.9. Earnings Yield Ratio

Earnings Yield Ratio

This ratio measures the yield earned by the company per share.

7.0 Summary

The Financial statements and ratios furnished in this paper are normally used in the accounting section are for validation, verification and for improvement of the company. The real success of any management lies with proper vision, mission towards the upgradation of our society.

Reference:

1)

Prof. C. Jeevanadam, Sardar Vallabhbhai Institute of Textile Management, Coimbatore, Notes on Financial Statements, Short Term Programme on Financial Management at Bannari Amman Institute of Technology, Sathyamangalam on 05.01.2005.

2) Principles of Accounting, Dr. Vinayagam, P. C. Mani, K. L. Nagarajan, Kalyani Publications, New Delhi, 2002. 3) Financial Management, Dr. R. S. Kulsherestha, Kalyani Publications, New Delhi,2002

4) Dr. B. K. Behra, Class notes on Costing and Management,IIT-Delhi,2003

About the Authors:

The authors are associated with Department of Textile Technology, Bannari Amman Institute of Technology and Department of Textile Technology, PSG College of Technology, Tamilnadu, respectively.

To read more articles on Textile, Industry, Technical Textile, Dyes & Chemicals, Machinery, Fashion, Apparel, Technology, Retail, Leather, Footwear & Jewellery, Software and General please visit http://articles.fibre2fashion.com To promote your company, product and services via promotional article, follow this link: http://www.fibre2fashion.com/services/article-writingservice/content-promotion-services.asp

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- End of The Earth.......Dokument3 SeitenEnd of The Earth.......Plaban Pratim BhuyanNoch keine Bewertungen

- The Chosen by Chaim PotokDokument12 SeitenThe Chosen by Chaim PotokDavid A. Malin Jr.Noch keine Bewertungen

- Presentasi Bahasa InggrisDokument18 SeitenPresentasi Bahasa InggrisIndraPrawiroAdiredjoNoch keine Bewertungen

- Netflix Case NotesDokument16 SeitenNetflix Case NotesSergio AcuñaNoch keine Bewertungen

- FI Market Research TemplateDokument3 SeitenFI Market Research TemplateAnonymous DCxx70Noch keine Bewertungen

- Case Digest-Mejoff V Director of PrisonersDokument2 SeitenCase Digest-Mejoff V Director of PrisonersJestherin BalitonNoch keine Bewertungen

- User Manual For State ExciseDokument29 SeitenUser Manual For State ExciserotastrainNoch keine Bewertungen

- Test 1 English Ii AdvanceDokument3 SeitenTest 1 English Ii AdvanceMartin Sepulveda JaraNoch keine Bewertungen

- Unit - I: Section - ADokument22 SeitenUnit - I: Section - AskirubaarunNoch keine Bewertungen

- Glo 20is 2017 PDFDokument317 SeitenGlo 20is 2017 PDFKristine LlamasNoch keine Bewertungen

- Family Law 2 Final.Dokument11 SeitenFamily Law 2 Final.Vedant VyasNoch keine Bewertungen

- Five Dials: Number 15Dokument49 SeitenFive Dials: Number 15DouglasW822Noch keine Bewertungen

- Ncert BookDokument14 SeitenNcert Bookviswanathan periyasamyNoch keine Bewertungen

- Majestic Writings of Promised Messiah (As) in View of Some Renowned Muslim Scholars by Hazrat Mirza Tahir Ahmad (Ra)Dokument56 SeitenMajestic Writings of Promised Messiah (As) in View of Some Renowned Muslim Scholars by Hazrat Mirza Tahir Ahmad (Ra)Haseeb AhmadNoch keine Bewertungen

- Test Bank For Essentials of Investments 9th Edition BodieDokument37 SeitenTest Bank For Essentials of Investments 9th Edition Bodiehanhvaleriefq7uNoch keine Bewertungen

- SSS Disability BenefitsDokument5 SeitenSSS Disability BenefitsJason TiongcoNoch keine Bewertungen

- Jurisdiction (Three Hours) Lesson OutlineDokument7 SeitenJurisdiction (Three Hours) Lesson OutlineChaNoch keine Bewertungen

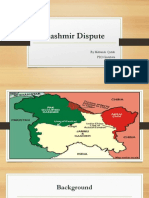

- Kashmir DisputeDokument13 SeitenKashmir DisputeAmmar ShahNoch keine Bewertungen

- Key Considerations For A Successful Hyperion Planning ImplementationDokument45 SeitenKey Considerations For A Successful Hyperion Planning Implementationayansane635Noch keine Bewertungen

- Quo Vadis PhilippinesDokument26 SeitenQuo Vadis PhilippineskleomarloNoch keine Bewertungen

- Model Paper ADokument7 SeitenModel Paper AAndrewwwCheahNoch keine Bewertungen

- Close Reading Practice Sherman Alexies Superman and MeDokument4 SeitenClose Reading Practice Sherman Alexies Superman and Meapi-359644173Noch keine Bewertungen

- Shaykh Rabee Advises Before He RefutesDokument7 SeitenShaykh Rabee Advises Before He Refuteshttp://AbdurRahman.orgNoch keine Bewertungen

- School Calendar Version 2Dokument1 SeiteSchool Calendar Version 2scituatemarinerNoch keine Bewertungen

- The Black Rite of HekateDokument6 SeitenThe Black Rite of HekateAugusto Macfergus100% (3)

- Seab A-Level Lit H2 9725 - 2011Dokument34 SeitenSeab A-Level Lit H2 9725 - 201127031993Noch keine Bewertungen

- Panel Hospital ListDokument4 SeitenPanel Hospital ListNoman_Saeed_1520100% (1)

- CondrenDokument303 SeitenCondrenbebelizaNoch keine Bewertungen

- Invoice: Issue Date Due DateDokument2 SeitenInvoice: Issue Date Due DateCheikh Ahmed Tidiane GUEYENoch keine Bewertungen