Beruflich Dokumente

Kultur Dokumente

E-Audit Form 704

Hochgeladen von

askinfoOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

E-Audit Form 704

Hochgeladen von

askinfoCopyright:

Verfügbare Formate

e-Audit Form 704 from Tally.

ERP 9

The information contained in this document is current as of the date of publication and subject to change. Because Tally must respond to changing market conditions, it should not be interpreted to be a commitment on the part of Tally, and Tally cannot guarantee the accuracy of any information presented after the date of publication. The information provided herein is general, not according to individual circumstances, and is not intended to substitute for informed professional advice. This document is for informational purposes only. TALLY MAKES NO WARRANTIES, EXPRESS OR IMPLIED, IN THIS DOCUMENT AND SHALL NOT BE LIABLE FOR LOSS OR DAMAGE OF WHATEVER NATURE, ARISING OUT OF, OR IN CONNECTION WITH THE USE OF OR INABILITY TO USE THE CONTENT OF THIS PUBLICATION, AND/OR ANY CONDUCT UNDERTAKEN BY PLACING RELIANCE ON THE CONTENTS OF THIS PUBLICATION. Complying with all applicable copyright and other intellectual property laws is the responsibility of the user. All rights including copyrights, rights of translation, etc., are vested exclusively with TALLY SOLUTIONS PRIVATE LIMITED. No part of this document may be reproduced, translated, revised, stored in, or introduced into a retrieval system, or transmitted in any form, by any means (electronic, mechanical, photocopying, recording, or otherwise), or for any purpose, without the express written permission of Tally Solutions Pvt. Ltd. Tally may have patents, patent applications, trademarks, copyrights, or other intellectual property rights covering subject matter in this document. Except as expressly provided in any written licence agreement from Tally, the furnishing of this document does not give you any licence to these patents, trademarks, copyrights, or other intellectual property. 2011 Tally Solutions Pvt. Ltd. All rights reserved. Tally, Tally 9, Tally9, Tally.ERP, Tally.ERP 9, Shoper, Shoper 9, Shoper POS, Shoper HO, Shoper 9 POS, Shoper 9 HO, TallyDeveloper, Tally Developer, Tally.Developer 9, Tally.NET, Tally Development Environment, Tally Extender, Tally Integrator, Tally Integrated Network, Tally Service Partner, TallyAcademy & Power of Simplicity are either registered trademarks or trademarks of Tally Solutions Pvt. Ltd. in India and/or other countries. All other trademarks are properties of their respective owners.

Version: e-Audit Form 704 from Tally.ERP 9/2.0/January 2011

Contents

Contents

e-Audit Form 704 .......................................................................................................................... 1

1.1 Introduction ....................................................................................................................................... 1 1.2 e-Form 704 in Tally.ERP 9 ............................................................................................................... 2

1.2.1 Details Captured from Form 704 Dashboard of Tally.ERP 9 ................................................................... 2 1.2.2 Details Directly exported to e-Form 704 from Tally.ERP 9 ..................................................................... 2

1.3 Exceptions ......................................................................................................................................... 3 1.4 Generating Form 704 with Audit Details using Tally.ERP 9 ........................................................... 3 1.5 Part 1 ................................................................................................................................................. 4

1.5.1 Audit Report and Certification .................................................................................................................. 4 1.5.2 Form 704 ................................................................................................................................................... 9

1.6 Part 2 ............................................................................................................................................... 10

1.6.1 General Information about Dealers Business ........................................................................................ 10 1.6.2 Form 704 ................................................................................................................................................. 12

1.7 Schedule I ....................................................................................................................................... 12 1.8 Schedule II ...................................................................................................................................... 15 1.9 Schedule III ..................................................................................................................................... 19 1.10 Schedule IV ................................................................................................................................... 23 1.11 Schedule V .................................................................................................................................... 23 1.12 Schedule VI ................................................................................................................................... 23 1.13 Annexure A ................................................................................................................................... 25 1.14 Annexure B ................................................................................................................................... 26 1.15 Annexure C ................................................................................................................................... 27 1.16 Annexure D ................................................................................................................................... 27 1.17 Annexure E ................................................................................................................................... 28 1.18 Annexure F ................................................................................................................................... 28 1.19 Annexure G ................................................................................................................................... 29 1.20 Annexure H ................................................................................................................................... 29 1.21 Annexure I .................................................................................................................................... 30 1.22 Annexure J .................................................................................................................................... 30

1.22.1 1.22.2 1.22.3 1.22.4 1.22.5 1.22.6 Section 1 ................................................................................................................................................. 30 Section 2 ................................................................................................................................................. 31 Section 3 ................................................................................................................................................. 31 Section 4 ................................................................................................................................................. 31 Section 5 ................................................................................................................................................. 32 Section 6 ................................................................................................................................................. 32

1.23 Annexure K ................................................................................................................................... 33 1.24 E-VAT Export Procedure ............................................................................................................. 33 1.25 Conclusion .................................................................................................................................... 34 1.26 Contact Us ..................................................................................................................................... 34

e-Audit Form 704

Introduction

The Commercial Taxes Department of Maharashtra has introduced electronic filing of Audit Report in Form 704. The Form 704 has to be filed using the Excel Template file available for download from the Department website www.mahavat.gov.in. Download the template FORM704.xls to Tally.ERP 9 installed folder. The current period at Gateway of Tally and the financial year of data to be exported needs to be the same. Each time while exporting the data from Tally.ERP 9 to template file ensure that fresh template is placed in the export location to avoid over-writing of information. Every Registered dealer whose turnover is in excess of Rs. 40 lakhs in the previous financial year has to get the VAT details of the business audited from a practising Chartered Accountant or Cost Accountant. The auditor has to record the audit findings in Form 704 and sign the audit report. This Audit Report has to be uploaded in electronic format to the Department website through a valid Login ID and Password. The Department will allot Login ID and Password for accessing the Commercial Tax website and filing returns to the Registered Dealers having valid TIN and CST Registration number. The registered dealers need to file the audit report in electronic format if all the criteria as prescribed by the department are satisfied. The Auditor needs to conduct the audit on the books of accounts of every eligible dealer under section 61 of Maharashtra Value Added Tax Act, 2002 even if the same is done under any other Acts of the Statute as in force for the time being. For example, Tax Audit u/s 44B of Income Tax Act, 1961, Central Excise Act etc. Form 704 in Tally.ERP 9 The facility to enter the audit details and export the information to the revised template is available only for the users of Tally.ERP 9 Release 2.1 and above versions. The Stat.900 Version 132 available in the Download centre of www.tallysolutions.com website supports this enhanced functionality.

Enabling VAT in Tally.ERP 9

1.1 e-Form 704 in Tally.ERP 9

1.1.1 Details Captured from Form 704 Dashboard of Tally.ERP 9

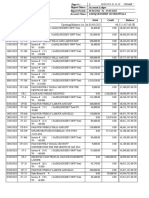

Worksheet of Form 704 Letter of Submission Part 1 Part 2 Sch I Sch II Sch III Sch VI Annexure_C Annexure_D Annexure_F Annexure_K Details Captured from Form 704 Dashboard Dealers Acceptance, VAT and CST amount with reasons for nonacceptance by the dealer Audit Report with Certification and Dealers Acceptance on Auditors Recommendation General & Business information of the Dealer As per Audit values of Form 231 As per Audit values of Form 232 As per Audit values of Form 233 As per Audit values of CST Form III (E) Details of TDS Certificates Received Details of TDS Certificates Issued Previous Year values entered for Financial Ratios Determination of Gross Turnover with Reconciliation

1.1.2 Details Directly exported to e-Form 704 from Tally.ERP 9

The following information pertaining to e-Form 704 can be captured in Tally.ERP 9: Worksheet of Form 704 Letter of Submission Sch I Sch II Sch III Sch VI Annexure_A Annexure_B Annexure_E Annexure_F Annexure_H Annexure_I Annexure_J_Sec 1 Annexure_J_Sec 2 Details Captured from Tally.ERP 9 Acceptance or non-acceptance of auditors recommendations by dealer for VAT and CST Details of Form 231 Details of Form 232 Details of Form 233 Details of CST Form III (E) VAT Payment Details CST Payment Details Computation of Purchases and set-off Values of current period for calculating Financial Ratios Report on Non-Receipt of Form H Report on Non-Receipt of Declaration Forms other than Form H Party-wise details of taxable sales Party-wise details of taxable purchases

Enabling VAT in Tally.ERP 9

Worksheet of Form 704 Annexure_J_Sec 3 Annexure_J_Sec 4

Details Captured from Tally.ERP 9 Customer-wise details of debit/credit notes Supplier-wise debit/credit notes details

1.2 Exceptions

The details of Schedule IV and V will not be captured as Form 234 and 235 are NOT provided in Tally.ERP 9. However, the user can enter the information in Sch IV and Sch V worksheets of Form 704 template file.

1.3 Generating Form 704 with Audit Details using Tally.ERP 9

Go to Gateway of Tally > Display > Statutory Reports > VAT Reports

Figure 1.1 VAT Reports menu

Click on Audit Forms to view the options for Audit Details and Form 704.

Figure 1.2 Audit Forms menu

Audit Details: Using this option, the auditor can record the audit related information. There are various fields provided in this menu. In these fields, the auditor can enter the information pertain-

Enabling VAT in Tally.ERP 9

ing to Audit of Dealer's VAT transactions along with general and business related information of the dealer in the required format. EForm 704: Using this option, the complete information of Return Forms and the audit details captured in Tally.ERP 9 can be exported to the Excel Template file - Form 704. In Tally.ERP 9 go to Audit Forms menu and click on the Audit Details option to view dashboard of Form 704. The Form 704 dashboard displays as shown:

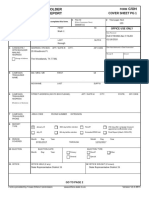

Figure 1.3 Form 704 Dashboard

In the Form 704 dashboard, the information as per the Auditors' requirement has to be entered in the respective menus. To move from one menu to another use Arrow (up and down) Keys.

1.4 Part 1

1.4.1 Audit Report and Certification

In Part I, the details related to verification, certification, computation of VAT and CST liability and the auditor's recommendation to the dealer need to be recorded. All these details can be provided in Tally.ERP 9 and when the same is exported, the information will be captured in the appropriate fields of template file - Form 704.

4

Enabling VAT in Tally.ERP 9

1. Audit Information The dates of various audit conducted with name of the auditor can be provided in Part 1 - 1(A-C) Audit Information in Form 704 dashboard of Tally.ERP 9.

Figure 1.4 Part I Audit Information

Some of the audit details required to be entered is given below:

The dates on which the Profit & Loss Account / Income & Expenditure Account, Balance Sheet etc. were audited Date on which Statutory Audit was conducted Name of the person/firm conducting audit

2. Return Information The Return related information can be provided in Part 1 - Table 1 Returns Information in Form 704 dashboard of Tally.ERP 9.

Figure 1.5 Part I Return Information

Some of the verifications done by the auditor are given below:

Periodicity of filing return whether Annual/monthly/quarterly/six-monthly Verification pertaining to maintenance of stock register, Returns being filed for the audit period, CST returns filed etc.

Enabling VAT in Tally.ERP 9

3. Certification Remarks The Auditor will certify various details and the same can be provided in Part 1 - Certification Remarks in Form 704 dashboard of Tally.ERP 9.

Figure 1.6 Part I Certification Remarks

Some of the certifications are given below:

Information and explanation provided by the dealer Maintenance of Books of accounts, registers, sales tax records etc. as per the MVAT Act and CST Act Gross turnover of sales and purchase determined for the tax period Adjustment entries made against sales and purchases with supporting documents Computation of tax and admissible set-off value Sales made against declaration forms Records of receipt and dispatch of goods Examination of bank statements and its reconciliation with books of accounts Visit made to dealer's principal place of business

Enabling VAT in Tally.ERP 9

4. Computation of Tax Liability under MVAT Act, 2002 The Auditor can enter the details pertaining VAT liability in Part 1 - Table 2 Computation of Tax Liability under MVAT Act, 2002 in Form 704 dashboard of Tally.ERP 9.

Figure 1.7 Part I Computation of Tax Liability under MVAT Act, 2002

Some of the information on computation of VAT liability is given below:

Amount of tax paid inclusive of interest as per Annexure A Tax credit computed on considering the TDS details as per Annexure C Refund amount adjusted against tax dues Interest computed u/s 30(2) and 30(4)

5. Computation of Tax Liability under CST Act, 1956 The Auditor can enter the details of CST liability in Part 1 - Table 3 Computation of Tax Liability under CST Act, 1956 in Form 704 dashboard of Tally.ERP 9.

Figure 1.8 Part I Computation of Tax Liability under CST Act, 1956

Some of the information on computation of CST liability is given below:

Amount of CST paid inclusive of interest as per Annexure B Interest computed u/s 9(2) read with Section 30(2) and 30(4) of MVAT Act

Enabling VAT in Tally.ERP 9

6. Classification of Additional Dues and Refunds The Auditor can enter the details pertaining VAT liability in Part 1 Table 5 Classification of Additional Dues and Refunds in Form 704 dashboard of Tally.ERP 9.

Figure 1.9 Part I Classification of Additional Dues and Refund

Some of the information fields on reasons for additional dues and refunds are given below:

Difference in taxable turnover Disallowance of Branch/consignment transfers, high seas sales, other non-admissible claims, inter-state sales or sales u/s 6(2) of CST Act. Additional tax liability due to absence of declarations and certificates Computation of tax at worng rates Excess claim of set-off or refund Total of interest and VAT/CST liability payable

7. Qualifications or Remarks The qualifications or remarks on the determination of tax liability given by the auditor can be provided in Part 1 Qualifications & Remarks for Tax Liability in Form 704 dashboard of Tally.ERP 9.

Figure 1.10 Part I Qualifications & Remarks for Tax Liability

Enabling VAT in Tally.ERP 9

8. Auditors Recommendations & Details The recommendations given by the auditor and the details of dealer can be provided in Part 1 Auditors Recommendations & Details in Form 704 Dashboard of Tally.ERP 9.

Figure 1.11 Part I Auditors Recommendations & Details

Some of the recommendations are given below: Payment of additional tax liability if any Excess refund claimed to be reversed Additional refund to be claimed Revised tax liability and closing balance of cumulative quantum benefits Interest liability u/s 30(2) and 30(4) Name, address details, membership number, e-mail ID and telephone number of auditor (chartered accountant / cost accountant) Date on which the auditor has signed the audit report Enclosures of audit reports with balance sheet, profit & loss account / income & expenditure account.

1.4.2 Form 704

In Form 704, the Financial Period is captured in DD/MM/YYYY format. The Mailing Name as entered in the Company Creation screen is displayed in the field The audit of M/s. The VAT TIN (Regular) and the Inter-State Sales Tax Number entered in F3: Statutory & Taxation features screen is captured in holder of Tax Payer Identification Number and under the Maharashtra Value Added Tax Act, 2002 (hereinafter referred to as "the MVAT Act") and Tax Payer Identification Number fields respectively.

Enabling VAT in Tally.ERP 9

1.5 Part 2

1.5.1 General Information about Dealers Business

1. Related Information under other Acts The registration details of the dealer like the R.C. number, E.C number, Eligibility certificate number, entitlement certificate number, EEC number, Import Export code, service tax registration number etc. obtained under various Acts can be provided in Part 2 1C Related Information under other Acts in Form 704 Dashboard of Tally.ERP 9.

Figure 1.12 Part II Registration Details

2. Business Related Information The dealers business details can be specified in Part 2 2(A-I) Business Related Information in Form 704 Dashboard of Tally.ERP 9. The dealer's business details like the type of dealer, constitution of business, description of business activity, commodities dealt with, address of place of business where the books of accounts are maintained, name of accounting software, change in accounting system/product line/method of valuation/accounting system, new business activity, and working capital etc. can be provided.

10

Enabling VAT in Tally.ERP 9

The Part II Business Details screen displays as shown:

Figure 1.13 Part II Business Details

3. Activity Code wise Information The Activity code, activity description, turnover, rate of tax and tax amount can be specified in Part 2 3 Activity Code wise Information in Form 704 Dashboard of Tally.ERP 9.

Figure 1.14 Part II Activity Code

11

Enabling VAT in Tally.ERP 9

1.5.2 Form 704

In Part II of Form 704, the Financial Period is captured in DD/MM/YYYY format. The Mailing Name as entered in the Company Creation screen is displayed in the field The audit of M/s. The VAT TIN (Regular) and the Inter-State Sales Tax Number entered in F3: Statutory & Taxation features screen is captured in holder of Tax Payer Identification Number and under the Maharashtra Value Added Tax Act, 2002 (hereinafter referred to as "the MVAT Act") and Tax Payer Identification Number fields respectively. In Particulars of the Bank Account(s) maintained during the period under Audit section, the details are captured as per the information provided in the bank ledger master. To capture correct details, bank ledger needs to be grouped under Bank Accounts and the account number, branch name and BSR code has to be entered in the A/c No., Branch Name and BSR Code fields of the ledger master.

1.6 Schedule I

In Schedule I, the details of Form 231 are captured. In the Applicable field displayed in Schedule I navigated from Part 3 Schedule I Form 231 of Form 704 dashboard of Tally.ERP 9, select Yes to export the details and validate the sheet Sch I of Form 704 template file else set it to No. Also the values in As per Audit columns needs to be entered in Schedule I screen.

Figure 1.15 Schedule I

12

Enabling VAT in Tally.ERP 9

Information Captured in Form 704 The TIN and tax period is captured in the first row of the Form 704. In Section 1 Computation of Net Turn-Over of Sales liable to tax, the values are captured as given below:

Box 1(a) - Gross Sales Turnover Box 1(c) - Net sales i.e. box 1(a) 1(b) Box 1(d) - Sales Return, Reduction in Sales due to change in price consideration and Discount Box 1(e) - Value of box 1(a) - [box (b) + box (d)] Box 1(f) - Consignment Branch Transfer within the state Box 1(g) - Inter-state Sales, Consignment/Branch Transfer Outward etc. Box 1(h) - Sale of Tax Free goods Box 1(i) - Sales of Exempted goods Box 1(j) - Labour Charges Box 1(k) - Other Allowable Deduction Box 1(l) - Value of box 1[(c) - (d+e+f+g+h+i+j+k)]

Note: The box 1(b) is currently left blank. In Section 2 Computation of tax payable under the MVAT Act is displayed based on percentage of tax rate. The values of Sales Tax Collected in Excess of Form 231 are captured in box 2(A). In Section 3 Computation of Purchases Eligible for Set-off, the values are captured as given below:

Box 3(a) - Gross Purchases including tax Box 3(c) - Value of box 3(a) - 3(b) Box 3(d) - Purchase Return, Reduction in purchases due to change in price consideration and Discount Box 3(e) - Direct Import Box 3(f) - High seas Purchases Box 3(g) - Inter-state Purchase Box 3(h) - Inter-state Branch Transfer Box 3(i) - Consignment/Branch Transfer within the state Box 3(j) - Purchases from Un-Registered Dealers Box 3(k) - Purchase not eligible for set-off Box 3(l) - Purchase of Exempt goods Box 3(m) - Purchase - Tax Free goods Box 3(n) - Other Allowable Deduction

13

Enabling VAT in Tally.ERP 9

Box 3(o) - Value of box [(c) - (d+e+f+g+h+i+j+k+l+m+n)]

Note: The box 3(b) is currently left blank. In Section 4 Tax rate wise break-up of Purchases from registered dealers eligible for setoff as per Box 3(o) above, the purchases are captured rate-wise and displayed. In Section 5 Computation of Set-off claimed for the period under audit, the values are captured as given below:

Box 5(a) - Local purchases made from registered dealers Box 5(b) - Value of Reduction in Set-Off u/r 53(1) and 53(2) Box 5(c) - Value of Reduction in Set-Off under any other sub-rule of 53 Box 5(d) - Amount of set-off available as per box 5[(a) - (c+b)]

In Section 6 Computation of tax payable there are three sections as given below: Section 6A Aggregate of credit available for the period covered under audit

Section 6B Sales tax payable and adjustment of CST / ET payable against available credit Section 6C Tax payable or Amount of Refund Available

In Section 6A Aggregate of credit available for the period covered under audit, the values are captured as given below: Box 6(A)(a) - Total Tax Eligible for set-off

Box 6(A)(b) - Tax Paid along with the Return Box 6(A)(c) - Excess Credit if any Box 6(A)(d) - Entry Tax Paid along with the Return Box 6(A)(e) - Refund Order if any with the Return Box 6(A)(f) - The details of any other credit available Box 6(A)(g) - Total available credit (a+b+c+d+e+f)

In Section 6B Sales tax payable and adjustment of CST / ET payable against available credit, the values are captured as given below:

Box 6(B)(a) - Sales Tax Payable Box 6(B)(b) - Interest Payable with the Return Box 6(B)(c) - Excess credit adjusted against amount payable Box 6(B)(d) - CST Adjustment with the Return Box 6(B)(e) - Entry Tax payabe on the entry of goods into Local Area Box 6(B)(f) - Excess tax credit carried forward to next subsequent period

14

Enabling VAT in Tally.ERP 9

Box 6(B)(g) - The value of box 2A is displayed here Box 6(B) - Total amount is captured

In Section 6C Tax payable or Amount of Refund Available, the values are captured as given below:

Box 6(C)(a) - Total Amount payable as per Box 6B(g) Box 6(C)(b) - Aggregate of Credit Available as per Box 6A(g) Box 6(C)(c) - Total Amount Payable (a-b) Box 6(C)(d) - Total Amount Refundable (b-a)

1.7 Schedule II

In the Applicable field displayed in Schedule II navigated from Part 3 Schedule II Form 232 of Form 704 dashboard of Tally.ERP 9, select Yes to export the details and validate the sheet Sch II of Form 704 template file else set it to No. Also the values in As per Audit columns needs to be entered in Schedule II screen.

Figure 1.16 Schedule II

15

Enabling VAT in Tally.ERP 9

Information captured in Form 704 The TIN and tax period is captured in the first row of the Form 704.

Box 1 - Gross Turnover liable to composition Box 3 - Balance turnover liable to composition

Note: Box 2 will be currently left blank. In Section 4 RETAILER, the values are captured as given below:

Box 4(a) - Gross Turnover Box 4(b) - Turnover of Sale of goods excluding composition scheme Box 4(c) - Sales Returns Box 4(d) - Net taxable sales

In Section 5 RESTAURANT, CLUB, CATERER ETC, the value of Sales displayed in box 7(a) of Form 232 is captured in Box 5(a). In Section 6 BAKER, the value of Sales displayed in box 8(a) of Form 232 is captured in Box 6(a). In Section 7 SECOND HAND MOTOR VEHICLES DEALER, the values of Form 232 are captured as given below:

Box 7(a) - Total Sales Turnover Box 7(b) - Deductions Box 7(c) - Net taxable sales

In Section 8 Total Turn-Over of Sales liable to tax under composition option [4(d) +5(a) +6(a) +7(c)], the value of box 4(d)+5(a)+6(a)+7(c) is displayed. In Section 9 Computation of Tax Payable under the MVAT Act, the break-up of tax payable amount based on percentages displayed in box 11 of Form 232 is captured here. In Section 10 Computation of Purchases Eligible for Set-off, the values of Form 232 are captured as given below:

Box 10(a) - Turnover of Purchase Box 10(c) - Balance purchase turnover (a) - (b) Box 10(d) - Break-up of Tax payable amount based on percentages Box 10(e) - Direct Import Box 10(f) - Imports (High Seas Purchase)

16

Enabling VAT in Tally.ERP 9

Box 10(g) - Inter-state Purchases Box 10(h) - Interstate Branch Transfer Box 10(i) - Consignment Branch Transfers within the State Box 10(j) - Purchases made from unregistered dealers within the State Box 10(k) - Purchases not eligible for set-off Box 10(l) - Purchase of exempt goods Box 10(m) - Purchase of Tax Free goods Box 10(n) - Value of other deduction Box 10(o) - Value of box [c]-[d+e+f+g+h+i+j+k+l+m+n]

Note: The values of Box 10(b) is currently left blank. In Section 11 Tax rate wise break-up of Purchases from registered dealers eligible for setoff as per Box 10(o) above The rate-wise break-up of taxable purchases are captured in the respective fields of this section. In Section 12 Computation of set-off claimed for the period under audit, the value of Form 232 will be captured as given below:

Box 12(a) - Taxable purchases made from registered dealers (as per box 11) Box 12(b) - Reduction in set-off u/r 53 (1) and 53 (2) Box 12(c) - Reduction in set-off under sub-rule 53 Box 12(d) - Total value is captured here.

Section 13 Computation of Tax Payable In Section 13(A) Aggregate of credit available for the period covered under this form 704, the value of Form 232 is captured as given below:

Box 13A(a) - Set-off value as per box 12(d) Box 13A(b) - Amount Already Paid Box 13A(c) - Excess credit adjusted against the payable value Box 13A(d) - Entry Tax Paid (Local) Box 13A(e) - Refund Order Box 13A(f) - Details of any other credits Box 13A(g) - Total value is captured (a+b+c+d+e+f)

17

Enabling VAT in Tally.ERP 9

In Section 13(B) Sales tax payable and adjustment of CST / ET payable against available credit, the value of Form 232 is captured as given below: Box 13B(a) - Sales tax payable as captured in box 9 Box 13B(b) - Excess credit adjusted against the payable value Box 13B(c) - CST Adjustment Box 13B(d) - Entry Tax Box 13B(e) - Excess Tax credit carried forward to subsequent period Box 13B(f) - Interest Payable Box 13B(g) - Total value is captured here. Note: Box 13B(e) is currently left blank.

In Section 13(C) Tax payable or Amount of Refund Available, the values are captured as given below:

Box 13C(a) - Amount payable as per box 13B(g) Box 13C(b) - Aggregate of credit available as per box 13A(g) Box 13C(c) - Total amount payable i.e., Value of box 13C(a) - 13C(b) Box 13C(d) - Total Amount refundable i.e., box 13C(b) - 13C(a)

18

Enabling VAT in Tally.ERP 9

1.8 Schedule III

In the Applicable field displayed in Schedule III navigated from Part 3 Schedule III Form 233 of Form 704 dashboard of Tally.ERP 9, select Yes to export the details and validate the sheet - Sch III of Form 704 template file else set it to No. Also the values in As per Audit columns needs to be entered in Schedule III screen.

Figure 1.17 Schedule III

The TIN and tax period is captured in the first row of the Form 704. PARTA: 1) Computation of Net Turnover of Sales liable to tax: In this section, the values are captured as given below:

Box 1(a) - Gross Turnover Box 1(c) - Value of box 1(a) - 1(b) Box 1(d) - Sales Returns including change in price consideration and discount Box 1(e) - Value of box 1(c) - 1(d) Box 1(f) - Turnover of sales under composition scheme captured in Part B Box 1(g) - Turnover of sales under composition scheme captured in Part C Box 1(h) - Turnover of sales under composition scheme captured in Part D Box 1(i) - Value of box 1(e) - [1(f)+(g)+(h)]

19

Enabling VAT in Tally.ERP 9

Box 1(j) - Tax Amount as displayed in box 6(h) Box 1(k) - Consignment/Branch Transfer within State Box 1(l) - Inter-state Sales, Exports and Consignment/Branch Transfer Outward Box 1(m) - Sale of Taxable goods fully exempted u/s 8 Box 1(n) - Non - taxable Labour Charges Box 1(o) - Amount paid by way of sub-contract Box 1(p) - Sale of tax free goods Box 1(q) - Labour Charges Box 1(r) - Other allowable deductions Box 1(s) - Tax liability - [(i) - (j+k+l+m+n+o+p+q+r)]

Note: Box 1(b) is currently left blank. PARTB: 2) Computation of Net Turnover of Sales liable to tax under Composition: In this section, the values are captured as given below:

Box 2B(a) - Turnover of Retail Sales Box 2B(b) - Turnover of Sales excluded from composition scheme Box 2B(c) - Allowable Deductions and Returns Box 2B(d) - Value of box 2B(a) - [2B(b)+2B(c)] Box 2C(a) - Turnover of Sales to Restaurant Box 2D(a) - Turnover of Sales to Bakers Box 2E(a) - Sales of Second Hand Vehicle Box 2E(b) - Allowable reduction on sale of second hand vehicles Box 2E(C) - Value of box 2E(a) - 2E(b) Box 2F- Value of box [2B(d)+2C(a)+ 2D(a)+2E(c)]

PARTC: 3) Computation of net turnover of sales relating to on-going works contracts liable to tax under section 96(1)(g) the MVAT Act, 2002: Reduction of set-off on corresponding purchases to be shown in Box 1(g) In this section, the values are captured as given below:

Box 3(a) - Turnover of on-going works contract under composition scheme Box 3(b) - Turnover of Exempt Sales Box 3(c) - Allowable reduction u/s 6 Box 3(d) - Allowable reduction u/s 6 (A) Box 3(e) - Value of [(a)]-[(b+c+d)]

20

Enabling VAT in Tally.ERP 9

PARTD: 4) Computation of net turnover of sales relating to on-going leasing contracts liable to tax under Section 96(1) (f) of the MVAT Act, 2002: In this section, the values are captured as given below:

Box 4(a) - Sale of on-going lease contract under composition scheme Box 4(b) - Turnover of Exempt Sales relating to On-going Leasing Contract Box 4(c) - Net taxable sales i.e., value of box 4(a) - 4(b)

5) Computation of tax payable under the MVAT Act: The rate-wise break-up of VAT liability is captured here. 5A) Sales Tax collected in Excess of the Amount Tax payable: The amount of sales tax payable is captured here. 6) Computation of Purchases Eligible for Set-off In this section, the values are captured as given below:

Box 6(a) - Purchase Turnover Box 6(c) - The value of box 6(a) - 6(b) is captured here. Box 6(d) - Purchase Returns, change in price consideration and discount Box 6(e) - Direct Import Box 6(f) - Import (High Seas Purchase) Box 6(g) - Inter-state Purchase Box 6(h) - Interstate Consignment Branch Transfer Box 6(i) - Consignment/Branch Transfer within state Box 6(j) - Purchase from URD within state Box 6(k) - Purchase not eligible for set-off Box 6(l) - Purchase of Exempt goods Box 6(m) - Purchase Tax Free goods Box 6(n) - Other Allowable Deductions Box 6(o) - Value of box (c) - (d+e+f+g+h+i+ j+k+l+m+n)

Note: Box 6(b) is currently left blank. 7) Tax rate wise break-up of Purchases from registered dealers eligible for set-off as per Box 6(o) above: The purchases are captured rate-wise.

21

Enabling VAT in Tally.ERP 9

8) Computation of set-off claim In this section, the values are captured as given below:

Box 8(a) - Purchase from registered dealers within the state as per box 7. Box 8(b) - Reduction in set-off u/r 53(1) and Reduction in set-off u/r 53(2). Box 8(c) - Reduction in set-off u/r 53. Box 8(d) - Value of box 8(a) - [8(b) + 8(c)]

9) Computation of Tax Payable 9A) Aggregate of credit available In this section, the values are captured as given below:

Box 9A(a) - Set-off value as per box 8(d) Box 9A(b) - Amount Paid Box 9A(c) - Excess credit adjusted against the payable value Box 9A(d) - Entry Tax Paid Box 9A(e) - Refund Box 9A(f) - Details of any other credits Box 9A(g) - Total value of tax credit (a+b+c+d+e+f)

9B) Sales tax payable and adjustment of CST / ET payable against available credit In this section, the values are captured as given below:

Box 9B(a) - Sales tax / VAT liability as per box 5. Box 9B(b) - Excess credit adjusted Box 9B(c) - CST Adjustment Box 9B(d) - Value of Entry Tax Payable Box 9A(e) - Excess tax credit carried forward to subsequent period Box 9B(f) - Sales tax payable as per box 5A Box 9B(g) - Interest Paid Box 9B(h) - Value of box 9B(a)+9B(b)+9B(c)+9B(d)+9B(e)+9B(f)

9C) Tax payable or Amount of Refund Available In this section, the values are captured as given below:

Box 9C(a) - Total Amount payable as per Box 9B(g) Box 9C(b) - Aggregate of Credit Available as per Box 9A(g) Box 9C(c) - Total Amount Payable, i.e. box 9C(a) - 9C(b) Box 9C(d) - Total Amount Refundable i.e., box 9C(b) - 9C(a)

22

Enabling VAT in Tally.ERP 9

1.9 Schedule IV

In Schedule IV, the details of Form 234 need to be entered. As the Form 234 is not provided in Tally.ERP 9, the user has to manually enter the information in Sch IV worksheet of Form 704 template file. In the Form 704 template file, select Yes in the Applicable field to validate the information entered if any, else set it to No.

1.10 Schedule V

In Schedule V, the details of Form 235 need to be entered. As the Form 235 is not provided in Tally.ERP 9, the user has to manually enter the information in Sch V worksheet of Form 704 template file. In the Form 704 template file, select Yes in the Applicable field to validate the information entered if any, else set it to No.

1.11 Schedule VI

In the Applicable field displayed in Schedule VI navigated from Part 3 Schedule VI Form III E of Form 704 dashboard of Tally.ERP 9, select Yes to export the details and validate the sheet Sch VI of Form 704 template file else set it to No. Also the values in As per Audit columns needs to be entered in Schedule VI screen.

Figure 1.18 Schedule VI

The TIN and tax period is captured in the first row of the Form 704.

23

Enabling VAT in Tally.ERP 9

1. Computation of tax liability under CST Act: In this section, the values are captured as given below:

Box 1 - Gross sales turnover Box 1(a) - Turnover of Sales within State Box 1(b) - Turnover of Interstate Sales u/s 6 (3) Box 1(c) - Sales Returns Box 1(d) - Sale of Goods outside the State Box 1(e) - Sales in the course of exports out India Box 1(f) - Sale in the course of Import into India Box 1(g) - Value of Goods Transferred Box 1(h) - Value of Exempted Goods

2. Balance:-Inter-State sales on which tax is leviable in Maharashtra State [1](a+b+c+d+e+f+g+h)]: In this section, the values are captured as given below:

Box 2(a) - Cost of Freight Box 2(b) - Zero Rated Sales Box 2(c) - Sales u/s 6 (2) Box 2(d) - Inter-state sales exempt from tax

3. Balance:-Total Taxable inter-state sales [2]-[a+b+c+d]: The value taxable inter-state sale, i.e., box 2 - [a+b+c+d] is captured. 4. Less:-Deduction u/s 8A(1)(a): The Deductions are captured here. 5. Net Taxable interstate sales (3-4): The value of box 3- 4 is captured here. 6A. A. Sales Taxable U/s. 8 (1) and section 8(1) read with 8(5): The rate-wise break-up of taxable Sales U/s. 8(1) is captured here. 6B. Sales Taxable U/s. 8 (2): The rate-wise break-up of taxable Sales U/s. 8(2) is captured here. 6C. Sales Taxable U/s. 8 (5): The rate-wise break-up of taxable Sales U/s. 8(5) is captured here. 6D. Amount of tax collected in Excess of Amount of Tax Payable: The rate-wise break-up of output VAT U/s. 8(5) is captured here.

24

Enabling VAT in Tally.ERP 9

7. Computation of Central Sales Tax payable: In this section, the values are captured as given below:

Box 7(a) - Value of box 6A+6B+6C is captured. Box 7(b) - Amount Deferred Box 7(c) - Balance Amount Payable i.e., box 7a - 7b Box 7(d) - Interest Payable Box 7(e) - Total Amount Payable

8. Aggregate of credit available: The value of Excess Input adjusted with CST, amount paid, credit obtained on refund adjustment order and the total amount of credit is captured in respective fields of this section. 9. Total Amount payable (7e-8e): The value of box 7(e) - 8(e) is captured here. 10. Total Amount of Refundable (8e-7e): The value of box 8(e) - 7(e) is captured here.

1.12 Annexure A

The information provided in VAT Payment Details screen of Payment Voucher by selecting VAT in Payment towards field is captured in Annexure_A worksheet of Form 704 template file. The TIN and tax period is captured in the first row of the Form 704. The transactions will be listed from March to April. Period The tax period is captured based on the From and To dates entered in the VAT Payment Details screen of Payment voucher. For example: If the dates are given as:

1-Oct-2009 to 31-Dec-2009, the period is Quarterly. 1-Apr-2009 to 30-Sep-2009, the period is Half-yearly.

Original Return Due Date of Payment: The return due date is captured as the 21st of the subsequent month of the tax period. Type of Return (Original or Revised): The Type of return selected in VAT Payment Details screen of payment voucher is captured here. For example: If Type of Payment is set to Not Applicable, Type of return is displayed as Original. If Revised/Fresh is selected Revised is captured. On selecting Interest, Challan is displayed. Date of Filing: The date of filing needs to be entered manually in the Annexure_A worksheet of Form 704 template file.

25

Enabling VAT in Tally.ERP 9

Amount of tax Paid: The debit value entered in payment voucher for paying the VAT liability is captured here. Date of Payment: The Deposit Date entered in VAT Payment Details screen of payment voucher is captured here. Amount of Interest on delayed Payment: This field is currently left blank. Amount of Interest Paid: The amount paid by selecting Interest as the Type of Payment in VAT Payment Details screen is captured here. Details of RAO: The debit value entered for VAT ledger in journal entry made by selecting Adjustment Towards Refund Order in the Used for field is captured here.

1.13 Annexure B

The information provided in VAT Payment Details screen of Payment Voucher by selecting CST in Payment towards field is captured in Annexure_B worksheet of Form 704 template file. The TIN and tax period is captured in the first row of the Form 704. The transactions will be listed from March to April. Period The tax period is captured based on the From and To dates entered in the VAT Payment Details screen of Payment voucher. For example: If the dates are given as:

1-Oct-2009 to 31-Dec-2009, the period is Quarterly. 1-Apr-2009 to 30-Sep-2009, the period is Half-yearly.

Original Return Due Date of Payment: The return due date is captured as the 21st of the subsequent month of the tax period. Type of Return (Original or Revised): The Type of return selected in VAT Payment Details screen of payment voucher is captured here. For example: If Type of Payment is set to Not Applicable, Type of return is displayed as Original. If Revised/Fresh is selected Revised is captured. On selecting Interest, Challan III E is displayed. Date of Filing: The date of filing needs to be entered manually in the Annexure_B worksheet of Form 704 template file. Amount of tax Paid: The debit value entered in payment voucher for paying the CST dues is captured here.

26

Enabling VAT in Tally.ERP 9

Date of Payment: The Deposit Date entered in VAT Payment Details screen of payment voucher is captured here. Amount of Interest on delayed Payment: This field is currently left blank. Amount of Interest Paid: The amount paid by selecting Interest as the Type of Payment in VAT Payment Details screen is captured here. Details of RAO: The debit value entered for CST ledger in journal entry made by selecting Adjustment Towards Refund Order in the Used for field is captured here.

1.14 Annexure C

The details entered on receipt of TDS Certificates in Annexure C Details of TDS Certificates Received of Form 704 Dashboard of Tally.ERP 9 are captured in Annexure_C worksheet of Form 704 template file. The TIN and tax period is captured in the first row of the Form 704.

Figure 1.19 Annexure C

1.15 Annexure D

The details entered on issuing of TDS Certificates in Annexure D Details of TDS Certificates Issued of Form 704 Dashboard are captured in Annexure_D worksheet of Form 704 template file. The TIN and tax period is captured in the first row of the Form 704.

Figure 1.20 Annexure D

27

Enabling VAT in Tally.ERP 9

1.16 Annexure E

The computation of Purchases and set-off details are captured in Annexure_E worksheet of Form 704 template file. Section 1: The rate-wise break-up of taxable purchases including purchase of capital goods is captured here. Section 2: The purchases made by selecting Non-Creditable Purchases as the VAT/Tax class or VAT adjustment in journal voucher is captured here. Section 3: The rate-wise break-up of capital goods purchased is captured here. Section 4: The value of Journal entry recorded using the VAT Adjustment - Reduction in Value of Purchases Used As Fuel U/r 53(1) and Reduction in Value of Purchases Used in Mfg. of Tax Free Goods U/r 53(2) are captured here. Section 5: The rate-wise break-up of taxable purchases is captured here. Section 6: The auditor has to fill-in the details in this column.

1.17 Annexure F

In Annexure F the ratios are auto-computed and displayed. The values of previous year can be entered in Annexure F Financial Ratios for the Audit Period of Form 704 dashboard and the ratios computed is captured in Annexure_F worksheet of Form 704 template file. The TIN and Period is captured in first row of Form 704.

Figure 1.21 Annexure F

28

Enabling VAT in Tally.ERP 9

1.18 Annexure G

The report on inter-state recorded against declaration forms like Form C and C+E1/E2 is displayed here. Name of the Dealer who has issued Declarations or Certificates: The name of party ledger from whom Form C, C+E1/E2 is received on account of sales made by selecting the VAT/Tax class Interstate Sales @ 2% Against Form C, Inter State Sales Against Form - E1 and Inter State Sales Against Form - E2 is captured here. TIN/RC Number: The TIN/Sales Tax Number specified in the ledger master of the selected party ledger is captured here. Declaration or Certificate Type: The Forms selected while invoicing is captured here. Issuing State: The State selected in the party ledger master selected while invoicing is captured here. Declaration No.: The Form number entered for the selected delcaration form is captured here. Gross amount as per invoice (Net of Goods Returned): The total value of sales recorded against a particular party by selecting a specific form type is captured here. Amount for which declaration received: The total value of sales recorded against a particular party by selecting a specific form type as the form to receive is captured here.

1.19 Annexure H

The report on Non-Receipt of Form H is displayed here. The TIN and period is captured in first row of Form 704. Name of the Dealer who has not issued Declarations or Certificates: The name of party ledger from whom Form H is not received on account of sales made by selecting the VAT/Tax class Sales (Against Form-H) is captured here. TIN, if Applicable: The TIN/Sales Tax Number specified in the ledger master of the selected party ledger is captured here. Invoice No.: The Sales Invoice number is captured here. Invoice Date: The sales invoice date is captured here. Taxable amount (Rs.) (Net): The assessable value of sales is captured here. Rate of tax applicable (Local Rate): The VAT rate pre-defined in the item master is captured here. Tax liability (Rs.): The tax value will be captured here.

29

Enabling VAT in Tally.ERP 9

1.20 Annexure I

Report on Non-Receipt of Declaration Forms other than Form H is captured in Annexure_I worksheet of Form 704 template file. Name of the Dealer who has not issued Declarations or Certificates: The name of party ledger from whom the declaration Forms, for e.g. Form C (other than Form H) are not received on account of inter-state sales made is captured here. CST TIN If any: The TIN/Sales Tax Number specified in the ledger master of the selected party ledger is captured here. Declaration or Certificate type (Please specify)*: The declaration Forms selected in Forms to receive field of inter-state sales entries are captured here. Invoice No.: The Sales Invoice number is captured here. Invoice Date: The sales invoice date is captured here. Taxable amount (Rs.) (Net): The assessable value of sales is captured here. Tax Amount (Rs.): The CST amount collected is captured here. Rate of tax applicable (Local Rate): The VAT rate pre-defined in the item master is captured here. Amount of Tax (Column 7*9*%): The value is auto-calculated as per the formula and captured. Differential tax liability (Rs.) (Col. 10-Col. 8): The value of column 10 - 8 is captured here.

1.21 Annexure J

In sections 1 to 4, the values are captured based on VAT amount in descending order - from highest VAT amount to lowest. In Section 5 and 6, the values are captured based on the gross amount in descending order - from highest gross value to lowest.

1.21.1 Section 1

The party-wise details of taxable sales are captured in Annexure_J_Sec 1 worksheet of Form 704 template file. Other Local Taxable SALES: The value of sales made by including the VAT amount in sale value using VAT inclusive voucher class is captured here. TIN of Customer: The TIN/Sales Tax Number pre-defined in the selected party ledger master or entered in Party Details screen while invoicing is captured here. Net Taxable Amount: The value of sales made by charging VAT separately is captured here. VAT Amount: The total VAT amount charged for the customer is captured here. Gross Total: The total invoice value i.e., column 3 + 4 is captured here.

30

Enabling VAT in Tally.ERP 9

1.21.2 Section 2

The party-wise details of taxable purchases are captured in Annexure_J_Sec 2 worksheet of Form 704 template file. Other Local Taxable PURCHASES: The value of purchases made by including the VAT amount in purchase value is captured here. TIN of Supplier: The TIN/Sales Tax Number pre-defined in the selected party ledger master or entered in Party Details screen while invoicing is captured here. Net Taxable Amount: The value of purchases including purchase of capital goods recorded by charging VAT separately is captured here. VAT Amount: The total VAT amount paid to the supplier is captured here. Gross Total: The total invoice value i.e., column 3 + 4 is captured here.

1.21.3 Section 3

The customer-wise details of debit/credit notes submitted are captured in Annexure_J_Sec 3 worksheet of Form 704 template file. The value of entries made in debit/credit note using the VAT Adjustments Goods Sold Returned, Change in Sales Considerations and Others are displayed in this section. TIN of Customer: The TIN/Sales Tax Number pre-defined in the selected party ledger master or entered in Party Details screen while invoicing is captured here. Net Taxable Amount: The net assessable value of debit/credit notes recorded by selecting the VAT Adjustments Goods Sold Returned, Change in Sales Considerations and Others are captured in this section. VAT Amount: The total VAT amount charged in debit/credit note is captured here. Gross Total: The total invoice value i.e., column 3 + 4 is captured here.

1.21.4 Section 4

The supplier-wise details of debit/credit notes are captured in Annexure_J_Sec 4 worksheet of Form 704 template file. The value of entries made in debit/credit to account for change in input VAT using the VAT Adjustments Purchase Returns Or Rejected, Change in Purchase Considerations and Others are displayed in this section. TIN of Customer: The TIN/Sales Tax Number pre-defined in the selected party ledger master or entered in Party Details screen while invoicing is captured here. Net Taxable Amount: The net assessable value of debit/credit notes recorded by selecting the VAT Adjustments Purchase Returns Or Rejected, Change in Purchase Considerations and Others are captured in this section. VAT Amount: The total VAT amount charged in debit/credit note is captured here. Gross Total: The total invoice value i.e., column 3 + 4 is captured here.

31

Enabling VAT in Tally.ERP 9

1.21.5 Section 5

The party-wise details of Exports are captured in Annexure_J_Sec 5 worksheet of Form 704 template file. The value of entries made in sales invoice using the VAT/Tax class - Exports is displayed in this section. Name of the Customer: The name of party ledger is captured here either from party master or Party Details screen. TIN of Customer: The TIN/Sales Tax Number pre-defined in the selected party ledger master or entered in Party Details screen while invoicing is captured here. Transaction Type: The Export sales will be captured as Direct Exports. Gross Total: The total value of all export sales is captured here. Major Commodity: The commodity name tagged to the stock items sold highest as exports is captured here.

1.21.6 Section 6

The party-wise details of Inter-State Purchases, Imports, Imports (High Seas), Purchases against form E1/E2 and consignment/branch transfer inwards are captured in Annexure_J_Sec 6 worksheet of Form 704 template file. The value of entries made in sales invoice using the VAT/Tax class - Inter-State Purchases, Interstate Purchases @ 1%, Interstate Purchases @ 12.5%, Interstate Purchases @ 2% Against Form C, Interstate Purchases @ 20%, Interstate Purchases @ 4%, Interstate Purchases @ 5%, InterState Purchases - Baker (Composition), Imports, Imports (High Seas), Consignment/Branch Transfer Inward and Consignment/Branch Transfer Inward (Within State) is captured in this section. Name of Supplier: The name of party ledger is captured here either from party master or Party Details screen. TIN of Supplier: The TIN/Sales Tax Number pre-defined in the selected party ledger master or entered in Party Details screen while invoicing is captured here. Transaction Type: The nature of purchase and transaction type will be captured as given below:

Interstate Purchases - OMS Purchase Imports - Direct Import Imports (High Seas) - High Seas Purchase Inter-State Purchases by selecting Form E1/E2 - Purchase u/s 6(2) Consignment/Branch Transfer Inward - Branch Transfer

Any Other Cost of Purchase: The value of additional cost entered for the above transactions will be captured here. In absence of additional cost, 0 will be displayed here. Gross Amount: The total value of the aforesaid purchases is captured here.

32

Enabling VAT in Tally.ERP 9

1.22 Annexure K

The Auditor's findings and comments entered in the Annexure K Determination of Gross Turnover with Reconciliation screen of Form 704 dashboard is captured in Annexure_K worksheet of Form 704 template file.

Figure 1.22 Annexure K

1.23 E-VAT Export Procedure

The steps to be followed for exporting the data are:

Download the excel template file - FORM-704 from Commercial Taxes Department website Copy/save the file in Tally.ERP 9 installed folder or the desired export location. Enter the From and To dates in the Report Generation screen of Audit Form 704 in Tally.ERP 9 (in the absence of the template file, the error message - FORM-704.xls does not Exists ! will be displayed). Accept the Report Generation screen to Export the file.

After exporting the information to excel template file, go to the Export Location, and open the Excel Template Form 704. Press Validate button in Part I to validate the entire file. Alternatively, the individual sheets can be validated using the Validate button displayed in each sheet. The errors if any found during validation will be reported in the Errors sheet of the same file. Based on the errors reported make the necessary correction and validate again. On successful validation, the validated file will be saved as Rem.txt in Drive C. The dealer can upload this file after logging on to Department website using the Login ID and Password.

33

Enabling VAT in Tally.ERP 9

1.24 Conclusion

The e-Audit form 704 was supported since Stat.900 version 98 of Tally.ERP 9 Series A Release 1.52. The revised e-Audit Form 704 is provided in Stat.900 version 132 of Tally.ERP 9 Series A Release 2.1. The facility is provided to export the details of Form 231, 232, 233, CST Form III(E) along with audit details, Auditor's Findings, dealer's details, letter of submission etc., to template file Form 704 for e-filing. The following information pertaining to Form 704 can be captured in Tally.ERP 9: Worksheet of Form 704 Letter of Submission Part 1 Part 2 Sch I Sch II Sch III Sch VI Annexure_A Annexure_B Annexure_C Annexure_D Annexure_E Annexure_F Annexure_H Annexure_I Annexure_J_Sec 1 Annexure_J_Sec 2 Annexure_J_Sec 3 Annexure_J_Sec 4 Annexure_K Details Captured from Tally.ERP 9 Acceptance or Non-acceptance of recommendations by the dealer Details of Audit and Dealers Acceptance on Auditors Recommendation General & Business information of the Dealer Details of Form 231 Details of Form 232 Details of Form 233 Details of CST Form III (E) VAT Payment Details CST Payment Details Details of TDS Certificates Received Details of TDS Certificates Issued Computation of Purchases and set-off Financial Ratios Report on Non-Receipt of Form H Report on Non-Receipt of Declaration Forms other than Form H Party-wise details of taxable sales Party-wise details of taxable purchases Customer-wise details of debit/credit notes Supplier-wise debit/credit notes details Auditor's Comments or findings

Contact Us

For further clarifications reach us at: E-mail: support@tallysolutions.com Telephone: 1800-425-8859 or 080 - 25638240

34

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Yes Bank EvaluationDokument11 SeitenYes Bank EvaluationPRAMODH VMNNoch keine Bewertungen

- Do Small Businesses Get The Credit They Need?: Michaël Dewally, PH.DDokument4 SeitenDo Small Businesses Get The Credit They Need?: Michaël Dewally, PH.DAnonymous Feglbx5Noch keine Bewertungen

- MCB Stretegic HRMDokument145 SeitenMCB Stretegic HRMfarooqkhan8559% (17)

- Online Trading at SharekhanDokument134 SeitenOnline Trading at SharekhanAshok GuptaNoch keine Bewertungen

- Historic Returns - Large Cap Fund, Large Cap Fund Performance Tracker Mutual Funds With Highest ReturnsDokument3 SeitenHistoric Returns - Large Cap Fund, Large Cap Fund Performance Tracker Mutual Funds With Highest ReturnsA.J NATIONAL SECURENoch keine Bewertungen

- What Are Mutual FundsDokument12 SeitenWhat Are Mutual FundsSuraj00sNoch keine Bewertungen

- Bank Statement EditedDokument4 SeitenBank Statement EditedAllen MedinaNoch keine Bewertungen

- AmericanExpressCompany 10K 20120224Dokument306 SeitenAmericanExpressCompany 10K 20120224technoxplorer100% (1)

- Terri Williams BankruptcyDokument59 SeitenTerri Williams BankruptcyThe Greenville Guardian100% (1)

- Comparative Study of The Products of HDFC Standard Life Insurance Company and MetLife India Insurance CompanyDokument58 SeitenComparative Study of The Products of HDFC Standard Life Insurance Company and MetLife India Insurance CompanyMayank Mahajan100% (2)

- Merkel's Comic Error Executive Pay Problem Child: Brussels Set To Open New Front in Google Battle by Tackling AndroidDokument22 SeitenMerkel's Comic Error Executive Pay Problem Child: Brussels Set To Open New Front in Google Battle by Tackling AndroidstefanoNoch keine Bewertungen

- 60 Car Loans Audit Report FINALDokument14 Seiten60 Car Loans Audit Report FINALEmil Victor Medina MasaNoch keine Bewertungen

- As11,19,20,22 PDFDokument55 SeitenAs11,19,20,22 PDFSolai pushpamNoch keine Bewertungen

- Executive Summary: The Report Explains The Concept of CRM in Private Bank With The Case Study On ICICI BankDokument56 SeitenExecutive Summary: The Report Explains The Concept of CRM in Private Bank With The Case Study On ICICI BankKevin DarrylNoch keine Bewertungen

- Current Account 05 June 2021 To 02 July 2021: Your Account Arranged Overdraft Limit 240Dokument5 SeitenCurrent Account 05 June 2021 To 02 July 2021: Your Account Arranged Overdraft Limit 240Carla GomesNoch keine Bewertungen

- Final Project 2017-18Dokument3 SeitenFinal Project 2017-18Monali rautNoch keine Bewertungen

- HDFC Life Click 2 Invest - Ulip - GJ - IllustrationDokument3 SeitenHDFC Life Click 2 Invest - Ulip - GJ - IllustrationYashpal SinghNoch keine Bewertungen

- Finlatics Research Insight 1Dokument7 SeitenFinlatics Research Insight 1Aishwarya GangawaneNoch keine Bewertungen

- Afar Part 1 (2017 Edition) - Sample OnlyDokument58 SeitenAfar Part 1 (2017 Edition) - Sample OnlyCM Lance67% (3)

- Example of Test Case From Use Case-AtmDokument10 SeitenExample of Test Case From Use Case-AtmSurbhi15Noch keine Bewertungen

- Eng. B P. 01 May 2010Dokument11 SeitenEng. B P. 01 May 2010Angel LawsonNoch keine Bewertungen

- ICOBSDokument124 SeitenICOBS1474543Noch keine Bewertungen

- Micro Finance KothariDokument21 SeitenMicro Finance KothariKokila AmbigaeNoch keine Bewertungen

- Keough CFR 6-12 2017Dokument133 SeitenKeough CFR 6-12 2017Houston ChronicleNoch keine Bewertungen

- Monte Carlo Fashions Limited - RHP - 21 November 2014Dokument336 SeitenMonte Carlo Fashions Limited - RHP - 21 November 2014Biswa Jyoti GuptaNoch keine Bewertungen

- Insurance Written ReportDokument6 SeitenInsurance Written ReportChasmere MagloyuanNoch keine Bewertungen

- Sadiq Hoi PDFDokument2 SeitenSadiq Hoi PDFHafiz Shoaib MaqsoodNoch keine Bewertungen

- LHV TranslateDokument1 SeiteLHV TranslateRevita AzilaNoch keine Bewertungen

- FinancialDokument272 SeitenFinancialshubhambhagat2009Noch keine Bewertungen

- Rapport Overzicht Verrichtingen PDFDokument3 SeitenRapport Overzicht Verrichtingen PDFDanaNoch keine Bewertungen