Beruflich Dokumente

Kultur Dokumente

The Impact of Dividend Policy On Stock Prices in Kse

Hochgeladen von

Rashid LatiefOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

The Impact of Dividend Policy On Stock Prices in Kse

Hochgeladen von

Rashid LatiefCopyright:

Verfügbare Formate

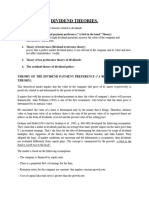

The impact of dividend policy on stock prices in kse

Introduction

Dividend is Latin word which means things to be divided. Dividends are payment made by organization to its share holder or we can say that dividends are a tool used by firms to return cash to shareholders. Dividend is basically a portion of organization profit paid out to share holders. when an organization earn profit it can be used in two ways the profit can be reinvested in business (which is known as retained earning) or it can be paid as dividend to share holders. Mostly organization retained some portion of profit as a retained earning remaining part of profit distribute among share holder as a dividend. Stock holder receives dividend according to their proportion of investment. The most common type of dividend is a regular cash dividend in which a firm announces that all shareholders of record on a certain date will receive a certain cash payment for each share they hold. Some time companies offered dividend reinvestment plan (DRIP) in which investor does not receive cash dividend but they can purchase additional shares. The dividend policy may vary from time to time. In dividend policy Board of directors declares the dividend announcement date ex-dividend date and dividend per share amount it becomes a liability of the firm. Stock price is the price of single stock of number of sale able shares of an organization. When an investor purchases a share of company then he will be the owner of that company up to the extent of his investment .In this paper we shall relate the dividend policy and share price. This study reveals that the impact of dividend policy on share prices. Different researcher present their different views about dividend policy mostly researcher said that dividend policy has strong

relationship with stock prices. But few of them said that there is no relationship between dividend policy and stock prices Dividend policy still source of controversy despite of empirical and theoretical research. MertonH,Miller and Frannco Modigliani(M&M) they suggest that the firm value is determined solely by earning power and risk of assets(investment).and the manner in which it splits its earning stream between dividends and internally retained funds does not effect this value. M&M theory suggest that in a perfect world (certainty, no taxes, no transaction cost, and other market imperfection) the firm value is unaffected by distribution of dividends. Some researches shows that change in dividend do affect stock price. Increase in dividend increase the stock price and decrease in dividend lead to decrease in stock prices in response M&M theory argue that these effects are attributable not to dividend itself but rather to informational content of dividends with respect to future earning M&M says that it is not preference of the share holder for current dividend (rather than future capital gain)that is responsible for such behavior investor view the change in dividends up or down as increased in dividend is viewed as positive signal the investor bid up share price; a decrease in dividend is a negative sign that may lead to decrease the stock prices as investor sell their shares. On the other hand J.Gordon and John lintner who suggest that there is in fact, a direct relationship between dividend policy and its market value. fundamentals to this proposition is their bird in-the-hand argument, which suggest that investor see current dividend as less risky then future dividend or capital gain.gordon and Lintner argue that current dividend payment reduce investor uncertainty causing investor to discount the firm earning at a lower rate and, else being equal, to place higher value on firm stock. conversely if dividend are reduced or are not to paid, investor uncertainty will increase, raising the required return and lowering the stock value.Altough many other arguments related to dividend relevance have been

put forward, empirical studies fail to provide conclusive evidence in support of the intuitively appealing dividend relevance argument. But according to me there is strong impact of dividend policy on stock prices. Lets see up to what extent I can prove it. I think M&M theory is acceptable if there will be the concept of efficient market. But here in Pakistan due to imperfect market we cant apply this theory.

Das könnte Ihnen auch gefallen

- Whatever Dividend Policy A Company AdoptsDokument4 SeitenWhatever Dividend Policy A Company Adoptsrobhanson90Noch keine Bewertungen

- Submitted For: Course Title: Course CodeDokument15 SeitenSubmitted For: Course Title: Course CodeDedar HossainNoch keine Bewertungen

- Impact of Dividend PolicyDokument12 SeitenImpact of Dividend PolicyGarimaNoch keine Bewertungen

- Dividend PolicyDokument7 SeitenDividend PolicyImran AhsanNoch keine Bewertungen

- Impact of Dividend Policy On Share PricesDokument16 SeitenImpact of Dividend Policy On Share PricesAli JarralNoch keine Bewertungen

- Bird in The Hand TheoryDokument3 SeitenBird in The Hand TheoryOMAYOMAYNoch keine Bewertungen

- Dividend PolicyDokument10 SeitenDividend Policysankalp singhNoch keine Bewertungen

- FinmanDokument7 SeitenFinmanNHEMIA ELEVENCIONADONoch keine Bewertungen

- Impact of Dividend Policy On A Firm PerformanceDokument11 SeitenImpact of Dividend Policy On A Firm PerformanceMuhammad AnasNoch keine Bewertungen

- Dividend and Valuation PolicyDokument7 SeitenDividend and Valuation Policyjeremie123Noch keine Bewertungen

- Dividend PolicyDokument8 SeitenDividend PolicyToufiq AmanNoch keine Bewertungen

- Dividend PolicyDokument4 SeitenDividend PolicyKiran Rajashekaran NairNoch keine Bewertungen

- The Effects of Dividend Yield and DivideDokument22 SeitenThe Effects of Dividend Yield and DividesandygtaNoch keine Bewertungen

- CH 14 - Mini Case - 23845Dokument11 SeitenCH 14 - Mini Case - 23845Aamir KhanNoch keine Bewertungen

- Dividend Policy AssignmentDokument8 SeitenDividend Policy Assignmentgeetikag2018Noch keine Bewertungen

- Finance 1 DineshDokument15 SeitenFinance 1 Dineshdinesh-mathew-5072Noch keine Bewertungen

- Dividend Decision Dividend Decision by NameDokument5 SeitenDividend Decision Dividend Decision by Namejack petersNoch keine Bewertungen

- Dividend Decisions: Prof. Nidhi BandaruDokument15 SeitenDividend Decisions: Prof. Nidhi Bandaruhashmi4a4Noch keine Bewertungen

- Divindend TheoriesDokument7 SeitenDivindend TheoriesKhadija AbubakarNoch keine Bewertungen

- FM Notes - Unit - 5Dokument7 SeitenFM Notes - Unit - 5Shiva JohriNoch keine Bewertungen

- FinanceDokument21 SeitenFinanceYash MandpeNoch keine Bewertungen

- Factors Affecting Dividend Policy in Manufacturing Companies in Indonesia Stock ExchangeDokument14 SeitenFactors Affecting Dividend Policy in Manufacturing Companies in Indonesia Stock ExchangeWindaNoch keine Bewertungen

- Dividend Irrelevance Theory DefinitionDokument2 SeitenDividend Irrelevance Theory DefinitionpsyashNoch keine Bewertungen

- Dividend Policy: Dividend Decision and Valuation of FirmsDokument10 SeitenDividend Policy: Dividend Decision and Valuation of FirmsudhavanandNoch keine Bewertungen

- Information Content of Dividend Evidence From NigeriaDokument10 SeitenInformation Content of Dividend Evidence From NigeriaAlexander DeckerNoch keine Bewertungen

- Report On Dividend PolicyDokument21 SeitenReport On Dividend PolicyMd. Golam Mortuza78% (9)

- Project On Impact of Dividends PolicyDokument45 SeitenProject On Impact of Dividends Policyarjunmba119624100% (1)

- A Study To Analyse Effect of Corporate Actions On Stock Market Returns of Selected Indian IT CompaniesDokument22 SeitenA Study To Analyse Effect of Corporate Actions On Stock Market Returns of Selected Indian IT CompaniesAnkit SarkarNoch keine Bewertungen

- Chapter-I: 1.1 Background of The StudyDokument51 SeitenChapter-I: 1.1 Background of The StudyCritical ViewNoch keine Bewertungen

- Project On Impact of Dividends Policy 1Dokument43 SeitenProject On Impact of Dividends Policy 1Soma BanikNoch keine Bewertungen

- Financial ManagementDokument8 SeitenFinancial ManagementAayush JainNoch keine Bewertungen

- Chapter-II Literature ReviewDokument32 SeitenChapter-II Literature Reviewbikash ranaNoch keine Bewertungen

- C-5 Dividend Policy 3rdDokument12 SeitenC-5 Dividend Policy 3rdsamuel debebeNoch keine Bewertungen

- Dividend Policy: Compiled To Fulfill The Duties of Financial Management Courses Lecturer: Prof. Dr. Isti Fadah, M.SiDokument10 SeitenDividend Policy: Compiled To Fulfill The Duties of Financial Management Courses Lecturer: Prof. Dr. Isti Fadah, M.SiGaluh DewandaruNoch keine Bewertungen

- Investment and Speculation WorkDokument5 SeitenInvestment and Speculation WorkWinifridaNoch keine Bewertungen

- Dividend Assignment ReportDokument20 SeitenDividend Assignment ReportSadia Afroz LeezaNoch keine Bewertungen

- Gitman c14 SG 13geDokument13 SeitenGitman c14 SG 13gekarim100% (3)

- Unit 4Dokument12 SeitenUnit 4Mohammad ShahvanNoch keine Bewertungen

- Dividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.Von EverandDividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.Noch keine Bewertungen

- Project On Dividend PolicyDokument50 SeitenProject On Dividend PolicyMukesh Manwani100% (3)

- FM Module 4 WordDokument12 SeitenFM Module 4 WordIrfanu NisaNoch keine Bewertungen

- DividendDokument32 SeitenDividendprincerattanNoch keine Bewertungen

- Dividend Policy of Indian Corporate FirmsDokument19 SeitenDividend Policy of Indian Corporate FirmsRoads Sub Division-I,PuriNoch keine Bewertungen

- Beximco Chapter 2Dokument15 SeitenBeximco Chapter 2Tanvir Ahmed Rana100% (2)

- Chapter 5 - The Dividend DecisionsDokument18 SeitenChapter 5 - The Dividend DecisionsMotiram paudelNoch keine Bewertungen

- 3.1. Problem Statement: Supply DemandDokument29 Seiten3.1. Problem Statement: Supply DemandAysha LipiNoch keine Bewertungen

- Chapter-I: 1.1 Background of The StudyDokument10 SeitenChapter-I: 1.1 Background of The StudyAnonymous NpglhCs1JNoch keine Bewertungen

- Dividend PolicyDokument13 SeitenDividend Policyrekha_savnaniNoch keine Bewertungen

- A Test of Dividend Irrelevance Using Volume Reactions To A Change in Dividend Policy - 1986 - Journal of Financial Economics PDFDokument21 SeitenA Test of Dividend Irrelevance Using Volume Reactions To A Change in Dividend Policy - 1986 - Journal of Financial Economics PDFZhang PeilinNoch keine Bewertungen

- Financial Management: Topic-Dividend PolicyDokument10 SeitenFinancial Management: Topic-Dividend PolicyVibhuti SharmaNoch keine Bewertungen

- Dividend Policy and Value of FirmDokument3 SeitenDividend Policy and Value of FirmSaadNoch keine Bewertungen

- FM II CH 1,2 and 3Dokument104 SeitenFM II CH 1,2 and 3Andualem ZenebeNoch keine Bewertungen

- FM II SlidesDokument119 SeitenFM II SlidesYasinNoch keine Bewertungen

- Dividend Payouts FinalDokument32 SeitenDividend Payouts FinalsubhapallaviNoch keine Bewertungen

- Dividend Decision: Vishal Tanwar Room 32 Roll No. 506 St. Xavier's CollegeDokument8 SeitenDividend Decision: Vishal Tanwar Room 32 Roll No. 506 St. Xavier's CollegeVishal TanwarNoch keine Bewertungen

- Dividend TheriesDokument7 SeitenDividend Theriesluciferofhell1969Noch keine Bewertungen

- Project FileDokument23 SeitenProject FileAnkit GuptaNoch keine Bewertungen

- Value Investing: A Comprehensive Beginner Investor's Guide to Finding Undervalued Stock, Value Investing Strategy and Risk ManagementVon EverandValue Investing: A Comprehensive Beginner Investor's Guide to Finding Undervalued Stock, Value Investing Strategy and Risk ManagementNoch keine Bewertungen