Beruflich Dokumente

Kultur Dokumente

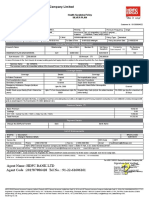

HDFC - Marketing - Insurance Sector

Hochgeladen von

Kritika DwivediOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

HDFC - Marketing - Insurance Sector

Hochgeladen von

Kritika DwivediCopyright:

Verfügbare Formate

PROJECT REPORT

ON

MARKETING RESEARCH ABOUT COMPETITION IN INSURANCE INDUSTRY & APPOINTMENT OF FCS

[EMPHASIS ON LIFE INSURANCE]

Respect Yourself

Submitted for the partial fulfillment towards the award of the degree in MASTER OF BUSINESS ADMINISTRATION of U.P. Technical University, Lucknow

(Session : 2006-2008)

UNDER THE SUPERVISION OF

MR. FAIZ KHAN

(Sales Development Manager, HDFC SLIC)

SUBMITTED TO DR. K.N. SINGH Faculty (MBA)

SUBMITTED BY ANSHUL CHAURASIA

MBA (IIIrd Sem) Roll No.: 0614970010

Marketing Research about Competition in Insurance Industry & Appointment of FCs

CENTER FOR MANAGEMENT TECHNOLOGY

25, 27, 28, KNOWLEDGE PARK, PHASE-I, GREATER NOIDA

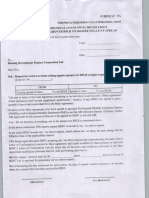

STUDENT DECLARATION

I, hereby certify that the Survey data collection and analysis work related to research project report on Marketing Research about Competition in Insurance Industry & Appointment of FCs has been carried out exclusively on my own effort under the supervision of Mr. FAIZ KHAN (Sales Development Manager, HDFC, SLIC) is my research guide and Dr. K.N. Singh, Faculty Guide.

Marketing Research about Competition in Insurance Industry & Appointment of FCs

ACKNOWLEDGEMENT

First of all I would like expressing my gratitude to my Mentor, who guided me with his knowledge and skill and helped me in successful completion of the work. I gratefully acknowledge my project guide Dr. K.N. Singh, Faculty Guide, and Supervision of Mr. Faiz Khan (Sales Development Manager, HDFC, SLIC). They have been fully support and guide that was provided to me by various individuals that led to the successful completion of this project. Their vision of the problem gave me enough direction to bring out a meaningful result. I am grateful to their great support and help all throughout the project. I am thankful to them for taking out time and pointing out the multitudinous aspects of customer service and helping me increase my learning out of the project. I would heartily thank all the respondents of the survey without whose support & valuable inputs this project would not have been completed.

ANSHUL CHAURASIA MBA (IIIrd Sem)

Marketing Research about Competition in Insurance Industry & Appointment of FCs

TABLE OF CONTENTS

COMPANY PROFILE INTRODUCTION IMPORTANCE OF STUDY SCOPE OF STUDY LITERATURE REVIEW RESEARCH DESIGN RESEACH ANALYSIS RESERCH OBJECTIVE DATA COLLECTION DATA ANALSYIS/INTERPRETATION CONCLUSION RECOMMENDATION FURTHER SCOPE OF STUDY APENDIX QUESTIONNAIRE BIBLIOGRAPHY

Marketing Research about Competition in Insurance Industry & Appointment of FCs

COMPANY PROFILE

Marketing Research about Competition in Insurance Industry & Appointment of FCs

ABOUT HDFC

Incorporated in 1977 as a public limited company To specialize in provision of housing finance to individuals, co-operative societies & the corporate sector First private sector retail housing finance company HDFC is listed on both BSE and NSE Market capitalisation (June 2002) - Rs. 79 billion (US $ 1.6 bn)

Strengths of HDFC

Strong Brand

Marketing Research about Competition in Insurance Industry & Appointment of FCs

Customer base of over 2 million Stable and experienced management High service standards High quality loan portfolio Provision for contingencies Constant technological upgradation of systems One of the best capital adequacy ratio

Marketing Research about Competition in Insurance Industry & Appointment of FCs

BACKGROUND

HDFC was incorporated in 1977 meeting a social need that of providing long-term finance to needs. HDFC was promoted with 100 million. with the primary objective of promoting home ownership by households for their housing an initial share capital of Rs.

Business Objectives

The primary objective of HDFC is to enhance residential housing stock in the country through the provision of housing finance in a systematic and professional manner, and to promote home ownership. Another objective is to increase the flow of resources to the housing sector by integrating the housing finance sector with the overall domestic financial markets...

Organizational Goals

HDFCs main goals are to a) develop close relationships with individual households, b) maintain its position as the premier housing finance institution in the country, c) transform ideas into viable and creative solutions, d) provide consistently high returns to shareholders, and e) to grow through diversification by leveraging off the existing client base. HDFC is a professionally managed organization with a board of directors consisting of eminent persons who represent various fields including finance, taxation, construction and urban policy & development. The board primarily focuses on strategy formulation, policy and control, designed to deliver increasing value to shareholders.

Board of Directors

Mr. D S Parekh - Chairman Mr. Keshub Mahindra Vice Chairman Ms. Renu S. Karnad - Executive Director Mr. K M Mistry - Managing Director Mr. D M Sukthankar Mr. D N Ghosh Mr. S Venkitaramanan Dr. Mr. Mr. Mr. Mr. Dr. Ram S Tarneja N M Munjee D M Satwalekar Shirish B Patel Bansi S Mehta S A Dave

Marketing Research about Competition in Insurance Industry & Appointment of FCs

HDFC has a staff strength of 1029, which includes professionals from the fields of finance, law, accountancy, engineering and marketing.

Consultancy Services

HDFC is a unique example of a housing finance company which has demonstrated the viability of market-oriented housing finance in a developing country. It is viewed as an innovative institution and a market leader in the housing finance sector in India. The World Bank considers HDFC a model private sector housing finance company in developing countries and a provider of technical assistance for new and existing institutions, in India and abroad. HDFCs executives have undertaken consultancy assignments related to housing finance and urban development on behalf of multilateral agencies all over the world. HDFC has also served as consultant to international agencies such as World Bank, United States Agency for International Development (USAID), Asian Development Bank, United Nations Center for Human Settlements, Commonwealth Development Corporation (CDC) and United Nations Development Programme (UNDP). HDFC has also undertaken assignments for the United Nations Capital Development Fund in Ethiopia, for the UNCHS in Nairobi, for USAID in Russia and Bulgaria, and projects of the World Bank in Indonesia and Ghana. At the national level, HDFC executives have played a key role in formulating national housing policies and strategies. Recognizing HDFCs expertise, the Government of India has invited HDFCs executives to join a number of committees and task forces related to housing finance, urban development and capital markets.

Consultancy assignments undertaken:

Proj e c t Ti tl e State Mortga ge Inve stme nt B ank Re vie w of O pe rati ons of B ank Tabun ga N e gara De tai l e d Anal ysi s of Housi ng Si tuati on Study of Housi ng Fi nanc e Se c tor Manage me nt and O pe rati ons Audi t Te c hni c al B ank Assi stanc e for Al l i anc e N ew Housi ng Mortga ge Proj e c t C ountry Russi a I ndone si a B hutan Ghan a Thai l and O man Mauri ti us Age nc y USAI D W orl d B ank Govt. B hutan Govt. Ghana C D C Di re c t C D C of of

Fe asi bi l i ty of Fi nanc e C omp

Establ i shi ng

Marketing Research about Competition in Insurance Industry & Appointment of FCs

Fe asi bi l i ty Study for a Se c ond B ui l di ng Soc i e ty W ork shop on Housi ng Fi nanc e & Manage ri al Effe c ti ve ne ss for Housi ng Profe ssi onal s Re vie w of Ne pal Housi ng De ve l opme nt F i nanc e C ompany L i mi te d (N HDF C ) Eval uati on of an i nve stme nt proposal C ommonw e al th De vel opme nt C orporati on Turk s & C ai c os Isl ands Eval uati on of C ari bbe an Housi ng C orporati on L i mi te d, Jamai c a

Mal aw i Ghan a N e pal

Di re c t W orl d B ank USAI D & UN DP

of Turk s & C D C i n C ai c os Isl ands J amai c a B ul gari a Phi l i ppi ne s C oal i ti on Russi a Abt. Assoc i ate s C D C The Urban I nsti tute Asi an

F i nanc e and L oan

Re vie w of Mortgage Unde rw ri ti ng Se rvi c i ng Manual s de ve l ope d for B ul gari a W ork shop Re c ove ry on C re di t Apprai sal &

De ve l opme nt of Mortgage Se rvi c i ng Manu al

Over the past two decades, HDFC has been making inroads into varied spheres of development, while retaining a focus on lowincome housing and related issues. During this year, HDFC further consolidated its operations as a wholesaler in microfinance and weaker section housing, while advancing the reconstruction activities at Gujarat into an intensive phase. In addition, HDFC has been engaged in some specific micro-finance initiatives involving for e.g. policy frameworks and developing case studies; these have been captured in a separate section below.

Lending Operations in Weaker-Section Housing

HDFC continued to utilize the Kreditanstalt fr Wiederaufbau (KfW) lines (HDFC II and HDFC III) by making loans to Non Governmental Organisation (NGO) intermediaries and state government agencies towards low-cost rural and urban EWS housing projects. Under the second line comprising DM 30 million as grant (HDFC II), HDFC has drawn the full amount from KfW (INR equivalent Rs. 67.98 crore) and all sub-projects have now reached completion. This includes loan disbursements in the amount of Rs. 56.91 crore and the balance has been released as grant funds towards rehabilitation housing projects in response to natural calamities. The third line, also a grant of DM 30 million is split into two components the smaller component of Euro 6 million is towards the micro-enterprise Finance Facility (MFF), whereas Euro 9.34 million have been earmarked towards the EWS housing component. The cumulative loan approvals,

10

Marketing Research about Competition in Insurance Industry & Appointment of FCs

disbursements and related information for the housing projects under HDFC II and III are furnished in Table I. The KfW has recently reviewed the progress under HDFC II and III and they have gathered that the borrowers were generally in control of their housing process, leading to optimal use of available resources, and good construction quality. The cost ceiling for housing construction has been increased to Rs. 60,000 per housing unit, as a consequence of which the endborrower loan size has increased from the current level of Rs. 45,000 to Rs. 54,000 (upto 90% of cost).

MFF Lending and KfW Lines for Micro-Finance

During the year, HDFC has approved 11 income-generation projects under the Micro-enterprise Finance Facility i.e. MFF component of HDFC III. On a cumulative basis, HDFC has approved 51 livelihood projects with a disbursement of Rs. 12.16 crore. The borrowing agencies, which act as social and financial intermediaries, range from professional micro-finance institutions (MFIs) to development NGOs to self-help group (SHG) federations. Until March 31, 2003, HDFC has covered over 35,000 EWS households, so far, and HDFC has experienced near 100% recoveries under the scheme. Under the National Renewal Fund Self Employed Women's Association (NRF SEWA) component comprising a special grant of DM 2.4 million from KfW towards micro-enterprise development (Sanjivani Project), HDFC has disbursed as at March 31, 2003, a cumulative amount of Rs. 4.37 crore to SEWA Bank, Ahmedabad. The SEWA Bank has utilized the funds in disbursing 2470 loans to their women members, covering a variety of livelihood activities. The bank's cumulative disbursements under this project stood at Rs. 4.15 crore, with an average loan size of Rs. 17,000. During the year KfW conducted an appraisal of the proposed Microfinance Refinance Facility (HDFC V, fifth line). As an outcome of which, bilateral funding of Euro 10 million has been committed, which includes a loan of Euro 9 million and the balance as a grant towards technical assistance (TA) and capacity building measures. In the first round of MFI selection, out of the eight detailed appraisals carried out, four prominent Indian MFIs have been identified viz. Bharatiya Samruddhi Finance Ltd., Friends of

11

Marketing Research about Competition in Insurance Industry & Appointment of FCs

A womans World Banking, DHAN Foundation and the Indian Association for Savings and Credit (IASC). HDFC may include more MFIs in the program at a later stage. The Ministry of Economic Cooperation (BMZ), Federal Republic of Germany has also approved HDFC V; and the TA and capacity building measures are expected to commence shortly.

FUTURE

HDFC has always been market-oriented and dynamic with respect to resource mobilization as well as its lending Programme. This renders it more than capable to meet the new challenges that have emerged. Over the years, HDFC has developed a vast client base of borrowers, depositors, shareholders and agents, and it hopes to capitalize on this loyal and satisfied client base for future growth. Internal systems have been developed to be robust and agile, to take into account changes in the volatile external environment. HDFC has developed a network of institutions through partnerships with some of the best institutions in the world, for providing specialized financial services. Each institution is being fine-tuned for a specific market, while offering the entire HDFC customer base the highest standards of quality in product design, facilities and service.

AWARDS

HDFC Ranked as Indias Third Best Managed Company by Finance Asia 2005 Mr. Deepak Parekh awarded the 'Hall of Fame' award by Outlook Money magazine. HDFC receives the 'Dream Home' award for the best Housing Finance company for 2004 from Outlook Money magazine Awards galore by HDFC at the 44th ABCI Awards!!! 5th Best Company to work for in India, ranked by Business Today in November 2004 Economic Times Corporate Citizen of the Year Award, November 2004 Rated by Deutsche Bank as one of the top 5 banks/Financial Institutions in Asia in October 2004 Ranked among the Top 20 companies to deliver healthiest returns to shareholders, Outlook Money Magazine September 2004

12

Marketing Research about Competition in Insurance Industry & Appointment of FCs

1st Prize at the New York Festival's Gold Midas Awards for Environmental Communication Ad in August 2004 Features in the Forbes list of Top 20 Leading Indian Companies in May 2004. One of the Top 10 Investor Friendly Companies, ranked by Business Today in March 2004. HDFC Ranked No. 3 - 'India's Best Managed Companies' by Finance Asia Clean Sweep by HDFC at the 43rd ABCI Awards!!! National Award for Excellence In Corporate Governance by The Institute of Company Secretaries of India 2nd Best Company for Corporate Governance in India by The Asset magazine. The Economic Times Lifetime Achievement Award - 2003. (For Mr. Deepak Parekh - Chairman, HDFC Ltd.) One of the Top Ten - Most Admired Companies in India ' 2003 by Business Barons One of the Top Ten - Most Admired CEOs in India ' - 2003 by Business Barons ( for Mr. Deepak Parekh ) India's Second Best Managed Company - 2003 by Finance Asia. India's Biggest Wealth Creator in the banking and financial series by the fourth Business Today - Stern Steward Survey. One of the Top Ten - Most Respected Companies in India' by Business world. Highest rating for ' Governance and Value Creation ' by CRISIL. One among the top ten ' Company Leaders in India' by the Far Eastern Economic Review Survey. Best Managed Financial Institution in India' by fox Pitt Survey.

13

Marketing Research about Competition in Insurance Industry & Appointment of FCs

HDFC GROUP

14

Marketing Research about Competition in Insurance Industry & Appointment of FCs

The Standard Life Insurance Assurance Company

Founded in 1825 Mutual Life Insurance Company since 1925 Largest mutual life insurance company in Europe Assets under management over Rs 707836 crores ( 89.2 bn) Total assets under management : Rs. 707836 Crores New premium income 2003 :Rs. 76277 Crores AA2 rated by Standard & Poors and Moodys

Financial Strengths of the company

Total assets under management: Rs. 5, 81,000 Crores New premium income 2001:Rs. 58,000 Crores AA2 rated by Standard & Poors and Moodys

About Standard Life

Standard Life has been looking after its customers for over 180 years, and currently over 7 million people rely on them for their financial needs. We have assets under management which are worth more than the combined market value of Shell, Reuters, Tesco, Cadbury Schweppes and Marks & Spencer.

Financial Security

Standard Life has the financial strength to remain secure and competitive. We aim to offer products that provide competitive returns to their customers while maintaining an adequate level of financial strength to ensure their security. Like most people, you want to know that your financial future is in good hands. Standard Life places a great deal of importance on getting your money to work hard for you; that's why we believe you can have confidence in us.

15

Marketing Research about Competition in Insurance Industry & Appointment of FCs

Standard Life has been awarded the "Raising Standards" quality mark. This shows that we:

use clear language to describe their products documents, have appropriate products and Provide a quality service for our customers.

on key

The quality mark covers products bought by individuals including pensions, long-term savings and protection. We were independently tested against a number of rigorous standards. And we have to continue to pass these tests every year to keep using the quality mark. Standard Life won the Money Marketing 'Company of the Year' award in March 2005 for the seventh year running. Other awards the Standard Life group has received include:

Money Marketing Awards

Company of the Year every year from 1999 to 2005 Best Pension Provider 2004 and 2005 Best Group Pension Provider every year from 1998 to 2003 Best Personal Pension Provider every year since 1998 to 2003 Best Life Investment Product Provider 2003 and 2004 Gold Award in the Poster Campaign Category (Advertising) 2004

Money facts Investment, Life & Pensions Awards

Best Pension Product 2003, 2004 and 2005 Best Pension Service 2003, 2004 and 2005

Bank hall Achievement Awards

Pension Provider of the Year 2003 and 2004

Financial Adviser Provider Awards

Overall Winner in 1999, 2000, 2001 and 2002 Pensions Provider of the Year 1999, 2000, 2001, 2002 and 2003 Pensions Company of the Year 2004 Individual Pensions Company of the Year 2004 Group Pensions Provider of the Year 2004 Health Insurance Company of the Year 2004

16

Marketing Research about Competition in Insurance Industry & Appointment of FCs

Financial Adviser Service Awards

Company of the Year every year from 1997 to 2001 5 Star Life and Pensions Provider every year from 1996 to 2004 5 Star Investment Provider every year from 1996 to 2002 and 2004

Pensions Management Administration and Service Awards

Overall Winner - Personal Pensions 2003 Overall Winner - Stakeholder Pensions 2002 and 2003 Overall Winner - Group Personal Pensions 2002 and 2004 Member Communications - Personal Pensions, Group Personal Pensions & Stakeholder Pensions 2003 Backup (branch office) - Personal Pensions 2003 Backup (head office technical support) - Personal Pensions & Stakeholder Pensions 2003

Pensions Management Technology Awards

Best extranet accessibility 2004

Guardian & Observer Consumer Finance Awards

Overall Winner in Personal & Stakeholder Pension Provider 2003

Professional Adviser Awards

Best Product Provider Website (adviser zone) 2005

Online Finance Awards

Best online Product Provider (ifazone) 2003 Best online Financial Adviser (ifazone) 2002

Head Office - Edinburgh, Scotland (UK) Presence United Kingdom: Canada Ireland 31 11 7 " branches "

17

Marketing Research about Competition in Insurance Industry & Appointment of FCs

Germany Austria Spain Hong Kong China

1 1 31 1

" sales office branches representative office

2 representative office

Year

Award

Company of the Year Company of the Year Best Personal Pension Provider Company of the Year Company of the Decade Company of the year 4 star service award Overall best company 3 star service award Best mortgage services

2003 2002 2001 2000 1999 1996-99 1995 1992-94 1991 1990

18

Marketing Research about Competition in Insurance Industry & Appointment of FCs

History Venture

of

Joint

Discussions commenced - January 1995 Joint venture agreement signed - October 1995 Joint venture agreement renewed - October 1998 Life Insurance project team established - January 2000 (Mumbai) Company officially incorporated - 14th August 2000 First private sector Life Insurance company to be granted a certificate of registration - 23 October 2000 Shareholding HDFC 81.4 % Standard Life 18.6 %

The Partnership: HDFC and Standard Life first came together for a possible joint venture, to enter the Life Insurance market, in January 1995. It was clear from the outset that both companies shared similar values and beliefs and a strong relationship quickly formed. In October 1995 the companies signed a 3 year

Joint venture agreement

Around this time Standard Life purchased a 5% stake in HDFC, further strengthening the

Relations

The next three years were filled with uncertainty, due to changes in government and ongoing delays in getting the IRDA

19

Marketing Research about Competition in Insurance Industry & Appointment of FCs

(Insurance Regulatory and Development authority) Act passed in parliament. Despite this both companies remained firmly committed to the venture. In October 1998, the joint venture agreement was renewed and additional resource made available. Around this time Standard Life purchased 2% of Infrastructure Development Finance Company Ltd. (IDFC). Standard Life also started to use the services of the HDFC Treasury department to advise them upon their investments in India. Towards the end of 1999, the opening of the market looked very promising and both companies agreed the time was right to move the operation to the next level. Therefore, in January 2000 an expert team from the UK joined a hand picked team from HDFC to form the core project team, based in Mumbai. Around this time Standard Life purchased a further 5% stake in HDFC and a 5% stake in HDFC Bank. In a further development Standard Life agreed to participate in the Asset Management Company promoted by HDFC to enter the mutual fund market. The Mutual Fund was launched on 20th July 2000.

Incorporation of HDFC Company Limited:

Standard

Life

Insurance

The company was incorporated on 14th August 2000 under the name of HDFC Standard Life Insurance Company Limited. Their ambition from as far back as October 1995 was to be the first private company to re-enter the life insurance market in India. On the 23rd of October 2000, this ambition was realized when HDFC Standard Life was the only life company to be granted a certificate of registration. HDFC are the main shareholders in HDFC Standard Life, with 81.4%, while Standard Life owns 18.6%. Given Standard Life's existing investment in the HDFC Group, this is the maximum investment allowed under current regulations. HDFC and Standard Life have a long and close relationship built upon shared values and trust. The ambition of HDFC Standard Life is to mirror the success of the parent companies and be the yardstick by which all other insurance company's in India are measured.

Their Mission:

20

Marketing Research about Competition in Insurance Industry & Appointment of FCs

They aim to be the top new life insurance company in the market. This does not just mean being the largest or the most productive company in the market, rather it is a combination of several things like

Customer service of the highest order Value for money for customers Professionalism in carrying out business Innovative products to cater to different needs of different customers Use of technology to improve service standards Increasing market share

Their Values:

SECURITY: Providing long term financial security to

policy holders will be their constant Endeavour. We will be doing this by offering life insurance and pension products. TRUST: We appreciate the trust placed by their policy holders in us. Hence, we will aim to manage their investments very carefully and live up to this trust. INNOVATION: Recognizing the different needs of their customers, we will be offering a range of innovative products to meet these needs.

Their mission is to be the best new life insurance company in India and these are the values that will guide us in this.

21

Marketing Research about Competition in Insurance Industry & Appointment of FCs

METHODOLOGY

Part- 1 Visiting Different Mutual Funds Companies, for the

complete knowledge of Mutual Funds and all of their provisions

Part - 2 Visiting insurance companies and to compare their

Unit linked plans as per HDFC plans and to make a final comparison with the Mutual Funds.

Part 3 Conducting a Survey of various people APPROACH

Study is divided into 3 parts: Data collection Survey Comparative Study

DATA COLLECTION PRIMARY DATA SOURCES

A visit was made to Mutual Funds companies and knowing their investment plans. Visited the company as a customer and asked for their good schemes and about their ROI. The companies covered were: HDFC Mutual Funds ICICI Mutual Funds India Bulls Franklin Templeton

Collected the Brochures from Four Insurance companies and compared their Unit Linked endowment plans

22

Marketing Research about Competition in Insurance Industry & Appointment of FCs

The Companies covered are o HDFC Standard Life o ICICI prudential o Birla Sun Life o Max New York Life A Survey was conducted in NCR region from 100 people and we asked about their interest in investment in mutual funds or unit linked plans The survey said o 62 percent people said that they want to invest in Unit Linked Policies o 27 percent people said that they want to invest in Mutual Funds o 8 percent people said they dont want to invest in private companies they just want to go with LIC traditional Plans as they dont want to bear risk. o 3 percent people said they want to invest in both the companies as they want to invest small amounts in all companies.

SECONDARY DATA SOURCES:

Websites was the Secondary data source 1. 2. 3. 4. 5. 6. www.investopedia.com www.hdfcinsurance.com www.valueresearchonline.com www.mutualfundsindia.com www.amfiindia.com www.hdfcmutualfunds.com

23

Marketing Research about Competition in Insurance Industry & Appointment of FCs

CONCEPT OF INSURANCE

Insurance is aimed at compensating the financial loss suffered on the happening of an insured event. Insurance cannot prevent the happening of the event; however it can protect a person from the financial losses he may suffer after the happening of the event. The above can be understood with the help of a simple example.

Example 1:

In case a person has a car worth Rs 5, 00,000 and he insures the car for Rs 5, 00,000. In the event of a loss of Rs 1, 00,000 during the term of the insurance, he would be compensated the amount lost of Rs 1, 00,000. Although the insurance is for Rs 5, 00,000 the person cannot be paid more than Rs 1, 00,000 as this is the loss he has suffered. In case the insurance company pays more than the financial loss suffered by the policyholder then there is an incentive to the policyholder to make claims and make profits. This will increase in the premium amounts and in case all the policyholders claim losses then the insurance would be un-viable. Thus to protect the interests of all the group of policyholders the insurance offered is only to the extent of the financial loss suffered by the policyholder. Insurance is therefore only a compensation of a financial loss.

Example 2:

In case a person has a car worth Rs 5, 00,000 and he insures the car for Rs 10, 00,000 (over insurance). In the event of a loss of Rs 1,00,000 during the term of the insurance the person cannot be compensated more than the amount of loss i.e. Rs 1,00,000 in this case. In case the policyholder is paid double the amount lost because he has insured for double the value, then he would make a profit. Profit would act as an inducement for the person to go for over-insurance to a large extent. This would mean that the whole group of policyholders pays for the profits made by one policyholder. More the number of policyholders who make such profits the more un-viable the insurance would become. Hence in insurance it is an established principle that even in case of over-insurance the policyholder would not be paid more than the loss suffered by him.

Example 3

In case a person has a car worth Rs 5, 00,000 and he insures the car for Rs 2, 50,000 (under-insurance). In the event of a loss of

24

Marketing Research about Competition in Insurance Industry & Appointment of FCs

Rs 1, 00,000 during the term of the insurance, the person would be compensated an amount of Rs 50,000 only. Whenever a person buys a car he is on risk. Any event like a theft, fire, riot, and earthquake can happen and destroy the car or cause a financial loss to him. In case he is not insured then he has to bear the loss himself. The maximum amount of such loss that can occur to him is the value of the car, which in this case happens to be Rs 5, 00,000. When a person buys the insurance, he actually transfers the risk, which he possesses, to the insurance company. Once insurance is granted to him the insurance company would pay in the event of the loss. As seen above the maximum amount of risk the person possesses is the value of the car. In case he insures for less than the value, what the person actually does is that he transfers a portion of the risk to the insurance company. In the given example the person has chosen to transfer half the risk to the insurance company. Thus in the event of the loss the person would be compensated only half the amount of loss. The reason being he chose to insure only half of the risk to the insurance company.

Subject matter of insurance:

When a person insurance his car the subject of the insurance is the car. What the insurance company guarantees is that in the event of a financial loss due arising due to an insured event then the company would compensate to the extent of the loss subject to the condition that the person has adequately insured the car. In Life insurance what is the subject matter? Or what is covered in life insurance. Surely it cannot be death because death cannot be compensated. It cannot be life either, as life too cannot be compensated. Life insurance aims to compensate the Income Earning Capacity of the person. In this session we are only talking of pure insurance or Term Assurance and not of any savings, investment or retirement plan.

Events covered in life insurance

In Life Insurance we cover the Income Earning Capacity. The loss of the Income Earning Capacity can be lost on the happening of the following events. 1. Death of the life assured 2. Sickness of the life assured (critical illness)

25

Marketing Research about Competition in Insurance Industry & Appointment of FCs

3. Accident of the life assured (death or permanent disability due to accident) 4. Retirement of the life assured Death of the life assured can destroy the income earning capacity of the individual. When a person takes a life insurance (pure insurance) with the sum assured payable on death he protects his family from the loss of income earning capacity due to death. A Life Insurance company does not pay money to the family because the life assured has died, but because the family has lost the income earning capacity. Death itself is not covered. The loss of income earning capacity due to death is covered in life insurance. It is often felt that life insurance means only death insurance. This is not true. Life insurance is insurance against the loss of the income earning capacity of the person. Sickness (critical illness only) can affect an income earning capacity of an individual. Life insurance offers protection for the loss of income earning capacity due to a sickness. Since minor ailments do not permanently destroy the income earning capacity of an individual the minor ailments are not covered in life insurance. Insurance against critical illnesses pay not because the person has contracted a critical illness, but because the person has lost his income earning capacity due to the critical illness. Similar is the case with accident cover. All accidents are not covered only those accidents, which result in death or permanent disability of the life assured, are covered in life insurance. The payment is not made because the person has met with an accident, but the payment is made because a person has lost the income earning capacity due to an accident. Retirement on the other hand is a certain event. A certain event cannot be insured at all. The only alternative left for the person is to save for retirement. All the lives assured would definitely retire hence insurance cannot be offered for retirement. Income earning capacity is affected on retirement. The retirement plans are therefore savings plans, which help a person, save for the retirement. It is important that we understand some of the terms frequently used in Insurance. The following gives a brief description of what we mean by risk, peril and a hazard.

Risk

It is a possibility of a loss. The loss may occur or may not occur if there is a possibility of a financial loss we can say that a risk exists. When a person has an income there is a risk of the loss

26

Marketing Research about Competition in Insurance Industry & Appointment of FCs

of the income. Similarly in case a person owns a car there is a risk that the car may be destroyed or damaged by fire, riots, strike, lightening etc.

Peril

It is the cause of the loss. The income earning capacity may be destroyed by death. Death in this case is the peril. Similarly fire, theft, earthquake are perils in car insurance.

Hazard

This is the condition that creates or increases the chance of the loss. An existing sickness is a condition that may cause death of the life assured at a future date. The existing sickness would be a hazard in life insurance. Risk is not avoidable. In case a person has income then there is a risk of loss of that income. The person has the choice to deal with the risk in the following manner: 1. Avoidance 2. Reduction 3. Retention 4. Transfer 5. Sharing Insurance is a means of sharing of the risk. All the policyholders agree to share the losses suffered by a few of the unfortunate policyholders. Since who is going to suffer the loss is not known all the policyholders are protected in case they are the victims of the insured event. All the risks cannot be insured. Only the risks, which satisfy the following criteria, can be insured. There has to be a large numbers of exposure units for the risk to be insured The loss occurred due to the risk should be definite and measurable The loss must be fortuitous The loss must not be catastrophic The losses due to the risk should be on suffered by the group of policyholders on random The risk cover should be economically viable The following are the limitation of insurance All risks cannot be insured There must be insurable interest

27

Marketing Research about Competition in Insurance Industry & Appointment of FCs

Insurance is limited to the financial value There must be large number of similar risks It must be possible to calculate the risk of loss Losses should not be catastrophic Losses must not be too small Losses must be reasonably unexpected Losses must be accidental It must be consistent with public policy

The following are the differences between life insurance and non-life insurance Risk (possibility of a loss) is certain in life insurance. Every person who is insured is likely to die, and death would completely destroy the income earning capacity. In non-life insurance the risk is uncertain and the insured event may or may not result in the loss to the policyholder. Life insurance is a long term contract while non-life insurance contracts are one year contracts. Difficulty in determining value of human life in life insurance. In non-life insurance the value can be determined with much ease. Life insurance is not a strict contract of indemnity. Non-Life insurance contracts are strict indemnity contracts.

28

Marketing Research about Competition in Insurance Industry & Appointment of FCs

WHY INSURANCE

Life Insurance has come a long way from the earlier days when it was originally conceived as a risk covering medium for short periods of time, covering temporary risk situations, such as sea voyages. As life insurance became more established, it was realized what a useful tool it was for a number of situations, including -

a) Temporary needs / threats:

The original purpose of life insurance remains an important element, namely providing for replacement of income on death etc.

b) Regular Savings:

Providing for one's family and oneself, as a medium to long term exercise (through a series of regular payment of premiums). This has become more relevant in recent times as people seek financial independence for their family.

c) Investment:

Put simply, the building up of savings while safeguarding it from the ravages of inflation. Unlike regular saving products, investment products are traditionally lump sum investments, where the individual makes a one off payment.

d) Retirement:

Provision especially can buy periodical for later years becomes increasingly necessary, in a changing cultural and social environment. One a suitable insurance policy, which will provide payments in one's old age.

An example to understand the need for insurance:

Mr. Atul is 45 and self-employed. His wife Nandini, who is a housewife, looks after their two children aged 3 and 7 years. They stay in a rented accommodation, where the rent is 15,000 rupees per month. Mr. Atul has taken up a loan of Rs. 2 lakh. His monthly earnings on average are 40,000 rupees. Mr. Atul passes away in an unfortunate road accident. What are some of the financial implications of his death on his family?

29

Marketing Research about Competition in Insurance Industry & Appointment of FCs

There may be several financial implications on his family. Some of these are: a) The monthly income, previously provided by Mr. Atul would stop. b) His wife and children may have to seek financial assistance from other relatives. c) His wife may not have enough money to pay back the loan of Rs. 2 lakhs. d) The family may have to move into a cheaper accommodation. e) His widow may have to take up work to earn money. f) The education of his children may suffer. This simple example illustrates the impact premature death can have on a family, where the main earner has no life cover. Had Mr. Atul taken life cover, his family would not have faced such hardships in the event of his unfortunate death. A simple life insurance policy could have provided Mr. Atul's family with a lump sum that could have been invested to provide an income equal to all or part of his income. In simple words, insurance protects against untimely losses. Insurance has been found useful in the lives of persons both in the short term and long term. Short term needs like sudden medical costs and long term needs like marriage expenses etc can be met with using life insurance.

Life Insurance Products

To understand the difference between life insurance products and insurance the analogy of medical science works well. The following points can be made while explaining the concepts of products and insurance. The difference between an agent and a consultant can be brought about by an analogy of a chemist and a doctor. A chemist is interested in selling medicines but not qualified to advise. He knows the medicines but is not good at diagnosis and prescription. A doctor on the other hand is a person qualified to advise and prescribe medicines. The doctor is not interested in selling medicines but is more interested in curing the client. There is a difference in the training of the chemist and the doctor. A chemist studies chemistry and then studies the

30

Marketing Research about Competition in Insurance Industry & Appointment of FCs

composition of the medicines and knows the manufactures of the medicines. He has to ensure that he gives the right medicines, which is prescribed by the doctor. On the other hand the doctor studies the human body and also studies the diseases. He has to understand the symptoms and then studies the effect of the medicines on the symptoms. He also knows the medicine and the compositions and is qualified to advice. When you are sick you need to take medicines. However taking any medicine would not work. What is important is that you consume the medicine designed to cure the ailment you are suffering from. The medicines are also to be consumed taking into account the body constitutions. Hence different people have to take different medicines as per their body constitution. There are certain limitations in medicines. One cannot consume medicines for the rest of ones life. One medicine cannot cure all the diseases. Medicines can be administered in more then one methods. Medicines can be made attractive by sugar coatings but the sugar coatings do not improve the medicine but only increase the price of the medicine. Products of life insurance are like medicine. Taking one policy is just not enough. It is important that the policy satisfies a need of the client. Life Insurance products are designed to satisfy a particular need of the client. When the product is sold as per the need of the client the product will be effective to satisfy the need of the client. There is no one product that satisfies all the need of the client. What a consultant needs to do is to make a combination of products so that he can satisfy the need of the client. Besides the financial circumstances of the client may dictate the insurance plans that the client needs to take. A consultant should note the financial condition of the client and suggest a plan as per the need of the client. The insurance needs of the clients keep on changing over a period of time and the consultant should help the client review his insurance needs periodically. Insurance is not a one-time affair. The consultant should build a relationship with the client and periodically help him review his insurance and suggest policies best suited to the needs of the client. One insurance policy cannot satisfy all the insurance needs of the client. A combination of the insurance policies can offer the insurance that a client needs. Consultants should suggest the best combination for the clients after analyzing the needs of the client. Simply suggesting a combination of the plans without analyzing the needs of the client is not correct and not in the interest of the client or the consultant.

31

Marketing Research about Competition in Insurance Industry & Appointment of FCs

Additional features in an insurance product make the insurance product look attractive; however the features may be immaterial to the satisfaction of the clients needs. The client also has to pay a price for the additional feature as no feature in any insurance comes free. The consultant should bring this to the notice of the client in case the client is insisting on some additional feature. The role of a consultant should be distinguished from the role of an agent. An agent is like the chemist. He is more interested in selling the Companies products than providing insurance solutions to the clients. Since he does not have a good understanding of the clients needs he does not analyze the needs of the client but simply offers the insurance products. On the other hand the consultant is more interested in providing an insurance solution to the client. He analyses the clients needs and then offers a solution to the client. A consultant has a wider role to play than an agent. An agent is more trained in the products and its features. He is also aware of the procedures of the Insurance Company he represents. On the other hand the consultant can understand a clients needs and also understands the consequences a client may face in case he does not plan for the future. He can make solutions for the client and can help the client to plan for the future. A consultant is more professional than an agent. Life Insurance products are not solutions in it. In fact life insurance products are a means to an insurance solution. When a person buys life insurance products as per his needs he insures his future. Insurance should be purchased as per individual needs and the insurance solutions of two or more individuals may not be the same. Today there are many insurance products available in the market. Each company has its set of products that it offers to the customers. This makes it difficult to keep track of all the products all the time. A better way to understand them is by way of classification. All insurance products can be classified in 4 basic categories.

Protection

Investment

Pension

32

Savings

Marketing Research about Competition in Insurance Industry & Appointment of FCs

This classification is based on the needs of the customers. Accordingly each of these categories has an end need to be satisfied and all the products coming under that category aim to fulfil that need e.g. Products coming under Investment category aim to provide long term real growth over the period. Thus understanding these categories will not only help us to understand various products but also help us to position our products strongly in a competitive market. Let us take a look at the distinctive features of each category:

Protection type of products: A typical protection type

of product aims at protecting income-earning capacity of the customers on happening of uncertain events mentioned above during the term of product. These are the pure risk products having no savings element. Naturally, these products dont have any maturity benefits. High-risk cover at low costs is the unique feature of this type that makes this category most attractive for the prospects who want high insurance cover without spending much for it. Usually offered for a definite term, mainly the Term Assurances come under this type. Various riders offered by different companies are also a part of protection category. The claim is paid only if the stipulated event happens otherwise there are no maturity values at the end of the term. There are some variations in protection products with refund of premiums, where some part of the premium has a savings component.

6. Investment type of products: In investment type of products, the focus is on maximizing returns for the customer over a period time. In a way, it is opposite to Protection type where the focus is maximizing the risk cover. Here the risk cover is very low. The objective is to put maximum in investments. The underlying principle is to commit money for a certain period of time and get the benefits of real long-term growth. The products are usually single premium policies where the entire premium is collected in advance. Surrenders are discouraged and there is a commitment for certain minimum no of years. In death during the term, value of the investments is returned. 7. Pension products : Along with the risk of an untimely death or disability, we also have a risk of living too long outliving our source of income. In other words, one needs to ensure that he gets a decent income even after his retirement and continues to get it as long as he lives! This is

33

Marketing Research about Competition in Insurance Industry & Appointment of FCs

where we have pension products addressing the need for a comfortable retirement. One can opt for an immediate pension or for pension at a future date (also called as deferred pension). There is a range of options that one can have when selecting a pension plan. There is a great amount of flexibility when it comes to selecting a pension product. The important point to be noted is that Pensions is a part of ones present income that he reserves for future consumption. Every year that income is accumulated and invested. The lump sum accumulation then is used for purchasing pension on the vesting date. 8. Savings type products: People in India like to save. Our savings rate has been well above 20% of our GDP for last few years. We save for events like childrens marriage, education etc. Savings types of products aim to strike a good balance between risk cover as well as returns. It acts as a protection on savings. Sum assured is usually the targeted savings that one looks for. He gets that amount at the end of the term along with bonuses if it is a participating policy. On the protection side if any unfortunate event happens during the term, the sum assured (in other words the targeted savings) is still paid. So it encourages a person to save for an event at the same time ensures that his savings are protected. This is the unique advantage of savings through life insurance that no other savings product offers. We find very popular products like Endowment Assurance; Money Back plans in this category. As stated earlier all the products come under these 4 broad categories. To understand a product, it is essential to find out the category of that product based on its features. Needless to say that it will not be possible to compare one category product to another. Each category is unique and caters to particular needs of the customer. The best approach is to find out what customer needs and then suggest a solution accordingly. The products launched by HDFC Standard Life can be classified as follows

Term Assurance and Loan Cover Term Assurance

Single Premium Whole of Life Insurance Endowment Assurance Money back Plans Childrens Plan

34

Personal Pension Plan

Marketing Research about Competition in Insurance Industry & Appointment of FCs

Protection Products Term Assurance and Loan Cover Term Assurance Plan Investment Product Single Premium Whole of Life Insurance Plan Pension Product Personal Pension Plan Savings Product Endowment Assurance, Money Back Plan and Childrens Plan

1. ROI RO I i s more i n Mutual funds, if c ustome r de al s prope rl y w i th the e qui ty, and i nve st i n good funds RO I is not fi xe d but e qui val e nt i n al l pl ans and thi s i s approx fi gure s, no one c an assure for re turns.

Comparasion o

AS per the survey Conducted for the People who are interested in Mutual Funds or Unit Linked Insurance Plans. Most of the Customer said that they will prefer for the Unit Linked insurance Plans as they are provided with Risk Cover also and even they are having the same facilities as per the mutual funds, and in long runs they are successful. As ULIP are the plans by the insurance companies and they invest the funds in AAA rated companies only, And they provide some riders also which are very beneficial to the customers.

Now the Survey was conducted for 100 people where the Results Are

o 62 percent people said that they want to invest in Unit Linked Policies

35

8000000 7000000 6000000

Marketing Research about Competition in Insurance Industry & Appointment of FCs

o 27 percent people said that they want to invest in Mutual Funds o 8 percent people said they dont want to invest in private companies they just want to go with LIC traditional Plans as they dont want to bear risk. o 3 percent people said they want to invest in both the companies as they want to invest small amounts in all companies.

S Even if y

Market Factoid 1. The growth options of ULIP have recorded annualized returns of over 20 per cent. 2. Various charges amounting to approximately 25 per cent in the initial years in all the schemes. 3. Most companies normally allow customers to switch, a fixed number of times annually from one fund to other fund. Later, they charge approximately Rs.100 per switch.

36

Rs3,00,000

Marketing Research about Competition in Insurance Industry & Appointment of FCs

4. Private insurance companies because of ULIPs today.

50

per

cent

sales

up

5. Individuals availing tax exemption under section 88 of Income Tax Act. 6. New Schemes coming into the market, which covers life insurance and accident insurance.

37

Marketing Research about Competition in Insurance Industry & Appointment of FCs

SURVEY REPORT FOR THE CUSTOMERS PERCEPTION FOR THEIR AWARENESS OF INSURANCE PRODUCTS (ULIP) AND MUTUAL FUNDS AND THE BUYING PREFERENCE.

As per the Questionnaire, I conducted a survey of 100 People and asked about their awareness of private insurance companies and the companies they know. So the form consisted of 6 companies option and each customer gave different views, now as per the survey reports.. o o o o o o o ICICI Prudential 20% Birla Sun Life 15% HDFC Standard Life 15% Bajaj Allianz Life 13% Tata Aig Life 10% Aviva Life 7% Max New York Life 6% o o o o o o o ING Vysya 4% SBI Life 4% Metlife 2% Om Kotak 2% Royal Sundaram 1% AMP Sanmar 1% SAHARA Life 0%

People Aware about the Companies as per the c

38

Marketing Research about Competition in Insurance Industry & Appointment of FCs

Out of Hundred People people are as Follows

the

Profession

of

the

Income of People According to the Survey

15 7

Status of insurance Cover according to the Survey

for

the

Persons

40

39

Marketing Research about Competition in Insurance Industry & Appointment of FCs

GLOBAL SCENARIO

WORLD LIFE AND NON LIFE INSURANCE PREMIUMS

Year 1994 1995

W o r ld L if e a n d N o n L if e In s u r a n c e P r e m iu m s

Nonlife Life Total 846,600 906,781 909,100 896,873 891,352 912,749 926,503 969,945 1,098,412

0

3 ,0 0 0 ,0 0 0

1,121,186 1,236,627 1,196,736 1,231,798 1,275,053 1,424,203 1,518,401 1,445,776 1,534,061

N o n life L ife T o ta l

1,967,786 2,143,408 2,105,836 2,128,671 2,166,405 2,336,952 2,444,904 2,415,721 2,632,473 2,940,671

2 1996,5 0 0 ,0 0 0

1997,0 0 0 ,0 0 0 2

U S $1 ,5 0 0 ,0 0 0

1998 1999

1 2000,0 0 0 ,0 0 0

2001 2002 2003

5 0 0 ,0 0 0

1 9 9 1 9 91,268,157 9 1 9 9 9 0 0 2 01,672,514 4 19 919 91 9 8 2 0 020 020 03 5 6 7 1 Y e a rs

40

Marketing Research about Competition in Insurance Industry & Appointment of FCs

41

Marketing Research about Competition in Insurance Industry & Appointment of FCs

The basic human trait is to be averse to the idea of taking risks. There is always an urge to minimise the risks and take protection against possible failure. The risk includes fire, death, accidents, etc. Any risk may be insured against at a premium commensurate with the risk involved. Thus collective bearing of risk is insurance. Insurance, whether life or non-life, provides people with a reasonable degree of security and assurance that they will be protected in the event of a calamity or failure of any sort. Indian insurance sector is witnessing exciting challenges, forcing companies to continuously innovate. Companies are under taking initiatives aimed at business process re-engineering, enterprise resource planning, customer relationship, breakdown of traditional organisational hierarchies besides introducing innovative, customer oriented insurance products. Service is becoming the source of gaining and retaining corporate leadership in the insurance business. Times have changed a lot since Triton insurance company has, was the first general insurance company to be established in India in 1850. The liberalised business environment led to competition in insurance sector also, which has helped ensure quality service to the customers besides spreading the market share.

42

Marketing Research about Competition in Insurance Industry & Appointment of FCs

INSURANCE MARKET IN INDIA By any yardstick, India, with about 300 million middle class households, presents a huge untapped potential for players in the insurance industry. Saturation of markets in many developed economies has made the Indian market even more attractive for global insurance majors. (Table 1 in appendix reflects the low percentage and per capita penetration of insurance in India compared to other developed and developing countries.) 7 With the per capita income in India expected to grow at over 6% for the next 10 years and with improvement in awareness levels, the demand for insurance is expected to grow at an attractive rate in India. An independent consulting company, The Monitor Group has estimated that the life insurance market will grow from Rs.218 billion in 1998 to Rs.1003 billion by 2008 (a compounded annual growth of 16.5%). Winds of Change Reforms have marked the entry of many of the global insurance majors into the Indian market in the form of joint ventures with Indian companies. Some of the key names are AIG, New York Life, Allianz, Prudential, Standard Life, Sun Life Canada and Old Mutual. The entry of new players has rejuvenated the erstwhile monopoly player LIC, which has responded to the competition in an admirable fashion by launching new products and improving service standards. The following are the key winds of change brought about by privatisation. Market Expansion: There has been an overall expansion in the market. This has been possible due to improved awareness levels thanks to the large number of advertising campaigns launched by all the players. The scope for expansion is still unlimited as virtually all the players are concentrating on large cities and towns except by LIC to an extent there was no significant attempt to tap the rural markets. New Product Offerings: There has been a plethora of new and innovative products offered by the new players, mainly from the stable of their international partners. Customers have tremendous choice from a large variety of products from pure term

43

Marketing Research about Competition in Insurance Industry & Appointment of FCs

(risk) insurance to unit-linked investment products. Customers are offered unbundled products with a variety of benefits as riders from which they can choose. More customers are buying products and services based on their true needs and not just traditional money-back policies, which is not considered very appropriate for longterm protection and savings. Customer Service: Not unexpectedly, this was one area that witnessed the most significant change with the entry of new players. There is an attempt to bring in international best practices in service and operational efficiency through use of latest Technologies. Advice and need based selling is emerging through much better trained sales force and advisors. There is improvement in response and turnaround times in specific areas such as delivery of first policy receipt, policy document, premium notice, final maturity payment, settlement of claims etc. However, there is a long way to go and various customer surveys indicate that the standards are still below customer expectation levels. Channels of Distribution: Till three years back, the only mode of distribution of life insurance products was through Agents. While agents continue to be the predominant distribution channel, today a number of innovative alternative channels are being offered to consumers. Some of them are banc assurance, brokers, the internet and direct marketing. Though it is too early to predict, the wide spread of bank branch network in India could lead to banc assurance emerging as a significant distribution mechanism. Though the market expansion has taken place, channel of distribution has increased and customer service is becoming the priority but still much has to be done as services are intangible, produced and consumed simultaneously and often less standardized than goods. These unique characteristics present special challenges and strategic marketing opportunities to the service marketers. The real competition between the service marketers was set after globalisation of the Indian economy the service marketing organisation has to adopt professional Management and its marketers have to imbibe the qualities of professionalism in order to meet the expectations of the customers.

44

Marketing Research about Competition in Insurance Industry & Appointment of FCs

Customers are now looking at insurance as complete financial solutions offering stable returns coupled with total protection. Companies will need to constantly innovate in terms of product development to meet ever changing consumer needs. Understanding the customer better will enable insurance companies to design appropriate products, determine price correctly and increase profitability. In the present scenario, a key differentiated would be professional customer service in terms of quality of advice on enhancing customer convenience. According to one of the survey published in Indian Journal of marketing, 44 percent Respondents buy insurance to avoid tax; their major source of awareness is from friends. From the study it is observed that majority of the respondents are willing to take new policies in new companies. This suggests that most respondents are not happy with their existing company. Hence in this project study, an attempt has been made to understand the marketing strategies that are prevalent now and suggestions have been made to improve those strategies. Various factors that affect the marketing of insurance services have also been touched.

45

Marketing Research about Competition in Insurance Industry & Appointment of FCs

EMERGENCE OF INSURANCE

Life insurance started in India about 200 years ago. The growth of the managing agencies system has been ascribed to the life insurance companies set up by the free merchants and the agency houses. Like insurance companies started in Calcutta and catered largely to the civil and military officers and European merchants. The Bombay Mutual Insurance society was started on immediate basis in the 1870s. The Oriental government security life Insurance company grew into the largest in Life Insurance Company. It was headed for many years by Sir Purshottam Das Thakur Das, who held director shit in over 60 companies, and was the President of the East India Cotton Exchange for many decades. Bharat Insurance was started in Lahore and was controlled by Lala Harkishan Lal before it was taken over by the Dalmias in 1933. Lakshmi insurance company was all so Lahore - based and was started by Lala Lajpat Rai. The Hindustan co-operative was pioneered by Sir NR Sircar in Calcutta. Another large Calcutta - based company was the National Insurance Company which was eventually taken over by a JK Singhania. The Birlas started new Asiatic and Ruby. Till 1939, there was no restriction on life Insurance company investments and the large business house is utilised their funds for the expansion and diversification of their trading and industrial interest. The Tatas had founded the New India Assurance Company in 1919. The garment of India decided to nationalise life insurance and the life Insurance Corporation (LIC) was set up in 1956. The second five - EA a plan had just started and the nationalisation of the Imperial Bank of India and life Insurance Corporation provided reforms for the large capital investment for the second plan investments. About 75 percent of the life Insurance Corporation (LIC) funds are invested in the public sector. A sizeable amount is also invested in foreign countries, in government securities, debentures and share has and loans to public bodies. Since 1955, with a marked fall in mortality, there has been a persistent demand for a reduction in the

46

Marketing Research about Competition in Insurance Industry & Appointment of FCs

premium rates. The Morarka committee's recommendations resulted in a slight Reduction in the premium rates for without profit policies and some increase in bonus; the expense ratio remains very high and the rates for policies with profits are largely unchanged. The service has deteriorated; now there was a move to spread the corporation into a number of zonal companies. The Insurance regulatory Act provided for 26 percent foreign participation in life and general insurance area has now. A number of leading foreign insurance companies, both life and general or setting up joint ventures with some of the leading Indian houses to enter the insurance field which holds good growth potential. The life Insurance Corporation is the biggest investor in the country. Its total investment in 1978 - 79 amounted to Rs.7, 386.2 million and has grown several fold in the 1980 s and 1990 s. The General Insurance Corporation (GIC) was formed after the nationalisation or General Insurance in 1971. The activities other than allegiance Corporation and its subsidiaries cover all kinds of insurance (except of human life). It has integrated Annan's seven private companies into just four subsidiaries, viz., National Insurance company, Calcutta's; New India Assurance, Mumbai; Oriental fire and General Insurance, New Delhi; and United India Insurance, Chennai. In January 1979, the Corporation announced a premium relief of over rupees 280 million, which resulted from a reduction of 20 percent in the premium rates for fire insurance.

OPENING OF INSURANCE SECTOR

In line with the economic reforms that were ushered in India in early nineties, the Government set up a Committee on Reforms (popularly called the Malhotra Committee) in April 1993 to suggest reforms in the insurance sector. The Committee recommended throwing open the sector to private players to usher in competition and bring more choice to the consumer. The objective was to improve the penetration of insurance as a percentage of GDP, which remains low in India even compared to some developing countries in Asia.

47

Marketing Research about Competition in Insurance Industry & Appointment of FCs

Reforms were initiated with the passage of Insurance Regulatory and Development Authority (IRDA) Bill in 1999. IRDA was set up as an independent regulatory authority, which has put in place regulations in line with global norms. So far in the private sector, 12 life insurance companies and 9 general insurance companies have been registered.

Rationale for opening of insurance sector A thriving insurance sector is of vital importance to every modern economy. First because it encourages the savings habit, second because it provides a safety net to rural and urban enterprises and productive individuals. And perhaps most importantly it generates long-term investible funds for infrastructure building. The nature of the insurance business is such that the cash inflow of insurance companies is constant while the payout is deferred and contingency related. Malhotra Committee appointed by the government of India for conducting a study on insurance is bullish on insurance sector potential. The poor reach of insurance in the country and the sheer numbers make India a market with tremendous potential. Some important recommendations of this committee were: The private sector to be allowed to enter insurance business An Insurance regulatory Authority to be set up to regulate, promote and ensure orderly growth of the insurance industry in India. Foreign insurance companies to be permitted on a selective basis, they may should be required to float an Indian company for the purpose preferably in a joint venture with a Indian partners. the quality of agents recruited needs to be improve, the minimum level of business to be written by them to be reviewed, institutional channels like cooperative societies, NGOs need to be harnessed as distribution channel

48

Marketing Research about Competition in Insurance Industry & Appointment of FCs

Entry of private sector in insurance has been the hall mark of the emerging scenario. Consequent to establishing IRDA were a good number of companies being given licences to start insurance business in India. SWOT Analysis of Insurance Sector in India

The aim of liberalisation of this sector was to provide better Services to the customers, to provide innovativeness and need based products at reasonable premium rates and provide satisfactory returns. The figures of the basic parameters of the Industry's performance viz. insurance density and insurance penetration also are evident of the hither to existing low yield Indian market conditions. The figure of premium vis--vis the GDP of 2000 today at 0.54 percent for non-life insurance business and 1.39 percent for the life insurance business. The term "insurance density" reflects the insurance purchasing power. The premium per capita in India amounted to US $2.40 for non-life Insurance and US $ 6.10 for life insurance in 2000. According to 2000 - 01 figures, the per capita insurance premium in India was only $8 as compared to $4,800 in Japan, $1,000 in South Korea, $887 in Singapore, $823 in Hong Kong and $144 in Malaysia. India's share in total insurance premium worldwide was only 0.3 percent, though it was second most populous country in the world while Japan's share was 31 percent, EU 25 percent, South Africa 2.3 percent and Canada 1.7 percent. The total insurance premium in India is two percent of our GDP, which is far below the world average of 7.8 percent. India's Share in the world insurance market is only 0.39 percent as against 34.17 percent of US, 21.02 percent of and 8.4 percent of UK .

49

Marketing Research about Competition in Insurance Industry & Appointment of FCs

STRENGTHS high growth rate of insurance sector; government's dependence on this sector for long range low cost funds for infrastructure development; huge contribution towards foreign exchange reserves by Re insurance ; high level of employment generation; Very big middle class (consuming class).

WEAKNESSES low per capita insurance premium; low penetration /reach; society's perception for saving ends at gold or house; Low faith of people in foreign companies for depositing hard earned savings; huge paper work/ time lag in settling claims; Rampant corruption in nationalised insurers; Low literacy rate.

OPPORTUNITIES huge potential to be tapped ; with coming of foreign insurance companies, their innovative insurance products and marketing expertise will also flow ; use of IT as service provider .

50

Marketing Research about Competition in Insurance Industry & Appointment of FCs

THREATS Insurance (life) is a long term business and it is not feasible to predict the interest rates over long tenures; insurance is susceptible to vagaries of nature i.e. floods, earthquakes, etc which can make insurance companies bankrupt ; Wrong commitments / communication by insurance agents (on behalf of company) to the gullible consumers.

51

Marketing Research about Competition in Insurance Industry & Appointment of FCs

MARKETING MIX IN THE INSURANCE SERVICES

PRODUCT

life insurance is a contract for payment of a sum of money to the person assured (or failing him/ her, to the person entitled to receive the same) on the happening of the event insured against.' usually the insurance contract provides for the payment of an amount of on the date of maturity or at specified rates at periodic intervals or at unfortunate death if it occurs earlier. Obviously, there is a price to be paid for this benefit. Among other things, the contract also provides for the payment of premiums by the assured. life Insurance is universally acknowledged as a tool to eliminate risk, substitute certainly for uncertainty and ensure timely aid for the family in the unfortunate event of the death of the breadwinner. In other words, it is the civilised world's partial solution to the problems caused by death. In a nutshell, life Insurance helps in two ways: dealing with the premature death, which leads to dependent families to fend for themselves and old age without visible means of support.

Product benefits Superior to any other savings plan: Unlike any other savings plan, a life insurance policy affords full protection against risk of death of the policy holder; the insurance company makes available the full sum assured to the policyholders' near and dear ones. In comparison, any other savings plan would amount to only the total savings accumulated till date. If the death occurs prematurely, such savings can be much less than the sum assured which means that the potential financial loss to the family is sizeable.

52

Marketing Research about Competition in Insurance Industry & Appointment of FCs

Encourages and forces thrift: A savings deposit can easily be with drawn. The payment of life insurance premiums, however, is conceded sacrosanct and is viewed with the same seriousness as the payment of interest on a mortgage. Thus, a life insurance policy in effect brings about compulsory savings.

Easy settlement and protection against creditors: A life insurance policy is the only financial instrument the proceeds of which can be protected against the claims of the creditor of the assured by effecting a valid assignment of the policy.

Administering the legacy for beneficiaries: Speculative or unwise expenses can quickly cause the proceeds to be squandered. Several policies have foreseen this possibility and provide for payments over period of years or in a combination of instalments and lump sum amounts.

Ready marketability and suitability for quick borrowing: A life insurance policy can, after a certain time period be surrendered for a cash value. The policy is also acceptable as a security for a commercial loan, for example, a student loan. It is particularly advisable for housing loans when an acceptable LIC policy may also cause the lending institution to give loan at lower interest rates.

Disability benefits: Death is not the only hazard that is insured; many policies also include disability benefits. Typically, these provide for waiver of future premiums and payment of monthly instalments spread over a certain time period.

Accidental death benefits: Many policies can also provide for an extra sum to be paid, if death occurs as a result of accidents.

53

Marketing Research about Competition in Insurance Industry & Appointment of FCs

PRICING The three main factors used for determining the premium rates under a life insurance plan or mortality, expense and interest. Significant changes in any of these factors normally entail revision of premium rates. Mortality: the average rate of mortality is one of the main considerations

than deciding upon the pricing strategy. In a country like South Africa which is unfortunately the plagued by a host of diseases especially like AIDS, the threat to life is very important. The price of the instalments, its frequency and its premium charges are decided accordingly. Expenses: the cost of processing, the kind of infrastructure costs involved

and the payment made to the agents, re insurance companies as well as the registration etc are all incorporated into the costs of the installments and premium sum and forms the integral part of the pricing strategy. Interest: the interest rate is one of the major factors, which determines

people's willingness to invest in the insurance issues. If the interest rate provided by the banks or other financial instruments has is much greater than the perceived returns from the insurance premiums then the people would not be willing to put their funds in this sector. The financial climate in South Africa how ever, is such that it is favourable to the insurance sector. The interest rate in South Africa is not very high. In fact for the past few years it has fluctuated in the early teen and this, compared to the interest rate in the other countries is certainly relatively low. Hence, we can safely say that the market is conducive to the perusal of Insurance Services in our chosen destination.

54

Marketing Research about Competition in Insurance Industry & Appointment of FCs

DISTRIBUTION

Distribution is a key determinant of success for all insurance companies and the nationalised insurers currently have a large reach and presence. New entrant's cannot and do not expect to supplant or duplicate such a network. Building the distribution network is expensive and time-consuming. Yet, if insures are to take advantage of India's large population and reach a profitable mass of customers, new distribution avenues and alliances will be imperative. This is also true for the nationalised corporations, which must find fresh avenues to reach existing and new customers. Initially, insurance was seen as a complex product with a high advice and service component. Buyers prefer a face to face interaction and place a High premium on brand names and reliability. As products become simpler and awareness increases, they become off- the- shelf commodity products. Various intermediaries, not necessarily insurance companies, are selling insurance. In the UK, for example, retailer Marks and Spencer now sells insurance products. At this point, buyers look for low price. Brand loyalty could shift from insurer to seller. The financial services industries, worldwide, has successfully used remote distribution channels such as the telephone or the Internet to reach more customers, cut out intermediaries, bring down overheads and increase profitability. A well known example is the UK insurer Direct Line. Established in 1985, it relied on telephone sales and low pricing to become the UK's largest motor insurance operator within a decade.

55

Marketing Research about Competition in Insurance Industry & Appointment of FCs